|

|

市場調査レポート

商品コード

1385528

アジア太平洋のシリコーン市場:地域別・国別分析、 - (2023年~2033年)Asia-Pacific Silicone Market - A Regional and Country Level Analysis, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のシリコーン市場:地域別・国別分析、 - (2023年~2033年) |

|

出版日: 2023年11月26日

発行: BIS Research

ページ情報: 英文 114 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 目次

シリコーンは、アジア太平洋の様々な産業における汎用性の高い用途に牽引され、アジア太平洋市場で力強い成長を遂げています。

この成長に寄与している重要な要因の一つは、盛んな製造業です。シリコーンの高温耐性、柔軟性、耐久性などのユニークな特性は、産業用部品、機械、装置の製造に好まれる材料となっています。中国、日本、韓国のような国々が主要な製造拠点であり続けているため、製造工程や産業用途で使用されるシリコーンの需要は着実に増加しており、市場全体の成長を後押ししています。

アジア太平洋のエレクトロニクス産業も、シリコーン需要拡大の主要な促進要因の一つです。シリコーンは電気絶縁性、熱安定性、耐湿性、耐薬品性に優れているため、電子部品やデバイスの製造に広く利用されています。アジア太平洋はエレクトロニクス製造の世界のハブであり、この分野におけるシリコーンの需要は特に高いです。半導体や家電製品を含む電子製品の信頼性と性能を高めるシリコーンの役割は、急速に進化するアジア太平洋の技術ランドスケープにおいて重要な材料として位置づけられています。

さらに、アジア太平洋の建設とインフラ整備は、シリコーンベースの製品に対する需要の増加に寄与しています。シリコーンベースの製品は、継ぎ目のシール、接着材料、耐候性の提供など、さまざまな用途のための建設業界で広く使用されています。アジア太平洋では、都市化の進展、インフラプロジェクト、持続可能でエネルギー効率の高い建設手法の重視が、シリコーンベースのソリューションの採用をさらに促進し、アジア太平洋におけるシリコーン市場の拡大を促進しています。

当レポートでは、アジア太平洋のシリコーン市場について調査し、市場の概要とともに、タイプ別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場:業界の見通し

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダーの分析

- 主要な世界的出来事の影響分析-COVID-19、ロシア/ウクライナ、中東危機

- 医療グレードのシリコーン製造の進歩

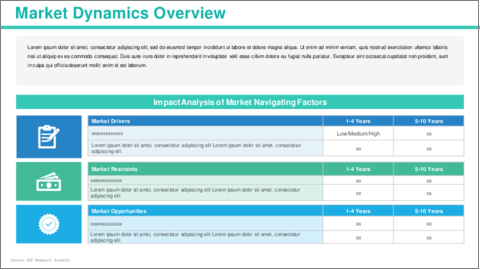

- 市場力学の概要

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- アジア太平洋のシリコーン市場(エンドユーザー別)

第3章 製品

- 製品のセグメンテーション

- 製品概要

- アジア太平洋のシリコーン市場(タイプ別)

第4章 地域

- 国の概要

- 促進要因と抑制要因

- アジア太平洋

第5章 市場-競合情勢と企業プロファイル

- 競合情勢

- 企業プロファイル

- DOW

- DIC Corporation

- KCC Corporation

- Mitsubishi Chemical Group Corporation

- SK siltron Co.,Ltd.

- Wynca Group

- Shin-Etsu Chemical Co.

- Elkem ASA

- DyStar Singapore Pte Ltd

- Wacker Chemie AG

- Tokuyama Corporation

- Momentive Performance Materials Inc.

- Evonik Industries AG

- Siltech Corporation

- Rogers Corporation

- その他の主要な市場参入企業

第6章 成長の機会と提言

第7章 調査手法

“Asia-Pacific Silicone Market Report Unveils Robust Growth and Emerging Trends.”

