|

|

市場調査レポート

商品コード

1421493

アジア太平洋の水電解用電源装置市場:分析と予測(2023年~2032年)Asia-Pacific Power Supply Equipment Market for Water Electrolysis: Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の水電解用電源装置市場:分析と予測(2023年~2032年) |

|

出版日: 2024年02月07日

発行: BIS Research

ページ情報: 英文 83 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の水電解用電源装置の市場規模(中国を除く)は、2023年に5,050万米ドルとなりました。

同市場は今後、CAGR 35.67%で拡大し、年~2032年年には7億8,560万米ドルに達すると予測されています。水電解電源装置市場の成長は、有利な政府政策、厳しいネットゼロ目標、水素燃料電池車、環境に優しいアンモニア、持続可能なメタノール、および同様の用途に対する要求の増加によって推進されると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年の評価 | 5,050万米ドル |

| 年~2032年年予測 | 7億8,560万米ドル |

| CAGR | 35.67% |

アジア太平洋は、水電解用電源装置市場において重要な市場になろうとしています。この成長の原動力は、クリーンエネルギーと持続可能性の促進を目的とした政策やインセンティブを通じた政府支援の増加など、複合的な要因です。アジア太平洋諸国は、エネルギー転換戦略における水素の重要性を認識しつつあり、水電解技術とそれに関連する電源装置への投資を後押ししています。

さらに、この地域の技術進歩、特に固体高分子形燃料電池(PEM)電解は、これらのシステムに合わせた特殊な電源装置の需要に寄与しています。アジア太平洋の広大な再生可能エネルギーの可能性と、再生可能エネルギー源の電力供給チェーンへの統合も、市場の成長を促進する上で重要な役割を果たしています。グリーン水素への注目が高まるにつれ、アジア太平洋の水電解用電源装置市場は大幅な拡大が見込まれます。同地域の企業は、この成長分野でのプレゼンスを確立するため、研究開発に積極的に投資しています。このダイナミックな情勢は、アジア太平洋を持続可能な水素製造の将来への重要な貢献者として位置づけています。

当レポートでは、アジア太平洋の水電解用電源装置市場について調査し、市場の概要とともに、装置タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- ビジネスダイナミクス

- スタートアップの情勢

第2章 地域

- 中国

- 市場

- 応用

- 製品

- アジア太平洋と日本

- 市場

- 応用

- 製品

- アジア太平洋と日本(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競合マトリックス

- 主要企業の製品マトリックス、機器タイプ別

- 主要企業の市場シェア分析、2022年

- 企業プロファイル

- Ador Powertron Ltd

- TMEIC

- Statcon Energiaa Pvt. Ltd.

- Green Power Co., Ltd.

- Liyuan Rectifier Group

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Power Supply Equipment Market for Water Electrolysis Snapshot, $Million, 2022, 2023, 2032

- Figure 2: Asia-Pacific Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022, 2032

- Figure 3: Asia-Pacific Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022, 2032

- Figure 4: Power Supply Equipment Market for Water Electrolysis (by Region), $Million, 2022, 2032

- Figure 5: Supply Chain Analysis of the Power Supply Equipment Market for Water Electrolysis

- Figure 6: Total Addressable Market for Hydrogen & Serviceable Market for Electrolyzer, by 2050

- Figure 7: Green Hydrogen Commitment from Nations Worldwide

- Figure 8: Onshore Wind Capacity Addition (GW)

- Figure 9: Research Methodology

- Figure 10: Top-Down and Bottom-Up Approach

- Figure 11: Power Supply Equipment Market for Water Electrolysis Influencing Factors

- Figure 12: Assumptions and Limitations

List of Tables

- Table 1: Consortiums and Associations

- Table 2: Regulatory/Certification Bodies

- Table 3: Recent and Upcoming Key Green Hydrogen Projects (2020-2024)

- Table 4: List of Hydrogen Programs by Some Major Countries

- Table 5: Key Product Developments

- Table 6: Key Market Developments (2020-2023)

