|

|

市場調査レポート

商品コード

1782079

鉛フリー圧電セラミックス:各種技術と世界の機会Lead-Free Piezoelectric Ceramics: Technologies and Global Opportunities |

||||||

|

|||||||

| 鉛フリー圧電セラミックス:各種技術と世界の機会 |

|

出版日: 2025年07月28日

発行: BCC Research

ページ情報: 英文 122 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の鉛フリー圧電セラミックスの市場規模は、2025年の3億730万米ドルから、予測期間中はCAGR 12.3%で推移し、2030年末には5億4,980万米ドルに達すると予測されています。

アジア太平洋地域市場は、2025年の1億6,450万米ドルから、予測期間中はCAGR 14.2%で推移し、2030年末には3億1,910万米ドルに達すると予測されています。北米市場は、2025年の7,470万米ドルから、予測期間中はCAGR 11.2%で推移し、2030年末には1億2,710万米ドルに達すると予測されています。

当レポートでは、世界の鉛フリー圧電セラミックスの市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と促進要因

- 動向と将来の展開

- セグメント別分析

- 地域市場および新興市場

- 結論

第2章 市場概要

- 意味

- 業界シナリオ

- 鉛フリー圧電セラミックスの開発の必要性

- 鉛フリー圧電セラミックスの特性

- 鉛フリー圧電セラミックスの用途

- 準備技術

- 規則

- EUの有害物質制限指令 (RoHS) における免除規定

- REACH規則

- 米中関税戦争の影響

- サプライチェーン分析

- ポーターのファイブフォース分析

第3章 市場力学

- 市場力学

- 市場促進要因

- 鉛系圧電材料の健康と環境へのリスク

- 好ましい規制環境

- 鉛フリー圧電セラミックスの用途

- 市場の課題

- 原材料の抽出に伴う環境リスク

- パフォーマンス上の制約

- 市場機会

- ナノ圧電セラミックス

- ウェアラブル技術

第4章 新興技術と開発

- 概要

- 材料と技術の動向

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 調査結果/サマリー

- 市場分析:材料別

- ニオブ酸カリウムナトリウム (KNN)

- チタン酸ビスマスナトリウム (BNT)

- チタン酸バリウム

- その他

- 市場分析:構成別

- 単層

- 多層

- 薄膜

- 市場分析:エンドユーザー別

- CE製品・オプトエレクトロニクス

- 輸送

- 産業機器

- 医療機器

- その他

- 地理的内訳

- 調査結果/サマリー

- 市場分析:地域別

- 北米

- アジア太平洋

- 欧州

- その他の地域

第6章 競合情報

- 競合シナリオ

- 企業ポジショニング

- 戦略的取り組み

第7章 鉛フリー圧電セラミックス産業の持続可能性:ESGの観点

- ESG目標

- ESG上の課題

- ESGパフォーマンス分析

- 環境問題

- 社会問題

- ガバナンスの問題

- ESGの現状

- 結論

第8章 付録

- 調査手法

- 情報源

- 略語

- 参考文献

- 企業プロファイル

- CERAMTEC GMBH

- CTS CORP.

- FUJI CERAMICS CORP.

- HONDA ELECTRONICS CO. LTD.

- IONIX AT

- KEMET CORP.

- KYOCERA CORP.

- NITERRA CO. LTD.

- NINGBO FBELE ELECTRONICS CO. LTD.

- PI CERAMIC GMBH

- PZT ELECTRONIC CERAMIC CO. LTD.

- SEIKO EPSON CORP.

- SUMITOMO CHEMICAL CO. LTD.

- TANIOBIS

- ZIBO YUHAI ELECTRONIC CERAMIC CO. LTD.