Silicone is experiencing robust growth in the Asia-Pacific market, driven by its versatile applications across various industries in the region. One significant factor contributing to this growth is the thriving manufacturing sector. Silicone's unique properties, such as high temperature resistance, flexibility, and durability, make it a preferred material in the production of industrial components, machinery, and equipment. As countries like China, Japan, and South Korea continue to be major manufacturing hubs, the demand for silicone for use in manufacturing processes and industrial applications is steadily increasing, bolstering the overall market growth.

The electronics industry in the Asia-Pacific region is another key driver for the growing demand for silicone. Silicone is widely utilized in the production of electronic components and devices due to its excellent electrical insulating properties, thermal stability, and resistance to moisture and chemicals. With the Asia-Pacific region being a global hub for electronics manufacturing, the demand for silicone in this sector is particularly high. Silicone's role in enhancing the reliability and performance of electronic products, including semiconductors and consumer electronics, positions it as a critical material in the rapidly evolving technology landscape of the Asia-Pacific region.

Additionally, the construction and infrastructure development across Asia-Pacific are contributing to the increasing demand for silicone-based products. Silicone based products are extensively used in the construction industry for various applications, such as sealing joints, bonding materials, and providing weatherproofing. The region's growing urbanization, infrastructure projects, and emphasis on sustainable and energy-efficient construction practices further drive the adoption of silicone-based solutions, fostering the expansion of the silicone market in the Asia-Pacific region.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing the company's coverage, product portfolio, its market penetration.

Some of the prominent names established in this market are:

|

|

Key Questions Answered in this Report:

- What are the main factors driving the demand for silicones in Asia-Pacific market?

- What are the major patents filed by the companies active in the Asia-Pacific silicone market?

- What are the anticipated effects in the mid-to-long-term resulting from the advancements made in the Asia-Pacific silicone market?

- What are the strategies adopted by the key companies to gain a competitive edge in Asia-Pacific silicone market?

- What is the futuristic outlook for the Asia-Pacific silicone market in terms of growth potential?

- Which end users, and type is expected to lead the market over the forecast period (2023-2033)?

- Which country is expected to grow at a faster rate in the next decade?

Table of Contents

1. Markets: Industry Outlook

- 1.1. Trends: Current and Future Impact Assessment

- 1.1.1. Rising Application in Automotive Sector

- 1.1.2. Rising Adoption of Advanced Manufacturing Processes

- 1.2. Supply Chain Overview

- 1.2.1. Value chain Analysis

- 1.2.2. Market Map

- 1.2.3. Pricing Forecast

- 1.3. R&D Review

- 1.3.1. Patent Filing Trend by Country, by Company

- 1.4. Regulatory Landscape

- 1.5. Stakeholder Analysis

- 1.5.1. Use Case

- 1.5.2. End User and buying criteria

- 1.6. Impact analysis for key global events- covid19, Russia/Ukraine or Middle East crisis

- 1.7. Advancements in Medical-Grade Silicone Manufacturing

- 1.8. Market Dynamics Overview

- 1.8.1. Market Drivers

- 1.8.2. Market Restraints

- 1.8.3. Market Opportunities

2. Application

- 2.1. Application Segmentation

- 2.2. Application Summary

- 2.3. Asia-Pacific Silicone Market (by End Users)

- 2.3.1. Building and Construction

- 2.3.2. Healthcare

- 2.3.3. Transportation

- 2.3.4. Electronics

- 2.3.5. Others

3. Product

- 3.1. Product Segmentation

- 3.2. Product Summary

- 3.3. Asia-Pacific Silicone Market (by Type)

- 3.3.1. Elastomers

- 3.3.2. Gels

- 3.3.3. Resins

- 3.3.4. Fluid

- 3.3.5. Others

4. Region

- 4.1. Country Summary

- Table: Asia-Pacific Silicone Market, By Country, (Kilo Tons), 2022-2033

- Table: Asia-Pacific Silicone Market, By Country, ($ Million), 2022-2033

- 4.2. Drivers and Restraints

- 4.3. Asia-Pacific

- 4.3.1. Key Market Participants in Asia-Pacific

- 4.3.2. Business Drivers

- 4.3.3. Business Challenges

- 4.3.4. Application

- Table: Asia-Pacific Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: Asia-Pacific Silicone Market, By End Users ($ Million), 2022-2033

