|

|

市場調査レポート

商品コード

1403956

リチウムイオン電池リサイクル市場:世界および地域別分析(2023年~2033年)Lithium-Ion Battery Recycling Market: A Global and Regional Analysis, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| リチウムイオン電池リサイクル市場:世界および地域別分析(2023年~2033年) |

|

出版日: 2024年01月10日

発行: BIS Research

ページ情報: 英文 178 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 目次

リチウムイオン電池リサイクルの市場規模は、2023年に35億4,000万米ドルとなりました。

同市場は今後、21.08%のCAGRで拡大し、2033年には239億6,000万米ドルに達すると予測されています。リチウムイオン電池リサイクル市場の成長は、電気自動車(EV)、携帯電子機器、再生可能エネルギー貯蔵システムの需要増に起因しています。これらの電池が寿命を迎えたり、古くなったりするにつれて、貴重な材料を回収して環境への影響を減らすために、効率的にリサイクルする必要性が高まっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033 |

| 2023年の評価額 | 35億4,000万米ドル |

| 2033年予測 | 239億6,000万米ドル |

| CAGR | 21.08% |

リチウムイオン電池リサイクルは、使用済みまたは使用済みのリチウムイオン電池から材料を回収して再利用し、貴重な金属や部品を取り出すプロセスです。このプロセスは、環境への影響を軽減し、資源を保護し、電池生産に使用される材料のより持続可能なサプライチェーンを構築することを目的としています。リチウムイオン電池リサイクルは、原材料の需要を減らし、採掘に伴う環境への影響を軽減し、電池に含まれる有害物質の廃棄に関する懸念に対処するのに役立ちます。回収された材料を再びサプライチェーンに戻し、廃棄物を減らし、資源を節約することで、循環型経済を促進します。

リチウムイオン電池リサイクル市場は、主にリチウムイオン電池に大きく依存する電気自動車生産の急増によって、大幅な成長を遂げています。リチウムイオン電池リサイクル市場を後押ししているいくつかの要因には、リサイクルを重視する政府の規制、持続可能な資源管理に対するニーズの高まり、環境保全に対する意識の高まり、リチウム、コバルト、ニッケル、その他の金属などの回収材料の経済的価値などがあります。さらに、リサイクル技術の継続的な進歩により、プロセスはより効率的で費用対効果が高くなっています。湿式冶金、乾式冶金、直接リサイクルなどのプロセスは、より高い収率と環境への影響の低減のために改良・最適化されています。

電気自動車とエネルギー貯蔵ソリューションの需要が増加し続ける中、リチウムイオン電池リサイクル市場はさらなる拡大が見込まれています。リサイクル技術の革新と、産業界と政府間の協力関係の強化が、この成長をさらに促進すると予想されます。

当レポートでは、世界のリチウムイオン電池リサイクル市場について調査し、市場の概要とともに、電池化学別、由来別、リサイクルプロセス別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

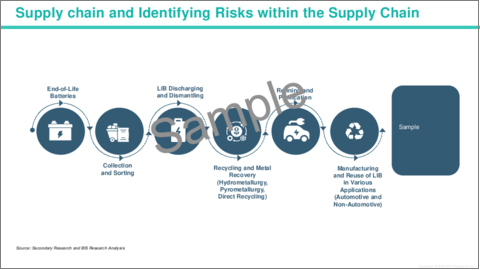

- サプライチェーンの概要

- 研究開発

- 規制状況

- ステークホルダーの分析

- 主要な世界的出来事の影響分析:COVID-19とロシア/ウクライナ戦争

- 主要な電池向け鉱物の比較分析

- スタートアップの情勢

- 市場力学の概要

- 市場の促進要因

- 市場の抑制要因

- 市場の機会

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 世界のリチウムイオン電池リサイクル市場(電池化学別)

- リチウムコバルト酸化物(LCO)

- リチウムニッケルマンガンコバルト(Li-NMC)

