|

|

市場調査レポート

商品コード

1433284

アジア太平洋のバイオLNG市場:分析と予測(2023年~2032年)Asia-Pacific Bio-LNG Market: Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のバイオLNG市場:分析と予測(2023年~2032年) |

|

出版日: 2024年02月27日

発行: BIS Research

ページ情報: 英文 83 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年の評価 | 6,180万米ドル |

| 2032年の予測 | 3億7,400万米ドル |

| CAGR | 22.1% |

アジア太平洋のバイオLNGの市場規模(中国を除く)は、2023年に6,180万米ドルとなりました。

同市場は、2032年には3億7,400万米ドルに達すると予測され、予測期間の2023年~2032年のCAGRは22.1%になると見込まれています。バイオLNG市場は、自動車や海運などの分野での需要増に後押しされ、大幅な拡大が見込まれています。さらに、自動車産業は、様々な地域でバイオLNGの生産と利用を促進することを目的とした政府の政策やインセンティブに後押しされ、より広範囲にバイオLNGを採用すると予測されます。

アジア太平洋地域は、自動車、海運、産業用途などの分野で、よりクリーンな代替燃料への需要の高まりに牽引され、バイオLNG市場の著しい急成長を経験しています。再生可能エネルギーと環境の持続可能性を促進する政府の取り組みが、この成長をさらに後押ししています。バイオLNGの生産と流通のためのインフラへの投資はアジア太平洋諸国全体で増加傾向にあり、市場の拡大を促進しています。さらに、バイオ燃料生産プロセスの技術的進歩も市場の勢いに寄与しています。二酸化炭素の排出と気候変動に対する懸念が高まる中、バイオLNGは従来の燃料に比べて温室効果ガスの排出を削減できる有望なソリューションとして浮上しています。アジア太平洋のバイオLNG市場は、産業界と政策立案者が経済と環境の両方の目標を達成するために持続可能なエネルギー選択肢を優先する傾向が強まっていることから、大きな成長が見込まれています。

当レポートでは、アジア太平洋のバイオLNG市場について調査し、市場の概要とともに、用途別、由来別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- ビジネスダイナミクス

- スタートアップの情勢

第2章 地域

- 中国

- 市場

- 用途

- 製品

- アジア太平洋と日本

- 市場

- 用途

- 製品

- アジア太平洋と日本(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競合マトリックス

- 主要企業の製品マトリックス、由来別

- 主要企業の市場シェア分析、2022年

- 企業プロファイル

- BoxLNG Pvt. Ltd

- Air Water Inc.

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Bio-LNG Market, $Million, 2022, 2023, and 2032

- Figure 2: Asia-Pacific Bio-LNG Market (by Application), $Million, 2022, 2032

- Figure 3: Asia-Pacific Bio-LNG Market (by Source), $Million, 2022, 2032

- Figure 4: Bio-LNG Market (by Region), $Million, 2022, 2032

- Figure 5: Conventional Fuel Prices, 2020, 2021

- Figure 6: Supply Chain Analysis of Bio-LNG Market

- Figure 7: Green Methanol Market Snapshot

- Figure 8: New Registrations of Medium and Heavy Trucks Over 3.5 Tons by Fuel Type in the EU in 2020

- Figure 9: Research Methodology

- Figure 10: Top-Down and Bottom-Up Approach

- Figure 11: Bio-LNG Market Influencing Factors

- Figure 12: Assumptions and Limitations

List of Tables

- Table 1: List of Consortiums and Associations

- Table 2: List of Regulatory Bodies

- Table 3: List of Programs by Research Institutions and Universities

- Table 4: Key Product Developments

- Table 5: Key Market Developments

- Table 6: Key Mergers and Acquisitions

- Table 7: Key Partnerships and Joint Ventures

- Table 8: Bio-LNG Market (by Region), Kilo Tons, 2022-2032

- Table 9: Bio-LNG Market (by Region), $Million, 2022-2032

- Table 10: China Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 11: China Bio-LNG Market (by Application), $Million, 2022-2032

- Table 12: China Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 13: China Bio-LNG Market (by Source), $Million, 2022-2032