- Table 7: Key Mergers and Acquisitions

- Table 8: Key Partnerships and Joint Ventures

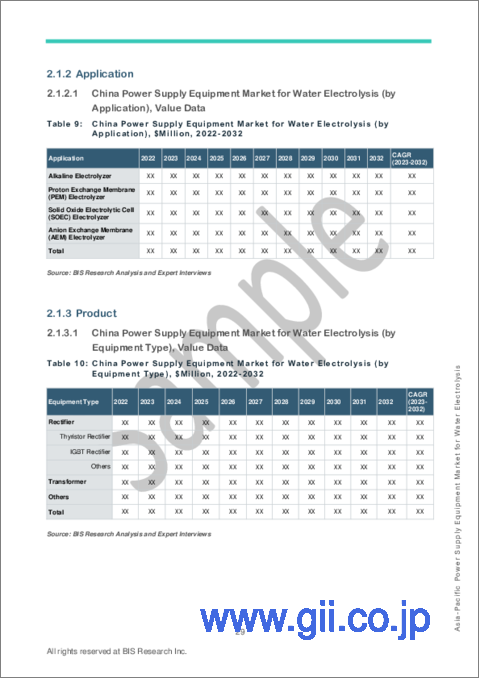

- Table 9: China Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 10: China Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 11: Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 12: Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 13: Japan Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 14: Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 15: South Korea Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 16: South Korea Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 17: India Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 18: India Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 19: Australia Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 20: Australia Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 21: Rest-of-Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Application), $Million, 2022-2032

- Table 22: Rest-of-Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), $Million, 2022-2032

- Table 23: Product Matrix for Key Companies, Equipment Type

- Table 24: Market Share of Key Companies Analysis, 2022

“The Asia-Pacific Power Supply Equipment Market for Water Electrolysis (excluding China) Expected to Reach $785.6 Million by 2032.”

Introduction to Asia-Pacific Power Supply Equipment Market for Water Electrolysis

The Asia-Pacific power supply equipment market for water electrolysis (excluding China) was valued at $50.5 million in 2023, and it is expected to grow at a CAGR of 35.67% and reach $785.6 million by 2032. The growth of the water electrolysis power supply equipment market is anticipated to be propelled by favorable government policies, stringent net-zero objectives, and increasing requirements for hydrogen fuel cell vehicles, environmentally friendly ammonia, sustainable methanol, and similar applications.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $50.5 Million |

| 2032 Forecast | $785.6 Million |

| CAGR | 35.67% |

Market Introduction

The Asia-Pacific (APAC) region is poised to become a significant player in the power supply equipment market for water electrolysis. This growth is driven by a combination of factors, including increasing government support through policies and incentives aimed at promoting clean energy and sustainability. APAC countries are increasingly recognizing the importance of hydrogen in their energy transition strategies, which is boosting investments in water electrolysis technology and its associated power supply equipment.

Moreover, the region's technological advancements, particularly in proton exchange membrane (PEM) electrolysis, are contributing to the demand for specialized power supply equipment tailored to these systems. APAC's vast renewable energy potential and the integration of renewable sources into the power supply chain also play a crucial role in driving the market's growth. As the focus on green hydrogen intensifies, the APAC power supply equipment market for water electrolysis is expected to witness significant expansion. Companies in the region are actively investing in research and development to establish their presence in this growing segment. This dynamic landscape positions APAC as a key contributor to the future of sustainable hydrogen production.

Market Segmentation:

Segmentation 1: by Application

- Alkaline Electrolyzer

- Proton Exchange Membrane (PEM) Electrolyzer

- Solid Oxide Electrolytic Cell (SOEC) Electrolyzer

- Anion Exchange Membrane (AEM) Electrolyzer

Segmentation 2: by Equipment Type

- Rectifier

- Thyristor Rectifier

- IGBT Rectifier

- Others

- Transformer

- Others

Segmentation 3: by Country

- Japan

- South Korea

- India

- Australia

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the power supply equipment used in the water electrolysis process, including rectifiers, transformers, and others. Moreover, the study provides the reader with a detailed understanding of the power supply equipment market for water electrolysis by different applications (alkaline electrolyzer, proton exchange membrane (PEM) electrolyzer, solid oxide electrolytic cell (SOEC) electrolyzer, and anion exchange membrane (AEM) electrolyzer).

Growth/Marketing Strategy: The power supply equipment market for water electrolysis has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships, agreements, and collaborations.

