|

|

市場調査レポート

商品コード

1382601

欧州のUWB技術ベースの車両アクセス制御市場の分析・予測:2022-2031年Europe UWB Technology-Based Vehicle Access Control Market - Analysis and Forecast, 2022-2031 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のUWB技術ベースの車両アクセス制御市場の分析・予測:2022-2031年 |

|

出版日: 2023年11月17日

発行: BIS Research

ページ情報: 英文 102 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

英国を除く欧州のUWB技術ベースの車両アクセス制御の市場規模は、2022年の2,950万米ドルから、予測期間中は16.72%のCAGRで推移し、2031年には1億1,870万米ドルの規模に成長すると予測されています。

欧州の自動車メーカーは、世界の認知度の高まりと先進国における技術利用の拡大に対応するため、UWB技術ベースの車両アクセスを次期モデルに組み込むことを優先しています。Mercedes、BMW、BGなどの大手自動車メーカーは、最近すでにUWB技術を利用した車両アクセスシステムの提供を開始しています。近い将来、OEMがUWB技術を利用した車両アクセス制御の開発に注力するようになるとみられており、市場拡大の原動力になると予想されています。

UWB技術による車両アクセス制御の市場は、欧州の自動車産業と経済全体に大きな影響を与えると予想されています。より便利で安全なカーエントリーを提供する上で、これらのソリューションはユーザーエクスペリエンスの向上を目指す自動車メーカーにとって大きな差別化要因となり得ます。欧州の自動車メーカーによるUWB技術への投資が大幅に拡大し、その結果、自動車でのUWBシステムの利用が拡大すると予測されています。従来のキーレスエントリーシステムに比べ、UWB技術は、その高度なセキュリティ機能によりUWB信号の傍受や妨害が困難なため、より優れた保護レベルを提供します。UWBベースの車両アクセス制御システムの使用により、自動車盗難件数が減ることが期待されています。

当レポートでは、欧州のUWB技術ベースの車両アクセス制御の市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、技術ロードマップ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2022-2031年 |

| 2022年評価 | 2,950万米ドル |

| 2031年予測 | 1億1,870万米ドル |

| CAGR | 16.72% |

市場セグメンテーション:

セグメンテーション1:車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

セグメンテーション2:認証タイプ別

- バイオメトリクス

- 非バイオメトリクス

セグメンテーション3:コンポーネントタイプ別

- ソフトウェア

- ハードウェア

- スマートデバイス

- キーフォブ

- 車載アクセスチップセット

セグメンテーション4:周波数帯域別

- 3.1 GHz~6 GHz

- 6 GHz~10.6 GHz

セグメンテーション5:測位技術別

- 到達時間差 (TDoA)

- 双方向測距 (TWR)

セグメンテーション6:国別

- ドイツ

- フランス

- イタリア

- その他の欧州

主要企業:

|

|

目次

第1章 市場

- 業界の展望

- UWB技術ベースの車両アクセス制御:概要

- 動向:現在と未来

- UWBと他の測位技術の比較

- 規制状況

- サプライチェーンネットワーク

- 技術ロードマップ

- 主要特許のマッピング

- その他の新たなUWB用途

- ケーススタディ

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 企業戦略

- 事業機会

第2章 地域

- 欧州

- 市場

- 用途

- 製品

- 欧州 (国別)

- 英国

- 市場

- 用途

- 製品

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 企業ランキング

- 企業プロファイル

- タイプ1:UWBチップサプライヤー

- タイプ2:UWBソリューションインテグレーター

第4章 調査手法

List of Figures

- Figure 1: Ultra-Wideband Technology-Based Vehicle Access Control Market Overview, $Million, 2021-2031

- Figure 2: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Figure 3: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Figure 4: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Hardware Type), $Million, 2021-2031

- Figure 5: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Figure 6: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Figure 7: Ultra-Wideband Technology-Based Vehicle Access Control Market (by Region), $Million, 2021

- Figure 8: Ultra-Wideband Technology-Based Vehicle Access Control Market Supply Chain

- Figure 9: Ultra-Wideband Technology-Based Vehicle Access Control Market Supply Chain Participants

- Figure 10: Technology Roadmap

- Figure 11: Business Dynamics for Europe Ultra-Wideband Technology-Based Vehicle Access Control Market

- Figure 12: Impact of Business Drivers

- Figure 13: Impact of Business Challenges

- Figure 14: Share of Key Business Strategies (2020-2022)

- Figure 15: Share of Key Market Developments (2020-2022)

- Figure 16: Share of Key Product Developments (2020-2022)