- Table 14: Asia-Pacific and Japan Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 15: Asia-Pacific and Japan Bio-LNG Market (by Application), $Million, 2022-2032

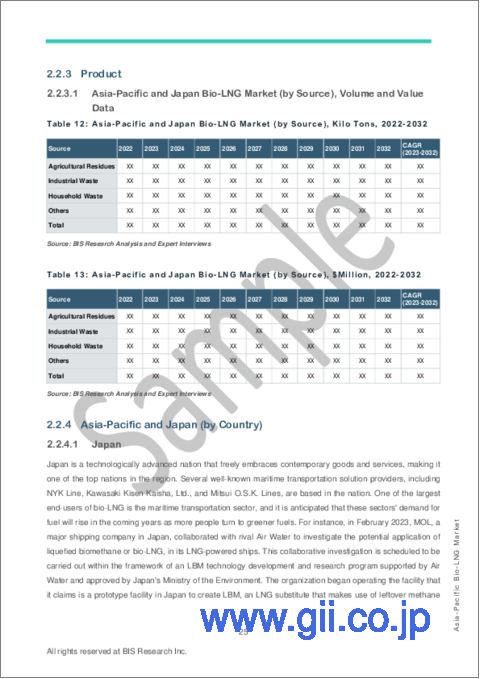

- Table 16: Asia-Pacific and Japan Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 17: Asia-Pacific and Japan Bio-LNG Market (by Source), $Million, 2022-2032

- Table 18: Japan Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 19: Japan Bio-LNG Market (by Application), $Million, 2022-2032

- Table 20: Japan Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 21: Japan Bio-LNG Market (by Source), $Million, 2022-2032

- Table 22: South Korea Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 23: South Korea Bio-LNG Market (by Application), $Million, 2022-2032

- Table 24: South Korea Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 25: South Korea Bio-LNG Market (by Source), $Million, 2022-2032

- Table 26: India Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 27: India Bio-LNG Market (by Application), $Million, 2022-2032

- Table 28: India Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 29: India Bio-LNG Market (by Source), $Million, 2022-2032

- Table 30: Australia Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 31: Australia Bio-LNG Market (by Application), $Million, 2022-2032

- Table 32: Australia Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 33: Australia Bio-LNG Market (by Source), $Million, 2022-2032

- Table 34: Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Application), Kilo Tons, 2022-2032

- Table 35: Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Application), $Million, 2022-2032

- Table 36: Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Source), Kilo Tons, 2022-2032

- Table 37: Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Source), $Million, 2022-2032

- Table 38: Product Matrix for Key Companies, By Source

- Table 39: Market Share of Key Companies, 2022

The Asia-Pacific Bio-LNG Market (excluding China) Expected to Reach $374.0 Million by 2032

Introduction to Asia-Pacific Bio-LNG Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $61.8 Million |

| 2032 Forecast | $374.0 Million |

| CAGR | 22.1% |

The Asia-Pacific bio-LNG market (excluding China) was valued at $61.8 million in 2023 and is anticipated to reach $374.0 million by 2032, witnessing a CAGR of 22.1% during the forecast period 2023-2032. The bio-LNG market is anticipated to expand significantly, fueled by increasing demand in sectors such as automotive and maritime. Furthermore, the automotive industry is forecasted to adopt bio-LNG more extensively, encouraged by government policies and incentives aimed at fostering its production and usage across various regions.

Market Introduction

The Asia-Pacific (APAC) region is experiencing a notable surge in the Bio-LNG market, driven by escalating demand for cleaner fuel alternatives in sectors like automotive, maritime, and industrial applications. Government initiatives promoting renewable energy sources and environmental sustainability further bolster this growth. Investments in infrastructure for Bio-LNG production and distribution are on the rise across APAC countries, facilitating market expansion. Moreover, technological advancements in biofuel production processes contribute to the market's momentum. With increasing concerns about carbon emissions and climate change, Bio-LNG emerges as a promising solution, offering reduced greenhouse gas emissions compared to conventional fuels. The APAC Bio-LNG market is poised for significant growth as industries and policymakers increasingly prioritize sustainable energy options to meet both economic and environmental objectives.

