|

|

市場調査レポート

商品コード

1657662

CAR-T細胞療法の世界市場 - 市場規模、予測、試験、動向(2025年)Global CAR-T Cell Therapy Market - Market Size, Forecasts, Trials & Trends |

||||||

|

|||||||

| CAR-T細胞療法の世界市場 - 市場規模、予測、試験、動向(2025年) |

|

出版日: 2025年10月30日

発行: BioInformant

ページ情報: 英文 333 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の薬事承認

2017年以降、13のCAR-T細胞療法が複数の医療市場で商業化に至っています。7つの治療法が米国FDAによって承認された後、その他の主要医療市場でも承認が発行されました。これらの治療法には以下が含まれます。

|

|

米国外では、Relma-cel、Fucaso、Yuanruida、Zever-celの4つのCAR-T療法が中国のNMPAから承認されています。さらに、NexCAR19とQartemiの2つの治療法がインドのCDSCOから承認を受けています。

市場の拡大と産業の成長

これらの薬事承認は大きな節目であり、CAR-T市場はバイオテクノロジーにおける優位性を確立しています。M&Aは特に積極的で、投資家の強い信頼感を示しています。CelgeneによるJuno Therapeuticsの90億米ドルでの買収は、この産業の可能性を浮き彫りにし、次いでBristol-Myers Squibb(BMS)がCelgeneを740億米ドルで買収しました。もう1つの重要な動きは、GileadがKite Pharmaを119億米ドルで買収し、この分野での地位をさらに強化したことです。さらに、Astellas PharmaはXyphos Biosciencesを6億6,500万米ドルで買収し、ポートフォリオを拡大しました。これらの取引は、主要な製薬企業がCAR-T技術に投資し、がん治療の未来を切り開こうとする姿勢を強めていることを示しています。

CAR-T療法が進化を続ける中、産業は遺伝子導入効率の向上や毒性リスクの軽減など、重要な課題に直面しています。研究者たちは、CRISPRとエレクトロポレーション技術を使ってT細胞の改変を強化することを積極的に模索しており、一方で他社はCAR-T活性を制御する「オン・オフ」スイッチを開発しています。

臨床試験では血液がんに比べて奏効率が低いことが示されているため、固形がんの治療が最大のハードルの1つであることに変わりはありません。そのため、固形がん特異的抗原を同定し、これらのがんに対する有効性を向上させることに主眼が置かれています。

現在、進行中の臨床試験の75%近くと上市済みのすべてのCAR-T療法は、自家(患者由来)細胞に依存しています。しかし、次のブレークスルーは同種CAR-T療法にあり、これは製造の合理化、コスト削減、患者へのアクセスの拡大が可能な既製のソリューションです。

世界のCAR-T細胞療法市場

CAR-T細胞療法市場は、初期の実験的治療から数十億米ドル規模の産業に成長し、世界的な広がりを見せています。血液がんにおける初期の成功は、より広範な応用への道を開き、スタートアップから大手バイオテクノロジー企業まで、さまざまな企業がこの分野の拡大に取り組んでいます。技術革新が進んでいることから、CAR-T療法の将来は、世界のがん治療に革命をもたらす計り知れない可能性を秘めています。

取り上げる企業と組織

|

|

目次

第1章 レポートの概要

- レポートの声明

- エグゼクティブサマリー

- イントロダクション

第2章 CAR-T細胞療法:技術開発

- CAR-T細胞療法の概要

- CAR-T開発の進化

- 造血悪性細胞に存在する抗原

- T細胞に受容体遺伝子を挿入するためのツール

- T細胞のCAR-T細胞への変換

- 世界中で利用可能な13種類のCAR-T療法:概略

- Kymriah(tisagenlecleucel)

- Yescarta(axicabtagene ciloleucel)

- Tecartus(brexucabtagene autoleucel)

- Breyanzi(lysocabtagene maraleucel)

- Abecma(idecabtagene vicleucel)

- Relma-cel(relmacabtagene autoleucel)

- Carvykti(ciltacabtagene autoleucel)

- Fucaso(equecabtagene autoleucel)

- NexCAR19(actalycabtagene autoleucel)

- Yuanruida(inaticabtagene autoleucel)

- Zevor-cel(zevorcabtagene autoleucel)

- Qartemi(varnimcabtagene autoleucel)

- Aucatzyl(obecabtagene autoleucel)

- 世界中のCAR-T療法のコスト

- CAR-T療法に伴う毒性

第3章 将来のCAR-T療法に対する戦略

- スイッチャブルCAR(sCAR/ユニバーサルCAR)

- アフィニティチューンドCAR

- アーマードCAR

- 液体がんから固形がんへの移行

- 入院期間の短縮への注力

- 新しい抗原の発見への注力

- 大衆向けCAR-T

- 新たな生体内CAR-Tアプローチ

- mRNAワクチンとの併用

- 腫瘍溶解性ウイルスとの併用

第4章 CAR-Tの開発における主な出来事(1989年~2024年)

- CAR-T細胞療法が達成した15の主なマイルストーン

- 今後のCAR-Tスター

- CAR-Tの対象となるごく少数のがん患者

- CAR-T細胞療法の利点

- CAR-T細胞療法の欠点

- CAR-T療法の成功率

第5章 CAR-T標的抗原

- 血液がんにおけるCAR-T標的抗原

- CAR-Tは固形がんの抗原を標的とする

- 臨床試験でCAR-T細胞が標的とするもっとも一般的な抗原

第6章 CAR-T細胞のスケーラブル製造

- 製造工程

- CAR-T製造プラットフォームの進化

- 同種CAR-T製造

- 現在使用されているCAR-T製造プラットフォーム

- CAR-T製造プラットフォームの比較

- CAR-T製造コスト

第7章 CAR-T特許情勢

- CAR-T細胞療法特許の地理的分布

- CAR-T細胞療法の特許出願人

- CAR-T特許発明者

- CAR-T細胞療法の特許所有者

- CAR-T療法特許の法的地位

- 特許の寿命を延ばす方法

第8章 CAR-T臨床試験の情勢

- CAR-T臨床試験:開発段階別

- CAR-T臨床試験のタイプ

- CAR-T臨床試験:資金提供タイプ別

- 臨床試験の対象となる血液がん(液体がん)のタイプ

- 1つのCAR-Tによる同時標的

- 臨床試験で使用されるCAR-T生成タイプ

- CAR-T試験:使用されるSvFv別

- CAR-T試験:使用されるベクタータイプ別

- 臨床試験における自家・同種CAR-T

- 固形がんに焦点を当てた臨床試験の情勢

第9章 PUBMED.GOVで公開されたCAR-T学術論文

- 自家・同種CAR-T細胞療法に関するPubMedの論文

- 液体がんと固形がんに対するCAR-T細胞療法(2013年~2024年)

- CAR-T細胞療法の5つの世代に関するPubMed.govの論文

第10章 CAR-Tの資金調達の情勢

- CAR-T部門におけるベンチャーキャピタルの資金調達(2014年~2024年)

- CAR-T企業に投資されたIPO資金(2014年~2024年)

- CAR-Tのライセンシング契約

- CAR-Tの共同研究契約

- CAR-Tの合併・買収(M&A)取引(2015年~2024年)

- CAR-Tの資金調達の概要

第11章 CAR-T細胞療法のコスト・償還

- 新しい決済モデル

- 承認されたCAR-T細胞療法の定価

- 米国におけるCAR-T細胞療法の償還

- 欧州におけるCAR-T療法のコスト

- アジア太平洋におけるCAR-T細胞療法

第12章 CAR-Tの対象となる血液がん

- 急性リンパ性白血病(ALL)

- びまん性大細胞型B細胞リンパ腫(DLBCL)

- マントル細胞リンパ腫(MCL)

- 多発性骨髄腫(MM)

- 血液がん治療の莫大なコスト

第13章 市場の分析

- CAR-T細胞療法の世界的普及率(2017年~2024年)

- CAR-T細胞療法製品の世界市場(2024年~2032年)

- CAR-T療法の世界市場:地域別(2024年~2032年)

- CAR-T療法の世界市場:適応症別(2024年~2032年)

- CAR-T細胞療法の世界的な導入に対する障害

第14章 CAR-T企業:概要

- 2seventy bio

- Abintus Bio, Inc.

