|

|

市場調査レポート

商品コード

1774365

インダストリー4.0技術の世界市場::~2030年Industry 4.0 Technologies: Global Market Through 2030 |

||||||

|

|||||||

| インダストリー4.0技術の世界市場::~2030年 |

|

出版日: 2025年07月10日

発行: BCC Research

ページ情報: 英文 221 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のインダストリー4.0技術の市場規模は、2024年の5,517億米ドル、2025年の6,552億米ドルから、予測期間中は19.4%のCAGRで推移し、2030年には1兆6,000億米ドルに成長すると予測されています。

北米市場は、2024年の2,276億米ドル、2025年の2,696億米ドルから、2025年から2030年までは17.3%のCAGRで推移し、2030年には5,995億米ドルに達すると予測されています。アジア太平洋市場は、2024年の1,554億米ドル、2025年の1,850億米ドルから、22.4%のCAGRで推移し、2030年には5,084億米ドルに達すると予測されています。

当レポートでは、世界のインダストリー4.0技術の市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 技術の進歩と応用

- 市場力学と成長要因

- 将来の動向と発展

- セグメント分析

- 地域分析と新興市場

- 総論

第2章 市場と技術の概要

- 技術概要

- インダストリー4.0の技術と用途

- 現在の市場概要

- ビッグデータとアナリティクス

- システム統合(水平統合と垂直統合)

- クラウドコンピューティング

- AR・VR

- 産業用IoT

- 3Dプリント

- ロボット工学

- デジタルツイン

- サイバーセキュリティ

- インダストリー4.0技術の未来

- マクロ経済要因

- 増大する研究開発投資がインダストリー4.0の導入を促進

- 経済成長と消費者支出の増加

- 地政学的紛争がインダストリー4.0市場を形成

- インダストリー4.0市場への関税の影響

- 航空宇宙および防衛

- 自動車

- 電気・電子工学

- エネルギー・ユーティリティ

- 化学品

- 医薬品

- 総論

- ポーターのファイブフォース分析

- インダストリー4.0技術のケーススタディ

第3章 市場力学

- 市場力学スナップショット

- 重要ポイント

- 市場促進要因

- IoT技術とデバイスの成長

- ロボット研究開発への政府資金の増額

- 深刻化する労働力不足

- センサーやその他のスマートデバイスから生成されるリアルタイムデータ

- 市場の課題

- インダストリー4.0における安全性とセキュリティの懸念

- インダストリー4.0向けIoTプロトコルの標準化の欠如

- レガシーインフラと通信ネットワークの相互運用性の問題

- 不十分なITインフラと接続性の問題

- 増加する世界のサイバー攻撃

- 市場機会

- クラウド導入の利用増加

- デジタルツインアプリケーションと組み合わせた3Dプリンティング技術

- 5G技術の継続的な展開と6Gの出現

- インダストリー4.0技術の開発を支援する政府の取り組み

第4章 新興技術と開発

- 新興技術と開発

- 5G

- 6G

- エッジコンピューティングとフォグコンピューティング

- ブロックチェーン

- 機械学習

- クラウドロボティクス

- Robotics as a Service

- Digital Twins as a Service

- AR・VR技術の開発

- 生成AIとデジタルツインソリューションの統合

- クラウド暗号化

- インダストリー4.0の柱となる付加製造技術

- マイクロ流体3Dプリンティング

- AIを活用した3Dプリントの予知保全

- 特許分析

- 企業シェアパターン

- 地域パターン

- 主な調査結果

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- インダストリー4.0技術市場:技術別

- 重要ポイント

- ビッグデータ・アナリティクス

- システム統合(水平統合と垂直統合)

- クラウドコンピューティング

- AR・VR

- 産業用IoT

- 3Dプリント

- ロボット工学

- デジタルツイン

- サイバーセキュリティ

- インダストリー4.0技術市場:エンドユーザー産業別

- 重要ポイント

- 航空宇宙および防衛

- 自動車

- 電気・電子工学

- エネルギー・ユーティリティ

- 化学品

- 医薬品

- その他

- 地理的内訳

- インダストリー4.0技術市場:地域別

- 重要ポイント

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 世界のその他の地域

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情報

- 市場エコシステム

- デバイス・ハードウェア

- ソフトウェア・アプリケーション

- プロフェッショナルサービス

- インダストリー4.0技術市場のトップ企業

- Amazon

- Microsoft Corp.

