|

|

市場調査レポート

商品コード

1724745

化学品の調査レビュー:2024年2024 Chemical Research Review |

||||||

|

|||||||

| 化学品の調査レビュー:2024年 |

|

出版日: 2025年04月28日

発行: BCC Research

ページ情報: 英文 183 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の塗料・コーティング剤の市場規模は、2024年の2,038億米ドルから、2024年から2029年にかけてはCAGR 5.2%で推移し、2029年には2,632億米ドルに達すると予測されています。

世界の接着剤・シーラントの市場規模は、2024年の661億米ドルから、2029年には816億米ドルに達すると推定され、2024年から2029年までのCAGRは4.3%です。

世界の接着剤および接着剤塗布装置の市場規模は、2024年の721億米ドルから、2029年には899億米ドルに達すると推定され、2024年から2029年までのCAGRは4.5%です。

世界の化学品産業は、現代の製造業において重要な役割を果たしており、建設、自動車、航空宇宙、医療、消費財など、幅広い用途に不可欠な材料を供給しています。技術の進歩、規制の変化、そして持続可能性への関心の高まりに伴い、この業界は大きな変革期を迎えています。先進的な化学製品、低排出のコーティング剤、循環型経済の取り組みに対する需要が、市場の動向を再構築しています。さらに、自動化やデジタル化により、生産プロセスの効率化、無駄の削減が進んでいます。

化学品業界の中でも、塗料・コーティング剤、接着剤・シーラント、接着剤塗布装置という3つの主要分野が急速な成長を遂げています。塗料・コーティング剤市場は、建設、自動車、船舶、産業用途における需要の高まりを背景に、力強い成長を見せています。これらの材料は装飾的な役割だけでなく、防食・耐摩耗・環境ダメージから表面を保護する機能も果たします。都市化やインフラ整備の進展に伴い、高性能なコーティング剤の需要は今後も増加し続けると見込まれています。

この業界における大きな変化の一つは、環境負荷を軽減する持続可能な配合への移行です。揮発性有機化合物 (VOC) や有害化学物質に関する規制の強化に伴い、水性塗料、粉体塗料、バイオベース樹脂の使用が広がりを見せています。PPG Industries、AkzoNobel、Sherwin-Williams、BASFといった企業は、耐久性・効率性・環境配慮の特性を兼ね備えた先進的な塗料の開発をリードしています。これらのイノベーションは、燃費向上や製品寿命の延長に寄与する軽量で高強度な塗料が求められる自動車や航空宇宙といった分野において特に重要です。

当調査レビューは、BCC Researchが2024年に発行した塗料・コーティング剤、接着剤・シーラント・接合・ファスニング、接着剤および接着剤塗布装置に関するレポートのハイライトと抜粋を含み、それぞれの市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析などをまとめています。

目次

第1章 序文

第2章 塗料およびコーティング剤の世界市場と先進技術 (CHM049H)

- 塗料・コーティング剤の世界市場と先進技術

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場概要

- 市場定義

- 組成

- バリューチェーン分析

- ポーターのファイブフォース分析

- 市場力学

- 市場推進因子

- 市場機会

- 市場の課題

- 塗料およびコーティング剤の規制状況

- 規制分析

- 新興技術

- 進歩

- 技術とイノベーションに関する業界専門家の発言

- 市場セグメンテーション分析

- 市場分析:技術別

- 地理的内訳

- 市場分析:地域別

- 塗料・コーティング剤業界における持続可能性:ESGの観点

- 塗料・コーティング剤業界におけるESGの重要性

- 塗料・コーティング剤業界におけるESG実践

- 塗料・コーティング剤市場におけるESGの現状

- 新たな持続可能性の動向

- BCCによる総論

第3章 接着剤・シーラント・接合・ファスニングの世界市場 (CHM048E)

- 接着剤・シーラントまたは接合・ファスニングの世界市場

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場概要

- 市場定義

- 接着剤とシーラントの特性

- 市場力学

- 市場推進因子

- 市場抑制

- 市場機会

- 新技術と開発

- 新しい技術

- 市場セグメンテーション分析

- 市場分析:タイプ別

- 地理的内訳

- 市場分析:地域別

- 接着剤・シーラント・接合・ファスニング業界における持続可能性:ESGの観点

- 接着剤・シーラント・接合・ファスニングセクターにおける主要なESG課題

- 接着剤・シーラント・接合・ファスニング業界のESGパフォーマンス分析

- 接着剤・シーラント・接合・ファスニング市場におけるESGに対する消費者の態度

- BCCによる総論

第4章 接着剤および接着剤塗布装置:各種技術と世界市場 (CHM073E)