- 4.3.3. Product

- Table: Asia-Pacific Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: Asia-Pacific Silicone Market, BY Type ($ Million), 2022-2033

- 4.3.4. Asia-Pacific Silicone Market (by Country)

- 4.3.4.1. China

- Table: China Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: China Silicone Market, By End Users ($ Million), 2022-2033

- Table: China Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: China Silicone Market, BY Type ($ Million), 2022-2033

- 4.3.4.2. Japan

- Table: Japan Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: Japan Silicone Market, By End Users ($ Million), 2022-2033

- Table: Japan Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: Japan Silicone Market, BY Type ($ Million), 2022-2033

- 4.4.4.2. South Korea

- Table: South Korea Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: South Korea Silicone Market, By End Users ($ Million), 2022-2033

- Table: South Korea Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: South Korea Silicone Market, BY Type ($ Million), 2022-2033

- 4.4.4.3. Australia

- Table: Australia Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: Australia Silicone Market, By End Users ($ Million), 2022-2033

- Table: Australia Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: Australia Silicone Market, BY Type ($ Million), 2022-2033

- 4.4.4.4. India

- Table: India Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: India Silicone Market, By End Users ($ Million), 2022-2033

- Table: India Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: India Silicone Market, BY Type ($ Million), 2022-2033

- 4.4.4.5. Rest-of-Asia-Pacific

- Table: Rest-of-Asia-Pacific Silicone Market, By End Users (Kilo Tons), 2022-2033

- Table: Rest-of-Asia-Pacific Silicone Market, By End Users ($ Million), 2022-2033

- Table: Rest-of-Asia-Pacific Silicone Market, BY Type (Kilo Tons), 2022-2033

- Table: Rest-of-Asia-Pacific Silicone Market, BY Type ($ Million), 2022-2033

- 4.3.4.1. China

5. Markets - Competitive Landscape & Company Profiles

- 5.1. Competitive Landscape

- 5.2. Company Profile

- 5.2.1. DOW

- 5.2.1.1. Company Overview

- 5.2.1.1.1. Role of DOW in Asia-Pacific Silicone Market

- 5.2.1.1.2. Product Portfolio

- 5.2.1.2. Business Strategies

- 5.2.1.3. Corporate Strategies

- 5.2.1.4. Analyst View

- 5.2.1.1. Company Overview

- 5.2.2. DIC Corporation

- 5.2.2.1. Company Overview

- 5.2.2.1.1. Role of DIC Corporation in Asia-Pacific Silicone Market

- 5.2.2.1.2. Product Portfolio

- 5.2.2.2. Business Strategies

- 5.2.2.3. Corporate Strategies

- 5.2.2.4. Analyst View

- 5.2.2.1. Company Overview

- 5.2.3. KCC Corporation

- 5.2.3.1. Company Overview

- 5.2.3.1.1. Role of KCC Corporation in Asia-Pacific Silicone Market

- 5.2.3.1.2. Product Portfolio

- 5.2.3.2. Business Strategies

- 5.2.3.3. Corporate Strategies

- 5.2.3.4. Analyst View

- 5.2.3.1. Company Overview

- 5.2.4. Mitsubishi Chemical Group Corporation

- 5.2.4.1. Company Overview

- 5.2.4.1.1. Role of Mitsubishi Chemical Group Corporation in Asia-Pacific Silicone Market

- 5.2.4.1.2. Product Portfolio

- 5.2.4.2. Business Strategies

- 5.2.4.3. Corporate Strategies

- 5.2.4.4. Analyst View

- 5.2.4.1. Company Overview

- 5.2.5. SK siltron Co.,Ltd.

- 5.2.5.1. Company Overview

- 5.2.5.1.1. Role of SK siltron Co.,Ltd. in Asia-Pacific Silicone Market

- 5.2.5.1.2. Product Portfolio

- 5.2.5.2. Business Strategies

- 5.2.5.3. Corporate Strategies

- 5.2.5.4. Analyst View

- 5.2.5.1. Company Overview

- 5.2.6. Wynca Group

- 5.2.6.1. Company Overview

- 5.2.6.1.1. Role of Wynca Group in Asia-Pacific Silicone Market

- 5.2.6.1.2. Product Portfolio

- 5.2.6.2. Business Strategies

- 5.2.6.3. Corporate Strategies

- 5.2.6.4. Analyst View

- 5.2.6.1. Company Overview

- 5.2.7. Shin-Etsu Chemical Co.

