|

|

市場調査レポート

商品コード

1141936

バイオリファイナリー製品の世界市場Biorefinery Products: Global Markets |

||||||

| バイオリファイナリー製品の世界市場 |

|

出版日: 2022年10月20日

発行: BCC Research

ページ情報: 英文 440 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のバイオリファイナリー製品の市場規模は、2022年に6,247億米ドルになるとみられています。

同市場は、2022年~2027年の予測期間中に8.0%のCAGRで拡大し、2027年には9,200億米ドルに達すると予測されています。

当レポートでは、世界のバイオリファイナリー製品市場について調査し、市場の概要とともに、最終用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 まとめとハイライト

第3章 市場概要

第4章 バイオ製品の歴史と市場浸透

- 歴史

- バイオ製品の市場機会

- バイオ製品市場への浸透

第5章 COVID-19とロシア・ウクライナ戦争の影響

- COVID-19の影響

- ロシア・ウクライナ戦争の影響

第6章 世界の生体エネルギー製品市場

第7章 世界の非生体エネルギー製品市場

第8章 世界のバイオリファイナリー製品市場、最終用途別

- イントロダクション

- バイオ製品の最終用途

第9章 技術

第10章 世界のバイオリファイナリー製品市場、地域別

第11章 製品開発

第12章 産業構造と競争率

第13章 国際的側面

第14章 市場シェア

- バイオエタノール

- バイオディーゼル

- グリセロール

- バイオテクノロジー企業のシェア

- 化学品および材料

- 2022年の設備投資、化学会社別

- Dow Chemicals

- BASF

- Ashland Inc.

- LyondellBasell

- 水素化処理エステル脂肪酸(HEFA):化学品、設備投資、研究開発費、株式

- バイオオイル生産

- エッセンシャルオイル企業の市場シェア

- Frutarom

- Symrise

- Robertet

- Mane

- Givaudan

- Sensient F&F

- IFF

- T. Hasegawa

- Firmenich

- Huaboa International

- Takasago

- 2021年の世界のフレグランスおよびフレーバー業界の市場シェア

- 製薬企業の市場シェア

- Pfizer Inc.

- Roche

- Novartis AG

- 先進バイオ燃料の市場シェア

- 生体高分子・バイオプラスチック

- NatureWorks

- Purac

- Dow Chemical

- Braskem

- ペレット

- 商用セルロース系バイオ燃料会社のシェア

第15章 規制、立法、命令、政策およびインセンティブ

第16章 企業プロファイル

- Profiles of Top Companies

- ABENGOA

- ADM

- AMYRIS

- BASF

- BP PLC

- CHEVRON CORP.

- HONEYWELL INTERNATIONAL INC.

- NESTE

- PETROBRAS

- VALERO

第17章 付録:その他のバイオリファイナリー企業と頭字語

List of Tables

- Summary Table : Global Market for Biorefinery Products, by Segment, Through 2027

Table A : Final Volume Requirement, 2020-2022

- Table 1 : Biorefinery Categorization

- Table 2 : Comparative Production of Platform and High-Value Compounds Based on Petrochemical (Black Carbon) and Biomass (Green Carbon) Feedstocks

- Table 3 : Global Market Volumes of Biomass, by End Use, Through 2027

- Table 4 : Global Market Volumes of Nonfood Biomass, by End Use, Through 2027

- Table 5 : Global Market for Biomass, by Type, Through 2027

- Table 6 : Categorization and Segmentation of Bioproducts

- Table 7 : Bio-based Products Cascading Pyramid, by Sector

- Table 8 : Increasing Value of Herbal Products with Processing and Standardization along the Cascading Pyramid

- Table 9 : Economic, Environmental and Health Benefits of Bioproducts

- Table 10 : Global Market for Bioproducts, by Product Category, Through 2027

- Table 11 : Global Market for Bioproducts, by Bioenergetic Product, Through 2027

- Table 12 : Global Market for Non-bioenergetic Products, Through 2027

- Table 13 : Global Market Penetration of Biorefinery Technology, Through 2027

- Table 14 : Global Market for Bioproducts vs. Global GDP, Through 2027

- Table 15 : Bio-based Industry Growth Compared to Global Economy Growth, 2021-2027

- Table 16 : Overview of Petroleum Raw Materials Replaced with Bio-based Raw Materials

- Table 17 : Description of Bioproduct Market Segmentation

- Table 18 : Global Renewable Energy Employment, by Technology, 2017-2020

- Table 19 : Direct and Indirect Jobs in Biorefining Worldwide, by Industry Sector, 2019-2020

- Table 20 : Major Topics Currently Being Explored for Synthetic Biology Applications

- Table 21 : Recent Developments in Bioderived Product Industry, 2015-2021

- Table 22 : Important Indications for the Bioderived Product Industry, 2014-2022

- Table 23 : Global Market Trends in Investment in Biorefining, by Segment, 2019-2027

- Table 24 : Top 50 Bio-based Innovations in Europe

- Table 25 : Examples of Biomaterials for Companies to Reduce Carbon Footprints

- Table 26 : Industrial Growth Rates of Key Countries, 2021

- Table 27 : Increased Vehicle Sales and Higher Motorization Rate, 2015-2021

- Table 28 : BRIC Nations' Total Vehicle Sales, by Country, 2021

- Table 29 : GDP Trends and Forecast, by Major Country, 2018-2027

- Table 30 : GDP Forecast Errors in 2020: H1 and Lockdown Stringency

- Table 31 : Lockdowns and Economic Activity Through a Broad Range of Indicators

- Table 32 : Global Crude Oil Production, by Key Country, 2021

- Table 33 : Global Natural Gas Production, by Key Country, 2021

- Table 34 : Opportunities in the Global Market for Bio-based Petroleum Replacements, Through 2025

- Table 35 : Process Flow of Biomass Feedstocks to Bio-based Products to Market Applications, Through 2027

