|

|

市場調査レポート

商品コード

1461951

パワー半導体市場:世界および地域別分析、2024年~2033年Power Semiconductor Market: A Global and Regional Analysis, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| パワー半導体市場:世界および地域別分析、2024年~2033年 |

|

出版日: 2024年04月11日

発行: BIS Research

ページ情報: 英文

納期: 1~5営業日

|

全表示

- 概要

- 目次

世界のパワー半導体の市場規模は、様々な要因や主要な推進力によって大幅な成長を遂げています。

この拡大の主な触媒は、多様な用途にわたるエネルギー効率の高い技術に対する需要の高まりです。パワートランジスタ、ダイオード、サイリスタなどのデバイスを含むパワー半導体は、電力の変換と管理を最適化する上で重要な役割を果たしています。産業界がより高いエネルギー効率を達成し、二酸化炭素排出量を削減しようと努める中、パワー半導体は、電源、モーター駆動、再生可能エネルギーシステムなどの用途で不可欠な部品となっています。電気自動車の成長と再生可能エネルギー源への移行は、電気ドライブトレインや再生可能エネルギーシステムの電力を効率的に制御・変換する上で不可欠な役割を果たすパワー半導体の需要をさらに高めています。

技術の進歩と半導体製造プロセスの継続的な進化は、世界のパワー半導体市場の成長を支える主な要因です。炭化ケイ素(SiC)や窒化ガリウム(GaN)などのワイドバンドギャップ半導体の開発により、半導体デバイスの効率と電力密度の向上が可能になっています。ワイドバンドギャップ材料は、熱性能の向上とエネルギー損失の低減を実現し、ハイパワーや高周波の用途で特に価値を発揮します。さらに、スマート技術、自動化、モノのインターネット(IoT)の普及により、さまざまな電子システムにおけるパワー半導体の統合が進んでいます。産業界がデジタルトランスフォーメーションと電化の動向を取り込む中、パワー半導体の需要は、多様な用途における効率と性能の強化に焦点を当てながら、成長を続けると予想されます。

当レポートでは、世界のパワー半導体市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的出来事の影響分析-COVID19、ロシア/ウクライナ、中東危機

- パワー半導体市場における主要企業の最近の動向

- 市場力学の概要

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 世界のパワー半導体市場- 用途別

第3章 製品

- 製品セグメンテーション

- 製品概要

- 世界のパワー半導体市場- コンポーネント別

- 世界のパワー半導体市場- 製品別

第4章 地域

- 地域別概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合情勢と企業プロファイル

- 競合情勢

- 企業プロファイル

- ON Semiconductor Corporation

- Renesas Electronics

- Toshiba Corporation.

- NXP Semiconductors N.V.

- Fuji Electric Co Ltd.

- Infineon Technologies AG

- Texas Instruments Inc.

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Hitachi, Ltd

- Maxim Integrated Products, Inc.

- ROHM Semiconductor

- Allegro MicroSystems, LLC

- Littelfuse, Inc.

- Vishay Intertechnology, Inc.

- その他の主要な市場参入企業

第6章 成長機会と推奨事項

第7章 調査手法

The global power semiconductor market has experienced substantial growth, driven by various factors and key driving forces. A primary catalyst for this expansion is the rising demand for energy-efficient technologies across a diverse range of applications. Power semiconductors, encompassing devices like power transistors, diodes, and thyristors, play a crucial role in optimizing the conversion and management of electrical power. As industries strive to achieve greater energy efficiency and reduce their carbon footprint, power semiconductors have become indispensable components in applications such as power supplies, motor drives, and renewable energy systems. The growth of electric vehicles and the transition to renewable energy sources have further heightened the demand for power semiconductors, given their integral role in efficiently controlling and converting electrical power in electric drivetrains and renewable energy systems.

