|

|

市場調査レポート

商品コード

1393900

欧州のEVベースのリキッドバイオプシー市場 - 分析と予測(2023年~2032年)Europe EV-Based Liquid Biopsy Market - Analysis and Forecast, 2023-2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 欧州のEVベースのリキッドバイオプシー市場 - 分析と予測(2023年~2032年) |

|

出版日: 2023年12月08日

発行: BIS Research

ページ情報: 英文 82 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州のEVベースのリキッドバイオプシーの市場規模は、2022年に1,888万米ドルと評価され、2023年から2032年の予測期間中に20.30%のCAGRで拡大するとみられ、2032年までに1億1,534万米ドルに達すると予測されています。

欧州のEVベースのリキッドバイオプシー市場は、継続的な技術の進歩、ヘルスケアプロバイダーによる採用の増加、個別化医療への注目の高まりによって牽引されると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年評価 | 2,185万米ドル |

| 2032年予測 | 1億1,534万米ドル |

| CAGR | 20.3% |

EVベースのリキッドバイオプシーの利用は、従来の生検技術に比べ多くの利点を提供し、疾病の診断とモニタリングを一変させました。その非侵襲性、リアルタイムのモニタリング機能、疾患の早期診断の可能性により、ヘルスケア診断の分野は革命を起こしています。EVベースのリキッドバイオプシーは、患者の転帰を改善し、ヘルスケアに関連する経費を削減し、がんを含む疾患のモニタリングと診断に、より低侵襲でより身近な手段を提供しています。さらに、Bio-Techne Corporation、QIAGEN N.V.、Thermo Fisher Scientific Inc.など多くの既存企業の参入が市場拡大を後押しすると予想されます。

さらに、EVベースのリキッドバイオプシー市場の拡大は、経済的機会を創出し、市場参入企業に学術機関との連携を促し、研究開発努力に火をつけています。

当レポートでは、欧州のEVベースのリキッドバイオプシー市場について調査し、市場の概要とともに、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 定義

第2章 調査範囲

第3章 調査手法

第4章 市場の概要

- 市場イントロダクション

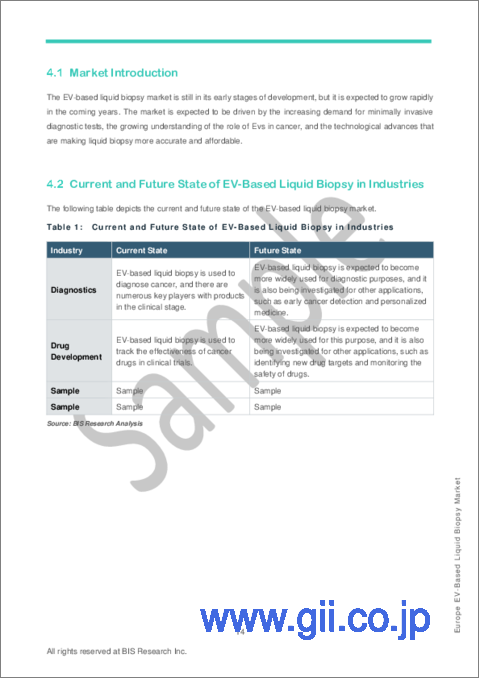

- 産業におけるEVベースのリキッドバイオプシーの現状と将来の状況

- 現在の市場規模と成長の可能性、100万米ドル、2022年~2032年

- COVID-19によるEVベースのリキッドバイオプシー市場への影響

- 運用への影響

- COVID-19の影響:市場の現在のシナリオ

第5章 EVの分離と分析の方法

- 概要

- 分離方法

- 分析方法

第6章 業界考察

- 概要

- 米国の法的要件

- 欧州の法的要件と枠組み

- アジア太平洋における法的要件と枠組み

- 償還シナリオ

第7章 市場力学

- 概要

- 影響分析

- 市場促進要因

- 市場抑制要因

- 市場機会

第8章 EVベースのリキッドバイオプシー市場(地域別)、100万米ドル、2022年~2032年

- 概要

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州諸国

第9章 企業プロファイル

- 企業概要

List of Figures

- Figure 1: EV-Based Liquid Biopsy Market (by Offering), $Million, 2022-2032

- Figure 2: EV-Based Liquid Biopsy Market (by End User), $Million, 2022 and 2032

- Figure 3: EV-Based Liquid Biopsy Market (by Region), 2022

- Figure 4: EV-Based Liquid Biopsy Market Methodology

- Figure 5: Primary Research Methodology

- Figure 6: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 7: Top-Down Approach (Segment-Wise Analysis)

- Figure 8: EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 9: Subtypes of Evs

- Figure 10: Methods of EV-Isolation from Biofluids

- Figure 11: Workflow of Differential Ultracentrifugation for Exosome Isolation

- Figure 12: Methods of EV-Analysis

- Figure 13: EV-Based Liquid Biopsy Market - Market Dynamics

- Figure 14: Structure of Evs Enveloped by Protective Lipid Membrane

- Figure 15: Number of Research Publications on Exosomes, 2015-2021

- Figure 16: Share of New Cancer Cases, 2020

- Figure 17: Number of Cancer Cases, 2020

- Figure 18: Currently Investigated Circulating Biomarkers Associated with Evs

- Figure 19: EV-Based Liquid Biopsy Market Snapshot (by Region)