Market Segmentation:

Segmentation 1: by Application

- Automotive

- Ships

- Others

Segmentation 2: by Source

- Agriculture Residues

- Industrial Waste

- Household Waste

- Others

Segmentation 3: by Country

- Japan

- India

- South Korea

- Australia

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader to understand the different sources involved in producing bio-LNG. Moreover, the study provides the reader with a detailed understanding of the APAC bio-LNG market based on the application (automotive, ships, and others). Bio-LNG is gaining traction in different applications on the back of sustainability concerns and less nitrogen oxide emissions. They are also being used for controlling greenhouse gas (GHG) emissions.

Growth/Marketing Strategy: The APAC bio-LNG market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been product developments, business expansions, and acquisitions to strengthen their position in the APAC bio-LNG market.

Competitive Strategy: Key players in the APAC bio-LNG market analyzed and profiled in the study involve bio-LNG manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the APAC bio-LNG market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- BoxLNG Pvt. Ltd

- Air Water Inc

Table of Contents

Executive Summary

Scope of the Study

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Favorable Government Policies Supporting Bio-LNG Production

- 1.1.1.2 Rise in Fossil Fuel-Based Alternative Price

- 1.1.2 Supply Chain Analysis

- 1.1.3 Ecosystem/Ongoing Programs

- 1.1.3.1 Consortiums and Associations

- 1.1.3.2 Regulatory Bodies

- 1.1.3.3 Programs by Research Institutions and Universities

- 1.1.4 Impact of COVID-19 on the Bio-LNG Market

- 1.1.5 Impact of Russia-Ukraine Conflict on Bio-LNG Market

- 1.1.6 Comparative Analysis of Bio-LNG and its Substitutes

- 1.1.7 Snapshot of Green Methanol Market

- 1.1.7.1 Leading Countries in the Green Methanol Market

- 1.1.7.2 Leading Companies in Green Methanol Market

- 1.1.7.3 Green Methanol Projections

- 1.1.1 Trends: Current and Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Rising Environmental Concerns

- 1.2.1.2 Increasing Number of LNG Trucks

- 1.2.2 Business Challenges

- 1.2.2.1 Limited Availability of Feedstocks

- 1.2.2.2 High Price of Bio-LNG as Compared to LNG

- 1.2.3 Business Strategies

- 1.2.3.1 Product Developments

- 1.2.3.2 Market Developments

- 1.2.4 Corporate Strategies

- 1.2.4.1 Mergers and Acquisitions

- 1.2.4.2 Partnerships and Joint Ventures

- 1.2.5 Business Opportunities

- 1.2.5.1 Increase in Demand from Shipping Industry

- 1.2.5.2 Technological Advancement

- 1.2.1 Business Drivers

- 1.3 Start-Up Landscape

- 1.3.1 Key Start-Ups in the Ecosystem

2 Regions

- 2.1 China

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Producers and Suppliers in China

- 2.1.1.3 Regulatory Landscape

- 2.1.1.4 Business Drivers

- 2.1.1.5 Business Challenges

- 2.1.2 Application

- 2.1.2.1 China Bio-LNG Market (by Application), Volume and Value Data

- 2.1.3 Product

- 2.1.3.1 China Bio-LNG Market (by Source), Volume and Value Data

- 2.1.1 Market

- 2.2 Asia-Pacific and Japan

- 2.2.1 Markets

- 2.2.1.1 Key Producers/Suppliers in Asia-Pacific and Japan

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.2 Application

- 2.2.2.1 Asia-Pacific and Japan Bio-LNG Market (by Application), Volume and Value Data

- 2.2.3 Product

- 2.2.3.1 Asia-Pacific and Japan Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4 Asia-Pacific and Japan (by Country)

