|

|

市場調査レポート

商品コード

1724755

航空宇宙用セラミックスの世界市場:~2029年Aerospace Ceramics: Global Markets to 2029 |

||||||

|

|||||||

| 航空宇宙用セラミックスの世界市場:~2029年 |

|

出版日: 2025年04月29日

発行: BCC Research

ページ情報: 英文 140 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の航空宇宙用セラミックスの市場規模は、2024年から2029年にかけてはCAGR 8.0%のCAGRで推移し、2029年には82億米ドルに成長すると予測されています。

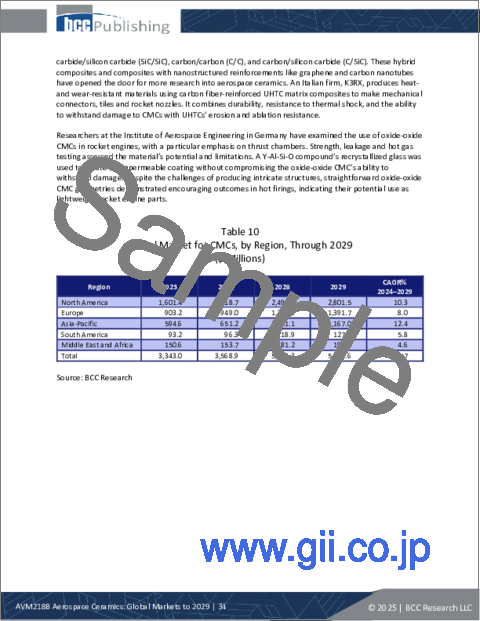

北米市場は、2024年の27億米ドルから、予測期間中はCAGR 8.3%で推移し、2029年には40億米ドルに成長すると予想されています。アジア太平洋市場は、2024年の11億米ドルから、CAGR 10.0%で推移し、2029年には18億米ドルに成長すると予測されています。

当レポートでは、世界の航空宇宙用セラミックスの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 重要ポイント

第2章 市場概要

- 概要

- 航空宇宙用セラミックスの利点

- 航空宇宙用セラミックスの特性

- CMCの技術的背景

- バリューチェーン分析

- 原材料の調達

- 材料加工

- 部品製造

- 品質試験と認証

- 流通と物流

- エンドユーザー産業

- リサイクル/再利用と廃棄

- 規制の枠組み

第3章 市場力学

- 市場力学

- 市場促進要因

- 航空交通量の増加

- 厳しい環境規制

- セラミックベースコーティングの需要

- 軍事・防衛プログラムの拡大

- 市場抑制要因

- 生産および加工コスト

- サプライチェーンの脆弱性

- 市場機会

- 宇宙探査と衛星の展開

- 都市型航空交通 (UAM) の普及

- 市場の課題

- 技術的課題

- 代替材料との競合

第4章 新興技術と開発

- 概要

- 航空宇宙産業の動向

- 空中モビリティ

- AI

- ブロックチェーン

- 超音速飛行

- 電気推進

- 新興技術

- 超高温セラミックス

- 機能傾斜セラミックス

- 付加製造

- プラズマ支援表面工学

- ナノ構造セラミックス

- 特許分析

- 重要ポイント

- 航空宇宙用セラミックスに関する特許付与

第5章 市場セグメント分析

- セグメンテーションの内訳

- 市場分析:構成別

- セラミックマトリックス複合材料

- 酸化物セラミックス

- 非酸化物セラミックス

- 市場分析:用途別

- 構造用途

- 熱用途

- 電気用途

- 市場分析:エンドユーザー別

- 商業航空

- 防衛・軍事航空宇宙

- 商業宇宙

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第6章 競合情報

- 業界構造

- 企業の市場シェア

- 戦略分析

第7章 航空宇宙用セラミックス産業における持続可能性:ESGの観点

- 航空宇宙用セラミックス産業におけるESG

- 業界における持続可能性の動向

- ESGの実践

- 航空宇宙用セラミックス産業におけるESGの現状

- ESGスコア分析

- リスクスケール、露出スケール、管理スケール

- リスクスケール

- 露出スケール

- マネジメントスケール

- ESGの未来:新たな動向と機会

- 総論

第8章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- 3M

- ADVANCED CERAMIC MATERIALS

- APPLIED CERAMICS INC.

