|

|

市場調査レポート

商品コード

1422245

アジア太平洋の急性期医療シンドロミック検査市場:分析と予測(2023年~2033年)Asia-Pacific Acute Care Syndromic Testing Market: Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の急性期医療シンドロミック検査市場:分析と予測(2023年~2033年) |

|

出版日: 2024年02月09日

発行: BIS Research

ページ情報: 英文 93 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の急性期医療シンドロミック検査の市場規模は、2023年に7億8,000万米ドルと評価され、2023年から2033年にかけて10.97%のCAGRで成長し、2033年には22億米ドルに達すると予測されています。

同市場の成長は、感染症の発生率の増加、パンデミックの発生、地球温暖化によって悪化した様々な地域における新たな感染症の特定によって、感染症の早期発見に対するニーズが高まっていることに起因しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 7億8,000万米ドル |

| 2033年予測 | 22億米ドル |

| CAGR | 10.97% |

アジア太平洋(アジア太平洋)の急性期医療シンドロミック検査市場は、力強い成長を遂げており、同地域のヘルスケア情勢における注目度が高まっています。シンドロミック検査は、急性疾患を迅速に診断・管理し、アウトブレイクや緊急事態にタイムリーに対応する上で極めて重要な役割を果たしています。この市場の拡大は、感染症の罹患率の上昇、早期診断の重要性に対する意識の高まり、診断技術の進歩といった要因によってもたらされています。

近年、アジア太平洋ではヘルスケア・インフラへの大規模な投資と革新的な診断ソリューションの導入が進んでいます。こうした投資は急性期医療シンドロミック検査市場を強化し、救急医療や重篤な医療現場においてより迅速で正確な診断を可能にしています。さらに、現在進行中のCOVID-19パンデミックは、公衆衛生対応におけるシンドロミック検査の重要な役割を強調し、アジア太平洋地域全体でこのような検査ソリューションの需要をさらに煽っています。

当レポートでは、アジア太平洋の急性期医療シンドロミック検査市場について調査し、市場の概要とともに、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 市場範囲

- 調査手法

第2章 市場概要

- 概要

- 急性期治療症候群検査のワークフロー分析

- 市場のフットプリントと成長の可能性

- 将来性

第3章 業界考察

- ステークホルダーの視点(N=20)

- 急性期医療シンドロミック検査市場の法的および規制の枠組み

- 製品のベンチマーク

第4章 市場力学

- 概要

- 影響分析

- 市場の促進要因

- 市場の課題

- 市場の機会

第5章 急性期医療シンドロミック検査市場(地域別)、2022年~2033年

- 概要

- アジア太平洋

- アジア太平洋の急性期医療シンドロミック検査市場、エンドユーザー別

- アジア太平洋の急性期医療シンドロミック検査市場、国別

第6章 企業プロファイル

- Acute Care Syndromic Testing Ecosystem Active Players

- Seegene Inc.

- SpeeDx

List of Figures

- Figure 1: Asia-Pacific Acute Care Syndromic Testing Market, $Billion, 2023 and 2033

- Figure 2: History of Known Pandemics

- Figure 3: Share of Acute Care Syndromic Testing Market (by Region), 2022

- Figure 4: Share of Key Developments and Strategies, January 2020-June 2023

- Figure 5: Acute Care Syndromic Testing Market (by Company), Share (%), 2022

- Figure 6: Acute Care Syndromic Testing Market: Research Methodology

- Figure 7: Primary Research Methodology

- Figure 8: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 9: Top-Down Approach (Segment-Wise Analysis)

- Figure 10: Acute Care Syndromic Testing Workflow

- Figure 11: Asia-Pacific Acute Care Syndromic Testing Market, $Billion, 2022-2033

- Figure 12: Physician's Perception on the Factors Affecting the Adoption of Acute Care Syndromic Testing

- Figure 13: Acute Care Syndromic Testing Market Dynamics

- Figure 14: Traditional Testing vs. Syndromic Testing

- Figure 15: Incidence of Common Infectious Diseases in the U.S (Excluding Influenza), 2020

- Figure 16: Incidence of Common Infectious Diseases in Germany (Excluding COVID-19), 2020

- Figure 17: Incidence of Common Infectious Diseases in China, 2020

- Figure 18: History of Known Pandemics

- Figure 19: Examples of Cost Reductions

- Figure 20: Time of Diagnosis vs. Disease Effect

- Figure 21: Syndromic Panels Reimbursement Scenario in the U.S.