List of Tables

- Summary Table : Global Market for Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 1 : Typical Piezoelectric Properties for Distinct Classes of Materials

- Table 2 : Updated ROHS Exemptions

- Table 3 : Global Market for Lead-Free Piezoelectric Ceramics, by Material, Through 2030

- Table 4 : Global Market for KNN Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 5 : Global Market for BNT Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 6 : Global Market for BT Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 7 : Global Market for Other Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 8 : Global Market for Lead-Free Piezoelectric Ceramics, by Configuration, Through 2030

- Table 9 : Global Market for Monolith Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 10 : Global Market for Multilayer Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 11 : Properties of KNN Piezoelectric Ceramic Thin Films

- Table 12 : Global Market for Thin-Film Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 13 : Global Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 14 : Global Market for Lead-Free Piezoelectric Ceramics in Consumer Electronics and Optoelectronics, by Region, Through 2030

- Table 15 : Global Market for Lead-Free Piezoelectric Ceramics in Transportation, by Region, Through 2030

- Table 16 : Global Market for Lead-Free Piezoelectric Ceramics in Industrial Equipment, by Region, Through 2030

- Table 17 : Global Market for Lead-Free Piezoelectric Ceramics in Medical Devices, by Region, Through 2030

- Table 18 : Global Market for Lead-Free Piezoelectric Ceramics in Other Industries, by Region, Through 2030

- Table 19 : Global Market for Lead-Free Piezoelectric Ceramics, by Region, Through 2030

- Table 20 : North American Market for Lead-Free Piezoelectric Ceramics, by Country, Through 2030

- Table 21 : North American Market for Lead-Free Piezoelectric Ceramics, by Material, Through 2030

- Table 22 : North American Market for Lead-Free Piezoelectric Ceramics, by Configuration, Through 2030

- Table 23 : North American Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 24 : U.S. Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 25 : Canadian Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 26 : Mexican Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 27 : Asia-Pacific Market for Lead-Free Piezoelectric Ceramics, by Country, Through 2030

- Table 28 : Asia-Pacific Market for Lead-Free Piezoelectric Ceramics, by Material, Through 2030

- Table 29 : Asia-Pacific Market for Lead-Free Piezoelectric Ceramics, by Configuration, Through 2030

- Table 30 : Asia-Pacific Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

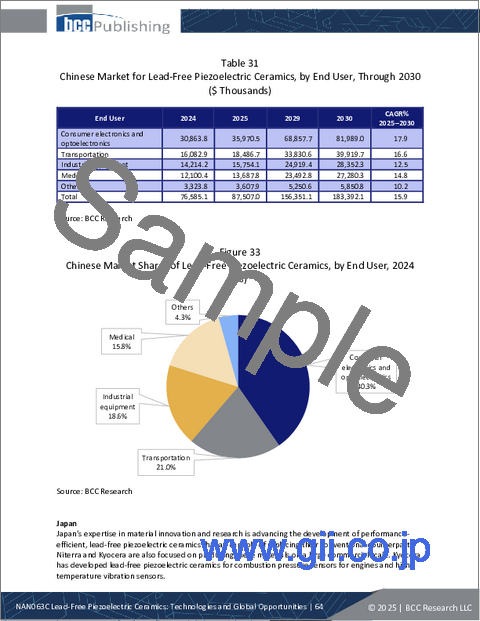

- Table 31 : Chinese Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 32 : Japanese Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 33 : South Korean Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 34 : Rest of Asia-Pacific Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 35 : European Market for Lead-Free Piezoelectric Ceramics, by Country, Through 2030

- Table 36 : European Market for Lead-Free Piezoelectric Ceramics, by Material, Through 2030

- Table 37 : European Market for Lead-Free Piezoelectric Ceramics, by Configuration, Through 2030

- Table 38 : European Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 39 : German Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 40 : French Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 41 : Italian Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 42 : Rest of Europe Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 43 : RoW Market for Lead-Free Piezoelectric Ceramics, by Sub-region, Through 2030

- Table 44 : RoW Market for Lead-Free Piezoelectric Ceramics, by Material, Through 2030

- Table 45 : RoW Market for Lead-Free Piezoelectric Ceramics, by Configuration, Through 2030

- Table 46 : RoW Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 47 : South American Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 48 : MEA Market for Lead-Free Piezoelectric Ceramics, by End User, Through 2030

- Table 49 : Recent Strategic Initiatives, Lead-Free Piezoelectric Ceramics Market, 2022-2025

