|

|

市場調査レポート

商品コード

1379165

アジア太平洋地域のサステナブルスチール市場:2022-2031年Asia-Pacific Sustainable Steel Market - Analysis and Forecast, 2022-2031 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋地域のサステナブルスチール市場:2022-2031年 |

|

出版日: 2023年11月10日

発行: BIS Research

ページ情報: 英文 103 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

中国を除くアジア太平洋地域のサステナブルスチールの市場規模は、2022年の684億米ドルから、予測期間中は9.39%のCAGRで推移し、2031年には1,534億米ドルの規模に成長すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2022-2031年 |

| 2022年評価 | 684億米ドル |

| 2031年予測 | 1,534億米ドル |

| CAGR | 9.39% |

同市場の成長は、厳格な政府規制、カーボンニュートラル目標、再生鋼材の使用におけるエネルギー効率、エネルギーおよび原材料供給の有限性による鉄鋼需要の大幅な増加が原動力になると予測されています。しかし一方で、不適切な分離や複雑な製品設計による回収鋼材中の汚染物質などの課題に加え、グリーンスチールの高い製造コストなどが大きな障壁となっています。

サステナブルスチール市場をリードしているのはアジア太平洋地域であり、同地域では低炭素製造技術、資源効率、環境に優しい事業の実践に焦点を置いています。環境規制の強化、カーボンニュートラルへの関心の高まり、手頃な価格で効率的な鉄鋼製造の必要性など、相互に関連する多くの要因が業界を牽引しています。サステナブルスチールはインフラ、自動車、建設など、さまざまな産業のニーズを満たすと同時に、鉄鋼生産による環境への影響を軽減するという喫緊のニーズにも応えています。

当レポートでは、世界のアジア太平洋地域のサステナブルスチールの市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

市場区分:

セグメンテーション1:エンドユーザー別

- 輸送

- 建築・建設

- 家具・アプライアンス

- パッケージング

- その他

セグメンテーション2:技術別

- 電気アーク炉 (EAF)

- 高炉-塩基性酸素炉 (BF-BOF)

- その他

セグメンテーション3:国別

- 日本

- インド

- 韓国

- その他のアジア太平洋地域

目次

第1章 市場

- 業界の展望

- 動向:現在と未来

- サプライチェーン分析

- COVID-19によるサステナブルスチール市場への影響

- ロシアとウクライナ戦争がサステナブルスチール市場に与える影響

- エコシステム/進行中のプログラム

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 経営戦略

- 事業機会

- スタートアップの情勢

- 特許分析

- 世界および地域レベル:平均価格分析

- 世界のグリーンスチールのプロジェクトと開発

第2章 アジア太平洋

- 中国

- 市場

- 用途

- 製品

- アジア太平洋および日本

- 市場

- 用途

- 製品

- アジア太平洋のサステナブルスチール市場 (国別)

- アジア太平洋および日本 (国別)

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 企業プロファイル

- HBIS GROUP

- NIPPON STEEL CORPORATION

- POSCO

- Tata Steel

- ScrapBuk

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Sustainable Steel Market, $Billion, 2021-2031

- Figure 2: Asia-Pacific Sustainable Steel Market (by End-Use Application), $Billion, 2021 and 2031

- Figure 3: Asia-Pacific Sustainable Steel Market (by Product Type), $Billion, 2021 and 2031

- Figure 4: Asia-Pacific Sustainable Steel Market (by Technology), $Billion, 2021 and 2031

- Figure 5: Sustainable Steel Market (by Region), $Billion, 2021 and 2031

- Figure 6: Supply Chain Analysis of the Sustainable Steel Market

- Figure 7: Patent Analysis (by Year), January 2019-November 2022

- Figure 8: Patent Analysis (by Status), January 2019-November 2022

- Figure 9: Patents Filed by Leading Countries, January 2019-November 2022

- Figure 10: Patents Granted to Leading Countries, January 2019-November 2022

- Figure 11: Research Methodology

- Figure 12: Top-Down and Bottom-Up Approach

- Figure 13: Influencing Factors of the Sustainable Steel Market

- Figure 14: Assumptions and Limitations

List of Tables

- Table 1: Asia-Pacific Sustainable Steel Market Snapshot, $Billion, 2021 and 2031

- Table 2: Key Market Developments

- Table 3: Key Product Developments (2019-2021)

- Table 4: Key Partnerships, Acquisitions, Collaborations, and Joint Ventures

- Table 5: Global Sustainable Steel Market, Average Pricing Analysis, $/Ton, 2021-2031

- Table 6: Sustainable Steel Market (by Region), Average Pricing Analysis, $/Ton, 2021-2031

