|

|

市場調査レポート

商品コード

1419002

欧州の新興感染症診断市場:分析・予測 (2023-2033年)Europe Emerging Infectious Disease Diagnostics Market: Analysis and Forecast, 2023-2033 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 欧州の新興感染症診断市場:分析・予測 (2023-2033年) |

|

出版日: 2024年01月31日

発行: BIS Research

ページ情報: 英文 127 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州の新興感染症診断の市場規模は、2023年の47億米ドルから、予測期間中はCAGR 5.28%で推移し、2033年には78億5,000万米ドルの規模に達すると予測されています。

同市場は、いくつかの重要な要因によって成長を遂げています。これらの要因には、感染症の経済的影響、資金援助やパートナーシップを通じた政府からの財政支援、ポイントオブケア検査やシンドロミック検査に対する需要の高まり、分子診断技術の進歩などが含まれます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 47億米ドル |

| 2033年予測 | 78億5,000万米ドル |

| CAGR | 5.28% |

欧州の新興感染症診断市場は、感染因子を迅速かつ正確に同定・検出することを目的とした多様な手法や技術によって特徴付けられます。この分野は、疾病のタイムリーな診断に重要な役割を果たし、適切な治療方針の決定や公衆衛生への対応を促進しています。欧州では、微生物培養が依然として基本的な方法であり、患者検体を特殊な増殖培地で培養し、特定の病原体を分離・同定します。これにより、原因菌を正確に特定し、抗菌薬に対する感受性を評価することができます。さらに、急速に発展している分子診断も注目されています。ポリメラーゼ連鎖反応 (PCR) や核酸増幅検査 (NAAT) のような技術が広く採用されており、低濃度でも高感度で特異的な病原体の同定が可能です。技術の進歩が進み、公衆衛生が重視されるようになったことで、新興感染症診断の欧州市場は継続的な発展と革新が見込まれています。

当レポートでは、欧州の新興感染症診断の市場を調査し、市場概要、市場成長への各種影響因子の分析、特許・パイプラインの動向、法規制環境、市場規模の推移・予測、主要国別の詳細分析、主要企業の分析などをまとめています。

市場の分類

セグメンテーション1:用途別

- ラボ検査

- ポイントオブケア検査

セグメンテーション2:技術別

- ポリメラーゼ連鎖反応 (PCR)

- 等温核酸増幅技術 (INAAT)

- 次世代シーケンサー (NGS)

- 免疫診断

- その他

セグメンテーション3:感染タイプ別

- 細菌

- ウイルス

- 真菌

- その他

セグメンテーション4:疾患タイプ別

- 呼吸器感染症

- 性感染症 (STI)

- 消化器感染症

- その他

セグメンテーション5:エンドユーザー別

- 病院・診療所

- 診断ラボ

- その他

セグメンテーション6:国別

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

目次

エグゼクティブサマリー

調査範囲

調査手法

第1章 市場

- 市場の見通し

- 業界の展望

- 市場概要

- 特許分析

- パイプライン分析

- COVID-19の感染症診断への影響

- サプライチェーン分析

- 市場力学

- 影響分析

- 促進要因

- 抑制要因

- 機会

第2章 新興感染症診断市場 (地域別)

- 欧州の新興感染症診断市場

- 規制の枠組み

- 市場力学

- 市場規模・予測

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合情勢

- 概要

- 経営戦略

- 事業戦略

- 市場シェア分析

- 新興感染症診断エコシステムのアクティブ企業

- 企業プロファイル

- bioMerieux S.A.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

- Tecan Trading AG

- Siemens Healthineers AG

- 企業スナップショット

- En Carta Diagnostics

List of Figures

- Figure 1: Europe Emerging Infectious Disease Diagnostics Market (by Technology), $Billion, 2022-2033

- Figure 2: Europe Emerging Infectious Disease Diagnostics Market, Impact Analysis

- Figure 3: Europe Emerging Infectious Disease Diagnostics Market (by Technology), Share (%), 2022 and 2033

- Figure 4: Europe Emerging Infectious Disease Diagnostics Market (by Application), Share (%), 2022 and 2033

- Figure 5: Share of Key Developments, January 2019-June 2023

- Figure 6: Market Share Analysis for Emerging Infectious Disease Diagnostics Market (by Company), 2022