- Siemens

- Cisco Systems Inc.

- IBM

- Oracle

- 戦略分析

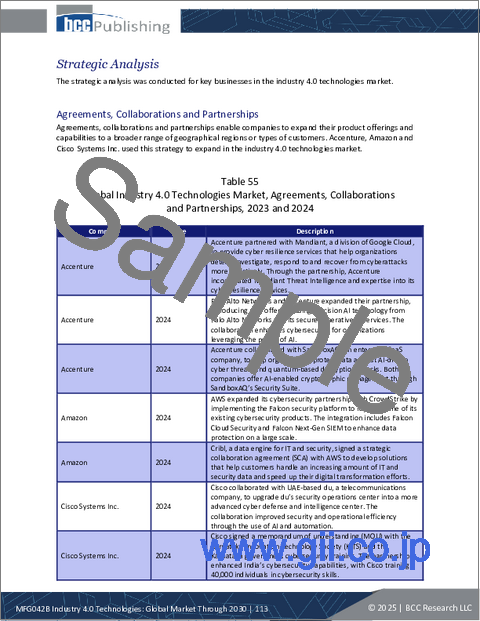

- 協定・協力・パートナーシップ

- M&A

- 投資・拡大

第7章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- 3D SYSTEMS INC.

- ABB

- ACCENTURE

- ALPHABET INC. (GOOGLE INC.)

- AMAZON.COM INC.

- AUTODESK INC.

- BOSCH REXROTH AG

- CISCO SYSTEMS INC.

- EOS GMBH

- GE VERNOVA

- IBM CORP.

- INTEL CORP.

- MATERIALISE

- MICROSOFT

- ORACLE

- ROCKWELL AUTOMATION

- SIEMENS

- SONY GROUP CORP.

- STRATASYS

- その他の主要企業

- ビッグデータ&アナリティクス企業

- システム統合企業

- クラウドコンピューティング企業

- AR・VR企業

- IIoT企業

- 3Dプリント企業

- ロボット企業

- デジタルツイン企業

- サイバーセキュリティ企業

List of Tables

- Summary Table : Global Market for Industry 4.0 Technologies, by Region, Through 2030

- Table 1 : Industry 4.0 Technologies and Applications

- Table 2 : U.S. Tariffs Overview, 2025

- Table 3 : Porter's Five Forces Analysis: Overview

- Table 4 : Start-ups in the Industry 4.0 Technology Market, 2015-2022

- Table 5 : Industry 4.0 Technologies Implementation Case Studies

- Table 6 : Global Networking Infrastructure Adoption by Manufacturers, in 2023

- Table 7 : Cyberattack Types

- Table 8 : Major Cyberattacks, 2023

- Table 9 : Future Trends in 5G Technologies in Manufacturing, 2023

- Table 10 : Impact of Generative AI on Digital Twins

- Table 11 : Published Patents for Industry 4.0 Technologies, 2023-2025*

- Table 12 : Global Market for Industry 4.0 Technologies, by Technology, Through 2030

- Table 13 : Global Market for Big Data and Analytics in Industry 4.0 Technologies, by Region, Through 2030

- Table 14 : Global Market for Big Data and Analytics in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 15 : Global Market for System Integration in Industry 4.0 Technologies, by Region, Through 2030

- Table 16 : Global Market for System Integration in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 17 : Global Market for Cloud Computing in Industry 4.0 Technologies, by Region, Through 2030

- Table 18 : Global Market for Cloud Computing in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 19 : Global Market for AR and VR in Industry 4.0 Technologies, by Region, Through 2030

- Table 20 : Global Market for AR and VR in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 21 : Global Market for IIoT in Industry 4.0 Technologies, by Region, Through 2030