- Table 36 : Global Market for Bioenergetic Products, Through 2027

- Table 37 : Global Market for Non-bioenergetic Products, Through 2027

- Table 38 : Major Announcements, by Mining Companies, 2020

- Table 39 : Metal and Mining Industry: Opportunities

- Table 40 : Major Announcements, by HVAC Companies, 2020

- Table 41 : Major Announcements, by Automotive Companies, 2020

- Table 42 : Automotive Industry: Opportunities

- Table 43 : Major Announcements, by Construction Companies, 2020

- Table 44 : Major Announcements, by Oil and Gas Companies, 2020

- Table 45 : Oil and Gas Industry: Opportunities

- Table 46 : Bioenergetic Processes, Biofuel Types and Feedstock Sources

- Table 47 : Global Market for Bioenergetic Products, by Physical State, Through 2027

- Table 48 : Global Market Volumes of Liquid Bioenergetic Products, by Generation, Through 2027

- Table 49 : Global Market Volumes of First-Generation Liquid Bioenergetic Products, by Biofuel Type, Through 2027

- Table 50 : Global Yearly RFS2 Program Biofuel Requirements, by Type, 2009-2022

- Table 51 : Global Market Volumes of Advanced Liquid Bioenergetic Production, by Type, Through 2027

- Table 52 : Global Production of Biofuel and Bioenergy per Unit of Land Area

- Table 53 : EPA's Final Volume Requirements Under the Renewable Fuel Standard Program, 2017-2023

- Table 54 : Common Gasoline Ethanol and Biodiesel Diesel Blends Available in Various Countries

- Table 55 : National and State/Provincial Biofuel Blend Mandate

- Table 56 : Global Market Volumes of Plant Oil Biofuels, by Type, Through 2027

- Table 57 : Global Market for Solid Bioenergetic Products, by Type, Through 2027

- Table 58 : Properties of Torrefied Wood and Charcoal

- Table 59 : Global Market for Charcoal, Industrial and Municipal Solid Waste (CIMSW), by Region, Through 2027

- Table 60 : Biogas Composition from Different Feedstocks

- Table 61 : Global Market for Gaseous Bioenergetic Products, by Type, Through 2027

- Table 62 : Non-bioenergetic Processes, Material Types and Feedstock Sources

- Table 63 : Global Market for Non-bioenergetic Products, by Product Group, Through 2027

- Table 64 : Global Market for Bioderived Chemicals, by Sector, Through 2027

- Table 65 : Global Market for Biotransform Platform Chemicals, by Type, Through 2027

- Table 66 : Global Market for Fermentation-Derived Fine Chemicals (Excluding Biofuels and Biopolymers), Through 2027

- Table 67 : Global Market for Bioderived Fine (Specialty) Chemicals, by Category, Through 2027

- Table 68 : Global Market for Bioderived Fine (Specialty) Chemicals, by Type, Through 2027

- Table 69 : Global Market for Production of Pharmaceutical Ingredients Using Biotransformation, by Type, Through 2027

- Table 70 : Phytochemicals Used as Pharmaceutical Additives/Ingredients

- Table 71 : List of Phytochemicals Used for Cosmetic Purposes

- Table 72 : Global Market for Bioproducts Used as Phytochemicals, by Type, Through 2027

- Table 73 : Global Market for Biodrugs and Herbals/Botanicals, by Type, Through 2027

- Table 74 : Pharmacognosy of the Top 10 Medicinal Plants

- Table 75 : Global Market for Herbal Drugs/Dietary Supplements, by Product, Through 2027

- Table 76 : Global Market for Botanical Dietary Supplements, by Product, Through 2027

- Table 77 : Global Market for Antibody Biodrugs, by Type, Through 2027

- Table 78 : Global Market for Bioplastics, by Compostability, Through 2027

- Table 79 : Current and Emerging Partially Biobased Plastics and Their Biodegradability

- Table 80 : Global Market for Biopolymer/Bioplastics, by Conversion, Through 2027

- Table 81 : Global Production Capacity for Bio-based/Non-biodegradable, Potentially Biobased and Biodegradable Plastics, Through 2027

- Table 82 : Global Market for Bio-based Composites, by Type, Through 2027

- Table 83 : Process Flow of Biomass Feedstocks to Bio-based Products to Market Applications

- Table 84 : Global Market for Biorefinery Products, by End Use, Through 2027

- Table 85 : Bioderived Products Technology Generations Matrix, by Feedstock

- Table 86 : Global Market for Bioderived Products, by Technology Generation, Through 2027

- Table 87 : Conversion Technologies

- Table 88 : Global Market for Biorefinery, by Technology Platform, Through 2027

- Table 89 : Global Market for Bioproducts, by Technology Platform, Through 2027

- Table 90 : Product Technology Development

- Table 91 : Global Number of Registered Biorefinery Patents, by Technology Platform, 2010-2016

- Table 92 : Global Market for Biorefinery Products, by Region, Through 2027

- Table 93 : Global Market Volumes of Advanced Bioenergetic Liquid Production, by Region, Through 2027

- Table 94 : Global Market for CIMSW, by Region, Through 2027

- Table 95 : Global Market for Pellets, Woody Chips and Briquettes (PWB), by Region, Through 2027

- Table 96 : Global Market for Pellets, Woody Chips and Briquettes (PWB), by Region, Through 2027

- Table 97 : Global Market for Gaseous Bioenergetic Products, by Region, Through 2027

- Table 98 : Global Market for Non-bioenergetic Products, by Region, Through 2027

- Table 99 : Global Market for Biodrugs and Herbals/Botanicals, by Region, Through 2027

- Table 100 : Global Production Capacity for Bio-based, Potentially Bio-based and Biodegradable Plastics, by Region, Through 2027

- Table 101 : Major Natural Fibers Producer Companies

- Table 102 : Global Market for Natural Fiber Composites, by Region, Through 2027