- 接着剤および接着剤塗布装置

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場概要

- 市場定義

- ポーターのファイブフォース分析

- サプライチェーン分析

- 市場力学

- 市場推進因子

- 市場抑制

- 市場機会

- 新技術と開発

- 新技術

- 市場セグメンテーション分析

- 接着剤

- 地域別内訳

- 市場分析:地域別

- 接着剤塗布装置

- 地域別内訳

- 市場分析:

- 接着剤および接着剤塗布装置業界における持続可能性:ESGの観点

- 接着剤および接着剤塗布装置業界における主要なESG課題

- 接着剤および接着剤塗布装置業界のESGパフォーマンス分析

- 接着剤および接着剤塗布装置市場におけるESGの現状

- BCCによる総論

第5章 付録

List of Tables

- Table 1 : Global Market for Paints and Coatings, by Region, Through 2029

- Table 2 : Regulations on Paints and Coatings Market, by Country, 2023

- Table 3 : Global Market for Paints and Coatings, by Technology, Through 2029

- Table 4 : Global Market for Water-borne Coatings, by Application, Through 2029

- Table 5 : Global Market for Water-borne Coatings, by Region, Through 2029

- Table 6 : Global Market for Solvent-borne Coatings, by Application, Through 2029

- Table 7 : Global Market for Solvent-borne Coatings, by Region, Through 2029

- Table 8 : Global Market for Powder Coatings, by Application, Through 2029

- Table 9 : Global Market for Powder Coatings, by Region, Through 2029

- Table 10 : Global Market for UV Cure Coatings, by Application, Through 2029

- Table 11 : Global Market for UV Cure Coatings, by Region, Through 2029

- Table 12 : Global Market for Emerging Coatings Technology, by Type, Through 2029

- Table 13 : Global Market for Emerging Coatings Technology, by Application, Through 2029

- Table 14 : Global Market for Emerging Coatings Technology, by Region, Through 2029

- Table 15 : Global Market for Paints and Coatings, by Region, Through 2029

- Table 16 : North American Market for Paints and Coatings, by Country, Through 2029

- Table 17 : North American Market for Paints and Coatings, by Technology, Through 2029

- Table 18 : North American Market for Paints and Coatings, by Chemistry, Through 2029

- Table 19 : North American Market for Paints and Coatings, by End Use, Through 2029

- Table 20 : European Market for Paints and Coatings, by Country, Through 2029

- Table 21 : European Market for Paints and Coatings, by Technology, Through 2029

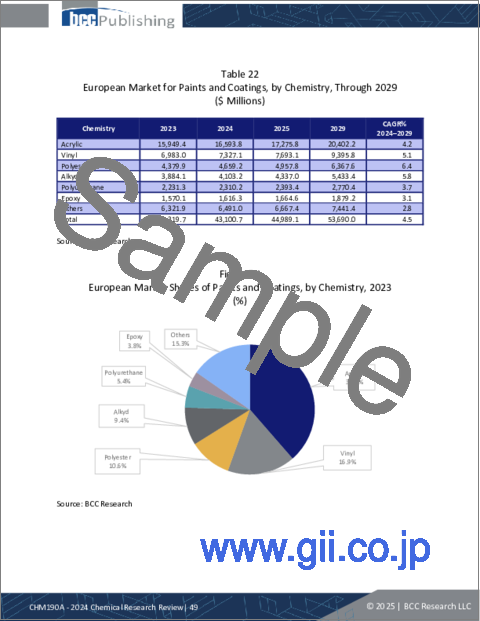

- Table 22 : European Market for Paints and Coatings, by Chemistry, Through 2029

- Table 23 : European Market for Paints and Coatings, by End Use, Through 2029

- Table 24 : Asia-Pacific Market for Paints and Coatings, by Country, Through 2029

- Table 25 : Asia-Pacific Market for Paints and Coatings, by Technology, Through 2029

- Table 26 : Asia-Pacific Market for Paints and Coatings, by Chemistry, Through 2029

- Table 27 : Asia-Pacific Market for Paints and Coatings, by End Use, Through 2029

- Table 28 : Rest of World Market for Paints and Coatings, by Sub-Region, Through 2029

- Table 29 : Rest of World Market for Paints and Coatings, by Technology, Through 2029

- Table 30 : Rest of World Market for Paints and Coatings, by Chemistry, Through 2029

- Table 31 : Rest of World Market for Paints and Coatings, by End Use, Through 2029

- Table 32 : ESG Carbon Footprint Issue Analysis

- Table 33 : ESG Risk Factor Ratings for Companies in Paints and Coatings Market

- Table 34 : Global Adhesives & Sealants or Joining and Fastening Market, by Region, Through 2029

- Table 35 : Bond Strength Between Diferent Chemistry Adhesives and Most Common Materials Used for Biomedical Applications