- Figure 17: Share of Key Corporate Strategies and Developments (2020-2022)

- Figure 18: Share of Key Mergers and Acquisitions (2020-2022)

- Figure 19: Share of Key Partnerships, Collaborations, and Joint Ventures (2020-2022)

- Figure 20: Impact of Business Opportunities

- Figure 21: Competitive Benchmarking, 2021

- Figure 22: NXP Semiconductors: R&D Expenditure, $Billion, 2019-2021

- Figure 23: STMicroelectronics N.V.: R&D Expenditure, $Billion, 2019-2021

- Figure 24: BMW Group: R&D Expenditure, $Billion, 2019-2021

- Figure 25: Continental AG: R&D Expenditure, $Billion, 2019-2021

- Figure 26: Robert Bosch GmbH: R&D Expenditure, $Billion, 2019-2021

- Figure 27: Valeo: R&D Expenditure, $Billion, 2019-2021

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Ultra-Wideband Technology-Based Vehicle Access Control Market Overview, 2021 and 2031

- Table 2: Comparison of UWB and Other Positioning Technologies

- Table 3: Consortiums, Associations, and Regulatory Bodies

- Table 4: Government Programs and Initiatives

- Table 5: Programs by Research Institutions and Universities

- Table 6: Key Patent Mapping

- Table 7: Ultra-Wideband Technology-Based Vehicle Access Control Market (by Region), $Million, 2021-2031

- Table 8: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 9: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 10: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 11: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 12: Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Table 13: Germany Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 14: Germany Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 15: Germany Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 16: Germany Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 17: Germany Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

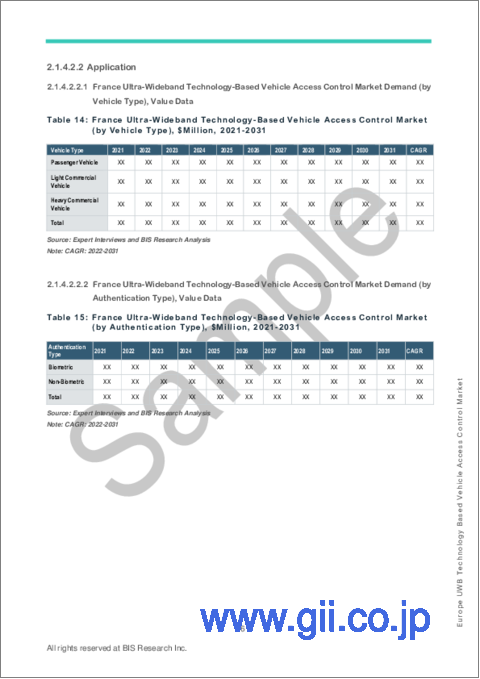

- Table 18: France Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 19: France Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 20: France Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 21: France Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 22: France Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Table 23: Italy Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 24: Italy Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 25: Italy Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 26: Italy Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 27: Italy Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Table 28: Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 29: Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 30: Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 31: Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 32: Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Table 33: U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market (by Vehicle Type), $Million, 2021-2031

- Table 34: U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market (by Authentication Type), $Million, 2021-2031

- Table 35: U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market (by Component Type), $Million, 2021-2031

- Table 36: U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market (by Frequency Range), $Million, 2021-2031

- Table 37: U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market (by Positioning Technique), $Million, 2021-2031

- Table 38: Ultra-Wideband Technology-Based Vehicle Access Control Market Player Ranking, 2021

- Table 39: NXP Semiconductors: Product and Service Portfolio

- Table 40: NXP Semiconductors: Product Development

- Table 41: NXP Semiconductors: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 42: STMicroelectronics N.V.: Product and Service Portfolio

- Table 43: STMicroelectronics N.V.: Product Development

- Table 44: STMicroelectronics N.V.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 45: BMW Group: Product and Service Portfolio

- Table 46: BMW Group: Product Development

- Table 47: BMW Group: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 48: Continental AG: Product and Service Portfolio

- Table 49: Continental AG: Product Development

- Table 50: Continental AG: Market Development

- Table 51: Robert Bosch GmbH: Product and Service Portfolio

- Table 52: Valeo: Product and Service Portfolio

“The Europe Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market (excluding U.K.) Expected to Reach $118.7 Million by 2031.”

