|

|

市場調査レポート

商品コード

1449234

輸送用表面材市場:ビニール・皮革・布地・その他の代替素材Surface Materials for Transportation Market: Focus on Vinyl, Leather, Fabric, and Other Alternatives |

||||||

カスタマイズ可能

|

|||||||

| 輸送用表面材市場:ビニール・皮革・布地・その他の代替素材 |

|

出版日: 2024年03月13日

発行: BIS Research

ページ情報: 英文

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

内装材、ダッシュボード、天井材などの輸送用表面材の市場は、自動車、船舶、航空、鉄道などのエンドユーザー産業からの需要の増加に伴い、需要が拡大すると予測されています。

また、予測期間中は、米国、カナダ、ドイツ、フランス、イタリア、中国、インドなど、いくつかの先進国における自動車産業での表面材料の採用が増加する見通しであり、市場のさらなる発展が期待されています。さらに、アフターマーケットでの顧客による改造への需要の高まりが、布地、天然皮革、合成皮革、不織布などの表面素材の需要増加の主な原動力となっており、自動車生産の急増が世界の輸送用表面材市場の成長に大きく影響しています。一方で、価格に敏感な市場では、設置コストの増加や原材料価格の変動が消費者による採用を妨げ、市場における課題として作用する可能性があります。

市場ライフサイクル段階

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 336億1,000万米ドル |

| 2033年予測 | 690億3,000万米ドル |

| CAGR | 7.46% |

輸送用表面材市場は成長段階にあります。同市場は、自動車のパーソナライゼーションに対する顧客の関心の高まりに後押しされており、市場の活性化が期待されています。さらに、エンドユーザー産業からの需要が高く、政府があらゆる分野で持続可能性を重視していることから、リサイクル素材、植物由来素材、バイオベース素材など、持続可能な表面素材への需要が高まり、世界の輸送用表面材市場を強化しています。また、輸送用表面材市場は、新興市場における製造施設の拡大からも恩恵を受けると予想されています。

当レポートでは、世界の輸送用表面材の市場を調査し、市場概要、主要動向、技術および特許の動向、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- トレンド分析:世界の輸送用表面材市場

- 高級車や高性能車の導入が増加

- 交通における快適性と美観を重視した消費者行動の変化

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- 研究開発レビュー

- 特許出願動向 (国・企業別)

- 規制状況

- ステークホルダーの分析

- 使用事例

- エンドユーザーと購入基準

- 市場力学の概要

- 市場促進要因

- 市場の課題

- 市場機会

- 表面素材と自動車の継続的な進歩との統合

- 表面材の選定基準

第2章 輸送用表面材市場 (用途別)

- 用途の分類

- 輸送用表面材市場 (用途別)

- 室内装飾品

- ヘッドライナー

- ダッシュボード

- その他

- 輸送用表面材 (販路別)

- OEM

- アフターマーケット

- 輸送用表面材市場 (エンドユーザー産業別)

- 自動車

- 船舶

- 航空

- 鉄道

第3章 輸送用表面材市場 (素材別)

- 輸送用表面材市場 (素材タイプ別)

- 製品概要

- ビニール

- レザー

- ファブリック

- その他の持続可能代替品

第4章 世界の輸送用表面材市場 (地域別)

- 輸送用表面材市場 (地域別)

- 地域概要

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場- 競合情勢・企業プロファイル

- 次のフロンティア

- 地理的評価

- 競合ベンチマーキング

- 市場シェア分析 (材料タイプ別)

- 企業プロファイル

- Lydall Gutsche GmbH & Co. KG

- Milliken & Company

- Toray Industries, Inc.

- Teijin Limited

- Sekisui Chemical Co., Ltd.

- AUTOSTOP AVIATION

- Schoeller Textil AG

- MIKO srl

- Covestro AG

- Continental AG

- Rogers Corporation

- INVISTA

- Kuraray Co. Ltd.