- AffyImmune Therapeutics, Inc.

- Aleta BioTherapeutics

- Allogene Therapeutics

- Anixa Biosciences, Inc.

- Arbele, Ltd.

- Arcellx

- Atara Biotherapeutics

- Aurora BioPharma

- Autolus Therapeutics plc

- AvenCell Europe GmbH

- Beam Therapeutics, Inc

- Bellicum Pharmaceuticals

- BioNTech

- Biosceptre

- Bluebird bio

- Bristol Myers Squibb/Celgene Corporation

- Cabaletta Bio

- Carina Biotech

- CARsgen Therapeutics

- Cartesian Therapeutics

- CARTherics Pty Ltd.

- CASI Pharmaceuticals

- Cellectis

- Celularity, Inc.

- Celyad Oncology

- CRISPR Therapeutics

- Curocell, Inc.

- DiaCarta

- Elicera Therapeutics AB

- EXUMA Biotech

- Fate Therapeutics

- Galapagos NV

- Gilead Sciences, Inc.

- Gracell Biotechnologies

- IASO Biotherapeutics

- ImmPACT Bio

- Immuneel Therapeutics, Pvt., Ltd.

- ImmunoACT

- Interius BioTherapeutics

- Juventas Cell Therapy

- JW Therapeutics

- Kite Pharma(Gilead)

- Kyverna Therapeutics

- Legend Biotech

- Leucid Bio

- Luminary Therapeutics, Inc.

- Lyell Immunopharma, Inc.

- March Biosciences

- MaxCyte, Inc.

- Minerva Biotechnologies Corporation

- Mustang Bio

- Noile-Immune Biotech

- Novartis AG

- Oncternal Therapeutics

- Oxford Biomedica plc

- PeproMene Bio, Inc.

- Poseida Therapeutics, Inc.

- Precigen, Inc.

- Prescient Therapeutics

- ProMab Biotechnologies, Inc.

- SOTIO Biotech BV

- Syngene International, Ltd

- Synthekine

- TC BioPharm

- T-CURX

- Umoja Biopharma

- ViTToria Biotherapeutics

- Vor Biopharma

- Wugen

- WuXi Advanced Therapies

- Xenetic Biosciences

- Xyphos Biosciences, Inc

図の索引

表の索引

AR-T cell therapy is a groundbreaking advancement in cancer treatment, offering remarkable promise for patients. This form of immunotherapy harnesses the power of the body's own immune cells, modifying them in a laboratory to enhance their ability to recognize and destroy cancer cells. Once infused back into the patient, these engineered cells multiply and persist in the body as "living drugs," continually working to fight the disease.

T-cells, a crucial component of the immune system, form the foundation of CAR-T therapy. These immune workhorses play a key role in directing immune responses and eliminating infected or abnormal cells. In CAR-T cell therapy, a patient's blood is drawn, and T-cells are separated out. Scientists then use a disarmed virus to genetically engineer these cells to express chimeric antigen receptors (CARs) on their surface. These CARs enable the T-cells to specifically target antigens found on cancer cells, leading to their destruction upon infusion back into the patient.

Global Regulatory Approvals

Since 2017, 13 CAR-T cell therapies have reached commercialization across multiple healthcare markets. Seven therapies have been approved by the U.S. FDA, after which approvals for them were issued in other major healthcare markets as well. These therapies include:

|

|

Beyond the U.S., four CAR-T therapies-Relma-cel, Fucaso, Yuanruida, and Zever-cel-have been approved by China's National Medical Products Administration (NMPA). Additionally, two therapies, NexCAR19 and Qartemi, have received approval from India's Central Drugs Standard Control Organisation (CDSCO).

Market Expansion and Industry Growth

These regulatory approvals mark a major milestone, solidifying the CAR-T market as a dominant force in biotech. Mergers and acquisitions have been particularly aggressive, demonstrating strong investor confidence. Celgene's acquisition of Juno Therapeutics for $9 billion underscored the industry's potential, followed by Bristol-Myers Squibb (BMS) acquiring Celgene for $74 billion. Another significant move was Gilead's acquisition of Kite Pharma for $11.9 billion, further strengthening its position in the space. Additionally, Astellas Pharma expanded its portfolio by purchasing Xyphos Biosciences for $665 million. These transactions highlight the increasing commitment from major pharmaceutical companies to invest in CAR-T technologies and shape the future of cancer treatment.

As CAR-T therapy continues to evolve, the industry faces key challenges, including improving gene-transfer efficiency and mitigating toxicity risks. Researchers are actively exploring CRISPR and electroporation technologies to enhance T-cell modification, while others develop "on-off" switches to regulate CAR-T activity.

One of the biggest hurdles remains the treatment of solid tumors, as clinical trials have shown lower response rates compared to blood cancers. Thus, a major focus is on identifying solid tumor-specific antigens to improve efficacy in these cancers.

Currently, nearly 75% of ongoing clinical trials and all marketed CAR-T therapies rely on autologous (patient-derived) cells. However, the next breakthrough lies in allogeneic CAR-T therapies-off-the-shelf solutions that could streamline manufacturing, reduce costs, and expand patient accessibility.

Global CAR-T Cell Therapy Market

The CAR-T cell therapy market has grown from early experimental treatments to a multi-billion-dollar industry with global reach. Early successes in blood cancers have paved the way for broader applications, with companies ranging from startups to biotech giants working to expand the field. As innovation continues, the future of CAR-T therapy holds immense potential to revolutionize cancer treatment worldwide.

This report aims to provide readers with the following insights:

- An overview of CAR-T therapy, covering the structure and function of T cells, how they normally act on infected cells, and how they are "armed" with engineered receptors to target and destroy cancer cells.

- A breakdown of chimeric antigen receptors (CARs), cancer cell antigens, CAR-T cell manufacturing, and the available CAR-T products, including autologous and allogeneic CAR-Ts.

- A brief history of CAR-T therapy, highlighting its evolution from 1989 to the present, its transformative potential, and the accelerating activities within the CAR-T sector.

- An examination of the manufacturing process and the costs associated with developing autologous and allogeneic CAR-T cell therapies.

- An overview of cancer biomarkers or antigens targeted by CAR-T cells.

- A detailed analysis of the global CAR-T patent landscape, including leading sponsors, inventors, and regions

- An in-depth look at the rates, types, and trends for clinical trials involving CAR-T cells.

- A review of the rates and types of CAR-T cell therapy scientific publications.

- An overview of NIH grants awarded to support CAR-T cell therapy research.

- A review of industry dealmaking and strategic partnerships within the CAR-T sector in 2024.

