|

|

市場調査レポート

商品コード

1341287

電気自動車アフターマーケットの世界市場 (2023-2032年):車両タイプ・推進タイプ・販売店舗・販売形態・パーツ・国別の分析・予測Electric Vehicle Aftermarket - A Global and Regional Market Analysis: Focus on Vehicle Type, Propulsion Type, Sales Outlet, Mode of Sales, Part, and Country-Level Analysis - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車アフターマーケットの世界市場 (2023-2032年):車両タイプ・推進タイプ・販売店舗・販売形態・パーツ・国別の分析・予測 |

|

出版日: 2023年08月25日

発行: BIS Research

ページ情報: 英文 263 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の電気自動車アフターマーケットは、2022年の445億2,000万米ドルから、予測期間中は20.73%のCAGRで推移し、2032年には2,862億6,000万米ドルの規模に成長すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2032年 |

| 2023年の評価 | 525億3,000万米ドル |

| 2032年の予測 | 2,862億6,000万米ドル |

| CAGR | 20.73% |

電気自動車アフターマーケットは、電気自動車の導入の急増、電気自動車のカスタマイズに対する消費者の関心の高まり、電気自動車をセカンドライフ用途に転用する動向の高まりなど、いくつかの要因によって牽引されています。

電気自動車アフターマーケットソリューションプロバイダーやベンダーは、R&Dへの多額の投資やエコシステムの他のステークホルダーとのパートナーシップを通じて、先進的な電気自動車アフターマーケットソリューションの開発に取り組んでいます。電気自動車の需要が急速に高まり、政策、補助金、投資を重視する行政機関が増加し、自動車製造業者が脱炭素化に向けて重点を移していることなどから、電気自動車アフターマーケットソリューションへの需要は予測期間中に大幅に拡大する可能性が高いと考えられています。

自動車タイプ別で見ると、乗用車の部門が2032年までに市場をリードすると予測されています。この優位性は、新興経済諸国と先進経済諸国の両方において、電気自動車の乗用車の採用が増加していることに起因しています。この上昇傾向は、より厳格な排ガス規制の導入と、補助金を含む政府のイニシアチブの強化に支えられています。

推進タイプ別では、BEVモデルがかなりの期間、市場で大きな支持を集めてきましたが、走行距離への不安と高い初期費用をめぐる懸念から、顧客はBEVよりHEVを選ぶ傾向となっています。HEVは、従来のガソリン車やディーゼル車と比較して排出ガスレベルが低いのが特徴です。HEVの普及が拡大し続ける中で、アフターマーケット事業者は、HEV用スペアパーツの需要増に対応することが不可欠となっています。

さらに、地域別では、アジア太平洋および日本が2022年の市場をリードしました。これは日本にHEVパークが豊富にあることに起因しています。同地域は、他のアジア諸国の中でもEVの普及が進んでいるため、今後数年間で大幅な成長が見込まれています。しかし、EVを好む消費者の変化、環境意識の高まり、必須原材料へのアクセス、堅調な経済成長、費用対効果の高い労働力などの背景を踏まえると、予測期間中は中国が最大の成長を記録すると予想されています。

当レポートでは、世界の電気自動車アフターマーケットの市場を調査し、市場の定義と概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 市場

- 産業の展望

- 動向:現在と未来

- 電気自動車アフターマーケットの構造

- エコシステム/進行中のプログラム

- 自動車のアフターマーケットのダイナミクス

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 経営戦略

- 事業機会

第2章 用途

- 電気自動車アフターマーケット:用途・仕様

- 電気自動車アフターマーケット:車両タイプ別

- 電気自動車アフターマーケット:推進タイプ別

- 電気自動車アフターマーケットの需要分析:用途別

- 電気自動車アフターマーケットの需要分析:車両タイプ別

- 電気自動車アフターマーケットの需要分析:推進タイプ別

第3章 製品

- 電気自動車アフターマーケット:製品・仕様

- 電気自動車アフターマーケット:販売店別

- 電気自動車アフターマーケット:販売形態別

- 電気自動車アフターマーケット:パーツ別

- 電気自動車アフターマーケットの需要分析

- 電気自動車アフターマーケットの需要分析:販売店別

- 電気自動車アフターマーケットの需要分析:販売形態別

- 電気自動車アフターマーケットの需要分析:パーツ別

- 製品ベンチマーキング:成長率・市場シェアマトリックス

第4章 地域

- 北米

- 欧州

- 英国

- 中国

- アジア太平洋および日本

- その他の地域

第5章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 企業プロファイル

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Schaeffler AG

- NTN Corporation

- BorgWarner Inc.

- Tenneco Inc.

- Michelin

- AISIN Corporation

- DENSO Corporation

- GUD Holdings Limited

- HELLA GmbH & Co. KGaA

- Kavo B.V.

- Marelli Holdings Co., Ltd.

- T Sportline, Inc.

- Bridgestone Corporation

- The Yokohama Rubber Co., Ltd.

- その他の企業

第6章 調査手法

List of Figures

- Figure 1: Global Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Figure 2: Global Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Figure 3: Global Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Figure 4: Global Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Figure 5: Global Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Figure 6: Global Electric Vehicle Aftermarket (by Region), $Billion, 2022

- Figure 7: Electric Vehicle Aftermarket Segmentation

- Figure 8: Electric Vehicle Aftermarket Structure

- Figure 9: Business Dynamics for Global Electric Vehicle Aftermarket

- Figure 10: Impact of Business Drivers

- Figure 11: Global EV Stock, Units, 2020-2022

- Figure 12: EV Sales Comparison (Cars), Units, 2020-2022

- Figure 13: Impact of Business Challenges

- Figure 14: Share of Key Business Strategies and Developments, 2021-2023

- Figure 15: Share of Key Product Developments, 2021-2023

- Figure 16: Share of Key Market Developments, 2021-2023

- Figure 17: Share of Key Corporate Strategies and Developments, 2021-2023

- Figure 18: Share of Key Partnerships, Collaborations, and Joint Ventures, 2021-2023

- Figure 19: Impact of Business Opportunities

- Figure 20: Electric Vehicle Aftermarket for Passenger Vehicles, $Billion, 2022-2032

- Figure 21: Electric Vehicle Aftermarket for Commercial Vehicles, $Billion, 2022-2032

- Figure 22: Electric Vehicle Aftermarket for Battery Electric Vehicles (BEVs), $Billion, 2022-2032

- Figure 23: Electric Vehicle Aftermarket for Plug-in Hybrid Electric Vehicles (PHEVs), $Billion, 2022-2032