- Figure 7: Key Insights Validated from Primary Interviews

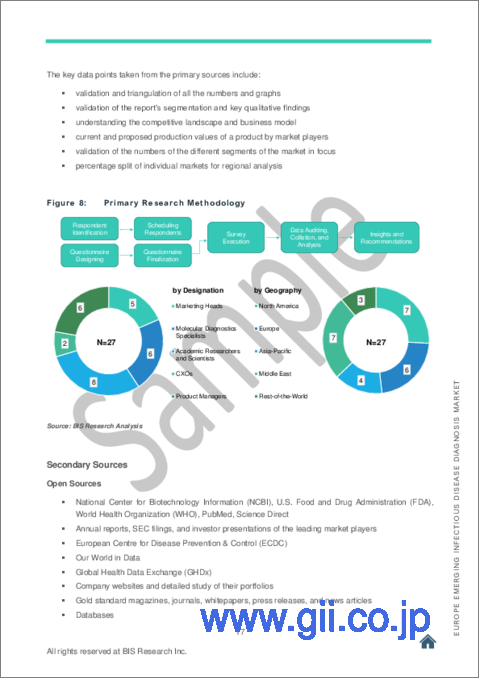

- Figure 8: Emerging Infectious Disease Diagnostics Market Research Methodology

- Figure 9: Primary Research Methodology

- Figure 10: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 11: Top-Down Approach (Segment-Wise Analysis)

- Figure 12: Timeline of Emerging Technologies for Infectious Disease Diagnostics

- Figure 13: Advantages of Emerging Infectious Disease Diagnostic Technologies

- Figure 14: Limitations of Emerging Infectious Disease Diagnostic Technologies

- Figure 15: Key Settings of POC Testing Deployment

- Figure 16: Key Challenges Associated with Point-of-Care Testing

- Figure 17: Emerging Infectious Disease Diagnostics Market (by Technology), $Billion, 2022-2033

- Figure 18: Future Potential of NGS in Infectious Disease Diagnostics

- Figure 19: Number of Molecular Diagnostics Patents for Infectious Diseases (by Year)

- Figure 20: Number of Molecular Diagnostic Patents for Infectious Diseases (by Country/Organization)

- Figure 21: Key Benefits of Home-Based Testing

- Figure 22: Typical Supply Chain for a Diagnostic Test

- Figure 23: Emerging Infectious Disease Diagnostics Market, Impact Analysis

- Figure 24: Fiscal Response to the COVID-19 Pandemic (% of GDP)

- Figure 25: Advantages of Point-of-Care Tests in Molecular Diagnostics

- Figure 26: Key Clinical Areas Demanding Commercial Availability of Syndromic Tests

- Figure 27: Advantages of INAAT over PCR

- Figure 28: Number of LAMP Publications on Public Databases, 2016-2022

- Figure 29: Number of INAAT Publications on Public Databases, 2016-2022

- Figure 30: Advantages of Digital PCR over Quantitative Real-Time PCR

- Figure 31: Number of "Digital PCR" Publications on Public Databases, 2016-2022

- Figure 32: Europe Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 33: Europe Emerging Infectious Disease Diagnostics Market (by Application), $Billion, 2022-2033

- Figure 34: Europe Emerging Infectious Disease Diagnostics Market (by Technology), $Billion, 2022-2033

- Figure 35: Europe Emerging Infectious Disease Diagnostics Market (by Type of Infection), $Billion, 2022-2033

- Figure 36: Europe Emerging Infectious Disease Diagnostics Market (by Disease Type), $Billion, 2022-2033

- Figure 37: Europe Emerging Infectious Disease Diagnostics Market (by End User), $Billion, 2022-2033

- Figure 38: Europe Emerging Infectious Disease Diagnostics Market (by Country), % Share, 2022 and 2033

- Figure 39: Germany Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 40: Germany Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 41: U.K. Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 42: U.K. Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 43: France Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 44: France Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 45: Italy Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 46: Italy Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 47: Spain Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 48: Spain Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 49: Rest-of-Europe Emerging Infectious Disease Diagnostics Market, $Billion, 2022-2033

- Figure 50: Rest-of-Europe Emerging Infectious Disease Diagnostics Market (by End User), $Million, 2022-2033

- Figure 51: Share of Key Developments, January 2019-June 2023

- Figure 52: Number of Mergers and Acquisitions (by Company), January 2019-June 2023

- Figure 53: Share of Synergistic Activities (by Company), January 2019-June 2023

- Figure 54: Number of Business Expansions and Funding Activities (by Company), January 2019-June 2023

- Figure 55: Number of Product Launches/Upgradations/Approvals (by Company), January 2019-June 2023

- Figure 56: Market Share Analysis for Emerging Infectious Disease Diagnostics Market (by Company), 2022

