|

|

市場調査レポート

商品コード

1420107

歯科感染症対策市場:世界および地域別分析 - 分析と予測(2023年~2033年)Dental Infections Control Market: A Global and Regional Analysis, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 歯科感染症対策市場:世界および地域別分析 - 分析と予測(2023年~2033年) |

|

出版日: 2024年02月05日

発行: BIS Research

ページ情報: 英文 158 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

世界の歯科感染症対策の市場規模は、予測期間の2023年~2033年にかけて大幅な成長が予測されています。

さらに、2022年の市場価値は12億1,530万米ドルで、2033年には24億4,540万米ドルに達すると予測され、予測期間中のCAGRは6.59 %になる見込みです。この成長は、歯科問題の有病率の上昇に加え、衛生、技術の進歩、機器の近代化を促進する政府支援のイニシアチブの増加に起因しています。この市場には、歯科医療現場における感染予防のためのさまざまな消耗品や使い捨て製品、機器が含まれます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年評価 | 12億9,000万米ドル |

| 2033年予測 | 24億4,000万米ドル |

| CAGR | 6.59% |

世界の歯科感染症対策市場は、成長・拡大段階の発展段階にあります。近年、滅菌機器(高速蒸散用)の改良と技術革新が進んでいます。より速く、より効率的に、またはより費用対効果の高い感染制御を提供する新しい技術や機器は、市場のさらなる活性化につながる可能性があります。

世界の歯科感染症対策市場は歯科業界に大きな影響を及ぼし、口腔ヘルスケアにおける基準や慣行を根本的に再構築しています。感染リスクに対する意識の高まりは、高度な管理ソリューションに対する需要の増加に拍車をかけ、歯科医療現場における製品開発と手順プロトコルの両方に影響を与えています。厳しい規制要件と患者の安全性重視の高まりにより、歯科開業医と施設は革新的な感染制御技術と手順に投資せざるを得なくなっています。

要するに、世界の歯科感染症対策市場は、感染制御と予防における数々の画期的な進歩を支援するだけでなく、その触媒となってきたのです。その影響力は、方法がより洗練され、利用しやすくなるにつれて拡大し続けており、将来的にはさらに画期的な発見が期待されます。

当レポートでは、世界の歯科感染症対策市場について調査し、市場の概要とともに、オファリング別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

範囲と定義

市場/製品の定義

主な質問への回答

分析と予測に関するメモ

第1章 歯科感染症対策市場:業界の展望

- 動向:現在および将来の影響評価- 歯科感染症対策市場

- 市場規模と成長の可能性、2022年~2033年

- 歯科感染症対策市場の研究開発レビュー

- 歯科感染症対策市場の規制状況

- COVID-19が歯科感染症対策市場に与える影響

- 歯科感染症対策市場の新興技術評価

- 歯科感染症対策市場の製品ベンチマーク

- 市場力学の概要

第2章 世界の歯科感染症対策市場、オファリング別

- オファリングのセグメンテーション

- 提供内容の概要

- 消耗品および使い捨て製品

- 設備

第3章 世界の歯科感染症対策市場、エンドユーザー別

- エンドユーザーのセグメンテーション

- エンドユーザーの概要

- 歯科病院およびクリニック

- 歯科学術研究機関

- 歯科技工所

第4章 地域

- 地域別の概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第5章 市場- 競合情勢と企業プロファイル

- 競合情勢

- 企業プロファイル

- 3M

- Steris, Plc

- Dentsply Sirona, Inc

- Envista Holding Corporation

- 3D Dental

- Air Techniques, Inc.

- BMS Dental

- Getinge AB

- Young Innovations, Inc.

- COLTENE Group

- Owens & Minor Inc.

- GC Corporation

- ASA Dental

- A-dec, Inc

- Tuttnauer

第6章 調査手法

“The Global Dental Infections control Market Expected to Reach $2.44 Billion by 2033.”

Global Dental Infections Control Market Overview

The global dental infections control market is projected to experience substantial growth over the forecast period 2023-2033. Moreover, the market value for 2022 was $1,215.3 million and is expected to reach $2,445.4 million by 2033, growing at a CAGR of 6.59 % during the forecast period. This growth can be attributed to the rising prevalence of dental problems, along with the increasing government-backed initiatives promoting hygiene, technological advancements, and modernization of equipment. The market includes various consumables and single-use products and equipment for preventing infections in dental settings.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1.29 Billion |

| 2033 Forecast | $2.44 Billion |

| CAGR | 6.59% |

Market Lifecycle Stage

The global dental infections control market is in a growth and expansion stage of the development phase. The recent years have seen improvements and innovations in sterilization equipment (for fast steaming). New technologies and devices that offer faster, more efficient, or more cost-effective infection control could help rejuvenate the market further.