- Table 36 : Types of Construction Sealants

- Table 37 : Global Adhesives & Sealants or Joining and Fastening Market, by Type, Through 2029

- Table 38 : Global Adhesives Market, by Technology, Through 2029

- Table 39 : Global Adhesives Market for Hot Melt Adhesives, by Region, Through 2029

- Table 40 : Global Adhesives Market for Reactive Adhesives, by Region, Through 2029

- Table 41 : Global Adhesives Market for Water-Based Adhesives, by Region, Through 2029

- Table 42 : Global Adhesives Market for Solvent-Based Adhesives, by Region, Through 2029

- Table 43 : Global Adhesives Market for Other Adhesives, by Region, Through 2029

- Table 44 : Global Sealants Market, by Chemicals, Through 2029

- Table 45 : Global Sealants Market for Silicone, by Region, Through 2029

- Table 46 : Global Sealants Market for Polyurethane, by Region, Through 2029

- Table 47 : Global Sealants Market for Acrylic, by Region, Through 2029

- Table 48 : Global Sealants Market for Butyl, by Region, Through 2029

- Table 49 : Global Sealants Market for Other Chemicals, by Region, Through 2029

- Table 50 : Global Adhesives & Sealants or Joining and Fastening Market, by Region, Through 2029

- Table 51 : North American Adhesives & Sealants or Joining and Fastening Market, by Country, Through 2029

- Table 52 : North American Adhesives & Sealants or Joining and Fastening Market, by Type, Through 2029

- Table 53 : North American Adhesives Market, by Technology, Through 2029

- Table 54 : North American Adhesives Market, by Chemicals, Through 2029

- Table 55 : North American Adhesives Market, by Curing Technique, Through 2029

- Table 56 : North American Sealants Market, by Class, Through 2029

- Table 57 : North American Sealants Market, by Chemicals, Through 2029

- Table 58 : North American Adhesives Market, by End Use, Through 2029

- Table 59 : North American Sealants Market, by End Use, Through 2029

- Table 60 : European Adhesives & Sealants or Joining and Fastening Market, by Country, Through 2029

- Table 61 : European Adhesives & Sealants or Joining and Fastening Market, by Type, Through 2029

- Table 62 : European Adhesives Market, by Technology, Through 2029

- Table 63 : European Adhesives Market, by Chemicals, Through 2029

- Table 64 : European Adhesives Market, by Curing Technique, Through 2029

- Table 65 : European Sealants Market, by Class, Through 2029

- Table 66 : European Sealants Market, by Chemicals, Through 2029

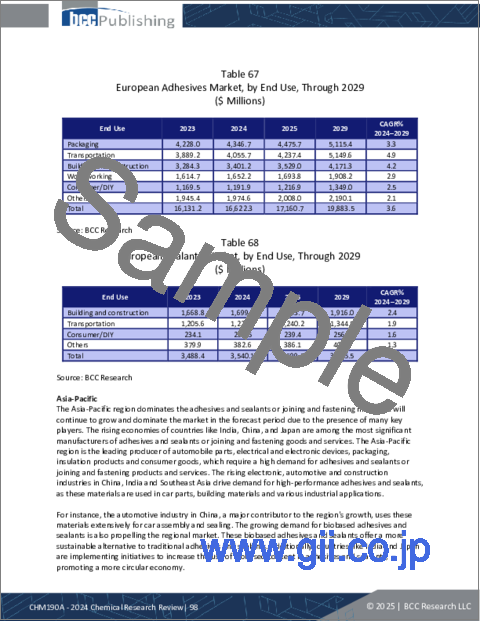

- Table 67 : European Adhesives Market, by End Use, Through 2029

- Table 68 : European Sealants Market, by End Use, Through 2029

- Table 69 : Asia-Pacific Adhesives & Sealants or Joining and Fastening Market, by Country, Through 2029

- Table 70 : Asia-Pacific Adhesives & Sealants or Joining and Fastening Market, by Type, Through 2029

- Table 71 : Asia-Pacific Adhesives Market, by Technology, Through 2029

- Table 72 : Asia-Pacific Adhesives Market, by Chemicals, Through 2029

- Table 73 : Asia-Pacific Adhesives Market, by Curing Technique, Through 2029

- Table 74 : Asia-Pacific Sealants Market, by Class, Through 2029

- Table 75 : Asia-Pacific Sealants Market, by Chemicals, Through 2029

- Table 76 : Asia-Pacific Adhesives Market, by End Use, Through 2029

- Table 77 : Asia-Pacific Sealants Market, by End Use, Through 2029

- Table 78 : Rest of the World Adhesives & Sealants or Joining and Fastening Market, by Sub-Region, Through 2029