- Figure 22: Syndromic Panels Reimbursement Scenario in Mexico

- Figure 23: Reduction in Antibiotics Use with Syndromic Testing

- Figure 24: Increasing Synergistic Activities of the Acute Care Syndromic Testing Market, January 2021-June 2023 (Number of Partnerships, Collaborations and Agreements)

- Figure 25: Key Mergers and Acquisitions in the Acute Care Syndromic Testing Market

- Figure 26: Acute Care Syndromic Testing Market Snapshot (by Region)

- Figure 27: Acute Care Syndromic Testing Market (by Region), $Billion, 2022-2033

- Figure 28: Asia-Pacific Acute Care Syndromic Testing Market, $Billion, 2022-2033

- Figure 29: Asia-Pacific Acute Care Syndromic Testing Market (by End User), $Billion, 2022-2033

- Figure 30: Asia-Pacific Acute Care Syndromic Testing Market (by Country), $Million, 2022-2033

- Figure 31: Reported Cases of Top 5 Infectious Diseases, China, 2020

- Figure 32: China Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 33: Japan Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 34: India Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 35: Incidence of the Most Common Infectious Diseases in Australia, 2021

- Figure 36: Australia Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 37: South Korea Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 38: Rest-of-Asia-Pacific Acute Care Syndromic Testing Market, $Million, 2022-2033

- Figure 39: Acute Care Syndromic Testing Market, Total Number of Companies Profiled

- Figure 40: Seegene, Inc.: Product Portfolio

- Figure 41: Seegene, Inc.: Overall Financials, $Million, 2020-2022

- Figure 42: Seegene, Inc.: Revenue (by Segment), $Million, 2020-2022

- Figure 43: Seegene, Inc.: Revenue (by Region), $Million, 2020-2022

- Figure 44: Seegene, Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 45: SpeeDX: Product Portfolio

List of Tables

- Table 1: Acute Care Syndromic Testing Product Mapping Analysis (by Disease Type)

- Table 2: Acute Care Syndromic Testing Market: Impact Analysis

- Table 3: Key Questions Answered in the Report

- Table 4: Product Benchmarking of Acute Care Syndromic Testing Panels

- Table 5: Likert Scale

- Table 6: Impact Analysis of Market Drivers

- Table 7: Impact Analysis of Market Challenges

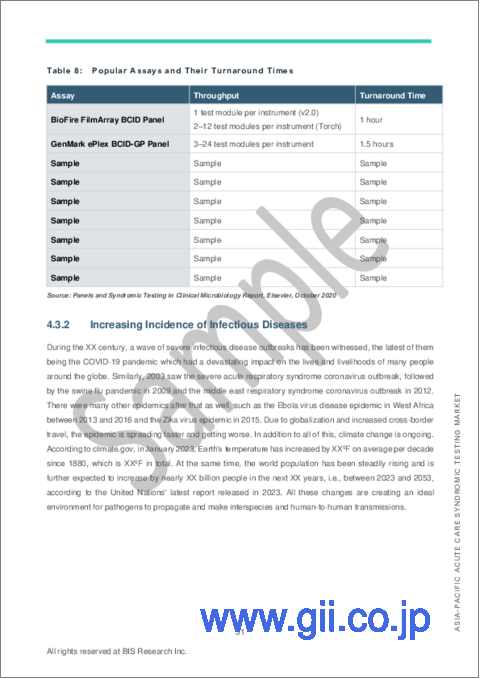

- Table 8: Popular Assays and Their Turnaround Times

- Table 9: Acute Care Syndromic Testing Ecosystem Active Players

“The Asia-Pacific Acute Care Syndromic Testing Market Expected to Reach $2.20 Billion by 2033.”

Introduction to Asia-Pacific Acute Care Syndromic Testing Market

The Asia-Pacific acute care syndromic testing market was valued at $0.78 billion in 2023 and is expected to reach $2.20 billion by 2033, growing at a CAGR of 10.97% between 2023 and 2033. The growth of the market can be attributed to the rising need for early detection of infectious diseases, driven by the growing incidence of such diseases, the occurrence of pandemics, and the identification of new infectious diseases in various regions, exacerbated by global warming.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $0.78 Billion |

| 2033 Forecast | $2.20 Billion |

| CAGR | 10.97% |

Market Introduction

The Asia-Pacific (APAC) acute care syndromic testing market is experiencing robust growth and increasing prominence in the region's healthcare landscape. Syndromic testing plays a pivotal role in rapidly diagnosing and managing acute illnesses, offering a timely response to outbreaks and emergencies. This market's expansion is driven by factors such as the rising incidence of infectious diseases, growing awareness of the importance of early diagnosis, and advancements in diagnostic technologies.