- CERAMCO INC.

- CERAMTEC GMBH

- COORSTEK INC.

- HEXCEL CORP.

- INTERNATIONAL SYALONS (NEWCASTLE) LTD.

- JIAXING NICEWAY PRECISION MACHINERY CO. LTD.

- KYOCERA CORP.

- MATERION CORP.

- MCDANEL ADVANCED MATERIAL TECHNOLOGIES LLC.

- MORGAN ADVANCED MATERIALS

- SAINT-GOBAIN

- STC MATERIAL SOLUTIONS

List of Tables

- Summary Table : Global Market for Aerospace Ceramics, by Region, Through 2029

- Table 1 : Electrical Properties of Aerospace Ceramics

- Table 2 : Mechanical Properties of Aerospace Ceramics

- Table 3 : Thermal Properties of Aerospace Ceramics

- Table 4 : CMC Fabrication Methods

- Table 5 : Regulatory Frameworks Supporting Aerospace Ceramics, 2023 and 2024

- Table 6 : Global Airline Industry Passenger Traffic, 2022-2024

- Table 7 : Patents on Aerospace Ceramics, 2023-2025

- Table 8 : Properties of Ceramics

- Table 9 : Global Market for Aerospace Ceramics, by Composition, Through 2029

- Table 10 : Global Market for CMCs, by Region, Through 2029

- Table 11 : Properties of Alumina and Zirconia

- Table 12 : Global Market for Oxide Ceramics, by Region, Through 2029

- Table 13 : Comparison of Aerospace Ceramics and Metals

- Table 14 : Global Market for Non-Oxide Ceramics, by Region, Through 2029

- Table 15 : Global Market for Aerospace Ceramics, by Application, Through 2029

- Table 16 : Global Market for Aerospace Ceramics in Structural Applications, by Region, Through 2029

- Table 17 : Global Market for Aerospace Ceramics in Thermal Applications, by Region, Through 2029

- Table 18 : Global Market for Aerospace Ceramics in Electrical Applications, by Region, Through 2029

- Table 19 : Global Market for Aerospace Ceramics, by End Use, Through 2029

- Table 20 : Global Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 21 : Global Market for Aerospace Ceramics in Commercial Aviation, by Region, Through 2029

- Table 22 : Global Market for Aerospace Ceramics in Passenger Aircraft, by Region, Through 2029

- Table 23 : Global Market for Aerospace Ceramics in Transport Aircraft, by Region, Through 2029

- Table 24 : Global Market for Aerospace Ceramics in Defense and Military Aerospace, by Region, Through 2029

- Table 25 : Global Market for Aerospace Ceramics in Commercial Space Industry, by Region, Through 2029

- Table 26 : Global Market for Aerospace Ceramics in the Other End Uses, by Region, Through 2029

- Table 27 : Global Market for Aerospace Ceramics, by Region, Through 2029

- Table 28 : North American Market for Aerospace Ceramics, by Country, Through 2029

- Table 29 : North American Market for Aerospace Ceramics, by Composition, Through 2029

- Table 30 : North American Market for Aerospace Ceramics, by Application, Through 2029

- Table 31 : North American Market for Aerospace Ceramics, by End Use, Through 2029

- Table 32 : North American Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 33 : European Market for Aerospace Ceramics, by Country, Through 2029

- Table 34 : European Market for Aerospace Ceramics, by Composition, Through 2029

- Table 35 : European Market for Aerospace Ceramics, by Application, Through 2029

- Table 36 : European Market for Aerospace Ceramics, by End Use, Through 2029

- Table 37 : European Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 38 : Asia-Pacific Market for Aerospace Ceramics, by Country, Through 2029

- Table 39 : Asia-Pacific Market for Aerospace Ceramics, by Composition, Through 2029