- Descriptions of CAR-T therapies, including Kymriah, Yescarta, Tecartus, Breyanzi, Abecma, Relma-cel, Carvykti, NexCAR19, Yuanruida, Qartemi, Aucatzyl, Fucaso, and Zever-cel.

- A review of reimbursement policies for CAR-T therapies in the U.S. and outcome-based reimbursement policies in Europe.

- A global market analysis for CAR-T cell therapies by Geography, Product, and Indication.

- Profiles of leading CAR-T cell therapy market competitors, including their novel products, emerging candidates, and proprietary technology platforms.

Key Questions Answered in This Report:

- What are T cells, and how do they target and destroy infected cells and pathogens?

- How are T cells armed with chimeric antigen receptors (CARs) to become CAR-T cells?

- What do first-, second-, third-, fourth-, and fifth-generation CAR-T therapies refer to?

- How are CAR genes inserted into T cells?

- What are the features of the FDA-approved CAR-T therapies currently available?

- What future developments are expected within the CAR-T sector?

- Which new CAR-T products are anticipated to enter the market soon?

- How many automated manufacturing systems are available for CAR-T production?

- Which antigens are most commonly targeted in liquid and solid cancers?

- What is the number of CAR-T-related patent publications and granted patents from 2012 to present?

- Which countries hold the most CAR-T patents?

- Which companies have filed the most CAR-T patents?

- Who are the top CAR-T patent inventors?

- How many CAR-T-related clinical trials have been registered from 2003 to the present?

- Which biomarker antigens dominate the CAR-T clinical trial landscape?

- How many CAR-T deals were signed in 2023-2024 and who entered into them?

- What is the current market size for FDA-approved CAR-T therapies?

- What promising CAR-T candidates are expected to reach commercialization soon?

- How are CAR-T therapies reimbursed in the U.S. and Europe?

- What is the market size for CAR-T therapies by geography, product, and indication?

- Which major companies are developing CAR-T cell therapies?

This global strategic report will position you to:

- 1. Capitalize on rapidly emerging trends

- 2. Optimize decision-making

- 3. Reduce company risk

- 4. Approach partners/investors for collaboration or funding

- 5. Implement an informed and advantageous business strategy in 2025

With the competitive nature of this global market, you don't have the time to do the research. Claim this report to become immediately informed, without missing critical opportunities.

Companies and Organizations Mentioned:

|

|

TABLE OF CONTENTS

1. REPORT OVERVIEW

- 1.1. Statement of the Report

- 1.2. Executive Summary

- 1.3. Introduction

2. CAR-T CELL THERAPY: TECHNOLOGY DEVELOPMENT

- 2.1. An Overview of CAR-T cell Therapy

- 2.2. Evolution of CAR-T Development

- 2.2.1. CAR-T cell Therapy Technology Progression

- 2.2.1.1. First Generation CARs

- 2.2.1.2. Second Generation CARs

- 2.2.1.3. Third Generation CARs

- 2.2.1.4. Fourth Generation CARs

- 2.2.1.5. Fifth Generation CARs

- 2.2.1. CAR-T cell Therapy Technology Progression

- 2.3. Antigens Present on Hematological Malignant Cells

- 2.4. Tools for Inserting Receptor Genes into T cells

- 2.5. Transforming T cells into CAR-T cells

- 2.6. The 13 CAR-T Therapies Available Globally: A Brief Overview

- 2.6.1. Kymriah (tisagenlecleucel)

- 2.6.1.1. Manufacturing

- 2.6.1.2. Indication

- 2.6.1.3. Dosage Composition

- 2.6.1.4. Approval History of Kymriah

- 2.6.1.5. Sales Revenue

- 2.6.2. Yescarta (axicabtagene ciloleucel)

- 2.6.2.1. Manufacturing of Yescarta

- 2.6.2.2. Indication

- 2.6.2.3. Dosage Composition

- 2.6.2.4. Approval History of Yescarta

- 2.6.2.5. Sales Revenue

- 2.6.3. Tecartus (brexucabtagene autoleucel)

- 2.6.3.1. Manufacturing of Tecartus

- 2.6.3.2. Indication

- 2.6.3.3. Dosage Composition

- 2.6.3.4. Approval History of Tecartus

- 2.6.3.5. Sales Revenue

- 2.6.4. Breyanzi (lysocabtagene maraleucel)

- 2.6.4.1. Manufacturing of Breyanzi

- 2.6.4.2. Indication

- 2.6.4.3. Dosage Composition

- 2.6.4.4. Approval History of Breyanzi

- 2.6.4.5. Sales Revenue

- 2.6.5. Abecma (idecabtagene vicleucel)

- 2.6.5.1. Manufacturing of Abecma

- 2.6.5.2. Indications

- 2.6.5.3. Dosage Composition

- 2.6.5.4. Approval History of Abecma

- 2.6.5.5. Sales Revenue

- 2.6.6. Relma-cel (relmacabtagene autoleucel)

- 2.6.7. Carvykti (ciltacabtagene autoleucel)

- 2.6.7.1. Manufacturing of Carvykti

- 2.6.7.2. Indications

- 2.6.7.3. Dosage

- 2.6.7.4. Approval History of Carvykti

- 2.6.7.5. Sales Revenue

- 2.6.8. Fucaso (equecabtagene autoleucel)

- 2.6.8.1. Dosage & Overall Response Rate

- 2.6.9. NexCAR19 (actalycabtagene autoleucel)

- 2.6.10. Yuanruida (inaticabtagene autoleucel)

- 2.6.11. Zevor-cel (zevorcabtagene autoleucel)

- 2.6.12. Qartemi (varnimcabtagene autoleucel)

- 2.6.12.1. Indication & Dosage

- 2.6.12.2. Product Description & Mechanism of Action

- 2.6.12.3. Manufacture

- 2.6.13. Aucatzyl (obecabtagene autoleucel)

- 2.6.13.1. Manufacturing

- 2.6.13.2. Indication & Dosage

- 2.6.13.3. Approval

- 2.6.13.4. Wholesale Price

- 2.6.1. Kymriah (tisagenlecleucel)

- 2.7. Cost of CAR-T Therapy around the World

- 2.8. Toxicities Associated with CAR-T Treatment

3. STRATEGIES FOR FUTURE CAR-T THERAPIES

- 3.1. Switchable CARs (sCARs/Universal CARs)

- 3.1.1. Switchable CAR-Ts in the Clinic

- 3.1.2. Suicide Genes

- 3.1.3. Transient Transfection

- 3.2. Affinity-Tuned CARs

- 3.3. Armored CARs

- 3.4. Shift from Liquid Cancers to Solid Cancers

- 3.5. Focus on Shortening Hospital Stay

- 3.6. Focus on Discovering New Antigens

- 3.7. CAR-T for the Masses

- 3.8. New In Vivo CAR-T Approaches

- 3.9. Combination with mRNA Vaccine

- 3.10. Combination with Oncolytic Virus

4. MAJOR EVENTS DURING THE DEVELOPMENT OF CAR-T, 1989-2024

- 4.1. Major 15 Milestones Crossed by CAR-T cell Therapy

- 4.1.1. First CAR Developed by Zelig Eshhar (1993)

- 4.1.2. Development of First Generation CAR-T (1993)

- 4.1.3. First Effective CAR-T Cells Developed (2002)

- 4.1.4. Second Generation CARs Developed (2003)