- Table 50 : Environmental Issues and Corporate ESG Initiatives

- Table 51 : Social Issues and Corporate ESG Initiatives

- Table 52 : Governance Issues and Corporate ESG Initiatives

- Table 53 : ESG Risk Ratings in the LF Piezoelectric Ceramics Market, 2025*

- Table 54 : Abbreviations Used in the Report

- Table 55 : CeramTec GmbH: Company Snapshot

- Table 56 : CeramTec GmbH: Product Portfolio

- Table 57 : CeramTec GmbH: News/Developments, 2024

- Table 58 : CTS Corp.: Company Snapshot

- Table 59 : CTS Corp.: Financial Performance, FY 2023 and 2024

- Table 60 : CTS Corp.: Product Portfolio

- Table 61 : CTS Corp.: News/Developments, 2022-2024

- Table 62 : Fuji Ceramics Corp.: Company Snapshot

- Table 63 : Fuji Ceramics Corp.: Product Portfolio

- Table 64 : Honda Electronics Co. Ltd.: Company Snapshot

- Table 65 : Honda Electronics Co. Ltd.: Product Portfolio

- Table 66 : Ionix AT: Company Snapshot

- Table 67 : Ionix AT: Product Portfolio

- Table 68 : Ionix AT: News/Developments, 2023

- Table 69 : Kemet Corp.: Company Snapshot

- Table 70 : Kemet Corp.: Product Portfolio

- Table 71 : Kyocera Corp.: Company Snapshot

- Table 72 : Kyocera Corp.: Financial Performance, FY 2023 and 2024

- Table 73 : Kyocera Corp.: Product Portfolio

- Table 74 : Niterra Co. Ltd.: Company Snapshot

- Table 75 : Niterra Co. Ltd.: Financial Performance, FY 2023 and 2024

- Table 76 : Niterra Co. Ltd.: Product Portfolio

- Table 77 : Niterra Co. Ltd.: News/Developments, 2024-2025

- Table 78 : Ningbo Fbele Electronics Co. Ltd.: Company Snapshot

- Table 79 : Ningbo Fbele Electronics Co. Ltd.: Product Portfolio

- Table 80 : PI Ceramic GmbH: Company Snapshot

- Table 81 : PI Ceramic GmbH: Product Portfolio

- Table 82 : PI Ceramic GmbH: News/Developments, 2025

- Table 83 : PZT Electronic Ceramic Co. Ltd.: Company Snapshot

- Table 84 : PZT Electronic Ceramic Co. Ltd.: Product Portfolio

- Table 85 : Seiko Epson Corp.: Company Snapshot

- Table 86 : Seiko Epson Corp.: Financial Performance, FY 2023 and 2024

- Table 87 : Seiko Epson Corp.: Product Portfolio

- Table 88 : Sumitomo Chemical Co. Ltd.: Company Snapshot

- Table 89 : Sumitomo Chemical Co. Ltd.: Financial Performance, FY 2023 and 2024

- Table 90 : Sumitomo Chemical Co. Ltd.: Product Portfolio

- Table 91 : Taniobis: Company Snapshot

- Table 92 : Taniobis: Product Portfolio

- Table 93 : Zibo Yuhai Electronic Ceramic Co. Ltd.: Company Snapshot

- Table 94 : Zibo Yuhai Electronic Ceramic Co. Ltd.: Product Portfolio

List of Figures

- Summary Figure : Global Market Shares of Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 1 : Analysis of Supply Chain for Lead-Free Piezoelectric Ceramics

- Figure 2 : Porter's Five Forces Analysis - Lead-Free Piezoelectric Ceramics Market

- Figure 3 : Market Dynamics of Lead-Free Piezoelectric Ceramics

- Figure 4 : Global Market Shares of Lead-Free Piezoelectric Ceramics, by Material, 2024

- Figure 5 : Global Market Shares of KNN Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 6 : Global Market Shares of BNT Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 7 : Global Market Shares of BT Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 8 : Global Market Shares of Other Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 9 : Global Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 10 : Global Market Shares of Monolith Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 11 : Global Market Shares of Multilayer Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 12 : Global Market Shares of Thin Film Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 13 : Global Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 14 : Production Value of the Global Electronics and IT Industries, by Category, 2023-2025

- Figure 15 : Global Market Shares of Lead-Free Piezoelectric Ceramics in Consumer Electronics and Optoelectronics, by Region, 2024

- Figure 16 : Global Market Shares of Lead-Free Piezoelectric Ceramics in Transportation, by Region, 2024