Technological advancements and the ongoing evolution of semiconductor manufacturing processes are key drivers behind the growth of the global power semiconductor market. The development of wide-bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), has enabled higher efficiency and power density in semiconductor devices. Wide-bandgap materials offer improved thermal performance and reduced energy losses, making them particularly valuable in high-power and high-frequency applications. Additionally, the widespread adoption of smart technologies, automation, and the Internet of Things (IoT) has led to an increased integration of power semiconductors in various electronic systems. As industries embrace digital transformation and electrification trends, the demand for power semiconductors is expected to continue growing, with a focus on enhancing efficiency and performance across diverse applications.

Market Segmentation:

Segmentation 1: by Application

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Transportation

- Medical

- Energy and Power

- Others

Segmentation 2: by Component

- Discrete

- Module

- Power Integrated Circuits

Segmentation 3: by Product

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Others

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Key Questions Answered in this Report:

- What are the main factors driving the demand for global power semiconductor market?

- What are the major patents filed by the companies active in the global power semiconductor market?

- What are the strategies adopted by the key companies to gain a competitive edge in power semiconductor industry?

- What is the futuristic outlook for the power semiconductor in terms of growth potential?

- Which application, component and product is expected to lead the market over the forecast period (2024-2033)?

- Which region and country is expected to lead the market over the forecast period (2024-2033)?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1 Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increase in the use of solar photovoltaic panels to generate electricity

- 1.1.2 Growing demand for wireless communication and consumer electronics

- 1.2 Supply Chain Overview

- 1.2.1 Value chain Analysis

- 1.2.2 Market Map

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use case

- 1.5.2 End User and buying criteria

- 1.6 Impact analysis for Key Global Events-covid19, Russia/Ukraine or Middle East crisis

- 1.7 Recent Developments by Key Players in Power Semiconductor Market

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.2 Market Restraints

- 1.8.3 Market Opportunities

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Power Semiconductor Market - by Application

- 2.3.1 IT and Telecommunication

- 2.3.2 Automotive

- 2.3.3 Aerospace and Defense

- 2.3.4 Transportation

- 2.3.5 Medical

- 2.3.6 Energy and Power

- 2.3.7 Others

3 Product

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Power Semiconductor Market - by Component

- 3.3.1 Discrete

- 3.3.2 Module

- 3.3.3 Power Integrated Circuits

- 3.4 Global Power Semiconductor Market - by Product

- 3.4.1 Silicon Carbide (SiC)

- 3.4.2 Gallium Nitride (GaN)

- 3.4.3 Others

4 Region

- 4.1 Regional Summary

Table: Global Power Semiconductor Market, By Region, ($ Million), 2023-2033

- 4.2 Drivers and Restraints

- 4.3 North America

- 4.3.1 Key Market Participants in North America

- 4.3.2 Business Drivers

- 4.3.3 Business Challenges

- 4.3.4 Application

Table: North America Power Semiconductor Market, by Application ($ Million), 2023-2033

- 4.3.5 Product

Table: North America Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: North America Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.3.6 North America Power Semiconductor Market (by Country)

- 4.3.6.1 U.S.

Table: U.S. Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: U.S. Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: U.S. Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.3.6.2 Canada

Table: Canada Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Canada Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Canada Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.3.6.3 Mexico

Table: Mexico Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Mexico Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Mexico Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4 Europe

- 4.4.1 Key Market Participants in Europe

- 4.4.2 Business Drivers

- 4.4.3 Business Challenges

- 4.4.4 Application

Table: Europe Power Semiconductor Market, by Application ($ Million), 2023-2033

- 4.4.5 Product

Table: Europe Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Europe Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4.6 Europe Power Semiconductor Market (by Country)

- 4.4.6.1 Germany

Table: Germany Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Germany Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Germany Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4.6.2 France

Table: France Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: France Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: France Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4.6.3 Italy

Table: Italy Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Italy Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Italy Power Semiconductor Market, by Product ($ Million), 2023-2033

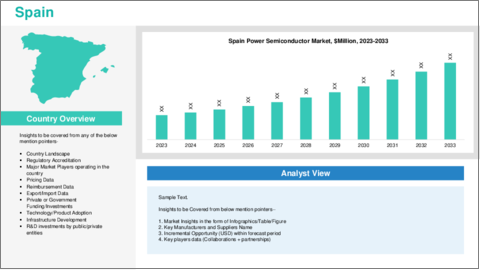

- 4.4.6.4 Spain

Table: Spain Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Spain Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Spain Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4.6.5 U.K.

