|

|

市場調査レポート

商品コード

1399758

欧州のISR (諜報・監視・偵察) 航空機およびドローン市場の分析・予測:2023-2033年Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market - Analysis and Forecast, 2023-2033 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 欧州のISR (諜報・監視・偵察) 航空機およびドローン市場の分析・予測:2023-2033年 |

|

出版日: 2023年12月28日

発行: BIS Research

ページ情報: 英文 94 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州のISR (諜報・監視・偵察) 航空機およびドローンの市場規模は、2022年の35億1,000万米ドルから、予測期間中は5.28%の成長率で推移し、2033年には65億米ドルの規模に成長すると予測されています。

ISR航空機およびドローンは、現代の軍事・戦略技術の最先端にあります。

さまざまなシナリオにおいて、これらの先端技術は有意義な情報を収集し、状況認識を向上させ、意思決定プロセスを支援するように設計されています。ISR航空機は、情報収集、監視、偵察活動のために作られた有人航空機であり、最新鋭のセンサー、画像システム、通信設備が装備されていることが多いです。無人航空機 (UAV) としても知られるドローンは、人的リスクを抑えながら遠隔地や危険な場所を探査する能力を持つため、ISR能力を変化させてきました。ISR技術は、軍事作戦、災害支援、国境警備、さらには環境モニタリングにも利用されています。これらは、現代の戦闘における情報支配の重要性と、国家安全保障の未来を形成する技術の影響力の高まりを強調しています。

市場イントロダクション

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 38億8,000万米ドル |

| 2033年予測 | 65億米ドル |

| CAGR | 5.28% |

当レポートでは、欧州のISR (諜報・監視・偵察) 航空機およびドローンの市場を調査し、市場の背景・概要、市場成長への各種影響因子の分析、技術動向、各種プロジェクト、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

市場の分類

セグメンテーション1:プラットフォーム別

- 軍用航空機

- 軍用ドローン

- 軍用ヘリコプター

セグメンテーション2:コンポーネント別

- 監視システム

- 通信システム

- SIGINTシステム

- ソフトウェア

セグメンテーション3:国別

- 英国

- ドイツ

- フランス

- ロシア

- その他

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- ISR航空機およびドローン市場:概要

- 進行中のプロジェクトと今後のプロジェクト

- 今後の技術動向

- さまざまな軍用機やドローンの比較分析

- バリューチェーン分析

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業機会

- 事業戦略

第2章 地域

- ISR航空機およびドローン市場 (地域別)

- 欧州

- 市場

- 製品

- 欧州 (国別)

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- BAE Systems

- Dassault Aviation

- QUANTUM-SYSTEMS GMBH

- ISS Aerospace

- その他の主要企業

- スタートアップ

第4章 調査手法

List of Figures

- Figure 1: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Billion, 2022-2033

- Figure 2: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, Units, 2022-2033

- Figure 3: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022 and 2033

- Figure 4: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Military Aircraft), $Billion, 2022 and 2033

- Figure 5: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Military Drones), $Billion, 2022 and 2033

- Figure 6: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Component), $Billion, 2022 and 2033

- Figure 7: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region), $Billion, 2033

- Figure 8: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, Value Chain

- Figure 9: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, Business Dynamics

- Figure 10: Share of Key Business Strategies and Development, January 2020- August 2023

- Figure 11: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, Competitive Benchmarking, 2022

- Figure 12: Research Methodology

- Figure 13: Top-Down and Bottom-Up Approach

- Figure 14: Assumptions and Limitations

List of Tables

- Table 1: Comparative Analysis of Various Military Aircraft

- Table 2: Comparative Analysis of Various Military Drones

- Table 3: Category of ISR Platform Manufacturers

- Table 4: ISR Platform Manufacturers Developments

- Table 5: Category of Payload Facilitators

- Table 6: Partnerships, Collaborations, Agreements and Contracts, January 2020-August 2023

- Table 7: Market Developments, January 2020- August 2023

- Table 8: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region), $Billion, 2022-2033

- Table 9: Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Component), $Billion, 2022-2033

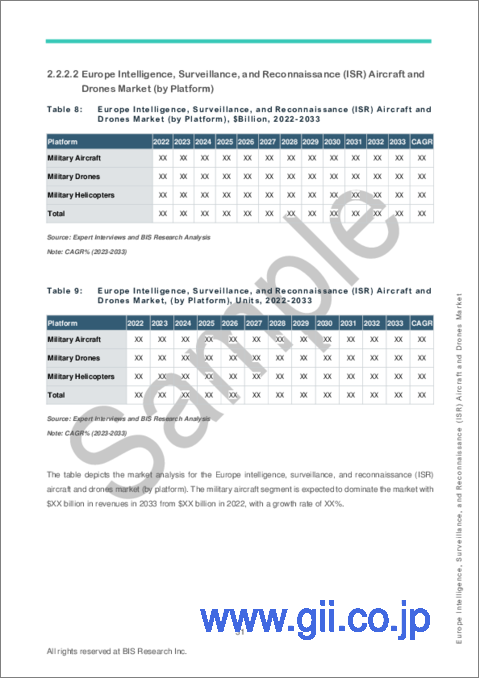

- Table 10: Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 11: Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, (by Platform), Units, 2022-2033

