|

|

市場調査レポート

商品コード

1799445

冷媒の世界市場 2025Refrigerants: Global Markets |

||||||

|

|||||||

| 冷媒の世界市場 2025 |

|

出版日: 2025年08月20日

発行: BCC Research

ページ情報: 英文 213 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の冷媒の市場規模は、2024年の259億米ドル、2025年の272億米ドルから、予測期間中はCAGR 6.2%で推移し、2030年には367億米ドルに達すると予測されています。

合成冷媒市場は2024年の166億米ドル、2025年の173億米ドルから、CAGR 5%で推移し、2030年には221億米ドルに達すると予測されています。天然冷媒の市場は2024年の92億米ドル、2025年の98億米ドルから、予測期間中はCAGR 8.2%で推移し、2030年には146億米ドルに達すると予測されています。

当レポートでは、世界の冷媒の市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 技術の進歩と応用

- 市場力学と成長要因

- 将来の動向と発展

- セグメント分析

- 地域市場および新興市場

- 総論

第2章 市場概要

- 市場定義

- 冷媒の分類

- 可燃性に基づく分類

- 沸点に基づく分類

- 冷媒の種類

- 一次冷媒

- 二次冷媒

- サプライチェーン分析

- 原材料とサプライヤー

- 製造および加工

- 流通と販売

- エンドユーザー

- 輸出入分析

- 米国の関税の影響

第3章 市場力学

- 市場力学

- ハイライト

- 市場促進要因

- 冷蔵・空調設備の需要増加

- 製薬業界における冷媒の需要

- 自動車産業における冷媒の使用

- 市場抑制要因

- 低GWP冷媒と改修に伴うコスト

- 環境および安全規制

- 市場の課題

- 毒性と可燃性の問題

- 有害冷媒の管理と廃棄

- 市場機会

- 天然冷媒の導入

- ニッチビジネスにおける冷媒

第4章 規制状況

- 規制シナリオ

- 規則

- モントリオール議定書

- キガリ改正

- Fガス規制

第5章 新興技術と開発

- 新しい技術

- 低GWP冷媒への移行

- 代替冷却技術

- 冷媒リサイクル

- 次世代天然冷媒

- 固体冷却

- 特許分析

第6章 市場セグメント分析

- セグメンテーションの内訳

- サマリー

- 市場分析:タイプ別

- 合成冷媒

- 天然冷媒

- 市場分析:用途別

- ACシステム

- 冷凍システム

- モバイルACシステム

- チラー

- その他

- 地理的内訳

- サマリー

- 市場分析:地域別

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第7章 競合情報

- 業界構造

- 企業シェア分析

- Daikin Industries Ltd.

- Linde Plc

- AGC Inc.

- The Chemours Company

- Honeywell International Inc.

- 戦略分析

- M&A

- 拡大、パートナーシップ、製品開発

第8章 冷媒産業における持続可能性:ESGの観点

- ESG:イントロダクション

- 冷媒業界におけるESG課題

- ESGパフォーマンス分析

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- 冷媒業界におけるESGの現状

- ESGスコア分析

- リスクスケール、露出スケール、管理スケール

- 総論

第9章 付録

- 調査手法

- 出典

- 参考文献

- 略語

- 企業プロファイル

- A-GAS INTERNATIONAL LTD.

- AGC INC.

- ARKEMA

- BROTHERS GAS

- DAIKIN INDUSTRIES LTD.

- DONGYUE GROUP

- GUJARAT FLUOROCHEMICALS LTD.

- HARP INTERNATIONAL LTD.

- HONEYWELL INTERNATIONAL INC.

- LINDE PLC

- NATIONAL REFRIGERANTS LTD.

- ORBIA

- SINOCHEM LANTIAN CO. LTD.

- SRF LTD.

- THE CHEMOURS CO.

List of Tables

- Summary Table A : Global Market Volume of Refrigerants, by Type, Through 2030

- Summary Table B : Global Market for Refrigerants, by Type, Through 2030

- Table 1 : Leading Importing Countries for HS Code: 8415, AC Machines Separately Regulated, 2022-2024

- Table 2 : Leading Exporting Countries for HS Code: 8415, AC Machines Separately Regulated, 2022-2024

- Table 3 : Leading Importing Countries for HS Code: 8418, Refrigerators, Freezers and Other Refrigerating or Freezing Equipment, (excluding AC Machines of Heading 8415), 2022-2024

- Table 4 : Leading Exporting Countries for HS Code: 8418, Refrigerators, Freezers and Other Refrigerating or Freezing Equipment, (excluding AC Machines of Heading 8415), 2022-2024