Introduction to Europe Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

The Europe ultra-wideband technology-based vehicle access control market (excluding U.K.) was valued at $29.5 million in 2022, which is expected to grow at a CAGR of 16.72% and reach $118.7 million by 2031. Automakers in Europe are prioritizing the integration of car access based on ultra-wideband technology in their forthcoming models, a response to the growing worldwide awareness and increased usage of this technology in developed nations. Prominent automobile manufacturers, like Mercedes, BMW, General Motors, and others, have already started offering car access systems that utilize ultra-wideband technology in recent times. In the near future, it is expected that market expansion will be driven by original equipment manufacturers' (OEMs) change in focus towards the development of vehicle access controls using ultra-wideband technology.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2022 - 2031 |

| 2022 Evaluation | $29.5 Million |

| 2031 Forecast | $118.7 Million |

| CAGR | 16.72% |

Market Introduction

The vehicle access control market driven by ultra-wideband technology is expected to have a significant impact on both the European automotive industry and the overall economy. When it comes to providing more convenient and safe car entry, these solutions could be a major differentiator for automakers looking to improve the user experience. We predict that European automakers will invest significantly more in ultra-wideband (UWB) technology, which will result in a greater use of UWB systems in automobiles. Compared to conventional keyless entry systems, ultra-wideband technology provides a better level of protection since its sophisticated security features make it difficult to intercept or jam UWB signals. It is anticipated that the use of UWB-based vehicle access control systems will lessen the number of cases involving car theft. An illustrative example is BMW, which introduced the BMW Digital Key Plus with ultra-wideband technology in January 2021 for the BMW iX, providing customers with a secure and straightforward keyless entry system.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger vehicles are currently credited with the highest share of the demand for ultra-wideband technology. Some key factors that have enabled the technical acceptance of these vehicles are high demand, higher registration of passenger cars, and less operating difficulty as compared to commercial vehicles. The need for passenger vehicles is growing due to the demand for heavy and luxury vehicles and an increase in the number of cars driven by diesel engines. Additionally, increased population, urbanization, and disposable income have significantly increased passenger vehicle production.

Segmentation 2: by Authentication Type

- Biometric

- Non-Biometric

The biometric segment accounts for the largest market. The combination of biometric and UWB technologies for vehicle access can provide a highly secure and convenient solution for keyless entry systems in vehicles. Biometric technology can verify the user's identity, while UWB technology can ensure that the user is physically present in the correct location. If the user's identity is verified and their location is confirmed, the vehicle's access control system could automatically unlock the doors, allowing the user to enter the vehicle. Overall, combining biometric and UWB technologies for vehicle access control can provide a seamless and secure user experience while offering enhanced protection against vehicle theft and unauthorized access.

Segmentation 3: by Component Type

- Software

- Hardware

- Smart Devices

- Key Fob

- In-Vehicle Access Chip Set

The hardware segment accounts for the largest market. Ultra-wideband (UWB) technology-based vehicle access systems use short-range radio waves to communicate between the vehicle and the access device. These systems require specific hardware components to operate. The UWB chip is the heart of the UWB system and is responsible for transmitting and receiving data; the control module manages the UWB system's functions and is usually located inside the vehicle. The access device is used to communicate with the UWB system and is generally located outside the vehicle.

Segmentation 4: by Frequency Range

- 3.1 GHz to 6 GHz

- 6 GHz to 10.6 GHz

Segmentation 5: by Positioning Technique

- Time Difference of Arrival (TDoA)

- Two-Way Ranging (TWR)

The TWR segment accounts for the largest market. Two-way ranging is used in ultra-wideband (UWB) technology-based vehicle access systems to determine the distance between the vehicle and the access device. This technique uses time-of-flight measurements to calculate the distance based on the time it takes for a signal to travel from the vehicle to the access device and back again. Two-way ranging in UWB technology-based vehicle access systems has several advantages. It provides accurate distance measurement with sub-centimeter precision, which is critical for ensuring secure and reliable vehicle access.

Segmentation 6: by Country

- Germany

- France

- Italy

- Rest-of-Europe

How can this report add value to end users?

Product/Innovation Strategy: The product segment helps the readers understand the different types of ultra-wideband technology. Furthermore, the study provides the readers with a detailed understanding of the Europe ultra-wideband technology-based vehicle access control market based on application and product.

Growth/Marketing Strategy: To improve the capabilities of their product offerings, players in the Europe ultra-wideband technology-based vehicle access control market are developing unique products. The readers will be able to comprehend the revenue-generating tactics used by players in the Europe ultra-wideband technology-based vehicle access control market by looking at the growth/marketing strategies. Other market participants' tactics, such as go-to-market plans, will also assist readers in making strategic judgments.

