|

|

市場調査レポート

商品コード

1799448

麻酔および呼吸器デバイス:世界市場Anesthesia and Respiratory Devices: Global Markets |

||||||

|

|||||||

| 麻酔および呼吸器デバイス:世界市場 |

|

出版日: 2025年08月06日

発行: BCC Research

ページ情報: 英文 178 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の麻酔および呼吸器デバイスの市場規模は、2025年の519億米ドルから、予測期間中はCAGR 7.6%で推移し、2030年末には748億米ドルに達すると予測されています。

北米市場は、2025年の211億米ドルから、予測期間中はCAGR 7.8%で推移し、2030年末には307億米ドルに達すると予測されています。アジア太平洋地域市場は、2025年の97億米ドルから、予測期間中はCAGR 9.7%で推移し、2030年末には153億米ドルに達すると予測されています。

当レポートでは、世界の麻酔および呼吸器デバイスの市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と成長要因

- 新興技術

- セグメント分析

- 地域分析

- 総論

第2章 市場概要

- 麻酔および呼吸器の種類

- 麻酔科の動向

- 麻酔機器の主な動向

- 呼吸器機器の主な動向

- 麻酔・呼吸器系機器に関する主要な統計調査のハイライト

- マクロ経済要因分析

- ポーターのファイブフォース分析

第3章 市場力学

- 重要ポイント

- 市場促進要因

- 外科手術件数の増加

- 世界中で高齢化が進む

- 睡眠障害治療機器の需要

- 大気汚染が呼吸器の健康に与える影響

- COPD症例の増加

- 市場抑制要因

- 麻酔とその機器の副作用

- 高度なデバイスの高コスト

- 訓練を受けた人材の不足

- 制限とリコール

- 市場機会

- 新製品とアプリのリリース

- 麻酔・呼吸器機器のデジタル化

第4章 業界展望:規制の枠組み

- 米国の規制枠組み

- 分類

- 市場承認

- 市販後調査

- EUにおける規制枠組み

- 分類

- 市場承認

- 固有デバイス識別

- 市販後調査

- 日本の規制枠組み

- 分類

- 市場承認

- 市販後調査

- インドの規制枠組み

- 分類

- 市場承認

- 市販後調査

- 中国の規制枠組み

- 分類

- 市販後調査

第5章 新興技術と開発

- 概要

- 閉ループ麻酔システム

- 全静脈麻酔の登場

- 高度な換気技術

- 超音波ガイド下麻酔

- 特許分析

- 主な調査結果

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場内訳:製品別

- 重要ポイント

- 呼吸器系デバイス

- 呼吸測定デバイス

- 麻酔デバイス

- 気道管理デバイス

- 睡眠時無呼吸症候群デバイス

- 呼吸用消耗品

- 麻酔用消耗品

- 地理的内訳

- 市場分析:地域別

- 重要ポイント

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第7章 競合情報

- 重要ポイント

- 競合情勢

- 主要企業の世界市場シェア

- 主な展開・戦略

- パートナーシップとコラボレーション

- 事業拡大

- 製品の発売、機能強化、拡張

- 買収

- 競合SWOT分析

第8章 麻酔および呼吸器デバイス業界における持続可能性

- ESGの機能の概要

- ESGの実施における主な課題

- ESGランキング

- 麻酔・呼吸器機器業界におけるESGの実践

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- BCCの総論

第9章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- ADVACARE PHARMA

- AMBU A/S

- B. BRAUN SE

- BD

- DRAGERWERK AG & CO. KGAA.

- F. HOFFMANN-LA ROCHE LTD.

- FISHER & PAYKEL HEALTHCARE LTD.

- GE HEALTHCARE

- ICU MEDICAL INC.

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- MEDTRONIC

- MERA

- RESMED

- TELEFLEX INC.