- Table 103 : Biofuel Product Development

- Table 104 : Bio-based Chemical Product Development

- Table 105 : Bio-based Plastics/Polymers Product Development

- Table 106 : Biocomposite Product Development

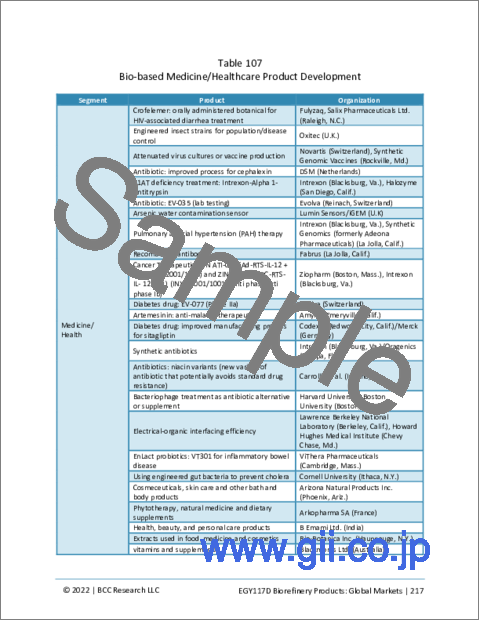

- Table 107 : Bio-based Medicine/Healthcare Product Development

- Table 108 : Biogas Product Development

- Table 109 : Wood Pellet/Chip/Log/Waste-to-Energy Product Development

- Table 110 : Biorefinery Industry Structure and Value-Added Activities

- Table 111 : Biorefinery Industry Activity Sectors

- Table 112 : Economics of Building a Biorefinery

- Table 113 : Basic Pathways for the Provision of Derived-Products from Biomass

- Table 114 : Upstream Advanced Biorefinery Value Chain

- Table 115 : Midstream Advanced Biorefinery Value Chain

- Table 116 : Companies Involved in Value Unlocking

- Table 117 : Companies Chasing Value Creation (New Feedstock/Products)

- Table 118 : Companies Involved in Value Adding (Existing Feedstocks)

- Table 119 : Downstream Advanced Biorefinery Value Chain

- Table 120 : Costing and Pricing in a Bioproduct Value Chain

- Table 121 : Number of Jobs in Bioderived Products Industry, by Region/Country, 2018-2020

- Table 122 : Employment Positions in Bioderived Products Industry

- Table 123 : Economic Impact of a 10 Million Gallon Biodiesel Plant in the U.S.*

- Table 124 : Multidisciplinary, Multi-Company Biorefinery Landscape

- Table 125 : Number of Biogreen Technology Strategic Investors, 2013-2018

- Table 126 : Major Blue-Chip Company Strategic Partnerships

- Table 127 : Companies with Significant Chemical Industry Partnerships

- Table 128 : Strategic Joint Ventures and Their Products

- Table 129 : Strategic Alliances in Bio-based Chemicals

- Table 130 : Network of Strategic Alliances

- Table 131 : Commodity Prices, 2017-2021

- Table 132 : World Bank Commodity Price Forecast, 2020-2024

- Table 133 : Global Population, by Region, Through 2025

- Table 134 : Global R&D Spending in Countries with Strong Biorefining Industries, 2020-2022

- Table 135 : Leading Countries in Key Technology Areas Where Biorefining Products are Applied, 2018

- Table 136 : Yearly Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars*, 2016-2021

- Table 137 : Main Case Scenario: International Bioethanol Trade, by Exporting Country, Through 2027

- Table 138 : Accelerated Case Scenario: International Bioethanol Trade, by Exporting Country, Through 2027

- Table 139 : International Biodiesel Trade, by Major Exporting Country, 2021-2027

- Table 140 : International Oilseed Export Trade, by Type, Through 2025

- Table 141 : International Oilseed Trade, by Major Exporting Country, Through 2025

- Table 142 : International Vegetable Oil Export Trade, by Type, Through 2025

- Table 143 : International Vegetable Oil Export Trade, by Major Export Country, Through 2025

- Table 144 : International Grain Export Trade, by Type, 2016/17-2020/21

- Table 145 : International Wheat Trade, by Major Export Country, 2016/17-2020/21

- Table 146 : International Rice Trade, by Major Export Country, 2016/17-2020/21

- Table 147 : International Coarse Grain Trade, by Major Export Country, 2016/17-2020/21

- Table 148 : International Maize (Corn) Trade, by Major Export Country, 2016/17-2020/21

- Table 149 : International Barley Trade, by Major Export Country, 2016/17-2020/21

- Table 150 : Global Exports of Wood Pellets, by Major Producer, Through 2025

- Table 151 : Global Exports of Essential Oils, by Major Producer, Through 2025

- Table 152 : Global Market Shares for Conventional Bioethanol, by Capacity, 2021

- Table 153 : Ethanol Biorefinery in U.S., by Capacity, 2022

- Table 154 : U.S Fuel Ethanol Capacity, by State, by Plants, 2021

- Table 155 : Global Market Shares for Conventional Bioethanol, by Capacity, 2021

- Table 156 : Biodiesel Production, by Country, 2021-2026

- Table 157 : U.S. Biodiesel Capacity, by State, by Plant, 2021

- Table 158 : Glycerol Company Market Capacity and Shares, 2021

- Table 159 : Industrial Biotechnology Company Sales, 2021

- Table 160 : Chemicals and Materials Company Market Shares Based on Sales, 2020

- Table 161 : Chemicals Capital Spending and R&D Spending and Shares, 2019

- Table 162 : Global Capacity and Shares for Fatty Hydroprocessed Esters and Acids (HEFA) "Drop-In" Biofuels, by Technology, 2020

- Table 163 : Global Capacity and Shares for Hydroprocessed Esters and Fatty Acids (HEFA) "Drop-In" Biofuels, 2015

- Table 164 : Global Capacity and Shares for Bio-Oil Production Companies, 2021

- Table 165 : Top 11 Flavor and Fragrance Company Market and Shares, 2018

- Table 166 : Top 10 Pharmaceutical Companies, by Prescription and Over-the-Counter Revenue and Shares, 2021

- Table 167 : Global Market for Selected Advanced Bioproducts, Through 2018

- Table 168 : Advanced Bioproducts Capacity in Asia-Pacific, Through 2018

- Table 169 : Producers of Bio-based, Potentially Bio-based and Biodegradable Plastics, Through 2018

- Table 170 : Global Pellet Companies' Capacity and Market Shares, 2017

- Table 171 : Market Shares of Commercial Cellulosic Biofuel Companies, 2021

- Table 172 : Policies and Legislation Affecting the Bioderived Products Industry

