|

|

市場調査レポート

商品コード

1422151

合成ホルモン市場の分析・予測 (2023-2033年):世界および地域の分析 - 製品タイプ・投与経路・用途・エンドユーザー・地域別Synthetic Hormones Market - A Global and Regional Analysis: Focus on Product Type, Route of Administration, Application, End User, and Region - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 合成ホルモン市場の分析・予測 (2023-2033年):世界および地域の分析 - 製品タイプ・投与経路・用途・エンドユーザー・地域別 |

|

出版日: 2024年02月08日

発行: BIS Research

ページ情報: 英文 137 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の合成ホルモンの市場規模は、2023年の194億米ドルから、予測期間中は6.98%のCAGRで推移し、2033年には380億8,000万米ドルの規模に成長すると予測されています。

同市場では、多くの企業が新規合成ホルモンの開発に積極的に取り組んでいるため、斬新なブレークスルーへの期待が成長を後押しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 194億米ドル |

| 2033年予測 | 380億8,000万米ドル |

| CAGR | 6.98% |

市場促進要因:

ホルモン障害の有病率の増加:甲状腺機能低下症、糖尿病、バランス異常を含むホルモン障害の発症の増加が合成ホルモン市場を推進する上で重要な役割を果たしています。世界保健機関 (WHO) によると、世界で数百万人がホルモン障害の影響を受けており、ホルモン補充療法の必要性が高まっています。世界人口の高齢化の進行とライフスタイルの変化に伴い、ホルモン障害の有病率は増加すると予想され、これらの症状に対処し管理するための合成ホルモンへの需要が促進されています。

市場機会:

さまざまな適応症への合成ホルモンの応用の拡大:より広範な適応症に対応する合成ホルモンの探求により、市場は従来の用途を越えて多様化しています。この多様化によって新たな成長の道が生まれ、合成ホルモンの製造業者はヘルスケア業界のさまざまな部門を開発し、より広範な患者集団にアプローチできるようになります。また、さまざまな治療分野におけるアンメットメディカルニーズに対応する機会も示されています。研究者や製薬会社は、さまざまな適応症における合成ホルモンの可能性を探る中で、現在の治療オプションにおけるギャップを特定し、これまで十分な治療を受けていなかった患者の特定のニーズを満たすための新たな解決策を開発することができます。

当レポートでは、世界の合成ホルモンの市場を調査し、市場概要、市場成長への各種影響因子の分析、特許およびR&Dの動向、法規制環境、市場規模の推移・予測、主要国別の詳細分析、主要企業の分析などをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現在および将来の影響評価

- 動向1:個別化合成ホルモン療法

- 動向2:AIの統合

- 市場規模と成長の可能性

- R&Dレビュー

- 特許公開動向 (国別)

- 特許公開動向 (年別)

- 規制状況

- 市場力学:概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 世界の合成ホルモン市場:製品タイプ別

- 市場概要

- ペプチドホルモン

- ステロイドホルモン

- その他

第3章 世界の合成ホルモン市場:投与経路別

- 市場概要

- 皮下

- 経口

- 静脈内/筋肉内

- その他

第4章 世界の合成ホルモン市場:用途別

- 市場概要

- 糖尿病

- 成長ホルモン欠乏症

- 避妊

- 男性の性腺機能低下症

- 閉経

- その他

第5章 世界の合成ホルモン市場:エンドユーザー別

- 市場概要

- 病院薬局

- 小売薬局

- オンライン薬局

第6章 地域

- 地域概要

- 促進要因・抑制要因

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第7章 市場:競合ベンチマーキング・企業プロファイル

- 企業評価

- Eli Lilly and Company

- Ferring B.V.

- Bayer AG

- Pfizer Inc.

- Novo Nordisk A/S

- Ipsen Pharma

- Novartis AG

- AbbVie, Inc.

- Changchun GeneScience Pharmaceutical Co., Ltd.

- Perrigo Company plc

- Sanofi

- Teva Pharmaceutical Industries Limited

- Viatris Inc.