- Figure 17 : Global Market Shares of Lead-Free Piezoelectric Ceramics in Industrial Equipment, by Region, 2024

- Figure 18 : Global Market Shares of Lead-Free Piezoelectric Ceramics in Medical Devices, by Region, 2024

- Figure 19 : Global Market Shares of Lead-Free Piezoelectric Ceramics in Other Industries, by Region, 2024

- Figure 20 : Global Market Shares of Lead-Free Piezoelectric Ceramics, by Region, 2024

- Figure 21 : North American Market Shares of Lead-Free Piezoelectric Ceramics, by Country, 2024

- Figure 22 : North American Market Shares of Lead-Free Piezoelectric Ceramics, by Material, 2024

- Figure 23 : North American Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 24 : North American Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 25 : U.S. Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 26 : Canadian Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 27 : Mexican Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 28 : Asia-Pacific Market Shares of Lead-Free Piezoelectric Ceramics, by Country, 2024

- Figure 29 : Asia-Pacific Market Shares of Lead-Free Piezoelectric Ceramics, by Material, 2024

- Figure 30 : Asia-Pacific Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 31 : Asia-Pacific Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 32 : Chinese Cumulative Growth Rate of Added Value, 2023 and 2024

- Figure 33 : Chinese Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 34 : Share of Japanese Companies in the Global Electronics and IT Industries Production, 2024

- Figure 35 : Japanese Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 36 : South Korean Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 37 : Rest of Asia-Pacific Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 38 : European Market Shares of Lead-Free Piezoelectric Ceramics, by Country, 2024

- Figure 39 : European Market Shares of Lead-Free Piezoelectric Ceramics, by Material, 2024

- Figure 40 : European Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 41 : European Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 42 : German Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 43 : French Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 44 : Italian Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 45 : Rest of Europe Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 46 : RoW Market Shares of Lead-Free Piezoelectric Ceramics, by Sub-region, 2024

- Figure 47 : RoW Market Shares of Lead-Free Piezoelectric Ceramics, by Material, 2024

- Figure 48 : RoW Market Shares of Lead-Free Piezoelectric Ceramics, by Configuration, 2024

- Figure 49 : RoW Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 50 : South American Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 51 : MEA Market Shares of Lead-Free Piezoelectric Ceramics, by End User, 2024

- Figure 52 : Company Positioning in the LF Piezoelectric Ceramics Market, 2024

- Figure 53 : ESG Issues in the Lead-Free Piezoelectric Ceramics Industry

- Figure 54 : CTS Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 55 : CTS Corp.: Revenue Share, by Country/Region, FY 2024

- Figure 56 : Kyocera Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 57 : Kyocera Corp.: Revenue Share, by Country/Region, FY 2024

- Figure 58 : Niterra Co. Ltd.: Revenue Share, by Business Unit, FY 2024

- Figure 59 : Seiko Epson Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 60 : Seiko Epson Corp.: Revenue Share, by Country/Region, FY 2024

- Figure 61 : Sumitomo Chemical Co. Ltd.: Revenue Share, by Business Unit, FY 2024

The global market for lead-free piezoelectric ceramics is projected to grow from $307.3 million in 2025 to reach $549.8 million by the end of 2030, at a compound annual growth rate (CAGR) of 12.3% from 2025 through 2030.

The Asia-Pacific market for lead-free piezoelectric ceramics is projected to grow from $164.5 million in 2025 to reach $319.1 million by the end of 2030, at a CAGR of 14.2% from 2025 through 2030.

The North American market for lead-free piezoelectric ceramics is projected to grow from $74.7 million in 2025 to reach $127.1 million by the end of 2030, at a CAGR of 11.2% from 2025 through 2030.

Report Scope

This report provides a qualitative as well as quantitative assessment of the global market for lead-free piezoelectric ceramics. It uses 2024 as the base year and provides revenue forecasts from 2025 to 2030 (USD thousands). The report analyzes the market in the following segments:

- By material.

- Potassium sodium niobate (KNN).

- Bismuth sodium titanate (BNT).

- Barium Titanate (BT).

- Others.

- By configuration.

- Monolith.

- Multilayer.

- Thin films.

- By end user.

- Consumer electronics and optoelectronics.

- Transportation.

- Industrial equipment.

- Medical.

- Others.

- By Region.