- BASF SE

- Infinited Fiber Company

第6章 調査手法

List of Figures

- Figure 1: Region with Largest Share of Market, 2022, 2026, and 2033

- Figure 2: Surface Materials for Transportation Market (by Application), 2022, 2026, and 2033

- Figure 3: Surface Materials for Transportation Market (by Sales Channel), 2022, 2026, and 2033

- Figure 4: Surface Materials for Transportation Market (by End-Use Industry), 2022, 2026, and 2033

- Figure 5: Surface Materials for Transportation Market (by Material Type), 2022, 2026, and 2033

- Figure 6: Surface Materials for Transportation Market, Recent Developments

- Figure 7: Surface Materials for Transportation Market: Coverage

- Figure 9: Supply Chain Analysis for Surface Materials for Transportation Market

- Figure 10: Patent Filed (by Company), January 2020-December 2023

- Figure 11: Patent Filed (by Country), January 2020-December 2023

- Figure 12: Impact Analysis of Market Navigating Factors, 2022-2033

- Figure 13: U.S. Surface Materials for Transportation Market, $Million, 2022-2032

- Figure 14: Canada Surface Materials for Transportation Market, $Million, 2022-2032

- Figure 15: Mexico Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 16: Germany Surface Materials for Transportation Market, $Million, 2022-2032

- Figure 17: France Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 18: U.K. Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 19: Italy Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 20: Rest-of-Europe Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 21: China Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 22: Japan Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 23: Australia Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 24: South Korea Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 25: India Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 26: Rest-of-Asia-Pacific Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 27: Brazil Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 28: U.A.E. Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 29: Others of Rest-of-the-World Surface Materials for Transportation Market, $Million, 2022-2033

- Figure 30: Strategic Initiatives, 2020-2023

- Figure 31: Share of Strategic Initiatives

- Figure 32: Data Triangulation

- Figure 33: Top-Down and Bottom-Up Approach

- Figure 34: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Surface Materials for Transportation Market, Regional Opportunities

- Table 3: Application Summary (by Application)

- Table 4: Application Summary (by Sales Channel)

- Table 5: Application Summary (by End-Use Industry)

- Table 6: Product Summary (by Material Type)

- Table 7: Surface Materials for Transportation Market (by Region), $Million, 2022-2033

- Table 8: North America Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 9: North America Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 10: North America Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 11: North America Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 12: U.S. Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 13: U.S. Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 14: U.S. Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 15: U.S. Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 16: Canada Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 17: Canada Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 18: Canada Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 19: Canada Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 20: Mexico Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 21: Mexico Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 22: Mexico Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 23: Mexico Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 24: Europe Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 25: Europe Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 26: Europe Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 27: Europe Surface Materials for Transportation Market (by Capacity), $Million, 2022-2033

- Table 28: Germany Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 29: Germany Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 30: Germany Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 31: Germany Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 32: France Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 33: France Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 34: France Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 35: France Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 36: U.K. Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 37: U.K. Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 38: U.K. Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 39: U.K. Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 40: Italy Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 41: Italy Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 42: Italy Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 43: Italy Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 44: Rest-of-Europe Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 45: Rest-of-Europe Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 46: Rest-of-Europe Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 47: Rest-of-Europe Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 48: Asia-Pacific Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 49: Asia-Pacific Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 50: Asia-Pacific Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 51: Asia-Pacific Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 52: China Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 53: China Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 54: China Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 55: China Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 56: Japan Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 57: Japan Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 58: Japan Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 59: Japan Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 60: Australia Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 61: Australia Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 62: Australia Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 63: Australia Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 64: South Korea Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 65: South Korea Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 66: South Korea Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 67: South Korea Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 68: India Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 69: India Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 70: India Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 71: India Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 72: Rest-of-Asia-Pacific Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 73: Rest-of-Asia-Pacific Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 74: Rest-of-Asia-Pacific Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 75: Rest-of-Asia-Pacific Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 76: Rest-of-the-World Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 77: Rest-of-the-World Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 78: Rest-of-the-World Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 79: Rest-of-the-World Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 80: Brazil Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 81: Brazil Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 82: Brazil Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 83: Brazil Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 84: U.A.E. Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 85: U.A.E. Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 86: U.A.E. Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 87: U.A.E. Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 88: Others of Rest-of-the-World Surface Materials for Transportation Market (by Application), $Million, 2022-2033

- Table 89: Others of Rest-of-the-World Surface Materials for Transportation Market (by Sales Channel), $Million, 2022-2033

- Table 90: Others of Rest-of-the-World Surface Materials for Transportation Market (by End-Use Industry), $Million, 2022-2033

- Table 91: Others of Rest-of-the-World Surface Materials for Transportation Market (by Material Type), $Million, 2022-2033

