|

|

市場調査レポート

商品コード

1423531

欧州の航空宇宙・防衛における非破壊検査(NDT)サービス市場:分析と予測(2023年~2033年)Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market: Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の航空宇宙・防衛における非破壊検査(NDT)サービス市場:分析と予測(2023年~2033年) |

|

出版日: 2024年02月12日

発行: BIS Research

ページ情報: 英文 72 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の航空宇宙・防衛における非破壊検査(NDT)サービスの市場規模は、2033年までに4億3,700万米ドルに達する見込みです。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年評価 | 3億1,330万米ドル |

| 2033年予測 | 4億3,700万米ドル |

| CAGR | 3.38% |

欧州の航空宇宙・防衛における非破壊検査(NDT)サービスの市場規模は、2023年の3億1,330万米ドルから2033年には4億3,700万米ドルに達すると予測され、予測期間の2023年~2033年年のCAGRは3.38%になるとみられています。非破壊検査(NDT)市場の成長は、衛星コンステレーションの増加やその他の宇宙活動の成長に起因しています。宇宙および航空分野では、部品製造に複合材料のような高度な材料を利用するため、検査にコンピュータ断層撮影法のような高度な非破壊検査技術が必要となります。さらに、人工知能(AI)や機械学習(ML)を組み込むことで、検査のスピードと品質が向上します。

欧州の非破壊検査(NDT)市場は、航空宇宙・防衛産業において極めて重要な役割を担っており、一貫した安定した需要で成熟した段階を誇っています。近年、欧州の非破壊検査技術は多様化しており、超音波探傷検査、渦電流探傷検査、磁粉探傷検査、X線探傷検査などの手法を包含しています。これらの手法は、航空宇宙・防衛部品の表面、表面下、内部の欠陥を特定する上で重要な役割を果たしています。欧州NDT市場は、特に人工知能(AI)と機械学習(ML)の統合など、検査の高精度と効率化につながる技術の進歩によって、さらなる成長が見込まれています。また、航空機の整備や安全基準の維持に対する厳しい要件も、NDTサービスの需要拡大に寄与しています。

当レポートでは、欧州の航空宇宙・防衛における非破壊検査(NDT)サービス市場について調査し、市場の概要とともに、タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 業界の展望

- ビジネスダイナミクス

第2章 地域

- 航空宇宙・防衛における非破壊検査(NDT)サービス市場(地域別)

- 欧州

- 市場

- サービス

- 欧州(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 市場シェア分析

- Applus Services, S.A

- Element Materials Technology

- FORCE Technology

- Intertek Group plc

- SGS Societe Generale de Surveillance SA

- Testia

- TWI Ltd.

- Waygate Technologies

第4章 調査手法

List of Figures

- Figure 1: Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market, $Million, 2022-2033

- Figure 2: Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022 and 2033

- Figure 3: Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Region), $Million, 2023

- Figure 4: Non-Destructive Testing (NDT) Services in Aerospace and Defense Market, Business Dynamics

- Figure 5: Share of Key Market Strategies and Developments, January 2020- January 2023

- Figure 6: Non-Destructive Testing (NDT) Services in Aerospace and Defense Share (by Company), $Million, 2022

- Figure 7: Intertek Group plc: R&D Analysis, $Million, 2019-2021

- Figure 8: SGS Societe Generale de Surveillance SA: R&D Analysis, $Million, 2020-2021

- Figure 9: Waygate Technologies: R&D Analysis, $Million, 2019-2021

- Figure 10: Research Methodology

- Figure 11: Top-Down Approach

- Figure 12: Assumptions and Limitations

List of Tables

- Table 1: New Product Launches (by Company), January 2020-January 2023

- Table 2: Partnerships, Collaborations, Agreements, and Contracts, January 2020-January 2023

- Table 3: Mergers and Acquisitions, January 2020-January 2023

- Table 4: Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Region), $Million, 2022-2033

- Table 5: Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022-2033

- Table 6: Germany Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022-2033

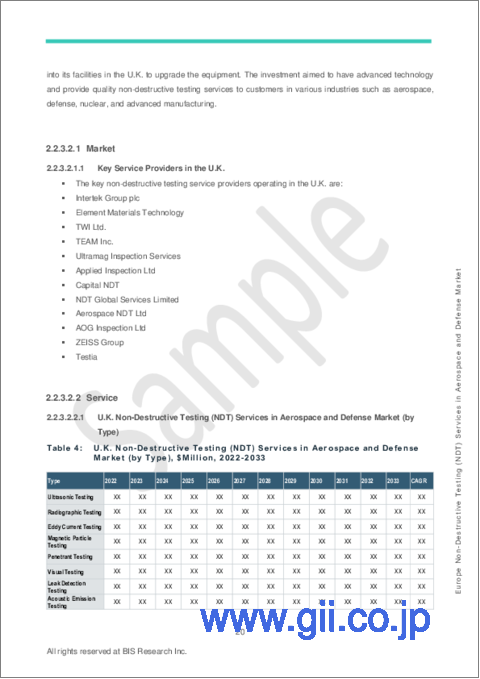

- Table 7: U.K. Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022-2033

- Table 8: France Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022-2033

- Table 9: Spain Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Payload Capacity), $Million, 2022-2033