- 4.1.5. Recipe for CD19 CARs Published (2009)

- 4.1.6. Coley Award Given for CAR-T Cell Therapy (2012)

- 4.1.7. Results for CAR-T Leukemia Published (2013)

- 4.1.8. Cancer Immunotherapy Voted "Breakthrough of the Year" (2013)

- 4.1.9. FDA Designates CARs a "Breakthrough" Therapy (2014)

- 4.1.10. Mesothelin-Directed CARs Developed (2014)

- 4.1.11. Armored CARs Developed (2015)

- 4.1.12. CRISPR CARs Built (2017)

- 4.1.13. First CAR-T Crosses Regulatory Finish Line (August 30, 2017)

- 4.1.14. Second CAR-T Approval (October 18, 2017)

- 4.1.15. Third CAR-T Approval (July 24, 2020)

- 4.1.16. Fourth CAR-T Approval (February 5, 2021)

- 4.1.17. Fifth CAR-T Approval (March 26, 2021)

- 4.1.18. Sixth CAR-T Approval (September 6, 2021)

- 4.1.19. Seventh CAR-T Approved (February 28, 2022)

- 4.1.20. Eighth CAR-T Approval (July 2, 2023)

- 4.1.21. Ninth CAR-T Approval (October 16, 2023)

- 4.1.22. Tenth CAR-T Approval (November 8, 2023)

- 4.1.23. Eleventh CAR-T Approval (March 1, 2024)

- 4.1.24. Twelfth CAR-T Approval (May 7, 2024)

- 4.1.25. Thirteenth CAR-T Approval (November 8, 2024)

- 4.2. The Upcoming CAR-T Stars

- 4.2.1. ALLO-501 & ALLO-501A

- 4.2.2. CTX-110, CTX-112, CTX-130 & CTX-131

- 4.2.3. UCART19

- 4.2.4. AUT01/22

- 4.2.5. JCARH125

- 4.2.6. PBCAR-20A

- 4.2.7. PRGN-3006

- 4.2.8. UCART22

- 4.2.9. UCARTCS1

- 4.3. The Very Small Cancer Population Addressed by CAR-T

- 4.4. Advantages of CAR-T cell Therapy

- 4.5. Disadvantages of CAR-T cell Therapy

- 4.6. Success Rate of CAR-T Therapy

5. CAR-T TARGETED ANTIGENS

- 5.1. CAR-T Target Antigens in Hematological Cancers

- 5.2. CAR-T Target Antigens in Solid Cancers

- 5.3. Most Common Antigens Targeted by CAR-T Cells in Clinical Trials

- 5.3.1. Cluster Differentiation 19 (CD19)

- 5.3.2. Mesothelin

- 5.3.3. Beta Cell Maturation Agent (BCMA)

- 5.3.4. GD2

- 5.3.5. Glypican-3 (GPC3)

- 5.3.6. Cluster Differentiation-22 (CD22)

6. SCALABLE MANUFACTURING OF CAR-T CELLS

- 6.1. Manufacturing Process

- 6.1.1. Local & Centralized CAR-T Supply Chain Pathways

- 6.2. The Evolution of CAR-T Manufacturing Platforms

- 6.2.1. Open vs. Closed Systems

- 6.2.2. Manual Processing vs. Automation

- 6.3. Allogeneic CAR-T Manufacturing

- 6.4. Currently Used CAR-T Manufacturing Platforms

- 6.4.1. CliniMACS Prodigy

- 6.4.2. Cocoon

- 6.4.3. Xuri Cell Expansion System W25

- 6.4.4. G-Rex

- 6.5. Comparison of CAR-T Manufacturing Platforms

- 6.6. CAR-T Manufacturing Cost

- 6.6.1. Breakdown of CAR-T Manufacturing Cost

7. CAR-T PATENT LANDSCAPE

- 7.1. Geographical Distribution of CAR-T Cell Therapy Patents

- 7.2. CAR-T Cell Therapy Patent Applicants

- 7.3. CAR-T Patent Inventors

- 7.4. CAR-T Cell Therapy Patent Owners

- 7.5. Legal Status of CAR-T Therapy Patents

- 7.6. Ways to Extend Patent Life

8. CAR-T CLINICAL TRIAL LANDSCAPE

- 8.1. CAR-T Clinical Trials by Phase of Development

- 8.2. Types of CAR-T Clinical Trials

- 8.3. CAR-T Clinical Trials by Funding Type

- 8.4. Types of Hematologic Cancers (Liquid Cancers) Addressed by Clinical Trials

- 8.5. Simultaneous Targets by One CAR-T

- 8.6. CAR-T Generation Types used in Clinical Trials

- 8.7. CAR-T Trials by SvFv Used

- 8.8. CAR-T Trials by Type of Vectors Used

- 8.9. Autologous & Allogeneic CAR-Ts in Clinical Trials

- 8.10. Landscape of Clinical Trials Focusing on Solid Cancers

- 8.10.1. Geographical Distribution of CAR-T Clinical Trials for Solid Tumors

- 8.10.2. Vectors used to Transduce CAR Gene into T Cells

9. PUBLISHED CAR-T SCIENTIFIC PAPERS IN PUBMED.GOV

- 9.1. PubMed Papers in Autologous and Allogeneic CAR-T Cell Therapies

- 9.2. CAR-T Cell Therapy for Liquid vs. Solid Cancers, 2013-2024

- 9.3. PubMed.gov Papers on Five Generations of CAR-T Cell Therapy

10. CAR-T FUNDING LANDSCAPE

- 10.1. Venture Capital Funding in CAR-T Sector, 2014-2024

- 10.1.1. VC Funding for CAR-T Companies by Year, 2014-2024

- 10.2. IPO Funding Invested in CAR-T Companies, 2014-2024

- 10.3. CAR-T Licensing Deals

- 10.4. CAR-T Collaboration Deals

- 10.5. CAR-T Merger & Acquisition (M&A) Deals, 2015-2024

- 10.6. Summary of CAR-T Funding

11. COST OF CAR-T CELL THERAPY & REIMBURSEMENT

- 11.1. New Payment Models

- 11.2. List Prices of Approved CAR-T Cell Therapies

- 11.2.1. Component Costs Associated with CAR-T Cell Therapy

- 11.2.2. Adverse Events (AEs) Costs

- 11.3. Reimbursement in the U.S. for CAR-T Cell Therapy

- 11.3.1. Medicare Payment Changes in 2025 for CAR-T Cases

- 11.3.1.1. High-Cost Outlier Payments

- 11.3.1.2. Adjustment for Clinical Trial Cases

- 11.3.1.3. Inpatient & Outpatient Medicare Spend for CAR-T

- 11.3.1. Medicare Payment Changes in 2025 for CAR-T Cases

- 11.4. Cost of CAR-T Therapies in Europe

- 11.4.1. Financing CAR-T Therapies in the E.U.

- 11.4.2. Estimated Cost of CAR-T Therapies in the E.U.