- Figure 20: EV-Based Liquid Biopsy Market (by Region), $Million, 2022-2032

- Figure 21: Europe EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 22: Europe: Market Dynamics

- Figure 23: Europe EV-Based Liquid Biopsy Market (by Country), $Million, 2022-2032

- Figure 24: Germany EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 25: U.K. EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 26: France EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 27: Italy EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 28: Spain EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 29: Rest-of-Europe EV-Based Liquid Biopsy Market, $Million, 2022-2032

- Figure 30: Total Number of Companies Profiled

- Figure 31: Abcam plc: Product Portfolio

- Figure 32: Qiagen N.V.: Product Portfolio

- Figure 33: Malvern Panalytical Ltd: Product Portfolio

- Figure 34: Lonza Group AG: Product Portfolio

List of Tables

- Table 1: Current and Future State of EV-Based Liquid Biopsy in Industries

- Table 2: Example of Few Commercial Kits Available for EV Isolation

- Table 3: Advantages and Disadvantages of the EV Isolation Methods

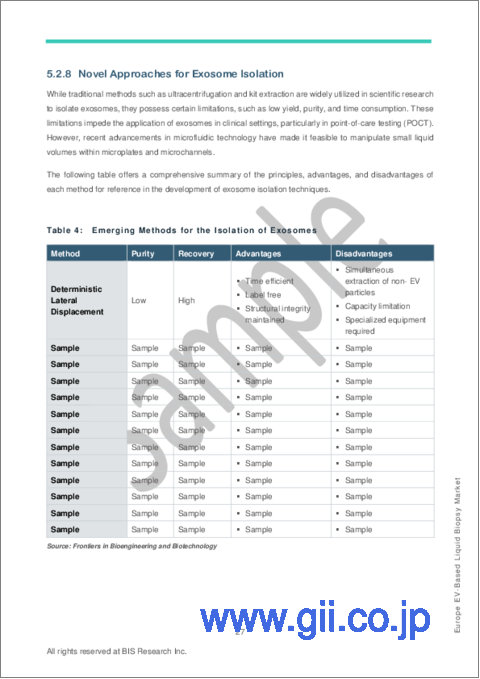

- Table 4: Emerging Methods for the Isolation of Exosomes

- Table 5: Advantages and Disadvantages of Analysis Methods for Evs

- Table 6: Legal Requirements in the U.S.

- Table 7: Legal Landscape for EV-Based Liquid Biopsies in Europe

- Table 8: Size and Densities of Evs and Various Lipoproteins

- Table 9: Technological Advancements in EV-Based Liquid Biopsy

“The Europe EV-Based Liquid Biopsy Market Expected to Reach $115.34 Million by 2032.”

Introduction to Europe EV (Extracellular vesicles)-Based Liquid Biopsy Market

The Europe EV-based liquid biopsy market was valued at $18.88 million in 2022 and is anticipated to reach $115.34 million by 2032, witnessing a CAGR of 20.30% during the forecast period 2023-2032. The Europe EV-based liquid biopsy market is expected to be driven by ongoing technological advancements, increasing adoption by healthcare providers, and a growing focus on personalized medicine.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $21.85 Million |

| 2032 Forecast | $115.34 Million |

| CAGR | 20.3% |

Market introduction

The use of EV-based liquid biopsy, that offers many advantages over conventional biopsy techniques, has transformed the diagnosis and monitoring of disease. The field of healthcare diagnostics has been revolutionized by its non-invasiveness, real-time monitoring capabilities, and potential for early disease diagnosis. EV-based liquid biopsy has improved patient outcomes, decreased expenses associated with healthcare, and provided a less intrusive and more accessible means of monitoring and diagnosing diseases, including cancer. Furthermore, the market expansion is anticipated to be aided by the entry of many established companies, including Bio-Techne Corporation, QIAGEN N.V., and Thermo Fisher Scientific Inc.

In addition, the market expansion for EV-based liquid biopsies has created economic opportunities, prompted industrial participants to collaborate with academic institutions, and sparked research and development efforts.

Market Segmentation

Segmentation 1: by Country

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe"

How can this report add value to an organization?

Growth/Marketing Strategy: EV-based liquid biopsy has tremendous growth potential due to its ability to revolutionize non-invasive cancer detection and monitoring. By analyzing the cargo of EVs, researchers can gain insights into the presence, type, and characteristics of tumors without directly accessing the tumor site.