- Table 92: Market Share, 2022

Global Surface Materials for Transportation Market: Industry Overview

The demand for surface materials for transportation market such as upholstery, dashboards, headliners, and others is anticipated to grow with the increasing demand from end-use industries such as automotive, marine, aviation, rail, and among others. Furthermore, it is anticipated that during the projected period, i.e., 2023-2033, the increasing adoption of surface materials in the automotive industry in several advanced economies, including the U.S., Canada, Germany, France, Italy, China, India, among others, are expected to further increase the advancement of the global surface materials for transportation market. However, the escalating emphasis on demand for aftermarket customer modification acts as a key driving force behind the increasing demand for surface materials such as fabrics, natural leather, synthetic leather, non-wovens, among others and the surge in vehicle production significantly affects the growth of the global surface materials for transportation market. However, in a price-sensitive market, increasing installation costs and fluctuation in raw material prices can hinder consumer adoption and act as a challenge in the global surface material for transportation market.

Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $33.61 Billion |

| 2033 Forecast | $69.03 Billion |

| CAGR | 7.46% |

The surface materials for transportation market is in the growth phase. The market is propelled by the growing customer interest in vehicle personalization and is expected to boost the market. Furthermore, high demand from end-use industries and governments' emphasis on sustainability in all sectors increases the demand for sustainable surface materials such as, recycled materials, plant-based materials, bio-based materials, and others, thereby bolstering the global surface materials for transportation market. Moreover, the surface materials for transportation market is expected to benefit from the expansion of manufacturing facilities in emerging markets, which represents a strategic move that holds immense potential for advanced economies in the surface materials for transportation market.

Industrial Impact

Surfac materials offer numerous advantages. It provides an excellent opportunity for automotive manufacturers to elevate themselves with the use of advance fabrics, natural leather, synthetic leather among others in various applications such as upholstery, dashboard, headliner, and others. Furthermore, surface materials can made into smart materials by embedding them with sensors or other materials that can respond to stimuli, for example synthetic leather could be made to change color in response to changes in temperature, or it could be made to become more conductive in the presence of moisture.various surfaces, facilitating consistent and visually attractive advertisemen. In the same vein, renowned for its durability, surface materials offer a resilient solution for vehicle interiors and exteriors. Surface materials offer a transformative solution for building industries by providing aesthetic designs for designers to enhance their creativity. Furthermore, the adaptability of surface materials allows the creation of dynamic and changeable surface elements.

Market Segmentation:

Segmentation 1: by Application

- Upholstery

- Headliner

- Dashboard

- Others

The upholstery leads the global surface materials for transportation market.

Segmentation 2: by Sales Channel

- OEM

- Aftermarket

The surface material for transportation marke tis estimated to be led by the OEM segment in terms of sales channel.

Segmentation 3: by End-Use Industry

- Automotive

- Marine

- Aviation

- Rail

The surface material for transportation market is estimated to be led by automotive in terms of end-use industry.

Segmentation 4: by Material Type

- Vinyl

- Leather

- Fabric

- Other Sustatinable Alternatives

The surface material for transportation market is estimated to be led by leather in terms of material type.

Segmentation 5: by Region

North America - U.S., Canada, and Mexico

Europe - Germany, France, U.K., Italy, and Rest-of-Europe

Asia-Pacific - China, Japan, Australia, South Korea, India, and Rest-of-Asia-Pacific

Rest-of-the-World - Brazil, U.A.E., and Others-of-Rest-of-the-World

In the surface materials for transportation market, Asia-Pacific is anticipated to gain traction in terms of production and adoption, owing to the continuous growth of surface materials such as natural leather, synthetic leather, fabric, among others and North America is anticipated to have a presence of key manufacturers in the region.

Recent Developments in the Global Surface Materials for Transportation Market

- In April 11, 2023 - Teijin Frontier Co., Ltd., the Teijin Group's fibers and products converting company, announced that it has developed an eco-friendly staple polyester nanofiber that offers excellent performance to reinforce rubber uses in products including automotive hoses belts, and others.