- リチウムマンガン酸化物(LMO)

- リン酸鉄リチウム(LFP)

- リチウムニッケルコバルト酸化アルミニウム(NCA)

- その他

第3章 製品

- 製品のセグメンテーション

- 製品概要

- 世界のリチウムイオン電池リサイクル市場(由来別)

- 自動車

- 非自動車用

- 世界のリチウムイオン電池リサイクル市場(リサイクルプロセス別)

- 湿式冶金

- 乾式冶金学

- 直接リサイクル

第4章 地域

- 地域別の概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合情勢と企業プロファイル

- 競合情勢

- 企業プロファイル

- ACCUREC-Recycling GmbH

- American Battery Technology Company

- Cirba Solutions

- Contemporary Amperex Technology Co., Limited

- Duesenfeld

- ECOBAT

- Fortum

- Ganfeng Lithium Co., Ltd.

- Glencore plc

- Li-Cycle Corp.

- Neometals Ltd

- RecycLiCo Battery Materials Inc.

- Redwood Materials Inc.

- Sumitomo Metal Mining Co., Ltd.

- Umicore

- その他の主要な市場参入企業

第6章 成長の機会と提言

第7章 調査手法

"The Global Lithium-Ion Battery Recycling Market Expected to Reach $23.96 Billion by 2033."

Lithium-Ion Battery Recycling Market Overview

The lithium-ion battery recycling market was valued at $3.54 billion in 2023, and it is expected to grow at a CAGR of 21.08% and reach $23.96 billion by 2033. The growth in the lithium-ion battery recycling market is attributable to the increasing demand for electric vehicles (EVs), portable electronics, and renewable energy storage systems. As these batteries reach their end-of-life or become obsolete, there's a growing need to recycle them efficiently to recover valuable materials and reduce environmental impact.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $3.54 Billion |

| 2033 Forecast | $23.96 Billion |

| CAGR | 21.08% |

Introduction of Lithium-Ion Battery Recycling

Lithium-ion battery recycling is the process of recovering and reusing materials from spent or end-of-life lithium-ion batteries to extract valuable metals and components. This process aims to mitigate environmental impact, conserve resources, and create a more sustainable supply chain for materials used in battery production. Lithium-ion battery recycling helps reduce the demand for raw materials, lessens the environmental impact associated with mining, and addresses concerns about the disposal of hazardous materials found in batteries. It promotes a circular economy by reintroducing recovered materials back into the supply chain, reducing waste, and conserving resources.

Market Introduction

The lithium-ion battery recycling market has been experiencing substantial growth, primarily driven by the surge in electric vehicle production, which heavily relies on lithium-ion batteries. Several factors fueling the lithium-ion battery recycling market include government regulations emphasizing recycling, the rising need for sustainable resource management, increasing awareness about environmental conservation, and the economic value of recovered materials such as lithium, cobalt, nickel, and other metals. Moreover, continuous advancements in recycling technologies have made the process more efficient and cost-effective. Processes such as hydrometallurgical, pyrometallurgical, and direct recycling are being refined and optimized for higher yields and reduced environmental impact.

Industrial Impact

The lithium-ion battery recycling market is poised for further expansion as the demand for electric vehicles and energy storage solutions continues to rise. Innovations in recycling technologies and increased collaborations between industries and governments are expected to drive this growth further.

The key players operating in the lithium-ion battery recycling ecosystem include: ACCUREC-Recycling GmbH, American Battery Technology Company, Cirba Solutions, Contemporary Amperex Technology Co., Limited, Duesenfeld, Fortum, Li-Cycle Corp., Sumitomo Metal Mining Co., Ltd., and Umicore, among others. These companies are focusing on strategic partnerships, collaborations, and acquisitions to enhance their product offerings and expand their market presence.

