|

|

市場調査レポート

商品コード

1256837

宇宙ベースのエッジコンピューティング市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2023年~2033年)Space-Based Edge Computing Market - A Global and Regional Analysis: Focus on Application, Product, and Country - Analysis and Forecast, 2023-2033 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 宇宙ベースのエッジコンピューティング市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2023年04月12日

発行: BIS Research

ページ情報: 英文 150 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の宇宙ベースのエッジコンピューティングの市場規模は、2023年に2億90万米ドルとなり、2033年には18億730万米ドルに達すると予測されています。

市場は、2023年から2033年までにCAGRで22.64%の成長が予測されています。

当レポートでは、世界の宇宙ベースのエッジコンピューティング市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場

- 業界の見通し

- ビジネスダイナミクス

第2章 用途

- 世界の宇宙ベースのエッジコンピューティング市場(エンドユーザー別)

- 市場概要

- 商業

- 防衛

- 民政

第3章 製品

- 世界の宇宙ベースのエッジコンポーネント市場(コンポーネント別)

- 市場概要

- ハードウェア

- ソフトウェア

- サービス

第4章 地域

- 世界の宇宙ベースのエッジコンピューティング市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- AICRAFT

- ALL.SPACE

- Exo-Space

- Hewlett Packard Enterprise

- KP Labs

- LEOcloud, Inc.

- Little Place Labs

- Loft Orbital

- Nearby Computing

- OrbitsEdge, Inc

- Ramon.Space

- Satellogic

- SKYWATCH

- Spiral Blue

- SkyServe

- Ubotica Technologies

- その他の主要参入企業

- Mangata Networks

- Wallaroo Labs, Inc.

第6章 成長の機会と推奨事項

第7章 調査手法

List of Figures

- Figure 1: Global Space-Based Edge Computing Market, $Million, 2022-2033

- Figure 2: Global Space-Based Edge Computing Market (by End User), $Million, 2022 and 2033

- Figure 3: Global Space-Based Edge Computing Market (by Component), $Million, 2022 and 2033

- Figure 4: Global Space-Based Edge Computing Market (by Region), $Million, 2033

- Figure 5: Global Space-Based Edge Computing Market Coverage

- Figure 6: Value Chain Analysis of the Global Space-Based Edge Computing Market

- Figure 7: Global Space-Based Edge Computing Market, Business Dynamics

- Figure 8: Share of Key Business Strategies and Developments, January 2021-March 2023

- Figure 9: Space-Based Edge Computing Market (by End User)

- Figure 10: Space-Based Edge Computing Market (by Component)

- Figure 11: Global Space-Based Edge Computing Market, Competitive Benchmarking

- Figure 12: Research Methodology

- Figure 13: Top-Down and Bottom-Up Approach

- Figure 14: Assumptions and Limitations

List of Tables

- Table 1: Terrestrial Model Pricing

- Table 2: Cloud Computing Model Pricing

- Table 3: Edge Computing Model Pricing

- Table 4: Startups and Investment Scenarios

- Table 5: Partnerships, Collaborations, Agreements and Contracts, January 2021-March 2023

- Table 6: Others, January 2021-March 2023

- Table 7: Global Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 8: Global Space-Based Edge Computing Market (by Commercial), $Million, 2022-2033

- Table 9: Global Space-Based Edge Computing Market (by Component), $Million, 2022-2033

- Table 10: Global Space-Based Edge Computing Market (by Region), 2022-2033

- Table 11: North America Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 12: U.S. Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 13: Canada Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 14: Europe Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 15: Germany Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 16: U.K. Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 17: France Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 18: Rest-of-Europe Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 19: Asia-Pacific Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 20: China Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 21: Japan Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 22: India Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 23: Rest-of-Asia-Pacific Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 24: Rest-of-the-World Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 25: Middle East and Africa Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 26: Latin America Space-Based Edge Computing Market (by End User), $Million, 2022-2033

