|

|

市場調査レポート

商品コード

1403557

欧州の農業用自律ロボット市場:分析と予測(2023年~2028年)Europe Agriculture Autonomous Robots Market: Analysis and Forecast, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の農業用自律ロボット市場:分析と予測(2023年~2028年) |

|

出版日: 2024年01月08日

発行: BIS Research

ページ情報: 英文 73 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州の農業用自律ロボットの市場規模(英国を除く)は、2023年に2億7,670万米ドルとなり、予測期間中に25.25%のCAGRで拡大し、2028年には8億5,310万米ドルに達すると予測されています。

効率的で持続可能な農業技術に対する需要の高まりが、世界の農業用自律ロボット市場の成長を促進すると見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2028年 |

| 2023年評価 | 2億7,670万米ドル |

| 2028年予測 | 8億5,310万米ドル |

| CAGR | 25.25% |

農業用自律ロボットは、人間が常に介入することなく農業を行うために構築された先進技術です。センサーと人工知能を備え、作物の植え付け、除草、収穫、監視を行うことができます。これらのロボットは畑をナビゲートし、リアルタイムで選択を行い、手作業を最小限に抑えることで農業の収穫量を増加させます。作物収穫ロボット、除草ロボット、搾乳ロボット、監視ロボットなどはその一例です。農作業を一変させるこれらのテクノロジーは、生産を最適化し、労働者への依存を減らし、資源を節約し、製品の品質を向上させます。

欧州の農業用自律ロボット市場は、さまざまな農業活動における自律型ロボットの活用に関連します。これらのロボットは、植え付け、収穫、水やり、作物の監視などの作業を人間の介入なしに実行するようにプログラムされています。ロボット工学、AI、IoTなど、農業分野における先端技術の採用が増加していることが、欧州における同市場の成長を後押ししています。

農業における自律型ロボットの使用にはいくつかの利点があります。第一に、これらのロボットは作業を効率的かつ正確に実行できるため、生産性が向上し、作物の収量が向上します。第二に、ロボットは24時間稼働できるため、農家は時間を節約し、作業効率を高めることができます。さらに、自律型ロボットは手作業の必要性を最小限に抑え、農業における労働力不足に伴う課題に対処することができます。

さらに、これらのロボットは、資源利用の最適化、化学薬品の使用量の削減、土壌侵食の緩和により、持続可能な農業に貢献することができます。また、正確なデータと分析を提供できるため、農家は作物管理や収穫について十分な情報に基づいた判断を下すことができます。

食料需要の増加に伴い、欧州の農業用自律ロボット市場は大きく成長する見込みです。精密農業を推進する政府の取り組みや、スマート農業のトレンドの高まりといった動向が、欧州農業分野での自律型ロボットの採用を促進すると予想されます。

当レポートでは、欧州の農業用自律ロボット市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

調査範囲

エグゼクティブサマリー

第1章 市場

- 業界の見通し

- ビジネスダイナミクス

- ビジネスの促進要因

- ビジネスの課題

- 市場戦略と展開

- ビジネスの機会

- ケーススタディ

- 資金調達と投資情勢

第2章 地域

- 欧州

- イタリア

- フランス

- ドイツ

- オランダ

- ベルギー

- スイス

- ギリシャ

- ウクライナ

- その他の地域

- 英国

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競合地位マトリックス

- 市場シェア分析

- 企業プロファイル

- Saga Robotics AS

- DAIRYMASTER

- GEA Group Aktiengesellschaft

- Lely

- Robert Bosch GmbH

- Trabotyx

第4章 調査手法

List of Figures

- Figure 1: Factors Driving the Need for Agriculture Autonomous Robots Market

- Figure 2: Agriculture Autonomous Robots Market, $Billion, 2022-2028

- Figure 3: Market Dynamics of the Agriculture Autonomous Robots Market

- Figure 4: Agriculture Autonomous Robots Market (by Application), $Billion, 2022-2028

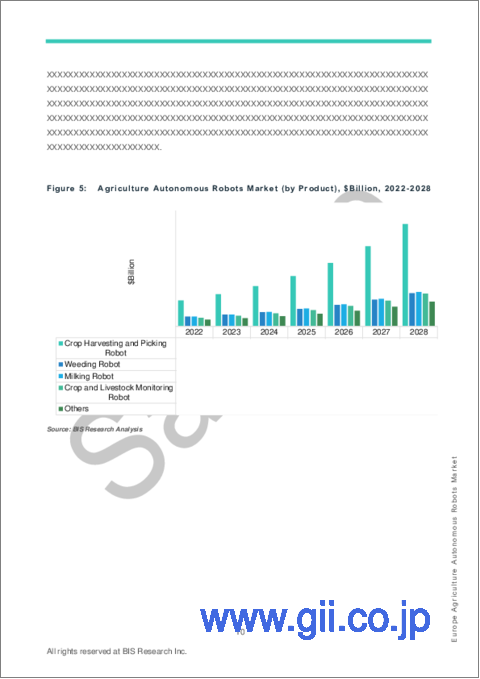

- Figure 5: Agriculture Autonomous Robots Market (by Product), $Billion, 2022-2028