Industry Impact

The global dental infections control market has exerted a significant impact on the dental industry, fundamentally reshaping standards and practices within oral healthcare. Heightened awareness of infection risks has spurred an increased demand for advanced control solutions, influencing both product development and procedural protocols in dental settings. Stringent regulatory requirements and an escalating emphasis on patient safety have compelled dental practitioners and facilities to invest in innovative infection control technologies and procedures.

In essence, the global dental infections control market has not just supported but catalyzed numerous breakthroughs in infection control and prevention. Its influence continues to grow as the methods become more refined and accessible, promising even more revolutionary findings in the future.

Market Segmentation:

Segmentation 1: by Offering

- Consumables and Single-Use Products

- Cleaning and Sterilization Products

- Unit Water-Line Cleaning Management Products

- Saliva Ejectors

- Others

- Equipment's

- Cleaning Monitors

- Ultrasonic Cleaning Units

- Sterilization Equipment

Consumables and Single-Use Products to Dominate the Global Dental Infections Control Market (by Offering)

Based on offering, the consumables and single-use products segment dominated the global dental infections control market in FY2022. The consumables and single-use segment constitute the prevalent offering type owing to their widespread use in almost all applications related to the global dental infections control market. Due to the increasing utilization of equipment for infection control in the market, it is anticipated that this segment will continue to witness significant growth in the coming years.

Segmentation 2: by End User

- Dental Hospitals and Clinics

- Dental Academic and Research Institutions

- Dental Laboratories

Dental Hospitals and Clinics Segment to Hold its Dominance in the Global Dental Infections Control Market (by End User)

Based on end user, the dental hospitals and clinics segment accounted for the largest share of the global dental infections control market in FY2022. Dental infection control is a rapidly growing field of dentistry that uses equipment, consumables, and single-use products for infection control and prevention.

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest-of-the-World

Japan dominated the Asia-Pacific market in 2022, with a share of 29.51%. Moreover, Asia-Pacific is expected to register the highest CAGR of 7.64% during the forecast period 2023-2033. The dental infections control market in the Asia-Pacific (APAC) region is witnessing significant growth, driven by various factors, including increasing demand for the aging population with increasing healthcare needs. This demographic shift would drive demand for dental infections control procedures.

The economic growth in countries such as China and India is resulting in increased healthcare spending. Patients are increasingly seeking high-quality medical care, including dental infections control services. This presents substantial opportunities for market expansion. Furthermore, technological advancement and adoption are on the rise.

Recent Developments in the Global Dental Infections Control Market

- In June 2021, STERIS plc. completed the acquisition of Cantel Medical Corp., a global provider of infection control products and services to dental customers.

- In June 2022, Henry Schein Inc. signed an acquisition agreement to acquire the privately held dental distribution company Condor Dental in a transaction that would enhance Henry Schein Inc.'s ability to serve pan-European dental support organizations.

- In December 2021, Owens & Minor, Inc. announced the completion of the acquisition of American Contract Systems, which offers sterilization capabilities without the high-volume use of ethylene oxide, enhancing the safety of communities and the environment.

Demand - Drivers, Restraints, and Opportunities

Market Demand Drivers:

Rising Prevalence of Dental Problems: The rising prevalence of dental ailments, such as gum diseases and periodontitis, can lead to tooth loss and infections. As a result, there has been a substantial demand for dental infections control products to uphold oral healthcare, prevent dental infections, and address dental issues. The rise in cases of dental caries and periodontal disease is expected to drive the need for dental infections control products, thereby fostering market growth. The diminished quality of life for those dealing with oral diseases extends to psychological distress and social implications. Additionally, poor oral health can influence educational and career opportunities, creating barriers to personal and economic advancement. Investing in preventive measures for infection control is crucial to mitigating the economic impact of oral diseases.

Market Restraints:

High Initial Costs of Advanced Infection Control Equipment: The high upfront costs may limit the adoption of advanced infection control solutions, especially among smaller dental practices with budget constraints. These costs include the procurement, installation, and integration of technologies designed to ensure the highest standards of infection prevention in dental settings. The purchase of sterilization equipment, such as advanced autoclaves with novel features and technologies, requires a significant initial investment.