- Table 27: Benchmarking and Weightage Parameters

- Table 28: AICRAFT: Product Portfolio

- Table 29: AICRAFT: New Product Launch and Merger and Acquisition

- Table 30: ALL.SPACE: Product Portfolio

- Table 31: ALL.SPACE: New Product Launches and Mergers and Acquisitions

- Table 32: Exo-Space: Product Portfolio

- Table 33: Exo-Space: Partnerships, Collaborations, Agreements, and Contracts

- Table 34: Hewlett Packard Enterprise: Product Portfolio

- Table 35: Hewlett Packard Enterprise: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 36: KP Labs: Service Portfolio

- Table 37: KP Labs.: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 38: LEOcloud, Inc.: Service Portfolio

- Table 39: LEOcloud, Inc.: Partnerships, Collaborations, Agreements, and Contracts

- Table 40: Little Place Labs: Product Portfolio

- Table 41: Little Place Labs: Partnerships, Collaborations, Agreements, and Contracts

- Table 42: Loft Orbital: Product Portfolio

- Table 43: Loft Orbital: Partnerships, Collaborations, Agreements, and Contracts

- Table 44: Nearby Computing: Product Portfolio

- Table 45: Nearby Computing: Partnerships, Collaborations, Agreements, and Contracts

- Table 46: OrbitsEdge, Inc.: Product Portfolio

- Table 47: OrbitsEdge, Inc.: Partnerships, Collaborations, Agreements, and Contracts

- Table 48: Ramon.Space: Product Portfolio

- Table 49: Ramon.Space: Partnerships, Collaborations, Agreements, and Contracts

- Table 50: Satellogic: Product Portfolio

- Table 51: Satellogic: Partnerships, Collaborations, Agreements, and Contracts

- Table 52: SKYWATCH: Product Portfolio

- Table 53: Spiral Blue: Product Portfolio

- Table 54: Spiral Blue: Partnerships, Collaborations, Agreements, and Contracts

- Table 55: SkyServe: Service Portfolio

- Table 56: SkyServe: Partnerships, Collaborations, Agreements, Investments, and Contracts

- Table 57: Ubotica Technologies: Product Portfolio

- Table 58: Ubotica Technologies: Partnerships, Collaborations, Agreements, and Contracts

Global Space-Based Edge Computing Market to Reach $1,807.3 Million by 2033

Global Space-Based Edge Computing Market Overview

The global space-based edge computing market is estimated to reach $1,807.3 million in 2033 from $200.9 million in 2022, at a CAGR of 22.64% during the forecast period 2023-2033. The space-based edge computing market companies have witnessed the demand from the growing defense industry. The ecosystem of the space-based edge computing market comprises component manufacturers and end users.

Market Lifecycle Stage

Edge computing emerged with the launch of Akamai's content delivery network (CDN) in the 1990s. The idea was to physically move nodes closer to the user to deliver stored content like videos and pictures. In the late 1970s, when big tech companies like IBM, Intel, Microsoft, and Apple began to emerge, the development of microprocessors and other micro-tech led to the creation of the first desktop computers. Since then, the market for edge computing has been growing and will continue to grow. Space-based edge computing is a part of edge computing that has also been becoming popular because of the growing demand for latency reduction in space and increase in demand for shifting data centers in space.

Currently, many space agencies and commercial companies across the globe have been focusing on developing low Earth orbit (LEO) satellite constellations for communication purposes. This would drive the market for the space-based edge computing market. Moreover, rising research and development activities to develop cost-efficient edge computing components are other factors contributing to the growth of the space-based edge computing market. For instance, in March 2023, Nearby Computing signed a partnership with Cellnex Telecom for the demonstration of 5G and edge computing infrastructure. The demonstration also shows the integration of 5G along with edge can be implemented into smart sensors on the ground and space for the use of serving smart cities.