- Table 22 : Global Market for IIoT in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 23 : Global Market for 3D Printing in Industry 4.0 Technologies, by Region, Through 2030

- Table 24 : Global Market for 3D Printing in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 25 : Global Market for Robotics in Industry 4.0 Technologies, by Region, Through 2030

- Table 26 : Global Market for Robotics in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 27 : Global Market for Digital Twins in Industry 4.0 Technologies, by Region, Through 2030

- Table 28 : Global Market for Digital Twins in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 29 : Prediction of Cybersecurity Vulnerabilities in 2025

- Table 30 : Global Market for Cybersecurity in Industry 4.0 Technologies, by Region, Through 2030

- Table 31 : Global Market for Cybersecurity in Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 32 : Global Market for End-Use Industries in Industry 4.0 Technologies, Through 2030

- Table 33 : Global Market for Aerospace and Defense in Industry 4.0 Technologies, Through 2030

- Table 34 : Global Market for Automotive in Industry 4.0 Technologies, Through 2030

- Table 35 : Global Market for Electrical and Electronics in Industry 4.0 Technologies, Through 2030

- Table 36 : Global Market for Energy and Utilities in Industry 4.0 Technologies, Through 2030

- Table 37 : Global Market for Chemical End-User Industry 4.0 Technologies, by Technologies, Through 2030

- Table 38 : Global Market for Pharmaceutical End-User Industry 4.0 Technologies, by Technologies, Through 2030

- Table 39 : Global Market for Other End-User Industry 4.0 Technologies, by Technologies, Through 2030

- Table 40 : Global Market for Industry 4.0 Technologies, by Region, Through 2030

- Table 41 : North American Market for Industry 4.0 Technologies, by Country, Through 2030

- Table 42 : North American Market for Industry 4.0 Technologies, by Technology, Through 2030

- Table 43 : North American Market for Industry 4.0 Technologies by End-Use Industry, Through 2030

- Table 44 : European Policy Initiatives for Industry 4.0, by Region

- Table 45 : European Market for Industry 4.0 Technologies, by Country, Through 2030

- Table 46 : European Market for Industry 4.0 Technologies, by Technology, Through 2030

- Table 47 : European Market for Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 48 : Asia-Pacific Market for Industry 4.0 Technologies, by Country, Through 2030

- Table 49 : Asia-Pacific Market for Industry 4.0 Technologies, by Technology, Through 2030

- Table 50 : Asia-Pacific Market for Industry 4.0 Technologies by End-Use Industry, Through 2030

- Table 51 : ROW Market for Industry 4.0 Technologies, by Country, Through 2030

- Table 52 : ROW Market for Industry 4.0 Technologies, by Technology, Through 2030

- Table 53 : ROW Market for Industry 4.0 Technologies, by End-Use Industry, Through 2030

- Table 54 : Global Industry 4.0 Technology Companies' Market Ranking, 2024

- Table 55 : Global Industry 4.0 Technologies Market, Agreements, Collaborations and Partnerships, 2023 and 2024

- Table 56 : Global Industry 4.0 Technologies Market, Mergers and Acquisitions, 2023 and 2024

- Table 57 : Global Industry 4.0 Technologies Market, Investments and Expansions, 2023-2025

- Table 58 : Report Information Sources

- Table 59 : Abbreviations Used in the Report

- Table 60 : 3D Systems Inc.: Company Snapshot

- Table 61 : 3D Systems Inc.: Financial Performance, FY 2023 and 2024

- Table 62 : 3D Systems Inc.: Product Portfolio

- Table 63 : 3D Systems Inc.: News/Key Developments, 2023 and 2024

- Table 64 : ABB: Company Snapshot

- Table 65 : ABB: Financial Performance, FY 2023 and 2024

- Table 66 : ABB: Product Portfolio

- Table 67 : ABB: News/Key Developments, 2023-2025

- Table 68 : Accenture: Company Snapshot

- Table 69 : Accenture: Financial Performance, FY 2023 and 2024

- Table 70 : Accenture: Product Portfolio

- Table 71 : Accenture: News/Key Developments, 2023 and 2024

- Table 72 : Alphabet Inc. (Google Inc.): Company Snapshot

- Table 73 : Alphabet Inc. (Google Inc.): Financial Performance, FY 2023 and 2024

