|

|

市場調査レポート

商品コード

1389590

持続可能な採鉱ソリューション市場 - 世界および地域別分析、2023年~2032年Sustainable Mining Solutions Market - A Global and Regional Analysis, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| 持続可能な採鉱ソリューション市場 - 世界および地域別分析、2023年~2032年 |

|

出版日: 2023年11月30日

発行: BIS Research

ページ情報: 英文 131 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 目次

持続可能な採鉱ソリューションの市場規模は、複数の主な要因の収束に牽引され、拡大が著しく加速しています。

この成長の背景には、環境問題に対する意識の高まり、絶え間ない技術革新、鉱業の持続可能性を奨励する規制状況の好転があります。例えば、カナダの「持続可能な採掘に向けて(TSM)」プログラムは、その代表的な例です。同プログラムは、持続可能な採掘慣行と透明性を積極的に奨励し、カナダを持続可能な採掘の世界的リーダーの1つと位置づけています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年の評価額 | 25億9,160万米ドル |

| 2032年予測 | 123億7,100万米ドル |

| CAGR | 18.97% |

さらに、特定の政策が持続可能な鉱業ソリューション市場の成長に大きな影響を及ぼしています。例えば、オーストラリアの鉱物・金属政策は、責任ある資源管理に重点を置き、同国の鉱物・金属産業の持続可能な発展を優先しています。したがって、このような支援政策は、持続可能な採鉱ソリューション市場の成長に影響を与えています。

持続可能な採鉱ソリューションとは、電力やクリーンで再生可能なエネルギーの力を利用したり、バッテリーシステムや燃料電池などの先進技術を取り入れたりすることで、環境への影響を低減しながら採鉱作業を推進する手法や採鉱機器を指します。国際エネルギー機関(IEA)は、クリーンエネルギーへの移行を支えるため、2040年までに特定の鉱物の需要が20倍以上に増加すると予測しています。世界の炭素削減目標を達成するためには、鉱業は極めて重要であり、脱炭素化のために環境に優しい慣行を採用する必要があります。そのため、鉱業各社はパリ協定に沿った温室効果ガス排出量削減目標を設定し、グリーンマイニング・ソリューションへの移行を着実に進めています。

しかし、持続可能な採鉱ソリューション市場の成長を制限する主な要因は、初期コストが高いことと、持続可能な技術をサポートするインフラが不足していることです。

環境問題に対する意識の高まりと、鉱業のエコロジカルフットプリントを削減する差し迫った必要性により、販売と融資の機会が大きく広がると予想されます。この変化は、欧州や北米などの地域で顕著に見られます。

当レポートでは、世界の持続可能な採鉱ソリューション市場について調査し、市場の概要とともに、用途別、プロセス別、採鉱設備別、エネルギー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場

- 業界の展望

- ビジネスダイナミクス

第2章 用途

- 世界の持続可能な採鉱ソリューション市場(用途別)

- 金属鉱物

- 非金属鉱物

第3章 製品

- 世界の持続可能な採鉱ソリューション市場(プロセス別)

- 地下採掘

- 露地採掘

- 世界の持続可能な採鉱ソリューション市場(鉱山機器別)

- 世界の持続可能な採鉱ソリューション市場(エネルギー源別)、価値データ

- 持続可能な採鉱ソリューション- 主要な持続可能な取り組み

- 製品ベンチマーク:世界の持続可能な採鉱ソリューション市場、成長率- 市場シェアマトリックス(プロセス別)、価値、2022年

- 特許分析

第4章 地域

- 北米

- 欧州

- 英国

- 中国

- アジア太平洋と日本

- その他の地域

第5章 市場:競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競争力マトリックス

- 企業プロファイル

- Sandvik AB

- Epiroc USA LLC

- Komatsu Ltd.

- XCMG Mining Machinery Co. Ltd.

- Hitachi Construction Machinery Co., Ltd

- Liebherr

- Lithium System AG (eMining AG)

- Caterpillar Inc.

- Xiangtan Electric Manufacturing Co Ltd (XEMC)

- BELAZ

- Aramine

- Prairie Machine & Parts Mfg

- SANY Group

- Miller Technology Incorporated

- Anglo American plc

第6章 調査手法

“Global Sustainable Mining Solutions Market Expected to Reach $12,371.0 Million by 2032.”