Market Opportunities:

Growing Dental Tourism in Emerging Economies: To boost dental tourism, health institutions are running online campaigns showcasing affordable services. They also emphasize personalized care, infection prevention measures, and affordable accommodation, making medical tourism packages attractive to consumers who can consider treatment options along with recreational choices. Due to the increasing prevalence of lifestyle-related diseases and unhealthy diets, dental disorders are on the rise. Diseases such as dental caries are becoming more common, leading to a higher demand for dental restoration procedures. This growing burden of dental issues is driving interest in cosmetic dentistry, creating opportunities for market growth.

How can this report add value to an organization?

Workflow/Innovation Strategy: The global dental infections control market (by offering) has been segmented into detailed segments, including different types of dental infections control equipment, such as cleaning monitors, ultrasonic cleaning units, and sterilization equipment. Moreover, the study provides the reader with detailed consumables and single-use products such as cleaning and sterilization products, unit water-line cleaning management products, saliva ejectors, and others.

Growth/Marketing Strategy: The dental infection control market has been experiencing notable growth driven by increasing awareness of infection risks and stringent regulatory standards. Key market players are adopting strategic initiatives to capitalize on this growth. Product innovation and technological advancements play a pivotal role, with companies focusing on developing advanced infection control solutions that meet or exceed industry standards. These innovations include the integration of smart technologies, enhanced sterilization methods, and eco-friendly disinfectants, catering to the evolving needs of dental practitioners.

Competitive Strategy: Key players in the global dental infections control market have been analyzed and profiled in the study, including manufacturers involved in acquisitions and strategic collaborations. Market participants are actively engaging in collaborations and partnerships to expand their market presence. This involves forging alliances with dental clinics, hospitals, and healthcare professionals to promote their infection control products and solutions. Additionally, mergers and acquisitions are strategic tools employed to strengthen market positions, acquire new technologies, and broaden product portfolios.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation:

- The base year considered for the calculation of the market size is 2022. The historical year analysis has been done from FY2020 to FY2021, and the market size has been calculated for FY2022 and projected for the period 2023-2033.

- The geographical distribution of the market revenue has been estimated to be the same as the company's net revenue distribution. All the numbers have been adjusted to two digits after decimals for report presentation reasons. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. CAGR is calculated from 2023 to 2033.

- The market has been mapped based on different types of products available in the market and based on several indications. All the key manufacturing companies that have a significant number of offerings to the global dental infections control market have been considered and profiled in the report.

- In the study, the primary respondent's verification has been considered to finalize the estimated market for the global dental infections control market.

- The latest annual reports of each market player have been taken into consideration for market revenue calculation.

- Market strategies and developments of key players have been considered for the calculation of sub-segment split.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year. The currency conversion rate has been taken from the historical exchange rate of the Oanda website or from the annual reports of the respective company if stated.

Primary Research

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding of the numbers of the various markets for market type

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- National Center for Biotechnology Information (NCBI), PubMed, Science Direct, World Bank Group, Organisation for Economic Co-operation and Development (OECD), Centers for Disease Control and Prevention (CDC), Global Burden Disease (GBD), and World Health Organization (WHO)

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolio

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentations, split-ups, and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

Controlling dental infections involves the systematic implementation of measures and protocols aimed at preventing, managing, and mitigating the spread of infections within dental care settings. This includes stringent adherence to sterilization procedures, the utilization of effective disinfectants, and the maintenance of a hygienic environment to ensure the highest standards of infection prevention and control in dental practices.

The dental infections control market consists of consumables and single-use products and equipment for the management and control of various infections in the dental practice. The dental infections control market includes equipment such as cleaning monitors, ultrasonic cleaning units, and sterilization equipment. It also includes consumables and single-use products, such as cleaning and sterilization products, unit water-line cleaning management products, and saliva ejectors.