- Figure 24: Electric Vehicle Aftermarket for Hybrid Electric Vehicles (HEVs), $Billion, 2022-2032

- Figure 25: Electric Vehicle Aftermarket for Authorized Service Centers (OEMs), $Billion, 2022-2032

- Figure 26: Electric Vehicle Aftermarket for Premium Multi-brand Service Centers, $Billion, 2022-2032

- Figure 27: Electric Vehicle Aftermarket for Other Sales Outlet, $Billion, 2022-2032

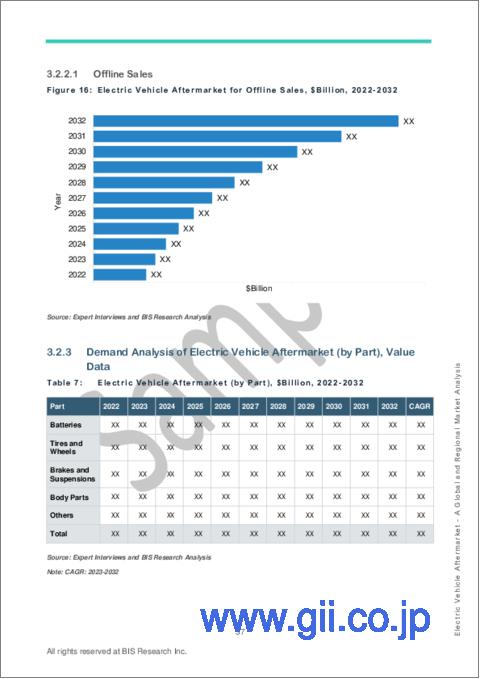

- Figure 28: Electric Vehicle Aftermarket for Offline Sales, $Billion, 2022-2032

- Figure 29: Electric Vehicle Aftermarket for Online Sales, $Billion, 2022-2032

- Figure 30: Electric Vehicle Aftermarket for Batteries, $Billion, 2022-2032

- Figure 31: Electric Vehicle Aftermarket for Tires and Wheels, $Billion, 2022-2032

- Figure 32: Electric Vehicle Aftermarket for Brakes and Suspensions, $Billion, 2022-2032

- Figure 33: Electric Vehicle Aftermarket for Body Parts, $Billion, 2022-2032

- Figure 34: Electric Vehicle Aftermarket for Other Parts, $Billion, 2022-2032

- Figure 35: Electric Vehicle Aftermarket, Opportunity Matrix (by Region), $Billion

- Figure 36: Electric Vehicle Aftermarket, Opportunity Matrix (by Part), $Billion

- Figure 37: Global Competitive Benchmarking, 2022

- Figure 38: Robert Bosch GmbH: R&D Expenditure, $Billion, 2020-2022

- Figure 39: Continental AG: R&D Expenditure, $Billion, 2020-2022

- Figure 40: ZF Friedrichshafen AG: R&D Expenditure, $Billion, 2020-2022

- Figure 41: Schaeffler AG: R&D Expenditure, $Million, 2020-2022

- Figure 42: NTN Corporation: R&D Expenditure, $Million, 2020-2022

- Figure 43: BorgWarner Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 44: Tenneco Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 45: Michelin: R&D Expenditure, $Million, 2020-2022

- Figure 46: AISIN Corporation: R&D Expenditure, $Billion, 2020-2022

- Figure 47: DENSO Corporation: R&D Expenditure, $Billion, 2020-2022

- Figure 48: GUD Holdings Limited: R&D Expenditure, $Million, 2020-2022

- Figure 49: Bridgestone Corporation: R&D Expenditure, $Million, 2020-2022

- Figure 50: The Yokohama Rubber Co., Ltd.: R&D Expenditure, $Million, 2020-2022

- Figure 51: Akebono Brake Industry Co., Ltd.: R&D Expenditure, $Million, 2020-2022

- Figure 52: Data Triangulation

- Figure 53: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Global Electric Vehicle Aftermarket Overview

- Table 2: Government Policies for Electric Vehicles, 2019-2023

- Table 3: List of Consortiums and Associations

- Table 4: Programs on Electric Vehicles by Research Institutions and Universities

- Table 5: Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 6: Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 7: Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 8: Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 9: Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 10: Electric Vehicle Aftermarket (by Region), $Billion, 2022-2032

- Table 11: North America Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 12: North America Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 13: North America Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 14: North America Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 15: North America Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 16: U.S. Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 17: U.S. Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 18: U.S. Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 19: U.S. Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 20: U.S. Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 21: Canada Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 22: Canada Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 23: Canada Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 24: Canada Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 25: Canada Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 26: Mexico Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 27: Mexico Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 28: Mexico Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 29: Mexico Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 30: Mexico Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 31: Europe Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 32: Europe Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 33: Europe Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 34: Europe Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 35: Europe Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 36: Germany Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 37: Germany Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 38: Germany Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 39: Germany Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 40: Germany Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 41: France Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 42: France Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 43: France Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 44: France Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 45: France Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 46: Spain Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 47: Spain Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 48: Spain Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 49: Spain Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 50: Spain Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 51: Netherlands Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 52: Netherlands Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 53: Netherlands Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 54: Netherlands Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 55: Netherlands Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 56: Rest-of-Europe Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 57: Rest-of-Europe Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 58: Rest-of-Europe Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 59: Rest-of-Europe Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 60: Rest-of-Europe Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 61: U.K. Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 62: U.K. Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 63: U.K. Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 64: U.K. Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 65: U.K. Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 66: China Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 67: China Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 68: China Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 69: China Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 70: China Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 71: Asia-Pacific and Japan Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 72: Asia-Pacific and Japan Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 73: Asia-Pacific and Japan Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 74: Asia-Pacific and Japan Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 75: Asia-Pacific and Japan Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 76: Japan Electric Vehicle Aftermarket (by Vehicle Type), $Billion, 2022-2032

- Table 77: Japan Electric Vehicle Aftermarket (by Propulsion Type), $Billion, 2022-2032

- Table 78: Japan Electric Vehicle Aftermarket (by Sales Outlet), $Billion, 2022-2032

- Table 79: Japan Electric Vehicle Aftermarket (by Mode of Sales), $Billion, 2022-2032

- Table 80: Japan Electric Vehicle Aftermarket (by Part), $Billion, 2022-2032

- Table 81: South Korea Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 82: South Korea Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 83: South Korea Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 84: South Korea Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 85: South Korea Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 86: Australia Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 87: Australia Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 88: Australia Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 89: Australia Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 90: Australia Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 91: Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 92: Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 93: Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 94: Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 95: Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 96: Rest-of-the-World Electric Vehicle Aftermarket (by Vehicle Type), $Million, 2022-2032

- Table 97: Rest-of-the-World Electric Vehicle Aftermarket (by Propulsion Type), $Million, 2022-2032