- Table 5 : Ban and Phase-Out Dates

- Table 6 : Global Market Volume for Refrigerants, by Type, Through 2030

- Table 7 : Global Market for Refrigerants, by Type, Through 2030

- Table 8 : Global Market Volume for Synthetic Refrigerants, by Region, Through 2030

- Table 9 : Global Market for Synthetic Refrigerants, by Region, Through 2030

- Table 10 : Global Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 11 : Global Market for Synthetic Refrigerants, by Type, Through 2030

- Table 12 : Global Market Volume for HFOs in Refrigerants, by Region, Through 2030

- Table 13 : Global Market for HFOs in Refrigerants, by Region, Through 2030

- Table 14 : HFC Ban and Status of Phase-Out

- Table 15 : Global Market Volume for HFCs in Refrigerants, by Region, Through 2030

- Table 16 : Global Market for HFCs in Refrigerants, by Region, Through 2030

- Table 17 : HCFC Ban and Status of Phase-Out

- Table 18 : Global Market Volume for HCFCs in Refrigerants, by Region, Through 2030

- Table 19 : Global Market for HCFCs in Refrigerants, by Region, Through 2030

- Table 20 : Global Market Volume for Other Synthetic Refrigerants, by Region, Through 2030

- Table 21 : Global Market for Other Synthetic Refrigerants, by Region, Through 2030

- Table 22 : Global Market Volume for Natural Refrigerants, by Region, Through 2030

- Table 23 : Global Market for Natural Refrigerants, by Region, Through 2030

- Table 24 : Global Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 25 : Global Market for Natural Refrigerants, by Type, Through 2030

- Table 26 : Global Market Volume for Ammonia in Refrigerants, by Region, Through 2030

- Table 27 : Global Market for Ammonia in Refrigerants, by Region, Through 2030

- Table 28 : Global Market Volume for CO2 in Refrigerants, by Region, Through 2030

- Table 29 : Global Market for CO2 in Refrigerants, by Region, Through 2030

- Table 30 : Global Market Volume for Propane in Refrigerants, by Region, Through 2030

- Table 31 : Global Market for Propane in Refrigerants, by Region, Through 2030

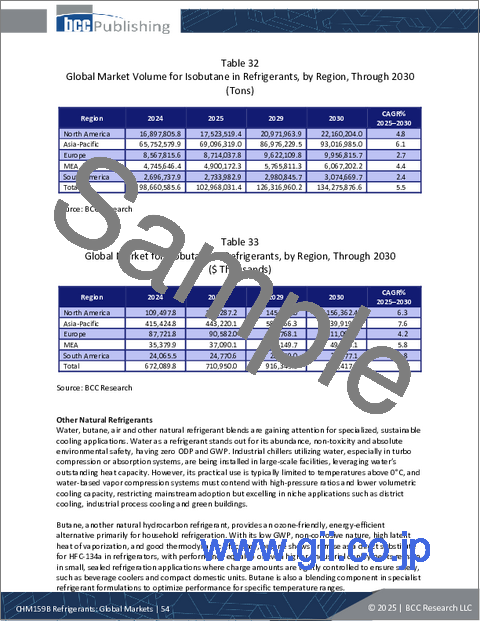

- Table 32 : Global Market Volume for Isobutane in Refrigerants, by Region, Through 2030

- Table 33 : Global Market for Isobutane in Refrigerants, by Region, Through 2030

- Table 34 : Global Market Volume for Other Natural Refrigerants, by Region, Through 2030

- Table 35 : Global Market for Other Natural Refrigerants, by Region, Through 2030

- Table 36 : Global Market Volume for Refrigerants, by Application, Through 2030

- Table 37 : Global Market for Refrigerants, by Application, Through 2030

- Table 38 : Global Market Volume for Refrigerants in AC Systems, by Region, Through 2030

- Table 39 : Global Market for Refrigerants in AC Systems, by Region, Through 2030

- Table 40 : Global Market Volume of Refrigerants in AC Systems, by Type, Through 2030

- Table 41 : Global Market for Refrigerants in AC Systems, by Type, Through 2030

- Table 42 : Global Market Volume for Refrigerants in Refrigeration Systems, by Region, Through 2030

- Table 43 : Global Market for Refrigerants in Refrigeration Systems, by Region, Through 2030

- Table 44 : Global Market Volume for Refrigerants in Refrigeration Systems, by End Use, Through 2030

- Table 45 : Global Market for Refrigerants in Refrigeration Systems, by End Use, Through 2030

- Table 46 : Global Market Volume for Refrigerants in Commercial Refrigeration Systems, by Type, Through 2030

