|

|

市場調査レポート

商品コード

1724760

デジタル病理:各種技術と世界市場Digital Pathology: Technologies and Global Markets |

||||||

|

|||||||

| デジタル病理:各種技術と世界市場 |

|

出版日: 2025年04月29日

発行: BCC Research

ページ情報: 英文 170 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデジタル病理の市場規模は、2024年の78億ドルから、2029年末には137億ドルに達すると予測されており、2024年から2029年の予測期間におけるCAGRは11.9%です。

北米市場は、2024年に33億ドルから、2029年には60億ドルに拡大すると見込まれており、同期間のCAGRは12.4%です。欧州市場は、2024年に22億ドルから、2029年には35億ドルに達すると予測されており、予測期間中のCAGRは10.2%です。

当レポートでは、世界のデジタル病理の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

第2章 市場概要

- 市場概要

- デジタル病理の歴史的発展

- 従来プロセス vs デジタル病理

第3章 市場力学

- 概要

- 促進要因

- コスト効率の良さがデジタル病理の拡大を促進

- 検査室の効率向上を目的としたデジタル病理の導入拡大

- 癌の発生率の増加

- デジタル病理への投資と資金の増加

- 抑制要因

- ワークフロー統合の課題

- リソースが限られた国々での導入の遅れ

- 機会

- デジタル病理におけるAI

- 技術の進歩

- 課題

- 病理医の不足と不平等な分布

- データ管理

- デジタル病理の最新動向

- より優れたソリューションを開発するための共同研究・提携

- 市場の成長を促進するイノベーション

- クラウドコンピューティングによる医療提供体制の強化

- デジタルおよび計算病理

第4章 規制状況

- 規制環境

- 米国

- 欧州

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 概要

- 市場分析:システム別

- デジタルIVDデバイス

- デジタル病理デバイス

- デジタル病理アナリティクス

- デジタル病理コミュニケーションプラットフォーム

- デジタル病理ストレージプラットフォーム

- テレパソロジーシステム

- 市場分析:タイプ別

- デジタル血液および臨床病理

- デジタル解剖病理

- デジタル微生物

- デジタル遺伝病理

- デジタル免疫病理

- デジタル化学病理

- デジタル法医学病理

- 市場分析:用途別

- 病気の診断

- 医薬品の発見と開発

- 研究開発およびその他

- 市場分析:エンドユーザー別

- 病院・診断センター

- バイオテクノロジーおよび製薬会社

- 学術センターなど

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 新たな動向と技術

- 概要

- 多重化手法の進歩

- 分子病理の進歩

- ハイパースペクトルおよびマルチスペクトルイメージング

- 空間バイオマーカー統合

- スライド全体のデジタル画像

- クラウドコンピューティングとデジタル病理

- デジタル病理におけるAI

- 2024年のデジタル病理におけるAIの進歩

第7章 ESGの動向

- ESG:イントロダクション

- デジタル病理市場におけるESGの持続可能性:主要製造業者別

- ESGリスク評価

- BCCによる見解

第8章 特許分析

第9章 競合情勢

- M&A・提携

- 企業シェア分析

- その他の主要戦略

第10章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- 3DHISTECH LTD.

- APOLLO ENTERPRISE IMAGING CORP.

- CLINISYS INC.

- CORISTA

- F. HOFFMANN-LA ROCHE LTD.

- FUJIFILM HOLDINGS CORP.

- HURON TECHNOLOGIES INTERNATIONAL INC.

- INDICA LABS LLC.

- KONINKLIJKE PHILIPS N.V.

- LEICA BIOSYSTEMS NUSSLOCH GMBH

- LIGOLAB INFORMATION SYSTEMS

- MIKROSCAN TECHNOLOGIES INC.

- NIKON INSTRUMENTS INC.

- VISIOPHARM A/S

- XIFIN INC.