- Table 74 : Alphabet Inc. (Google Inc.): Product Portfolio

- Table 75 : Alphabet Inc. (Google Inc.): News/Key Developments, 2025

- Table 76 : Amazon.com Inc.: Company Snapshot

- Table 77 : Amazon.com Inc.: Financial Performance, FY 2023 and 2024

- Table 78 : Amazon.com Inc.: Product Portfolio

- Table 79 : Amazon.com Inc.: News/Key Developments, 2023 and 2024

- Table 80 : Autodesk Inc.: Company Snapshot

- Table 81 : Autodesk Inc.: Financial Performance, FY 2023 and 2024

- Table 82 : Autodesk Inc.: Product Portfolio

- Table 83 : Autodesk Inc.: News/Key Developments, 2023

- Table 84 : Bosch Rexroth AG: Company Snapshot

- Table 85 : Bosch Rexroth AG: Financial Performance, FY 2023 and 2024

- Table 86 : Bosch Rexroth AG: Product Portfolio

- Table 87 : Bosch Rexroth AG: News/Key Developments, 2023

- Table 88 : Cisco Systems Inc.: Company Snapshot

- Table 89 : Cisco Systems Inc.: Financial Performance, FY 2023 and 2024

- Table 90 : Cisco Systems Inc.: Product Portfolio

- Table 91 : Cisco Systems Inc.: News/Key Developments, 2023 and 2024

- Table 92 : EOS GmbH: Company Snapshot

- Table 93 : EOS GmbH: Product Portfolio

- Table 94 : EOS GmbH: News/Key Developments, 2023 and 2024

- Table 95 : GE Vernova: Company Snapshot

- Table 96 : GE Vernova: Financial Performance, FY 2022 and 2023

- Table 97 : GE Vernova: Product Portfolio

- Table 98 : GE Vernova: News/Key Developments, 2023 and 2024

- Table 99 : IBM Corp.: Company Snapshot

- Table 100 : IBM Corp.: Financial Performance, FY 2023 and 2024

- Table 101 : IBM Corp.: Product Portfolio

- Table 102 : IBM Corp.: News/Key Developments, 2023 and 2024

- Table 103 : Intel Corp.: Company Snapshot

- Table 104 : Intel Corp.: Financial Performance, FY 2023 and 2024

- Table 105 : Intel Corp.: Product Portfolio

- Table 106 : Intel Corp.: News/Key Developments, 2023 and 2024

- Table 107 : Materialise: Company Snapshot

- Table 108 : Materialise: Financial Performance, FY 2023 and 2024

- Table 109 : Materialise: Product Portfolio

- Table 110 : Microsoft: Company Snapshot

- Table 111 : Microsoft: Financial Performance, FY 2022 and 2023

- Table 112 : Microsoft: Product Portfolio

- Table 113 : Microsoft: News/Key Developments, 2023 and 2024

- Table 114 : Oracle: Company Snapshot

- Table 115 : Oracle: Financial Performance, FY 2022 and 2023

- Table 116 : Oracle: Product Portfolio

- Table 117 : Oracle: News/Key Developments, 2023 and 2024

- Table 118 : Rockwell Automation: Company Snapshot

- Table 119 : Rockwell Automation: Financial Performance, FY 2023 and 2024

- Table 120 : Rockwell Automation: Product Portfolio

- Table 121 : Rockwell Automation: News/Key Developments, 2023 and 2024

- Table 122 : Siemens: Company Snapshot

- Table 123 : Siemens: Financial Performance, FY 2023 and 2024

- Table 124 : Siemens: Product Portfolio

- Table 125 : Siemens: News/Key Developments, 2023 and 2024

- Table 126 : Sony Group Corp.: Company Snapshot

- Table 127 : Sony Group Corp.: Financial Performance, FY 2023 and 2024

- Table 128 : Sony Group Corp.: Product Portfolio

- Table 129 : Sony Group Corp.: News/Key Developments, 2024

- Table 130 : Stratasys: Company Snapshot

- Table 131 : Stratasys: Financial Performance, FY 2023 and 2024

- Table 132 : Stratasys: Product Portfolio

- Table 133 : Stratasys: News/Key Developments, 2023 and 2024

- Table 134 : Big Data and Analytics Companies in the Industry 4.0 Technologies Market