- 新興スタートアップ企業や市場のディスラプター

List of Tables

- Summary Table : Global Market for Anesthesia and Respiratory Devices, by Region, Through 2030

- Table 1 : Anesthesia Machines, Product Matrix, 2025

- Table 2 : Ventilator Equipment and Related Accessories and Services, Product Matrix, 2025

- Table 3 : Macroeconomic Factors Analysis

- Table 4 : Porter's Five Forces Analysis

- Table 5 : Regional Anesthesia Techniques for Cancer Patients

- Table 6 : Cardiac Surgical Volumes per 100,000 Population, 2024

- Table 7 : Causes of Sleep Disorder in ResMed Surveyed Countries, 2024

- Table 8 : Recall of Anesthesia and Respiratory Devices, 2025

- Table 9 : Product Approvals and Launches, 2022-2025

- Table 10 : Philips Devices Recalled by the FDA, 2024

- Table 11 : ResMed Devices Recalled by the FDA, 2024

- Table 12 : Anesthesia-Related Regulatory Bodies and Societies in Europe, 2024

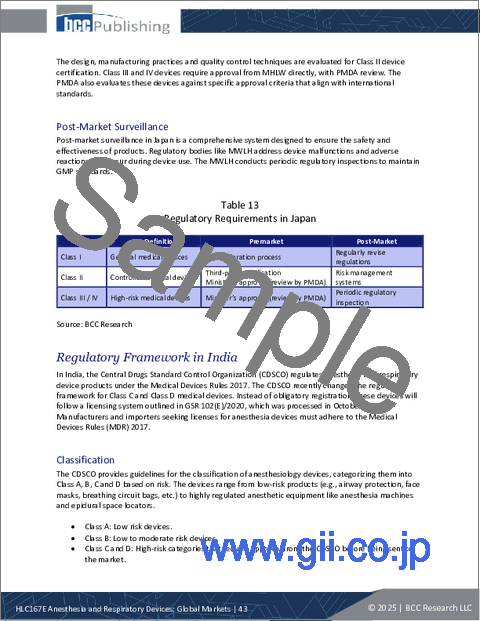

- Table 13 : Regulatory Requirements in Japan

- Table 14 : Regulation of Anesthesia and Respiratory Devices in India

- Table 15 : Published Patents for Anesthesia and Respiratory Devices, 2024 and 2025

- Table 16 : Global Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 17 : Global Market for Respiratory Devices, by Region, Through 2030

- Table 18 : Global Market for Respiratory Measurement Devices, by Region, Through 2030

- Table 19 : Global Market for Anesthesia Machines, by Region, Through 2030

- Table 20 : Applications and Ethical Considerations on Anesthesia Use

- Table 21 : Global Market for Airway Management Devices, by Region, Through 2030

- Table 22 : Everyday Use of Airway Management Devices

- Table 23 : Global Market for Sleep Apnea Devices, by Region, Through 2030

- Table 24 : Global Market for Respiratory Disposables, by Region, Through 2030

- Table 25 : Global Market for Anesthesia Disposables, by Region, Through 2030

- Table 26 : Global Market for Anesthesia and Respiratory Devices, by Region, Through 2030

- Table 27 : North American Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 28 : North American Market for Anesthesia and Respiratory Devices, by Country, Through 2030

- Table 29 : European Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 30 : European Market for Anesthesia and Respiratory Devices, by Country, Through 2030

- Table 31 : Asia-Pacific Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 32 : Asia-Pacific Market for Anesthesia and Respiratory Devices, by Country, Through 2030

- Table 33 : South American Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 34 : South American Market for Anesthesia and Respiratory Devices, by Country/Region, Through 2030

- Table 35 : Total Cases of Respiratory Viruses, 2020-2024

- Table 36 : MEA Market for Anesthesia and Respiratory Devices, by Product, Through 2030

- Table 37 : MEA Market for Anesthesia and Respiratory Devices, by Region, Through 2030

- Table 38 : African Countries with CTS Procedures, 2024

- Table 39 : Key Partnerships and Collaborations in the Anesthesia and Respiratory Devices Market, 2022-2024