- Figure 6: Agriculture Autonomous Robots Market (by Region), $Billion, 2022

- Figure 7: Sales Value of Organic Food Production, $Billion, 2017-2021

- Figure 8: Agriculture Workforce Trend in the U.S, 1950-2050

- Figure 9: Percentage Share of Individuals Using Internet in Urban and Rural Areas, 2019-2022

- Figure 10: Share of Key Market Strategies and Developments, January 2019-September 2023

- Figure 11: Share of Product Development and Innovations (by Company), January 2019-September 2023

- Figure 12: Share of Market Development (by Company), January 2019-September 2023

- Figure 13: Share of Mergers and Acquisitions (by Company), January 2019- September 2023

- Figure 14: BouMatic - Case Study

- Figure 15: Tevel

- Figure 16: Investment and Funding Landscape (by Year), $Million, January 2019-September 2023

- Figure 17: Investment and Funding Landscape (by Company), Share (%), 2019-September 2023

- Figure 18: Investment and Funding Landscape (by Country), Share (%), 2019- September 2023

- Figure 19: Competitive Benchmarking Matrix for Key Agriculture Autonomous Robot Providers

- Figure 20: Market Share Analysis of Agriculture Autonomous Robots Market, 2022

- Figure 21: Saga Robotics AS: Product and Customer Portfolio Analysis

- Figure 22: DAIRYMASTER: Product and Customer Portfolio Analysis

- Figure 23: GEA Group Aktiengesellschaft: Product and Customer Portfolio Analysis

- Figure 24: Lely: Product and Customer Portfolio Analysis

- Figure 25: Robert Bosch GmbH: Product and Customer Portfolio Analysis

- Figure 26: Trabotyx: Product and Customer Portfolio Analysis

- Figure 27: Data Triangulation

- Figure 28: Top-Down and Bottom-Up Approach

- Figure 29: Assumptions and Limitations

List of Tables

- Table 1: Key Consortiums and Associations in the Agriculture Autonomous Robots Market

- Table 2: Description and Impact of Government Initiative

- Table 3: List of Key Companies Providing Small Robots

“The Europe Agriculture Autonomous Robots Market (excluding U.K.) Expected to Reach $853.1 Million by 2028.”

Introduction to Europe Agriculture Autonomous Robots Market

The Europe agriculture autonomous robots market (excluding U.K.) was valued at $276.7 million in 2023, and it is expected to grow with a CAGR of 25.25% during the forecast period to reach $853.1 million by 2028. The increasing demand for efficient and sustainable agricultural techniques is predicted to fuel growth in the worldwide agriculture autonomous robots market.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $276.7 Million |

| 2028 Forecast | $853.1 Million |

| CAGR | 25.25% |

Agriculture autonomous robots are advanced technologies built for farming without the constant intervention of humans. They are equipped with sensors and artificial intelligence and can plant, weed, harvest, and monitor crops. These robots navigate fields, make choices in real time, and increase agricultural yield by minimizing manual work. Crop harvesting robots, weeding robots, milking robots, and monitoring robots are just a few examples. These technologies, which are transforming farming operations, optimize production, reduce worker dependency, conserve resources, and increase product quality.

Market Introduction

The Europe agriculture autonomous robot market pertains to the utilization of autonomous robots in various agricultural activities. These robots are programmed to carry out tasks like planting, harvesting, watering, and monitoring crops, among others, without human intervention. The increasing adoption of advanced technologies in the agriculture sector, such as robotics, AI, and IoT, has driven the growth of this market in Europe.

The use of autonomous robots in agriculture offers several advantages. Firstly, these robots can perform tasks efficiently and accurately, resulting in higher productivity and better crop yields. Secondly, they can operate round the clock, helping farmers save time and increasing operational efficiency. Additionally, autonomous robots can minimize the need for manual labor, addressing the challenges associated with labor shortages in the agriculture industry.

Moreover, these robots can contribute to sustainable agriculture by optimizing resource utilization, reducing chemical usage, and mitigating soil erosion. They can also provide precise data and analysis, enabling farmers to make informed decisions about crop management and harvesting.

With the increasing demand for food, the Europe agriculture autonomous robot market is poised for significant growth. Factors such as government initiatives to promote precision farming and the rising trend of smart farming are expected to drive the adoption of autonomous robots in the European agriculture sector.