- Table 173 : Regulations and Legislation Affecting the Bioderived Industry

- Table 174 : Countries with Renewable Policies, Through 2012

- Table 175 : U.S. Biofuels Targets Mandated, by EISA

- Table 176 : Mandates Currently in Place, by Country

- Table 177 : Ethanol Blend Mandates for Major Countries

- Table 178 : Key Policy Instruments in Selected Countries

- Table 179 : Estimates of EU-27 Government Subsidies, Including Mandates, for Liquid Biofuels Used in Transportation

- Table 180 : North American Government Subsidies, Including Mandates, for Liquid Biofuels Used in Transportation

- Table 181 : Asia-Pacific Government Subsidies, Including Mandates, for Liquid Biofuels Used in Transportation

- Table 182 : South American Government Subsidies, Including Mandates, for Liquid Biofuels Used in Transportation

- Table 183 : Country of Origin of Biofuel Companies in Africa

- Table 184 : Chemical Initiatives and Regulations Supporting Bio-based Chemicals

- Table 185 : National Instruments and Programs for the Sound Management of Chemicals and Materials

- Table 186 : Economic Instruments for Sound Management of Chemicals

- Table 187 : Methods and Tools Developed by Corporations for Chemical Hazard Assessment and Identification of Preferred Chemicals and Products

- Table 188 : Methods and Tools Developed by CSOs and NGOs for Chemical Hazard Assessment and Chemical and Product Prioritization

- Table 189 : Stakeholder Initiatives for Bio-based Products

- Table 190 : Policy Reactions to High Biofuels and Oil Prices, April 2022

- Table 191 : Abengoa: Key Financial Highlights, 2018-2020

- Table 192 : Abengoa: Company Overview

- Table 193 : Abengoa: Operating Segment

- Table 194 : Abengoa: Recent Developments, 2021-2022

- Table 195 : ADM: Key Financial Highlights, 2019-2021

- Table 196 : ADM: Company Overview

- Table 197 : ADM: Operating Segment

- Table 198 : ADM: Recent Developments, 2021-2022

- Table 199 : Amyris: Key Financial Highlights, 2019-2021

- Table 200 : Amyris: Company Overview

- Table 201 : Amyris: Operating Segment

- Table 202 : Amyris: Recent Developments, 2021-2022

- Table 203 : BASF: Key Financial Highlights, 2019-2021

- Table 204 : BASF: Company Overview

- Table 205 : BASF: Operating Segment

- Table 206 : BASF: Recent Developments, 2021-2022

- Table 207 : BP plc: Key Financial Highlights, 2019-2021

- Table 208 : BP plc: Company Overview

- Table 209 : BP plc: Operating Segment

- Table 210 : BP plc: Recent Developments, 2022

- Table 211 : Chevron Corp.: Key Financial Highlights, 2019-2021

- Table 212 : Chevron Corp.: Company Overview

- Table 213 : Chevron Corp.: Operating Segment

- Table 214 : Chevron Corp.: Recent Developments, 2021-2022

- Table 215 : Honeywell International Inc.: Key Financial Highlights, 2019-2021

- Table 216 : Honeywell International Inc.: Company Overview

- Table 217 : Honeywell International Inc.: Operating Segment

- Table 218 : Honeywell International Inc.: Recent Developments, 2021-2022

- Table 219 : Neste: Key Financial Highlights, 2019-2021

- Table 220 : Neste: Company Overview

- Table 221 : Neste: Operating Segment

- Table 222 : Neste: Recent Developments, 2021-2022

- Table 223 : Petrobras: Key Financial Highlights, 2019-2021

- Table 224 : Petrobras: Company Overview

- Table 225 : Petrobras: Operating Segment

- Table 226 : Petrobras: Recent Developments, 2022

- Table 227 : Valero: Key Financial Highlights, 2019-2021

- Table 228 : Valero: Company Overview

- Table 229 : Valero: Operating Segment

- Table 230 : Valero: Recent Developments, 2021

- Table 231 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market for Biorefinery Products, by Segment, 2021-2027

- Figure 1 : Schematic Representation of a Biorefinery

- Figure 2 : Bioproduct-Oriented Value Chain

- Figure 3 : Liquid Biofuel Employment, by Top 10 Countries, 2020

- Figure 4 : Applications of Biotechnology in Anthropogenic Activities (Industry, Agriculture, Medicine, Health, Environment)

- Figure 5 : Opportunities for Bio-based Products Based on H/C Ratio

- Figure 6 : Lockdowns and Economic Activity

- Figure 7 : Russian Share of Global Production, 2021

- Figure 8 : European Reliance on Russian Gas, 2022

- Figure 9 : Global Market for Bioenergetic Products, by Physical Segment, 2021-2027

- Figure 10 : Global Market for Solid Bioenergetic Products, by Type, 2021-2027

- Figure 11 : Global Market for Charcoal, Industrial and Municipal Solid Waste (CIMSW), by Region, 2021-2027

- Figure 12 : Global Market for Gaseous Bioenergetic Products, by Type, 2021-2027

- Figure 13 : Global Market for Non-bioenergetic Products, by Product Group, 2021-2027

- Figure 14 : Global Market for Bioderived Chemicals, by Sector, 2021-2027

- Figure 15 : Global Market for Biodrugs and Herbals/Botanicals, by Type, 2021-2027

- Figure 16 : Global Market for Bioplastics, by Compostability, 2020-2027

- Figure 17 : Global Market for Biobased Composites, by Type, 2021-2027

- Figure 18 : Global Market for Biorefinery Products, by End Use, 2021-2027

- Figure 19 : Worldwide Deployment of Biorefinery Plants, 2021

- Figure 20 : Number of Biorefineries, by Select Countries, 2021

- Figure 21 : Global Market for Pellets, Woody Chips and Briquettes (PWB), by Region, 2021-2027

- Figure 22 : Global Market for Gaseous Bioenergetic Products, by Region, 2021-2027

- Figure 23 : Global Market for Non-bioenergetic Products, by Region, 2021-2027

- Figure 24 : Global Market for Biodrugs and Herbals/Botanicals, by Region, 2021-2027