- Figure 57: Emerging Infectious Disease Diagnostics Market, Total Number of Companies Profiled

- Figure 58: bioMerieux S.A.: Product Portfolio

- Figure 59: bioMerieux S.A.: Overall Financials, $Million, 2020-2022

- Figure 60: bioMerieux S.A.: Revenue (by Segment), $Million, 2020-2022

- Figure 61: bioMerieux S.A.: Revenue (by Region), $Million, 2020-2022

- Figure 62: bioMerieux S.A.: R&D Expenditure, $Million, 2020-2022

- Figure 63: DiaSorin S.p.A.: Product Portfolio

- Figure 64: DiaSorin S.p.A.: Overall Financials, $Million, 2021-2022

- Figure 65: DiaSorin S.p.A.: Revenue (by Region), $Million, 2021-2022

- Figure 66: DiaSorin S.p.A.: R&D Expenditure, $Million, 2021-2022

- Figure 67: F. Hoffmann-La Roche Ltd: Product Portfolio

- Figure 68: F. Hoffmann-La Roche Ltd: Overall Financials, 2020-2022

- Figure 69: F. Hoffmann-La Roche Ltd: Revenue (by Segment), 2020-2022

- Figure 70: F. Hoffmann-La Roche Ltd: R&D Expenditure, 2020-2022

- Figure 71: QIAGEN N.V.: Product Portfolio

- Figure 72: QIAGEN N.V.: Overall Financials, $Million, 2020-2022

- Figure 73: QIAGEN N.V.: Revenue (by Segment), $Million, 2020-2022

- Figure 74: QIAGEN N.V.: Revenue (by Region), $Million, 2020-2022

- Figure 75: QIAGEN N.V.: R&D Expenditure, $Million, 2020-2022

- Figure 76: Tecan Trading AG: Product Portfolio

- Figure 77: Tecan Trading AG: Overall Financials, $Million, 2020-2022

- Figure 78: Tecan Trading AG: Revenue (by Segment), $Million, 2020-2022

- Figure 79: Tecan Trading AG: Revenue (by Region), $Million, 2020-2022

- Figure 80: Tecan Trading AG: R&D Expenditure, $Million, 2020-2022

- Figure 81: Siemens Healthineers AG: Product Portfolio

- Figure 82: Siemens Healthineers AG: Overall Financials, $Million, 2020-2022

- Figure 83: Siemens Healthineers AG: Revenue (by Segment), $Million, 2020-2022

- Figure 84: Siemens Healthineers AG: Revenue (by Region), $Million, 2020-2022

- Figure 85: Siemens Healthineers AG: R&D Expenditure, $Million, 2020-2022

- Figure 86: En Carta Diagnostics: Overall Product Portfolio

List of Tables

- Table 1: Some of the Key Developments By Companies Leveraging Emerging Technologies in Infectious Disease Diagnostics

- Table 2: Key Product Offerings by Players in the Emerging Infectious Disease Diagnostics Market

- Table 3: Key Questions Answered in the Report

- Table 4: Some of the RT-LAMP Assays Developed during COVID-19

- Table 5: Molecular Diagnostic Products for Infectious Diseases Under Development

- Table 6: At-Home COVID-19 Kits Approved for Commercial Use by ICMR

- Table 7: Examples of International Research Consortiums for Managing Response to Infectious Diseases

- Table 8: List of Infectious Disease Outbreaks (by Region and Year)

- Table 9: Europe Emerging Infectious Disease Diagnostics Market, Impact Analysis

- Table 10: Emerging Infectious Disease Diagnostics Market, Key Active Players

“The Europe Emerging Infectious Disease Diagnostics Market Expected to Reach $7.85 Billion by 2033.”

Introduction to Europe Emerging Infectious Disease Diagnostics Market

The Europe emerging infectious disease diagnostics market was valued at $4.70 billion in 2023 and is expected to reach $7.85 billion by 2033, growing at a CAGR of 5.28% between 2023 and 2033. The market for diagnosing emerging infectious diseases is experiencing growth due to several key factors. These factors encompass the economic impact of infectious diseases, financial support from governments through funding and partnerships, rising demand for point-of-care and syndromic testing, and advancements in molecular diagnostics technology.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $4.70 Billion |

| 2033 Forecast | $7.85 Billion |

| CAGR | 5.28% |

Market Introduction

The European emerging infectious disease diagnostics market is characterized by a diverse array of methods and techniques aimed at identifying and detecting infectious agents swiftly and accurately. This sector plays a crucial role in the timely diagnosis of diseases, facilitating appropriate treatment decisions and public health responses. Within Europe, microbiological culture remains a fundamental method, involving the cultivation of patient specimens on specialized growth media to isolate and identify specific pathogens. This allows for the precise determination of the causative organism and an assessment of its susceptibility to antimicrobial agents. In addition, molecular diagnostics, a rapidly evolving field, is gaining prominence. Techniques like polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs) are extensively employed, offering highly sensitive and specific pathogen identification, even at low concentrations. With ongoing technological advancements and a growing emphasis on public health, the European market for emerging infectious disease diagnostics is poised for continuous development and innovation.