- Table 7: Global Sustainable Steel Market (by Product Type), Average Pricing Analysis, $/Ton, 2021-2031

- Table 8: Global Green Steel Projects and Developments, by Company

- Table 9: Global Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 10: Global Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 11: Global Sustainable Steel Market (by Product Type), Million Tons, 2021-2031

- Table 12: Global Sustainable Steel Market (by Product Type), $Billion, 2021-2031

- Table 13: Global Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 14: Global Sustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 15: Global Sustainable Steel Market (by Region), Million Tons, 2021-2031

- Table 16: Global Sustainable Steel Market (by Region), $Billion, 2021-2031

- Table 17: China Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 18: China Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 19: China Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 20: China Sustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 21: Asia-PacificSustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 22: Asia-PacificSustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 23: Asia-PacificSustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 24: Asia-PacificSustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 25: Asia-Pacific Sustainable Steel Market (by Country), Million Tons, 2021-2031

- Table 26: Asia-Pacific Sustainable Steel Market (by Country), $Billion, 2021-2031

- Table 27: Japan Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 28: Japan Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 29: Japan Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 30: Japan Sustainable Steel Market (by Technology), $Billion, 2021-2031

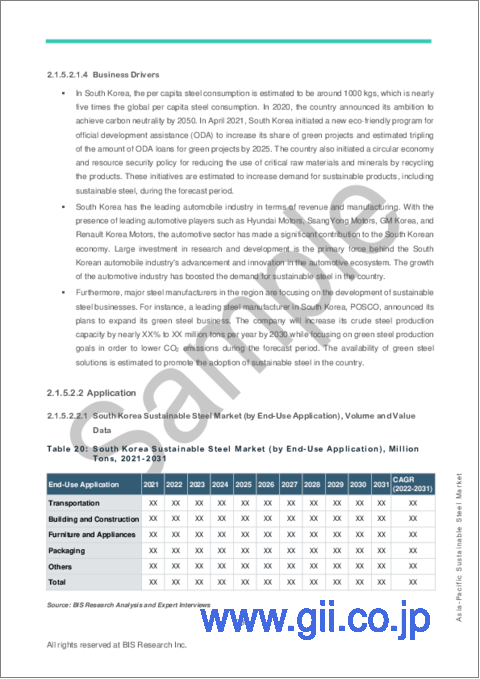

- Table 31: South Korea Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 32: South Korea Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 33: South Korea Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 34: South Korea Sustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 35: India Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 36: India Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 37: India Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 38: India Sustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 39: Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by End-Use Application), Million Tons, 2021-2031

- Table 40: Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by End-Use Application), $Billion, 2021-2031

- Table 41: Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by Technology), Million Tons, 2021-2031

- Table 42: Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by Technology), $Billion, 2021-2031

- Table 43: Product Matrix for Key Companies

- Table 44: Market Share of Key Companies

- Table 45: HBIS GROUP: Product Portfolio

- Table 46: NIPPON STEEL CORPORATION: Product Portfolio

- Table 47: POSCO: Product Portfolio

- Table 48: Tata Steel: Product Portfolio

- Table 49: ScrapBuk Product Portfolio

“The Asia-Pacific Sustainable Steel Market (excluding China) Expected to Reach $153.4 Billion by 2031.”

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2022 - 2031 |

| 2022 Evaluation | $68.4 Billion |

| 2031 Forecast | $153.4 Billion |

| CAGR | 9.39% |

Introduction to Asia Pacific (APAC) Sustainable Steel Market

The Asia-Pacific sustainable steel market (excluding China) is projected to reach $153.4 billion by 2031 from $68.4 billion in 2022, growing at a CAGR of 9.39% during the forecast period 2022-2031. The expansion of the Asia-Pacific sustainable steel market is anticipated to be driven by strict government regulations, carbon neutrality objectives, energy efficiency in the use of recycled steel, and a significant increase in steel demand as a result of finite energy and raw material supplies. However, challenges like contaminants in recovered steel from improper separation and complex product designs, in addition to high production costs of green steel in the face of significant infrastructure costs and green hydrogen prices, constitute significant market barriers in this area.

Market Introduction

Leading the way in the sustainable steel market is the Asia-Pacific area, which places a strong emphasis on the use of low-carbon manufacturing techniques, resource efficiency, and environmentally friendly practices. Many interrelated issues, such as tightening environmental regulations, the increased focus on carbon neutrality, and the need for affordable and efficient steel manufacturing, are driving the industry. In the Asia-Pacific area, sustainable steel is becoming more and more popular. It meets the needs of a variety of industries, such as infrastructure, automotive, and construction, while also meeting the urgent need to lessen the environmental impact of steel production.