第8章 調査手法

List of Figures

- Figure 1: Synthetic Hormones Optimistic, Pessimistic and Realistic Growth, 2023, 2027,2033

- Figure 2: Global Synthetic Hormones Market (by Region), $Billion, 2022, 2027, and 2033

- Figure 3: Global Synthetic Hormones Market (by Product Type), $Billion, 2022, 2027, and 2033

- Figure 4: Global Synthetic Hormones Market (by Route of Administration), $Billion, 2022, 2027, and 2033

- Figure 5: Key Events to Keep Track of within Synthetic Hormones Market

- Figure 6: Benefits of Personalized Synthetic Hormone Therapies

- Figure 7: AI Utilization in Synthetic Hormones

- Figure 8: Global Synthetic Hormones Market, $Billion, 2022-2033

- Figure 9: Patent Published (by Country), January 2020-December 2023

- Figure 10: Patent Published (by Year), January 2020-December 2023

- Figure 11: Impact Analysis of Market Dynamics, 2022-2033

- Figure 12: Trends in Occurrence of Diabetes, 2001-2020

- Figure 13: Hormonal Disorders and their Prevalence Globally, 2020

- Figure 14: Uptake of HRT Medicines and Prescribing Rate, Europe

- Figure 15: Examples of a Few Technological Advancements

- Figure 16: Factors Contributing to High Developmental Costs

- Figure 17: Cost of Synthetic Hormone Therapy

- Figure 18: Regulatory Process for Synthetic Hormones

- Figure 19: Indications and Applications of Synthetic Hormones

- Figure 20: Factors Contributing to Precision Medicine for Synthetic Hormones

- Figure 21: Strategic Initiatives, 2021-2023

- Figure 22: Data Triangulation

- Figure 23: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Global Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 4: Global Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

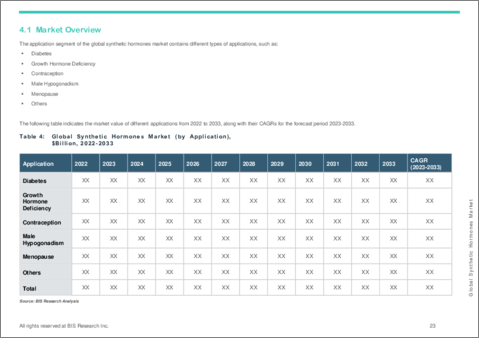

- Table 5: Global Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 6: Global Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 7: Global Synthetic Hormones Market (by Region), $Billion, 2022-2033

- Table 8: North America Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 9: North America Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 10: North America Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 11: North America Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 12: U.S. Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 13: U.S. Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 14: U.S. Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 15: U.S. Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 16: Canada Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 17: Canada Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 18: Canada Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 19: Canada Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 20: Europe Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 21: Europe Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 22: Europe Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 23: Europe Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 24: U.K. Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 25: U.K. Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 26: U.K. Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 27: U.K. Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 28: Germany Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 29: Germany Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 30: Germany Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 31: Germany Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 32: France Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 33: France Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 34: France Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 35: France Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 36: Italy Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 37: Italy Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 38: Italy Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 39: Italy Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 40: Spain Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 41: Spain Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 42: Spain Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 43: Spain Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 44: Rest-of-Europe Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 45: Rest-of-Europe Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 46: Rest-of-Europe Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 47: Rest-of-Europe Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 48: Asia-Pacific Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 49: Asia-Pacific Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 50: Asia-Pacific Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 51: Asia-Pacific Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 52: Japan Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 53: Japan Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 54: Japan Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 55: Japan Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 56: China Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 57: China Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 58: China Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 59: China Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 60: Australia Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 61: Australia Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 62: Australia Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 63: Australia Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 64: South Korea Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 65: South Korea Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 66: South Korea Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 67: South Korea Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 68: India Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 69: India Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 70: India Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 71: India Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 72: Rest-of-Asia-Pacific Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 73: Rest-of-Asia-Pacific Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 74: Rest-of-Asia-Pacific Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 75: Rest-of-Asia-Pacific Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 76: Latin America Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 77: Latin America Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 78: Latin America Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 79: Latin America Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 80: Brazil Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 81: Brazil Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 82: Brazil Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 83: Brazil Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 84: Mexico Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 85: Mexico Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 86: Mexico Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 87: Mexico Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 88: Rest-of-Latin America Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 89: Rest-of-Latin America Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 90: Rest-of-Latin America Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 91: Rest-of-Latin America Synthetic Hormones Market (by End User), $Billion, 2022-2033