- 11.4.3. Utilization of CAR-T Cell Therapy in Europe

- 11.4.4. Utilization of CAR-T in Europe by Indication

- 11.5. CAR-T Cell Therapy in Asia Pacific (APAC)

- 11.5.1. CAR-T Funding in Australia

- 11.5.2. CAR-T Funding in Singapore

- 11.5.3. CAR-T in South East Asia (SEA) [Except in Singapore]

- 11.5.3.1. Cost & Reimbursement for CAR-T in Japan

- 11.5.3.2. Cost & Reimbursement for CAR-T in South Korea

- 11.5.3.3. CAR-T Reimbursement in China

- 11.5.3.4. CAR-T Reimbursement in Malaysia

- 11.5.3.5. Cost & Reimbursement for CAR-T in India

12. BLOOD CANCERS ADDRESSED BY CAR-T

- 12.1. Acute Lymphoblastic Leukemia (ALL)

- 12.1.1. Available Therapies for ALL

- 12.2. Diffuse Large B-cell Lymphoma (DLBCL)

- 12.2.1. Available Therapies for DLBCL

- 12.3. Mantle Cell Lymphoma (MCL)

- 12.3.1. Available Therapies for MCL

- 12.4. Multiple Myeloma (MM)

- 12.4.1. Available Therapies for Multiple Myeloma

- 12.5.1. Available Therapies for Follicular Lymphoma

- 12.6. The Staggering Cost of Blood Cancer Therapies

13. MARKET ANALYSIS

- 13.1. Global Rates of CAR-T Cell Therapies, 2017-2024

- 13.1.1. Current Global Market for CAR-T by Product, 2017-2024

- 13.2. Global Market for CAR-T Cell Therapy Products, 2024-2032

- 13.3. Global Market for CAR-T Therapy by Geography, 2024-2032

- 13.4. Global Market for CAR-T Therapies by Indication, 2024-2032

- 13.5. Obstacles to Global Implementation of CAR-T Cell Therapies

- 13.5.1. Patient-Related Factors

- 13.3.2. Disease Biology Factor

- 13.3.3. Adverse Events

- 13.3.4. Cost

- 13.3.5. Manufacturing Chain and Supply

- 13.3.6. Hospitals and Pathways of Care

14. CAR-T COMPNIES: AN OVERVIEW

- 14.1 2seventy bio

- 14.1.1. Abecma (idecabtagene vicleucel)

- 14.2. Abintus Bio, Inc.

- 14.3. AffyImmune Therapeutics, Inc.

- 14.3.1. Affinity-Tuned CARs

- 14.3.1.1. ICAM-1: AffyImmune's Target Antigen

- 14.3.1.2. Targeted Indication

- 14.3.1. Affinity-Tuned CARs

- 14.4. Aleta BioTherapeutics

- 14.4.1. Aleta's CAR-T Engager Pipeline

- 14.5. Allogene Therapeutics

- 14.5.1. AlloCAR-T

- 14.5.1.1. Manufacturing of AlloCAR-T

- 14.5.1. AlloCAR-T

- 14.6. Anixa Biosciences, Inc.

- 14.7. Arbele, Ltd.

- 14.7.1. Advanced Cell Therapy

- 14.8. Arcellx

- 14.8.1. D-Domain Technology

- 14.8.2. ddCAR Platform

- 14.8.3. ARC-SparX Platform

- 14.9. Atara Biotherapeutics

- 14.9.1. Technology

- 14.9.2. Allogeneic CAR-T Programs

- 14.10. Aurora BioPharma

- 14.10.1. HER2 Platform

- 14.11. Autolus Therapeutics plc

- 14.11.1. Technology

- 14.11.2. CAR-T Cell Production

- 14.11.3. Manufacturing

- 14.11.4. Therapies in Development

- 14.11.4.1. obe-cel

- 14.12. AvenCell Europe GmbH

- 14.12.1. Universal Switchable CAR

- 14.12.2. Allogeneic Platform

- 14.12.3. Clinical & Preclinical Pipeline Overview

- 14.13. Beam Therapeutics, Inc

- 14.13.1. BEAM-201

- 14.14. Bellicum Pharmaceuticals

- 14.14.1. GoCAR Technology

- 14.14.2. CaspaCIDe Safety Switch

- 14.15. BioNTech

- 14.15.1. BioNTech's Engineered Cell Therapies

- 14.15.2. BN211

- 14.15.3. BN212

- 14.16. Biosceptre

- 14.16.1. Biosceptre's Unique Target nf2X

- 14.16.2. BRiDGECAR Program

- 14.17. Bluebird bio

- 14.17.1. Blebird bio's CAR-T Collaborations

- 14.17.2. Collaboration with BMS

- 14.17.3. Collaboration with TC BioPharm

- 14.17.4. Collaboration with Inhibrx

- 14.17.5. Collaboration with PsiOxus

- 14.18. Bristol Myers Squibb/Celgene Corporation

- 14.18.1. Products

- 14.18.1.1. Abecma (idecabtagene vicleucel)

- 14.18.1.2. Breyanzi (lisocabtagene maraleucel)

- 14.18.1. Products

- 14.19. Cabaletta Bio

- 14.19.1. CABA Platform

- 14.19.2. Cabaletta's Pipeline

- 14.20. Carina Biotech

- 14.21. CARsgen Therapeutics

- 14.21.1. CycloCAR-T

- 14.21.2. THANK-uCAR

- 14.21.3. LADAR

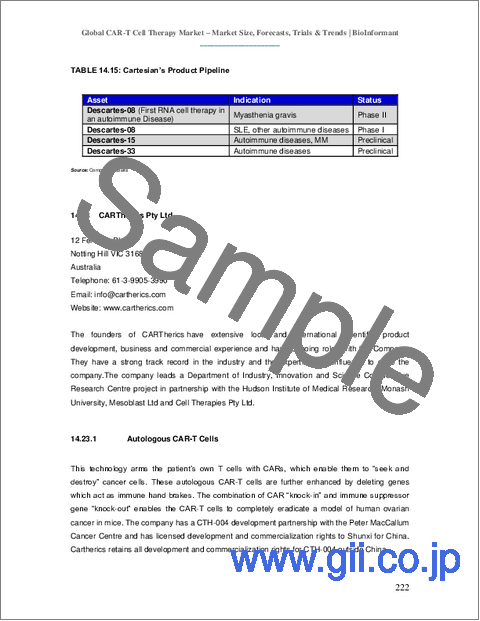

- 14.22. Cartesian Therapeutics

- 14.22.1. mRNA CAR-T Cell Program (RNA Armory)

- 14.22.2. Pipeline

- 14.23. CARTherics Pty Ltd.

- 14.23.1. Autologous CAR-T Cells

- 14.24. CASI Pharmaceuticals

- 14.24.1. Yuanruida (inaticabtagene autoleucel; CNCT19)

- 14.25. Cellectis

- 14.25.1. TAL nucleases, or TALEN

- 14.25.2. Gene Editing

- 14.25.3. PulseAgile Technology

- 14.25.4. Main Product Candidates

- 14.26. Celularity, Inc.

- 14.26.1. P CAR-T

- 14.27. Celyad Oncology

- 14.27.1. NKG2D-Based CAR-T Cells

- 14.27.2. Multispecific CAR

- 14.27.3. Short Hairpin RNA-based Platform

- 14.27.4. CAR-T Therapy Development Services

- 14.27.5. Biomarker Identification and Selection

- 14.27.6. scFv Generation

- 14.27.7. CAR-T Gene Packaging and Delivery

- 14.27.8. Virus Testing Service

- 14.27.9. CAR Cell in vitro Assay Service

- 14.27.10. CAR-T Preclinical in vivo Assay

- 14.27.11. IND Development for CAR-T Cell Therapy

- 14.27.12. GMP Production for CAR-T Products

- 14.27.13. CAR-T Clinical Trial Services

- 14.28. CRISPR Therapeutics

- 14.28.1. CRISPR Therapeutics' Immuno-Oncology Programs

- 14.28.2. CRISPR/Cas9-enabled Allogeneic CAR-T Design

- 14.29. Curocell, Inc.