Global Sustainable Mining Solutions Market Overview

The sustainable mining solutions market is experiencing a significant upsurge in expansion, driven by the convergence of multiple key factors. This growth is attributed to the growing awareness of environmental concerns, the continuous stream of technological innovations, and the increasingly favorable regulatory landscape that encourages sustainability in the mining industry. For instance, Canada's Towards Sustainable Mining (TSM) program stands out as a prime example. It actively encourages sustainable mining practices and transparency, positioning Canada as one of the global leaders in sustainable mining.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $2,591.6 Million |

| 2032 Forecast | $12,371.0 Million |

| CAGR | 18.97% |

Furthermore, specific policies are exerting a profound influence on the growth of the sustainable mining solutions market. For instance, Australia's Minerals and Metals Policy prioritizes the sustainable development of the country's minerals and metals industry, with an emphasis on responsible resource management. Therefore, such supportive policies are influencing the sustainable mining solutions market growth.

Market Lifecycle Stage

Sustainable mining solutions refer to practices and mining equipment that harness the power of electricity and clean & renewable energy or incorporate advanced technologies, such as battery systems and fuel cells, to drive mining operations with reduced environmental impact. The International Energy Agency (IEA) predicts a more than twentyfold increase in demand for certain minerals by 2040 to support the transition to clean energy. To meet global carbon reduction goals, the mining industry is crucial, and it needs to adopt greener practices for decarbonization. Thus, mining companies are setting targets to reduce their greenhouse gas emissions in alignment with the Paris Agreement and are steadily moving toward green mining solutions.

However, the key factors limiting the growth of the sustainable mining solutions market are the high initial cost and lack of infrastructure to support sustainable technologies.

Impact

The growing awareness of environmental concerns and the pressing need to reduce the ecological footprint of the mining industry are expected to open significant sales and financing opportunities. This shift was prominently experienced in regions such as Europe and North America.

Market Segmentation:

Segmentation 1: by Application

- Metallic Minerals

- Industrial Metals

- Precious Metals

- Iron Ore

- Non-Metallic Minerals

- Coal

- Others

Based on application, the metallic minerals led the sustainable mining solutions market in 2022. This can be attributed to several factors, including the continued demand for metallic minerals driven by industries such as construction, infrastructure development, and growing interest in electric vehicles, which rely heavily on materials such as lithium, cobalt, and rare earth elements.

Segmentation 2: by Process

- Underground Mining

- Surface Mining

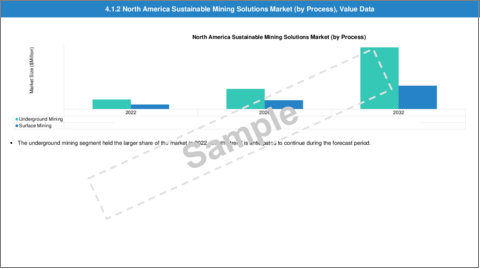

Based on the process, the underground mining segment dominated the sustainable mining solutions market in 2022. This shift can be primarily attributed to the increasing recognition of the heightened risk of pollution and harm to workers associated with underground mining activities.

Segmentation 3: by Mining Equipment

- Drill Rigs

- Bolters

- Dozers

- Loaders

- Trucks

- Mining Excavators

- Others

Based on mining equipment, the trucks segment led the sustainable mining solutions market in 2022. A recent example highlighting the dominance of electric trucks in the sustainable mining solutions market is the adoption of electric haul trucks by major mining companies such as BHP and Rio Tinto. These industry leaders have made substantial investments in electric truck fleets as part of their commitment to reducing carbon emissions and promoting sustainability.

Segmentation 4: by Energy Source

- Battery

- Lithium-Ion Battery

- Lead Acid Battery

- Others

- Hydrogen Fuel Cell

- Bio-Fuel

In 2022, the battery segment led the sustainable mining solutions market. This trend is a result of the growing adoption of battery-powered vehicles in mining operations. Numerous industry participants are actively incorporating battery vehicles into their fleets and have established goals to transform diesel vehicles into battery-powered variants.

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, Russia, Sweden, Spain, and Rest-of-Europe

- China

- U.K.