Impact

The evolving customer requirement, along with access to cheaper LEO-based satellite connectivity, has placed a high demand for the production of the space-based edge computing market during the forecast period.

Furthermore, there is a rise in research and development activities for the development of smaller and cheaper space-based edge computing components, which has increased the demand for space-based edge computing for satellites.

Market Segmentation:

Segmentation 1: by End User

- Commercial

- Defense

- Civil Government

The global space-based edge computing market is expected to witness huge revenues from the defense segment, followed by the commercial segment.

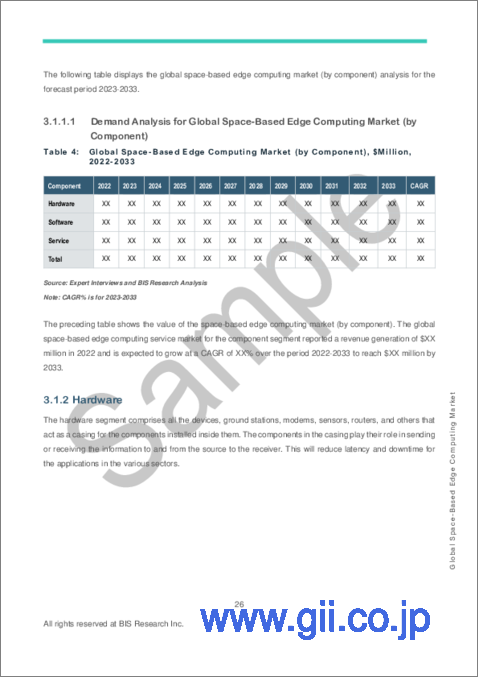

Segmentation 2: by Component

- Hardware

- Software

- Service

Based on components, the global space-based edge computing market is expected to witness huge revenues from the software segment, followed by the hardware segment.

Segmentation 3: by Region

- North America - U.S. and Canada

- Europe - France, Germany, U.K., and Rest-of-Europe

- Asia-Pacific - China, India, Japan, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa and Latin America

North America accounted for the highest share of 67.50% in the global space-based edge computing market by value in 2022, owing to a significant number of service providers based in the region.

Recent Developments in the Global Space-Based Edge Computing Market

- In March 2023, Nearby Computing signed a partnership with Cellnex Telecom for the demonstration of 5G and edge computing infrastructure. The demonstration also shows the integration of 5G along with edge can be implemented into smart sensors on the ground and space for the use of serving smart cities.

- In November 2022, Ubotica Technologies and Open Cosmos signed an agreement to deploy CogniSat-6, an AI-focused CubeSat flight with autonomous skills. It's equipped with the CogniSat edge computing platform to LEO and will provide reactive retargeting to optimize image gathering scope in-orbit.

- In October 2022, Exo-Space signed a contract with Sidus Space to integrate a payload into its hybrid 3D-printed satellite LizzieSat, which is expected to launch sometime in 2023.

- In August 2022, OrbitsEdge signed a long-term launch agreement with Vaya Space, with a launch slotted for the fourth quarter of 2023. The agreement aims to develop high-performance computing data centers that can handle and evaluate data generated in space, which will be launched into low Earth orbit (LEO) above the cloud. By using this approach, the present bandwidth restrictions and the transmission delay brought on by sending huge amounts of satellite data to Earth for processing are reduced.

Demand - Drivers and Limitations

Following are the drivers for the global space-based edge computing market:

- Reduction in Data Processing Time Framework

- Evolving Service Requirements

Following are the challenges for the global space-based edge computing market:

- Cyber Security Constraints in Space-Based Edge Computing

- Evolving Rules and Regulations for Device Management

Following are the opportunities for the global space-based edge computing market:

- Increase in Adoption of Satellite-Based IoT Services

How can this report add value to an organization?