- Table 135 : System Integration Companies in the Industry 4.0 Technologies Market

- Table 136 : Cloud Computing Companies in the Industry 4.0 Technologies Market

- Table 137 : AR and VR Companies in the Industry 4.0 Technologies Market

- Table 138 : IIoT Companies in the Industry 4.0 Technologies Market

- Table 139 : 3D Printing Companies in the Industry 4.0 Technologies Market

- Table 140 : Robotics Companies in the Industry 4.0 Technologies Market

- Table 141 : Digital Twin Companies in the Industry 4.0 Technologies Market

- Table 142 : Cybersecurity Companies in the Industry 4.0 Technologies Market

List of Figure

- Summary Figure : Summary Figure: Global Market Shares of Industry 4.0 Technologies, by Region, 2024

- Figure 1 : Gross Domestic Expenditure on R&D, 2023

- Figure 2 : Industry 4.0 Technologies Market: Porter's Five Forces Analysis

- Figure 3 : Industry 4.0 Technologies Market: Bargaining Power of Buyers

- Figure 4 : Industry 4.0 Technologies Market: Bargaining Power of Suppliers

- Figure 5 : Industry 4.0 Technologies Market: Potential of New Entrants

- Figure 6 : Industry 4.0 Technologies Market: Threat from Substitutes

- Figure 7 : Industry 4.0 Technologies Market: Competition in the Industry

- Figure 8 : Market Dynamics of Industry 4.0 Technologies

- Figure 9 : Data Generated, by Year, 2019-2023

- Figure 10 : Patents Published for Industry 4.0 Technologies, 2023-2025*

- Figure 11 : Industry 4.0 Technologies Patents Share, by Company, 2023-2025*

- Figure 12 : Published Patent Shares Related to Industry 4.0 Technologies, by Region, 2023-2025*

- Figure 13 : Global Market Shares of Industry 4.0 Technologies, by Technology, 2024

- Figure 14 : Global Market Shares of End-Use Industries in Industry 4.0 Technologies, 2024

- Figure 15 : Global Market Shares of Industry 4.0 Technologies, by Region, 2024

- Figure 16 : Industry 4.0 Technologies Market: Market Ecosystem

- Figure 17 : 3D Systems Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 18 : 3D Systems Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 19 : ABB: Revenue Shares, by Business Unit, FY 2024

- Figure 20 : ABB: Revenue Shares, by Country/Region, FY 2024

- Figure 21 : ACCENTURE: Revenue Shares, by Business Unit, FY 2024

- Figure 22 : ACCENTURE: Revenue Shares, by Country/Region, FY 2024

- Figure 23 : (%)

- Figure 24 : (%)

- Figure 25 : Amazon.com Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 26 : Amazon.com Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 27 : Autodesk Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 28 : Autodesk Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 29 : Bosch Rexroth AG: Revenue Shares, by Country/Region, FY 2024

- Figure 30 : Cisco Systems Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 31 : Cisco Systems Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 32 : GE Vernova: Revenue Shares, by Business Unit, FY 2024