List of Tables

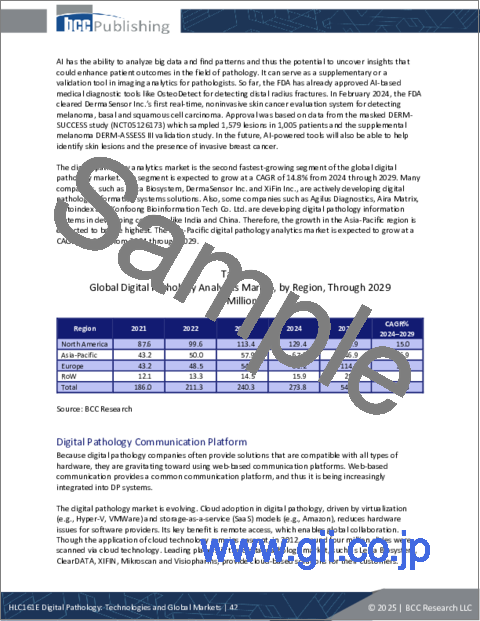

- Summary Table : Global Digital Pathology Market, by Region, Through 2029

- Table 1 : Evolution of Pathology: Key Milestones and Technological Advances

- Table 2 : Comparison of Traditional Pathology vs. Digital Pathology

- Table 3 : Recent Funding for Digital Pathology, 2025

- Table 4 : Global Digital Pathology Market, by System, Through 2029

- Table 5 : Global Digital Pathology Market, by System, Through 2029

- Table 6 : Global Digital IVD Devices Market, by Product, Through 2029

- Table 7 : Global Automated Hematology Analyzers and Blood Cell Counters Market, by Region, Through 2029

- Table 8 : Global Digital Holographic Microscopy Market, by Region, Through 2029

- Table 9 : Global Digital Urine Sediment Analyzers Market, by Region, Through 2029

- Table 10 : Global Digital Chromosome Analyzers Market, by Region, Through 2029

- Table 11 : Global Immunohistochemistry Image Analysis Applications Market, by Region, Through 2029

- Table 12 : Global Digital Polymerase Chain Reaction Market, by Region, Through 2029

- Table 13 : Global Digital Cytopathology Market, by Region, Through 2029

- Table 14 : Global Digital Cytopathology Market, by Region, Through 2029

- Table 15 : Global Signet Cell Detection Market, by Region, Through 2029

- Table 16 : Global Digital Pathology Devices Market, by Region, Through 2029

- Table 17 : Global Digital Pathology Devices Market, by Type, Through 2029

- Table 18 : Global Scanners Segment in the Digital Pathology Devices Market, by Region, Through 2029

- Table 19 : Global Robotic Microscopes Segment in the Digital Pathology Devices Market, by Region, Through 2029

- Table 20 : Global Digital Cameras Segment in the Digital Pathology Devices Market, by Region, Through 2029

- Table 21 : Global Digital Pathology Analytics Market, by Region, Through 2029

- Table 22 : Global Digital Pathology Communication Platform Market, by Region, Through 2029

- Table 23 : Global Digital Pathology Storage Platform Market, by Region, Through 2029

- Table 24 : Global Telepathology Systems Market, by Region, Through 2029

- Table 25 : Global Digital Pathology Market, by Type, Through 2029

- Table 26 : Global Digital Hematology and Clinical Pathology Market, by Region, Through 2029

- Table 27 : Global Digital Anatomic Pathology Market, by Region, Through 2029

- Table 28 : Global Digital Microbiology Market, by Region, Through 2029

- Table 29 : Global Digital Genetic Pathology Market, by Region, Through 2029

- Table 30 : Global Digital Immunopathology Market, by Region, Through 2029

- Table 31 : Global Digital Chemical Pathology Market, by Region, Through 2029

- Table 32 : Global Digital Forensic Pathology Market, by Region, Through 2029

- Table 33 : Global Digital Pathology Market, by Application, Through 2029

- Table 34 : Global Digital Pathology Disease Diagnosis Market, by Region, Through 2029

- Table 35 : Global Digital Pathology Drug Discovery and Development Market, by Region, Through 2029

- Table 36 : R&D Expenditures in the Global Pharmaceutical Industry, by Leading 19 Companies, 2023

- Table 37 : Global Digital Pathology R&D and Others Market, by Region, Through 2029

- Table 38 : Global Digital Pathology Market, by End User, Through 2029

- Table 39 : Global Digital Pathology Market in Hospitals and Diagnostic Centers, by Region, Through 2029

- Table 40 : Global Digital Pathology Market in Biotech and Pharmaceutical Companies, by Region, Through 2029

- Table 41 : Global Digital Pathology Market in Academic Centers and Other End-Users, by Region, Through 2029