- Table 10: Rest-of-Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type), $Million, 2022-2033

- Table 11: Applus Services, S.A.: Service Portfolio

- Table 12: Applus Services, S.A.: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 13: Applus Services, S.A.: Mergers and Acquisitions

- Table 14: Element Materials Technology: Service Portfolio

- Table 15: Element Materials Technology: Mergers and Acquisitions

- Table 16: FORCE Technology: Service Portfolio

- Table 17: FORCE Technology: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 18: Intertek Group plc: Service Portfolio

- Table 19: SGS Societe Generale de Surveillance SA: Service Portfolio

- Table 20: SGS Societe Generale de Surveillance SA: Mergers and Acquisitions

- Table 21: Testia: Service Portfolio

- Table 22: Testia: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 23: TWI Ltd.: Service Portfolio

- Table 24: TWI Ltd.: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 25: Waygate Technologies: Service Portfolio

- Table 26: Waygate Technologies: New Product Launches

The Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market Expected to Reach $437.0 Million by 2033

Introduction to Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $313.3 Million |

| 2033 Forecast | $437.0 Million |

| CAGR | 3.38% |

The Europe non-destructive testing services in aerospace and defense market is estimated to reach $437.0 million by 2033 from $313.3 million in 2023, at a CAGR of 3.38% during the forecast period 2023-2033. The growth of Non-Destructive Testing (NDT) market can be attributed to increased satellite constellations and other growing space activities. The space and aviation sectors utilize advanced materials like composites in component manufacturing, necessitating advanced NDT techniques such as computed tomography for inspections. Furthermore, the incorporation of artificial intelligence (AI) and machine learning (ML) enhances testing speed and quality.

Market Introduction

The non-destructive testing (NDT) market in Europe holds a pivotal role in the aerospace and defense industry, boasting a mature stage with consistent and stable demand. In recent years, NDT techniques in Europe have diversified, encompassing methods like ultrasonic testing, eddy current testing, magnetic particle inspection, and radiographic inspection. These methods play a crucial role in identifying surface, sub-surface, and internal defects within aerospace and defense components. The Europe NDT market is poised for further growth driven by technological advancements, notably the integration of artificial intelligence (AI) and machine learning (ML), leading to higher accuracy and efficiency in inspections. The stringent requirements for aircraft maintenance and safety standards maintenance also contribute to the growing demand for NDT services.

Market Segmentation:

Segmentation 1: by Type

- Ultrasonic Testing

- Radiographic Testing

- Eddy Current Testing

- Magnetic Particle Testing

- Penetrant Testing

- Visual Testing

- Leak Detection Testing

- Acoustic Emission Testing

- Shearography

- Thermography

Segmentation 3: by Country

- Germany

- France

- U.K.

- Spain

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The service segment helps the reader understand the different NDT methods and end users that will generate the demand for non-destructive testing services. Moreover, the study provides the reader with a detailed understanding of the different non-destructive testing services market by type (ultrasonic testing, radiographic testing, eddy current testing, magnetic particle testing, penetrant testing, visual testing, leak detection testing, acoustic emission testing, and shearography, and thermography), and country.

Growth/Marketing Strategy: The non-destructive testing services market has seen major development by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been acquisitions and contracts to strengthen their position in the Europe non-destructive testing services in aerospace and defense market.

Competitive Strategy: Key players in the Europe non-destructive testing (NDT) services in aerospace and defense market analyzed and profiled in the study involve non-destructive testing service providers. Moreover, a detailed competitive benchmarking of the players operating in the Europe non-destructive testing (NDT) services in aerospace and defense market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Applus Services, S.A.

- Element Materials Technology

- FORCE Technology

- Intertek Group plc

- SGS Societe Generale de Surveillance SA

- Testia

- TWI Ltd.

- Waygate Technologies

Table of Contents

Executive Summary

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Non-Destructive Testing Services in Aerospace and Defense: Overview

- 1.1.2 Non-Destructive Testing Services in Aerospace Manufacturing and Maintenance

- 1.1.2.1 Aviation

- 1.1.2.2 Space

- 1.1.3 Non-Destructive Testing Services in Defense Manufacturing and Maintenance

- 1.1.4 Evolving Technological Trends and Disruptions in Non-destructive Testing

- 1.1.4.1 Computed Tomography (CT) for 3D Reconstruction of the Test Parts

- 1.1.4.2 Integration of IoT and Cloud-Based Services

- 1.1.4.3 Drone-Based Enabled NDT Inspection

- 1.1.5 Evolving End-User Requirements for Non-Destructive Testing

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Easy Integration with the Manufacturing Process