- Product/Innovation Strategy: The product segment helps the reader understand the different types of space-based edge computing markets available for deployment in the industries for space platforms and their potential globally. Moreover, the study provides the reader with a detailed understanding of the different space-based edge computing market by application (commercial, defense, and civil government) and product (hardware, software, and service).

- Growth/Marketing Strategy: The global space-based edge computing market has seen major development by start-up players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the global space-based edge computing market. For instance, in October 2022, SkyServe signed a partnership with Ellipsis Drive for the use of their virtualization tool to observe and distribute edge-computed findings to their clients and Proof of Concept partners. Such use cases are best served by ED's cloud-powered online viewer, which enables third parties to view SkyServe's spatial insights without the need to acquire large files or possess a strong technological foundation.

- Competitive Strategy: Key players in the global space-based edge computing market analyzed and profiled in the study involve space-based edge computing services and space-based edge computing product providers. Moreover, a detailed competitive benchmarking of the players operating in the global space-based edge computing market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

The top segment players leading the market include established players of space-based edge computing, which constitutes 11% of the presence in the market. Other players include start-up entities that account for approximately 89% of the presence in the market.

Key Companies Profiled:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Global Space-Based Edge Computing Market: Overview

- 1.1.2 Current and Emerging Technological Trends

- 1.1.2.1 Edge Computing With 5G

- 1.1.2.2 In-Orbit Data Centers

- 1.1.2.3 Edge Computing for Constellation Applications

- 1.1.2.4 Interplanetary Edge Computing

- 1.1.3 Edge-Based Earth Observation Optimization

- 1.1.4 Emerging Small Satellite Constellations (0-600Kg): A Growth Opportunity for Space-Based Edge Computing Solutions, 2023-2033

- 1.1.5 Ongoing and Upcoming Projects

- 1.1.5.1 ISS-HPE Spaceborne Computer

- 1.1.5.2 Space-Based Data Centers

- 1.1.6 Pricing Analysis: Terrestrial vs. Cloud Computing vs. Edge Computing

- 1.1.7 Startups and Investment Scenarios

- 1.1.8 Value Chain Analysis

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Reduction in Data Processing Time Framework

- 1.2.1.2 Evolving Service Requirements

- 1.2.2 Business Challenges

- 1.2.2.1 Cyber Security Constraints in Space-Based Edge Computing

- 1.2.2.2 Evolving Rules and Regulations for Device Management

- 1.2.3 Corporate Strategies

- 1.2.3.1 Partnerships, Collaborations, Agreements, and Contracts

- 1.2.3.2 Others

- 1.2.4 Business Opportunities

- 1.2.4.1 Increase in Adoption of Satellite-Based IoT Services

- 1.2.1 Business Drivers

2 Application

- 2.1 Global Space-Based Edge Computing Market (by End User)

- 2.1.1 Market Overview

- 2.1.1.1 Demand Analysis of Space-Based Edge Computing Market (by End User)

- 2.1.2 Commercial

- 2.1.2.1 Demand Analysis of Space-Based Edge Computing Market (by Commercial)

- 2.1.2.2 Transport and Logistics

- 2.1.2.3 Agriculture

- 2.1.2.4 Marine

- 2.1.2.5 Automotive

- 2.1.2.6 Remote Monitoring

- 2.1.2.7 Banking, Financial Services, and Insurance (BFSI)

- 2.1.2.8 Others (Construction, Disaster Management, Infrastructure)

- 2.1.3 Defense

- 2.1.3.1 Land

- 2.1.3.2 Airborne

- 2.1.3.3 Naval

- 2.1.4 Civil Government

- 2.1.1 Market Overview

3 Products

- 3.1 Global Space-Based Edge Component Market (by Component)

- 3.1.1 Market Overview

- 3.1.1.1 Demand Analysis for Global Space-Based Edge Computing Market (by Component)