- Table 40 : Business Expansion Activities in the Anesthesia and Respiratory Devices Market, 2022-2025

- Table 41 : Product Launches and Product Approvals in the Anesthesia and Respiratory Devices Market, 2022-2025

- Table 42 : Key Acquisitions in the Anesthesia and Respiratory Devices Market, 2022-2024

- Table 43 : ESG Rankings for the Anesthesia and Respiratory Devices Industry, 2025*

- Table 44 : ESG Practices: Environmental Performance

- Table 45 : ESG Practices: Social Performance

- Table 46 : ESG Practices: Governance Performance

- Table 47 : Abbreviations Used in the Report

- Table 48 : AdvaCare Pharma: Company Snapshot

- Table 49 : AdvaCare Pharma: Product Portfolio

- Table 50 : Ambu A/S: Company Snapshot

- Table 51 : Ambu A/S: Financial Performance, FY 2023 and 2024

- Table 52 : Ambu A/S: Product Portfolio

- Table 53 : Ambu A/S: News/Key Developments, 2022-2025

- Table 54 : B. Braun SE.: Company Snapshot

- Table 55 : B. Braun SE.: Financial Performance, FY 2023 and 2024

- Table 56 : B. Braun SE: Product Portfolio

- Table 57 : B. Braun SE: News/Key Developments, 2024-2025

- Table 58 : BD: Company Snapshot

- Table 59 : BD: Financial Performance, FY 2023 and 2024

- Table 60 : BD: Product Portfolio

- Table 61 : BD: News/Key Developments, 2023-2024

- Table 62 : Dragerwerk AG & Co. KGaA.: Company Snapshot

- Table 63 : Dragerwerk AG & Co. KGaA.: Financial Performance, FY 2023 and 2024

- Table 64 : Dragerwerk AG & Co. KGaA.: Product Portfolio

- Table 65 : Dragerwerk AG & Co. KGaA.: News/Key Developments, 2023-2025

- Table 66 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 67 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2023 and 2024

- Table 68 : F. Hoffmann-La Roche Ltd: Product Portfolio

- Table 69 : F. Hoffmann-La Roche Ltd.: News/Key Developments, 2021-2024

- Table 70 : Fisher & Paykel Healthcare Ltd.: Company Snapshot

- Table 71 : Fisher & Paykel Healthcare Ltd.: Financial Performance, FY 2023 and 2024