Competitive Strategy: Players in the Europe ultra-wideband technology-based vehicle access control market analyzed and profiled in the study include vehicle manufacturers that capture the maximum share of the market. Moreover, a detailed competitive benchmarking of the players operating in the Europe ultra-wideband technology-based vehicle access control market has been done to help the readers understand how players compete against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, collaborations, and mergers and acquisitions are expected to help the readers understand the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing the company's coverage, product portfolio, its market penetration.

Some of the prominent names established in this market are:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Ultra-Wideband (UWB) Technology-Based Vehicle Access Control: Overview

- 1.1.2 Trends: Current and Future

- 1.1.2.1 Deployment of UWB Technology in Automotive Applications

- 1.1.2.2 Emergence of Various Technologies, Such as 5G and AI

- 1.1.2.3 Rising Investments in Automobile Industry

- 1.1.3 Comparison of UWB and Other Positioning Technologies

- 1.1.4 Regulatory Landscape

- 1.1.4.1 Consortiums, Associations, and Regulatory Bodies

- 1.1.4.2 Government Programs and Initiatives

- 1.1.4.3 Programs by Research Institutions and Universities

- 1.1.5 Supply Chain Network

- 1.1.6 Technology Roadmap

- 1.1.7 Key Patent Mapping

- 1.1.8 Other Emerging Ultra-Wideband Applications

- 1.2 Case Study

- 1.2.1 Case Study 1: UWB Technology-Based Digital Keys for Secured Vehicles Access

- 1.2.2 Case Study 2: BMW Digital Key Plus

- 1.2.3 Case Study 3: Continental Key as a Service (CKaaS)

- 1.3 Business Dynamics

- 1.3.1 Business Drivers

- 1.3.1.1 Increasing Adoption of Real-Time Location System (RTLS) Applications in Vehicle

- 1.3.1.2 Growing Adoption of the Internet of Things (IoT) in Automotive Applications

- 1.3.2 Business Challenges

- 1.3.2.1 Risk of Cyber Attacks

- 1.3.2.2 Spectrum Expansion for New Applications

- 1.3.3 Business Strategies

- 1.3.3.1 Market Development

- 1.3.3.2 Product Development

- 1.3.4 Corporate Strategies

- 1.3.4.1 Mergers and Acquisitions

- 1.3.4.2 Partnerships, Collaborations, and Joint Ventures

- 1.3.5 Business Opportunities

- 1.3.5.1 Growing Demand for Connected and Autonomous Vehicles

- 1.3.5.2 Future Potential of 5G and Artificial Intelligence

- 1.3.1 Business Drivers

2 Regions

- 2.1 Europe

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Solution Providers in Europe

- 2.1.1.3 Business Challenges

- 2.1.1.4 Business Drivers

- 2.1.2 Application

- 2.1.2.1 Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.1.2.2 Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.1.3 Product

- 2.1.3.1 Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.1.3.2 Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.1.3.3 Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.1.4 Europe (by Country)

- 2.1.4.1 Germany

- 2.1.4.1.1 Market

- 2.1.4.1.1.1 Buyer Attributes

- 2.1.4.1.1.2 Key Solution Providers in Germany

- 2.1.4.1.1.3 Business Challenges

- 2.1.4.1.1.4 Business Drivers

- 2.1.4.1.2 Application

- 2.1.4.1.2.1 Germany Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.1.4.1.2.2 Germany Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.1.4.1.3 Product

- 2.1.4.1.3.1 Germany Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.1.4.1.3.2 Germany Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.1.4.1.3.3 Germany Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.1.4.1.1 Market

- 2.1.4.2 France

- 2.1.4.2.1 Market

- 2.1.4.2.1.1 Buyer Attributes

- 2.1.4.2.1.2 Key Solution Providers in France

- 2.1.4.2.1.3 Business Challenges

- 2.1.4.2.1.4 Business Drivers

- 2.1.4.2.2 Application

- 2.1.4.2.2.1 France Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.1.4.2.2.2 France Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.1.4.2.3 Product

- 2.1.4.2.3.1 France Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.1.4.2.3.2 France Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.1.4.2.3.3 France Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.1.4.2.1 Market

- 2.1.4.3 Italy

- 2.1.4.3.1 Market

- 2.1.4.3.1.1 Buyer Attributes

- 2.1.4.3.1.2 Key Solution Providers in Italy

- 2.1.4.3.1.3 Business Challenges

- 2.1.4.3.1.4 Business Drivers

- 2.1.4.3.2 Application

- 2.1.4.3.2.1 Italy Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.1.4.3.2.2 Italy Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.1.4.3.3 Product

- 2.1.4.3.3.1 Italy Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.1.4.3.3.2 Italy Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.1.4.3.3.3 Italy Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.1.4.3.1 Market

- 2.1.4.4 Rest-of-Europe

- 2.1.4.4.1 Market

- 2.1.4.4.1.1 Buyer Attributes

- 2.1.4.4.1.2 Key Solution Providers in Rest-of-Europe

- 2.1.4.4.1.3 Business Challenges

- 2.1.4.4.1.4 Business Drivers

- 2.1.4.4.2 Application

- 2.1.4.4.2.1 Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.1.4.4.2.2 Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.1.4.4.3 Product

- 2.1.4.4.3.1 Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.1.4.4.3.2 Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.1.4.4.3.3 Rest-of-Europe Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.1.4.4.1 Market

- 2.1.4.1 Germany

- 2.1.1 Market

- 2.2 U.K.