- Table 98: Rest-of-the-World Electric Vehicle Aftermarket (by Sales Outlet), $Million, 2022-2032

- Table 99: Rest-of-the-World Electric Vehicle Aftermarket (by Mode of Sales), $Million, 2022-2032

- Table 100: Rest-of-the-World Electric Vehicle Aftermarket (by Part), $Million, 2022-2032

- Table 101: Key Market Player Ranking: Automotive Tires

- Table 102: Key Market Player Ranking: Automotive Brakes

- Table 103: Key Market Player Ranking: Electric Vehicle Batteries

- Table 104: Key Market Player Ranking: Automotive Wipers

- Table 105: Key Market Player Ranking: Automotive Lighting

- Table 106: Robert Bosch GmbH: Product Portfolio

- Table 107: Robert Bosch GmbH: Product Development

- Table 108: Continental AG: Product Portfolio

- Table 109: Continental AG: Product Development

- Table 110: Continental AG: Market Development

- Table 111: ZF Friedrichshafen AG: Product Portfolio

- Table 112: ZF Friedrichshafen AG: Product Development

- Table 113: ZF Friedrichshafen AG: Market Development

- Table 114: ZF Friedrichshafen AG: Partnership, Collaboration, and Joint Venture

- Table 115: Schaeffler AG: Product Portfolio

- Table 116: Schaeffler AG: Product Development

- Table 117: Schaeffler AG: Market Development

- Table 118: NTN Corporation: Product Portfolio

- Table 119: NTN Corporation: Product Development

- Table 120: BorgWarner Inc.: Product Portfolio

- Table 121: BorgWarner Inc.: Product Development

- Table 122: BorgWarner Inc.: Merger and Acquisition

- Table 123: Tenneco Inc.: Product Portfolio

- Table 124: Tenneco Inc.: Product Development

- Table 125: Tenneco Inc.: Partnership, Collaboration, and Joint Venture

- Table 126: Michelin: Product Portfolio

- Table 127: Michelin: Product Development

- Table 128: AISIN Corporation: Product Portfolio

- Table 129: DENSO Corporation: Product Portfolio

- Table 130: DENSO Corporation: Partnership, Collaboration, and Joint Venture

- Table 131: GUD Holdings Limited: Product Portfolio

- Table 132: HELLA GmbH & Co. KGaA: Product Portfolio

- Table 133: Kavo B.V.: Product Portfolio

- Table 134: Marelli Holdings Co., Ltd.: Product Portfolio

- Table 135: Marelli Holdings Co., Ltd.: Product Development

- Table 136: Marelli Holdings Co., Ltd.: Market Development

- Table 137: Marelli Holdings Co., Ltd.: Partnership, Collaboration, and Joint Venture

- Table 138: T Sportline, Inc.: Product Portfolio

- Table 139: Bridgestone Corporation: Product Portfolio

- Table 140: Bridgestone Corporation: Market Development

- Table 141: Bridgestone Corporation: Partnership, Collaboration, and Joint Venture

- Table 142: The Yokohama Rubber Co., Ltd.: Product Portfolio

- Table 143: The Yokohama Rubber Co., Ltd.: Product Development

- Table 144: The Yokohama Rubber Co., Ltd.: Market Development

- Table 145: The Yokohama Rubber Co., Ltd.: Partnership, Collaboration, and Joint Venture

- Table 146: Akebono Brake Industry Co., Ltd.: Product Portfolio

- Table 147: Akebono Brake Industry Co., Ltd.: Partnership, Collaboration, and Joint Venture

“Global Electric Vehicle Aftermarket to Reach $286.26 Billion by 2032.”

Electric Vehicle Aftermarket Overview

The global electric vehicle aftermarket is projected to reach $286.26 billion by 2032 from $44.52 billion in 2022, growing at a CAGR of 20.73% during the forecast period 2023-2032. The growth in the electric vehicle aftermarket is expected to be driven by the rising popularity of electric vehicles, proliferating consumer demand for electric vehicle customization, and increasing popularity of electric vehicle second-life applications.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $52.53 Billion |

| 2032 Forecast | $286.26 Billion |

| CAGR | 20.73% |

Market Lifecycle Stage

Electric vehicles (EVs) are a pivotal technology in the pursuit of decarbonizing the road transportation sector, which contributes to approximately one-sixth of global emissions. The continued implementation of ambitious policies remains indispensable for fostering growth within the global electric vehicle markets.

Few sectors within the clean energy domain exhibit as much dynamism as the electric car industry. Recent years have witnessed remarkable growth in sales, accompanied by enhancements in driving range, broader model availability, and heightened performance standards. According to the International Energy Agency (IEA), nearly 20% of new car sales in 2023 are projected to be electric.

Should the robust growth observed over the previous two years persist, it is conceivable that by 2030, carbon dioxide emissions resulting from vehicular usage can be steered onto a trajectory that aligns with the Net Zero Emission (NZE) Scenario 2050. Nevertheless, the widespread adoption of electric vehicles remains a phenomenon yet to be fully realized on a global scale. Sales of electric vehicle aftermarket components in developing and emerging economies have encountered sluggishness, primarily due to the comparatively elevated upfront cost of electric vehicles and inadequate availability of charging infrastructure.

The electrification of lightweight vehicles presents a multifaceted challenge, given that portfolio and investment strategies have become notably intricate. Market entities operating in the aftermarket realm will be required to cater to both electric vehicles and internal combustion engine (ICE) vehicles. Additional complexities emerge as battery-electric vehicles (BEVs) exert an estimated 30% lesser demand for traditional aftermarket components compared to ICE vehicles, thereby presenting manifold challenges for the aftermarket sector.

The process of electrification ushers in an array of novel opportunities for stakeholders across the value chain. Manufacturers of automotive components can strategically transition their product portfolios to encompass BEV-specific elements and expand their operational framework to encompass remanufacturing initiatives. Collaborations with battery experts, who frequently lack post-sale capabilities, also present avenues for growth. Wholesale distributors can play a pivotal role in managing end-of-life components and may leverage their established logistics networks to engage new customer segments. Service workshops can opt for a specialized focus on BEVs or uphold a dual specialization in both ICE and BEV technologies, potentially forging partnerships with specialized service providers in the process.

Impact

The electric vehicle aftermarket is driven by several factors, such as the surge in the adoption of electric vehicles, the burgeoning consumer interest in customizing electric vehicles, and the growing trend of repurposing electric vehicles for second-life applications.