- Table 72 : Fisher & Paykel Healthcare Ltd.: Product Portfolio

- Table 73 : Fisher & Paykel Healthcare Ltd.: News/Key Developments, 2024-2025

- Table 74 : GE HealthCare: Company Snapshot

- Table 75 : GE HealthCare: Financial Performance, FY 2023 and 2024

- Table 76 : GE HealthCare: Product Portfolio

- Table 77 : GE Healthcare: News/Key Developments, 2022-2024

- Table 78 : ICU Medical Inc.: Company Snapshot

- Table 79 : ICU Medical Inc.: Financial Performance, FY 2023 and 2024

- Table 80 : ICU Medical Inc.: Product Portfolio

- Table 81 : ICU Medical Inc.: News/Key Developments, 2022-2025

- Table 82 : Koninklijke Philips N.V.: Company Snapshot

- Table 83 : Koninklijke Philips N.V.: Financial Performance, FY 2023 and 2024

- Table 84 : Koninklijke Philips N.V.: Product Portfolio

- Table 85 : Koninklijke Philips N.V.: News/Key Developments, 2024

- Table 86 : Masimo: Company Snapshot

- Table 87 : Masimo: Financial Performance, FY 2023 and 2024

- Table 88 : Masimo: Product Portfolio

- Table 89 : Masimo: News/Key Developments, 2023-2024

- Table 90 : Medtronic: Company Snapshot

- Table 91 : Medtronic: Financial Performance, FY 2022 and 2023

- Table 92 : Medtronic: Product Portfolio

- Table 93 : Medtronic: News/Key Developments, 2022-2024

- Table 94 : MERA: Company Snapshot

- Table 95 : MERA: Product Portfolio

- Table 96 : MERA: News/Key Developments, 2021

- Table 97 : ResMed: Company Snapshot

- Table 98 : Resmed: Financial Performance, FY 2022 and 2023

- Table 99 : ResMed: Product Portfolio

- Table 100 : ResMed: News/Key Developments, 2022-2025

- Table 101 : Teleflex Inc.: Company Snapshot

- Table 102 : Teleflex Inc.: Financial Performance, FY 2024 and 2024

- Table 103 : Teleflex Inc.: Product Portfolio

- Table 104 : Teleflex Inc.: News/Key Developments, 2023-2025

- Table 105 : List of Emerging Startups

List of Figures

- Summary Figure : Global Market Shares of Anesthesia and Respiratory Devices, by Region, 2024

- Figure 1 : Collaborative Research Highlights of Anesthesia and Cardiothoracic Research, 2025

- Figure 2 : Surgical Volume per Year (Reporting Countries), 2020-2023

- Figure 3 : Market Dynamics of Anesthesia and Respiratory Devices

- Figure 4 : Transplantation of Organs, 2024

- Figure 5 : ResMed Sleep Survey, 2024

- Figure 6 : Diseases Occurring from Air Pollution, 2024

- Figure 7 : Average Years of Life Lost Due to Long-Term Exposure to PM2.5 in Europe, 2025

- Figure 8 : Global Prevalence of COPD, by Sex and Age Group, 2024

- Figure 9 : Global Prevalence of COPD, by Country, 2024

- Figure 10 : 510(k) Submission Pathways for Anesthesia and Respiratory Devices

- Figure 11 : Emerging Technologies in the Anesthesia and Respiratory Devices Market

- Figure 12 : Global Market Shares of Anesthesia and Respiratory Devices, by Product, 2024

- Figure 13 : Global Market Shares of Respiratory Devices, by Region, 2024

- Figure 14 : Global Market Shares of Respiratory Measurement Devices, by Region, 2024

- Figure 15 : Global Market Shares of Anesthesia Machines, by Region, 2024

- Figure 16 : Global Market Shares of Airway Management Devices, by Region, 2024

- Figure 17 : Global Market Shares of Sleep Apnea Devices, by Region, 2024

- Figure 18 : Global Market Shares of Respiratory Disposables, by Region, 2024

- Figure 19 : Companies Manufacturing Respiratory Disposables

- Figure 20 : Global Market Shares of Anesthesia Disposables, by Region, 2024

- Figure 21 : Global Market Shares of Anesthesia and Respiratory Devices, by Region, 2024

- Figure 22 : North American Market Shares of Anesthesia and Respiratory Devices, by Country, 2024

- Figure 23 : COPD Occurrence in the U.S States, 2023

- Figure 24 : European Market Shares of Anesthesia and Respiratory Devices, by Country, 2024

- Figure 25 : Emergency Hospital Admissions in England, 2024

- Figure 26 : Asia-Pacific Market Shares of Anesthesia and Respiratory Devices, by Country, 2024

- Figure 27 : South American Market Shares of Anesthesia and Respiratory Devices, by Country/Region, 2024

- Figure 28 : MEA Market Shares of Anesthesia and Respiratory Devices, by Region, 2024

- Figure 29 : Company Market Share Analysis, 2024

- Figure 30 : SWOT Analysis of Competitors in the Anesthesia and Respiratory Devices Market, 2024