- Table 47 : Global Market for Refrigerants in Commercial Refrigeration Systems, by Type, Through 2030

- Table 48 : Global Market Volume for Refrigerants in Mobile AC Systems, by Region, Through 2030

- Table 49 : Global Market for Refrigerants in Mobile AC Systems, by Region, Through 2030

- Table 50 : Global Market Volume for Refrigerants in Chiller Systems, by Region, Through 2030

- Table 51 : Global Market for Refrigerants in Chiller Systems, by Region, Through 2030

- Table 52 : Global Market Volume for Refrigerants Used in Other Applications, by Region, Through 2030

- Table 53 : Global Market for Refrigerants Used in Other Applications, by Region, Through 2030

- Table 54 : Global Market Volume for Refrigerants, by Region, Through 2030

- Table 55 : Global Market for Refrigerants, by Region, Through 2030

- Table 56 : North American Market Volume for Refrigerants, by Country, Through 2030

- Table 57 : North American Market for Refrigerants, by Country, Through 2030

- Table 58 : North American Market Volume for Refrigerants, by Type, Through 2030

- Table 59 : North American Market for Refrigerants, by Type, Through 2030

- Table 60 : North American Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 61 : North American Market for Synthetic Refrigerants, by Type, Through 2030

- Table 62 : North American Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 63 : North American Market for Natural Refrigerants, by Type, Through 2030

- Table 64 : North American Market Volume for Refrigerants, by Application, Through 2030

- Table 65 : North American Market for Refrigerants, by Application, Through 2030

- Table 66 : North American Market Volume for AC Systems, by Type, Through 2030

- Table 67 : North American Market for AC Systems, by Type, Through 2030

- Table 68 : North American Market Volume for Refrigeration Systems, by End Use, Through 2030

- Table 69 : North American Market for Refrigeration Systems, by End Use, Through 2030

- Table 70 : North American Market Volume for Commercial Refrigeration Systems, by Type, Through 2030

- Table 71 : North American Market for Commercial Refrigeration Systems, by Type, Through 2030

- Table 72 : U.S. Market Volume for Refrigerants, by Application, Through 2030

- Table 73 : U.S. Market for Refrigerants, by Application, Through 2030

- Table 74 : Mexican Market Volume for Refrigerants, by Application, Through 2030

- Table 75 : Mexican Market for Refrigerants, by Application, Through 2030

- Table 76 : Climate-friendly Supermarket Scorecard in Canada, 2024

- Table 77 : Canadian Market Volume for Refrigerants, by Application, Through 2030

- Table 78 : Canadian Market for Refrigerants, by Application, Through 2030

- Table 79 : Asia-Pacific Market Volume for Refrigerants, by Country, Through 2030

- Table 80 : Asia-Pacific Market for Refrigerants, by Country, Through 2030

- Table 81 : Asia-Pacific Market Volume for Refrigerants, by Type, Through 2030

- Table 82 : Asia-Pacific Market for Refrigerants, by Type, Through 2030

- Table 83 : Asia-Pacific Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 84 : Asia-Pacific Market for Synthetic Refrigerants, by Type, Through 2030

- Table 85 : Asia-Pacific Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 86 : Asia-Pacific Market for Natural Refrigerants, by Type, Through 2030

- Table 87 : Asia-Pacific Market Volume for Refrigerants, by Application, Through 2030

- Table 88 : Asia-Pacific Market for Refrigerants, by Application, Through 2030

- Table 89 : Asia-Pacific Market Volume for AC Systems, by Type, Through 2030

- Table 90 : Asia-Pacific Market for AC Systems, by Type, Through 2030

- Table 91 : Asia-Pacific Market Volume for Refrigeration Systems, by End Use, Through 2030

- Table 92 : Asia-Pacific Market for Refrigeration Systems, by End Use, Through 2030

- Table 93 : Asia-Pacific Market Volume for Commercial Refrigeration Systems, by Type, Through 2030

- Table 94 : Asia-Pacific Market for Commercial Refrigeration Systems, by Type, Through 2030

- Table 95 : Chinese Market Volume for Refrigerants, by Application, Through 2030

- Table 96 : Chinese Market for Refrigerants, by Application, Through 2030

- Table 97 : Japanese Market Volume for Refrigerants, by Application, Through 2030

- Table 98 : Japanese Market for Refrigerants, by Application, Through 2030

- Table 99 : Indian Market Volume for Refrigerants, by Application, Through 2030

- Table 100 : Indian Market for Refrigerants, by Application, Through 2030

- Table 101 : South Korean Market Volume for Refrigerants, by Applications, Through 2030

- Table 102 : South Korean Market for Refrigerants, by Application, Through 2030

- Table 103 : Indonesian Market Volume for Refrigerants, by Application, Through 2030