- In November 10, 2023 - Covestro, a materials manufacturer, has established a worldwide collaboration with Xinquan Automotive, a China automotive trim company, during the China International Import Expo held in Shanghai. The partnership aims to bolster business operations in China while fostering global cooperation, thereby facilitating Xinquan's entry into North America, Europe, and ASEAN nations. Broadening their technical partnership, Covestro and Xinquan will leverage Covestro's extensive global research and development resources to create low-carbon polyurethane solutions for automotive interiors. This initiative involves incorporating partially bio-based raw materials into the manufacturing process.

- In February 17, 2022 - Teijin Limited announced that it has launched a lightweight, strong and cost-effective carbon fiber woven fabric developed with the company's proprietary tow-spreading technology.

- In November 15, 2021 - Covestro and voxeljet announce partnership to advance additive manufacture in series production. Materials company Covestro and industrial 3D printer manufacturer voxeljet are collaborating to develop a material-machine combination for economic large series additive manufacturing.

Demand - Drivers and Challenges

The following are the demand drivers for the global surface material for transportation market:

- Increase in Demand for Aftermarket Customer Modifications

- Increase in Vehicle Production

The surface materials for transportation market is expected to face some limitations as well due to the following challenges:

- High Material and Installation Cost

- Increase in Regulations for Materials

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different surface materials, various sales channels such as OEM and aftermarket, end-use industries, and different material types involved in the production of surface materials. Moreover, the study provides the reader with a detailed understanding of the surface materials for transportation marketbased on the end user (automotive, marine, aviation, rail and others).

Growth/Marketing Strategy: The surface materials for transportation market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been product developments, business expansions, and acquisitions to strengthen their position in the global surface materials for transportation market. For instance, Covestro, a materials manufacturer, has established a worldwide collaboration with Xinquan Automotive, a China automotive trim company, during the China International Import Expo held in Shanghai.

Competitive Strategy: Key players in the surface materials for transportation market analyzed and profiled in the study involve surface materials manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the surface materials for transportation market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on input gathered from primary experts, analyzing company coverage, product portfolio, and market penetration.

The surface materials for transportation market has been segmented based on material type, among which leather accounted for around 44.1%, fabric around 38.0%, vinyl held around 9.8%, and other sustainable alternatives held for approximately 8.1% of the total surface materials consumed in the year 2022 in terms of value.

Some of the prominent established names in this market are:

Company Type 1 (by Material Type): Vinyl

- Sekisui Chemical Co., Ltd.

- Covestro

- Continental

- Kuraray Co. Ltd.

Company Type 2 (by Material Type): Leather

- MILLIKEN & COMPANY

- Toray Industries, Inc.

- Teijin Limited

- Sekisui Chemical Co., Ltd.

- Autostop Aviation

- Covestro

- Continental

- Kuraray Co. Ltd.

- BASF SE

Company Type 3 (by Material Type): Fabric

- Lydall Gutsche GmbH & Co. KG

- Toray Limited, Inc.

- Autostop Aviation

- Schoellar Textil AG

- MIKO srl

- Covestro

- Roger Corporation

- INVISTA

Company Type 4 (by Material Type): Other Sustainable Alternatives

- Teijin Limited

- BASF SE

- Infinited Fiber Company

- Continental

- Covestro

- MIKO srl

Companies that are not a part of the previously mentioned poll have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope of the Study

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trend Analysis: Global Surface Materials for Transportation Market

- 1.1.2 Increasing Adoption of Luxury and Performance Vehicles

- 1.1.3 Changing Consumer Behavior toward Comfort and Aesthetics in Transportation

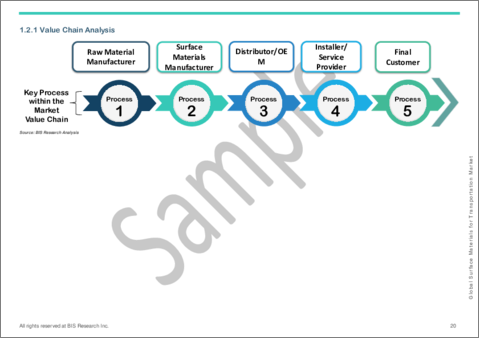

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast (by Material Type, $/Meter)

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Company)

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Increase in Demand for Aftermarket Customer Modifications