- Figure 31 : Key ESG Trends in the Anesthesia and Respiratory Devices Industry

- Figure 32 : Key ESG Trends in the Anesthesia and Respiratory Devices Industry

- Figure 33 : Ambu A/S.: Revenue Shares, by Business Unit, FY 2024

- Figure 34 : Ambu A/S.: Revenue Shares, by Country/Region, FY 2024

- Figure 35 : B. Braun SE: Revenue Shares, by Business Unit, FY 2024

- Figure 36 : B. Braun SE: Revenue Shares, by Country/Region, FY 2024

- Figure 37 : BD: Revenue Shares, by Business Unit, FY 2024

- Figure 38 : BD: Revenue Shares, by Country/Region, FY 2024

- Figure 39 : Dragerwerk AG & Co. KGaA.: Revenue Shares, by Business Unit, FY 2024

- Figure 40 : Dragerwerk AG & Co. KGaA.: Revenue Shares, by Country/Region, FY 2024

- Figure 41 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Business Unit, FY 2024

- Figure 42 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Country/Region, FY 2024

- Figure 43 : Fisher & Paykel Healthcare Ltd.: Revenue Shares, by Business Segment, FY 2024

- Figure 44 : Fisher & Paykel Healthcare Ltd.: Revenue Shares, by Country/Region, FY 2024

- Figure 45 : GE HealthCare: Revenue Shares, by Business Unit, FY 2024

- Figure 46 : GE HealthCare: Revenue Shares, by Country/Region, FY 2024

- Figure 47 : ICU Medical Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 48 : ICU Medical Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 49 : Koninklijke Philips N.V.: Revenue Shares, by Business Unit, FY 2024

- Figure 50 : Koninklijke Philips N.V.: Revenue Shares, by Country/Region, FY 2024

- Figure 51 : Masimo: Revenue Shares, by Business Unit, FY 2024

- Figure 52 : Masimo: Revenue Shares, by Country/Region, FY 2024

- Figure 53 : Medtronic: Revenue Shares, by Business Unit, FY 2023

- Figure 54 : Medtronic: Revenue Shares, by Country/Region, FY 2023

- Figure 55 : ResMed: Revenue Shares, by Business Unit, FY 2023

- Figure 56 : ResMed: Revenue Shares, by Country/Region, FY 2023

- Figure 57 : Teleflex Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 58 : Teleflex Inc.: Revenue Shares, by Country/Region, FY 2024

The global market for anesthesia and respiratory devices is expected to grow from $51.9 billion in 2025 and is projected to reach $74.8 billion by the end of 2030, at a compound annual growth rate (CAGR) of 7.6% during the forecast period of 2025 to 2030.

The North American market for anesthesia and respiratory devices is expected to grow from $21.1 billion in 2025 and is projected to reach $30.7 billion by the end of 2030, at a CAGR of 7.8% during the forecast period of 2025 to 2030.

The Asia-Pacific market for anesthesia and respiratory devices is expected to grow from $9.7 billion in 2025 and is projected to reach $15.3 billion by the end of 2030, at a CAGR of 9.7% during the forecast period of 2025 to 2030.

Report Scope

The report provides an overview of the global markets for anesthesia and respiratory devices and analyzes market trends. The report includes global revenue ($ million) for base year 2024, estimated data for 2025 and a forecast through 2030. The market is segmented based on products and region. The regions covered in this study include North America, Europe, Asia-Pacific, South America, and the Middle East and Africa, with a focus on major countries in these regions.

The report examines the driving trends and challenges in the market and vendor landscapes. It also analyzes environmental, social and governance (ESG) developments and discusses the regulations and emerging technologies used in anesthesia and respiratory devices.

The report concludes with an analysis of the competitive landscape, providing the ranking/share of key global markets for companies producing anesthesia and respiratory devices. A dedicated section of company profiles for major anesthesia and respiratory devices is also included.