- 14.29.1. OVIS Technology

- 14.30. DiaCarta

- 14.30.1. Personalized CAR-T Immunotherapy Platform

- 14.31. Elicera Therapeutics AB

- 14.31.1. iTANK CAR-T Technology

- 14.31.2. Elicera's Product Pipeline

- 14.32. EXUMA Biotech

- 14.32.1. TMR CAR-T Technology

- 14.32.2. CCT3 CAR-T

- 14.32.3. rPOC SC CAR-TaNKs

- 14.32.4. GCAR "in vivo Cell Therapy"

- 14.33. Fate Therapeutics

- 14.33.1. FT819

- 14.33.2. FT825

- 14.34. Galapagos NV

- 14.35. Gilead Sciences, Inc.

- 14.35.1. CAR-T Products

- 14.35.1.1. Tecartus (brexucabtagene autoleucel)

- 14.34.1.2. Yescarta (axicabtagene ciloleucel)

- 14.35.1. CAR-T Products

- 14.36. Gracell Biotechnologies

- 14.36.1. FasTCAR

- 14.36.2. TruUCAR

- 14.36.3. SMART CAR-T

- 14.36.4. Gracell's Product Pipeline

- 14.37. IASO Biotherapeutics

- 14.37.1. Technology Platforms

- 14.37.2. Fully Human Antibody Discovery Platform

- 14.37.3. High-Throughput Screening Platform for CAR-T Candidates

- 14.37.4. Universal CAR-T Technology Platform

- 14.37.5. CAR-T Manufacturing Technology Platform

- 14.37.6. IASO's Diverse Product Pipeline

- 14.38. ImmPACT Bio

- 14.38.1. CD19/20 Bispecific CAR

- 14.38.2. TGF-Beta

- 14.39. Immuneel Therapeutics, Pvt., Ltd.

- 14.39.1. Immuneel's R&D Roadmap

- 14.40. ImmunoACT

- 14.40.1. NexCAR19 (Actalycabtagene autoleucel)

- 14.41. Interius BioTherapeutics

- 14.41.1. Core Technology

- 14.42. Juventas Cell Therapy

- 14.42.1. Yuanruida (inaticabtagene autoleucel)

- 14.43. JW Therapeutics

- 14.43.1. Carteyva (relmacabtagene autoleucel; relma-cel)

- 14.44. Kite Pharma (Gilead)

- 14.44.1. Kite's Marketed CAR-T Products

- 14.44.1.1. Yescarta (axicabtagene ciloleucel)

- 14.44.1.2. Tecartus (brexucabtagene autoleucel)

- 14.44.2. Kite's Pipeline Cancer Therapies

- 14.44.1. Kite's Marketed CAR-T Products

- 14.45. Kyverna Therapeutics

- 14.45.1. Kyverna's CAR-T Therapy for Autoimmune Diseases

- 14.46. Legend Biotech

- 14.46.1. Technology Platforms

- 14.46.1.1. CAR-T

- 14.46.1.2. CAR-Gamma Delta T

- 14.46.1.3. CAR-NK

- 14.46.1.4. Non-Gene-Editing Universal CAR-T

- 14.46.2. Product Pipeline

- 14.46.1. Technology Platforms

- 14.47. Leucid Bio

- 14.47.1. Leucid's Lateral CAR-Platform

- 14.47.2. LEU011 - NKG2D CAR-T Cell Therapy

- 14.47.3. T2, Gamma Delta T-Cells for Off-The-Shelf Therapy

- 14.47.4. T4 Immunotherapy

- 14.47.5. Novel Manufacturing Platform

- 14.48. Luminary Therapeutics, Inc.

- 14.48.1. Allogeneic Gamma 2.0+ Platform

- 14.48.2. Non-Viral Gene Modification Process

- 14.48.3. Split Co-Stim Dual CAR

- 14.48.4. Ligand-Based CAR to Target Three Antigens

- 14.48.5. Product Pipeline

- 14.49. Lyell Immunopharma, Inc.

- 14.49.1. Technology

- 14.49.1.1. Gen-R Technology

- 14.49.1.2. Epi-R Technology

- 14.49.2. Lyell's Product Pipeline

- 14.49.1. Technology

- 14.50. March Biosciences

- 14.50.1. MB-105

- 14.50.2. March Biosciences' Pipeline

- 14.51. MaxCyte, Inc.

- 14.51.1. Technology: Flow Electroporation

- 14.51.2. MaxCyte's Electroporation Systems

- 14.51.2.1. ATx

- 14.51.2.2. GTx

- 14.51.2.3. STx

- 14.51.2.4. VLx

- 14.52. Minerva Biotechnologies Corporation

- 14.52.1. CAR-T (huMNC2-CAR44)

- 14.53. Mustang Bio

- 14.53.1. Mustang's CAR-T Focus

- 14.54. Noile-Immune Biotech

- 14.54.1. PRIME CAR-T

- 14.55. Novartis AG

- 14.55.1. The Pioneer in CAR-T

- 14.55.2. Kymriah (tisagenlecleucel)

- 14.55.3. T-Charge Platform

- 14.55.3.1. Phase I YTB323 Clinical Study

- 14.55.3.2. Phase I PHE 885 Clinical Study

- 14.56. Oncternal Therapeutics

- 14.56.1. ONCT-808

- 14.57. Oxford Biomedica plc

- 14.57.1. LentiVector Platform

- 14.57.2. inAAVate Platform

- 14.57.3. CDMO Services

- 14.58. PeproMene Bio, Inc.

- 14.58.1. BAFFR CAR-T Cells

- 14.59. Poseida Therapeutics, Inc.

- 14.59.1. Poseida's Genetic Engineering Platforms

- 14.59.2. PiggyBac Platform for Insertion

- 14.59.3. Cas-CLOVER Platform for Editing

- 14.59.4. Poseida's CAR-T Product Candidates

- 14.60. Precigen, Inc.

- 14.60.1. UltraCAR-T

- 14.60.2. Sleeping Beauty System

- 14.60.3. UltraPorator System

- 14.60.4. Product Pipeline

- 14.61. Prescient Therapeutics

- 14.61.1. OmniCAR

- 14.61.2. CellPryme

- 14.62. ProMab Biotechnologies, Inc.