- Table 104 : Indonesian Market for Refrigerants, by Application, Through 2030

- Table 105 : Australia/New Zealand Market Volume for Refrigerants, by Application, Through 2030

- Table 106 : Australia/New Zealand Market for Refrigerants, by Application, Through 2030

- Table 107 : Thai Market Volume for Refrigerants, by Application, Through 2030

- Table 108 : Thai Market for Refrigerants, by Application, Through 2030

- Table 109 : Rest of Asia-Pacific Market Volume for Refrigerants, by Application, Through 2030

- Table 110 : Rest of Asia-Pacific Market for Refrigerants, by Application, Through 2030

- Table 111 : European Market Volume for Refrigerants, by Country, Through 2030

- Table 112 : European Market for Refrigerants, by Country, Through 2030

- Table 113 : European Market Volume for Refrigerants, by Type, Through 2030

- Table 114 : European Market for Refrigerants, by Type, Through 2030

- Table 115 : European Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 116 : European Market for Synthetic Refrigerants, by Type, Through 2030

- Table 117 : European Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 118 : European Market for Natural Refrigerants, by Type, Through 2030

- Table 119 : European Market Volume for Refrigerants, by Application, Through 2030

- Table 120 : European Market for Refrigerants, by Application, Through 2030

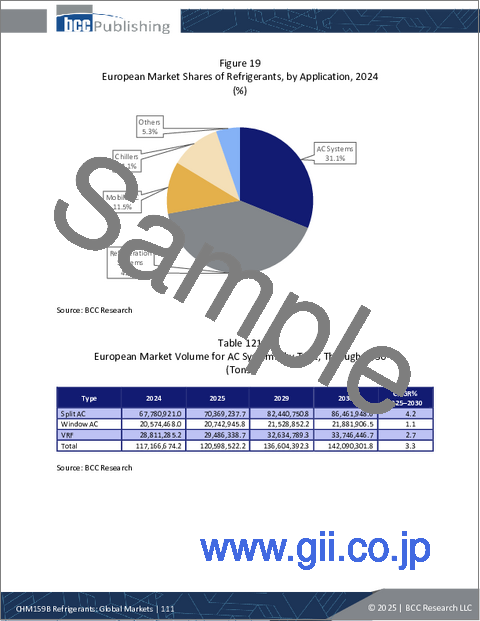

- Table 121 : European Market Volume for AC Systems, by Type, Through 2030

- Table 122 : European Market for AC Systems, by Type, Through 2030

- Table 123 : European Market Volume for Refrigeration Systems, by End Use, Through 2030

- Table 124 : European Market for Refrigeration Systems, by End Use, Through 2030

- Table 125 : European Market Volume for Commercial Refrigeration Systems, by Type, Through 2030

- Table 126 : European Market for Commercial Refrigeration Systems, by Type, Through 2030

- Table 127 : U.K. Market Volume for Refrigerants, by Application, Through 2030

- Table 128 : U.K. Market for Refrigerants, by Application, Through 2030

- Table 129 : Italian Market Volume for Refrigerants, by Application, Through 2030

- Table 130 : Italian Market for Refrigerants, by Application, Through 2030

- Table 131 : German Market Volume for Refrigerants, by Application, Through 2030

- Table 132 : German Market for Refrigerants, by Application, Through 2030

- Table 133 : French Market Volume for Refrigerants, by Application, Through 2030

- Table 134 : French Market for Refrigerants, by Application, Through 2030

- Table 135 : Russian Market Volume for Refrigerants, by Application, Through 2030

- Table 136 : Russian Market for Refrigerants, by Application, Through 2030

- Table 137 : Spanish Market Volume for Refrigerants, by Application, Through 2030

- Table 138 : Spanish Market for Refrigerants, by Application, Through 2030

- Table 139 : Netherlands Market Volume for Refrigerants, by Application, Through 2030

- Table 140 : Netherlands Market for Refrigerants, by Application, Through 2030

- Table 141 : Polish Market Volume for Refrigerants, by Application, Through 2030

- Table 142 : Polish Market for Refrigerants, by Application, Through 2030

- Table 143 : Belgian Market Volume for Refrigerants, by Application, Through 2030

- Table 144 : Belgian Market for Refrigerants, by Application, Through 2030

- Table 145 : Rest of European Market Volume for Refrigerants, by Application, Through 2030

- Table 146 : Rest of European Market for Refrigerants, by Application, Through 2030