- Table 40 : Asia-Pacific Market for Aerospace Ceramics, by Application, Through 2029

- Table 41 : Asia-Pacific Market for Aerospace Ceramics, by End Use, Through 2029

- Table 42 : Asia-Pacific Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 43 : South American Market for Aerospace Ceramics, by Composition, Through 2029

- Table 44 : South American Market for Aerospace Ceramics, by Application, Through 2029

- Table 45 : South American Market for Aerospace Ceramics, by End Use, Through 2029

- Table 46 : South American Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 47 : MEA Market for Aerospace Ceramics, by Composition, Through 2029

- Table 48 : MEA Market for Aerospace Ceramics, by Application, Through 2029

- Table 49 : MEA Market for Aerospace Ceramics, by End Use, Through 2029

- Table 50 : MEA Market for Aerospace Ceramics in Commercial Aviation, by Type, Through 2029

- Table 51 : Recent Developments in the Aerospace Ceramics Industry, 2023-2025

- Table 52 : ESG Carbon Footprint Initiatives

- Table 53 : ESG Water and Waste Reduction Initiatives

- Table 54 : ESG Diversity Initiatives

- Table 55 : ESG Employee Safety and Labor Practice Initiatives

- Table 56 : ESG: Governance and Sustainable Supply Chain Initiatives

- Table 57 : ESG Scores for Aerospace Ceramics Companies, 2024

- Table 58 : Abbreviations Used in This Report

- Table 59 : 3M: Company Snapshot

- Table 60 : 3M: Financial Performance, FY 2023 and 2024

- Table 61 : 3M: Product Portfolio

- Table 62 : 3M: News/Key Developments, 2024

- Table 63 : Advanced Ceramic Materials: Company Snapshot

- Table 64 : Advanced Ceramic Materials: Product Portfolio

- Table 65 : Applied Ceramics Inc.: Company Snapshot

- Table 66 : Applied Ceramics Inc.: Product Portfolio

- Table 67 : Ceramco Inc.: Company Snapshot

- Table 68 : Ceramco Inc.: Product Portfolio

- Table 69 : CeramTec GmbH: Company Snapshot

- Table 70 : CeramTec GmbH: Product Portfolio

- Table 71 : CeramTec GmbH: News/Key Developments, 2024

- Table 72 : CoorsTek Inc.: Company Snapshot

- Table 73 : CoorsTek Inc.: Product Portfolio

- Table 74 : CoorsTek Inc.: News/Key Developments, 2023 and 2024

- Table 75 : Hexcel Corp.: Company Snapshot

- Table 76 : Hexcel Corp.: Financial Performance, FY 2023 and 2024

- Table 77 : Hexcel Corp.: Product Portfolio

- Table 78 : Hexcel Corp.: News/Key Developments, 2023 and 2024

- Table 79 : International Syalons (Newcastle) Ltd.: Company Snapshot

- Table 80 : International Syalons (Newcastle) Ltd.: Product Portfolio

- Table 81 : Jiaxing Niceway Precision Machinery Co. Ltd.: Company Snapshot

- Table 82 : Jiaxing Niceway Precision Machinery Co. Ltd.: Product Portfolio

- Table 83 : Kyocera Corp.: Company Snapshot

- Table 84 : Kyocera Corp.: Financial Performance, FY 2022 and FY 2023

- Table 85 : Kyocera Corp.: Product Portfolio

- Table 86 : Kyocera Corp.: News/Key Developments, 2023 and 2024

- Table 87 : Materion Corp.: Company Snapshot

- Table 88 : Materion Corp.: Financial Performance, FY 2023 and 2024

- Table 89 : Materion Corp.: Product Portfolio

- Table 90 : McDanel Advanced Material Technologies LLC.: Company Snapshot

- Table 91 : McDanel Advanced Material Technologies LLC.: Product Portfolio

- Table 92 : Morgan Advanced Materials: Company Snapshot

- Table 93 : Morgan Advanced Materials: Financial Performance, FY 2023 and 2024

- Table 94 : Morgan Advanced Materials: Product Portfolio

- Table 95 : Morgan Advanced Materials: News/Key Developments, 2024

- Table 96 : Saint-Gobain: Company Snapshot

- Table 97 : Saint-Gobain: Financial Performance, FY 2023 and 2024