- 1.6.1.2 Increase in Vehicle Production

- 1.6.2 Market Challenges

- 1.6.2.1 High Material and Installation Cost

- 1.6.2.2 Increase in Regulations for Materials

- 1.6.3 Market Opportunities

- 1.6.3.1 Advancements in Technology for Surface Materials

- 1.6.3.2 Growth in Adoption of Smart Features

- 1.6.1 Market Drivers

- 1.7 Integration of Surface Materials with Ongoing Automotive Advancements

- 1.8 Selection Criteria for Surface Materials

- 1.8.1 Key Comparisons between Fabrics and Properties

- 1.8.1.1 Vinyl

- 1.8.1.2 Natural Leather

- 1.8.1.2.1 Synthetic Leather

- 1.8.1.2.2 Polyurethane (PU)

- 1.8.1.2.3 Polyvinyl Chloride (PVC)

- 1.8.1.2.4 Polyester

- 1.8.1.2.5 Others

- 1.8.1.3 Fabric

- 1.8.1.3.1 Polyester

- 1.8.1.3.2 Natural Fabric

- 1.8.1.3.3 Wool/Nylon Blend

- 1.8.1.4 Other Sustainable Alternatives

- 1.8.1.4.1 Recycled Materials

- 1.8.1.4.2 Plant- and Bio-Based Materials

- 1.8.1.4.3 Bio-Based Fabric

- 1.8.2 Evaluation of Chemical Composition

- 1.8.3 Application-Wise Compatibility

- 1.8.1 Key Comparisons between Fabrics and Properties

2 Surface Materials for Transportation Market (by Application)

- 2.1 Application Segmentation

- 2.1.1 Application Summary

- 2.2 Surface Materials for Transportation Market (by Application)

- 2.2.1 Upholstery

- 2.2.2 Headliner

- 2.2.3 Dashboard

- 2.2.4 Others

- 2.3 Surface Materials for Transportation (by Sales Channel)

- 2.3.1 OEM

- 2.3.2 Aftermarket

- 2.4 Surface Materials for Transportation Market (by End-Use Industry)

- 2.4.1 Automotive

- 2.4.1.1 Passenger

- 2.4.1.2 Commercial

- 2.4.2 Marine

- 2.4.3 Aviation

- 2.4.4 Rail

- 2.4.1 Automotive

3 Surface Materials for Transportation Products

- 3.1 Surface Materials for Transportation Market by Material Type

- 3.1.1 Product Summary

- 3.1.2 Vinyl

- 3.1.3 Leather

- 3.1.3.1 Natural Leather

- 3.1.3.2 Synthetic Leather

- 3.1.3.2.1 Polyurethane (PU)

- 3.1.3.2.2 Polyvinyl Chloride (PVC)

- 3.1.3.2.3 Polyester

- 3.1.3.2.4 Others (Silicon- and Bio-Based)

- 3.1.4 Fabric

- 3.1.4.1 Polyester

- 3.1.4.2 Natural Fabric (including Hemp and Bambo Fiber apart from Cotton and Other Commonly Used Fabrics)

- 3.1.4.3 Wool/Nylon Blend

- 3.1.5 Other Sustainable Alternatives

- 3.1.5.1 Recycled Materials

- 3.1.5.2 Plant-Based and Bio-Based Materials

- 3.1.5.3 Bio-Based Fabric (Lyocell and Modal Fabrics)

4 Global Surface Materials for Transportation Market (by Region)

- 4.1 Surface Materials for Transportation Market (by Region)

- 4.2 Regional Summary

- 4.3 North America

- 4.3.1 Market

- 4.3.1.1 Key Market Participants in North America

- 4.3.1.2 Business Drivers

- 4.3.1.3 Business Challenges

- 4.3.2 Application

- 4.3.3 Product

- 4.3.4 North America (by Country)

- 4.3.4.1 U.S.

- 4.3.4.2 Application

- 4.3.4.3 Product

- 4.3.4.4 Canada

- 4.3.4.4.1 Application

- 4.3.4.4.2 Product

- 4.3.4.5 Mexico

- 4.3.4.5.1 Application

- 4.3.4.5.2 Product

- 4.3.1 Market

- 4.4 Europe

- 4.4.1 Market

- 4.4.1.1 Key Market Participants in Europe

- 4.4.1.2 Business Drivers

- 4.4.1.3 Business Challenges

- 4.4.2 Application

- 4.4.3 Product

- 4.4.4 Europe (by Country)

- 4.4.4.1 Germany

- 4.4.4.1.1 Application

- 4.4.4.1.2 Product

- 4.4.4.2 France

- 4.4.4.2.1 Application

- 4.4.4.2.2 Product

- 4.4.4.3 U.K.