- Table 147 : MEA Market Volume for Refrigerants, by Country, Through 2030

- Table 148 : MEA Market for Refrigerants, by Country, Through 2030

- Table 149 : MEA Market Volume for Refrigerants, by Type, Through 2030

- Table 150 : MEA Market for Refrigerants, by Type, Through 2030

- Table 151 : MEA Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 152 : MEA Market for Synthetic Refrigerants, by Type, Through 2030

- Table 153 : MEA Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 154 : MEA Market for Natural Refrigerants, by Type, Through 2030

- Table 155 : MEA Market Volume for Refrigerants, by Application, Through 2030

- Table 156 : MEA Market for Refrigerants, by Application, Through 2030

- Table 157 : MEA Market Volume for AC Systems, by Type, Through 2030

- Table 158 : MEA Market for AC Systems, by Type, Through 2030

- Table 159 : MEA Market Volume for Refrigeration Systems, by End Use, Through 2030

- Table 160 : MEA Market for Refrigeration Systems, by End Use, Through 2030

- Table 161 : MEA Market Volume for Commercial Refrigeration Systems, by Type, Through 2030

- Table 162 : MEA Market for Commercial Refrigeration Systems, by Type, Through 2030

- Table 163 : Saudi Arabian Market Volume for Refrigerants, by Application, Through 2030

- Table 164 : Saudi Arabian Market for Refrigerants, by Application, Through 2030

- Table 165 : Turkish Market Volume for Refrigerants, by Application, Through 2030

- Table 166 : Turkish Market for Refrigerants, by Application, Through 2030

- Table 167 : UAE Market Volume for Refrigerants, by Application, Through 2030

- Table 168 : UAE Market for Refrigerants, by Application, Through 2030

- Table 169 : Egyptian Market Volume for Refrigerants, by Application, Through 2030

- Table 170 : Egyptian Market for Refrigerants, by Application, Through 2030

- Table 171 : South African Market Volume for Refrigerants, by Application, Through 2030

- Table 172 : South African Market for Refrigerants, by Application, Through 2030

- Table 173 : Rest of MEA Market Volume for Refrigerants, by Application, Through 2030

- Table 174 : Rest of MEA Market for Refrigerants, by Application, Through 2030

- Table 175 : South American Market Volume for Refrigerants, by Country, Through 2030

- Table 176 : South American Market for Refrigerants, by Country, Through 2030

- Table 177 : South American Market Volume for Refrigerants, by Type, Through 2030

- Table 178 : South American Market for Refrigerants, by Type, Through 2030

- Table 179 : South American Market Volume for Synthetic Refrigerants, by Type, Through 2030

- Table 180 : South American Market for Synthetic Refrigerants, by Type, Through 2030

- Table 181 : South American Market Volume for Natural Refrigerants, by Type, Through 2030

- Table 182 : South American Market for Natural Refrigerants, by Type, Through 2030

- Table 183 : South American Market Volume for Refrigerants, by Application, Through 2030

- Table 184 : South American Market for Refrigerants, by Application, Through 2030

- Table 185 : South American Market Volume for AC Systems, by Type, Through 2030

- Table 186 : South American Market for AC Systems, by Type, Through 2030

- Table 187 : South American Market Volume for Refrigeration System, by End Use, Through 2030

- Table 188 : South American Market for Refrigeration Systems, by End Use, Through 2030

- Table 189 : South American Market Volume for Commercial Refrigeration Systems, by Type, Through 2030

- Table 190 : South American Market for Commercial Refrigeration Systems, by Type, Through 2030

- Table 191 : Brazilian Market Volume for Refrigerants, by Application, Through 2030

- Table 192 : Brazilian Market for Refrigerants, by Application, Through 2030

- Table 193 : Argentine Market Volume for Refrigerants, by Application, Through 2030

- Table 194 : Argentine Market for Refrigerants, by Application, Through 2030

- Table 195 : Rest of South American Market Volume for Refrigerants, by Application, Through 2030

- Table 196 : Rest of South American Market for Refrigerants, by Application, Through 2030