- Figure 33 : GE Vernova: Revenue Shares, by Country/Region, FY 2024

- Figure 34 : IBM Corp.: Revenue Shares, by Business Unit, FY 2024

- Figure 35 : IBM Corp.: Revenue Shares, by Country/Region, FY 2024

- Figure 36 : Intel Corp.: Revenue Shares, by Business Unit, FY 2024

- Figure 37 : Intel Corp.: Revenue Shares, by Country/Region, FY 2024

- Figure 38 : MATERIALISE: Revenue Shares, by Business Unit, FY 2024

- Figure 39 : MATERIALISE: Revenue Shares, by Country/Region, FY 2024

- Figure 40 : MICROSOFT: Revenue Shares, by Business Unit, FY 2023

- Figure 41 : MICROSOFT: Revenue Shares, by Country/Region, FY 2023

- Figure 42 : ORACLE: Revenue Shares, by Business Unit, FY 2023

- Figure 43 : ORACLE: Revenue Shares, by Country/Region, FY 2023

- Figure 44 : Rockwell Automation: Revenue Shares, by Business Unit, FY 2024

- Figure 45 : Rockwell Automation: Revenue Shares, by Country/Region, FY 2024

- Figure 46 : SIEMENS: Revenue Shares, by Business Unit, FY 2024

- Figure 47 : SIEMENS: Revenue Shares, by Country/Region, FY 2024

- Figure 48 : Sony Group Corp.: Revenue Shares, by Business Unit, FY 2024

- Figure 49 : STRATASYS: Revenue Shares, by Business Unit, FY 2024

- Figure 50 : STRATASYS: Revenue Shares, by Country/Region, FY 2024

The global market for Industry 4.0 technologies was valued at $551.7 billion in 2024 and is estimated to increase from $655.2 billion in 2025 to reach $1.6 trillion by 2030, at a compound annual growth rate (CAGR) of 19.4% from 2025 through 2030.

The North American market for Industry 4.0 technologies was valued at $227.6 billion in 2024 and is estimated to increase from $269.6 billion in 2025 to reach $599.5 billion by 2030, at a CAGR of 17.3% from 2025 through 2030.

The Asia-Pacific market for Industry 4.0 technologies was valued at $155.4 billion in 2024 and is estimated to increase from $185 billion in 2025 to reach $508.4 billion by 2030, at a CAGR of 22.4% from 2025 through 2030.

Report Scope

This report segments the market based on technology, end-user industry and geographical region. It provides an overview of the global Industry 4.0 technologies market and analyzes market trends. Using 2024 as the base year, the report provides estimated market data for the forecast period 2025 through 2030. The report covers the market for Industry 4.0 technologies with regard to the user base across different regions. It also highlights major trends and challenges that affect the market and the vendor landscape.

The scope of the report includes the global market for Industry 4.0 technologies, such as big data and analytics, system integration (horizontal and vertical integration), cloud computing, augmented reality (AR) and virtual reality (VR), Industrial Internet of Things (IIoT), 3D printing, robotics, digital twins and cybersecurity, as they relate specifically to Industry 4.0.

The report also examines the key trends and challenges driving the market and the companies operating within it. It analyzes patents and emerging technologies in the market, it surveys the competition among major companies, and it includes profiles of leading businesses in the market.

Report Includes

- 59 data tables and 84 additional tables

- An overview of the current and future global markets for industry 4.0 technologies

- An analysis of the global market trends with market revenue data from 2024, estimates for 2025, forecasts for 2026, 2028, and projected CAGRs through 2030

- Estimates of the size and revenue prospects of the global market, along with a market share analysis by technology, end use industry, and region

- Facts and figures pertaining to market dynamics, technological advances, regulations, and the impact of macroeconomic factors

- An analysis of patents, emerging trends and developments in the industry

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Company profiles of major players within the industry, including Amazon.com Inc., Microsoft, Siemens, Cisco Systems Inc., and IBM Corp.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Technological Advances and Applications

- Market Dynamics and Growth Factors

- Future Trends and Developments

- Segmental Analysis

- Regional Insights and Emerging Markets

- Conclusion

Chapter 2 Market and Technology Overview

- Technology Overview

- Industry 4.0 Technologies and Applications

- Current Market Overview

- Big Data and Analytics

- System Integration (Horizontal and Vertical Integration)