Market Segmentation:

Segmentation 1: by Battery Chemistry

- Lithium-Cobalt Oxide (LCO)

- Lithium-Nickel Manganese Cobalt (Li-NMC)

- Lithium-Manganese Oxide (LMO)

- Lithium-Iron Phosphate (LFP)

- Lithium-Nickel Cobalt Aluminum Oxide (NCA)

- Others

Lithium-Cobalt Oxide (LCO) to Dominate the Lithium-Ion Battery Recycling Market (by Battery Chemistry)

Lithium-cobalt oxide (LCO) has historically been a prevalent chemistry in lithium-ion batteries due to its high energy density, making it suitable for various consumer electronics such as smartphones, laptops, tablets, and other portable devices. In terms of dominating the battery chemistry, specifically within the non-automotive sector of the lithium-ion battery recycling market, there are several considerations. LCO has indeed been extensively used in consumer electronics due to its specific energy capabilities, establishing a significant presence in this sector. Consumer electronics, especially portable devices, have been a primary domain for LCO batteries due to their compact size and energy requirements. As the demand for consumer electronics and energy storage systems continues to surge, the dominance of LCO batteries in these applications will ensure a substantial market for their recycling. Development and implementation of advanced recycling technologies tailored to efficiently handle LCO batteries will be crucial to meeting the escalating demand for sustainable recycling solutions in the lithium-ion battery recycling market.

Segmentation 2: by Source

- Automotive

- Non-Automotive

- Consumer Electronics

- Energy Storage Systems

- Others

Non-Automotive to Dominate the Lithium-Ion Battery Recycling Market (by Source)

The landscape of the lithium-ion battery recycling market is undergoing a notable shift as the non-automotive segment, encompassing consumer electronics, energy storage systems, and diverse industrial applications, emerges as the dominant force. This shift in dominance stems from several compelling factors. The exponential surge in consumer electronics usage, from smartphones to laptops and tablets, fuels a consistent influx of spent batteries, contributing significantly to the recycling volume. Moreover, the growing adoption of renewable energy sources necessitates efficient energy storage solutions, where lithium-ion batteries play a pivotal role. With shorter lifespans and replacement cycles characterizing these batteries, the non-automotive sector presents a continuous and sizable supply for recycling efforts.

Segmentation 3: by Recycling Process

- Hydrometallurgy

- Pyrometallurgy

- Direct Recycling

Hydrometallurgy to Dominate the Lithium-Ion Battery Recycling Market (by Recycling Process)

Hydrometallurgy plays an important role in the lithium-ion battery recycling market. Its effectiveness in extracting valuable materials such as lithium, cobalt, nickel, and other metals from spent batteries has positioned it as a leading method in the lithium-ion battery recycling process. The process involves dissolving these metals in a liquid solution, allowing for efficient separation and purification. This method's ability to recover high-purity materials makes it highly sought-after, driving its prominence in the market. As the demand for lithium-ion batteries continues to surge, the importance of recycling and sustainable practices becomes increasingly apparent. Hydrometallurgy's efficiency and environmental friendliness make it a frontrunner in meeting this demand while reducing the environmental impact of battery disposal. Its growth in the lithium-ion battery recycling market signifies a significant step towards a more circular economy and the conservation of valuable resources.

Segmentation 4: by Region

- North America: U.S., Canada, and Mexico

- Europe: Germany, France, Italy, U.K., and Rest-of-Europe

- Asia-Pacific: China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World: South America and Middle East and Africa

Asia-Pacific is a major manufacturing hub for lithium-ion batteries used in electric vehicles, consumer electronics, and energy storage systems. Asia-Pacific region includes countries such as China, Japan, South Korea, India, and Rest-of-Asia-Pacific. The region has witnessed a significant surge in the adoption of electric vehicles, especially in countries such as China. This rapid growth in EV sales will result in a large number of batteries reaching their end-of-life, further emphasizing the need for efficient recycling solutions. The Asia-Pacific lithium-ion battery recycling market for recycled lithium-ion batteries is dominated by China. The lithium-ion battery recycling market in Asia-Pacific is probably expanding at the fastest rate in China. The Chinese government's growing adoption of battery recycling and clean energy initiatives is the main cause of this.