Electric vehicle aftermarket solution providers/vendors are working toward the development of advanced electric vehicle aftermarket solutions through significant investment in research and development (R&D) and partnerships with other key stakeholders in the electric vehicle ecosystem. With rapidly rising demand for electric vehicles, increasing emphasis on policies, subsidies, and investment by the governing bodies, and shifting the focus of automakers towards decarbonization, among others, the electric vehicle aftermarket solutions are likely to witness a considerable increase in their demand during the review period.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Among the vehicle types, the passenger vehicles segment is expected to dominate the vehicle type segment in the global electric vehicle aftermarket by 2032. This prominence can be attributed to the rising adoption of passenger electric vehicles in both developing and developed economies. The upward trajectory is underpinned by the convergence of more rigorous emission regulations and the reinforcement of governmental initiatives, including subsidies, culminating in augmented demand for passenger EVs in recent times.

Segmentation 2: by Propulsion Type

- Battery Electric Vehicles (BEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs) are the major propulsion types that are served by the global electric vehicle aftermarket. While BEV models have garnered significant traction in the market for a considerable period, concerns surrounding range anxiety and higher upfront costs have encouraged customers to opt for HEVs over BEVs. HEVs exhibit lower emission levels in comparison to traditional gasoline and diesel vehicles. As the prevalence of HEVs continues to grow, it becomes essential for the aftermarket participants to cater to the growing demand for spare parts for HEVs along with their parc size.

Segmentation 3: by Sales Outlet

- Authorized Service Centers

- Premium Multi-brand Service Centers

- Others

Among the various sales outlets, the authorized service centers (OEMs) segment occupied the largest market share in 2022. These centers are staffed by highly trained technicians possessing expert knowledge in electric vehicle technology.

Segmentation 4: by Mode of Sales

- Offline sales

- Online sales

Among the mode of sales, the offline sales segment is expected to dominate the market throughout the forecast period 2023-2032.

Segmentation 5: by Part

- Batteries

- Tires and Wheels

- Brakes and Suspensions

- Body Parts

- Others

The tires and wheels segment is expected to generate the majority of revenue throughout the forecast period. Vehicle electrification will positively influence the demand for tire and wheel replacements in the coming years. It can be ascribed to the increased overall weight of the vehicle, leading to a higher wear rate for this part category.

Segmentation 6: by Region

- North America

- Europe

- U.K.

- China

- Asia-Pacific and Japan

- Rest-of-the-World

Asia-Pacific and Japan dominated the electric vehicle aftermarket in 2022. It can be ascribed to the abundance of HEV parc in Japan. The region is also likely to witness substantial growth in coming years owing to the rising adoption of EVs in other Asian countries. However, it is China that is expected to register the fastest growth during the forecast period as compared to other regions covered within the scope of this report, owing to evolving consumer preferences favoring EVs, rising environmental awareness, access to essential raw materials, robust economic growth, and cost-effective labor force. These pivotal factors collectively contribute to the robust growth of its domestic electric vehicle ecosystem, thereby paving the way for a thriving aftermarket demand in the forthcoming years.

Recent Developments in the Electric Vehicle Aftermarket

- In April 2023, Robert Bosch GmbH launched the "Ultra White bulb range." The enhanced color temperature would now be available across a range of headlight types, spanning from 4,200 to 4,800 kelvin, delivering a more vibrant and brilliant light output. These 'Ultra White' bulbs offer a remarkable 40 percent increase in luminosity compared to standard halogen bulbs.

- In June 2022, Schaeffler AG launched a new four-in-one electric axle for e-mobility. The product offers increased comfort and range owing to innovative thermal management and enhances performance through the interaction of an electric motor, thermal management, power electronics, and transmission in one complete system.

- In January 2022, Continental AG achieved a significant milestone by becoming the inaugural tire manufacturer to showcase its esteemed brands, namely, Continental, Uniroyal, Semperit, Barum, General Tire, Viking, Gislaved, Mabor, and Matador, within the newly introduced tire product category in the TecDoc Catalogue. This advancement allows users to conveniently explore a comprehensive range of summer, winter, and all-season tires specifically tailored to their vehicles, accessible through size specifications or by conducting a vehicle search.

- In September 2021, ZF Friedrichshafen AG unveiled the TRW Electric Brake Booster, a cutting-edge brake technology specifically engineered for electric vehicles. This innovative system utilizes advanced electronic components to enhance brake actuation, offering superior performance and responsiveness. The introduction of the TRW Electric Brake Booster underscores ZF's commitment to delivering tailored solutions that cater to the unique requirements of electric vehicles, further solidifying its position as a leader in the aftermarket industry.

- In April 2021, Michelin launched the new " MICHELIN X Incity EV Z" tires. It's the first range of tires offered by the company for electric buses, which can also be used for traditional suburban and urban vehicles.

Demand - Drivers and Limitations

Following are the demand drivers for the electric vehicle aftermarket:

- Rising Popularity of Electric Vehicles

- Proliferating Consumer Demand for Electric Vehicle Customization

- Increasing Popularity of Electric Vehicle Second-Life Applications

Following are the limitations of the electric vehicle aftermarket:

- Lack of Electric Vehicle Aftermarket Infrastructure and Awareness

- Cost and Availability Issues of Electric Vehicle Spare Parts

How can this report add value to an organization?

- Product/Innovation Strategy: The product strategy helps the readers understand the different aftermarket solutions provided by the industry participants.

- Growth/Marketing Strategy: The electric vehicle aftermarket is growing at a significant pace and holds enormous opportunities for market players. Some of the strategies covered in this segment are product launches, partnerships, collaborations, business expansions, and investments. The companies' preferred strategy has been product launches, partnerships, and collaborations to strengthen their positions in the global electric vehicle aftermarket.

- Competitive Strategy: The key players in the electric vehicle aftermarket analyzed and profiled in the study include electric vehicle aftermarket solution providers that develop parts and accessories for EVs. Moreover, a detailed competitive benchmarking of the players operating in the electric vehicle aftermarket has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing companies' coverage, product portfolio, and regional presence.

