|

|

市場調査レポート

商品コード

1389578

欧州のバイオ製造ウイルス検出および定量化市場: 分析と予測(2023年~2032年)Europe Biomanufacturing Viral Detection and Quantification Market - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のバイオ製造ウイルス検出および定量化市場: 分析と予測(2023年~2032年) |

|

出版日: 2023年11月30日

発行: BIS Research

ページ情報: 英文 81 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州のバイオ製造ウイルス検出および定量化の市場規模は、2022年に1億3,730万米ドルとなりました。

同市場は、2032年には3億4,590万米ドルに達すると予測され、予測期間の2023年~2032年のCAGRは9.80%になると見込まれています。バイオ医薬品の使用拡大とウイルス検査技術の向上が、欧州のバイオ製造ウイルス検出および定量化市場の成長を促進すると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年評価 | 1億4,920万米ドル |

| 2032年予測 | 3億4,590万米ドル |

| CAGR | 9.8% |

欧州のバイオ製造ウイルス検出および定量化市場は、バイオ医薬品の利用拡大により急速に拡大しています。生物製剤の需要が高まるにつれて、これらの製品の安全性、有効性、一貫性の確保がますます重要になっています。規制を遵守し、製品の完全性を維持するためには、強固な品質管理手順が必要です。そのような手順のひとつに、バイオ製造中のウイルス汚染の測定があります。その結果、欧州のバイオ製造ウイルス検出・定量市場では、消耗品や機器に対する需要が急増しています。技術的改善と高水準の維持へのコミットメントにより、同市場はこの分野で継続的な成長を遂げる好位置にあります。

当レポートでは、欧州のバイオ製造ウイルス検出および定量化市場について調査し、市場の概要とともに、オファリングタイプ別、技術別、用途別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 製品の定義

第2章 市場の範囲

第3章 調査手法

第4章 欧州

- 概要

- 欧州

- 欧州のバイオ製造ウイルス検出および定量化市場(オファリングタイプ別)

- 欧州のバイオ製造ウイルス検出および定量化市場(技術別)

- 欧州のバイオ製造ウイルス検出および定量化市場(用途別)

- 欧州のバイオ製造ウイルス検出および定量化市場(エンドユーザー別)

- 欧州のバイオ製造ウイルス検出および定量化市場(国別)

第5章 市場-競合ベンチマーキングと企業プロファイル

- 概要

- 企業シェア分析

- バイオ製造ウイルス検出および定量化市場の参入企業

- Merck KGaA

- Sartorius AG

- QIAGEN N.V

List of Figures

- Figure 1: Biomanufacturing Viral Detection and Quantification Market, $Billion, 2022-2032

- Figure 2: Biomanufacturing Viral Detection and Quantification Market: Drivers, Restraints, and Opportunities

- Figure 3: Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Billion, 2022-2032

- Figure 4: Biomanufacturing Viral Detection and Quantification Market (by Technology), $Billion, 2022-2032

- Figure 5: Biomanufacturing Viral Detection and Quantification Market (by Application), $Billion, 2022-2032

- Figure 6: Biomanufacturing Viral Detection and Quantification Market (by Region), $Billion, 2022 and 2032

- Figure 7: Biomanufacturing Viral Detection and Quantification Market: Research Methodology

- Figure 8: Primary Research Methodology

- Figure 9: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 10: Top-Down Approach (Segment-Wise Analysis)

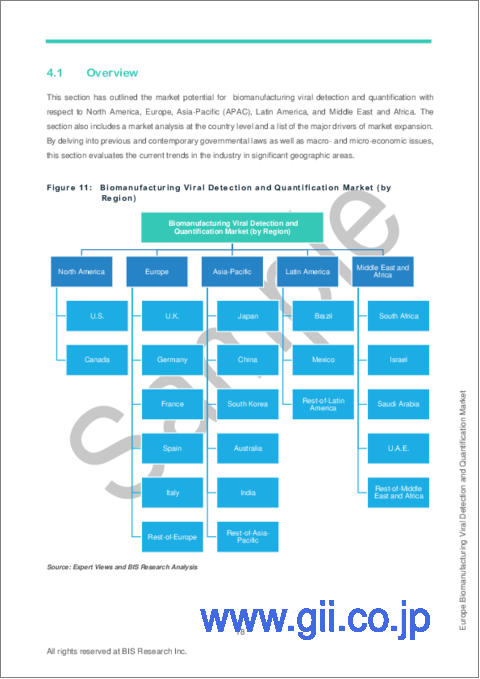

- Figure 11: Biomanufacturing Viral Detection and Quantification Market (by Region)