- Table 98 : Saint-Gobain: Product Portfolio

- Table 99 : Saint-Gobain: News/Key Developments, 2022 and 2023

- Table 100 : STC Material Solutions: Company Snapshot

- Table 101 : STC Material Solutions: Product Portfolio

- Table 102 : STC Material Solutions.: News/Key Developments, 2023

List of Figures

- Summary Figure : Share of Global Market for Aerospace Ceramics, by Region, 2023

- Figure 1 : CMC Fabrication Steps

- Figure 2 : Aerospace Ceramics Market Value Chain

- Figure 3 : Market Dynamics - Aerospace Ceramics

- Figure 4 : Emerging Technologies in the Aerospace Ceramics Industry

- Figure 5 : Share of Global Market for Aerospace Ceramics, by Composition, 2023

- Figure 6 : Share of Global Market for CMCs, by Region, 2023

- Figure 7 : Schematic Diagram of High Bypass Turbofan Engine

- Figure 8 : Share of Global Market for Oxide Ceramics, by Region, 2023

- Figure 9 : Share of Global Market for Non-Oxide Ceramics, by Region, 2023

- Figure 10 : Share of Global Market for Aerospace Ceramics, by Application, 2023

- Figure 11 : Share of Global Market for Aerospace Ceramics in Structural Applications, by Region, 2023

- Figure 12 : Share of Global Market for Aerospace Ceramics in Thermal Applications, by Region, 2023

- Figure 13 : Share of Global Market for Aerospace Ceramics in Electrical Applications, by Region, 2023

- Figure 14 : Share of Global Market for Aerospace Ceramics, by End Use, 2023

- Figure 15 : Share of Global Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 16 : Share of Global Market for Aerospace Ceramics in Commercial Aviation, by Region, 2023

- Figure 17 : Share of Global Market for Aerospace Ceramics in Passenger Aircraft, by Region, 2023

- Figure 18 : Share of Global Market for Aerospace Ceramics in Transport Aircraft, by Region, 2023

- Figure 19 : Share of Global Market for Aerospace Ceramics in Defense and Military Aerospace, by Region, 2023

- Figure 20 : Share of Global Market for Aerospace Ceramics in Commercial Space Industry, by Region, 2023

- Figure 21 : Share of Global Market for Aerospace Ceramics in the Other End Uses, by Region, 2023

- Figure 22 : Share of Global Market for Aerospace Ceramics, by Region, 2023

- Figure 23 : Share of North American Market for Aerospace Ceramics, by Country, 2023

- Figure 24 : Share of North American Market for Aerospace Ceramics, by Composition, 2023

- Figure 25 : Share of North American Market for Aerospace Ceramics, by Application, 2023

- Figure 26 : Share of North American Market for Aerospace Ceramics, by End Use, 2023

- Figure 27 : Share of North American Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 28 : Share of European Market for Aerospace Ceramics, by Country, 2023

- Figure 29 : Share of European Market for Aerospace Ceramics, by Composition, 2023

- Figure 30 : Share of European Market for Aerospace Ceramics, by Application, 2023

- Figure 31 : Share of European Market for Aerospace Ceramics, by End Use, 2023

- Figure 32 : Share of European Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 33 : Share of Asia-Pacific Market for Aerospace Ceramics, by Country, 2023

- Figure 34 : Share of Asia-Pacific Market for Aerospace Ceramics, by Composition, 2023

- Figure 35 : Share of Asia-Pacific Market for Aerospace Ceramics, by Application, 2023

- Figure 36 : Share of Asia-Pacific Market for Aerospace Ceramics, by End Use, 2023

- Figure 37 : Share of Asia-Pacific Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 38 : Share of South American Market for Aerospace Ceramics, by Composition, 2023