Competitive Strategy: The key players in the Asia-Pacific power supply equipment market for water electrolysis analyzed and profiled in the study involve power supply equipment manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the APAC power supply equipment market for water electrolysis has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

|

|

Table of Contents

Executive Summary

Scope of the Study

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Trends: Current and Future

- 1.1.1.1. Rising Interest in Green Hydrogen as a Clean Energy Source

- 1.1.1.2. Advancements in Power Electronics

- 1.1.2. Supply Chain Analysis

- 1.1.3. Ecosystem of Power Supply Equipment Market for Water Electrolysis

- 1.1.3.1. Consortiums and Associations

- 1.1.3.2. Regulatory/Certification Bodies

- 1.1.3.3. Government Programs

- 1.1.3.4. Programs by Research Institutions and Universities

- 1.1.4. Total Addressable Market for Hydrogen & Serviceable Market for Electrolyzer, by 2050

- 1.1.5. Key Strategies Adopted Across Globe: Sustainable Hydrogen

- 1.1.6. Recent and Upcoming Key Green Hydrogen Projects (2020-2024)

- 1.1.7. Impact of COVID-19 on the Power Supply Equipment Market for Water Electrolysis

- 1.1.1. Trends: Current and Future

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Shift toward Renewable Energy Integration

- 1.2.1.2. Government Support for Renewable Hydrogen Production

- 1.2.2. Business Challenges

- 1.2.2.1. Expensive Hydrogen Technology

- 1.2.2.2. High Energy Losses during the Electrolysis Process

- 1.2.3. Business Strategies

- 1.2.4. Product Developments

- 1.2.5. Market Developments

- 1.2.6. Corporate Strategies

- 1.2.7. Mergers and Acquisitions

- 1.2.8. Partnerships and Joint Ventures

- 1.2.9. Business Opportunities

- 1.2.9.1. Advancements in Electrolysis Technology

- 1.2.9.2. Lucrative Demand for Water Electrolysis from End-User Industries

- 1.2.1. Business Drivers

- 1.3. Start-Up Landscape

- 1.3.1. Key Start-Ups in the Ecosystem

2. Region

- 2.1. China

- 2.1.1. Market

- 2.1.1.1. Buyer Attributes

- 2.1.1.2. Key Producers and Suppliers in China

- 2.1.1.3. Regulatory Landscape

- 2.1.1.4. Business Drivers

- 2.1.1.5. Business Challenges

- 2.1.2. Application

- 2.1.2.1. China Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.1.3. Product

- 2.1.3.1. China Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.1.1. Market

- 2.2. Asia-Pacific and Japan

- 2.2.1. Markets

- 2.2.1.1. Key Producers and Suppliers in Asia-Pacific and Japan

- 2.2.1.2. Business Drivers

- 2.2.1.3. Business Challenges

- 2.2.2. Application

- 2.2.2.1. Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.3. Product

- 2.2.3.1. Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4. Asia-Pacific and Japan (by Country)

- 2.2.4.1. Japan

- 2.2.4.1.1. Markets

- 2.2.4.1.1.1. Buyer Attributes

- 2.2.4.1.1.2. Key Producers and Suppliers in Japan

- 2.2.4.1.1.3. Regulatory Landscape

- 2.2.4.1.1.4. Business Drivers

- 2.2.4.1.1.5. Business Challenges

- 2.2.4.1.2. Application

- 2.2.4.1.2.1. Japan Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.4.1.3. Product

- 2.2.4.1.3.1. Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4.1.1. Markets

- 2.2.4.2. South Korea

- 2.2.4.2.1. Market

- 2.2.4.2.1.1. Buyer Attributes

- 2.2.4.2.1.2. Key Producers and Suppliers in South Korea

- 2.2.4.2.1.3. Regulatory Landscape

- 2.2.4.2.1.4. Business Drivers

- 2.2.4.2.1.5. Business Challenges

- 2.2.4.2.2. Application

- 2.2.4.2.2.1. South Korea Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.4.2.3. Product

- 2.2.4.2.3.1. South Korea Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4.2.1. Market

- 2.2.4.3. India

- 2.2.4.3.1. Markets

- 2.2.4.3.1.1. Buyer Attributes

- 2.2.4.3.1.2. Key Producers and Suppliers in India

- 2.2.4.3.1.3. Regulatory Landscape

- 2.2.4.3.1.4. Business Drivers

- 2.2.4.3.1.5. Business Challenges

- 2.2.4.3.2. Application

- 2.2.4.3.2.1. India Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.4.3.3. Product