- Figure 25 : Global Market for Natural Fiber Composites, by Region, 2021-2027

- Figure 26 : Global Fragrance and Flavors Industry Market Share, 2021

- Figure 27 : Abengoa: Operating Segment Share, 2020

- Figure 28 : ADM: Operating Segment Share, 2021

- Figure 29 : Amyris: Operating Segment Share, 2020

- Figure 30 : BASF: Operating Segment Share, 2021

- Figure 31 : BP plc: Operating Segment Share, 2021

- Figure 32 : Chevron Corp.: Operating Segment Share, 2021

- Figure 33 : Honeywell International Inc.: Operating Segment Share, 2021

- Figure 34 : Neste: Operating Segment Share, 2021

- Figure 35 : Petrobras: Operating Segment Share, 2021

- Figure 36 : Valero: Operating Segment Share, 2021

Highlights:

The global market for biorefinery products is estimated to increase from $624.7 billion in 2022 to $920.0 billion by 2027, at a compound annual growth rate (CAGR) of 8.0% from 2022 through 2027.

The global market for non-bioenergetic biorefinery products is estimated to increase from $410.7 billion in 2022 to $647.6 billion by 2027, at a CAGR of 9.5% from 2022 through 2027.

The global market for bioenergetic biorefinery products is estimated to increase from $213.9 billion in 2022 to $272.3 billion by 2027, at a CAGR of 4.9% from 2022 through 2027.

Report Scope:

This research report quantifies the two categories of bioenergetic and non-bioenergetic bioproducts into seven major product segments: bio-derived chemicals, biofuels, pharmaceuticals (biodrugs and herbal/botanicals), biocomposite materials, biopolymers/bioplastics, biogas and biopower.

The report is divided into 16 chapters.

- Chapter Two analyzes demand by category, with a forecast to 2027.

- Chapter Three presents an overview that defines and quantifies biorefinery products and assesses market trends and categories/segments with a forecast to 2027.

- Chapter Four presents the history, opportunity and penetration of bio-products with a forecast to 2027.

- Chapter Five presents the impacts of COVID-19 and the Russia-Ukraine war on various end-use industries globally.

- Chapter Six presents the demand for bioenergetic bioproducts and analyzes the market for biofuels, biogas and wood pellets, with regional breakdowns and forecasts to 2027.

- Chapter Seven presents the demand for non-bioenergetic bioproducts and analyzes the market for chemicals, pharmaceuticals and biomaterials. These are quantified by type, with regional breakdowns and forecasts to 2027.

- Chapter Eight considers the applications of bioproducts and quantifies the demand in up to 11 key markets, offering forecasts to 2027.

- Chapter Nine considers the technology and quantifies demand by type of technology used for the conversion of biomass to bioproducts, offering estimates for 2027.

- Chapter Ten presents the region wise market for biorefinery products.

- Chapter Eleven discusses product development in the chemical, pharmaceutical, materials, power and fuel sectors, which will enable utilization of the biomass that Earth's biology produces every year.

- Chapter Twelve presents an analysis of the industry structure, showing how each market segment will interact over the next five years to 2027, including the macroeconomic factors that affect the global economy.

- Chapter Thirteen presents the international aspects, including market leadership. It also quantifies international trade in bioproducts with a forecast for 2027.

- Chapter Fourteen presents the market shares of the major companies involved in the manufacture of bio-based products and discusses these companies and products.

- Chapter Fifteen analyzes the regulatory environment of the biorefinery industry.

- Chapter Sixteen presents company product profiles and identifies the various companies involved in manufacturing these products.

A negative economic outlook has been assumed in all the segments for 2020 due to COVID-19. A negative impact due to the Russia-Ukraine war that started in February 2022 has also been considered in this report. The growing economies are assumed to attract key companies in the market and increase consumer spending.

Report Includes:

- 124 data tables and 109 additional tables

- A comprehensive overview and up-to-date analysis of the global markets for biorefinery products

- Analyses of the global market trends, with market revenue for 2021, estimates for 2022, and projections of compound annual growth rates (CAGRs) through 2027

- Estimation of the actual market size and market forecast for biorefinery products in value and volumetric terms, and their corresponding market share analysis based on product, technology, end-use application, and geographic region

- Highlights of the current and future market potential for two main types of biorefinery products (energetic/non-energetic), along with a detailed analysis of the competitive environment, industry outlook, and opportunities and penetration of bio-products

- Discussion of the value chain of basic products and the structure of the biorefinery industry and its interaction with the fossil-based industry

- A critical evaluation of the current status of commercial biorefinery markets and how recent environmental legislation and breakthroughs in technology will make the use of bio-based products competitive with established fossil-based platforms

- Holistic review of the effects of Covid-19 pandemic and the Russia-Ukraine war on the global biorefinery industry

- Updated information on the technology landscape of biorefinery products, conversion technologies, and number of registered patents for bioproducts (biochemicals, ethanol, biodiesel and biological materials)

- Insight into the end-users of biorefinery products, and assessment of the product technology development, and international trade and regulations within the biorefinery industry

- Descriptive company profiles of the market leading players, including Abengoa, ADM, Amyris, BASF, BP plc, Chevron Corp., Neste, and Petrobras

Table of Contents

Chapter 1 Introduction

- 1.1 Market Definition

- 1.2 Study Goals and Objectives

- 1.3 Reasons for Doing This Study

- 1.4 Intended Audience

- 1.5 What's New in This Update?