Recent Developments in the Lithium-Ion Battery Recycling Market

- In October 2023, American Battery Technology Company commercialized its technologies for the manufacturing of primary battery minerals and the recycling of secondary batteries.

- In September 2023, Business Finland granted funding to Fortum Battery Recycling to establish a new test production facility for battery material to test a novel and more effective process for making cathode and anode materials, which are essential components of battery cells.

- In July 2023, Fortum Battery Recycling began to investigate the viability of setting up a production facility for sustainable secondary battery materials in the industrial area of Artern, Thuringia, Germany.

- In March 2023, Li-Cycle and KION Group entered a strategic partnership for global lithium-ion battery recycling.

- In February 2022, Umicore signed a battery recycling services agreement with Automotive Cells Company (ACC) to meet the requirements of the ACC pilot plant located in Nersac, France.

Demand - Drivers, Limitations, and Opportunities

Market Drivers: Government Initiatives with Technological Advancements

The International Energy Agency (IEA) asserts that China is the industry leader in production at all stages of the electric vehicle supply chain, comprising raw materials, raw materials refinement, battery cell manufacture, cathode, and anode production, along with battery and electric vehicle production. The increasing demand for electric vehicles, along with government support for recycling, is expected to drive the growth of the lithium-ion battery recycling market.

China is an excellent example of recycling due to recycling rules and grants. It provides a useful blueprint for what can be accomplished in the U.S. and Europe. When compared to Europe and North America, battery recycling firms in China seem to be more inclined to be vertically integrated; battery collection, black mass manufacture, black mass refining, and production of CAM (cathode active material) and batteries are all done by different companies.

Many companies in the U.S. are interested in the lithium-ion battery recycling market to strengthen the assurance of the availability of the battery raw materials required to speed the transition to renewable energy. Moreover, the hydrometallurgical method is the most used in the U.S. to separate critical metals from lithium batteries.

In 2022, the U.S. Department of Energy (DoE) commenced the execution of a $335 million battery recycling scheme. The initiative intends to promote and encourage battery recycling capabilities within the U.S. and has been released by the DoE as a Request for Information (RFI).

Moreover, the U.S. Department of Energy (DoE) announced the continuation of the lithium-ion battery recycling prize, which was established in 2019, as well as the announcement of more than $192 million in new funding for the recycling of batteries from consumer products and the formation of an advanced battery research and development (R&D) consortium. In order to support a safe, dependable, and circular domestic supply chain for essential materials, DOE says it is imperative to invest in sustainable, low-cost consumer battery recycling. All this is expected to drive the lithium-ion battery recycling market growth in the U.S. By 2030, the market for lithium-ion batteries is expected to have grown by up to 10 times due to the demand for electric vehicles (EVs) and stationary energy storage.

Market Challenges: Broad Array of Battery Chemistries

The broad array of battery chemistries is a frequently neglected challenge in the discussion about the circular economy for the lithium-ion battery recycling market. Recycling is an end-of-pipe operation, processing a device that has been created for optimum performance frequently without consideration of disassembly or recycling methods. Due to the numerous battery chemistries, the structure and quality of critical metals vary greatly; this is eventually posing a challenge for recyclers to standardize and commoditize battery materials. The metals in the battery are a complicated product that needs the proper procedures to recover elements suitable for batteries.

The complicated structure, as well as the risks of electric shock and probable fires, make safe disassembly time-consuming and labor-intensive. There could be variations in the chemistries used in each component of a lithium-ion battery compared to other battery industry manufacturers. The cathode chemistry of lithium-ion batteries varies greatly, such as variations of lithium-cobalt oxide (LCO), lithium-nickel manganese cobalt (Li-NMC), lithium-iron phosphate (LFP), lithium-manganese oxide (LMO), lithium-nickel cobalt aluminum oxide (NCA) and others. Various components of the cell must be segregated before being processed to be used as raw resources. The technical procedure differs depending on the company and the precise type of materials used. In some situations, the first step can be to pulverize everything, then come mechanical separation or pyrometallurgy treatment at extremely high temperatures. After this, hydrometallurgy is used for the last phase of separation and refinement.