Market Segmentation

Segmentation 1: by End-Use Application

- Transportation

- Building and Construction

- Furniture and Appliances

- Packaging

- Others

Segmentation 2: by Technology

- Electric Arc Furnace (EAF)

- Blast Furnace-Basic Oxygen Furnace (BF-BOF)

- Others

Segmentation 3: by Country

- Japan

- India

- South Korea

- Rest-of-Asia Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of sustainable steel available and their potential in the asia-pacific region. Moreover, the study provides the reader with a detailed understanding of the different sustainable steel end-use applications in industries such as transportation, building and construction, furniture and appliances, packaging, and others.

Growth/Marketing Strategy: Business expansions, partnerships, acquisitions, collaborations, and joint ventures are some key strategies adopted by key players operating in the space.

Competitive Strategy: Key players in the APAC sustainable steel market analyzed and profiled in the study involve sustainable steel providers. Moreover, a detailed competitive benchmarking of the players operating in the APAC sustainable steel market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Rising Investments in Green Technologies

- 1.1.1.2 Change in Business Models of Companies due to Climate Action

- 1.1.2 Supply Chain Analysis

- 1.1.3 Impact of COVID-19 on the Sustainable Steel Market

- 1.1.4 Impact of Russia and Ukraine War on the Sustainable Steel Market

- 1.1.5 Ecosystem/Ongoing Programs

- 1.1.5.1 Associations

- 1.1.1 Trends: Current and Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Stringent Regulations and Carbon Neutrality Targets

- 1.2.1.2 Energy and Cost Efficiency owing to the Use of Recycled Steel

- 1.2.1.3 Significant Increase in Steel Demand with Scarcity of Raw Materials and Energy

- 1.2.2 Business Challenges

- 1.2.2.1 Impurities due to Incomplete Separation and Complex Product Design

- 1.2.2.2 High Infrastructure Cost and Green Hydrogen Prices Curbing the Green Steel Developments

- 1.2.3 Business Strategies

- 1.2.3.1 Market Developments

- 1.2.3.2 Product Developments

- 1.2.4 Corporate Strategies

- 1.2.4.1 Partnerships, Acquisitions, Collaborations, and Joint Ventures

- 1.2.5 Business Opportunity

- 1.2.5.1 Increasing Demand for Green Steel across the Value Chain

- 1.2.5.2 Development of Economic and Environmental Technologies

- 1.2.1 Business Drivers

- 1.3 Start-Up Landscape

- 1.3.1 Key Start-Ups in the Ecosystem

- 1.4 Patent Analysis

- 1.4.1 Patent Analysis (by Status)

- 1.4.2 Patent Analysis (by Leading Countries)

- 1.5 Global and Regional Level: Average Pricing Analysis

- 1.6 Global Green Steel Projects and Developments

2 Asia-Pacific

- 2.1 China

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Manufacturers/Suppliers in China

- 2.1.1.3 Business Challenges

- 2.1.1.4 Business Drivers

- 2.1.2 Application

- 2.1.2.1 China Sustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.1.3 Product

- 2.1.3.1 China Sustainable Steel Market (by Technology), Volume and Value Data

- 2.1.1 Market

- 2.2 Asia-Pacific and Japan

- 2.2.1 Market

- 2.2.1.1 Key Manufacturers/Suppliers in Asia-Pacific and Japan

- 2.2.1.2 Business Challenges

- 2.2.1.3 Business Drivers

- 2.2.2 Application

- 2.2.2.1 Asia-PacificSustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.2.3 Product

- 2.2.3.1 Asia-PacificSustainable Steel Market (by Technology), Volume and Value Data

- 2.2.4 Asia-Pacific Sustainable Steel Market (by Country), Volume and Value Data

- 2.2.5 Asia-Pacific and Japan (by Country)

- 2.2.5.1 Japan

- 2.2.5.1.1 Market

- 2.2.5.1.1.1 Buyer Attributes

- 2.2.5.1.1.2 Key Manufacturers/Suppliers in Japan

- 2.2.5.1.1.3 Business Challenges

- 2.2.5.1.1.4 Business Drivers

- 2.2.5.1.2 Application

- 2.2.5.1.2.1 Japan Sustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.2.5.1.3 Product

- 2.2.5.1.3.1 Japan Sustainable Steel Market (by Technology), Volume and Value Data

- 2.2.5.1.1 Market

- 2.2.5.2 South Korea

- 2.2.5.2.1 Market

- 2.2.5.2.1.1 Buyer Attributes

- 2.2.5.2.1.2 Key Manufacturers/Suppliers in South Korea

- 2.2.5.2.1.3 Business Challenges

- 2.2.5.2.1.4 Business Drivers

- 2.2.5.2.2 Application

- 2.2.5.2.2.1 South Korea Sustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.2.5.2.3 Product