- 1.6 Scope of Report

- 1.7 Information Sources

- 1.8 Methodology

- 1.8.1 Currency

- 1.8.2 Unit Considered

- 1.9 Geographic Breakdown

- 1.10 Analyst's Credentials

- 1.11 BCC Custom Research

- 1.12 Related BCC Research Reports

Chapter 2 Summary and Highlights

Chapter 3 Market Overview

- 3.1 Introduction

- 3.1.1 Understanding Biorefinery Products

- 3.1.2 Understanding Biomass

- 3.2 Global Biomass Market Overview

- 3.3 Overview of Demand for Nonfood Biomass

- 3.3.1 Biomass Use for Energy

- 3.3.2 Biomass Use for Materials (Non-energy)

- 3.4 Overview of Global Biomass Demand by Use

- 3.4.1 Understanding Bioproducts and its Categorization

- 3.5 Global Market for Bioproducts

- 3.5.1 Global Market for Identified Bioenergetic Products

- 3.5.2 Global Market for Identified Non-bioenergetic Products

- 3.6 Overview of Bio-based Replacement of Petro-Based Products

- 3.7 Overview of the Bioproduct-Oriented Value Chain

- 3.8 Overview of the Market Segmentation of Bioproducts

- 3.9 Where Bioderived Products Fit in the Global Economy

- 3.10 Important Indications and Developments in the Bioderived Product Industry

- 3.11 Global Investment in the Biorefining Industry

- 3.12 Bio-based Product Terminology

- 3.12.1 Biopolymers/Biodegradable Polymers

- 3.12.2 Environmental Issues

- 3.12.3 Bio-based Products

- 3.12.4 Degradable and Biodegradable

- 3.12.5 Compostable vs. Biodegradable

- 3.13 Bio-based Products in the Chemical Industry

- 3.13.1 Bio-based Chemical Products

- 3.14 Factors Driving Market Growth

- 3.14.1 Climate Change and Environment

- 3.14.2 Innovations

- 3.14.3 Corporate Sustainability

- 3.14.4 Growing Industrial Activities in Emerging Economies

- 3.14.5 Growth in Industrial and Building Automation Technology

- 3.14.6 Growth in Automotive Industry in Emerging Economies

- 3.14.7 Growing Demand for Processed Food in Emerging Economies

- 3.14.8 Increasing Per Capita Income of Consumers

- 3.14.9 Shift in Consumer Preference from Conventional Packaging to Eco-Friendly Packaging Materials

- 3.14.10 Favorable Government Policies towards Green, Ecofriendly and Biodegradable Products

- 3.14.11 Technological Emergence and Development of New Bio-based and Renewable Raw Materials

- 3.15 Opportunities in the Market

- 3.15.1 Rising Awareness of Using Bio-based Lubricants

- 3.15.2 Rising Demand for Renewable Energy

- 3.15.3 Rising Industrial Growth in BRIC Countries

- 3.16 Industry Outlook

- 3.16.1 GDP Trends and Forecast of Major Economies

- 3.16.2 Lockdowns and Economic Activity

- 3.16.3 Crude Oil

- 3.16.4 Natural Gas

Chapter 4 History and Market Penetration of Bioproducts

- 4.1 History

- 4.1.1 Bioethanol

- 4.1.2 Biodiesel

- 4.1.3 Herbal/Botanical

- 4.1.4 Biodrugs

- 4.1.5 Wood Pellets

- 4.1.6 Biomaterials and Biocomposites

- 4.2 Bioproducts Market Opportunity

- 4.3 Bioproduct Market Penetration

- 4.3.1 Bioenergetic Bioproduct Market Penetration

- 4.3.2 Non-bioenergetic Products Market Penetration

Chapter 5 Impact of COVID-19 and Russia-Ukraine War

- 5.1 Impact of COVID-19

- 5.1.1 Disruption in Major Industries

- 5.1.2 Chemical Industry

- 5.1.3 Metal and Mining Industry

- 5.1.4 HVAC Industry

- 5.1.5 Automotive Industry

- 5.1.6 Construction Industry

- 5.1.7 Oil and Gas Industry

- 5.2 Impact of Russia-Ukraine War

- 5.2.1 Biofuel Industry

- 5.2.2 Chemical Industry

- 5.2.3 Metal and Mining Industry

- 5.2.4 HVAC Companies

- 5.2.5 Automotive Industry

- 5.2.6 Construction Industry

- 5.2.7 Oil and Gas Industry

Chapter 6 Global Market for Bioenergetic Products

- 6.1 Bioenergetic Products

- 6.2 Global Demand for Bioenergetic Products by Physical State/Type

- 6.2.1 Liquid Bioproducts

- 6.3 Advanced Biofuels

- 6.3.1 Global Demand for Bioenergetic Advanced Liquid Bioproducts

- 6.3.2 First-Generation and Advanced Bioenergetic Liquid Bioproducts Production per Unit of Land Area

- 6.4 U.S. Environmental Protection Agency's Final Rule

- 6.5 National Biofuel Blend Wall

- 6.6 State and Provincial Biofuel Blend Mandates

- 6.6.1 United States

- 6.6.2 EU-28

- 6.6.3 Brazil

- 6.7 Plant Oil Biofuel

- 6.7.1 Global Demand for Plant Oil Biofuel

- 6.7.2 Straight Vegetable Oil

- 6.7.3 Plant Oil-Diesel Blends as Fuel

- 6.7.4 Hydrotreated Oils

- 6.7.5 Bio-Oil and Other

- 6.8 Solid Bioenergetic Products

- 6.8.1 Demand for Solid Bioenergetic Products by Type

- 6.8.2 Pellets, Woody Chips and Briquettes

- 6.8.3 Charcoal, Industrial and Municipal Solid Waste (CIMSW)