To overcome these challenges, the industry needs ongoing research and development efforts to create versatile and adaptable recycling technologies capable of handling diverse battery chemistries efficiently. Collaboration among stakeholders, including governments, industries, and research institutions, is crucial to standardize recycling practices and establish guidelines for handling various chemistries, ensuring safe and sustainable recycling processes across different types of batteries.

Market Opportunities: Creating Circular Value, i.e., Making Batteries from Recyclable Materials

According to the International Energy Agency, reaching the world's Paris Agreement climate targets will necessitate a 40% rise in copper and rare earth element supply, a 70% increase in nickel and cobalt supply, and a nearly 90% increase in lithium supply by 2030. The long-term goal is to establish a circular economy for battery packs by achieving closed-loop regeneration. The European Commission is now developing a law that will gradually enforce the utilization of recycled materials in the construction of batteries for electric vehicles. No matter where a battery was generated, the European market will indeed be liable to benchmark standards for recycled components. Moreover, declaring the percentage of recycled materials will be required starting in 2025.

Veolia plans to contribute significantly to the development of this new industry within the circular economy. The company has been working to develop EV battery recycling procedures using its expertise in handling hazardous materials. Veolia collaborates equally with vehicle and battery manufacturers (gigafactories). Veolia, for instance, has secured an agreement with Renault to build a battery recycling factory in France employing streams of materials derived from Renault automobiles.

Veolia is also looking into ways to recycle electric vehicle battery packs in plenty of other sectors, such as energy production for renewable energy, rapid chargers for electric vehicles, and smart grid facilities, all of which have affinities with Veolia's existing business. Projects are being researched in the U.K. and France. This strategy intends to provide remedies that make use of greater circularity to reduce Veolia's clients' carbon footprints.

The European Union (EU) has set a goal of becoming the world leader in climate-neutral business and society by 2050. Although it is the world's greatest economy and a powerhouse, the U.S. is also one of the top emitters of carbon dioxide due to its rapid development.

To achieve net-zero government emissions by 2050, the U.S. developed the Net-Zero Initiative and committed to decarbonization. Furthermore, the U.S. has joined forces with 18 other nations, including the U.K., Canada, Germany, France, Switzerland, the Netherlands, Belgium, Finland, Ireland, Austria, Cyprus, Lithuania, Israel, Japan, Korea, Singapore, Australia, and New Zealand. China is the nation's biggest generator of renewable energy and the world's largest source of CO2, accounting for 28% of worldwide emissions.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of the lithium-ion battery recycling products available based on battery chemistry (lithium-cobalt oxide (LCO), lithium-nickel manganese cobalt (Li-NMC), lithium-iron phosphate (LFP), lithium-manganese oxide (LMO), lithium-nickel cobalt aluminum oxide (NCA), and others), source (automotive and non-automotive), recycling process (hydrometallurgy, pyrometallurgy, and direct recycling). The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the importance of recycling. Therefore, the lithium-ion battery recycling business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The lithium-ion battery recycling market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the lithium-ion battery recycling market analyzed and profiled in the study include lithium-ion battery recycling manufacturers that develop, maintain, and market lithium-ion battery recycling materials. Additionally, corporate strategies such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modeling

- The scope of this report has been focused on lithium-ion battery recycling applications and products.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2020 to October 2023 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major breakthroughs in technology.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, gold and silver standard websites, directories, and major databases, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the lithium-ion battery recycling market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for these quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the lithium-ion battery recycling market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- current and proposed production by market players

- validation of the numbers of markets by segmentations

- percentage split of individual markets for regional analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as IRENA and IEA.

Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the lithium-ion battery recycling market report have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent recyclers in the lithium-ion battery recycling industry are:

|

|

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Scope of the Study

Executive Summary

1. Markets: Industry Outlook

- 1.1. Trends: Current and Future Impact Assessment

- 1.1.1. Rising Demand in Electric Vehicle Industry

- 1.1.2. Widespread Adoption of Circular Economy as a Sustainable Practice

- 1.1.3. Rising Demand for Raw Materials

- 1.2. Supply Chain Overview

- 1.2.1. Value Chain Analysis

- 1.2.2. Market Map

- 1.2.3. Pricing Forecast

- 1.3. Research and Development

- 1.3.1. Patent Filing Trend (by Number of Patents, Country)

- 1.4. Regulatory Landscape

- 1.5. Stakeholder Analysis

- 1.5.1. Use Case

- 1.5.2. End User and Buying Criteria

- 1.6. Impact Analysis for Key Global Events: COVID-19 and Russia/Ukraine War

- 1.7. Comparative Analysis of Key Battery Minerals

- 1.8. Start-up Landscape

- 1.9. Market Dynamics Overview

- 1.9.1. Market Drivers

- 1.9.2. Market Restraints

- 1.9.3. Market Opportunities

2. Application

- 2.1. Application Segmentation

- 2.2. Application Summary

- 2.3. Global Lithium-Ion Battery Recycling Market (by Battery Chemistry)

- 2.3.1. Lithium-Cobalt Oxide (LCO)

- 2.3.2. Lithium-Nickel Manganese Cobalt (Li-NMC)

- 2.3.3. Lithium-Manganese Oxide (LMO)

- 2.3.4. Lithium-Iron Phosphate (LFP)

- 2.3.5. Lithium-Nickel Cobalt Aluminum Oxide (NCA)

- 2.3.6. Others

3. Product

- 3.1. Product Segmentation

- 3.2. Product Summary

- 3.3. Global Lithium-Ion Battery Recycling Market (by Source)

- 3.3.1. Automotive

- 3.3.2. Non-Automotive

- 3.3.2.1. Consumer Electronics

- 3.3.2.2. Energy Storage Systems

- 3.3.2.3. Others

- 3.4. Global Lithium-Ion Battery Recycling Market (by Recycling Process)

- 3.4.1. Hydrometallurgy

- 3.4.2. Pyrometallurgy

- 3.4.3. Direct Recycling

4. Region

- 4.1. Regional Summary

- Table: Global Lithium-Ion Battery Recycling Market (by Region), Kiloton, 2022-2033

- Table: Global Lithium-Ion Battery Recycling Market (by Region), $Million, 2022-2033

- 4.2. Drivers and Restraints

- 4.3. North America

- Regional Overview and Analyst View

- Business Drivers

- Business Challenges

- 4.3.1. Application

- Table: North America Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: North America Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- 4.3.2. Product

- Table: North America Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: North America Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: North America Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: North America Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.3.3. North America Lithium-Ion Battery Recycling Market (by Country)

- 4.3.3.1. U.S.

- Table: U.S. Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: U.S. Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: U.S. Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: U.S. Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: U.S. Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: U.S. Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.3.3.2. Canada

- Table: Canada Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Canada Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Canada Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Canada Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Canada Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Canada Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.3.3.3. Mexico

- Table: Mexico Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Mexico Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Mexico Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Mexico Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Mexico Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Mexico Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.3.3.1. U.S.

- 4.4. Europe

- 4.4.1. Regional Overview and Analyst View

- 4.4.2. Business Drivers

- 4.4.3. Business Challenges

- 4.4.4. Application

- Table: Europe Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Europe Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- 4.4.5. Product

- Table: Europe Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Europe Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Europe Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Europe Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6. Europe Lithium-Ion Battery Recycling Market (by Country)

- 4.4.6.1. Germany

- Table: Germany Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Germany Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Germany Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Germany Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Germany Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Germany Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6.2. France

- Table: France Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: France Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: France Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: France Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: France Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: France Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6.3. Italy

- Table: Italy Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Italy Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Italy Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Italy Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Italy Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Italy Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6.4. U.K.