Some of the prominent companies in this market are:

|

|

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Dental Infections Control Market: Industry Outlook

- 1.1. Trends: Current and Future Impact Assessment- Dental Infections Control Market

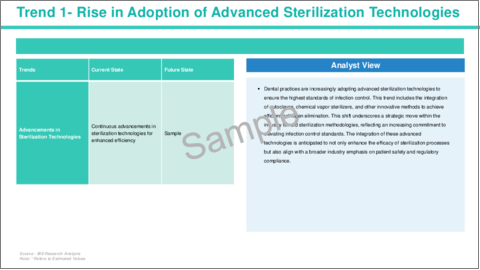

- 1.1.1. Rise in Adoption of Advanced Sterilization Technologies

- 1.1.2. Shift Towards Single-Use Disposable Products

- 1.1.3. Integration of Digital Solutions and IoT

- 1.2. Market Footprint and Growth Potential, $ Billion, 2022-2033

- 1.3. R&D Review of the Dental Infections Control Market

- 1.3.1. Patent Filing Trend by Country, by Year

- 1.3.2. Patent Filing Trend by Country, by Country

- 1.3.3. Patent Filing Trend by Country, by Offering

- 1.4. Regulatory Landscape of the Dental Infections Control Market

- 1.5. Impact of COVID-19 on Dental Infections Control Market

- 1.5.1. Pre COVID and During COVID

- 1.5.2. Impact of COVID-19 on Hospitals and Clinics and Dental Manufacturers

- 1.6. Emerging Technology Assessment of the Dental Infections Control Market

- 1.7. Product Benchmarking of the Dental Infections Control Market

- 1.7. Market Dynamics Overview

- 1.7.1. Market Drivers

- 1.7.2. Market Restraints

- 1.7.3. Market Opportunities

2. Global Dental Infections Control Market (By Offering)

- 2.1. Offering Segmentation

- 2.2. Offering Summary

- 2.3. Consumables and Single-Use Products

- 2.3.1. Cleaning and Sterilization Products

- 2.3.2. Unit Water-Line Cleaning Management Products

- 2.3.3. Saliva Ejectors

- 2.3.3. Others

- 2.4. Equipment's

- 2.4.1. Cleaning Monitors

- 2.4.2. Ultrasonic Cleaning Units

- 2.4.3. Sterilization Equipment

3. Global Dental Infections Control Market (By End User)

- 3.1. End User Segmentation

- 3.2. End User Summary

- 3.3. Dental Hospitals and Clinics

- 3.4. Dental Academic and Research Institutions

- 3.5. Dental Laboratories

4. Region

- 4.1. Regional Summary

- 4.2. Drivers and Restraints

- 4.3. North America

- 4.3.1. North America Dental Infections Market, by Offering

- 4.3.2. North America Dental Infections Market, by End User

- 4.3.3. North America (by Country)

- 4.3.3.1. U.S.

- 4.3.3.2. Canada

- 4.4. Europe

- 4.4.1. Europe Dental Infections Market, by Offering

- 4.4.2. Europe Dental Infections Market, by End User

- 4.4.3. Europe (by Country)

- 4.4.3.1. U.K.

- 4.4.3.2. Germany

- 4.4.3.3. France

- 4.4.3.4. Italy

- 4.4.3.5. Spain

- 4.4.3.6. Rest-of-Europe

- 4.5. Asia-Pacific

- 4.5.1. Asia-Pacific Dental Infections Market, by Offering

- 4.5.2. Asia-Pacific Dental Infections Market, by End User

- 4.5.3. Asia-Pacific (by Country)

- 4.5.3.1. Japan

- 4.5.3.2. China

- 4.5.3.3. Australia

- 4.5.3.4. South Korea

- 4.5.3.5. India

- 4.5.3.6. Rest-of-Asia-Pacific

- 4.6. Latin America

- 4.6.1. Latin America Dental Infections Market, by Offering

- 4.6.2. Latin America Dental Infections Market, by End User

- 4.6.3. Latin America (by Country)