- Table 197 : M&A in the Refrigerant Industry, 2021-2024

- Table 198 : Product Developments and Partnerships, 2022-2025

- Table 199 : ESG: Environmental Initiatives in the Refrigeration Industry

- Table 200 : ESG: Social Initiatives in the Refrigeration Industry

- Table 201 : ESG: Governance Initiatives in the Refrigeration Industry

- Table 202 : ESG Rating Scores and Risk Ratings, 2025

- Table 203 : Information Sources for this Report

- Table 204 : Abbreviations Used in This Report

- Table 205 : A-Gas International Ltd.: Company Snapshot

- Table 206 : A-Gas International Ltd.: Product Portfolio

- Table 207 : A-Gas International Ltd.: News/Key Developments, 2025

- Table 208 : AGC Inc.: Company Snapshot

- Table 209 : AGC Inc.: Financial Performance, FY 2023 and 2024

- Table 210 : AGC Inc.: Product Portfolio

- Table 211 : AGC Inc.: News/Key Developments, 2022

- Table 212 : Arkema: Company Snapshot

- Table 213 : Arkema: Financial Performance, FY 2023 and 2024

- Table 214 : Arkema: Product Portfolio

- Table 215 : Arkema: News/Key Developments, 2025

- Table 216 : Brothers Gas: Company Snapshot

- Table 217 : Brothers Gas: Product Portfolio

- Table 218 : Brothers Gas: News/Key Developments, 2023

- Table 219 : Daikin Industries Ltd.: Company Snapshot

- Table 220 : Daikin Industries Ltd.: Financial Performance, FY 2023 and 2024

- Table 221 : Daikin Industries Ltd.: Product Portfolio

- Table 222 : Daikin Industries Ltd.: News/Key Developments, 2023

- Table 223 : Dongyue Group: Company Snapshot

- Table 224 : Dongyue Group: Financial Performance, FY 2023 and 2024

- Table 225 : Dongyue Group: Product Portfolio

- Table 226 : Gujarat Fluorochemicals Ltd.: Company Snapshot

- Table 227 : Gujarat Fluorochemicals Ltd.: Financial Performance, FY 2023 and 2024

- Table 228 : Gujarat Fluorochemicals Ltd.: Product Portfolio

- Table 229 : Harp International Ltd.: Company Snapshot

- Table 230 : Harp International Ltd.: Product Portfolio

- Table 231 : Honeywell International Inc.: Company Snapshot

- Table 232 : Honeywell International Inc.: Financial Performance, FY 2023 and 2024

- Table 233 : Honeywell International Inc.: Product Portfolio

- Table 234 : Honeywell International Inc.: News/Key Developments, 2024 and 2025

- Table 235 : Linde plc: Company Snapshot

- Table 236 : Linde PLC: Financial Performance, FY 2023 and 2024

- Table 237 : Linde PLC: Product Portfolio

- Table 238 : Linde plc: News/Key Developments, 2023

- Table 239 : National Refrigerants Ltd.: Company Snapshot

- Table 240 : National Refrigerants Ltd.: Product Portfolio

- Table 241 : Orbia: Company Snapshot

- Table 242 : Orbia: Financial Performance, FY 2023 and 2024

- Table 243 : Orbia: Product Portfolio

- Table 244 : Orbia: News/Key Developments, 2022-2024

- Table 245 : Sinochem Lantian Co. Ltd.: Company Snapshot

- Table 246 : Sinochem Lantian Co. Ltd: Product Portfolio

- Table 247 : SRF Ltd.: Company Snapshot

- Table 248 : SRF Ltd.: Financial Performance, FY 2023 and 2024

- Table 249 : SRF Ltd.: Product Portfolio

- Table 250 : The Chemours Co.: Company Snapshot

- Table 251 : The Chemours Co.: Financial Performance, FY 2023 and 2024

- Table 252 : The Chemours Co.: Product Portfolio

List of Figures

- Summary Figure : Global Market Shares of Refrigerants, by Type, 2024

- Figure 1 : Refrigerants: Supply Chain Analysis

- Figure 2 : Market Dynamics of Refrigerants

- Figure 3 : Global Market Shares of Refrigerants, by Type, 2024

- Figure 4 : Global Market Shares of Natural Refrigerants, by Type, 2024

- Figure 5 : Global Market Shares of Refrigerants, by Application, 2024

- Figure 6 : Global Market Shares of Refrigerants in AC Systems, by Type, 2024

- Figure 7 : Global Market Shares of Refrigerants in Refrigeration Systems, by End Use, 2024

- Figure 8 : Global Market Shares of Refrigerants in Commercial Refrigeration Systems, by Type, 2024

- Figure 9 : Global Market Shares of Refrigerants Used in Other Applications, by Region, 2024