- Figure 39 : Share of South American Market for Aerospace Ceramics, by Application, 2023

- Figure 40 : Share of South American Market for Aerospace Ceramics, by End Use, 2023

- Figure 41 : Share of South American Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 42 : Share of MEA Market for Aerospace Ceramics, by Composition, 2023

- Figure 43 : Share of MEA Market for Aerospace Ceramics, by Application, 2023

- Figure 44 : Share of MEA Market for Aerospace Ceramics, by End Use, 2023

- Figure 45 : Share of MEA Market for Aerospace Ceramics in Commercial Aviation, by Type, 2023

- Figure 46 : Share of Global Market for Aerospace Ceramics Manufacturers, 2023

- Figure 47 : Advantages of Sustainability for Aerospace Ceramics Companies

- Figure 48 : 3M: Revenue Share, by Business Unit, FY 2024

- Figure 49 : 3M: Revenue Share, by Country/Region, FY 2024

- Figure 50 : Hexcel Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 51 : Hexcel Corp.: Revenue Share, by Country/Region, 2024

- Figure 52 : Kyocera Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 53 : Kyocera Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 54 : Materion Corp.: Revenue Share, by Business Unit, FY 2024

- Figure 55 : Materion Corp.: Revenue Share, by Country/Region, FY 2024

- Figure 56 : Morgan Advanced Materials: Revenue Share, by Business Unit, FY 2024

- Figure 57 : Morgan Advanced Materials: Revenue Share, by Country/Region, FY 2024

- Figure 58 : Saint-Gobain: Revenue Share, by Country/Region, FY 2024

The global market for aerospace ceramics was valued at $5.3 billion in 2024. It is expected to grow from $5.6 billion in 2024 to $8.2 billion by 2029, at a compound annual growth rate (CAGR) of 8.0% from 2024 through 2029.

The North American market for aerospace ceramics is expected to grow from $2.7 billion in 2024 to $4.0 billion by 2029, at a CAGR of 8.3% from 2024 through 2029.

The Asia-Pacific market for aerospace ceramics is expected to grow from $1.1 billion in 2024 to $1.8 billion by 2029, at a CAGR of 10.0% from 2024 through 2029.

Report Scope

This report analyzes the global market for aerospace ceramics, reflecting the latest data, trends and market projections. Aerospace ceramics are advanced materials that exhibit superior thermal and electrical performance and lightweight properties, leading to enhanced aircraft performance, including fuel efficiency, greater speed, range and payload capacity. They are primarily found in thermal protection shields, engine and exhaust systems, and structures for aircraft.

For this analysis, the global market for aerospace ceramics is segmented by:

- Composition: ceramic matrix composites (CMCs), oxides ceramics (alumina, zirconia) and non-oxide ceramics (silicon carbide, silicon nitride, boron carbide).

- Application: structural, thermal and electrical.

- End use: commercial aviation (commercial passenger and commercial transport), defense and military aerospace, commercial space industry, and others (helicopter, general aviation).

- Region: North America, Europe, Asia-Pacific, South America, the Middle East and Africa.

The report focuses on aerospace ceramics for the commercial aviation and space exploration sector with a focus on structural, thermal and electrical applications. Structural applications include engine components, such as turbine blades and nozzles, airframes, landing gear and structural reinforcements. Thermal applications include thermal protection systems (TPS), heat shields, thermal barrier coatings, insulation in engines and re-entry systems, and hypersonic vehicle exteriors. Electrical applications include electronic components such as capacitors, antennas and sensors, avionics and substrates. The base year for the market study is 2023, with estimates and forecasts for 2024 to 2029. Market estimates are in U.S. dollars (millions).

Forecasts for growth rates are based on expected industry capacity additions, feedback from key companies, revenue reports of major companies, and anticipated regulatory updates. Data from major ceramic associations such as the Australian Ceramics Association, Contemporary Ceramic Studios Association, European Ceramic Industry Association, British Ceramic Confederation, Ceramics Southern Africa, Midwest Ceramic Association and the Association of British Ceramic Distributors were used to anticipate the market dynamics and further triangulate the market size.