Market Segmentation:

Segmentation 1: by Application

- Laboratory Testing

- Point-of-Care Testing

Segmentation 2: by Technology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Next-Generation Sequencing (NGS)

- Immunodiagnostics

- Other Technologies

Segmentation 3: by Type of Infection

- Bacterial

- Viral

- Fungal

- Other Infections

Segmentation 4: by Disease Type

- Respiratory Infections

- Sexually Transmitted Infections (STIs)

- Gastrointestinal Infections

- Other Infections

Segmentation 5: by End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Other End Users

Segmentation 6: by Country

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The Europe emerging infectious disease diagnostics market has been extensively segmented on the basis of various categories, such as application, technology, type of infection, disease type, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: The Europe emerging infectious disease diagnostics market is fragmented, with several established as well as emerging players. Key players in the Europe emerging infectious disease diagnostics market analyzed and profiled in the study involve established players that offer various kinds of molecular diagnostic tests for infectious diseases.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent names in this market are:

|

|

Table of Contents

Executive Summary

Scope of the Study

Research Methodology

1. Markets

- 1.1. Market Outlook

- 1.1.1. Product Definition

- 1.1.2. Inclusion and Exclusion Criteria

- 1.1.3. Key Findings

- 1.2. Industry Outlook

- 1.2.1. Market Overview

- 1.2.1.1. Timeline of Emerging Technologies for Infectious Disease Diagnostics

- 1.2.1.2. Advantages and Limitations of Emerging Infectious Disease Diagnostic Technologies

- 1.2.1.3. Advantages and Limitations of Point-of-Care Emerging Infectious Disease Diagnostics

- 1.2.1.4. Current Market Landscape of Emerging Infectious Disease Diagnostics

- 1.2.1.5. Future Potential

- 1.2.1.5.1. CRISPR

- 1.2.1.5.2. NGS

- 1.2.1.5.3. INAAT

- 1.2.1.5.4. Digital PCR (dPCR)

- 1.2.2. Patent Analysis

- 1.2.2.1. By Year

- 1.2.2.2. By Country/Organization

- 1.2.3. Pipeline Analysis

- 1.2.4. Impact of COVID-19 on Infectious Disease Diagnostics

- 1.2.4.1. Post-COVID-19 Scenario: A Paradigm Shift to Home-Based Testing

- 1.2.5. Supply Chain Analysis

- 1.2.1. Market Overview

- 1.3. Market Dynamics

- 1.3.1. Impact Analysis

- 1.3.2. Drivers

- 1.3.2.1. Economic Burden of Infectious Diseases

- 1.3.2.2. Government Support to Advance Research and Facilitate Early Diagnosis of Infectious Diseases Through Funding and Collaboration

- 1.3.2.3. Increasing Demand for Point-of-Care (POC) and Syndromic Testing

- 1.3.2.4. Technological Advancements in Molecular Diagnostics

- 1.3.2.4.1. Isothermal Nucleic Acid Amplification Techniques (INAATs)

- 1.3.2.4.2. Digital PCR

- 1.3.2.4.3. CRISPR Technologies

- 1.3.3. Restraints

- 1.3.3.1. Poor Reimbursement for Molecular Diagnostic Tests for Infectious Diseases

- 1.3.3.2. Erratic Trend in Infectious Disease Epidemic Outbreaks Globally

- 1.3.3.3. Lack of an Established Framework for NGS-based Tests for Infectious Diseases

- 1.3.4. Opportunities

- 1.3.4.1. Potential of Molecular Diagnostic Tests in Low-Resource Settings

- 1.3.4.2. Potential of Rapid Point-of-Care Tests in Managing Antimicrobial Resistance

2. Emerging Infectious Disease Diagnostics Market (by Region)

- 2.1. Europe Emerging Infectious Disease Diagnostics Market

- 2.1.1. Regulatory Framework

- 2.1.2. Market Dynamics

- 2.1.2.1. Impact Analysis

- 2.1.3. Market Sizing and Forecast

- 2.1.3.1. Europe Emerging Infectious Disease Diagnostics Market (by Application)

- 2.1.3.2. Europe Emerging Infectious Disease Diagnostics Market (by Technology)

- 2.1.3.3. Europe Emerging Infectious Disease Diagnostics Market (by Type of Infection)

- 2.1.3.4. Europe Emerging Infectious Disease Diagnostics Market (by Disease Type)

- 2.1.3.5. Europe Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.1. Germany

- 2.1.3.5.1.1. Market Dynamics

- 2.1.3.5.1.2. Market Size and Forecast

- 2.1.3.5.1.2.1. Germany Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.2. U.K.