- 14.62.1. ProMab's CAR-T Cells

- 14.62.2. ProMab's Services

- 14.62.3. ProMab's Preclinical and Clinical Study Services

- 14.63. SOTIO Biotech BV

- 14.63.1. BOXR Technology

- 14.63.2. BOXR1030

- 14.64. Syngene International, Ltd

- 14.64.1. CAR-T Services

- 14.65. Synthekine

- 14.65.1. STK-009 + SYNCAR-001

- 14.66. TC BioPharm

- 14.66.1. Gamma Delta T Cells

- 14.66.2. Cell Banks

- 14.66.3. Co-Stim CAR-T

- 14.66.4. Product Pipeline

- 14.66.4.1. OmnImmune

- 14.66.5. CAR-T Programs

- 14.67. T-CURX

- 14.67.1. Technologies

- 14.68. Umoja Biopharma

- 14.68.1. Umoja's Technology Platforms

- 14.68.1.1. VivoVec in vivo Gene Delivery

- 14.68.1.2. RACR-Induced Cytotoxic Lymphocytes (iCIL)

- 14.68.1.3. RACR/CAR: in vivo Cell Programming

- 14.68.1.4. TumorTag: Universal CAR Tumor Targeting

- 14.68.1. Umoja's Technology Platforms

- 14.69. ViTToria Biotherapeutics

- 14.69.1. Senza5

- 14.69.2. VIPER-101

- 14.70. Vor Biopharma

- 14.70.1. Vor Biopharma's Approach

- 14.71. Wugen

- 14.72. WuXi Advanced Therapies

- 14.72.1. WuXi's Closed Process CAR-T manufacturing

- 14.73. Xenetic Biosciences

- 14.73.1. DNase-based Oncology Platform

- 14.74. Xyphos Biosciences, Inc

- 14.74.1. ACCEL & UDC Technology

- 14.74.2. convertibleCAR

- 14.74.3. Universal Donor Cells

INDEX OF FIGURES

- FIGURE 2.1: The Basic Structure of a T cell

- FIGURE 2.2: Binding of a T cell on to an Infected Cell

- FIGURE 2.3: Components of a CAT-T cell

- FIGURE 2.4: The Three Domains of a CAR

- FIGURE 2.5: First Generation CARs

- FIGURE 2.6: Second Generation CARs

- FIGURE 2.7: Third Generation CARs

- FIGURE 2.8: Fourth Generation CARs

- FIGURE 2.9: Fifth Generation CARs

- FIGURE 2.10: Antigens Present on Normal and Cancer Cells

- FIGURE 2.11: Preparation and Administration of CAR-T cells

- FIGURE 2.12: Kymriah in Infusion Bag

- FIGURE 2.13: Yescarta in Infusion Bag

- FIGURE 2.14: Tecartus in Infusion Bag

- FIGURE 2.15: Breyanzi in Package

- FIGURE 2.16: Abecma in the Infusion Bag

- FIGURE 2.17: Relma-cel in Infusion Bag

- FIGURE 3.1: Switchable CAR

- FIGURE 3.2: Action of Suicide Genes

- FIGURE 3.3: Graphical Abstract for Transient Transfection

- FIGURE 3.4: A Model of Armored CAR

- FIGURE 4.1: The Five Generations of CARs

- FIGURE 6.1: CAR-T Target Antigens Evaluated in Clinical Trials

- FIGURE 6.1: CAR-T Manufacturing Process Schematics

- FIGURE 6.2: Local and Centralized Supply Chain Pathways

- FIGURE 6.2: Scaling up off Allogeneic CAR-T Cells

- FIGURE 7.1: Number of CAR-T Cell Therapy Patents Filed, 2000-2024

- FIGURE 8.1: Types of Hematological Cancers Addressed by CAR-T Trials

- FIGURE 8.2: Studies for Simultaneous Targets for One CAR-T

- FIGURE 8.3: CAR-T Generation Types used in Clinical Trials

- FIGURE 8.4: CAR-T Trials by Type of SeFv Used

- FIGURE 8.5: CAR-T Trials by Type of Vectors Used

- FIGURE 8.6: Autologous & Allogeneic CAR-Ts in Clinical Trials

- FIGURE 8.7: Geographical Distribution of CAR-T Clinical Trials for Solid Tumors

- FIGURE 8.8: Vectors used to Transduce CAR Genes into T Cells for Solid Tumor Studies

- FIGURE 9.1: Number of Published CAR-T Papers on PubMed.gov, 2000-2024

- FIGURE 9.2: PubMed.gov Papers on Autologous & Allogeneic CAR-T, 2013-2024

- FIGURE 9.3: Number of PubMed.gov Papers on Liquid vs. Solid Cancers, 2013-2024

- FIGURE 9.4: Percent Shares of the Five Generations of CARs

- FIGURE 10.1: VC Funding for CAR-T Companies, 2014-2024

- FIGURE 10.2: IPO Funds Raised by CAR-T Companies, 2014-2024

- FIGURE 11.1: Total Medicare Spend for CAR-T in OP & IP Setting

- FIGURE 11.1: Utilization of CAR-T Cell Therapy in Europe

- FIGURE 11.2: CAR-T Cell Therapy Uptake in Europe by Indication

- FIGURE 11.3: Cost Breakdown of CAR-T Cell Therapy in Singapore

- FIGURE 13.1: Estimated CAR-T Uptake in Numbers, 2017-2024

- FIGURE 13.2: Revenue Generation by CAR-T Cell Therapies by Product, 2017-2024

- FIGURE 13.3: Global Market for CAR-T Cell Therapy Products, 2024-2032

- FIGURE 13.4: Global Market for CAR-T Cell Therapy by Geography, 2024-2032

- FIGURE 13.5: Global market Share for CAR-T Therapies by Indication, 2024

- FIGURE 14.1: Atara's Approach to Allogeneic Cell Therapy

- FIGURE 14.2: Illustration of CycloCAR-T

- FIGURE 14.3: Illustration of THANK-uCAR-T

- FIGURE 14.5: Schematic of Allogeneic P CAR-T with TCR KO

- FIGURE 14.6: NKG2D-based CAR

- FIGURE 14.7: Celyad's Multispecific CAR

- FIGURE 14.8: CRISPR/Cas9-enabled Allogeneic CAR-T Design

- FIGURE 14.9: FT819

- FIGURE 14.10: FT825

- FIGURE 14.11: FasTCAR vs. Conventional CAR-T Manufacturing Time

- FIGURE 14.12: Action of TruUCAR

- FIGURE 14.13: SMART CAR-T

- FIGURE 14.14: CD19/CD20 CAR-T Technology

- FIGURE 14.15: TGF-Beta Bispecific CAR Technology

- FIGURE 14.16: Lateral CAR

- FIGURE 14.17: T4 T-Cell

- FIGURE 14.18: Split Co-Stim Dual CAR

- FIGURE 14.19: Ligand-Based CAR to Target Three Antigens

- FIGURE 14.20: Natural Killing of CAR-T Cells

- FIGURE 14.21: ATx

- FIGURE 14.22: GTx

- FIGURE 14.23: STx

- FIGURE 14.24: VLx

- FIGURE 14.25: Features of PRIME CAR-T Cell Therapy

- FIGURE 14.26: BAFFR CAR-T Cells

- FIGURE 14.27: Poseida's PiggyBac Platform for Insertion

- FIGURE 14.28: Poseida's Cas-CLOVER Platform for Editing

- FIGURE 14.29: UltraCAR-T Cell

- FIGURE 14.30: Precigen's Ultraporator System

- FIGURE 14.31: Prescient's OmniCAR

- FIGURE 14.32: VIPER-101, the Lead Program of ViTToria

- FIGURE 14.33: WuXi's Closed Process CAR-T Platform

- FIGURE 14.34: Convertible CAR Parts

- FIGURE 14.35: Xyphos' Universal Donor Cells

INDEX OF TABLES

- TABLE 2.1: Potential Antigens Present on Hematological Malignant Cells

- TABLE 2.2: Key Differences between the Available Vectors

- TABLE 2.3: The 13 CAR-T Therapies Available Globally

- TABLE 2.3: (CONTINUED)

- TABLE 2.3: (CONTINUED)

- TABLE 2.3: (CONTINUED)