- Table: U.K. Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: U.K. Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: U.K. Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: U.K. Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: U.K. Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: U.K. Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6.5. Rest-of-Europe

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Rest-of-Europe Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.4.6.1. Germany

- 4.5. Asia-Pacific

- 4.5.1. Regional Overview and Analyst View

- 4.5.2. Business Drivers

- 4.5.3. Business Challenges

- 4.5.4. Application

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- 4.5.5. Product

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Asia-Pacific Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6. Asia-Pacific Lithium-Ion Battery Recycling Market (by Country)

- 4.5.6.1. China

- Table: China Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: China Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: China Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: China Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: China Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: China Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6.2. Japan

- Table: Japan Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Japan Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Japan Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Japan Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Japan Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Japan Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6.3. South Korea

- Table: South Korea Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: South Korea Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: South Korea Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: South Korea Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: South Korea Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: South Korea Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6.4. India

- Table: India Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: India Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: India Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: India Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: India Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: India Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6.5. Rest-of-Asia-Pacific

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Rest-of-Asia-Pacific Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.5.6.1. China

- 4.6. Rest-of-the-World

- 4.6.1. Regional Overview and Analyst View

- 4.6.2. Business Drivers

- 4.6.3. Business Challenges

- 4.6.4. Application

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- 4.6.5. Product

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: Rest-of-the-World Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.6.6. Rest-of-the-World Lithium-Ion Battery Recycling Market (by Region)

- 4.6.6.1. Middle East and Africa

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: The Middle East and Africa Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.6.6.2. South America

- Table: South America Lithium-Ion Battery Recycling Market (by Battery Chemistry), Kiloton, 2022-2033

- Table: South America Lithium-Ion Battery Recycling Market (by Battery Chemistry), $Million, 2022-2033

- Table: South America Lithium-Ion Battery Recycling Market (by Source), Kiloton, 2022-2033

- Table: South America Lithium-Ion Battery Recycling Market (by Source), $Million, 2022-2033

- Table: South America Lithium-Ion Battery Recycling Market (by Recycling Process), Kiloton, 2022-2033

- Table: South America Lithium-Ion Battery Recycling Market (by Recycling Process), $Million, 2022-2033