- 4.4.4.3.1 Application

- 4.4.4.3.2 Product

- 4.4.4.4 Italy

- 4.4.4.4.1 Application

- 4.4.4.4.2 Product

- 4.4.4.5 Rest-of-Europe

- 4.4.4.5.1 Application

- 4.4.4.5.2 Product

- 4.4.4.1 Germany

- 4.4.1 Market

- 4.5 Asia-Pacific

- 4.5.1 Market

- 4.5.1.1 Key Market Participants in Asia-Pacific

- 4.5.1.2 Business Drivers

- 4.5.1.3 Business Challenges

- 4.5.2 Application

- 4.5.3 Product

- 4.5.4 Asia-Pacific (by Country)

- 4.5.4.1 China

- 4.5.4.1.1 Application

- 4.5.4.1.2 Product

- 4.5.4.2 Japan

- 4.5.4.2.1 Application

- 4.5.4.2.2 Product

- 4.5.4.3 Australia

- 4.5.4.3.1 Application

- 4.5.4.3.2 Product

- 4.5.4.4 South Korea

- 4.5.4.4.1 Application

- 4.5.4.4.2 Product

- 4.5.4.5 India

- 4.5.4.5.1 Application

- 4.5.4.5.2 Product

- 4.5.4.6 Rest-of-Asia-Pacific

- 4.5.4.6.1 Application

- 4.5.4.6.2 Product

- 4.5.4.1 China

- 4.5.1 Market

- 4.6 Rest-of-the-World

- 4.6.1 Market

- 4.6.1.1 Key Market Participants in Rest-of-the-World

- 4.6.1.2 Business Drivers

- 4.6.1.3 Business Challenges

- 4.6.2 Application

- 4.6.3 Product

- 4.6.4 Rest-of-the-World (by Country)

- 4.6.4.1 Brazil

- 4.6.4.1.1 Application

- 4.6.4.1.2 Product

- 4.6.4.2 U.A.E.

- 4.6.4.2.1 Application

- 4.6.4.2.2 Product

- 4.6.4.3 Others of Rest-of-the-World

- 4.6.4.3.1 Application

- 4.6.4.3.2 Product

- 4.6.4.1 Brazil

- 4.6.1 Market

5 Markets - Competitive Landscaped and Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographical Assessment

- 5.3 Competitive Benchmarking

- 5.4 Market Share Analysis (by Material Type)

- 5.5 Company Profiles

- 5.5.1 Lydall Gutsche GmbH & Co. KG

- 5.5.1.1 Overview

- 5.5.1.2 Top Products/Product Portfolio

- 5.5.1.3 Top Competitors

- 5.5.1.4 Target Customers/End-Use Industries

- 5.5.1.5 Key Personnel

- 5.5.1.6 Analyst View

- 5.5.1.7 Market Share (2022)

- 5.5.2 Milliken & Company

- 5.5.2.1 Overview

- 5.5.2.2 Top Products/Product Portfolio

- 5.5.2.3 Top Competitors

- 5.5.2.4 Target Customers/End-Use Industries

- 5.5.2.5 Key Personnel

- 5.5.2.6 Analyst View

- 5.5.2.7 Market Share (2022)

- 5.5.3 Toray Industries, Inc.

- 5.5.3.1 Overview

- 5.5.3.2 Top Products/Product Portfolio

- 5.5.3.3 Top Competitors

- 5.5.3.4 Target Customers/End-Use Industries

- 5.5.3.5 Key Personnel

- 5.5.3.6 Analyst View

- 5.5.3.7 Market Share (2022)

- 5.5.4 Teijin Limited

- 5.5.4.1 Overview

- 5.5.4.2 Top Products/Product Portfolio

- 5.5.4.3 Top Competitors

- 5.5.4.4 Target Customers/End-Use Industries

- 5.5.4.5 Key Personnel

- 5.5.4.6 Analyst View

- 5.5.4.7 Market Share (2022)

- 5.5.5 Sekisui Chemical Co., Ltd.