- Cloud Computing

- AR and VR

- The Industrial Internet of Things

- 3D Printing

- Robotics

- Digital Twins

- Cybersecurity

- Future of Industry 4.0 Technologies

- Macroeconomic Factors

- Growing R&D Investments Driving Industry 4.0 Adoption

- Economic Growth and Rising Consumer Spending

- Geopolitical Conflict Shaping the Industry 4.0 Market

- Tariff Impact on the Industry 4.0 Market

- Aerospace and Defense

- Automotive

- Electrical and Electronics

- Energy and Utilities

- Chemicals

- Pharmaceuticals

- Conclusion

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential of New Entrants

- Threat from Substitutes

- Competition in the Industry

- Case Studies of Industry 4.0 Technologies

Chapter 3 Market Dynamics

- Market Dynamics Snapshot

- Key Takeaways

- Market Drivers

- Growth of IoT Technology and Devices

- Increased Government Funding for Robotics R&D

- Increasing Labor Shortages

- Real-Time Data Generated from Sensors and Other Smart Devices

- Market Challenges

- Safety and Security Concerns in Industry 4.0

- Absence of Standardization in IoT Protocols for Industry 4.0

- Interoperability Issues of Legacy Infrastructure and Communication Networks

- Inadequate Information Technology Infrastructure and Connectivity Issues

- Growing Number of Global Cyberattacks

- Market Opportunities

- Increasing Use of Cloud Deployments

- 3D-Printing Technologies Combined with Digital Twin Applications

- The Ongoing Deployment of 5G Technology and the Emergence of 6G

- Government Initiatives Supporting the Development of Industry 4.0 Technologies

Chapter 4 Emerging Technologies and Developments

- Emerging Technologies and Developments

- 5G

- 6G

- Edge and Fog Computing

- Blockchain

- Machine Learning

- Cloud Robotics

- Robotics as a Service

- Digital Twins as a Service

- Development in Augmented Reality and Virtual Reality Technology

- Integration of Generative AI and Digital Twin Solutions

- Cloud Encryption

- Additive Manufacturing Technology as a Pillar of Industry 4.0

- Microfluidic 3D Printing

- AI-Powered Predictive Maintenance for 3D Printing

- Patent Analysis

- Company Share Patterns

- Regional Patterns

- Key Findings

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Industry 4.0 Technologies Market by Technology

- Key Takeaways

- Big Data and Analytics

- System Integration (Horizontal and Vertical Integration)

- Cloud Computing

- Augmented Reality and Virtual Reality

- Industrial Internet of Things

- 3D Printing

- Robotics

- Digital Twins

- Cybersecurity

- Industry 4.0 Technologies Market by End-Use Industry

- Key Takeaways

- Aerospace and Defense

- Automotive

- Electrical and Electronics

- Energy and Utilities

- Chemicals

- Pharmaceuticals

- Others

- Geographic Breakdown

- Industry 4.0 Technologies Market by Region

- Key Takeaways

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- The U.K.

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Latin America

- Middle East and Africa

Chapter 6 Competitive Intelligence

- Market Ecosystem

- Devices and Hardware

- Software and Applications

- Professional Services

- Top Companies in the Industry 4.0 Technologies Market

- Amazon

- Microsoft Corp.

- Siemens

- Cisco Systems Inc.

- IBM

- Oracle

- Strategic Analysis

- Agreements, Collaborations and Partnerships

- Mergers and Acquisitions

- Investments and Expansions

Chapter 7 Appendix

- Methodology

- References

- Abbreviations

- Company Profiles

- 3D SYSTEMS INC.

- ABB

- ACCENTURE

- ALPHABET INC. (GOOGLE INC.)

- AMAZON.COM INC.

- AUTODESK INC.

- BOSCH REXROTH AG

- CISCO SYSTEMS INC.

- EOS GMBH

- GE VERNOVA

- IBM CORP.

- INTEL CORP.

- MATERIALISE

- MICROSOFT

- ORACLE

- ROCKWELL AUTOMATION

- SIEMENS

- SONY GROUP CORP.

- STRATASYS

- List of Other Key Companies in the Industry 4.0 Technologies Market

- Big Data and Analytics Companies

- System Integration Companies

- Cloud Computing Companies

- AR and VR Companies

- IIoT Companies

- 3D Printing Companies

- Robotics Companies

- Digital Twin Companies

- Cybersecurity Companies