- Table 42 : Global Digital Pathology Market, by Region, Through 2029

- Table 43 : North American Digital Pathology Market, by Country, Through 2029

- Table 44 : North American Digital Pathology Market, by System, Through 2029

- Table 45 : North American Digital Pathology Market, by Type, Through 2029

- Table 46 : North American Digital Pathology Market, by Application, Through 2029

- Table 47 : North American Digital Pathology Market, by End User, Through 2029

- Table 48 : U.S. Digital Pathology Market, by System, Through 2029

- Table 49 : U.S. Digital Pathology Market, by Type, Through 2029

- Table 50 : Canadian Digital Pathology Market, by System, Through 2029

- Table 51 : Canadian Digital Pathology Market, by Type, Through 2029

- Table 52 : Mexican Digital Pathology Market, by System, Through 2029

- Table 53 : Mexican Digital Pathology Market, by Type, Through 2029

- Table 54 : European Digital Pathology Market, by Country, Through 2029

- Table 55 : European Digital Pathology Market, by System, Through 2029

- Table 56 : European Digital Pathology Market, by Type, Through 2029

- Table 57 : European Digital Pathology Market, by Application, Through 2029

- Table 58 : European Digital Pathology Market, by End User, Through 2029

- Table 59 : U.K. Digital Pathology Market, by System, Through 2029

- Table 60 : U.K. Digital Pathology Market, by Type, Through 2029

- Table 61 : French Digital Pathology Market, by System, Through 2029

- Table 62 : French Digital Pathology Market, by Type, Through 2029

- Table 63 : Italian Digital Pathology Market, by System, Through 2029

- Table 64 : Italian Digital Pathology Market, by Type, Through 2029

- Table 65 : German Digital Pathology Market, by System, Through 2029

- Table 66 : German Digital Pathology Market, by Type, Through 2029

- Table 67 : Spanish Digital Pathology Market, by System, Through 2029

- Table 68 : Spanish Digital Pathology Market, by Type, Through 2029

- Table 69 : Rest of the European Digital Pathology Market, by System, Through 2029

- Table 70 : Rest of the European Digital Pathology Market, by Type, Through 2029

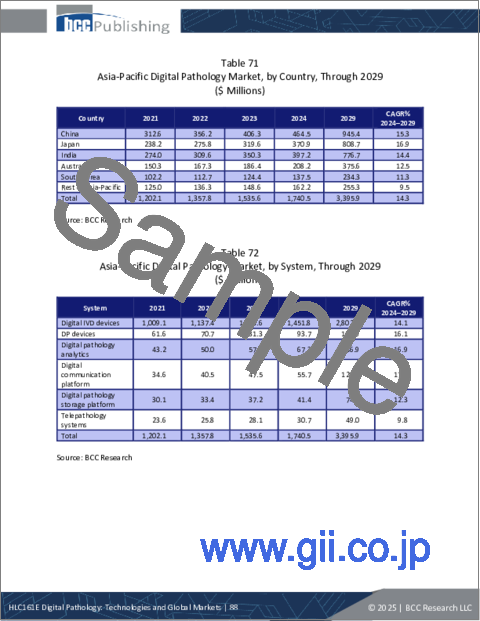

- Table 71 : Asia-Pacific Digital Pathology Market, by Country, Through 2029

- Table 72 : Asia-Pacific Digital Pathology Market, by System, Through 2029

- Table 73 : Asia-Pacific Digital Pathology Market, by Type, Through 2029

- Table 74 : Asia-Pacific Digital Pathology Market, by Application, Through 2029

- Table 75 : Asia-Pacific Digital Pathology Market, by End User, Through 2029

- Table 76 : Chinese Digital Pathology Market, by System, Through 2029

- Table 77 : Chinese Digital Pathology Market, by Type, Through 2029

- Table 78 : Indian Digital Pathology Market, by System, Through 2029

- Table 79 : Indian Digital Pathology Market, by Type, Through 2029

- Table 80 : Japanese Digital Pathology Market, by System, Through 2029

- Table 81 : Japanese Digital Pathology Market, by Type, Through 2029

- Table 82 : Australian Digital Pathology Market, by System, Through 2029

- Table 83 : Australian Digital Pathology Market, by Type, Through 2029

- Table 84 : South Korean Digital Pathology Market, by System, Through 2029

- Table 85 : South Korean Digital Pathology Market, by Type, Through 2029

- Table 86 : Rest of Asia-Pacific Digital Pathology Market, by System, Through 2029