- Figure 10 : Global Market Shares of Refrigerants, by Region, 2024

- Figure 11 : North American Market Shares of Refrigerants, by Country, 2024

- Figure 12 : North American Market Shares of Refrigerants, by Type, 2024

- Figure 13 : North American Market Shares of Refrigerants, by Application, 2024

- Figure 14 : Asia-Pacific Market Shares of Refrigerants, by Country, 2024

- Figure 15 : Asia-Pacific Market Shares of Refrigerants, by Type, 2024

- Figure 16 : Asia-Pacific Market Shares of Refrigerants, by Application, 2024

- Figure 17 : European Market Shares of Refrigerants, by Country, 2024

- Figure 18 : European Market Shares of Refrigerants, by Type, 2024

- Figure 19 : European Market Shares of Refrigerants, by Application, 2024

- Figure 20 : MEA Market Shares of Refrigerants, by Country, 2024

- Figure 21 : MEA Market Shares of Refrigerants, by Type, 2024

- Figure 22 : MEA Market Shares of Refrigerants, by Application, 2024

- Figure 23 : South American Market Shares of Refrigerants, by Country, 2024

- Figure 24 : South American Market Shares of Refrigerants, by Type, 2024

- Figure 25 : South American Market Shares of Refrigerants, by Application, 2024

- Figure 26 : Global Market Shares of Refrigerant Companies, 2024

- Figure 27 : ESG Perspective

- Figure 28 : AGC Inc.: Revenue Share, by Business Unit, FY 2024

- Figure 29 : AGC Inc.: Revenue Share, by Country/Region, FY 2024

- Figure 30 : ARKEMA: Revenue Share, by Business Unit, FY 2024

- Figure 31 : ARKEMA: Revenue Share, by Country/Region, FY 2024

- Figure 32 : Daikin Industries Ltd.: Revenue Share, by Business Unit, FY 2024

- Figure 33 : Daikin Industries Ltd.: Revenue Share, by Country/Region, FY 2024

- Figure 34 : Dongyue Group: Revenue Share, by Business Unit, FY 2024

- Figure 35 : Dongyue Group: Revenue Share, by Country/Region, FY 2024

- Figure 36 : Honeywell International Inc.: Revenue Share, by Business Unit, FY 2024

- Figure 37 : Honeywell International Inc.: Revenue Share, by Country/Region, FY 2024

- Figure 38 : Linde plc: Revenue Share, by Business Unit, FY 2024

- Figure 39 : Linde plc: Revenue Share, by Country/Region, FY 2024

- Figure 40 : ORBIA: Revenue Share, by Business Unit, FY 2024

- Figure 41 : ORBIA: Revenue Share, by Region, FY 2024

- Figure 42 : SRF Ltd.: Revenue Share, by Business Unit, FY 2024

- Figure 43 : SRF Ltd.: Revenue Share, by Country/Region, FY 2024

- Figure 44 : The Chemours Co.: Revenue Share, by Business Unit, FY 2024

- Figure 45 : The Chemours Co.: Revenue Share, by Region, FY 2024

The global market for refrigerants was valued at $25.9 billion in 2024 and is estimated to increase from $27.2 billion in 2025 to reach $36.7 billion by 2030, at a compound annual growth rate (CAGR) of 6.2% from 2025 through 2030.

The synthetic market for refrigerants was valued at $16.6 billion in 2024 and is estimated to increase from $17.3 billion in 2025 to reach $22.1 billion by 2030, at a CAGR of 5% from 2025 through 2030.

The natural market for refrigerants was valued at $9.2 billion in 2024 and is estimated to increase from $9.8 billion in 2025 to reach $14.6 billion by 2030, at a CAGR of 8.2% from 2025 through 2030.

Report Scope

This report provides an analysis of market trends in the global refrigerant market. This report includes the refrigerant industry's technological, economic and business evaluations and provides forecasts of global markets. The report discusses the market forces, the leading manufacturers and emerging opportunities. All market value estimates are based on an analysis of multiple factors and manufacturer revenues, offering insight into the refrigerant industry. The report segments the market by type, application and region:

- Type: synthetic (hydrofluoroolefins, hydrofluorocarbons, hydrochlorofluorocarbons and others) and natural (ammonia, CO2, propane, isobutane and others).

- Application: air conditioning (AC) systems (split AC, window AC, variable refrigerant flow [VRF]), refrigeration systems (industrial, commercial [retail food, commercial properties, and other], domestic), mobile AC, chillers and others.

- Region: North America, Europe (including the Netherlands, Poland and Belgium), Asia-Pacific, South America, the Middle East and Africa (MEA).

The report analyzes the supply chain for the industry as well as the drivers and regional forces of the refrigerant market. This report includes forecasts for the market's growth from 2025 to 2030. It includes profiles of leading manufacturers, ESG developments, the competitive landscape, and regulatory aspects, both international and regional.