- Table 12: U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 13: U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, (by Platform), Units, 2022-2033

- Table 14: France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 15: France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, (by Platform), Units, 2022-2033

- Table 16: Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 17: Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, (by Platform), Units, 2022-2033

- Table 18: Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 19: Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, (by Platform), Units, 2022-2033

- Table 20: Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), $Billion, 2022-2033

- Table 21: Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), Units, 2022-2033

- Table 22: Benchmarking and Weightage Parameters

- Table 23: BAE Systems: Product Portfolio

- Table 24: BAE Systems: Market Development

- Table 25: BAE Systems: Partnerships, Collaborations, Agreements, and Contracts

- Table 26: Dassault Aviation: Product Portfolio

- Table 27: Dassault Aviation: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 28: QUANTUM-SYSTEMS GMBH: Product Portfolio

- Table 29: QUANTUM-SYSTEMS GMBH: Partnerships, Collaborations, Agreements and Contracts

- Table 30: QUANTUM-SYSTEMS GMBH: Market Development

- Table 31: ISS Aerospace: Product Portfolio

- Table 32: ISS Aerospace: Partnerships, Collaborations, Agreements and Contracts

- Table 33: ISS Aerospace: Market Development

Introduction to Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

The Europe ISR aircraft and drones market is estimated to reach $6.50 billion by 2033 from $3.51 billion in 2022, at a growth rate of 5.28% during the forecast period 2023-2033. Intelligence, surveillance, and reconnaissance (ISR) aircraft and drones are at the cutting edge of modern military and strategic technology. In a variety of scenarios, these advanced technologies are designed to collect meaningful information, improve situational awareness, and aid decision-making processes. ISR aircraft are manned aircraft built for gathering intelligence, surveillance, and reconnaissance activities. They are frequently outfitted with cutting-edge sensors, image systems, and communication suites. Drones, also known as unmanned aerial vehicles (UAVs), have altered ISR capabilities due to their ability to explore remote or dangerous locations while limiting human risk. ISR technology has been used in military operations, disaster assistance, border security, and even environmental monitoring. These underline the critical importance of information dominance in modern battle, as well as the growing influence of technology in molding the future of national security.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $3.88 Billion |

| 2033 Forecast | $6.50 Billion |

| CAGR | 5.28% |

The development of military technology and tactics is heavily influenced by the history and early days of intelligence, surveillance, and reconnaissance (ISR) aircraft and drones. Aerial reconnaissance has been practiced since World War I, when early aviators flew over enemy positions with cameras in hand. However, it was not until World War II that ISR capabilities really took off. Cameras were previously fitted in classic aircraft such as the Lockheed P-38 Lightning and the Supermarine Spitfire to collect critical imagery for intelligence purposes. In the postwar era, the advent of jet propulsion and superior sensors resulted in the development of specialist reconnaissance aircraft such as the U-2 and the SR-71 Blackbird. These high-altitude, high-speed vehicles transformed information collection during the Cold War.

Now fast forward to the late twentieth and early twenty-first centuries, the introduction of unmanned aerial vehicles (UAVs) or drones has altered ISR. Remotely piloted aircraft, such as the Predator and Global Hawk, provide constant surveillance and have played critical roles in modern conflicts and terrorist activities. Today, ISR is advancing with the incorporation of cutting-edge technology, such as artificial intelligence, which improves the capacity to acquire essential intelligence in more complex and dynamic global situations.

Market Segmentation:

Segmentation 1: by Platform

- Military Aircraft

- Military Drones

- Military Helicopters

Segmentation 2: by Component

- Surveillance Systems

- Communication Systems

- Signal Intelligence (SIGINT) Systems

- Software

Segmentation 3: by Country

- U.K.

- Germany

- France

- Russia

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market by product on the basis of platform (ISR aircraft, ISR drones, and ISR helicopters), and by component (surveillance systems, communications systems, signal (SIGINT) systems, software, others).

Growth/Marketing Strategy: The Europe intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been merger and acquisition to strengthen their position in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market.