Key Companies Profiled:

|

|

Table of Contents

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Trends: Current and Future

- 1.1.1.1. Electrification of Fleets

- 1.1.1.2. Governments Increase their Influence on the e-Mobility Industry

- 1.1.2. Electric Vehicle Aftermarket Structure

- 1.1.3. Ecosystem/Ongoing Programs

- 1.1.3.1. Consortiums, Associations, and Regulatory Bodies for Electric Vehicles

- 1.1.3.2. Programs on Electric Vehicles by Research Institutions and Universities

- 1.1.4. Automotive Aftermarket Dynamics

- 1.1.4.1. Declining Demand for Traditional Engines and Drivetrains

- 1.1.4.2. New Opportunities for Industry Players through Electric Vehicle Aftermarket across the Board

- 1.1.1. Trends: Current and Future

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Rising Popularity of Electric Vehicles

- 1.2.1.2. Proliferating Consumer Demand for Electric Vehicle Customization

- 1.2.1.3. Increasing Popularity of Electric Vehicle Second-Life Applications

- 1.2.2. Business Challenges

- 1.2.2.1. Lack of Electric Vehicle Aftermarket Infrastructure and Awareness

- 1.2.2.2. Cost and Availability Issues of Electric Vehicle Spare Parts

- 1.2.3. Business Strategies

- 1.2.3.1. Product Development

- 1.2.3.2. Market Development

- 1.2.4. Corporate Strategies

- 1.2.4.1. Mergers and Acquisitions

- 1.2.4.2. Partnerships, Collaborations, and Joint Ventures

- 1.2.5. Business Opportunities

- 1.2.5.1. Electric Vehicle Battery Repair and Replacement

- 1.2.5.2. EV Component Recycling and Disposal

- 1.2.5.3. Training and Education on Electric Vehicle Aftermarket

- 1.2.5.4. Shifting Trend toward E-commerce

- 1.2.1. Business Drivers

2. Application

- 2.1. Electric Vehicle Aftermarket - Applications and Specifications

- 2.1.1. Electric Vehicle Aftermarket (by Vehicle Type)

- 2.1.1.1. Passenger Vehicles

- 2.1.1.2. Commercial Vehicles

- 2.1.2. Electric Vehicle Aftermarket (by Propulsion Type)

- 2.1.2.1. Battery Electric Vehicles (BEVs)

- 2.1.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 2.1.2.3. Hybrid Electric Vehicles (HEVs)

- 2.1.1. Electric Vehicle Aftermarket (by Vehicle Type)

- 2.2. Demand Analysis of Electric Vehicle Aftermarket (by Application)

- 2.2.1. Demand Analysis of Electric Vehicle Aftermarket (by Vehicle Type)

- 2.2.1.1. Passenger Vehicles

- 2.2.1.2. Commercial Vehicles

- 2.2.2. Demand Analysis of Electric Vehicle Aftermarket (by Propulsion Type)

- 2.2.2.1. Battery Electric Vehicles (BEVs)

- 2.2.2.2. Plug-in Hybrid Electric Vehicles (PHEVs)

- 2.2.2.3. Hybrid Electric Vehicles (HEVs)

- 2.2.1. Demand Analysis of Electric Vehicle Aftermarket (by Vehicle Type)

3. Products

- 3.1. Electric Vehicle Aftermarket - Products and Specifications

- 3.1.1. Electric Vehicle Aftermarket (by Sales Outlet)

- 3.1.1.1. Authorized Service Centers

- 3.1.1.2. Premium Multi-brand Service Centers

- 3.1.1.3. Others

- 3.1.2. Electric Vehicle Aftermarket (by Mode of Sales)

- 3.1.2.1. Offline Sales

- 3.1.2.2. Online Sales

- 3.1.3. Electric Vehicle Aftermarket (by Part)

- 3.1.3.1. Batteries

- 3.1.3.2. Tires and Wheels

- 3.1.3.3. Brakes and Suspensions

- 3.1.3.4. Body Parts

- 3.1.3.5. Others

- 3.1.1. Electric Vehicle Aftermarket (by Sales Outlet)

- 3.2. Demand Analysis of Electric Vehicle Aftermarket

- 3.2.1. Demand Analysis of Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 3.2.1.1. Authorized Service Centers (OEMs)

- 3.2.1.2. Premium Multi-brand Service Centers

- 3.2.1.3. Others

- 3.2.2. Demand Analysis of Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 3.2.2.1. Offline Sales

- 3.2.2.2. Online Sales

- 3.2.3. Demand Analysis of Electric Vehicle Aftermarket (by Part), Value Data

- 3.2.3.1. Batteries

- 3.2.3.2. Tires and Wheels

- 3.2.3.3. Brakes and Suspensions

- 3.2.3.4. Body Parts

- 3.2.3.5. Others

- 3.2.1. Demand Analysis of Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 3.3. Product Benchmarking: Growth Rate - Market Share Matrix

- 3.3.1. Opportunity Matrix (by Region)

- 3.3.2. Opportunity Matrix (by Part)

4. Regions

- 4.1. North America

- 4.1.1. Market

- 4.1.1.1. Buyer Attributes

- 4.1.1.2. Key Solution Providers in North America

- 4.1.1.3. Business Challenges

- 4.1.1.4. Business Drivers

- 4.1.2. Application

- 4.1.2.1. North America Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.1.2.2. North America Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.1.3. Product

- 4.1.3.1. North America Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.1.3.2. North America Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.1.3.3. North America Electric Vehicle Aftermarket (by Part), Value Data

- 4.1.4. North America (by Country)

- 4.1.4.1. U.S.

- 4.1.4.1.1. Market

- 4.1.4.1.1.1. Buyer Attributes

- 4.1.4.1.1.2. Key Solution Providers in the U.S.

- 4.1.4.1.1.3. Business Challenges

- 4.1.4.1.1.4. Business Drivers

- 4.1.4.1.2. Application

- 4.1.4.1.2.1. U.S. Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.1.4.1.2.2. U.S. Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.1.4.1.3. Product

- 4.1.4.1.3.1. U.S. Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.1.4.1.3.2. U.S. Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.1.4.1.3.3. U.S. Electric Vehicle Aftermarket (by Part), Value Data

- 4.1.4.1.1. Market

- 4.1.4.2. Canada

- 4.1.4.2.1. Market

- 4.1.4.2.1.1. Buyer Attributes

- 4.1.4.2.1.2. Key Solution Providers in Canada

- 4.1.4.2.1.3. Business Challenges

- 4.1.4.2.1.4. Business Drivers

- 4.1.4.2.2. Application

- 4.1.4.2.2.1. Canada Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.1.4.2.2.2. Canada Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.1.4.2.3. Product

- 4.1.4.2.3.1. Canada Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.1.4.2.3.2. Canada Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.1.4.2.3.3. Canada Electric Vehicle Aftermarket (by Part), Value Data

- 4.1.4.2.1. Market

- 4.1.4.3. Mexico

- 4.1.4.3.1. Market

- 4.1.4.3.1.1. Buyer Attributes

- 4.1.4.3.1.2. Key Solution Providers in Mexico

- 4.1.4.3.1.3. Business Challenges

- 4.1.4.3.1.4. Business Drivers

- 4.1.4.3.2. Application

- 4.1.4.3.2.1. Mexico Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.1.4.3.2.2. Mexico Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.1.4.3.3. Product

- 4.1.4.3.3.1. Mexico Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.1.4.3.3.2. Mexico Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.1.4.3.3.3. Mexico Electric Vehicle Aftermarket (by Part), Value Data

- 4.1.4.3.1. Market

- 4.1.4.1. U.S.