- 6.9 Gaseous Bioenergetic Products

- 6.9.1 Global Demand for Gaseous Bioenergetic Products

Chapter 7 Global Market for Non-bioenergetic Products

- 7.1 Non-bioenergetic Products

- 7.1.1 Bioderived Chemicals

- 7.1.2 Fermentation-Derived Fine Chemicals Products

- 7.1.3 Bioderived Fine (Specialty) Chemicals

- 7.1.4 Pharmaceutical Ingredients Produced by Biotransformation

- 7.1.5 Phytochemicals

- 7.1.6 Biodrugs and Herbals/Botanicals

- 7.1.7 Biodrugs

- 7.1.8 Bioplastics/Biopolymers

Chapter 8 Global Market for Biorefinery Products by End Use

- 8.1 Introduction

- 8.2 Bioproduct End Uses

- 8.2.1 Industrial

- 8.2.2 Manufacturing

- 8.2.3 Transportation

- 8.2.4 Flame Retardants

- 8.2.5 Safe Food Supply

- 8.2.6 Environment

- 8.2.7 Communications

- 8.2.8 Construction/Housing

- 8.2.9 Recreation

- 8.2.10 Agriculture

- 8.2.11 Health and Hygiene

- 8.2.12 Energy

Chapter 9 Technology

- 9.1 Demand for Bioproducts by Type of Technology Generation

- 9.1.1 First-Generation Bioproducts

- 9.1.2 Second-Generation Bioproducts

- 9.1.3 Third-Generation Bioproducts

- 9.1.4 Fourth-Generation Bioproducts

- 9.1.5 Fifth-Generation Bioproducts

- 9.2 Demand for Bioproducts by Type of Conversion Technology

- 9.2.1 Thermochemical Conversion Technology

- 9.2.2 Physicochemical Technology

- 9.2.3 Biological Conversion Technology

- 9.2.4 Hybrid Technology Platform

- 9.3 Product Technology Development

- 9.4 Patent Evaluation

Chapter 10 Global Market for Biorefinery Products by Region

- 10.1 Introduction

- 10.2 Global Deployment of Biorefineries

- 10.3 Global Market for Biorefinery Products, by Region

- 10.3.1 Global Market Volumes of Advanced Bioenergetic Liquid Production, by Region

- 10.3.2 Global Demand for Charcoal, Industrial and Municipal Solid Waste, by Region

- 10.3.3 Pellets, Woody Chips and Briquettes

- 10.3.4 Global Market Volumes of Pellets, Woody Chips and Briquettes (PWB), by Region

- 10.3.5 Global Demand for Gaseous Bioenergetic Products, by Region

- 10.4 Global Market for Non-bioenergetic Products

- 10.4.1 Global Market for Bioderived Chemicals, by Region

- 10.5 Biodrugs and Herbals/Botanicals

- 10.5.1 Global Demand for Biodrugs and Herbals/Botanicals, by Region

- 10.6 Global Production Capacity for Bio-based, Potentially Bio-based and Biodegradable Plastics, by Region

- 10.6.1 North America

- 10.6.2 Europe

- 10.6.3 Asia-Pacific

- 10.6.4 South America

- 10.7 Demand for Bio-based Composites, by Region

- 10.7.1 North America

- 10.7.2 European Union

- 10.7.3 Asia-Pacific

- 10.7.4 South America

- 10.7.5 ROW

Chapter 11 Product Development

- 11.1 Biofuel Product Development

- 11.2 Bio-based Chemical Product Development

- 11.3 Bio-based Plastics/Polymer Product Development

- 11.4 Biocomposite Product Development

- 11.5 Bio-based Medicine/Healthcare Product Development

- 11.6 Biogas Product Development

- 11.7 Wood Pellet/Chip/Log Product Development

Chapter 12 Industry Structure and Competitive Rates

- 12.1 Biorefinery Industry Activity Sectors

- 12.2 Economics of Biorefineries

- 12.3 Pathways for the Provision of Bio-based Products

- 12.4 Value Addition/Creation/Unlocking Through Feedstock Control

- 12.4.1 Upstream: Controlling Feedstock Costs

- 12.4.2 Midstream: Value Creation, Value Unlocking and Value Addition

- 12.4.3 Downstream

- 12.5 Sales, Distribution and Supporting Industries

- 12.6 Employment, Working Conditions and Economic Impact

- 12.7 Economic Impact of Biorefinery

- 12.8 Major Trends

- 12.8.1 Strategic Investments, Partnerships, Alliances and Networks

- 12.8.2 Strategic Companies Investing in Biogreen Technology

- 12.8.3 Major Blue Chip Company Strategic Partnerships

- 12.9 Chemical Industry Partnerships

- 12.10 Strategic Joint Ventures

- 12.11 Strategic Alliances in Bio-based Chemicals

- 12.12 Network of Partners

Chapter 13 International Aspect

- 13.1 Global Commodity Prices

- 13.1.1 Crude Oil

- 13.1.2 Biofuels Feedstock

- 13.1.3 Natural Gas

- 13.1.4 Liquefied Natural Gas

- 13.1.5 Metals and Minerals

- 13.2 Global Population

- 13.2.1 North America

- 13.2.2 Asia-Pacific

- 13.2.3 Middle East and Africa

- 13.2.4 Europe

- 13.3 Global R&D Spending in Countries with Strong Biorefining Industries

- 13.4 Leading Countries in Key Technology Areas Where Biorefining Products are Applied

- 13.4.1 United States

- 13.4.2 EU

- 13.4.3 China

- 13.4.4 Japan

- 13.4.5 South Korea

- 13.4.6 ROW

- 13.5 International Currency Exchange Rates

- 13.6 International Trade in Key Bioproducts

- 13.6.1 Liquid Biofuels

- 13.6.2 Grains

- 13.6.3 Wood Pellets

- 13.6.4 Essential Oils

Chapter 14 Market Share

- 14.1 Bioethanol

- 14.1.1 Archer Daniels Midland

- 14.1.2 Green Plains Renewable Energy

- 14.1.3 Poet

- 14.1.4 Valero Energy Corp.

- 14.1.5 Cosan

- 14.2 Biodiesel

- 14.2.1 Neste Oil

- 14.2.2 Dynoil LLC

- 14.2.3 Brazil Eco Energia

- 14.2.4 Dominion Energy Services LLC

- 14.2.5 SE Energy

- 14.2.6 Menlo Energy LLC

- 14.2.7 Imperium Renewables

- 14.2.8 Louis Dreyfus

- 14.2.9 Canadian Green Fuels

- 14.2.10 Others

- 14.3 Glycerol

- 14.4 Biotechnology Company Shares

- 14.5 Chemicals and Materials

- 14.5.1 BASF

- 14.5.2 Sinopec

- 14.5.3 Dow Chemical

- 14.5.4 SABIC

- 14.5.5 ExxonMobil

- 14.6 2022 Capital Investment, by Chemical Companies

- 14.6.1 Dow Chemicals

- 14.6.2 BASF

- 14.6.3 Ashland Inc.