Report Includes

- 204 data tables and 50 additional tables

- An overview of the global market for refrigerants

- In-depth analysis of global market trends, featuring historical revenue data for 2024, estimated figures for 2025, and forecasts for 2029. This analysis includes projections of compound annual growth rates (CAGRs) through 2030

- Evaluation of the current market size and revenue growth prospects specific to the refrigerants, accompanied by a market share analysis by region, type and application

- Analysis of current and future demand in the global refrigerants market, along with a detailed analysis of the competitive environment, market regulations and reimbursement practices

- Analysis of drivers, challenges and opportunities affecting market growth

- Discussion on preference of greener refrigerants such as ammonia, isobutene, propane and carbon dioxide, over fluorocarbon refrigerants due to high ozone-depleting potential (ODP) and global warming potential (GWP)

- Review of patent grants for innovations related to the refrigerant industry across major categories

- Impact analysis of AI adoption on the refrigerants market, including case studies, disruption trends, and market spending and investment scenario

- Coverage of evolving technologies, the current and future market potential, R&D activities, growth strategies, new product pipeline, regulatory framework and reimbursement scenarios, and ESG trends

- Market share analysis of the key market participants in the refrigerant market, along with their research priorities, product portfolios, global rankings and competitive landscape

- Company profiles of major players within the industry, including Daikin Industries Ltd., Linde plc., AGC Inc., The Chemours Co., Honeywell International Inc., Orbia, and Arkema

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Technological Advances and Applications

- Market Dynamics and Growth Factors

- Future Trends and Developments

- Segmental Analysis

- Regional and Emerging Markets

- Conclusion

Chapter 2 Market Overview

- Market Definition

- Classification of Refrigerants

- Based on Flammability

- Based on the Boiling Point

- Types of Refrigerants

- Primary Refrigerants

- Secondary Refrigerants

- Supply Chain Analysis

- Raw Materials and Suppliers

- Manufacturing and Processing

- Distribution and Sales

- End Users

- Import-Export Analysis

- Impact of the U.S. Tariffs

Chapter 3 Market Dynamics

- Market Dynamics

- Highlights

- Market Drivers

- Growing Demand for Refrigeration and AC

- Demand for Refrigerants in the Pharmaceutical Industry

- Use of Refrigerants in the Automotive Industry

- Market Restraints

- Costs Associated with Low-GWP Refrigerants and Retrofitting

- Environmental and Safety Regulations

- Market Challenges

- Toxicity and Flammability Issues

- Management and Disposal of Harmful Refrigerants

- Market Opportunities

- Adoption of Natural Refrigerants

- Refrigerants in Niche Businesses

Chapter 4 Regulatory Landscape

- Regulatory Scenario

- Regulations

- Montreal Protocol

- Kigali Amendment

- F-Gas Regulation

Chapter 5 Emerging Technologies and Developments

- New Technologies

- Shift Toward Low-GWP Refrigerants

- Alternative Cooling Technologies

- Refrigerant Recycling

- Next-Generation Natural Refrigerants

- Solid-State Cooling

- Patent Analysis

Chapter 6 Market Segment Analysis

- Segmentation Breakdown

- Takeaways

- Market Analysis, by Type

- Synthetic Refrigerants

- Natural Refrigerants

- Market Analysis, by Application

- AC Systems

- Refrigeration Systems

- Mobile AC Systems

- Chillers

- Other Refrigeration Systems

- Geographic Breakdown

- Takeaways

- Market Analysis, by Region

- North America

- Asia-Pacific

- Europe

- Middle East and Africa

- South America

Chapter 7 Competitive Intelligence

- Industry Structure

- Company Share Analysis

- Daikin Industries Ltd.

- Linde Plc

- AGC Inc.

- The Chemours Company

- Honeywell International Inc.

- Strategic Analysis

- Mergers and Acquisitions (M&A)

- Expansions, Partnerships and Product Developments

- Mergers and Acquisitions (M&A)

Chapter 8 Sustainability in the Refrigerant Industry: ESG Perspective

- Introduction to ESG

- ESG Issues in the Refrigerant Sector

- ESG Performance Analysis

- Environmental Performance

- Social Performance

- Governance Performance

- Status of ESG in the Refrigerant Industry

- ESG Score Analysis

- Risk Scale, Exposure Scale and Management Scale

- Concluding Remarks

Chapter 9 Appendix

- Methodology

- Sources

- References

- Abbreviations

- Company Profiles

- A-GAS INTERNATIONAL LTD.

- AGC INC.

- ARKEMA

- BROTHERS GAS

- DAIKIN INDUSTRIES LTD.

- DONGYUE GROUP

- GUJARAT FLUOROCHEMICALS LTD.

- HARP INTERNATIONAL LTD.

- HONEYWELL INTERNATIONAL INC.

- LINDE PLC

- NATIONAL REFRIGERANTS LTD.

- ORBIA

- SINOCHEM LANTIAN CO. LTD.

- SRF LTD.

- THE CHEMOURS CO.