- 4.6.3.1. Brazil

- 4.6.3.2. Mexico

- 4.6.3.3. Rest-of-Latin America

- 4.7. Rest-of-the-World

- 4.7.1. Rest-of-the-World Dental Infections Market, by Offering

- 4.7.2. Rest-of-the-World Dental Infections Market, by End User

5. Markets - Competitive Landscape and Company Profiles

- 5.1. Competitive Landscape

- 5.2. Company Profile

- 5.2.1. 3M

- 5.2.1.1. Company Overview

- 5.2.1.2. Product Portfolio

- 5.2.1.3. Key Personnel

- 5.2.1.4. Target Customers

- 5.2.1.5. Top Competitors

- 5.2.1.6. Market Share

- 5.2.1.7. Analyst View

- 5.2.2. Steris, Plc

- 5.2.2.1. Company Overview

- 5.2.2.2. Product Portfolio

- 5.2.2.3. Key Personnel

- 5.2.2.4. Target Customers

- 5.2.2.5. Top Competitors

- 5.2.2.6. Market Share

- 5.2.2.7. Analyst View

- 5.2.3. Dentsply Sirona, Inc

- 5.2.3.1. Company Overview

- 5.2.3.2. Product Portfolio

- 5.2.3.3. Key Personnel

- 5.2.3.4. Target Customers

- 5.2.3.5. Top Competitors

- 5.2.3.6. Market Share

- 5.2.3.7. Analyst View

- 5.2.4. Envista Holding Corporation

- 5.2.4.1. Company Overview

- 5.2.4.2. Product Portfolio

- 5.2.4.3. Key Personnel

- 5.2.4.4. Target Customers

- 5.2.4.5. Top Competitors

- 5.2.4.6. Market Share

- 5.2.4.7. Analyst View

- 5.2.5. 3D Dental

- 5.2.5.1. Company Overview

- 5.2.5.2. Product Portfolio

- 5.2.5.3. Key Personnel

- 5.2.5.4. Target Customers

- 5.2.5.5. Top Competitors

- 5.2.5.6. Market Share

- 5.2.5.7. Analyst View

- 5.2.6. Air Techniques, Inc.

- 5.2.6.1. Company Overview

- 5.2.6.2. Product Portfolio

- 5.2.6.3. Key Personnel

- 5.2.6.4. Target Customers

- 5.2.6.5. Top Competitors

- 5.2.6.6. Market Share

- 5.2.6.7. Analyst View

- 5.2.7. BMS Dental

- 5.2.7.1. Company Overview

- 5.2.7.2. Product Portfolio

- 5.2.7.3. Key Personnel

- 5.2.7.4. Target Customers

- 5.2.7.5. Top Competitors

- 5.2.7.6. Market Share

- 5.2.7.7. Analyst View

- 5.2.8. Getinge AB

- 5.2.8.1. Company Overview

- 5.2.8.2. Product Portfolio

- 5.2.8.3. Key Personnel

- 5.2.8.4. Target Customers

- 5.2.8.5. Top Competitors

- 5.2.8.6. Market Share

- 5.2.8.7. Analyst View

- 5.2.9. Young Innovations, Inc.

- 5.2.9.1. Company Overview

- 5.2.9.2. Product Portfolio

- 5.2.9.3. Key Personnel

- 5.2.9.4. Target Customers

- 5.2.9.5. Top Competitors

- 5.2.9.6. Market Share

- 5.2.9.7. Analyst View

- 5.2.10. COLTENE Group

- 5.2.10.1. Company Overview

- 5.2.10.2. Product Portfolio

- 5.2.10.3. Key Personnel

- 5.2.10.4. Target Customers

- 5.2.10.5. Top Competitors

- 5.2.10.6. Market Share

- 5.2.10.7. Analyst View

- 5.2.11. Owens & Minor Inc.

- 5.2.11.1. Company Overview

- 5.2.11.2. Product Portfolio

- 5.2.11.3. Key Personnel

- 5.2.11.4. Target Customers

- 5.2.11.5. Top Competitors

- 5.2.11.6. Market Share

- 5.2.11.7. Analyst View

- 5.2.12. GC Corporation

- 5.2.12.1. Company Overview

- 5.2.12.2. Product Portfolio

- 5.2.12.3. Key Personnel

- 5.2.12.4. Target Customers

- 5.2.12.5. Top Competitors

- 5.2.12.6. Market Share

- 5.2.12.7. Analyst View

- 5.2.13. ASA Dental

- 5.2.13.1. Company Overview

- 5.2.13.2. Product Portfolio

- 5.2.13.3. Key Personnel

- 5.2.13.4. Target Customers

- 5.2.13.5. Top Competitors

- 5.2.13.6. Market Share

- 5.2.13.7. Analyst View

- 5.2.14. A-dec, Inc

- 5.2.14.1. Company Overview

- 5.2.14.2. Product Portfolio

- 5.2.14.3. Key Personnel

- 5.2.14.4. Target Customers

- 5.2.14.5. Top Competitors

- 5.2.14.6. Market Share

- 5.2.14.7. Analyst View

- 5.2.15. Tuttnauer

- 5.2.15.1. Company Overview

- 5.2.15.2. Product Portfolio

- 5.2.15.3. Key Personnel

- 5.2.15.4. Target Customers

- 5.2.15.5. Top Competitors

- 5.2.15.6. Market Share

- 5.2.15.7. Analyst View

- 5.2.1. 3M