- 4.1.1. Market

- 4.2. Europe

- 4.2.1. Market

- 4.2.1.1. Buyer Attributes

- 4.2.1.2. Key Solution Providers in Europe

- 4.2.1.3. Business Challenges

- 4.2.1.4. Business Drivers

- 4.2.2. Application

- 4.2.2.1. Europe Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.2.2. Europe Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.3. Product

- 4.2.3.1. Europe Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.3.2. Europe Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.3.3. Europe Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4. Europe (by Country)

- 4.2.4.1. Germany

- 4.2.4.1.1. Market

- 4.2.4.1.1.1. Buyer Attributes

- 4.2.4.1.1.2. Key Solution Providers in Germany

- 4.2.4.1.1.3. Business Challenges

- 4.2.4.1.1.4. Business Drivers

- 4.2.4.1.2. Application

- 4.2.4.1.2.1. Germany Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.4.1.2.2. Germany Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.4.1.3. Product

- 4.2.4.1.3.1. Germany Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.4.1.3.2. Germany Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.4.1.3.3. Germany Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4.1.1. Market

- 4.2.4.2. France

- 4.2.4.2.1. Market

- 4.2.4.2.1.1. Buyer Attributes

- 4.2.4.2.1.2. Key Solution Providers in France

- 4.2.4.2.1.3. Business Challenges

- 4.2.4.2.1.4. Business Drivers

- 4.2.4.2.2. Application

- 4.2.4.2.2.1. France Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.4.2.2.2. France Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.4.2.3. Product

- 4.2.4.2.3.1. France Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.4.2.3.2. France Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.4.2.3.3. France Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4.2.1. Market

- 4.2.4.3. Spain

- 4.2.4.3.1. Market

- 4.2.4.3.1.1. Buyer Attributes

- 4.2.4.3.1.2. Key Solution Providers in Spain

- 4.2.4.3.1.3. Business Challenges

- 4.2.4.3.1.4. Business Drivers

- 4.2.4.3.2. Application

- 4.2.4.3.2.1. Spain Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.4.3.2.2. Spain Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.4.3.3. Product

- 4.2.4.3.3.1. Spain Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.4.3.3.2. Spain Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.4.3.3.3. Spain Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4.3.1. Market

- 4.2.4.4. Netherlands

- 4.2.4.4.1. Market

- 4.2.4.4.1.1. Buyer Attributes

- 4.2.4.4.1.2. Key Solution Providers in the Netherlands

- 4.2.4.4.1.3. Business Challenges

- 4.2.4.4.1.4. Business Drivers

- 4.2.4.4.2. Application

- 4.2.4.4.2.1. Netherlands Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.4.4.2.2. Netherlands Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.4.4.3. Product

- 4.2.4.4.3.1. Netherlands Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.4.4.3.2. Netherlands Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.4.4.3.3. Netherlands Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4.4.1. Market

- 4.2.4.5. Rest-of-Europe

- 4.2.4.5.1. Market

- 4.2.4.5.1.1. Buyer Attributes

- 4.2.4.5.1.2. Key Solution Providers in Rest-of-Europe

- 4.2.4.5.1.3. Business Challenges

- 4.2.4.5.1.4. Business Drivers

- 4.2.4.5.2. Application

- 4.2.4.5.2.1. Rest-of-Europe Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.2.4.5.2.2. Rest-of-Europe Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.2.4.5.3. Product

- 4.2.4.5.3.1. Rest-of-Europe Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.2.4.5.3.2. Rest-of-Europe Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.2.4.5.3.3. Rest-of-Europe Electric Vehicle Aftermarket (by Part), Value Data

- 4.2.4.5.1. Market

- 4.2.4.1. Germany

- 4.2.1. Market

- 4.3. U.K.

- 4.3.1. Market

- 4.3.1.1. Buyer Attributes

- 4.3.1.2. Key Solution Providers in the U.K.

- 4.3.1.3. Business Challenges

- 4.3.1.4. Business Drivers

- 4.3.2. Application

- 4.3.2.1. U.K. Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.3.2.2. U.K. Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.3.3. Product

- 4.3.3.1. U.K. Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.3.3.2. U.K. Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.3.3.3. U.K. Electric Vehicle Aftermarket (by Part), Value Data

- 4.3.1. Market

- 4.4. China

- 4.4.1. Market

- 4.4.1.1. Buyer Attributes

- 4.4.1.2. Key Solution Providers in China

- 4.4.1.3. Business Challenges

- 4.4.1.4. Business Drivers

- 4.4.2. Application

- 4.4.2.1. China Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.4.2.2. China Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.4.3. Product

- 4.4.3.1. China Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.4.3.2. China Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.4.3.3. China Electric Vehicle Aftermarket (by Part), Value Data

- 4.4.1. Market

- 4.5. Asia-Pacific and Japan

- 4.5.1. Market

- 4.5.1.1. Buyer Attributes

- 4.5.1.2. Key Solution Providers in Asia-Pacific and Japan

- 4.5.1.3. Business Challenges

- 4.5.1.4. Business Drivers

- 4.5.2. Application

- 4.5.2.1. Asia-Pacific and Japan Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.5.2.2. Asia-Pacific and Japan Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.5.3. Product

- 4.5.3.1. Asia-Pacific and Japan Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.5.3.2. Asia-Pacific and Japan Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.5.3.3. Asia-Pacific and Japan Electric Vehicle Aftermarket (by Part), Value Data

- 4.5.4. Asia-Pacific and Japan (by Country)

- 4.5.4.1. Japan

- 4.5.4.1.1. Market

- 4.5.4.1.1.1. Buyer Attributes

- 4.5.4.1.1.2. Key Solution Providers in Japan

- 4.5.4.1.1.3. Business Challenges

- 4.5.4.1.1.4. Business Drivers

- 4.5.4.1.2. Application

- 4.5.4.1.2.1. Japan Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.5.4.1.2.2. Japan Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.5.4.1.3. Product

- 4.5.4.1.3.1. Japan Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.5.4.1.3.2. Japan Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.5.4.1.3.3. Japan Electric Vehicle Aftermarket (by Part), Value Data

- 4.5.4.1.1. Market

- 4.5.4.2. South Korea

- 4.5.4.2.1. Market

- 4.5.4.2.1.1. Buyer Attributes

- 4.5.4.2.1.2. Key Solution Providers in South Korea

- 4.5.4.2.1.3. Business Challenges

- 4.5.4.2.1.4. Business Drivers

- 4.5.4.2.2. Application

- 4.5.4.2.2.1. South Korea Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.5.4.2.2.2. South Korea Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.5.4.2.3. Product