- Table 87 : Rest of Asia-Pacific Digital Pathology Market, by Type, Through 2029

- Table 88 : Rest of the World Digital Pathology Market, by System, Through 2029

- Table 89 : Rest of the World Digital Pathology Market, by Type, Through 2029

- Table 90 : Rest of the World Digital Pathology Market, by Application, Through 2029

- Table 91 : Rest of the World Digital Pathology Market, by End User, Through 2029

- Table 92 : Key Focus Areas in Environmental Sustainability

- Table 93 : ESG Highlights, by Major Players, 2023

- Table 94 : ESG Risk Rankings for Digital Pathology Solutions Manufacturing Companies, 2023

- Table 95 : Mergers and Acquisitions in Digital Pathology Market, 2021-2024

- Table 96 : New Product Launches in the Digital Pathology Market, 2021-2024

- Table 97 : Other Key Strategies in the Digital Pathology Market, 2022-2025

- Table 98 : Information Sources in this Report

- Table 99 : Major Abbreviations Used in This Report

- Table 100 : 3DHISTECH Ltd.: Company Snapshot

- Table 101 : 3DHISTECH Ltd.: Product Portfolio

- Table 102 : 3DHISTECH Ltd.: Recent Developments, 2021-2024

- Table 103 : Apollo Enterprise Imaging Corp.: Company Snapshot

- Table 104 : Apollo Enterprise Imaging Corp.: Product Portfolio

- Table 105 : Apollo Enterprise Imaging Corp.: Recent Developments, 2022-2024

- Table 106 : Clinisys Inc.: Company Snapshot

- Table 107 : CliniSys Inc.: Product Portfolio

- Table 108 : CliniSys Inc.: Recent Developments, 2021-2024

- Table 109 : Corista: Company Snapshot

- Table 110 : Corista: Product Portfolio

- Table 111 : Corista: Recent Developments, 2022-2024

- Table 112 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 113 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 114 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 115 : F. Hoffmann-La Roche Ltd.: Recent Developments, 2021-2024

- Table 116 : Fujifilm Holdings Corp.: Company Snapshot

- Table 117 : Fujifilm Holdings Corp.: Financial Performance, FY 2022 and 2023

- Table 118 : Fujifilm Holdings Corp.: Product Portfolio

- Table 119 : Fujifilm Holdings Corp.: News/Key Developments, 2021-2024

- Table 120 : Huron Technologies International Inc.: Company Snapshot

- Table 121 : Huron Technologies International Inc.: Product Portfolio

- Table 122 : Huron Technologies International Inc.: Recent Developments, 2021-2023