- Figure 12: Europe: Market Dynamics

- Figure 13: Europe Biomanufacturing Viral Detection and Quantification Market, $Billion, 2022-2032

- Figure 14: Europe Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 15: Europe Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 16: Europe Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 17: Europe Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 18: Germany Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 19: Germany Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 20: Germany Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 21: Germany Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 22: Germany Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 23: U.K. Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 24: U.K. Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 25: U.K. Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 26: U.K. Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 27: U.K. Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 28: France Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 29: France Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 30: France Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 31: France Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 32: France Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 33: Spain Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 34: Spain Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 35: Spain Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 36: Spain Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 37: Spain Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 38: Italy Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 39: Italy Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 40: Italy Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 41: Italy Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 42: Italy Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 43: Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market, $Million, 2022-2032

- Figure 44: Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Offering Type), $Million, 2022-2032

- Figure 45: Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Technology), $Million, 2022-2032

- Figure 46: Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Application), $Million, 2022-2032

- Figure 47: Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by End User), $Million, 2022-2032

- Figure 48: Biomanufacturing Viral Detection and Quantification Market, Total Number of Companies Profiled

- Figure 49: Biomanufacturing Viral Detection and Quantification Market, Company Share Analysis, % Share, 2022

- Figure 50: Merck KGaA: Product Portfolio

- Figure 51: Merck KGaA: Overall Financials, $Million, 2020-2022

- Figure 52: Merck KGaA: Revenue (by Segment), $Million, 2020-2022

- Figure 53: Merck KGaA: Revenue (by Region), $Million, 2020-2022

- Figure 54: Merck KGaA: R&D Expenditure, $Million, 2020-2022

- Figure 55: Sartorius AG: Product Portfolio

- Figure 56: Sartorius AG: Overall Financials, $Million, 2020-2022

- Figure 57: Sartorius AG: Revenue (by Segment), $Million, 2020-2022

- Figure 58: Sartorius AG: Revenue (by Region), $Million, 2020-2022

- Figure 59: QIAGEN N.V.: Product Portfolio

- Figure 60: QIAGEN N.V.: Overall Financials, $Million, 2020-2022

- Figure 61: QIAGEN N.V.: Revenue (by Segment), $Million, 2020-2022

- Figure 62: QIAGEN N.V.: Revenue (by Region), $Million, 2020-2022

- Figure 63: QIAGEN N.V.: R&D Expenditure, $Million, 2020-2022

List of Tables

- Table 1: Biomanufacturing Viral Detection and Quantification Market, Impact Analysis

- Table 2: Key Questions Answered in the Report

“The Europe Biomanufacturing Viral Detection and Quantification Market Expected to Reach $345.9 Million by 2032.”

Introduction to Europe Biomanufacturing Viral Detection and Quantification Market

The Europe biomanufacturing viral detection and quantification market was valued at $137.3 million in 2022 and is anticipated to reach $345.9 million by 2032, witnessing a CAGR of 9.80% during the forecast period 2023-2032. The growing use of biopharmaceutical products and improvements in viral testing technologies are expected to drive the growth of the biomanufacturing viral detection and quantification market in the European market.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $149.2 Million |

| 2032 Forecast | $345.9 Million |

| CAGR | 9.8% |

The market for viral detection and quantification biomanufacturing in Europe is expanding quickly as a result of the growing use of biopharmaceutical products. Ensuring the safety, efficacy, and consistency of these products becomes increasingly important as the demand for biologics develops. Sturdy quality control procedures are necessary to comply with regulations and preserve product integrity. One such procedure is the measurement of viral contamination during biomanufacturing. As a result, the European biomanufacturing viral detection and quantification market is experiencing a surge in demand for consumables and instruments. With technological improvements and a commitment to upholding high standards, the market is well-positioned for ongoing growth in the area.