- 2.2.4.3.3.1. India Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4.3.1. Markets

- 2.2.4.4. Australia

- 2.2.4.4.1. Markets

- 2.2.4.4.1.1. Buyer Attributes

- 2.2.4.4.1.2. Key Producers and Suppliers in Australia

- 2.2.4.4.1.3. Regulatory Landscape

- 2.2.4.4.1.4. Business Drivers

- 2.2.4.4.1.5. Business Challenges

- 2.2.4.4.2. Application

- 2.2.4.4.2.1. Australia Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.4.4.3. Product

- 2.2.4.4.3.1. Australia Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4.4.1. Markets

- 2.2.4.5. Rest-of-Asia-Pacific and Japan

- 2.2.4.5.1. Market

- 2.2.4.5.1.1. Buyer Attribute

- 2.2.4.5.1.2. Key Producers and Suppliers in Rest-of-Asia-Pacific and Japan

- 2.2.4.5.1.3. Business Drivers

- 2.2.4.5.1.4. Business Challenges

- 2.2.4.5.2. Application

- 2.2.4.5.2.1. Rest-of-Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Application), Value Data

- 2.2.4.5.3. Product

- 2.2.4.5.3.1. Rest-of-Asia-Pacific and Japan Power Supply Equipment Market for Water Electrolysis (by Equipment Type), Value Data

- 2.2.4.5.1. Market

- 2.2.4.1. Japan

- 2.2.1. Markets

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.1.1. Competitive Position Matrix

- 3.1.2. Product Matrix for Key Companies, Equipment Type

- 3.1.3. Market Share Analysis of Key Companies, 2022

- 3.2. Company Profiles

- 3.2.1. Ador Powertron Ltd

- 3.2.1.1. Company Overview

- 3.2.1.1.1. Role of Ador Powertron Ltd in the Power Supply Equipment Market for Water Electrolysis

- 3.2.1.1.2. Product Portfolio

- 3.2.1.1.3. Production Sites

- 3.2.1.2. Analyst View

- 3.2.1.1. Company Overview

- 3.2.2. TMEIC

- 3.2.2.1. Company Overview

- 3.2.2.1.1. Role of TMEIC in the Power Supply Equipment Market for Water Electrolysis

- 3.2.2.1.2. Product Portfolio

- 3.2.2.1.3. Production Sites

- 3.2.2.2. Business Strategies

- 3.2.2.2.1. Product Developments

- 3.2.2.3. Analyst View

- 3.2.2.1. Company Overview

- 3.2.3. Statcon Energiaa Pvt. Ltd.

- 3.2.3.1. Company Overview

- 3.2.3.1.1. Role of Statcon Energiaa Pvt. Ltd. in the Power Supply Equipment Market for Water Electrolysis

- 3.2.3.1.2. Product Portfolio

- 3.2.3.1.3. Production Sites

- 3.2.3.2. Analyst View

- 3.2.3.1. Company Overview

- 3.2.4. Green Power Co., Ltd.

- 3.2.4.1. Company Overview

- 3.2.4.1.1. Role of Green Power Co., Ltd. in the Power Supply Equipment Market for Water Electrolysis

- 3.2.4.1.2. Product Portfolio

- 3.2.4.1.3. Production Sites

- 3.2.4.2. Business Strategies

- 3.2.4.2.1. Product and Market Developments

- 3.2.4.3. Analyst View

- 3.2.4.1. Company Overview

- 3.2.5. Liyuan Rectifier Group

- 3.2.5.1. Company Overview

- 3.2.5.1.1. Role of Liyuan Rectifier Group in the Power Supply Equipment Market for Water Electrolysis

- 3.2.5.1.2. Product Portfolio

- 3.2.5.1.3. Production Sites

- 3.2.5.1.4. Business Strategies

- 3.2.5.1.4.1. Product Developments

- 3.2.5.1.4.2. Market Developments

- 3.2.5.2. Analyst View

- 3.2.5.1. Company Overview

- 3.2.1. Ador Powertron Ltd