- 5.2.7.1. Company Overview

- 5.2.7.1.1. Role of Shin-Etsu Chemical Co. in Asia-Pacific Silicone Market

- 5.2.7.1.2. Product Portfolio

- 5.2.7.2. Business Strategies

- 5.2.7.3. Corporate Strategies

- 5.2.7.4. Analyst View

- 5.2.7.1. Company Overview

- 5.2.8. Elkem ASA

- 5.2.8.1. Company Overview

- 5.2.8.1.1. Role of Elkem ASA in Asia-Pacific Silicone Market

- 5.2.8.1.2. Product Portfolio

- 5.2.8.2. Business Strategies

- 5.2.8.3. Corporate Strategies

- 5.2.8.4. Analyst View

- 5.2.8.1. Company Overview

- 5.2.9. DyStar Singapore Pte Ltd

- 5.2.9.1. Company Overview

- 5.2.9.1.1. Role of DyStar Singapore Pte Ltd in Asia-Pacific Silicone Market

- 5.2.9.1.2. Product Portfolio

- 5.2.9.2. Business Strategies

- 5.2.9.3. Corporate Strategies

- 5.2.9.4. Analyst View

- 5.2.9.1. Company Overview

- 5.2.10. Wacker Chemie AG

- 5.2.10.1. Company Overview

- 5.2.10.1.1. Role of Wacker Chemie AG in Asia-Pacific Silicone Market

- 5.2.10.1.2. Product Portfolio

- 5.2.10.2. Business Strategies

- 5.2.10.3. Corporate Strategies

- 5.2.10.4. Analyst View

- 5.2.10.1. Company Overview

- 5.2.11. Tokuyama Corporation

- 5.2.11.1. Company Overview

- 5.2.11.1.1. Role of Tokuyama Corporation in Asia-Pacific Silicone Market

- 5.2.11.1.2. Product Portfolio

- 5.2.11.2. Business Strategies

- 5.2.11.3. Corporate Strategies

- 5.2.11.4. Analyst View

- 5.2.11.1. Company Overview

- 5.2.12. Momentive Performance Materials Inc.

- 5.2.12.1. Company Overview

- 5.2.12.1.1. Role of Momentive Performance Materials Inc. in Asia-Pacific Silicone Market

- 5.2.12.1.2. Product Portfolio

- 5.2.12.2. Business Strategies

- 5.2.12.3. Corporate Strategies

- 5.2.12.4. Analyst View

- 5.2.12.1. Company Overview

- 5.2.13. Evonik Industries AG

- 5.2.13.1. Company Overview

- 5.2.13.1.1. Role of Evonik Industries AG in Asia-Pacific Silicone Market

- 5.2.13.1.2. Product Portfolio

- 5.2.13.2. Business Strategies

- 5.2.13.3. Corporate Strategies

- 5.2.13.4. Analyst View

- 5.2.13.1. Company Overview

- 5.2.14. Siltech Corporation

- 5.2.14.1. Company Overview

- 5.2.14.1.1. Role of Siltech Corporation in Asia-Pacific Silicone Market

- 5.2.14.1.2. Product Portfolio

- 5.2.14.2. Business Strategies

- 5.2.14.3. Corporate Strategies

- 5.2.14.4. Analyst View

- 5.2.14.1. Company Overview

- 5.2.15. Rogers Corporation

- 5.2.15.1. Company Overview

- 5.2.15.1.1. Role of Rogers Corporation in Asia-Pacific Silicone Market

- 5.2.15.1.2. Product Portfolio

- 5.2.15.2. Business Strategies

- 5.2.15.3. Corporate Strategies

- 5.2.15.4. Analyst View

- 5.2.15.1. Company Overview

- 5.2.1. DOW

- 5.3. Other Key Market Participants