- 4.5.4.2.3.1. South Korea Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.5.4.2.3.2. South Korea Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.5.4.2.3.3. South Korea Electric Vehicle Aftermarket (by Part), Value Data

- 4.5.4.2.1. Market

- 4.5.4.3. Australia

- 4.5.4.3.1. Market

- 4.5.4.3.1.1. Buyer Attributes

- 4.5.4.3.1.2. Key Solution Providers in Australia

- 4.5.4.3.1.3. Business Challenges

- 4.5.4.3.1.4. Business Drivers

- 4.5.4.3.2. Application

- 4.5.4.3.2.1. Australia Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.5.4.3.2.2. Australia Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.5.4.3.3. Product

- 4.5.4.3.3.1. Australia Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.5.4.3.3.2. Australia Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.5.4.3.3.3. Australia Electric Vehicle Aftermarket (by Part), Value Data

- 4.5.4.3.1. Market

- 4.5.4.4. Rest-of-Asia-Pacific and Japan

- 4.5.4.4.1. Market

- 4.5.4.4.1.1. Buyer Attributes

- 4.5.4.4.1.2. Key Solution Providers in Rest-of-Asia-Pacific and Japan

- 4.5.4.4.1.3. Business Challenges

- 4.5.4.4.1.4. Business Drivers

- 4.5.4.4.2. Application

- 4.5.4.4.2.1. Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.5.4.4.2.2. Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.5.4.4.3. Product

- 4.5.4.4.3.1. Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.5.4.4.3.2. Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.5.4.4.3.3. Rest-of-Asia-Pacific and Japan Electric Vehicle Aftermarket (by Part), Value Data

- 4.5.4.4.1. Market

- 4.5.4.1. Japan

- 4.5.1. Market

- 4.6. Rest-of-the World

- 4.6.1. Market

- 4.6.1.1. Buyer Attributes

- 4.6.1.2. Key Solution Providers in Rest-of-the-World

- 4.6.1.3. Business Challenges

- 4.6.1.4. Business Drivers

- 4.6.2. Application

- 4.6.2.1. Rest-of-the-World Electric Vehicle Aftermarket (by Vehicle Type), Value Data

- 4.6.2.2. Rest-of-the-World Electric Vehicle Aftermarket (by Propulsion Type), Value Data

- 4.6.3. Product

- 4.6.3.1. Rest-of-the-World Electric Vehicle Aftermarket (by Sales Outlet), Value Data

- 4.6.3.2. Rest-of-the-World Electric Vehicle Aftermarket (by Mode of Sales), Value Data

- 4.6.3.3. Rest-of-the-World Electric Vehicle Aftermarket (by Part), Value Data

- 4.6.1. Market

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1. Competitive Benchmarking

- 5.1.1. Key Market Player Ranking

- 5.1.1.1. Key Market Player Ranking: Automotive Tires

- 5.1.1.2. Key Market Player Ranking: Automotive Brakes

- 5.1.1.3. Key Market Player Ranking: Electric Vehicle Batteries

- 5.1.1.4. Key Market Player Ranking: Automotive Wipers

- 5.1.1.5. Key Market Player Ranking: Automotive Lighting

- 5.1.1. Key Market Player Ranking

- 5.2. Company Profiles

- 5.2.1. Robert Bosch GmbH

- 5.2.1.1. Company Overview

- 5.2.1.1.1. Role of Robert Bosch GmbH in the Electric Vehicle Aftermarket

- 5.2.1.1.2. Product Portfolio

- 5.2.1.1.3. R&D Analysis

- 5.2.1.1.4. Company Offices

- 5.2.1.2. Business Strategies

- 5.2.1.2.1. Product Development

- 5.2.1.3. Analyst View

- 5.2.1.1. Company Overview

- 5.2.2. Continental AG

- 5.2.2.1. Company Overview

- 5.2.2.1.1. Role of Continental AG in the Electric Vehicle Aftermarket

- 5.2.2.1.2. Product Portfolio

- 5.2.2.1.3. R&D Analysis

- 5.2.2.1.4. Company Offices

- 5.2.2.2. Business Strategies

- 5.2.2.2.1. Product Development

- 5.2.2.2.2. Market Development

- 5.2.2.3. Analyst View

- 5.2.2.1. Company Overview

- 5.2.3. ZF Friedrichshafen AG

- 5.2.3.1. Company Overview

- 5.2.3.1.1. Role of ZF Friedrichshafen AG in the Electric Vehicle Aftermarket

- 5.2.3.1.2. Product Portfolio

- 5.2.3.1.3. R&D Analysis

- 5.2.3.1.4. Company Offices

- 5.2.3.2. Business Strategies

- 5.2.3.2.1. Product Development

- 5.2.3.2.2. Market Development

- 5.2.3.3. Corporate Strategies

- 5.2.3.3.1. Partnership, Collaboration, and Joint Venture

- 5.2.3.4. Analyst View

- 5.2.3.1. Company Overview

- 5.2.4. Schaeffler AG

- 5.2.4.1. Company Overview

- 5.2.4.1.1. Role of Schaeffler AG in the Electric Vehicle Aftermarket

- 5.2.4.1.2. Product Portfolio

- 5.2.4.1.3. R&D Analysis

- 5.2.4.1.4. Company Offices

- 5.2.4.2. Business Strategies

- 5.2.4.2.1. Product Development

- 5.2.4.2.2. Market Development

- 5.2.4.3. Analyst View

- 5.2.4.1. Company Overview

- 5.2.5. NTN Corporation

- 5.2.5.1. Company Overview

- 5.2.5.1.1. Role of NTN Corporation in Electric Vehicle Aftermarket

- 5.2.5.1.2. Product Portfolio

- 5.2.5.1.3. Company Offices

- 5.2.5.1.4. R&D Analysis

- 5.2.5.2. Business Strategies

- 5.2.5.2.1. Product Development

- 5.2.5.3. Analyst View

- 5.2.5.1. Company Overview

- 5.2.6. BorgWarner Inc.

- 5.2.6.1. Company Overview

- 5.2.6.1.1. Role of BorgWarner Inc. in the Electric Vehicle Aftermarket

- 5.2.6.1.2. Product Portfolio

- 5.2.6.1.3. R&D Analysis

- 5.2.6.1.4. Company Offices

- 5.2.6.2. Business Strategies

- 5.2.6.2.1. Product Development

- 5.2.6.3. Corporate Strategies

- 5.2.6.3.1. Merger and Acquistion

- 5.2.6.4. Analyst View

- 5.2.6.1. Company Overview

- 5.2.7. Tenneco Inc.