Competitive Strategy: Key players in the EV-based liquid biopsy market have been analyzed and profiled in the study, including manufacturers. Moreover, a detailed competitive benchmarking of the players operating in the EV-based liquid biopsy market has been done to help the reader understand how players stack against each other, presenting a clear market landscape.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent names in this market are:

|

|

Table of Contents

1 Definition

- 1.1 Inclusion and Exclusion Criteria

2 Research Scope

- 2.1 Key Questions Answered in the Report:

3 Research Methodology

- 3.1 EV-Based Liquid Biopsy Market: Research Methodology

- 3.2 Primary Data Sources

- 3.3 Secondary Data Sources

- 3.4 Market Estimation Model

- 3.5 Criteria for Company Profiling

4 Markets Overview

- 4.1 Market Introduction

- 4.2 Current and Future State of EV-Based Liquid Biopsy in Industries

- 4.3 Current Market Size and Growth Potential, $Million, 2022-2032

- 4.4 COVID-19 Impact on EV-based Liquid Biopsy Market

- 4.4.1 Impact on Operations

- 4.4.2 COVID-19 Impact: Current Scenario of the Market

5 Methods of EV Isolation and Analysis

- 5.1 Overview

- 5.1.1 Evs Introduction

- 5.2 Isolation Methods

- 5.2.1 EV Isolation Techniques Utilizing Ultracentrifugation Methods

- 5.2.1.1 Differential Ultracentrifugation

- 5.2.1.2 Density Gradient Centrifugation

- 5.2.1.3 Moving Zone or Rate-Zonal Centrifugation

- 5.2.1.4 Isopycnic Centrifugation

- 5.2.2 EV Isolation Techniques Utilizing Size-Based Methods

- 5.2.2.1 Ultrafiltration

- 5.2.2.2 Sequential Filtration

- 5.2.2.3 Size Exclusion Chromatography (SEC)

- 5.2.2.4 Flow Field-Flow Fractionation (FFFF)

- 5.2.2.5 Hydrostatic Filtration Dialysis (HFD)

- 5.2.3 EV Isolation Techniques Utilizing Immunoaffinity Methods

- 5.2.3.1 Enzyme-Linked Immunosorbent Assay (ELISA)

- 5.2.3.2 Magneto-Immunoprecipitation

- 5.2.4 EV Isolation Techniques Utilizing Precipitation Methods

- 5.2.4.1 Polyethylene Glycol (PEG) Precipitation

- 5.2.4.2 Lectin Induced Agglutination

- 5.2.5 EV Isolation Techniques Utilizing Microfluidic Technology

- 5.2.6 EV Isolation Techniques Utilizing Commercial Kits

- 5.2.7 Advantages and Disadvantages of the EV Isolation Methods

- 5.2.8 Novel Approaches for Exosome Isolation

- 5.2.1 EV Isolation Techniques Utilizing Ultracentrifugation Methods

- 5.3 Analysis Methods

- 5.3.1 Advantages and Disadvantages of Analysis Methods for Evs

6 Industry Insights

- 6.1 Overview

- 6.2 Legal Requirements in the U.S.

- 6.3 Legal Requirements and Frameworks in Europe

- 6.4 Legal Requirements and Frameworks in Asia-Pacific

- 6.5 Reimbursement Scenario

7 Market Dynamics

- 7.1 Overview

- 7.2 Impact Analysis

- 7.3 Market Drivers

- 7.3.1 Abundance and Remarkable Stability of Exosomes Compared to CfDNA or CTCs

- 7.3.2 Amplified Funding and Dedicated Research Efforts

- 7.3.3 Rising Prevalence of Cancers

- 7.4 Market Restraints

- 7.4.1 Lack of Standardized EV Isolation and Characterization Protocols

- 7.4.2 Lack of Precise EV Subtype Classification and Biomarkers Validation

- 7.5 Market Opportunities

- 7.5.1 Advancements in EV-Based Liquid Biopsy Technologies

- 7.5.2 Development of New EV-Based Biomarkers

- 7.5.3 Approved Products in the Market

8 EV-Based Liquid Biopsy Market (by Region), $Million, 2022-2032

- 8.1 Overview

- 8.2 Europe

- 8.2.1 Germany

- 8.2.2 U.K.

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Rest-of-Europe

9 Company Profiles

- 9.1 Company Overview

- 9.1.1 Abcam plc

- 9.1.1.1 Company Overview

- 9.1.1.2 Role of Abcam plc in the EV-Based Liquid Biopsy Market

- 9.1.1.3 Major Products: Key Specifications

- 9.1.1.4 Key Competitors

- 9.1.1.5 Analyst Perspective

- 9.1.2 Qiagen N.V.

- 9.1.2.1 Company Overview

- 9.1.2.2 Role of Qiagen N.V. in the EV-Based Liquid Biopsy Market

- 9.1.2.3 Major Products: Key Specifications

- 9.1.2.4 Key Competitors

- 9.1.2.5 Analyst Perspective

- 9.1.3 Malvern Panalytical Ltd

- 9.1.3.1 Company Overview

- 9.1.3.2 Role of Malvern Panalytical Ltd in the EV-Based Liquid Biopsy Market

- 9.1.3.3 Major Products: Key Specifications

- 9.1.3.4 Key Competitors

- 9.1.3.5 Analyst Perspective

- 9.1.4 Lonza Group AG

- 9.1.4.1 Company Overview

- 9.1.4.2 Role of Lonza Group AG in the EV-Based Liquid Biopsy Market

- 9.1.4.3 Major Products: Key Specifications

- 9.1.4.4 Key Competitors

- 9.1.4.5 Analyst Perspective

- 9.1.1 Abcam plc