- 2.2.1 Market

- 2.2.1.1 Buyer Attributes

- 2.2.1.2 Key Solution Providers in the U.K.

- 2.2.1.3 Business Challenges

- 2.2.1.4 Business Drivers

- 2.2.2 Application

- 2.2.2.1 U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Vehicle Type), Value Data

- 2.2.2.2 U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Authentication Type), Value Data

- 2.2.3 Product

- 2.2.3.1 U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Component Type), Value Data

- 2.2.3.2 U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Frequency Range), Value Data

- 2.2.3.3 U.K. Ultra-Wideband Technology-Based Vehicle Access Control Market Demand (by Positioning Technique), Value Data

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.2 Market Player Ranking

- 3.3 Company Profiles

- 3.3.1 Type 1: UWB Chip Suppliers

- 3.3.1.1 NXP Semiconductors

- 3.3.1.1.1 Company Overview

- 3.3.1.1.1.1 Role of NXP Semiconductors in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.1.1.1.2 Product Portfolio

- 3.3.1.1.1.3 R&D Analysis

- 3.3.1.1.2 Business Strategies

- 3.3.1.1.2.1 Product Development

- 3.3.1.1.3 Corporate Strategies

- 3.3.1.1.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.1.1.4 Analyst View

- 3.3.1.1.1 Company Overview

- 3.3.1.2 STMicroelectronics N.V.

- 3.3.1.2.1 Company Overview

- 3.3.1.2.1.1 Role of STMicroelectronics N.V. in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.1.2.1.2 Product Portfolio

- 3.3.1.2.1.3 R&D Analysis

- 3.3.1.2.2 Business Strategies

- 3.3.1.2.2.1 Product Development

- 3.3.1.2.3 Corporate Strategies

- 3.3.1.2.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.1.2.4 Analyst View

- 3.3.1.2.1 Company Overview

- 3.3.1.1 NXP Semiconductors

- 3.3.2 Type 2: UWB Solution Integrators

- 3.3.2.1 BMW Group

- 3.3.2.1.1 Company Overview

- 3.3.2.1.1.1 Role of BMW Group in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.2.1.1.2 Product Portfolio

- 3.3.2.1.1.3 R&D Analysis

- 3.3.2.1.2 Business Strategies

- 3.3.2.1.2.1 Product Development

- 3.3.2.1.3 Corporate Strategies

- 3.3.2.1.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 3.3.2.1.4 Analyst View

- 3.3.2.1.1 Company Overview

- 3.3.2.2 Continental AG

- 3.3.2.2.1 Company Overview

- 3.3.2.2.1.1 Role of Continental AG in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.2.2.1.2 Product Portfolio

- 3.3.2.2.1.3 R&D Analysis

- 3.3.2.2.2 Business Strategies

- 3.3.2.2.2.1 Product Development

- 3.3.2.2.2.2 Market Development

- 3.3.2.2.3 Analyst View

- 3.3.2.2.1 Company Overview

- 3.3.2.3 Robert Bosch GmbH

- 3.3.2.3.1 Company Overview

- 3.3.2.3.1.1 Role of Robert Bosch GmbH in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.2.3.1.2 Product Portfolio

- 3.3.2.3.1.3 R&D Analysis

- 3.3.2.3.2 Analyst View

- 3.3.2.3.1 Company Overview

- 3.3.2.4 Valeo

- 3.3.2.4.1 Company Overview

- 3.3.2.4.1.1 Role of Valeo in the Ultra-Wideband (UWB) Technology-Based Vehicle Access Control Market

- 3.3.2.4.1.2 Product Portfolio

- 3.3.2.4.1.3 R&D Analysis

- 3.3.2.4.2 Analyst View

- 3.3.2.4.1 Company Overview

- 3.3.2.1 BMW Group

- 3.3.1 Type 1: UWB Chip Suppliers

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast

- 4.2.1 Factors for Data Prediction and Modeling