Report Includes

- 33 data tables and 73 additional tables

- An analysis of the global market for anesthesia and respiratory devices

- Analyses of the global market trends, with historic revenue data from 2022 to 2024, estimates for 2025, and projected CAGRs through 2030

- Estimates of the market's size and revenue prospects, along with a corresponding market share analysis on the basis of product type and sub-type, and region

- Facts and figures pertaining to market dynamics, technological advancements, regulations, industry structure and the impacts of macroeconomic variables

- Insights derived from Porter's Five Forces model, global supply chain and SWOT analyses

- Patent analysis, and emerging trends and developments in patent activity

- An overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of the leading companies, including F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., ResMed, Teleflex Inc., GE Healthcare, and Medtronic

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Market Dynamics and Growth Factors

- Emerging Technologies

- Segmental Analysis

- Regional Analysis

- Conclusion

Chapter 2 Market Overview

- Introduction

- Types of Anesthesia and Respiratory Devices

- Trends in Anesthesiology

- Key Trends in Anesthesia Devices

- Key Trends in Respiratory Devices

- Key Statistical Research Highlights in Anesthesia and Respiratory Devices

- Macroeconomic Factors Analysis

- Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry and Degree of Competition

Chapter 3 Market Dynamics

- Key Takeaways

- Market Drivers

- Increase in the Number of Surgical Procedures

- Growing Aging Population Worldwide

- Demand for Devices to Treat Sleep Disorders

- Impact of Air Pollution on Respiratory Health

- Increase in COPD Cases

- Market Restraints

- Side Effects of Anesthesia and Its Devices

- High Cost of Advanced Devices

- Shortage of Trained Personnel

- Restrictions and Recalls

- Market Opportunities

- New Products and Apps Launches

- Digitalization in Anesthesia and Respiratory Devices

Chapter 4 Industry Outlook: Regulatory Framework

- Regulatory Framework in the U.S.

- Classification

- Market Authorization

- Post-Market Surveillance

- Regulatory Framework in the EU

- Classification

- Market Authorization

- Unique Device Identification

- Post-Market Surveillance

- Regulatory Framework in Japan

- Classification

- Market Authorization

- Post-Market Surveillance

- Regulatory Framework in India

- Classification

- Market Authorization

- Post-Market Surveillance

- Regulatory Framework in China

- Classification

- Post-Market Surveillance

Chapter 5 Emerging Technologies and Developments

- Overview

- Closed-Loop Anesthesia Systems

- Emergence of Total Intravenous Anesthesia

- Advanced Ventilation Techniques

- Ultrasound-Guided Anesthesia

- Patent Analysis

- Key Findings

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- Market Breakdown by Product

- Key Takeaways

- Respiratory Devices

- Respiratory Measurement Devices

- Anesthesia Machines

- Airway Management Devices

- Sleep Apnea Devices

- Respiratory Disposables

- Anesthesia Disposables

- Geographic Breakdown

- Market Analysis by Region

- Key Takeaways

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Chapter 7 Competitive Intelligence

- Key Takeaways

- Competitive Landscape

- Global Market Shares of Leading Companies

- Key Developments and Strategies

- Partnerships and Collaborations

- Business Expansions

- Product Launches, Enhancements and Expansions

- Acquisitions

- SWOT Analysis of Anesthesia and Respiratory Device Competitors

- Strengths

- Weakness

- Opportunities

- Threats

Chapter 8 Sustainability in the Anesthesia and Respiratory Devices Industry

- Introduction

- Snapshot on the Functions of ESG

- Key Challenges to Implementing ESG Practices

- ESG Ranking

- ESG Practices in the Anesthesia and Respiratory Devices Industry

- Environmental Performance

- Social Performance

- Governance Performance

- Concluding Remarks from BCC Research

Chapter 9 Appendix

- Research Methodology

- References

- Abbreviations

- Company Profiles

- ADVACARE PHARMA

- AMBU A/S

- B. BRAUN SE

- BD

- DRAGERWERK AG & CO. KGAA.

- F. HOFFMANN-LA ROCHE LTD.

- FISHER & PAYKEL HEALTHCARE LTD.

- GE HEALTHCARE

- ICU MEDICAL INC.

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- MEDTRONIC

- MERA

- RESMED

- TELEFLEX INC.

- Few Emerging Startups/Market Disruptors