- Asia-Pacific and Japan - Japan, India, Australia, and Rest-of-Asia-Pacific and Japan

- Rest-of-the-World - South America and Middle East and Africa

In the global sustainable mining solutions market, North America dominated the market due to stringent environmental regulations that have compelled mining companies to embrace sustainable practices. Moreover, the region benefits from the presence of prominent organizations and associations dedicated to advancing sustainable mining. For instance, the U.S. has the National Mining Association, which actively promotes responsible mining practices. Furthermore, in 2020, the Environmental Protection Agency (EPA) announced the Cleaner Trucks Initiative, which seeks to reduce greenhouse gas emissions from heavy-duty trucks, including those used in the mining sector. Such initiatives are further pushing mining companies to invest in cleaner, more sustainable vehicles, which is expected to augment the market growth of the sustainable mining solutions market.

Recent Developments in the Global Sustainable Mining Solutions Market

- In April 2023, XCMG Machinery unveiled a range of new electric mining equipment products, broadening its application scope to encompass the complete cycle of mining operations. This development underscores XCMG's dedication to providing comprehensive solutions for the mining industry, further enhancing efficiency and effectiveness in mining operations.

- In March 2023, CharIN, in collaboration with ICMM, inaugurated a new mining taskforce. This initiative signifies a concerted effort to advance sustainable practices and innovation within the mining industry, further promoting the goals of both organizations in advancing responsible mining operations.

- In June 2023, Fortescue Metals Group and Liebherr formed a partnership aimed at developing zero-emission mining equipment. This collaboration is a major step in the pursuit of sustainable mining practices, aligning with the global push for cleaner and more environment-friendly operations in the mining industry.

Demand - Drivers and Limitations

The following are the demand drivers for the global sustainable mining solutions market:

- Incentives and Support from Governments

- Lower Operating Cost Over Time

The market is expected to face some limitations as well due to the following challenges:

- High Initial Costs

- Lack of Infrastructure to Support Sustainable Technologies

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different processes, mining equipment, and energy sources involved in sustainable mining solutions. Moreover, the study provides the reader with a detailed understanding of the global sustainable mining solutions market based on the application (metallic minerals and non-metallic minerals).

Growth/Marketing Strategy: The global sustainable mining solutions market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been product developments, business expansions, and acquisitions to strengthen their position in the global sustainable mining solutions market.

Competitive Strategy: Key players in the global sustainable mining solutions market analyzed and profiled in the study involve sustainable mining solutions manufacturers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the global sustainable mining solutions market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Of the top players profiled in the report, the public companies operating in the global sustainable mining solutions market accounted for around 73% of the market share in 2022, while the private companies operating in the market captured around 27% of the market share.

Some of the established names in this market are:

Company Type (Public)

|

Company Type (Private)

|

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

1 Market

- 1.1 Industry Outlook

- 1.1.1 Trends: Current & Future

- 1.1.1.1 Increasing Global Awareness of Environmental Issues

- 1.1.1.2 Increasing Minerals Demand for Clean Energy Technology and Strict Environmental Regulations

- 1.1.2 Sustainable Mining Solutions Market: Supply Chain Analysis

- 1.1.1 Trends: Current & Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Incentives and Support from Governments

- 1.2.1.2 Lower Operating Cost Over Time

- 1.2.2 Business Challenges

- 1.2.2.1 High Initial Costs

- 1.2.2.2 Lack of Infrastructure To Support Sustainable Technologies

- 1.2.3 Business Stratergies

- 1.2.4 Corporate Stratergies

- 1.2.5 Business Opportunities

- 1.2.5.1 Continued Innovation in Sustainable Mining Equipment

- 1.2.5.2 Rising Focus toward Introducing Hydrogen and Bio-Fuel Mining Equipment

- 1.2.1 Business Drivers

2 Application

- 2.1 Global Sustainable Mining Solutions Market (by Application), Value Data

- 2.1.1 Metallic Minerals

- 2.1.1.1 Industrial Metals

- 2.1.1.2 Precious Metals

- 2.1.1.3 Iron Ore

- 2.1.2 Non-Metallic Minerals

- 2.1.2.1 Coal

- 2.1.2.2 Others

- 2.1.1 Metallic Minerals

3 Product

- 3.1 Global Sustainable Mining Solutions Market (by Process), Value Data

- 3.1.1 Underground Mining

- 3.1.2 Surface Mining

- 3.2 Global Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 3.2.1 Drill Rigs

- 3.2.2 Bolters

- 3.2.3 Dozers

- 3.2.4 Loaders

- 3.2.5 Trucks

- 3.2.6 Mining Excavator

- 3.2.7 Others

- 3.3 Global Sustainable Mining Solutions Market (by Energy Source), Value Data

- 3.3.1 Battery

- 3.3.1.1 Lithium-Ion Battery

- 3.3.1.2 Lead Acid Battery

- 3.3.1.3 Others

- 3.3.2 Hydrogen Fuel Cell

- 3.3.3 Bio-Fuel

- 3.3.1 Battery

- 3.4 Sustaianble Mining Solutions - Key Sustainable Initiatives

- 3.5 Product Benchmarking: Global Sustainable Mining Solutions Market, Growth Rate - Market Share Matrix (by Process), Value, 2022

- 3.6 Patent Analysis

- 3.6.1 Patent Analysis (by Status)

- 3.6.2 Patent Analysis (by Organization)

4 Region

- 4.1 North America

- 4.1.1 North America Sustainable Mining Solutions Market (by Application), Value Data

- 4.1.2 North America Sustainable Mining Solutions Market (by Process), Value Data

- 4.1.3 North America Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.1.4 North America Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.1.5 North America Sustainable Mining Solutions Market (By Country)

- 4.1.5.1 U.S.

- 4.1.5.1.1 U.S. Sustainable Mining Solutions Market (by Application), Value Data

- 4.1.5.1.2 U.S. Sustainable Mining Solutions Market (by Process), Value Data

- 4.1.5.1.3 U.S. Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.1.5.1.4 U.S. Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.1.5.2 Canada

- 4.1.5.2.1 Canada Sustainable Mining Solutions Market (by Application), Value Data

- 4.1.5.2.2 Canada Sustainable Mining Solutions Market (by Process), Value Data

- 4.1.5.2.3 Canada Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.1.5.2.4 Canada Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.1.5.3 Mexico

- 4.1.5.3.1 Mexico Sustainable Mining Solutions Market (by Application), Value Data

- 4.1.5.3.2 Mexico Sustainable Mining Solutions Market (by Process), Value Data

- 4.1.5.3.3 Mexico Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.1.5.3.4 Mexico Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.1.5.1 U.S.

- 4.2 Europe

- 4.2.1 Europe Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.2 Europe Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.3 Europe Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.4 Europe Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5 Europe Sustainable Mining Solutions Market (By Country)

- 4.2.5.1 Germany

- 4.2.5.1.1 Germany Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.5.1.2 Germany Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.5.1.3 Germany Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.5.1.4 Germany Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5.2 Russia

- 4.2.5.2.1 Russia Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.5.2.2 Russia Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.5.2.3 Russia Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.5.2.4 Russia Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5.3 Spain

- 4.2.5.3.1 Spain Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.5.3.2 Spain Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.5.3.3 Spain Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.5.3.4 Spain Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5.4 Sweden

- 4.2.5.4.1 Sweden Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.5.4.2 Sweden Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.5.4.3 Sweden Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.5.4.4 Sweden Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5.5 Rest-of-Europe

- 4.2.5.5.1 Rest-of-Europe Sustainable Mining Solutions Market (by Application), Value Data

- 4.2.5.5.2 Rest-of-Europe Sustainable Mining Solutions Market (by Process), Value Data

- 4.2.5.5.3 Rest-of-Europe Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.2.5.5.4 Rest-of-Europe Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.2.5.1 Germany

- 4.3 U.K.

- 4.3.1 U.K Sustainable Mining Solutions Market (by Application), Value Data

- 4.3.2 U.K. Sustainable Mining Solutions Market (by Process), Value Data

- 4.3.3 U.K. Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.3.4 U.K. Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.4 China

- 4.4.1 China Sustainable Mining Solutions Market (by Application), Value Data

- 4.4.2 China Sustainable Mining Solutions Market (by Process), Value Data

- 4.4.3 China Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.4.4 China Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5 Asia-Pacific & Japan

- 4.5.1 Asia-Pacific and Japan Sustainable Mining Solutions Market (by Application), Value Data

- 4.5.2 Asia-Pacific and Japan Sustainable Mining Solutions Market (by Process), Value Data

- 4.5.3 Asia-Pacific and Japan Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.5.4 Asia-Pacific and Japan Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5.5 Asia-Pacific & Japan Sustainable Mining Solutions Market (By Country)

- 4.5.5.1 Japan

- 4.5.5.1.1 Japan Sustainable Mining Solutions Market (by Application), Value Data

- 4.5.5.1.2 Japan Sustainable Mining Solutions Market (by Process), Value Data

- 4.5.5.1.3 Japan Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.5.5.1.4 Japan Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5.5.2 India