- 1.2.1.2 Increase in Demand to Maintain High Standards

- 1.2.2 Business Challenges

- 1.2.2.1 Limitations in Testing Large and Complex Structures

- 1.2.2.2 Unskilled Labor for the NDT Industry 4.0

- 1.2.3 Business Strategies

- 1.2.3.1 New Product Launches

- 1.2.4 Corporate Strategies

- 1.2.4.1 Partnerships, Collaborations, Agreements, and Contracts

- 1.2.4.2 Mergers and Acquisitions

- 1.2.5 Business Opportunities

- 1.2.5.1 Upcoming Demand for Satellite Constellation to Cater NewSpace Ecosystem

- 1.2.5.2 Technological Advancements in NDT Inspections

- 1.2.1 Business Drivers

2 Region

- 2.1 Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Region)

- 2.2 Europe

- 2.2.1 Market

- 2.2.1.1 Key Service Providers in Europe

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.2 Service

- 2.2.2.1 Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type)

- 2.2.3 Europe (by Country)

- 2.2.3.1 Germany

- 2.2.3.1.1 Market

- 2.2.3.1.1.1 Key Service Providers in Germany

- 2.2.3.1.2 Service

- 2.2.3.1.2.1 Germany Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type)

- 2.2.3.1.1 Market

- 2.2.3.2 U.K.

- 2.2.3.2.1 Market

- 2.2.3.2.1.1 Key Service Providers in the U.K.

- 2.2.3.2.2 Service

- 2.2.3.2.2.1 U.K. Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type)

- 2.2.3.2.1 Market

- 2.2.3.3 France

- 2.2.3.3.1 Market

- 2.2.3.3.1.1 Key Service Providers in France

- 2.2.3.3.2 Service

- 2.2.3.3.2.1 France Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type)

- 2.2.3.3.1 Market

- 2.2.3.4 Spain

- 2.2.3.4.1 Market

- 2.2.3.4.1.1 Key Service Providers in Spain

- 2.2.3.4.2 Service

- 2.2.3.4.2.1 Spain Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Payload Capacity)

- 2.2.3.4.1 Market

- 2.2.3.5 Rest-of-Europe

- 2.2.3.5.1 Market

- 2.2.3.5.1.1.1 Key Service Providers in Rest-of-Europe

- 2.2.3.5.2 Service

- 2.2.3.5.2.1 Rest-of-Europe Non-Destructive Testing (NDT) Services in Aerospace and Defense Market (by Type)

- 2.2.3.5.1 Market

- 2.2.3.1 Germany

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Market Share Analysis

- 3.2 Applus Services, S.A.

- 3.2.1 Company Overview

- 3.2.1.1 Role of Applus Services, S.A. in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.2.1.2 Service Portfolio

- 3.2.2 Corporate Strategies

- 3.2.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.2.2.2 Mergers and Acquisitions

- 3.2.3 Analyst View

- 3.2.1 Company Overview

- 3.3 Element Materials Technology

- 3.3.1 Company Overview

- 3.3.1.1 Role of Element Materials Technology in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.3.1.2 Service Portfolio

- 3.3.2 Corporate Strategies

- 3.3.2.1 Mergers and Acquisitions

- 3.3.3 Analyst View

- 3.3.1 Company Overview

- 3.4 FORCE Technology

- 3.4.1 Company Overview

- 3.4.1.1 Role of FORCE Technology in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.4.1.2 Service Portfolio

- 3.4.2 Corporate Strategies

- 3.4.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.4.3 Analyst View

- 3.4.1 Company Overview

- 3.5 Intertek Group plc

- 3.5.1 Company Overview

- 3.5.1.1 Role of Intertek Group plc in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.5.1.2 Service Portfolio

- 3.5.2 R&D Analysis

- 3.5.3 Analyst View

- 3.5.1 Company Overview

- 3.6 SGS Societe Generale de Surveillance SA

- 3.6.1 Company Overview

- 3.6.1.1 Role of SGS Societe Generale de Surveillance SA in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.6.1.2 Service Portfolio

- 3.6.2 Corporate Strategies

- 3.6.2.1 Mergers and Acquisitions

- 3.6.3 R&D Analysis

- 3.6.4 Analyst View

- 3.6.1 Company Overview

- 3.7 Testia

- 3.7.1 Company Overview

- 3.7.1.1 Role of Testia in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.7.1.2 Service Portfolio

- 3.7.2 Corporate Strategies

- 3.7.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.7.3 Analyst View

- 3.7.1 Company Overview

- 3.8 TWI Ltd.

- 3.8.1 Company Overview

- 3.8.1.1 Role of TWI Ltd. in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.8.1.2 Service Portfolio

- 3.8.2 Corporate Strategies

- 3.8.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.8.3 Analyst View

- 3.8.1 Company Overview

- 3.9 Waygate Technologies

- 3.9.1 Company Overview

- 3.9.1.1 Role of Waygate Technologies in the Non-Destructive Testing (NDT) Services in Aerospace and Defense Market

- 3.9.1.2 Service Portfolio

- 3.9.2 Business Strategies

- 3.9.2.1 New Product Launches

- 3.9.3 R&D Analysis

- 3.9.4 Analyst View

- 3.9.1 Company Overview

4 Research Methodology

- 4.1 Factors for Data Prediction and Modeling