- TABLE 2.4: Acquisition Cost of CAR-T Therapy Products around the World

- TABLE 3.1: Strategies for Future CAR-T Therapies

- TABLE 3.2: A Sample of Clinical Studies on Solid Cancers

- TABLE 3.3: New Target Antigens and New Target Cancers

- TABLE 4.1: History of CAR-T Therapy Development

- TABLE 4.2: Upcoming CAR-T Stars

- TABLE 4.3: The Small Cancer Population Addressed by CAR-T Therapy

- TABLE 5.1: CAR-T Target Antigens in Hematological Cancers

- TABLE 5.2: Select CAR-T Target Antigens in Clinical Trials

- TABLE 5.3: Targeted Antigens by Approved CAR-Ts

- TABLE 6.2: Key Process Metrics with Increasing Levels of Automation

- TABLE 6.3: Breakdown of CAR-T Manufacturing Cost

- TABLE 7.1: Geographical Distribution of CAR-T Cell Therapy Patents

- TABLE 7.2: CAR-T Cell Therapy Patent Applicants

- TABLE 7.2: (CONTINUED)

- TABLE 7.2: (CONTINUED)

- TABLE 7.3: Top 100 CAR-T Patent Inventors

- TABLE 7.3: (CONTINUED)

- TABLE 7.3: (CONTINUED)

- TABLE 7.4: Top 100 CAR-T Cell Therapy Patent Owners

- TABLE 7.4: (CONTINUED)

- TABLE 7.4: (CONTINUED)

- TABLE 7.5: Legal Status of CAR-T Therapy Patents

- TABLE 8.1: CAR-T Clinical Trials by Phase of Development, January 15, 2025

- TABLE 8.2: Types of CAR-T Clinical Trials

- TABLE 8.3: CAR-T Clinical Trials by Funding Type

- TABLE 8.4: CAR-T for Solid Cancers: An Overview of Data

- TABLE 10.1: Venture Capital Funding in CAR-T Sector, 2014-2024

- TABLE 10.1: (CONTINUED)

- TABLE 10.1: (CONTINUED)

- TABLE 10.2: IPOs by CAR-T Cell Therapy Companies, 2014-2024

- TABLE 10.2: (CONTINUED)

- TABLE 10.3: CAR-T Licencing Deals, 2015-2024

- TABLE 10.3: (CONTINUED)

- TABLE 10.3: (CONTINUED)

- TABLE 10.3: (CONTINUED)

- TABLE 10.4: CAR-T Collaboration Deals, 2013-2024

- TABLE 10.4: (CONTINUED)

- TABLE 10.4: (CONTINUED)

- TABLE 10.4: (CONTINUED)

- TABLE 10.5: CAR-T Merger & Acquisition (M&A) Deals, 2015-2024

- TABLE 10.5: (CONTINUED)

- TABLE 10.6: Summary of CAR-T Funding, 2014-2024

- TABLE 11.1: List Prices of CAR-T Cells

- TABLE 11.2: Pre-, Peri- & Post Infusion Unit Costs

- TABLE 11.3: Adverse Events Rates & Unit Costs of Management

- TABLE 11.4: Reimbursement for CAR-T Cases, 2024 vs. 2025

- TABLE 11.5: EU-Approved CAR-T Cell Therapies

- TABLE 11.7: Approximate Cost of CAR-T Cell Therapies in Select E.U. Countries

- TABLE 11.8: CAR-T Funding Sources in Singapore

- TABLE 12.1: Available Therapies for ALL

- TABLE 12.2: Available Therapies for DLBCL

- TABLE 12: Available Therapies for MCL

- TABLE 12.4: Approved Therapies for Multiple Myeloma

- TABLE 12.5 Available Therapies for Follicular Lymphoma (FL)

- TABLE 12.6: The Staggering Cost of Blood Cancer Therapies

- TABLE 13.2: Revenue Generation by CAR-T Cell Therapies by Product, 2017-2024

- TABLE 13.3: Global Market for CAR-T Cell Therapy Products, 2024-2032

- TABLE 13.4: Global Market for CAR-T Therapy by Geography, 2024-2032

- TABLE 13.5: Global Market for CAR-T Therapies by Indication, 2024-2032

- TABLE 14.1: AffyImmune's Affinity-Tuned Pipeline Products

- TABLE 14.2: Aleta's CAR-T Engager Pipeline

- TABLE 14.3: Allogene's AlloCAR-T Pipeline

- TABLE 14.4: Anixa's CAR-T Pipeline

- TABLE 14.5: Arbele's Advanced Cell Therapy Product Candidates

- TABLE 14.6: ArcellX's Current Product Pipeline

- TABLE 14.7: Atara's Product Pipeline

- TABLE 14.8: Autolus' Therapies in Development

- TABLE 14.9: Clinical & Preclinical Pipeline Overview

- TABLE 14.10: Bellicum's Pipeline

- TABLE 14.11: BRiDGECAR Program

- TABLE 14.12: Cabaletta's Autoimmune Therapy Candidates in Development

- TABLE 14.13: Carina's Clinical Programs

- TABLE 14.14: CARsgen's Product Pipeline

- TABLE 14.15: Cartesian's Product Pipeline

- TABLE 14.16: Cellectis' Allogeneic CAR-T Cell Product Pipeline

- TABLE 14.17: CRISPR Therapeutics' CAR-T Programs

- TABLE 14.18: Elicera's Product Pipeline

- TABLE 14.19: EXUMA's Pipeline Assets

- TABLE 14.20: Galapagos' Oncology CAR-T Pipeline

- TABLE 14.21: Gracell's Rich Product Pipeline

- TABLE 14.22: IASO's Diverse Product Pipeline

- TABLE 14.23: ImmPACT Bio's Product Pipeline

- TABLE 14.24: Immuneels Product Pipeline

- TABLE 14.25: JW Therapeutics' Product Pipeline

- TABLE 14.26: Kite's Pipeline Cancer Therapies

- TABLE 14.27: Product Pipeline to address Autoimmune Diseases

- TABLE 14.28: Legend Biotech's Product Pipeline

- TABLE 14.29: Leucid's Product Pipeline

- TABLE 14.30: Luminary's Product Pipeline

- TABLE 14.31: Lyell's Product Pipeline

- TABLE 14.32: March Biosciences' Product Pipeline

- TABLE 14.33: A Comparison Guide for MaxCyte's Electroporation Systems

- TABLE 14.34: Minerva's CAR-T Pipeline Products for Solid Tumors

- TABLE 14.35: Mustang's CAR-T Product Candidates

- TABLE 14.36: Noile-Immune's PRIME-Based Product Pipeline

- TABLE 14.37: Oxford Biomedica's CDMO Services

- TABLE 14.38: PeproMene's Product Pipeline

- TABLE 14.39: Poseida's CAR-T Product Pipeline

- TABLE 14.40: Precigen's UltraCAR-T Pipeline

- TABLE 14.41: Prescient's CAR-T Pruct Pipeline

- TABLE 14.42: ProMabs CAR-T Cells

- TABLE 14.43: ProMab's Discovery Services Plans & Prices

- TABLE 14.44: Synthekine's Pipeline with SYNCAR-001 + STK-009

- TABLE 14.45: T-CURX' Product Candidates in Clinical Trials

- TABLE 14.46: Umoja's Product Pipeline

- TABLE 14.47: Vor Biopharma's Current Product Pipeline

- TABLE 14.48: Wugen's Product Pipeline

- TABLE 14.49: Xenetic's CAR-T Product Pipeline