- 3.1.2 Hardware

- 3.1.2.1 Communication

- 3.1.2.2 Earth Observation

- 3.1.2.3 Space Debris Removal

- 3.1.3 Software

- 3.1.4 Service

- 3.1.4.1 Hardware Consulting

- 3.1.4.1.1 Hardware Design and Operation

- 3.1.4.2 Software Development

- 3.1.4.2.1 Firmware and Middleware

- 3.1.4.3 End User Services

- 3.1.4.1 Hardware Consulting

- 3.1.1 Market Overview

4 Regions

- 4.1 Global Space-Based Edge Computing Market (by Region)

- 4.2 North America

- 4.2.1 Market

- 4.2.1.1 Key Manufacturers and Suppliers in North America

- 4.2.1.2 Business Drivers

- 4.2.1.3 Business Challenges

- 4.2.2 Application

- 4.2.2.1 North America Space-Based Edge Computing Market (by End User)

- 4.2.3 North America (by Country)

- 4.2.3.1 U.S.

- 4.2.3.1.1 Market

- 4.2.3.1.1.1 Key Manufacturers and Suppliers in the U.S.

- 4.2.3.1.2 Application

- 4.2.3.1.2.1 U.S. Space-Based Edge Computing Market (by End User)

- 4.2.3.1.1 Market

- 4.2.3.2 Canada

- 4.2.3.2.1 Application

- 4.2.3.2.1.1 Canada Space-Based Edge Computing Market (by End User)

- 4.2.3.2.1 Application

- 4.2.3.1 U.S.

- 4.2.1 Market

- 4.3 Europe

- 4.3.1 Market

- 4.3.1.1 Key Manufacturers and Suppliers in Europe

- 4.3.1.2 Business Drivers

- 4.3.1.3 Business Challenges

- 4.3.2 Application

- 4.3.2.1 Europe Space-Based Edge Computing Market (by End User)

- 4.3.3 Europe (by Country)

- 4.3.3.1 Germany

- 4.3.3.1.1 Application

- 4.3.3.1.1.1 Germany Space-Based Edge Computing Market (by End User)

- 4.3.3.1.1 Application

- 4.3.3.2 U.K.

- 4.3.3.2.1 Market

- 4.3.3.2.1.1 Key Manufacturers and Suppliers in the U.K.

- 4.3.3.2.2 Application

- 4.3.3.2.2.1 U.K. Space-Based Edge Computing Market (by End User)

- 4.3.3.2.1 Market

- 4.3.3.3 France

- 4.3.3.3.1 Market

- 4.3.3.3.1.1 Key Manufacturers and Service Providers in France

- 4.3.3.3.2 Application

- 4.3.3.3.2.1 France Space-Based Edge Computing Market (by End User)

- 4.3.3.3.1 Market

- 4.3.3.4 Rest-of-Europe

- 4.3.3.4.1 Application

- 4.3.3.4.1.1 Rest-of-Europe Space-Based Edge Computing Market (by End User)

- 4.3.3.4.1 Application

- 4.3.3.1 Germany

- 4.3.1 Market

- 4.4 Asia-Pacific

- 4.4.1 Market

- 4.4.1.1 Key Manufacturers and Service Providers in Asia-Pacific

- 4.4.1.2 Business Drivers

- 4.4.1.3 Business Challenges

- 4.4.2 Application

- 4.4.2.1 Asia-Pacific Space-Based Edge Computing Market (by End User)

- 4.4.3 Asia-Pacific (by Country)

- 4.4.3.1 China

- 4.4.3.1.1 Application

- 4.4.3.1.1.1 China Space-Based Edge Computing Market (by End User)

- 4.4.3.1.1 Application

- 4.4.3.2 Japan

- 4.4.3.2.1 Market

- 4.4.3.2.1.1 Key Manufacturers and Service Providers in Japan

- 4.4.3.2.2 Application

- 4.4.3.2.2.1 Japan Space-Based Edge Computing Market (by End User)