- Table 92: Rest-of-the-World Synthetic Hormones Market (by Product Type), $Billion, 2022-2033

- Table 93: Rest-of-the-World Synthetic Hormones Market (by Route of Administration), $Billion, 2022-2033

- Table 94: Rest-of-the-World Synthetic Hormones Market (by Application), $Billion, 2022-2033

- Table 95: Rest-of-the-World (by End User), $Billion, 2022-2033

- Table 96: Market Share

“The Global Synthetic Hormones Market Expected to Reach $38.08 Billion by 2033.”

Global Synthetic Hormones Market Overview

The market size was estimated at $19.40 billion in 2023 and is expected to reach $38.08 billion by 2033, growing at a CAGR of 6.98% during the forecast period 2023-2033. The market's trajectory is fuelled by the promise of a novel breakthrough in the global synthetic hormones market, as numerous key players in the market are actively engaged in the pursuit of developing novel synthetic hormones.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $19.40 Billion |

| 2033 Forecast | $38.08 Billion |

| CAGR | 6.98% |

Market Lifecycle Stage

The global synthetic hormones market is currently in a mature stage, characterized by steady growth, well-established market players, and a broad range of products catering to various medical needs. Despite its maturity, the market continues to evolve, driven by ongoing research and development efforts that focus on improving the safety and effectiveness of synthetic hormones. Innovations in drug delivery systems, the advent of bioidentical hormones, and a growing emphasis on personalized medicine are key factors that keep the market dynamic.

Industry Impact

The global synthetic hormones market significantly impacts the healthcare industry by offering crucial therapeutic solutions for a myriad of hormonal disorders and conditions. Its expansive range of applications, from treating menopause symptoms and hormonal imbalances to aiding in birth control and gender-affirming treatments, has made it an indispensable part of modern healthcare. This market's growth has spurred considerable research and development investments, leading to innovative drug formulations and delivery methods that enhance efficacy and minimize side effects.

The global synthetic hormones market exerts a varied regional impact, reflecting differences in healthcare infrastructure, regulatory environments, and cultural attitudes toward hormone therapies. In North America and Europe, where the market is highly developed, there's a strong emphasis on advanced treatment options and personalized medicine, leading to the wide adoption of synthetic hormones for various therapies, including hormone replacement and contraception. These regions, with their robust healthcare systems and high healthcare spending, also drive significant research and innovation in the field. In contrast, regions such as Asia-Pacific are experiencing rapid growth in the market, fuelled by increasing awareness of hormonal health, expanding healthcare infrastructure, and rising disposable incomes.

Market Segmentation:

Segmentation 1: by Product Type

- Steroid Hormones

- Peptide Hormones

- Others

Peptide Hormones to Dominate the Global Synthetic Hormones Market (by Product Type)

The peptide hormones segment dominated the global synthetic hormones market (by product type) in 2022. The dominance of peptide hormones in the global synthetic hormones market, categorized by type, and the increasing prevalence of chronic diseases such as diabetes, which often requires insulin therapy (a peptide hormone), has led to significant demand for these treatments. Secondly, advancements in biotechnology have improved the efficacy and safety profile of peptide hormones, making them a preferred choice for both patients and healthcare providers. Additionally, the growing understanding and treatment of hormonal deficiencies and the expanding applications of peptide hormones in both therapeutic and diagnostic fields have further bolstered their market prominence.

Segmentation 2: by Route of Administration

- Subcutaneous

- Oral

- Intravenous/Intramuscular

- Others

Subcutaneous to Dominate the Global Synthetic Hormones Market (by Route of Administration)

Subcutaneous route of administration dominated the global synthetic hormones market (by route of administration) in 2022 due to its advantages in terms of efficacy, convenience, and patient compliance. Subcutaneous injections allow for the direct delivery of synthetic hormones into the fatty tissue beneath the skin, ensuring a more controlled and sustained release of the medication into the bloodstream. This method is particularly advantageous for long-term treatments, such as hormone replacement therapy, and chronic conditions, such as diabetes, where regular dosing is essential.