- 2.2.4.1 Japan

- 2.2.4.1.1 Market

- 2.2.4.1.1.1 Buyer Attributes

- 2.2.4.1.1.2 Key Producers and Suppliers in Japan

- 2.2.4.1.1.3 Regulatory Landscape

- 2.2.4.1.1.4 Business Drivers

- 2.2.4.1.1.5 Business Challenges

- 2.2.4.1.2 Application

- 2.2.4.1.2.1 Japan Bio-LNG Market (by Application), Volume and Value Data

- 2.2.4.1.3 Product

- 2.2.4.1.3.1 Japan Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4.1.1 Market

- 2.2.4.2 South Korea

- 2.2.4.2.1 Market

- 2.2.4.2.1.1 Buyer Attributes

- 2.2.4.2.1.2 Key Producers and Suppliers in South Korea

- 2.2.4.2.1.3 Regulatory Landscape

- 2.2.4.2.1.4 Business Drivers

- 2.2.4.2.1.5 Business Challenges

- 2.2.4.2.2 Application

- 2.2.4.2.2.1 South Korea Bio-LNG Market (by Application), Volume and Value Data

- 2.2.4.2.3 Product

- 2.2.4.2.3.1 South Korea Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4.2.1 Market

- 2.2.4.3 India

- 2.2.4.3.1 Markets

- 2.2.4.3.1.1 Buyer Attributes

- 2.2.4.3.1.2 Key Producers/ Suppliers in India

- 2.2.4.3.1.3 Regulatory Landscape

- 2.2.4.3.1.4 Business Drivers

- 2.2.4.3.1.5 Business Challenges

- 2.2.4.3.2 Application

- 2.2.4.3.2.1 India Bio-LNG Market (by Application), Volume and Value Data

- 2.2.4.3.3 Product

- 2.2.4.3.3.1 India Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4.3.1 Markets

- 2.2.4.4 Australia

- 2.2.4.4.1 Markets

- 2.2.4.4.1.1 Buyer Attributes

- 2.2.4.4.1.2 Key Producers/ Suppliers in Australia

- 2.2.4.4.1.3 Regulatory Landscape

- 2.2.4.4.1.4 Business Drivers

- 2.2.4.4.1.5 Business Challenges

- 2.2.4.4.2 Application

- 2.2.4.4.2.1 Australia Bio-LNG Market (by Application), Volume and Value Data

- 2.2.4.4.3 Product

- 2.2.4.4.3.1 Australia Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4.4.1 Markets

- 2.2.4.5 Rest-of-Asia-Pacific and Japan

- 2.2.4.5.1 Markets

- 2.2.4.5.1.1 Buyer Attributes

- 2.2.4.5.1.2 Key Producers/ Suppliers in the Rest-of-Asia-Pacific and Japan

- 2.2.4.5.1.3 Business Drivers

- 2.2.4.5.1.4 Business Challenges

- 2.2.4.5.2 Application

- 2.2.4.5.2.1 Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Application), Volume and Value Data

- 2.2.4.5.3 Product

- 2.2.4.5.3.1 Rest-of-Asia-Pacific and Japan Bio-LNG Market (by Source), Volume and Value Data

- 2.2.4.5.1 Markets

- 2.2.4.1 Japan

- 2.2.1 Markets

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.1.2 Product Matrix for Key Companies, By Source

- 3.1.3 Market Share Analysis of Key Companies, 2022

- 3.2 Company Profiles

- 3.2.1 BoxLNG Pvt. Ltd

- 3.2.1.1 Company Overview

- 3.2.1.2 Role of BoxLNG Pvt. Ltd in the Bio-LNG Market

- 3.2.1.3 Product Portfolio

- 3.2.1.4 Production Site

- 3.2.1.5 Corporate Strategies

- 3.2.1.5.1 Mergers, Acquisitions, Partnerships, and Joint Ventures

- 3.2.1.6 Analyst View

- 3.2.2 Air Water Inc.

- 3.2.2.1 Company Overview

- 3.2.2.2 Role of Air Water Inc. in the Bio-LNG Market

- 3.2.2.3 Product Portfolio

- 3.2.2.4 Production Site

- 3.2.2.5 Business Strategies

- 3.2.2.5.1 Product Developments

- 3.2.2.6 Analyst View

- 3.2.1 BoxLNG Pvt. Ltd