Competitive Strategy: Key players in the Europe intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market analyzed and profiled in the study involve major intelligence, surveillance, and reconnaissance (ISR) aircraft and drones offering companies providing aircraft and drones for the purpose. Moreover, a detailed competitive benchmarking of the players operating in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Key Companies Profiled:

|

|

Table of Contents

Executive Summary

Scope of the Study

1. Market

- 1.1. Industry Outlook

- 1.1.1. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market: Overview

- 1.1.2. On-Going and Upcoming Projects

- 1.1.3. Future Technological Trends

- 1.1.3.1. Hypersonic ISR Aircraft

- 1.1.3.2. Manned-Unmanned Teaming (MUM-T)

- 1.1.4. Comparative Analysis of Various Military Aircraft and Drones

- 1.1.4.1. Military Aircraft

- 1.1.4.2. Military Drones

- 1.1.5. Value Chain Analysis

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Increasing UAV Adoption in Military Application

- 1.2.1.2. Increasing Multi-Domain Operations (MDO) in Defense Sector

- 1.2.1.3. Growing Threats from Asymmetric Warfare

- 1.2.2. Business Challenges

- 1.2.2.1. Challenges with Data Formats

- 1.2.2.2. Availability of Modern Systems for Air Penetration

- 1.2.2.3. Lack of Trained Personnel

- 1.2.3. Business Opportunities

- 1.2.3.1. AI and ML Integration

- 1.2.3.2. Adoption of C5ISR

- 1.2.4. Business Strategies

- 1.2.4.1. Partnerships, Collaborations, Agreements and Contracts

- 1.2.4.2. Market Developments

- 1.2.1. Business Drivers

2. Region

- 2.1. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region)

- 2.2. Europe

- 2.2.1. Market

- 2.2.1.1. Key Manufacturers in Europe

- 2.2.1.2. Business Drivers

- 2.2.1.3. Business Challenges

- 2.2.2. Product

- 2.2.2.1. Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Component)

- 2.2.2.2. Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform)

- 2.2.3. Europe (by Country)

- 2.2.3.1. U.K.

- 2.2.3.1.1. Market

- 2.2.3.1.1.1. Key Manufacturers in the U.K.

- 2.2.3.1.2. Product

- 2.2.3.1.2.1. U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform)

- 2.2.3.1.1. Market

- 2.2.3.2. France

- 2.2.3.2.1. Market

- 2.2.3.2.1.1. Key Manufacturers in France

- 2.2.3.2.2. Product

- 2.2.3.2.2.1. France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by platform)

- 2.2.3.2.1. Market

- 2.2.3.3. Germany

- 2.2.3.3.1. Market

- 2.2.3.3.1.1. Key Manufacturers in Germany

- 2.2.3.3.2. Product

- 2.2.3.3.2.1. Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform)

- 2.2.3.3.1. Market

- 2.2.3.4. Russia

- 2.2.3.4.1. Market

- 2.2.3.4.1.1. Key Manufacturers in Russia

- 2.2.3.4.2. Product

- 2.2.3.4.2.1. Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform)

- 2.2.3.4.1. Market

- 2.2.3.5. Rest-of-Europe

- 2.2.3.5.1. Product

- 2.2.3.5.1.1. Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform)

- 2.2.3.5.1. Product

- 2.2.3.1. U.K.

- 2.2.1. Market

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.2. BAE Systems

- 3.2.1. Company Overview

- 3.2.1.1. Role of BAE Systems in the Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

- 3.2.1.2. Product Portfolio

- 3.2.2. Business Strategies

- 3.2.2.1. Market Development

- 3.2.3. Corporate Strategies

- 3.2.3.1. Partnerships, Collaborations, Agreements, and Contracts

- 3.2.4. Analyst View

- 3.2.1. Company Overview

- 3.3. Dassault Aviation

- 3.3.1. Company Overview

- 3.3.1.1. Role of Dassault Aviation in the Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

- 3.3.1.2. Product Portfolio

- 3.3.2. Corporate Strategies

- 3.3.2.1. Partnerships, Collaborations, Agreements, Investments, and Contracts

- 3.3.3. Analyst View

- 3.3.1. Company Overview

- 3.4. QUANTUM-SYSTEMS GMBH

- 3.4.1. Company Overview

- 3.4.1.1. Role of QUANTUM-SYSTEMS GMBH in the Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

- 3.4.1.2. Product Portfolio

- 3.4.2. Corporate Strategies

- 3.4.2.1. Partnerships, Collaborations, Agreements and Contracts

- 3.4.3. Business Strategies

- 3.4.3.1. Market Development

- 3.4.4. Analyst View

- 3.4.1. Company Overview

- 3.5. ISS Aerospace

- 3.5.1. Company Overview

- 3.5.1.1. Role of ISS Aerospace in the Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

- 3.5.1.2. Product Portfolio

- 3.5.2. Corporate Strategies

- 3.5.2.1. Partnerships, Collaborations, Agreements and Contracts

- 3.5.3. Business Strategies

- 3.5.3.1. Market Development

- 3.5.4. Analyst View

- 3.5.1. Company Overview

- 3.6. Other Key Players

- 3.7. Startups

4. Research Methodology

- 4.1. Factors for Data Prediction and Modeling