- 4.6.6.1. Middle East and Africa

5. Market - Competitive Landscape and Company Profiles

- 5.1. Competitive Landscape

- 5.2. Company Profile

- 5.2.1. ACCUREC-Recycling GmbH

- 5.2.1.1. Company Overview

- 5.2.1.2. Top Products/Product Portfolio

- 5.2.1.3. Top Competitors

- 5.2.1.4. Target Customers

- 5.2.1.5. Key Personnel

- 5.2.1.6. Market Share

- 5.2.1.7. Analyst View

- 5.2.2. American Battery Technology Company

- 5.2.2.1. Company Overview

- 5.2.2.2. Top Products/Product Portfolio

- 5.2.2.3. Top Competitors

- 5.2.2.4. Target Customers

- 5.2.2.5. Key Personnel

- 5.2.2.6. Market Share

- 5.2.2.7. Analyst View

- 5.2.3. Cirba Solutions

- 5.2.3.1. Company Overview

- 5.2.3.2. Top Products/Product Portfolio

- 5.2.3.3. Top Competitors

- 5.2.3.4. Target Customers

- 5.2.3.5. Key Personnel

- 5.2.3.6. Market Share

- 5.2.3.7. Analyst View

- 5.2.4. Contemporary Amperex Technology Co., Limited

- 5.2.4.1. Company Overview

- 5.2.4.2. Top Products/Product Portfolio

- 5.2.4.3. Top Competitors

- 5.2.4.4. Target Customers

- 5.2.4.5. Key Personnel

- 5.2.4.6. Market Share

- 5.2.4.7. Analyst View

- 5.2.5. Duesenfeld

- 5.2.5.1. Company Overview

- 5.2.5.2. Top Products/Product Portfolio

- 5.2.5.3. Top Competitors

- 5.2.5.4. Target Customers

- 5.2.5. Key Personnel

- 5.2.5.6. Market Share

- 5.2.5.7. Analyst View

- 5.2.6. ECOBAT

- 5.2.6.1. Company Overview

- 5.2.6.2. Top Products/Product Portfolio

- 5.2.6.3. Top Competitors

- 5.2.6.4. Target Customers

- 5.2.6.5. Key Personnel

- 5.2.6.6. Market Share

- 5.2.6.7. Analyst View

- 5.2.7. Fortum

- 5.2.7.1. Company Overview

- 5.2.7.2. Top Products/Product Portfolio

- 5.2.7.3. Top Competitors

- 5.2.7.4. Target Customers

- 5.2.7.5. Key Personnel

- 5.2.7.6. Market Share

- 5.2.7.7. Analyst View

- 5.2.8. Ganfeng Lithium Co., Ltd.

- 5.2.8.1. Company Overview

- 5.2.8.2. Top Products/Product Portfolio

- 5.2.8.3. Top Competitors

- 5.2.8.4. Target Customers

- 5.2.8.5. Key Personnel

- 5.2.8.6. Market Share

- 5.2.8.7. Analyst View

- 5.2.9. Glencore plc

- 5.2.9.1. Company Overview

- 5.2.9.2. Top Products/Product Portfolio

- 5.2.9.3. Top Competitors

- 5.2.9.4. Target Customers

- 5.2.9.5. Key Personnel

- 5.2.9.6. Market Share

- 5.2.9.7. Analyst View

- 5.2.10. Li-Cycle Corp.

- 5.2.10.1. Company Overview

- 5.2.10.2. Top Products/Product Portfolio

- 5.2.10.3. Top Competitors

- 5.2.10.4. Target Customers

- 5.2.10.5. Key Personnel

- 5.2.10.6. Market Share

- 5.2.10.7. Analyst View

- 5.2.11. Neometals Ltd

- 5.2.11.1. Company Overview

- 5.2.11.2. Top Products/Product Portfolio

- 5.2.11.3. Top Competitors

- 5.2.11.4. Target Customers

- 5.2.11.5. Key Personnel

- 5.2.11.6. Analyst View

- 5.2.12. RecycLiCo Battery Materials Inc.

- 5.2.12.1. Company Overview

- 5.2.12.2. Top Products/Product Portfolio

- 5.2.12.3. Top Competitors

- 5.2.12.4. Target Customers

- 5.2.12.5. Key Personnel

- 5.2.12.6. Analyst View

- 5.2.13. Redwood Materials Inc.

- 5.2.13.1. Company Overview

- 5.2.13.2. Top Products/Product Portfolio

- 5.2.13.3. Top Competitors

- 5.2.13.4. Target Customers

- 5.2.13.5. Key Personnel

- 5.2.13.6. Market Share

- 5.2.13.7. Analyst View

- 5.2.14. Sumitomo Metal Mining Co., Ltd.

- 5.2.14.1. Company Overview

- 5.2.14.2. Top Products/Product Portfolio

- 5.2.14.3. Top Competitors

- 5.2.14.4. Target Customers

- 5.2.14.5. Key Personnel

- 5.2.14.6. Market Share

- 5.2.14.7. Analyst View

- 5.2.15. Umicore

- 5.2.15.1. Company Overview

- 5.2.15.2. Top Products/Product Portfolio

- 5.2.15.3. Top Competitors

- 5.2.15.4. Target Customers

- 5.2.15.5. Key Personnel

- 5.2.15.6. Market Share

- 5.2.15.7. Analyst View

- 5.2.1. ACCUREC-Recycling GmbH

- 5.3. Other Key Market Participants