Segmentation 3: by Application

- Diabetes

- Growth Hormone Deficiency

- Contraception

- Male Hypogonadism

- Menopause

- Others

Diabetes to Dominate the Global Synthetic Hormones Market (by Application)

The global synthetic hormones market (by application) was dominated by the diabetes segment in 2022. This trend is largely driven by the escalating global prevalence of diabetes, particularly Type 1 and advanced Type 2, which require insulin therapy. Insulin, a critical synthetic hormone for diabetes management, has seen a surge in demand due to the growing diabetic population, increased awareness and better diagnostic practices leading to earlier and more frequent treatment initiation.

Segmentation 4: by End User

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hospital Pharmacies to Continue its Dominance in the Global Synthetic Hormones Market (by End User)

The hospital pharmacies segment accounted for the largest share of the global synthetic hormones market (by end user) in 2022. This is due to their critical role in providing comprehensive healthcare services. Hospital pharmacies are integral to the healthcare system, ensuring the availability and management of a wide range of medications, including synthetic hormones. Their proximity to diagnostic and treatment centers enables immediate and coordinated care, which is particularly vital for conditions requiring hormone therapies. Hospitals often deal with acute and severe cases where immediate hormone therapy, such as insulin for diabetes or emergency hormonal treatments, is essential.

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest-of-the-World

The synthetic hormones market in the North America region is expected to witness significant growth of 6.76% during the forecast period, marked by the high incidence of hormonal disorders, technological advancements, and high research and development investments. In 2022, Asia-Pacific accounted for a share of 32.64% of the global synthetic hormones market.

Demand - Drivers, Restraints, and Opportunities

Market Drivers:

Increasing Prevalence of Hormonal Disorders: The increasing occurrence of hormonal disorders, including hypothyroidism, diabetes, and imbalances, plays a crucial role in propelling the synthetic hormones market. According to the World Health Organization (WHO), millions of individuals globally are impacted by hormonal disorders, resulting in an escalating need for hormone replacement therapies. With the ongoing aging of the global population and shifts in lifestyles, the prevalence of hormonal disorders is anticipated to grow, driving the demand for synthetic hormones to address and manage these conditions.

Market Restraints:

High Cost of Synthetic Hormone Development and Therapy: The high cost of synthetic hormone therapy can be a major obstacle to their development and accessibility, posing challenges for both health and the synthetic hormone industry. The complexity of designing and synthesizing hormone compounds, conducting comprehensive safety and efficacy evaluations, and navigating stringent regulatory frameworks adds to the financial burden.

Market Opportunities:

Expanding Applications of Synthetic Hormone in Various Indications: The exploration of synthetic hormones for a broader range of medical indications allows the market to diversify its reach beyond traditional applications. This diversification creates new avenues for growth, enabling synthetic hormone manufacturers to tap into different segments of the healthcare industry and reach a more extensive patient population. It also provides an opportunity to address unmet medical needs in various therapeutic areas. As researchers and pharmaceutical companies explore the potential of synthetic hormones in different indications, they can identify gaps in current treatment options and develop novel solutions to meet the specific needs of patients with previously underserved.

How can this report add value to an organization?

Workflow/Innovation Strategy: The synthetic hormones market (by product type) has been segmented based on product type, including peptide hormones, steroid hormones, and others. Moreover, the study provides the reader with a detailed understanding of the different routes of administration and application.

Growth/Marketing Strategy: To foster growth in the global synthetic hormones market, a dual strategy focusing on research and development for safer, more effective formulations, alongside expanding global outreach through strategic partnerships and education campaigns, is essential. Emphasizing personalized medicine and leveraging digital platforms for market expansion and patient engagement can also be pivotal in driving market growth and visibility.

Competitive Strategy: Key players in the global synthetic hormones market have been analyzed and profiled in the study, including manufacturers involved in new product launches, acquisitions, expansions, and strategic collaborations. Moreover, a detailed competitive benchmarking of the players operating in the global synthetic hormones market has been done to help the reader understand how players stack against each other, presenting a clear market landscape.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue is estimated to be the same as the company's net revenue distribution. All the numbers are adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR is calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and based on several indications. All the key manufacturing companies that have a significant number of offerings to the synthetic hormones market have been considered and profiled in the report.