- 5.2.7.1. Company Overview

- 5.2.7.1.1. Role of Tenneco Inc. in the Electric Vehicle Aftermarket

- 5.2.7.1.2. Product Portfolio

- 5.2.7.1.3. R&D Analysis

- 5.2.7.1.4. Company Offices

- 5.2.7.2. Business Strategies

- 5.2.7.2.1. Product Development

- 5.2.7.3. Corporate Strategies

- 5.2.7.3.1. Partnership, Collaboration, and Joint Venture

- 5.2.7.4. Analyst View

- 5.2.7.1. Company Overview

- 5.2.8. Michelin

- 5.2.8.1. Company Overview

- 5.2.8.1.1. Role of Michelin in the Electric Vehicle Aftermarket

- 5.2.8.1.2. Product Portfolio

- 5.2.8.1.3. R&D Analysis

- 5.2.8.1.4. Company Offices

- 5.2.8.2. Business Strategies

- 5.2.8.2.1. Product Development

- 5.2.8.3. Analyst View

- 5.2.8.1. Company Overview

- 5.2.9. AISIN Corporation

- 5.2.9.1. Company Overview

- 5.2.9.1.1. Role of AISIN Corporation in the Electric Vehicle Aftermarket

- 5.2.9.1.2. Product Portfolio

- 5.2.9.1.3. R&D Analysis

- 5.2.9.1.4. Company Offices

- 5.2.9.2. Analyst View

- 5.2.9.1. Company Overview

- 5.2.10. DENSO Corporation

- 5.2.10.1. Company Overview

- 5.2.10.1.1. Role of DENSO Corporation in the Electric Vehicle Aftermarket

- 5.2.10.1.2. Product Portfolio

- 5.2.10.1.3. R&D Analysis

- 5.2.10.1.4. Company Offices

- 5.2.10.2. Corporate Strategies

- 5.2.10.2.1. Partnership, Collaboration, and Joint Venture

- 5.2.10.3. Analyst View

- 5.2.10.1. Company Overview

- 5.2.11. GUD Holdings Limited

- 5.2.11.1. Company Overview

- 5.2.11.1.1. Role of GUD Holdings Limited in the Electric Vehicle Aftermarket

- 5.2.11.1.2. Product Portfolio

- 5.2.11.1.3. R&D Analysis

- 5.2.11.1.4. Company Offices

- 5.2.11.2. Analyst View

- 5.2.11.1. Company Overview

- 5.2.12. HELLA GmbH & Co. KGaA

- 5.2.12.1. Company Overview

- 5.2.12.1.1. Role of HELLA GmbH & Co. KGaA in the Electric Vehicle Aftermarket

- 5.2.12.1.2. Product Portfolio

- 5.2.12.1.3. R&D Analysis

- 5.2.12.1.4. Company Offices

- 5.2.12.2. Analyst View

- 5.2.12.1. Company Overview

- 5.2.13. Kavo B.V.

- 5.2.13.1. Company Overview

- 5.2.13.1.1. Role of Kavo B.V. in the Electric Vehicle Aftermarket

- 5.2.13.1.2. Product Portfolio

- 5.2.13.1.3. Company Offices

- 5.2.13.2. Analyst View

- 5.2.13.1. Company Overview

- 5.2.14. Marelli Holdings Co., Ltd.

- 5.2.14.1. Company Overview

- 5.2.14.1.1. Role of Marelli Holdings Co., Ltd. in the Electric Vehicle Aftermarket

- 5.2.14.1.2. Product Portfolio

- 5.2.14.1.3. Company Offices

- 5.2.14.2. Business Strategies

- 5.2.14.2.1. Product Development

- 5.2.14.2.2. Market Development

- 5.2.14.3. Corporate Strategies

- 5.2.14.3.1. Partnership, Collaboration, and Joint Venture

- 5.2.14.4. Analyst View

- 5.2.14.1. Company Overview

- 5.2.15. T Sportline, Inc.

- 5.2.15.1. Company Overview

- 5.2.15.1.1. Role of T Sportline, Inc. in the Electric Vehicle Aftermarket

- 5.2.15.1.2. Product Portfolio

- 5.2.15.1.3. Company Offices

- 5.2.15.2. Analyst View

- 5.2.15.1. Company Overview

- 5.2.16. Bridgestone Corporation

- 5.2.16.1. Company Overview

- 5.2.16.1.1. Role of Bridgestone Corporation in the Electric Vehicle Aftermarket

- 5.2.16.1.2. Product Portfolio

- 5.2.16.1.3. R&D Analysis

- 5.2.16.1.4. Company Offices

- 5.2.16.2. Business Strategies

- 5.2.16.2.1. Market Development

- 5.2.16.3. Corporate Strategies

- 5.2.16.3.1. Partnership, Collaboration, and Joint Venture

- 5.2.16.4. Analyst View

- 5.2.16.1. Company Overview

- 5.2.17. The Yokohama Rubber Co., Ltd.

- 5.2.17.1. Company Overview

- 5.2.17.1.1. Role of The Yokohama Rubber Co., Ltd. in the Electric Vehicle Aftermarket

- 5.2.17.1.2. Product Portfolio

- 5.2.17.1.3. R&D Analysis

- 5.2.17.1.4. Company Offices

- 5.2.17.2. Business Strategies

- 5.2.17.2.1. Product Development

- 5.2.17.2.2. Market Development

- 5.2.17.3. Corporate Strategies

- 5.2.17.3.1. Partnership, Collaboration, and Joint Venture

- 5.2.17.4. Analyst View

- 5.2.17.1. Company Overview

- 5.2.18. Akebono Brake Industry Co., Ltd.

- 5.2.18.1. Company Overview

- 5.2.18.1.1. Role of Akebono Brake Industry Co., Ltd. in the Electric Vehicle Aftermarket

- 5.2.18.1.2. Product Portfolio

- 5.2.18.1.3. R&D Analysis

- 5.2.18.1.4. Company Offices

- 5.2.18.2. Corporate Strategies

- 5.2.18.2.1. Partnership, Collaboration, and Joint Venture

- 5.2.18.3. Analyst View

- 5.2.18.1. Company Overview

- 5.2.1. Robert Bosch GmbH

- 5.3. Other Companies

6. Research Methodology

- 6.1. Data Sources

- 6.1.1. Primary Data Sources

- 6.1.2. Secondary Data Sources

- 6.1.3. Data Triangulation

- 6.2. Market Estimation and Forecast

- 6.2.1. Factors for Data Prediction and Modeling