- 5.5.5.1 Overview

- 5.5.5.2 Top Products/Product Portfolio

- 5.5.5.3 Top Competitors

- 5.5.5.4 Target Customers/End-Use Industries

- 5.5.5.5 Key Personnel

- 5.5.5.6 Analyst View

- 5.5.5.7 Market Share (2022)

- 5.5.6 AUTOSTOP AVIATION

- 5.5.6.1 Overview

- 5.5.6.2 Top Products/Product Portfolio

- 5.5.6.3 Top Competitors

- 5.5.6.4 Target Customers/End-Use Industries

- 5.5.6.5 Key Personnel

- 5.5.6.6 Analyst View

- 5.5.6.7 Market Share (2022)

- 5.5.7 Schoeller Textil AG

- 5.5.7.1 Overview

- 5.5.7.2 Top Products/Product Portfolio

- 5.5.7.3 Top Competitors

- 5.5.7.4 Target Customers/End-Use Industries

- 5.5.7.5 Key Personnel

- 5.5.7.6 Analyst View

- 5.5.7.7 Market Share (2022)

- 5.5.8 MIKO srl

- 5.5.8.1 Overview

- 5.5.8.2 Top Products/Product Portfolio

- 5.5.8.3 Top Competitors

- 5.5.8.4 Target Customers/End-Use Industries

- 5.5.8.5 Key Personnel

- 5.5.8.6 Analyst View

- 5.5.8.7 Market Share (2022)

- 5.5.9 Covestro AG

- 5.5.9.1 Overview

- 5.5.9.2 Top Products/Product Portfolio

- 5.5.9.3 Top Competitors

- 5.5.9.4 Target Customers/End-Use Industries

- 5.5.9.5 Key Personnel

- 5.5.9.6 Analyst View

- 5.5.9.7 Market Share (2022)

- 5.5.10 Continental AG

- 5.5.10.1 Overview

- 5.5.10.2 Top Products/Product Portfolio

- 5.5.10.3 Top Competitors

- 5.5.10.4 Target Customers/End-Use Industries

- 5.5.10.5 Key Personnel

- 5.5.10.6 Analyst View

- 5.5.10.7 Market Share (2022)

- 5.5.11 Rogers Corporation

- 5.5.11.1 Overview

- 5.5.11.2 Top Products/Product Portfolio

- 5.5.11.3 Top Competitors

- 5.5.11.4 Target Customers/End-Use Industries

- 5.5.11.5 Key Personnel

- 5.5.11.6 Analyst View

- 5.5.11.7 Market Share (2022)

- 5.5.12 INVISTA

- 5.5.12.1 Overview

- 5.5.12.2 Top Products/Product Portfolio

- 5.5.12.3 Top Competitors

- 5.5.12.4 Target Customers/End-Use Industries

- 5.5.12.5 Key Personnel

- 5.5.12.6 Analyst View

- 5.5.12.7 Market Share (2022)

- 5.5.13 Kuraray Co. Ltd.

- 5.5.13.1 Overview

- 5.5.13.2 Top Products/Product Portfolio

- 5.5.13.3 Top Competitors

- 5.5.13.4 Target Customers/End-Use Industries

- 5.5.13.5 Key Personnel

- 5.5.13.6 Analyst View

- 5.5.13.7 Market Share (2022)

- 5.5.14 BASF SE

- 5.5.14.1 Overview

- 5.5.14.2 Top Products/Product Portfolio

- 5.5.14.3 Top Competitors

- 5.5.14.4 Target Customers/End-Use Industries

- 5.5.14.5 Key Personnel

- 5.5.14.6 Analyst View

- 5.5.14.7 Market Share (2022)

- 5.5.15 Infinited Fiber Company

- 5.5.15.1 Overview

- 5.5.15.2 Top Products/Product Portfolio

- 5.5.15.3 Top Competitors

- 5.5.15.4 Target Customers/End-Use Industries

- 5.5.15.5 Key Personnel

- 5.5.15.6 Analyst View

- 5.5.15.7 Market Share (2022)

- 5.5.1 Lydall Gutsche GmbH & Co. KG

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast