|

|

市場調査レポート

商品コード

1389579

アジア太平洋の産業用コンピュータX線撮影装置市場-分析と予測(2023年~2033年)Asia-Pacific Industrial Computed Radiography Market - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の産業用コンピュータX線撮影装置市場-分析と予測(2023年~2033年) |

|

出版日: 2023年12月01日

発行: BIS Research

ページ情報: 英文 96 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋の産業用コンピュータX線撮影装置の市場規模は、2023年~2033年の予測期間中に3.49%の成長率で拡大し、2022年の1,350万米ドルから2033年には1,930万米ドルに達すると予測されます。

非破壊検査(NDT)ソリューションへのニーズの高まり、技術的ブレークスルー、デジタル画像への移行、持続可能性への注目の高まりなどにより、産業用コンピュータX線撮影装置市場は急速に拡大しています。新興国市場における継続的な市場開拓と応用の可能性により、市場は今後も成長を続けると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年評価 | 1,370万米ドル |

| 2033年予測 | 1,930万米ドル |

| CAGR | 3.49% |

アジア太平洋の産業用コンピュータX線撮影装置市場は順調に拡大しており、コンピュータX線撮影装置技術への提携や投資が活発化しています。しかし、コンピュータX線撮影装置装置を用いた非破壊検査を実施する有資格者の不足など、業界はいくつかの困難に直面しています。さらに、画像をリアルタイムで視覚化し、欠陥を自動的に特定する機能を持つデジタルX線撮影システムの利用が拡大していることも、産業用コンピュータX線撮影システムの開発に影響を与えています。

また、航空宇宙や石油・ガスなどの分野では、洋上でもリアルタイムで画像を可視化できる小型の可搬型X線撮影装置が求められるが、このような分野特有の要件がさらなる困難をもたらしています。これらの分野では、効果的な欠陥補正が要求されます。その結果、産業用X線CTシステムメーカーや非破壊検査サービスプロバイダーは、ますますX線CTから移行しつつあります。

これらの要素はアジア太平洋の産業用コンピュータX線撮影装置市場に影響を与えており、高度な非破壊検査手法の必要性が技術革新とデジタル技術の採用に拍車をかけています。市場は業界固有のニーズを満たすために変化し続け、熟練した人材と技術の改善によって障害を乗り越えていくと予想されます。

当レポートでは、アジア太平洋の産業用コンピュータX線撮影装置市場について調査し、市場の概要とともに、用途別、コンポーネント別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場

- 業界の展望

- ビジネスダイナミクス

第2章 地域

- 産業用コンピュータX線撮影装置ー市場(地域別)

- アジア太平洋

第3章 市場-競合ベンチマーキングと企業プロファイル

- 市場シェア分析

- 産業用コンピュータ放射線撮影開発業者

- MQS Technologies Pvt. Ltd.

- Rigaku Corporation

第4章 調査手法

List of Figures

- Figure 1: Industrial Computed Radiography Market, Units, 2022-2033

- Figure 2: Industrial Computed Radiography Market, $Million, 2022-2033

- Figure 3: Industrial Computed Radiography Market, Consumables (Imaging Plates), Units, 2022-2033

- Figure 4: Industrial Computed Radiography Market, Consumables (Imaging Plates), $Million, 2022-2033

- Figure 5: Industrial Computed Radiography Market (by Application), Units, 2023 and 2033

- Figure 6: Industrial Computed Radiography Market (by Application), $Million, 2023 and 2033

- Figure 7: Industrial Computed Radiography Market (by Region), $Million, 2023

- Figure 8: Factors Analyzed in Business Dynamics

- Figure 9: Commercial Aircraft Order Backlog (as of December 2021)

- Figure 10: Share of Key Market Strategies and Developments, January 2020- November 2022

- Figure 11: Industrial Computed Radiography Market Share (by Company), $Million, 2022

- Figure 12: Research Methodology

- Figure 13: Top-Down Approach

- Figure 14: Assumptions and Limitations

List of Tables

- Table 1: Comparison of Computed Radiography (CR) vs. Digital Radiography (DR) vs. Computed Tomography (CT)

- Table 2: Advantages and Disadvantages of Computed Radiography:

- Table 3: Advantages and Disadvantages of Digital Radiography:

- Table 4: New Product Launch, January 2018- January 2023

- Table 5: Expansion, January 2018- January 2023

- Table 6: Partnerships, Collaborations, Agreements, and Contracts, January 2018- January 2023

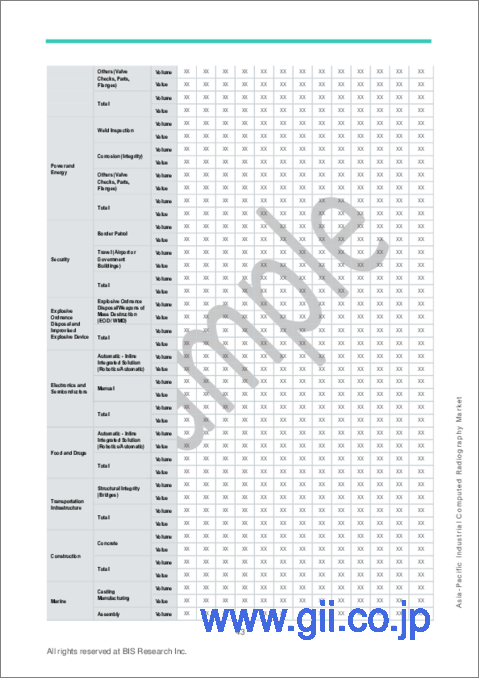

- Table 7: Industrial Computed Radiography Market (by Region), Units and $Million, 2022-2033

- Table 8: Asia-Pacific Industrial Computed Radiography Market (by Country), Units and $Million, 2022-2033

- Table 9: China Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

- Table 10: China Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

- Table 11: China Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

- Table 12: India Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

- Table 13: India Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

- Table 14: India Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

- Table 15: Japan Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

- Table 16: Japan Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

- Table 17: Japan Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

- Table 18: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

- Table 19: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

- Table 20: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

- Table 21: MQS Technologies Pvt. Ltd.: Product Portfolio

- Table 22: Rigaku Corporation: Product Portfolio

- Table 23: Rigaku Corporation: Partnerships

“The Asia-Pacific Industrial Computed Radiography Market Expected to Reach $19.30 Million by 2033.”

Introduction to Asia-Pacific Industrial Computed Radiography Market

The Asia-Pacific industrial computed radiography market is estimated to reach $19.30 million by 2033 from $13.50 million in 2022, at a growth rate of 3.49% during the forecast period 2023-2033. The market for industrial computed radiography systems is expanding rapidly due to the increasing need for non-destructive testing (NDT) solutions, technical breakthroughs, the shift to digital imaging, and the growing focus on sustainability. The market is anticipated to keep growing in the upcoming years due to ongoing developments and possible applications in developing industries.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $13.70 Million |

| 2033 Forecast | $19.30 Million |

| CAGR | 3.49% |

The industrial computed radiography market in the Asia-Pacific region is expanding steadily, which is encouraging partnerships and investments in computed radiography technology. Nonetheless, the industry confronts some difficulties, such as a lack of qualified personnel to carry out non-destructive testing using computed radiography equipment. Moreover, the development of industrial computed radiography systems is being impacted by the growing use of digital radiography systems, which have the ability to visualize images in real time and automatically identify defects.

The unique requirements of sectors like aerospace and oil and gas, which call for small, portable radiography equipment that can visualize images in real time even in offshore settings, provide additional difficulties. These sectors require effective flaw correction. Consequently, industrial computed radiography system makers and non-destructive testing service providers are increasingly moving away from computed radiography.

These elements influence the Asia-Pacific industrial computed radiography market, where the need for sophisticated non-destructive testing methods spurs technological innovation and digital technology adoption. It is anticipated that the market will keep changing to satisfy industry-specific needs and get over obstacles with skilled personnel and technology improvements.

Market Segmentation

Segmentation 1: by Application

- Aerospace and Defense

- Automotive

- Oil and Gas

- Power and Energy

- Security

- Explosive Ordnance Disposal and Improvised Explosive Device

- Electronics and Semiconductors

- Food and Drugs

- Transportation Infrastructure

- Construction

- Marine

- Manufacturing

- Heavy Industries

- Others

Segmentation 2: by Component

- Imaging Plates

- Computed Radiography Reader (Digitizer)

- Review Station with Acquisition Software

Segmentation 3: by Region

- Asia-Pacific - China, Japan, India, and Rest-of-Asia-Pacific

How can this report add value to an organization?

Platform/Innovation Strategy: The product segment helps the reader understand the various component that is integrated with industrial computed radiography to conduct safe, secure, and efficient non-destructive testing. Moreover, the study provides the reader with a detailed understanding of the components, such as imaging plates and computed radiography readers. In addition, it provides a detailed understanding of the acquisition software that the review station uses to review the images captured by the imaging plates.

Growth/Marketing Strategy: The Asia-Pacific industrial computed radiography market has seen major development activities by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the industrial computed radiography market.

Competitive Strategy: Key players in the Asia-Pacific industrial computed radiography market analyzed and profiled in the study involve industrial computed radiography manufacturers that offer docking systems and enabling capabilities. Moreover, a detailed competitive benchmarking of the players operating in the Asia-Pacific industrial computed radiography market offers various solutions to conduct non-destructive testing efficiently through portable computed radiography systems. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Industrial Computed Radiography Market: Overview

- 1.1.2 Computed Radiography Services within the Non-Destructive Testing Landscape

- 1.1.3 Evolving Technological Trends and Disruptions in Computed Radiography Services

- 1.1.3.1 Artificial Neural Networks for Defect Detection

- 1.1.3.2 Battery Operated Flat Panel Detectors

- 1.1.3.3 Mobile Computed Tomography

- 1.1.3.4 Computed Laminography

- 1.1.4 Comparison of Computed Radiography (CR) vs. Digital Radiography (DR) vs. Computed Tomography (CT)

- 1.1.5 Evolving End-User Requirements for Industrial Computed Radiography Market

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Emerging Demand from the Aerospace and Defense Industry

- 1.2.1.2 Rising Demand for Computed Radiography Due to the Evolution of Industry 4.0 Practices

- 1.2.1.2.1 Case Study: Advantages of Using CR Technology Observed by Emerson Electric Co.

- 1.2.1.3 Rising Demand for Portable Computed Radiography

- 1.2.2 Business Challenges

- 1.2.2.1 Lack of Skilled Labors

- 1.2.2.2 Increasing Demand for Real-Time Image Visualization

- 1.2.3 Business Strategies

- 1.2.3.1 Business Strategies

- 1.2.3.1.1 New Product Launch and Business Expansion

- 1.2.3.2 Corporate Strategies

- 1.2.3.1 Business Strategies

- 1.2.4 Business Opportunities

- 1.2.4.1 Persisting Need for CR Capabilities in Oil and Gas Domain

- 1.2.4.2 Opportunities in the Aviation/MRO Domain

- 1.2.4.3 Opportunities in Providing NDT Certification to Technician

- 1.2.1 Business Drivers

2 Region

- 2.1 Industrial Computed Radiography Market (by Region)

- 2.2 Asia-Pacific

- 2.2.1 Markets

- 2.2.1.1 Key Industrial Computed Radiography Manufacturer in Asia-Pacific

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.1.4 Asia-Pacific Industrial Computed Radiography Market (by Country)

- 2.2.2 Asia-Pacific (by Country)

- 2.2.2.1 China

- 2.2.2.1.1 Product

- 2.2.2.1.1.1 China Industrial Computed Radiography Market (Components by Application)

- 2.2.2.1.1 Product

- 2.2.2.2 India

- 2.2.2.2.1 Markets

- 2.2.2.2.1.1 Key Industrial Computed Radiography Manufacturers in India

- 2.2.2.2.2 Product

- 2.2.2.2.2.1 India Industrial Computed Radiography Market (Components by Application)

- 2.2.2.2.1 Markets

- 2.2.2.3 Japan

- 2.2.2.3.1 Markets

- 2.2.2.3.1.1 Key Industrial Computed Radiography Manufacturers in Japan

- 2.2.2.3.2 Product

- 2.2.2.3.2.1 Japan Industrial Computed Radiography Market (Components by Application)

- 2.2.2.3.1 Markets

- 2.2.2.4 Rest-of-Asia-Pacific

- 2.2.2.4.1 Product

- 2.2.2.4.1.1 Rest-of-Asia-Pacific Industrial Computed Radiography Market (Components by Application)

- 2.2.2.4.1 Product

- 2.2.2.1 China

- 2.2.1 Markets

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Market Share Analysis

- 3.2 Industrial Computed Radiography Developers

- 3.2.1 MQS Technologies Pvt. Ltd.

- 3.2.1.1 Company Overview

- 3.2.1.1.1 Role of MQS Technologies Pvt. Ltd. in the Industrial Computed Radiography Market

- 3.2.1.1.2 Customers

- 3.2.1.1.3 Product Portfolio

- 3.2.1.2 Analyst View

- 3.2.1.1 Company Overview

- 3.2.2 Rigaku Corporation

- 3.2.2.1 Company Overview

- 3.2.2.1.1 Role of Rigaku Corporation in the Industrial Computed Radiography Market

- 3.2.2.1.2 Customers

- 3.2.2.1.3 Product Portfolio

- 3.2.2.2 Corporate Strategies

- 3.2.2.2.1 Partnerships

- 3.2.2.3 Analyst View

- 3.2.2.1 Company Overview

- 3.2.1 MQS Technologies Pvt. Ltd.

4 Research Methodology

- 4.1 Factors for Data Prediction and Modeling