- In the study, the primary respondent's verification has been considered to finalize the estimated market for the synthetic hormone market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company, if stated.

Primary Research

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding of the numbers of the various markets for market type

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- World Health Organization (WHO), PubMed, and National Center for Biotechnology Information (NCBI), Food and Drug Administration (FDA)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolio

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The global synthetic hormones market includes a diverse range of products designed to mimic natural hormones in the human body. These synthetic hormones are widely used for various therapeutic purposes, including hormone replacement therapy (HRT), contraception, and treatment of endocrine disorders. The market is driven by factors such as the increasing prevalence of hormonal imbalance disorders, the aging global population, and advancements in biotechnology that have improved the efficacy and safety of synthetic hormones.

Key factors driving this expansion include the rising awareness about gender-affirming treatments and the growing demand for effective contraception methods, which are contributing to the market's expansion. The development of new delivery systems and formulations that enhance patient compliance and reduce side effects further fuels the market growth. However, concerns over the potential side effects of long-term hormone use and stringent regulatory frameworks can pose challenges to market expansion. Overall, the synthetic hormones market is expected to continue growing, driven by the need for effective treatments for hormonal disorders and the ongoing research and development in this field.

Some of the prominent companies in this market are:

|

|

Companies that are not a part of the aforementioned pool have been well-represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1. Markets

- 1.1. Trends: Current and Future Impact Assessment

- 1.1.1. Trend 1: Personalized Synthetic Hormones Therapies

- 1.1.2. Trend 2: Integration of Artificial Intelligence (AI)

- 1.2. Market Footprint and Growth Potential, $Billion, 2022-2033

- 1.3. Research and Development Review

- 1.3.1. Patent Publishing Trend (by Country)

- 1.3.2. Patent Publishing Trend (by Year)

- 1.4. Regulatory Landscape

- 1.5. Market Dynamics: Overview

- 1.5.1. Market Drivers

- 1.5.2. Market Restraints

- 1.5.3. Market Opportunities

2. Global Synthetic Hormones Market (by Product Type)

- 2.1. Market Overview

- 2.1.1. Peptide Hormones

- 2.1.2. Steroid Hormones

- 2.1.3. Others

3. Global Synthetic Hormones Market (by Route of Administration)

- 3.1. Market Overview

- 3.1.1. Subcutaneous

- 3.1.2. Oral

- 3.1.3. Intravenous/Intramuscular

- 3.1.4. Others

4. Global Synthetic Hormones Market (by Application)

- 4.1. Market Overview

- 4.1.1. Diabetes

- 4.1.2. Growth Hormone Deficiency

- 4.1.3. Contraception

- 4.1.4. Male Hypogonadism

- 4.1.5. Menopause

- 4.1.6. Others

5. Global Synthetic Hormones Market (by End User)

- 5.1. Market Overview

- 5.1.1. Hospital Pharmacies

- 5.1.2. Retail Pharmacies

- 5.1.3. Online Pharmacies

6. Regions

- 6.1. Regional Summary

- 6.2. Drivers and Restraints

- 6.3. North America

- 6.3.1. Regional Overview

- 6.3.1.1. Driving Factors for Market Growth

- 6.3.1.2. Factors Challenging the Market

- 6.3.2. U.S.

- 6.3.3. Canada

- 6.3.1. Regional Overview

- 6.4. Europe

- 6.4.1. Driving Factors for Market Growth

- 6.4.2. Factors Challenging the Market

- 6.4.3. U.K.