- Table 123 : Indica Labs LLC.: Company Snapshot

- Table 124 : Indica Labs LLC.: Product Portfolio

- Table 125 : Indica Labs LLC.: Recent Developments, 2022-2025

- Table 126 : Koninklijke Philips N.V.: Company Snapshot

- Table 127 : Koninklijke Philips N.V.: Financial Performance, FY 2022 and 2023

- Table 128 : Koninklijke Philips N.V.: Product Portfolio

- Table 129 : Koninklijke Philips N.V.: News/Key Developments, 2021-2024

- Table 130 : Leica Biosystems Nussloch GmbH.: Company Snapshot

- Table 131 : Leica Biosystems Nussloch GmbH: Product Portfolio

- Table 132 : Leica Biosystems Nussloch GmbH: Recent Developments, 2021-2025

- Table 133 : LigoLab Information Systems: Company Snapshot

- Table 134 : LigoLab Information Systems: Product Portfolio

- Table 135 : Mikroscan Technologies Inc.: Company Snapshot

- Table 136 : Mikroscan Technologies Inc.: Product Portfolio

- Table 137 : Mikroscan Technologies Inc.: Recent Developments, 2021 and 2024

- Table 138 : Nikon Instruments Inc.: Company Snapshot

- Table 139 : Nikon Instruments Inc.: Product Portfolio

- Table 140 : Nikon Instruments Inc.: Recent Developments, 2021-2024

- Table 141 : Visiopharm A/S: Company Snapshot

- Table 142 : Visiopharm A/S: Product Portfolio

- Table 143 : Visiopharm A/S: Recent Developments, 2021-2024

- Table 144 : XIFIN Inc.: Company Snapshot

- Table 145 : XIFIN Inc.: Product Portfolio

- Table 146 : XIFIN Inc.: Recent Developments, 2021-2022

- Table 147 : List of Few Emerging Startups

List of Figures

- Summary Figure : Global Digital Pathology Market Shares, by Region, 2023

- Figure 1 : Digital Pathology Adopters, 2025

- Figure 2 : Snapshot of Market Dynamics

- Figure 3 : Global Shares of Cancer Incidence (New) Cases, by WHO Region, 2022

- Figure 4 : Global Shares of Cancer Mortality Cases, by WHO Region, 2022

- Figure 5 : U.S. Digital Health Funding and Number of Deals, 2012-2022

- Figure 6 : Distribution of Pathologists, by Continent, 2019-2022

- Figure 7 : Global Digital Pathology Market Shares, by System, 2023

- Figure 8 : Global Digital Pathology Market Shares, by Type, 2023

- Figure 9 : Global Digital Pathology Market Shares, by Application, 2023

- Figure 10 : Global Digital Pathology Market Shares, by End User, 2023

- Figure 11 : Global Digital Pathology Market Shares, by Region, 2023

- Figure 12 : 2024 Progress Assessment: Tracking the Sustainable Development Goals

- Figure 13 : Patents Documented, by Top Owners, 2021-2024

- Figure 14 : Share of Patents Documented, by Jurisdiction, 2021-2024

- Figure 15 : Patents Documented Over Time, 2010-November 2024

- Figure 16 : Shares of Global Market for Medical Imaging, by Leading Manufacturers, 2023

- Figure 17 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Business Unit, FY 2023

- Figure 18 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Country/Region, FY 2023

- Figure 19 : Fujifilm Holdings Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 20 : Fujifilm Holdings Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 21 : Koninklijke Philips N.V.: Revenue Shares, by Business Unit, FY 2023

- Figure 22 : Koninklijke Philips N.V.: Revenue Shares, by Country/Region, FY 2023

The global digital pathology market is expected to grow from $7.8 billion in 2024 and is projected to reach $13.7 billion by the end of 2029, at a compound annual growth rate (CAGR) of 11.9% during the forecast period of 2024 to 2029.

The North American digital pathology market is expected to grow from $3.3 billion in 2024 and is projected to reach $6.0 billion by the end of 2029, at a CAGR of 12.4% during the forecast period of 2024 to 2029.

The European digital pathology market is expected to grow from $2.2 billion in 2024 and is projected to reach $3.5 billion by the end of 2029, at a CAGR of 10.2% during the forecast period of 2024 to 2029.

Report Scope

This report analyzes the digital pathology market, providing forecasted trends and sales projections for this market through 2029. It covers key market players, product segments, supporting technologies, emerging trends, competitive intelligence, major geographies and their competitive landscapes, and it offers regional insights. The report's in-depth analysis of market dynamics and their impact(s) forms the foundation for its qualitative assessments and market estimates.

Digital pathology is the process of converting glass slide samples into digital images to enable electronic analysis, storage and sharing. This conversion, which enhances diagnostic accuracy, collaboration and efficiency by facilitating advanced imaging, computational analysis and telepathology, has revolutionized pathology with data-driven insights and remote consultations.

While this report outlines the conventional processes of pathology laboratories, it does not include market analysis for traditional lab devices such as microscopes and slides. The connectivity and network issues discussed are specific to data and information related to pathology lab diagnoses, excluding broader hospital-based mHealth (Mobile Health) concerns. This report's coverage of telepathology is focused on diagnostic applications, research and development (R&D), and education and training but does not address telemedicine at a broader level.

This report addresses regulatory aspects, including innovations; technological advances (patents and approvals); and the latest trends, preferences and developments in digital pathology. As part of its analysis, it segments the digital pathology market by system, type, application and end user. The market has also been segmented into the following major geographies, North America, Asia-Pacific, Europe and the Rest of the World, and there is focused coverage of countries such as the U.S., Canada, Mexico, France, Germany, the U.K., Italy, Spain, Japan, India, Australia, South Korea and China.