- 4.4.3.2.1 Market

- 4.4.3.3 India

- 4.4.3.3.1 Market

- 4.4.3.3.1.1 Key Manufacturers and Service Providers in India

- 4.4.3.3.2 Application

- 4.4.3.3.2.1 India Space-Based Edge Computing Market (by End User)

- 4.4.3.3.1 Market

- 4.4.3.4 Rest-of-Asia-Pacific

- 4.4.3.4.1 Market

- 4.4.3.4.1.1 Key Manufacturers and Service Providers in Rest-of-Asia-Pacific

- 4.4.3.4.2 Application

- 4.4.3.4.2.1 Rest-of-Asia-Pacific Space-Based Edge Computing Service Market (by End User)

- 4.4.3.4.1 Market

- 4.4.3.1 China

- 4.4.1 Market

- 4.5 Rest-of-the-World

- 4.5.1 Market

- 4.5.1.1 Business Drivers

- 4.5.1.2 Business Challenges

- 4.5.2 Application

- 4.5.2.1 Rest-of-the-World Space-Based Edge Computing Market (by End User)

- 4.5.3 Rest-of-the-World (by Region)

- 4.5.3.1 Middle East and Africa

- 4.5.3.1.1 Application

- 4.5.3.1.1.1 Middle East and Africa Space-Based Edge Computing Market (by End User)

- 4.5.3.1.1 Application

- 4.5.3.2 Latin America

- 4.5.3.2.1 Application

- 4.5.3.2.1.1 Latin America Space-Based Edge Computing Market (by End User)

- 4.5.3.2.1 Application

- 4.5.3.1 Middle East and Africa

- 4.5.1 Market

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.2 AICRAFT

- 5.2.1 Company Overview

- 5.2.1.1 Role of AICRAFT in Global Space-Based Edge Computing Market

- 5.2.1.2 Product Portfolio

- 5.2.2 Business Strategies

- 5.2.2.1 New Product Launch and Merger and Acquisition

- 5.2.3 Analyst View

- 5.2.1 Company Overview

- 5.3 ALL.SPACE

- 5.3.1 Company Overview

- 5.3.1.1 Role of ALL.SPACE in Global Space-Based Edge Computing Market

- 5.3.1.2 Product Portfolio

- 5.3.2 Business Strategies

- 5.3.2.1 New Product Launches and Mergers and Acquisitions

- 5.3.3 Analyst View

- 5.3.1 Company Overview

- 5.4 Exo-Space

- 5.4.1 Company Overview

- 5.4.1.1 Role of Exo-Space in Global Space-Based Edge Computing Market

- 5.4.1.2 Product Portfolio

- 5.4.2 Corporate Strategies

- 5.4.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.4.3 Analyst View

- 5.4.1 Company Overview

- 5.5 Hewlett Packard Enterprise

- 5.5.1 Company Overview

- 5.5.1.1 Role of Hewlett Packard Enterprise in Global Space-Based Edge Computing Market

- 5.5.1.2 Product Portfolio

- 5.5.2 Corporate Strategies

- 5.5.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.5.3 Analyst View

- 5.5.1 Company Overview

- 5.6 KP Labs

- 5.6.1 Company Overview

- 5.6.1.1 Role of KP Labs in Global Space-Based Edge Computing Market

- 5.6.1.2 Product Portfolio

- 5.6.2 Corporate Strategies

- 5.6.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.6.3 Analyst View

- 5.6.1 Company Overview

- 5.7 LEOcloud, Inc.