- 2.2.5.2.3.1 South Korea Sustainable Steel Market (by Technology), Volume and Value Data

- 2.2.5.2.1 Market

- 2.2.5.3 India

- 2.2.5.3.1 Market

- 2.2.5.3.1.1 Buyer Attributes

- 2.2.5.3.1.2 Key Manufacturers/Suppliers in India

- 2.2.5.3.1.3 Business Challenges

- 2.2.5.3.1.4 Business Drivers

- 2.2.5.3.2 Application

- 2.2.5.3.2.1 India Sustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.2.5.3.3 Product

- 2.2.5.3.3.1 India Sustainable Steel Market (by Technology), Volume and Value Data

- 2.2.5.3.1 Market

- 2.2.5.4 Rest-of-Asia-Pacific and Japan

- 2.2.5.4.1 Market

- 2.2.5.4.1.1 Buyer Attributes

- 2.2.5.4.1.2 Key Manufacturers/Suppliers in Rest-of-Asia-Pacific and Japan

- 2.2.5.4.1.3 Business Challenges

- 2.2.5.4.1.4 Business Drivers

- 2.2.5.4.2 Application

- 2.2.5.4.2.1 Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by End-Use Application), Volume and Value Data

- 2.2.5.4.3 Product

- 2.2.5.4.3.1 Rest-of-Asia-Pacific and Japan Sustainable Steel Market (by Technology), Volume and Value Data

- 2.2.5.4.1 Market

- 2.2.5.1 Japan

- 2.2.1 Market

3 Markets-- Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.1.2 Product Matrix for Key Companies

- 3.1.3 Market Share Analysis of Key Companies

- 3.2 Company Profiles

- 3.2.1 HBIS GROUP

- 3.2.1.1 Company Overview

- 3.2.1.1.1 Role of HBIS GROUP in the Sustainable Steel Market

- 3.2.1.1.2 Product Portfolio

- 3.2.1.1.3 Business Strategies

- 3.2.1.1.3.1 Market Development

- 3.2.1.1.4 Corporate Strategies

- 3.2.1.1.4.1 Partnerships, Acquisitions, Collaborations, and Joint Ventures

- 3.2.1.1.5 Analyst View

- 3.2.1.1 Company Overview

- 3.2.2 NIPPON STEEL CORPORATION

- 3.2.2.1 Company Overview

- 3.2.2.1.1 Role of NIPPON STEEL CORPORATION in the Sustainable Steel Market

- 3.2.2.1.2 Product Portfolio

- 3.2.2.1.3 Business Strategies

- 3.2.2.1.3.1 Market Development

- 3.2.2.1.3.2 Product Development

- 3.2.2.1.4 Corporate Strategies

- 3.2.2.1.4.1 Partnerships, Acquisitions, Collaborations, and Joint Ventures

- 3.2.2.1.5 R&D Analysis

- 3.2.2.1.6 Analyst View

- 3.2.2.1 Company Overview

- 3.2.3 POSCO

- 3.2.3.1 Company Overview

- 3.2.3.1.1 Role of POSCO in the Sustainable Steel Market

- 3.2.3.1.2 Product Portfolio

- 3.2.3.1.3 Business Strategies

- 3.2.3.1.3.1 Product Development

- 3.2.3.1.4 Corporate Strategies

- 3.2.3.1.4.1 Partnerships, Acquisitions, Collaborations, and Joint Ventures

- 3.2.3.1.5 Analyst View

- 3.2.3.1 Company Overview

- 3.2.4 Tata Steel

- 3.2.4.1 Company Overview

- 3.2.4.1.1 Role of Tata Steel in the Sustainable Steel Market

- 3.2.4.1.2 Product Portfolio

- 3.2.4.1.3 Business Strategies

- 3.2.4.1.3.1 Market Development

- 3.2.4.1.3.2 Product Development

- 3.2.4.1.4 Corporate Strategies

- 3.2.4.1.4.1 Partnerships, Acquisitions, Collaborations, and Joint Ventures

- 3.2.4.1.5 R&D Analysis

- 3.2.4.1.6 Analyst View

- 3.2.4.1 Company Overview

- 3.2.5 ScrapBuk

- 3.2.5.1 Company Overview

- 3.2.5.1.1 Role of ScrapBuk in the Sustainable Steel Market

- 3.2.5.1.2 Product Portfolio

- 3.2.5.1.3 Analyst View

- 3.2.5.1 Company Overview

- 3.2.1 HBIS GROUP