Market Segmentation:

Segmentation 1: by Application

- Crop Monitoring

- Livestock Monitoring and Management

- Harvesting and Picking

- Weeding

- Others

Segmentation 2: by Product

- Crop Harvesting and Picking Robot

- Weeding Robot

- Milking Robot

- Crop and Livestock Monitoring Robot

- Others

Segmentation 3: by Country

- Germany

- France

- Italy

- Greece

- Ukraine

- Netherlands

- Belgium

- Switzerland

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different technologies used for agriculture autonomous robots and their potential in Europe region. Moreover, the study gives the reader a detailed understanding of the different solutions provided by the agriculture autonomous robot equipment providers, such as imaging, AI, and analyzing. Compared to conventional agricultural methods, the agriculture autonomous robots market enables more exact targeting of planting, weeding, and harvesting, allowing farmers to save money by maximizing the use of their inputs.

Growth/Marketing Strategy: The Europe agriculture autonomous robots market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnership, collaboration, and joint venture activities to strengthen their position in the Europe agriculture autonomous robots market.

Competitive Strategy: Key players in the Europe agriculture autonomous robots market analyzed and profiled in the study, including their market segments covered by distinct products, applications served, and regional presence, as well as the influence of important market tactics. Moreover, a detailed competitive benchmarking of the players operating in the agriculture autonomous robots market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some Prominent Names Established in the Market are:

|

|

Table of Contents

Scope of the Study

Executive Summary

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Ongoing Trends

- 1.1.1.1. Emerging Climate Smart Agriculture Practices

- 1.1.1.2. Emerging Sustainable Solution: Agrivoltaics

- 1.1.2. Ecosystem/Ongoing Programs

- 1.1.2.1. Consortiums and Associations

- 1.1.2.2. Government Initiatives and Their Impacts

- 1.1.1. Ongoing Trends

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Need for Organic Food Production

- 1.2.1.2. Agriculture Labor Shortage

- 1.2.2. Business Challenges

- 1.2.2.1. High Initial Investment and Cost

- 1.2.2.2. Less Adoption among Small-Scale Farmers

- 1.2.3. Market Strategies and Developments

- 1.2.3.1. Business Strategies

- 1.2.3.1.1. Product Development and Innovations

- 1.2.3.1.2. Market Development

- 1.2.3.2. Corporate Strategies

- 1.2.3.2.1. Mergers and Acquisitions

- 1.2.3.2.2. Partnerships, Collaborations, Joint Ventures, and Alliances

- 1.2.3.2.3. Others

- 1.2.3.1. Business Strategies

- 1.2.4. Business Opportunities

- 1.2.4.1. Rise of Small Farm Robots

- 1.2.4.2. Focus on Innovative Solutions

- 1.2.5. Case Studies

- 1.2.1. Business Drivers

- 1.3. Funding and Investment Landscape

- 1.3.1. Funding Analysis (by Year)

- 1.3.2. Funding Analysis (by Company)

- 1.3.3. Funding Analysis (by Country)

2. Regions

- 2.1. Europe

- 2.1.1. Italy

- 2.1.2. France

- 2.1.3. Germany

- 2.1.4. Netherland

- 2.1.5. Belgium

- 2.1.6. Switzerland

- 2.1.7. Greece

- 2.1.8. Ukraine

- 2.1.9. Rest-of-Europe

- 2.2. U. K.

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.1.1. Competitive Position Matrix

- 3.1.2. Market Share Analysis

- 3.2. Company Profiles

- 3.2.1. Saga Robotics AS

- 3.2.1.1. Company Overview

- 3.2.1.2. Product and Customer Portfolio Analysis

- 3.2.2. DAIRYMASTER

- 3.2.2.1. Company Overview

- 3.2.2.2. Product and Customer Portfolio Analysis

- 3.2.3. GEA Group Aktiengesellschaft

- 3.2.3.1. Company Overview

- 3.2.3.2. Product and Customer Portfolio Analysis

- 3.2.4. Lely

- 3.2.4.1. Company Overview

- 3.2.4.2. Product and Customer Portfolio Analysis

- 3.2.5. Robert Bosch GmbH

- 3.2.5.1. Company Overview

- 3.2.5.2. Product and Customer Portfolio Analysis

- 3.2.6. Trabotyx

- 3.2.6.1. Company Overview

- 3.2.6.2. Product and Customer Portfolio Analysis

- 3.2.1. Saga Robotics AS

4. Research Methodology

- 4.1. Data Sources

- 4.1.1. Primary Data Sources

- 4.1.2. Secondary Data Sources

- 4.2. Market Estimation and Forecast

- 4.2.1. Factors for Data Prediction and Modeling