Market Segmentation:

Segmentation 1: by Offering Type

- Consumables

- Instruments

- Services

Segmentation 2: by Technology

- PCR

- ELISA

- Flow Cytometry

- Plaque Assay

- Others

Segmentation 3: by Application

- Blood and Blood Products Manufacturing

- Vaccines and Therapeutics Manufacturing

- Cellular and Gene Therapy Products Manufacturing

- Stem Cell Products Manufacturing

- Tissue and Tissue Products Manufacturing

Segmentation 4: by End User

- Life Science Companies

- Testing Laboratories

- CROs and CDMOs

Segmentation 6: by Country

- Germany

- France

- U.K.

- Spain

- Italy

- Rest-of-Europe

How can this report add value to an organization?

Workflow/Innovation Strategy: The biomanufacturing viral detection and quantification market (by offering type) has been segmented into consumables, instruments, and services. Moreover, the study provides the reader with a detailed understanding of the different applications of biomanufacturing viral detection and quantification in raw material preparation, upstream processing, downstream processing, and packaging.

Growth/Marketing Strategy: Biomanufacturing viral detection and quantification is being used for raw material preparation, upstream processing, downstream processing, and packaging. Various companies are providing products and services to aid in the viral testing of various biologic production, which is also the key strategy for market players to excel in the current biomanufacturing viral detection and quantification market.

Competitive Strategy: Key players in the Europe biomanufacturing viral detection and quantification market have been analyzed and profiled in the study, including manufacturers. Moreover, a detailed competitive benchmarking of the players operating in the Europe biomanufacturing viral detection and quantification market has been done to help the reader understand how players stack against each other, presenting a clear market landscape.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent names in this market are:

|

|

|

Table of Contents

1 Product Definition

- 1.1 Inclusion and Exclusion Criteria

2 Market Scope

- 2.1 Key Questions Answered in the Report

3 Research Methodology

4 Europe

- 4.1 Overview

- 4.2 Europe

- 4.2.1 Europe Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.2 Europe Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.3 Europe Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.4 Europe Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5 Europe Biomanufacturing Viral Detection and Quantification Market (by Country)

- 4.2.5.1 Germany

- 4.2.5.1.1 Germany Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.1.2 Germany Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.1.3 Germany Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.1.4 Germany Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.2 U.K.

- 4.2.5.2.1 U.K. Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.2.2 U.K. Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.2.3 U.K. Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.2.4 U.K. Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.3 France

- 4.2.5.3.1 France Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.3.2 France Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.3.3 France Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.3.4 France Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.4 Spain

- 4.2.5.4.1 Spain Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.4.2 Spain Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.4.3 Spain Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.4.4 Spain Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.5 Italy

- 4.2.5.5.1 Italy Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.5.2 Italy Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.5.3 Italy Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.5.4 Italy Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.6 Rest-of-Europe

- 4.2.5.6.1 Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Offering Type)

- 4.2.5.6.2 Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Technology)

- 4.2.5.6.3 Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by Application)

- 4.2.5.6.4 Rest-of-Europe Biomanufacturing Viral Detection and Quantification Market (by End User)

- 4.2.5.1 Germany

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Overview

- 5.2 Company Share Analysis

- 5.3 Biomanufacturing Viral Detection and Quantification Ecosystem Active Players

- 5.4 Merck KGaA

- 5.4.1 Company Overview

- 5.4.2 Role of Merck KGaA in the Biomanufacturing Viral Detection and Quantification Market

- 5.4.3 Key Competitors

- 5.4.4 Financials

- 5.4.5 Key Insights about the Financial Health of the Company

- 5.4.6 Analyst Perspective

- 5.5 Sartorius AG

- 5.5.1 Company Overview

- 5.5.2 Role of Sartorius AG in the Biomanufacturing Viral Detection and Quantification Market

- 5.5.3 Key Competitors

- 5.5.4 Financials

- 5.5.5 Analyst Perspective

- 5.6 QIAGEN N.V.

- 5.6.1 Company Overview

- 5.6.2 Role of QIAGEN N.V. in the Biomanufacturing Viral Detection and Quantification Market

- 5.6.3 Key Competitors

- 5.6.4 Financials

- 5.6.5 Key Insights about the Financial Health of the Company

- 5.6.6 Analyst Perspective