- Asia-Pacific: China, Japan, South Korea and Rest of APAC.

- Europe: Germany, France, Italy and Rest of Europe.

- North America: U.S., Canada and Mexico.

- Rest of the World: South America, and the Middle East and Africa.

Report Includes

- 51 data tables and 44 additional tables

- An analysis of the global market for lead-free piezoelectric ceramics (LFPECs), including materials, applications and fabrication processes

- Analyses of the global market trends, with revenue data from 2024, estimates for 2025, forecast for 2029 and projected CAGRs through 2030

- Estimates of the market's size and revenue prospects, accompanied by a market share analysis based on material type, configuration, end-user industry and region

- Facts and figures pertaining to market dynamics, technological advancements, regulations, industry structure and the impacts of macroeconomic variables

- Review of the current market status for Pb-free piezoelectric ceramic products, key technology issues, competitive scenario and R&D activities

- Insights derived from Porter's Five Forces model and global value chain analysis

- An analysis of U.S. patents across each major category, and emerging trends and developments in patent activity

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of the leading companies, including CTS Corp., PI Ceramic GmbH, Niterra Co. Ltd., Kyocera Corp., and Sumitomo Chemical Co. Ltd.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Market Dynamics and Drivers

- Trends and Future Developments

- Analysis by Segment

- Regional and Emerging Markets

- Conclusion

Chapter 2 Market Overview

- Definition

- Industry Scenario

- Need for Developing Lead-Free Piezoelectric Ceramics

- Characteristics of Lead-Free Piezoelectric Ceramics

- Applications of Lead-Free Piezoelectric Ceramics

- Preparation Techniques

- Regulations

- EU Restriction of Hazardous Substances Exemption

- REACH

- Implications of U.S.-China Tariff War

- Supply Chain Analysis

- Suppliers of Raw Materials

- Lead-Free Piezoelectric Ceramics Manufacturers

- Distribution

- Lead-Free Piezoelectric Device Manufacturers

- End Users

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential for New Entrants

- Threat of Substitutes

- Level of Competition in the Industry

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Health and Environmental Risks of Lead-Based Piezoelectric Materials

- Favorable Regulatory Environment

- Applications of Lead-Free Piezoelectric Ceramics

- Market Challenges

- Environmental Risks Associated with Raw Material Extraction

- Performance Constraints

- Market Opportunities

- Nano-Piezoelectric Ceramics

- Wearable Technology

Chapter 4 Emerging Technologies and Developments

- Overview

- Material and Technological Trends in Materials and Technology

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Findings/Takeaways

- Market Analysis by Material

- Potassium Sodium Niobate (KNN)

- Bismuth Sodium Titanate (BNT)

- Barium Titanate

- Others

- Market Analysis by Configuration

- Monolith

- Multilayer

- Thin films

- Market Analysis by End User

- Consumer Electronics and Optoelectronics

- Transportation

- Industrial Equipment

- Medical Devices

- Other Industries/Sectors

- Geographic Breakdown

- Findings/Takeaways

- Market Analysis by Region

- North America

- Asia-Pacific

- Europe

- Rest of the World (RoW)

Chapter 6 Competitive Intelligence

- Competitive Scenario

- Company Positioning

- Strategic Initiatives

Chapter 7 Sustainability in the Lead-Free Piezoelectric Ceramics Industry: ESG Perspective

- ESG Goals

- ESG Issues

- ESG Performance Analysis

- Environmental Issue

- Social Issue

- Governance Issue

- Current Status of ESG

- Conclusion

Chapter 8 Appendix

- Methodology

- Information Sources

- Abbreviations

- References

- Company Profiles

- CERAMTEC GMBH

- CTS CORP.

- FUJI CERAMICS CORP.

- HONDA ELECTRONICS CO. LTD.

- IONIX AT

- KEMET CORP.

- KYOCERA CORP.

- NITERRA CO. LTD.

- NINGBO FBELE ELECTRONICS CO. LTD.

- PI CERAMIC GMBH

- PZT ELECTRONIC CERAMIC CO. LTD.

- SEIKO EPSON CORP.

- SUMITOMO CHEMICAL CO. LTD.

- TANIOBIS

- ZIBO YUHAI ELECTRONIC CERAMIC CO. LTD.