- 4.5.5.2.1 India Sustainable Mining Solutions Market (by Application), Value Data

- 4.5.5.2.2 India Sustainable Mining Solutions Market (by Process), Value Data

- 4.5.5.2.3 India Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.5.5.2.4 India Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5.5.3 Australia

- 4.5.5.3.1 Australia Sustainable Mining Solutions Market (by Application), Value Data

- 4.5.5.3.2 Australia Sustainable Mining Solutions Market (by Process), Value Data

- 4.5.5.3.3 Australia Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.5.5.3.4 Australia Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5.5.4 Rest-of-Asia-Pacific & Japan

- 4.5.5.4.1 Rest-of-Asia-Pacific and Japan Sustainable Mining Solutions Market (by Application), Value Data

- 4.5.5.4.2 Rest-of-Asia-Pacific and Japan Sustainable Mining Solutions Market (by Process), Value Data

- 4.5.5.4.3 Rest-of-Asia-Pacific and Japan Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.5.5.4.4 Rest-of-Asia-Pacific and Japan Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.5.5.1 Japan

- 4.6 Rest-of-the-World

- 4.6.1 Rest-of-the-World Sustainable Mining Solutions Market (by Application), Value Data

- 4.6.2 Rest-of-the-World Sustainable Mining Solutions Market (by Process), Value Data

- 4.6.3 Rest-of-the-World Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.6.4 Rest-of-the-World Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.6.5 Rest-of-the-World Sustainable Mining Solutions Market (By Region)

- 4.6.5.1 South America

- 4.6.5.1.1 South America Sustainable Mining Solutions Market (by Application), Value Data

- 4.6.5.1.2 South America Sustainable Mining Solutions Market (by Process), Value Data

- 4.6.5.1.3 South America Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.6.5.1.4 South America Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.6.5.2 Middle East and Africa

- 4.6.5.2.1 Middle East and Africa Sustainable Mining Solutions Market (by Application), Value Data

- 4.6.5.2.2 Middle East and Africa Sustainable Mining Solutions Market (by Process), Value Data

- 4.6.5.2.3 Middle East and Africa Sustainable Mining Solutions Market (by Mining Equipment), Value Data

- 4.6.5.2.4 Middle East and Africa Sustainable Mining Solutions Market (by Energy Source), Value Data

- 4.6.5.1 South America

5 Markets: Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.1.1 Competitive Position Matrix

- 5.2 Company Profiles

- 5.2.1 Sandvik AB

- 5.2.1.1 Overview

- 5.2.1.2 Top Products / Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers/End-Users

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Epiroc USA LLC

- 5.2.2.1 Overview

- 5.2.2.2 Top Products / Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers/End-Users

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Komatsu Ltd.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products / Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers/End-Users

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 XCMG Mining Machinery Co. Ltd.

- 5.2.4.1 Overview

- 5.2.4.2 Top Products / Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers/End-Users

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Hitachi Construction Machinery Co., Ltd

- 5.2.5.1 Overview

- 5.2.5.2 Top Products / Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers/End-Users

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Liebherr

- 5.2.6.1 Overview

- 5.2.6.2 Top Products / Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers/End-Users

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Lithium System AG (eMining AG)

- 5.2.7.1 Overview

- 5.2.7.2 Top Products / Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers/End-Users

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Caterpillar Inc.

- 5.2.8.1 Overview

- 5.2.8.2 Top Products / Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers/End-Users

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Xiangtan Electric Manufacturing Co Ltd (XEMC)

- 5.2.9.1 Overview

- 5.2.9.2 Top Products / Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers/End-Users

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 BELAZ

- 5.2.10.1 Overview

- 5.2.10.2 Top Products / Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers/End-Users

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Aramine

- 5.2.11.1 Overview

- 5.2.11.2 Top Products / Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers/End-Users

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Prairie Machine & Parts Mfg

- 5.2.12.1 Overview

- 5.2.12.2 Top Products / Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers/End-Users

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 SANY Group

- 5.2.13.1 Overview

- 5.2.13.2 Top Products / Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers/End-Users

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Miller Technology Incorporated

- 5.2.14.1 Overview

- 5.2.14.2 Top Products / Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers/End-Users

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Anglo American plc

- 5.2.15.1 Overview

- 5.2.15.2 Top Products / Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers/End-Users

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 Sandvik AB