- 14.6.4 LyondellBasell

- 14.7 Hydroprocessed Esters Fatty Acids (HEFA): Chemicals, Capital Spending, R&D Spending and Shares

- 14.7.1 Neste Oil

- 14.7.2 Others

- 14.8 Bio-Oil Production

- 14.8.1 KiOR

- 14.8.2 Others

- 14.9 Market Shares of Essential Oil Companies

- 14.9.1 Frutarom

- 14.9.2 Symrise

- 14.9.3 Robertet

- 14.9.4 Mane

- 14.9.5 Givaudan

- 14.9.6 Sensient F&F

- 14.9.7 IFF

- 14.9.8 T. Hasegawa

- 14.9.9 Firmenich

- 14.9.10 Huaboa International

- 14.9.11 Takasago

- 14.10 2021 Market Share of Global Fragrance and Flavors Industry

- 14.11 Pharmaceutical Company Market Shares

- 14.11.1 Pfizer Inc. (U.S.)

- 14.11.2 Roche (Switzerland)

- 14.11.3 Novartis AG (Switzerland)

- 14.12 Advanced Biofuel Market Shares

- 14.13 Biopolymer/Bioplastics

- 14.13.1 NatureWorks

- 14.13.2 Purac

- 14.13.3 Dow Chemical

- 14.13.4 Braskem

- 14.14 Pellets

- 14.14.1 Enova Wood Pellet Group

- 14.14.2 General Biofuels Georgia

- 14.14.3 Fram Renewable Fuels

- 14.14.4 Drax Group

- 14.14.5 German Pellets

- 14.14.6 Zilkha Biomass

- 14.14.7 New Biomass Energy LLC

- 14.14.8 Thermogen Industries

- 14.14.9 2021 Scenario of Pellet Companies

- 14.15 Commercial Cellulosic Biofuel Company Shares

- 14.15.1 Poet-DSM Advanced Biofuels LLC

- 14.15.2 Abengoa Bioenergy

- 14.15.3 DuPont

- 14.15.4 Quad County Corn Processors

- 14.15.5 Renewable Energy Group

- 14.15.6 Yield 10 Bioscience Inc.

- 14.15.7 EcoSynthetix Inc.

Chapter 15 Regulations, Legislation, Mandates, Policies and Incentives

- 15.1 Introduction

- 15.2 Regulations and Legislation

- 15.3 Mandates and Support Policies

- 15.4 U.S. Biofuels Targets Mandated, by EISA

- 15.5 Mandates Currently in Place in Other Countries

- 15.6 Key Policy Instruments in Selected Countries

- 15.7 Government Subsidies, Including Mandates for Liquid Biofuels Used in Transportation for Top Biofuel-Producing Countries

- 15.7.1 European Union

- 15.7.2 United States

- 15.7.3 Asia-Pacific

- 15.7.4 South America

- 15.7.5 Africa

- 15.8 Instruments and Approaches for the Sound Management of Chemicals and Materials

- 15.9 Stakeholder Initiatives

- 15.9.1 Policy Reactions to High Biofuel and Oil Prices

Chapter 16 Company Profiles

- 16.1 Profiles of Top Companies

- ABENGOA

- ADM

- AMYRIS

- BASF

- BP PLC

- CHEVRON CORP.

- HONEYWELL INTERNATIONAL INC.

- NESTE

- PETROBRAS

- VALERO

Chapter 17 Appendix: Other Biorefinery Companies and Acronyms

- 17.1 Biorefineries

- 17.1.1 Integrated Biorefinery

- 17.1.2 Biodiesel

- 17.1.3 Cellulosic Biorefineries

- 17.2 Biofuels

- 17.2.1 Genetic Engineering

- 17.2.2 Renewable Biodiesel

- 17.2.3 Cellulosic Gasoline and Diesel

- 17.2.4 Cyanobacteria

- 17.2.5 Industrial Enzymes

- 17.2.6 Biofuel Enzymes

- 17.2.7 Genome Engineering

- 17.2.8 Engineered Enzymes

- 17.2.9 Enzymatic Hydrolysis and Pyrolysis/Gasification

- 17.2.10 Renewable Oil and Bioproducts

- 17.2.11 Grain Ethanol

- 17.3 Chemicals

- 17.3.1 Bio-based Propylene Glycol

- 17.3.2 Ethylene Glycol (EG)

- 17.3.3 D(-) Lactic Acid

- 17.3.4 Glucaric Acid

- 17.3.5 C4-C6 Chemicals

- 17.3.6 Bio-based Nylon

- 17.3.7 Fatty Acids

- 17.3.8 Isobutanol

- 17.3.9 Squalane

- 17.3.10 Succinic Acid

- 17.3.11 Bio-based Gamma-Butyrolactone (GBL)/1,4-Butanediol (BDO) and Bio-based Acrylic Acid

- 17.3.12 1,4-Butanediol

- 17.3.13 Pellets/Chips/Logs

- 17.4 Biogas

- 17.5 Materials

- 17.5.1 Pet Bottle Containing Bioplastics

- 17.5.2 Benzene, Toluene and Xylene (BTX)

- 17.5.3 Furan Dicarboxylic Acid (FDCA)

- 17.5.4 Bioacrylic

- 17.6 Biopolymers

- 17.7 Biocomposites

- 17.8 Biopower

- 17.8.1 Electricity

- 17.8.2 Sale of Excess Biomass Power

- 17.8.3 Biomass Waste Utilization

- 17.8.4 Wood Pellets

- 17.9 Seeds

- 17.9.1 Amylase Corn

- 17.10 BioDrugs and Herbals/Botanicals

- 17.10.1 Biopharming

- 17.10.2 Natural Skincare Products

- 17.10.3 Vanillin

- 17.10.4 Genetically Modified Yeast

- 17.10.5 Valencene (Citrus Flavoring)

- 17.11 Medicine and Healthcare

- 17.11.1 Engineered Insect Strains

- 17.11.2 Attenuated Virus Cultures

- 17.11.3 Cephalexin

- 17.11.4 Palifosfamide

- 17.11.5 Genetically Engineered Plant Cells

- 17.11.6 Botanical Preparation

- 17.12 Acronyms