- 6.4.4. Germany

- 6.4.5. France

- 6.4.6. Italy

- 6.4.7. Spain

- 6.4.8. Rest-of-Europe

- 6.5. Asia-Pacific

- 6.5.1. Regional Overview

- 6.5.1.1. Driving Factors for Market Growth

- 6.5.1.2. Factors Challenging the Market

- 6.5.2. Japan

- 6.5.3. China

- 6.5.4. Australia

- 6.5.5. South Korea

- 6.5.6. India

- 6.5.7. Rest-of-Asia-Pacific

- 6.5.1. Regional Overview

- 6.6. Latin America

- 6.6.1. Regional Overview

- 6.6.1.1. Driving Factors for Market Growth

- 6.6.1.2. Factors Challenging the Market

- 6.6.2. Brazil

- 6.6.3. Mexico

- 6.6.4. Rest-of-Latin America

- 6.6.1. Regional Overview

- 6.7. Rest-of-the-World

- 6.7.1. Regional Overview

- 6.7.1.1. Driving Factors for Market Growth

- 6.7.1.2. Factors Challenging the Market

- 6.7.1. Regional Overview

7. Markets - Competitive Benchmarking & Company Profiles

- 7.1. Company Assessment

- 7.1.1. Eli Lilly and Company

- 7.1.1.1. Overview

- 7.1.1.2. Top Products

- 7.1.1.3. Top Competitors

- 7.1.1.4. Key Personnel

- 7.1.1.5. Analyst View

- 7.1.2. Ferring B.V.

- 7.1.2.1. Overview

- 7.1.2.2. Top Products

- 7.1.2.3. Top Competitors

- 7.1.2.4. Key Personnel

- 7.1.2.5. Analyst View

- 7.1.3. Bayer AG

- 7.1.3.1. Overview

- 7.1.3.2. Top Products

- 7.1.3.3. Top Competitors

- 7.1.3.4. Key Personnel

- 7.1.3.5. Analyst View

- 7.1.4. Pfizer Inc.

- 7.1.4.1. Overview

- 7.1.4.2. Top Products

- 7.1.4.3. Top Competitors

- 7.1.4.4. Key Personnel

- 7.1.4.5. Analyst View

- 7.1.5. Novo Nordisk A/S

- 7.1.5.1. Overview

- 7.1.5.2. Top Products

- 7.1.5.3. Top Competitors

- 7.1.5.4. Key Personnel

- 7.1.5.5. Analyst View

- 7.1.6. Ipsen Pharma

- 7.1.6.1. Overview

- 7.1.6.2. Top Products

- 7.1.6.3. Top Competitors

- 7.1.6.4. Key Personnel

- 7.1.6.5. Analyst View

- 7.1.7. Novartis AG

- 7.1.7.1. Overview

- 7.1.7.2. Top Products

- 7.1.7.3. Top Competitors

- 7.1.7.4. Key Personnel

- 7.1.7.5. Analyst View

- 7.1.8. AbbVie, Inc.

- 7.1.8.1. Overview

- 7.1.8.2. Top Products

- 7.1.8.3. Top Competitors

- 7.1.8.4. Key Personnel

- 7.1.8.5. Analyst View

- 7.1.9. Changchun GeneScience Pharmaceutical Co., Ltd.

- 7.1.9.1. Overview

- 7.1.9.2. Top Products

- 7.1.9.3. Top Competitors

- 7.1.9.4. Key Personnel

- 7.1.9.5. Analyst View

- 7.1.10. Perrigo Company plc

- 7.1.10.1. Overview

- 7.1.10.2. Top Products

- 7.1.10.3. Top Competitors

- 7.1.10.4. Key Personnel

- 7.1.10.5. Analyst View

- 7.1.11. Sanofi

- 7.1.11.1. Overview

- 7.1.11.2. Top Products

- 7.1.11.3. Top Competitors

- 7.1.11.4. Key Personnel

- 7.1.11.5. Analyst View

- 7.1.12. Teva Pharmaceutical Industries Limited

- 7.1.12.1. Overview

- 7.1.12.2. Top Products

- 7.1.12.3. Top Competitors

- 7.1.12.4. Key Personnel

- 7.1.12.5. Analyst View

- 7.1.13. Viatris Inc.

- 7.1.13.1. Overview

- 7.1.13.2. Top Products

- 7.1.13.3. Top Competitors

- 7.1.13.4. Key Personnel

- 7.1.13.5. Analyst View

- 7.1.1. Eli Lilly and Company

8. Research Methodology

- 8.1. Data Sources

- 8.1.1. Primary Data Sources

- 8.1.2. Secondary Data Sources

- 8.1.3. Data Triangulation