Report Includes

- 91 data tables and 57 additional tables

- An analysis of the global market for digital pathology technologies

- Analyses of global market trends, with data from 2021-2023, estimates for 2024, and projections of compound annual growth rates (CAGRs) through 2029

- Descriptions of the upcoming market opportunities for the digital pathology market, factors driving its growth, and forecasts for this market's segments and sub-segments

- Estimates of the market size and forecasts for the digital pathology market in value (USD millions) terms, and a corresponding market share analysis by system, type, application, end user and geographic region

- In-depth information regarding major market dynamics, technology updates, new products and applications, and COVID-19's impact on the market for digital pathology

- Coverage of the technological, economic, and business considerations of the global market for digital pathology, with analyses and market forecasts through 2029

- Information on mergers and acquisitions, agreements, collaborations and product launches in the digital pathology industry

- Analysis of relevant patents

- A discussion of the industry's ESG challenges and practices

- Analysis of the competitive landscape for digital pathology companies, and a value share analysis based on their segmental revenues and financial performance

- Profiles of the leading global companies, including F. Hoffmann-La Roche Ltd., 3DHISTECH Ltd., Nikon Instruments Inc., Danaher Corp., and Indica Labs Inc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Market Overview

- Historical Development of Digital Pathology

- Conventional Process Versus Digital Pathology

Chapter 3 Market Dynamics

- Overview

- Drivers

- Cost-Effectiveness Drives Digital Pathology Expansion

- Growing Adoption of Digital Pathology to Enhance Lab Efficiency

- Increasing Incidence of Cancer

- Increasing Investments and Funding in Digital Pathology

- Restraints

- Workflow Integration

- Slow Implementation of Digital Pathology in Low-Resource Countries

- Opportunities

- AI in Digital Pathology

- Technology Advances

- Challenges

- Shortage and Unequal Distribution of Pathologists

- Data Management

- Current Trends in Digital Pathology

- Collaborations to Develop Better Solutions

- Innovations to Drive Market Growth

- Cloud Computing to Enhance Healthcare Delivery Systems

- Digital and Computational Pathology

Chapter 4 Regulatory Landscape

- Regulatory Environment

- U.S.

- Europe

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Overview

- Market Analysis by System

- Digital IVD devices

- Digital Pathology Devices

- Digital Pathology Analytics

- Digital Pathology Communication Platform

- Digital Pathology Storage Platform

- Telepathology Systems

- Market Analysis by Type

- Digital Hematology and Clinical Pathology

- Digital Anatomical Pathology

- Digital Microbiology

- Digital Genetic Pathology

- Digital Immunopathology

- Digital Chemical Pathology

- Digital Forensic Pathology

- Market Analysis by Application

- Disease Diagnosis

- Drug Discovery and Development

- R&D and Others

- Market Analysis by End User

- Hospitals and Diagnostic Centers

- Biotech and Pharma Companies

- Academic Centers and Others

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World

Chapter 6 Emerging Trends and Technologies

- Overview

- Advances in Multiplexing Methods

- Advancing Molecular Pathology

- Hyperspectral and Multispectral Imaging

- Spatial Biomarker Integration

- Whole Slide Digital Imaging

- Cloud Computing and Digital Pathology

- AI in Digital Pathology

- Advances in AI in Digital Pathology in 2024

Chapter 7 ESG Developments

- Introduction to ESG

- ESG Sustainability in Digital Pathology Market, by Major Manufacturers

- ESG Risk Ratings

- BCC Research Viewpoint

Chapter 8 Patent Analysis

- Overview

- Digital Pathology

Chapter 9 Competitive Landscape

- Mergers, Acquisitions and Collaborations

- Company Share Analysis

- Other Key Strategies

Chapter 10 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- 3DHISTECH LTD.

- APOLLO ENTERPRISE IMAGING CORP.

- CLINISYS INC.

- CORISTA

- F. HOFFMANN-LA ROCHE LTD.

- FUJIFILM HOLDINGS CORP.

- HURON TECHNOLOGIES INTERNATIONAL INC.

- INDICA LABS LLC.

- KONINKLIJKE PHILIPS N.V.

- LEICA BIOSYSTEMS NUSSLOCH GMBH

- LIGOLAB INFORMATION SYSTEMS

- MIKROSCAN TECHNOLOGIES INC.

- NIKON INSTRUMENTS INC.

- VISIOPHARM A/S

- XIFIN INC.

- Emerging Start-ups/Market Disrupters