Report Includes

- 48 data tables and 55 additional tables

- An overview of the current and future global markets for aerospace ceramics

- An analysis of global market trends, with market revenue data from 2023, estimates for 2024, forecasts for 2028, and projected CAGRs through 2029

- Estimates of the size and revenue prospects of the global market, along with a market share analysis by composition, application, end user and region

- Identification of the trends that will affect the use of aerospace ceramics, as well as their major source markets

- Coverage of technologies that are currently used or in the future could be used in aerospace ceramics, and an assessment of the potential impact of aerospace ceramics on the global market

- Facts and figures pertaining to market dynamics, technological advances, regulations, and the impact of macroeconomic factors

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Profiles of the leading companies, including Saint-Gobain, 3M, Kyocera Corp., Morgan Advanced Materials Plc., and Hexcel Corp.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Key Takeaways

Chapter 2 Market Overview

- Overview

- Benefits of Aerospace Ceramics

- Properties of Aerospace Ceramics

- Technological Background of CMCs

- Value Chain Analysis

- Sourcing of Raw Materials

- Material Processing

- Component Production

- Quality Testing and Certification

- Distribution and Logistics

- End-Use Industries

- Recycling/Reuse and Disposal

- Regulatory Framework

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Growth of Air Traffic

- Stringent Environmental Regulations

- Demand for Ceramic-Based Coatings

- Expansion of Military and Defense Programs

- Market Restraints

- Production and Processing Costs

- Supply Chain Vulnerabilities

- Market Opportunities

- Space Exploration and Satellite Deployments

- Prevalence of Urban Air Mobility (UAM)

- Market Challenges

- Technological Challenges

- Competition With Substitute Materials

Chapter 4 Emerging Technologies and Developments

- Overview

- Aerospace Industry Trends

- Aerial Mobility

- Artificial Intelligence

- Blockchain

- Supersonic Flights

- Electric Propulsion

- Emerging Technologies

- Ultra-High-Temperature Ceramics

- Functionally Graded Ceramics

- Additive Manufacturing

- Plasma-Assisted Surface Engineering

- Nanostructured Ceramics

- Patent Analysis

- Key Takeaways

- Patent Grants Related to Aerospace Ceramics

Chapter 5 Market Segment Analysis

- Segmentation Breakdown

- Market Analysis by Composition

- Ceramic Matrix Composites

- Oxide Ceramics

- Non-Oxide Ceramics

- Market Analysis by Application

- Structural Applications

- Thermal Applications

- Electrical Applications

- Market Analysis by End Use

- Commercial Aviation

- Defense and Military Aerospace

- Commercial Space Industry

- Other End Uses

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Chapter 6 Competitive Intelligence

- Industry Structure

- Company Market Shares

- Strategic Analysis

Chapter 7 Sustainability in the Aerospace Ceramics Industry: ESG Perspective

- ESG in the Aerospace Ceramics Industry

- Sustainability Trends in the Industry

- ESG Practices

- Status of ESG in the Aerospace Ceramics Industry

- ESG Score Analysis

- Risk Scale, Exposure Scale and Management Scale

- Risk Scale

- Exposure Scale

- Management Scale

- Future of ESG: Emerging Trends and Opportunities

- Concluding Remarks

Chapter 8 Appendix

- Methodology

- References

- Abbreviations

- Company Profiles

- 3M

- ADVANCED CERAMIC MATERIALS

- APPLIED CERAMICS INC.

- CERAMCO INC.

- CERAMTEC GMBH

- COORSTEK INC.

- HEXCEL CORP.

- INTERNATIONAL SYALONS (NEWCASTLE) LTD.

- JIAXING NICEWAY PRECISION MACHINERY CO. LTD.

- KYOCERA CORP.

- MATERION CORP.

- MCDANEL ADVANCED MATERIAL TECHNOLOGIES LLC.

- MORGAN ADVANCED MATERIALS

- SAINT-GOBAIN

- STC MATERIAL SOLUTIONS