In recent years, APAC has witnessed significant investments in healthcare infrastructure and the adoption of innovative diagnostic solutions. These investments have bolstered the acute care syndromic testing market, enabling quicker and more accurate diagnoses in emergency and critical care settings. Furthermore, the ongoing COVID-19 pandemic has underscored the critical role of syndromic testing in public health response, further fueling the demand for such testing solutions across the APAC region.

Market Segmentation:

Segmentation 1: by End User

- Hospitals

- Clinical and Diagnostic Laboratories

- Research and Academic Institutions

- Other End Users

Segmentation 2: by Country

- Japan

- India

- China

- South Korea

- Australia

- Rest-of-Asia-Pacific

How Can This Report Add Value to an Organization?

Growth/Marketing Strategy: Synergistic activities, product launches, and approvals accounted for the maximum number of key developments.

Competitive Strategy: The APAC acute care syndromic testing market has numerous startups paving their way into manufacturing kits, panels, assays, and instruments and entering the market. Key players in the APAC acute care syndromic testing market analyzed and profiled in the study involve established players that offer various kinds of disease-specific panels and multiplex instruments.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

|

|

Table of Contents

Executive Summary

1. Markets

- 1.1. Market Scope

- 1.1.1. Key Questions Answered in the Report

- 1.2. Research Methodology

- 1.2.1. Acute Care Syndromic Testing Market: Research Methodology

- 1.2.2. Data Sources

- 1.2.2.1. Primary Data Sources

- 1.2.2.2. Secondary Data Sources

- 1.2.3. Market Estimation Model

- 1.2.4. Criteria for Company Profiling

2. Market Overview

- 2.1. Overview

- 2.2. Acute Care Syndromic Testing Workflow Analysis

- 2.3. Market Footprint and Growth Potential

- 2.4. Future Potential

3. Industry Insight

- 3.1. Stakeholder's Perspective (N=20)

- 3.1.1. Physician's Perception

- 3.1.2. Payor's Perception

- 3.1.3. Investor's Perception

- 3.2. Legal and Regulatory Framework of the Acute Care Syndromic Testing Market

- 3.2.1. Regulatory Framework in Asia-Pacific

- 3.2.1.1. Japan

- 3.2.1.2. China

- 3.2.1.3. India

- 3.2.1.4. South Korea

- 3.2.1.5. Australia

- 3.2.1. Regulatory Framework in Asia-Pacific

- 3.3. Product Benchmarking

4. Market Dynamics

- 4.1. Overview

- 4.2. Impact Analysis

- 4.3. Market Drivers

- 4.3.1. Faster Results Acquired with Syndromic Tests

- 4.3.2. Increasing Incidence of Infectious Diseases

- 4.3.3. Overall Reduced Cost of Care Due to Early Diagnosis with Syndromic Testing

- 4.3.4. Reduced Severe Adverse Effects from Pathogens

- 4.4. Market Challenges

- 4.4.1. Need for Better Policies with Respect to Acute Care Syndromic Test Reimbursement

- 4.4.2. Lack of High-Complexity Testing Centres

- 4.5. Market Opportunities

- 4.5.1. Quick Access to Treatment and Reduced Use of Antibiotics

- 4.5.2. High Number of Synergistic Activities and Mergers and Acquisitions (M&A) Over the Past Years

5. Acute Care Syndromic Testing Market (By Region), 2022-2033

- 5.1. Overview

- 5.2. Asia-Pacific

- 5.2.1. Asia-Pacific Acute Care Syndromic Testing Market, By End User

- 5.2.2. Asia-Pacific Acute Care Syndromic Testing Market, By Country

- 5.2.2.1. China

- 5.2.2.2. Japan

- 5.2.2.3. India

- 5.2.2.4. Australia

- 5.2.2.5. South Korea

- 5.2.2.6. Rest-of-Asia-Pacific

6. Company Profiles

- 6.1. Overview

- 6.2. Acute Care Syndromic Testing Ecosystem Active Players

- 6.3. Seegene Inc.

- 6.3.1. Company Overview

- 6.3.2. Role of Seegene, Inc. in the Acute Care Syndromic Testing Market

- 6.3.3. Financials

- 6.3.4. Recent Developments

- 6.3.4.1. Corporate Strategies

- 6.3.4.2. Business Strategies

- 6.3.5. Analyst Perspective

- 6.4. SpeeDx

- 6.4.1. Company Overview

- 6.4.2. Role of SpeeDX in the Acute Care Syndromic Testing Market

- 6.4.3. Analyst Perspective