- 5.7.1 Company Overview

- 5.7.1.1 Role of LEOcloud, Inc. in Global Space-Based Edge Computing Market

- 5.7.1.2 Service Portfolio

- 5.7.2 Corporate Strategies

- 5.7.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.7.3 Analyst View

- 5.7.1 Company Overview

- 5.8 Little Place Labs

- 5.8.1 Company Overview

- 5.8.1.1 Role of Little Place Labs in Global Space-Based Edge Computing

- 5.8.1.2 Product Portfolio

- 5.8.2 Corporate Strategies

- 5.8.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.8.3 Analyst View

- 5.8.1 Company Overview

- 5.9 Loft Orbital

- 5.9.1 Company Overview

- 5.9.1.1 Role of Loft Orbital in Global Space-Based Edge Computing

- 5.9.1.2 Product Portfolio

- 5.9.2 Corporate Strategies

- 5.9.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.9.3 Analyst View

- 5.9.1 Company Overview

- 5.1 Nearby Computing

- 5.10.1 Company Overview

- 5.10.1.1 Role of Nearby Computing in Global Space-Based Edge Computing

- 5.10.1.2 Product Portfolio

- 5.10.2 Corporate Strategies

- 5.10.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.10.3 Analyst View

- 5.10.1 Company Overview

- 5.11 OrbitsEdge, Inc.

- 5.11.1 Company Overview

- 5.11.1.1 Role of OrbitsEdge, Inc. in Global Space-Based Edge Computing Market

- 5.11.1.2 Product Portfolio

- 5.11.2 Corporate Strategies

- 5.11.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.11.3 Analyst View

- 5.11.1 Company Overview

- 5.12 Ramon.Space

- 5.12.1 Company Overview

- 5.12.1.1 Role of Ramon.Space in Global Space-Based Edge Computing Market

- 5.12.1.2 Product Portfolio

- 5.12.2 Corporate Strategies

- 5.12.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.12.3 Analyst View

- 5.12.1 Company Overview

- 5.13 Satellogic

- 5.13.1 Company Overview

- 5.13.1.1 Role of Satellogic in Global Space-Based Edge Computing Market

- 5.13.1.2 Product Portfolio

- 5.13.2 Corporate Strategies

- 5.13.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.13.3 Analyst View

- 5.13.1 Company Overview

- 5.14 SKYWATCH

- 5.14.1 Company Overview

- 5.14.1.1 Role of SKYWATCH in Global Space-Based Edge Computing Market

- 5.14.1.2 Product Portfolio

- 5.14.2 Analyst View

- 5.14.1 Company Overview

- 5.15 Spiral Blue

- 5.15.1 Company Overview

- 5.15.1.1 Role of Spiral Blue in Global Space-Based Edge Computing Market

- 5.15.1.2 Product Portfolio

- 5.15.2 Corporate Strategies

- 5.15.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.15.3 Analyst View

- 5.15.1 Company Overview

- 5.16 SkyServe

- 5.16.1 Company Overview

- 5.16.1.1 Role of SkyServe in Global Space-Based Edge Computing Market

- 5.16.1.2 Service Portfolio

- 5.16.2 Corporate Strategies

- 5.16.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.16.3 Analyst View

- 5.16.1 Company Overview

- 5.17 Ubotica Technologies

- 5.17.1 Company Overview

- 5.17.1.1 Role of Ubotica Technologies in Global Space-Based Edge Computing Market

- 5.17.1.2 Product Portfolio

- 5.17.2 Corporate Strategies

- 5.17.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.17.3 Analyst View

- 5.17.1 Company Overview

- 5.18 Other Key Players

- 5.18.1 Mangata Networks

- 5.18.1.1 Company Overview

- 5.18.2 Wallaroo Labs, Inc.

- 5.18.2.1 Company Overview

- 5.18.1 Mangata Networks

6 Growth Opportunities and Recommendations

- 6.1 Growth Opportunities

- 6.1.1 Growth Opportunity: Customized Software and Application

- 6.1.1.1 Recommendations

- 6.1.2 Growth Opportunity: Increasing Adoption in AI, IoT, and Smart Devices

- 6.1.2.1 Recommendations

- 6.1.1 Growth Opportunity: Customized Software and Application

7 Research Methodology

- 7.1 Factors for Data Prediction and Modeling