- 2.1.3.5.2.1. Market Dynamics

- 2.1.3.5.2.2. Market Size and Forecast

- 2.1.3.5.2.2.1. U.K. Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.3. France

- 2.1.3.5.3.1. Market Dynamics

- 2.1.3.5.3.2. Market Size and Forecast

- 2.1.3.5.3.2.1. France Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.4. Italy

- 2.1.3.5.4.1. Market Dynamics

- 2.1.3.5.4.2. Market Size and Forecast

- 2.1.3.5.4.2.1. Italy Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.5. Spain

- 2.1.3.5.5.1. Market Dynamics

- 2.1.3.5.5.2. Market Size and Forecast

- 2.1.3.5.5.2.1. Spain Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.6. Rest-of-Europe

- 2.1.3.5.6.1. Market Dynamics

- 2.1.3.5.6.2. Market Size and Forecast

- 2.1.3.5.6.2.1. Rest-of-Europe Emerging Infectious Disease Diagnostics Market (by End User)

- 2.1.3.5.1. Germany

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Landscape

- 3.1.1. Overview

- 3.1.2. Corporate Strategies

- 3.1.2.1. Mergers and Acquisitions

- 3.1.2.2. Synergistic Activities

- 3.1.2.3. Business Expansions and Funding

- 3.1.3. Business Strategies

- 3.1.3.1. Product Launches/Upgradations/Approvals

- 3.2. Market Share Analysis

- 3.3. Emerging Infectious Disease Diagnostics Ecosystem Active Players

- 3.4. Company Profiles

- 3.4.1. bioMerieux S.A.

- 3.4.1.1. Company Overview

- 3.4.1.2. Role of bioMerieux S.A. in the Emerging Infectious Disease Diagnostics Market

- 3.4.1.3. Financials

- 3.4.1.1. Recent Developments

- 3.4.1.2. Analyst Perspective

- 3.4.2. DiaSorin S.p.A.

- 3.4.2.1. Company Overview

- 3.4.2.2. Role of DiaSorin S.p.A. in the Emerging Infectious Disease Diagnostics Market

- 3.4.2.3. Financials

- 3.4.2.4. Recent Developments

- 3.4.2.5. Analyst Perspective

- 3.4.3. F. Hoffmann-La Roche Ltd

- 3.4.3.1. Company Overview

- 3.4.3.2. Role of F. Hoffmann-La Roche Ltd in the Emerging Infectious Disease Diagnostics Market

- 3.4.3.3. Financials

- 3.4.3.4. Recent Developments

- 3.4.3.5. Analyst Perspective

- 3.4.4. QIAGEN N.V.

- 3.4.4.1. Company Overview

- 3.4.4.2. Role of QIAGEN N.V. in the Emerging Infectious Disease Diagnostics Market

- 3.4.4.3. Financials

- 3.4.4.4. Recent Developments

- 3.4.4.5. Analyst Perspective

- 3.4.5. Tecan Trading AG

- 3.4.5.1. Company Overview

- 3.4.5.2. Role of Tecan Trading AG in the Emerging Infectious Disease Diagnostics Market

- 3.4.5.3. Financials

- 3.4.5.4. Recent Developments

- 3.4.5.5. Analyst Perspective

- 3.4.6. Siemens Healthineers AG

- 3.4.6.1. Company Overview

- 3.4.6.2. Role of Siemens Healthineers AG in the Emerging Infectious Disease Diagnostics Market

- 3.4.6.3. Financials

- 3.4.6.4. Recent Developments

- 3.4.6.5. Analyst Perspective

- 3.4.1. bioMerieux S.A.

- 3.5. Company Snapshots

- 3.5.1. En Carta Diagnostics

- 3.5.1.1. Company Overview

- 3.5.1.2. Role of En Carta Diagnostics in the Emerging Infectious Disease Diagnostics Market

- 3.5.1. En Carta Diagnostics