Table: U.K. Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: U.K. Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: U.K. Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.4.6.6 Rest-of-Europe

Table: Rest-of-Europe Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Rest-of-Europe Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Rest-of-Europe Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5 Asia-Pacific

- 4.5.1 Key Market Participants in Asia-Pacific

- 4.5.2 Business Drivers

- 4.5.3 Business Challenges

- 4.5.4 Application

Table: Asia-Pacific Power Semiconductor Market, by Application ($ Million), 2023-2033

- 4.5.5 Product

Table: Asia-Pacific Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Asia-Pacific Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5.6 Asia-Pacific Power Semiconductor Market (by Country)

- 4.5.6.1 China

Table: China Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: China Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: China Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5.6.2 Japan

Table: Japan Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Japan Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Japan Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5.6.3 India

Table: India Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: India Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: India Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5.6.4 South Korea

Table: South Korea Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: South Korea Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: South Korea Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.5.6.5 Rest-of-Asia-Pacific

Table: Rest-of-Asia-Pacific Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: Rest-of-Asia-Pacific Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Rest-of-Asia-Pacific Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.6 Rest-of-the-World

- 4.6.1 Key Market Participants in Rest-of-the-World

- 4.6.2 Business Drivers

- 4.6.3 Business Challenges

- 4.6.4 Application

Table: Rest-of-the-World Power Semiconductor Market, by Application ($ Million), 2023-2033

- 4.6.5 Product

Table: Rest-of-the-World Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: Rest-of-the-World Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.6.6 Rest of the World Power Semiconductor Market (By Region)

- 4.6.6.1 The Middle East and Africa

Table: The Middle East and Africa Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: The Middle East and Africa Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: The Middle East and Africa Power Semiconductor Market, by Product ($ Million), 2023-2033

- 4.6.6.2 South America

Table: South America Power Semiconductor Market, by Application ($ Million), 2023-2033

Table: South America Power Semiconductor Market, by Component ($ Million), 2023-2033

Table: South America Power Semiconductor Market, by Product ($ Million), 2023-2033

5 Markets - Competitive Landscape & Company Profiles

- 5.1 Competitive Landscape

- 5.2 Company Profiles

- 5.2.1 ON Semiconductor Corporation

- 5.2.1.1 Overview

- 5.2.1.2 Top Products / Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers/End-Users

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Renesas Electronics

- 5.2.2.1 Overview

- 5.2.2.2 Top Products / Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers/End-Users

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Toshiba Corporation.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products / Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers/End-Users

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 NXP Semiconductors N.V.

- 5.2.4.1 Overview

- 5.2.4.2 Top Products / Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers/End-Users

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Fuji Electric Co Ltd.

- 5.2.5.1 Overview

- 5.2.5.2 Top Products / Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers/End-Users

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Infineon Technologies AG

- 5.2.6.1 Overview

- 5.2.6.2 Top Products / Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers/End-Users

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Texas Instruments Inc.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products / Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers/End-Users

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 STMicroelectronics N.V.

- 5.2.8.1 Overview

- 5.2.8.2 Top Products / Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers/End-Users

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Mitsubishi Electric Corporation

- 5.2.9.1 Overview

- 5.2.9.2 Top Products / Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers/End-Users

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Hitachi, Ltd

- 5.2.10.1 Overview

- 5.2.10.2 Top Products / Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers/End-Users

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Maxim Integrated Products, Inc.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products / Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers/End-Users

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 ROHM Semiconductor

- 5.2.12.1 Overview

- 5.2.12.2 Top Products / Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers/End-Users

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Allegro MicroSystems, LLC

- 5.2.13.1 Overview

- 5.2.13.2 Top Products / Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers/End-Users

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Littelfuse, Inc.

- 5.2.14.1 Overview

- 5.2.14.2 Top Products / Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers/End-Users

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Vishay Intertechnology, Inc.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products / Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers/End-Users

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 ON Semiconductor Corporation

- 5.3 Other Key Market Participants