- Table 79 : Rest of the World Adhesives & Sealants or Joining and Fastening Market, by Type, Through 2029

- Table 80 : Rest of the World Adhesives Market, by Technology, Through 2029

- Table 81 : Rest of the World Adhesives Market, by Chemicals, Through 2029

- Table 82 : Rest of the World Adhesives Market, by Curing Technique, Through 2029

- Table 83 : Rest of the World Sealants Market, by Class, Through 2029

- Table 84 : Rest of the World Sealants Market, by Chemicals, Through 2029

- Table 85 : Rest of the World Adhesives Market, by End Use, Through 2029

- Table 86 : Rest of the World Sealants Market, by End Use, Through 2029

- Table 87 : Environmental Performance: Assesses a Company's Effect on the Natural Environment

- Table 88 : Social Performance: Processes a Company's Impact on Society and Communities.

- Table 89 : Governance Performance: Evaluation of a Business's Administration and Oversight Practices

- Table 90 : Global Adhesives and Adhesive-Applying Equipment Market, by Segment, Through 2029

- Table 91 : Global Adhesives Market, by Chemicals, Through 2029

- Table 92 : Global Adhesives Market for Acrylic, by Region, Through 2029

- Table 93 : Global Adhesives Market for Epoxy, by Region, Through 2029

- Table 94 : Global Adhesives Market for Polyurethane, by Region, Through 2029

- Table 95 : Global Adhesives Market for Silicone, by Region, Through 2029

- Table 96 : Global Adhesives Market for Cyanoacrylate, by Region, Through 2029

- Table 97 : Global Adhesives Market for Other Chemicals, by Region, Through 2029

- Table 98 : Global Adhesives Market, by Region, Through 2029

- Table 99 : North American Adhesives Market, by Country, Through 2029

- Table 100 : North American Adhesives Market, by Technology, Through 2029

- Table 101 : North American Adhesives Market, by Chemicals, Through 2029

- Table 102 : North American Adhesives Market, by Curing Technique, Through 2029

- Table 103 : North American Adhesives Market, by End Use, Through 2029

- Table 104 : European Adhesives Market, by Country, Through 2029

- Table 105 : European Adhesives Market, by Technology, Through 2029

- Table 106 : European Adhesives Market, by Chemicals, Through 2029

- Table 107 : European Adhesives Market, by Curing Technique, Through 2029

- Table 108 : European Adhesives Market, by End Use, Through 2029

- Table 109 : Asia-Pacific Adhesives Market, by Country, Through 2029

- Table 110 : Asia-Pacific Adhesives Market, by Technology, Through 2029

- Table 111 : Asia-Pacific Adhesives Market, by Chemicals, Through 2029

- Table 112 : Asia-Pacific Adhesives Market, by Curing Technique, Through 2029

- Table 113 : Asia-Pacific Adhesives Market, by End Use, Through 2029

- Table 114 : Rest of the World Adhesives Market, by Sub-Region, Through 2029

- Table 115 : Rest of the World Adhesives Market, by Technology, Through 2029

- Table 116 : Rest of the World Adhesives Market, by Chemicals, Through 2029

- Table 117 : Rest of the World Adhesives Market, by Curing Technique, Through 2029

- Table 118 : Rest of the World Adhesives Market, by End Use, Through 2029

- Table 119 : Global Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 120 : Global Adhesive-Applying Equipment Market for Auxiliary Equipment, by Region, Through 2029

- Table 121 : Global Adhesive-Applying Equipment Market for Auxiliary Equipment, by Type, Through 2029

- Table 122 : Global Adhesive-Applying Equipment Market for Robotics and Automatic, by Region, Through 2029

- Table 123 : Global Adhesive-Applying Equipment Market for Web-Handling, by Region, Through 2029

- Table 124 : Global Adhesive-Applying Equipment Market for Curing Equipment, by Region, Through 2029

- Table 125 : Global Adhesive-Applying Equipment Market for Other Equipment, by Region, Through 2029

- Table 126 : Global Adhesive-Applying Equipment Market for Application Process Equipment, by Region, Through 2029

- Table 127 : Global Adhesive-Applying Equipment Market for Application Process Equipment, by Type, Through 2029

- Table 128 : Global Adhesive-Applying Equipment Market for Dots and Beads, by Region, Through 2029

- Table 129 : Global Adhesive-Applying Equipment Market for Sprays, by Region, Through 2029

- Table 130 : Global Adhesive-Applying Equipment Market for Web Coating, by Region, Through 2029

- Table 131 : Global Adhesive-Applying Equipment Market for Brush, by Region, Through 2029

- Table 132 : Global Adhesive-Applying Equipment Market for Others, by Region, Through 2029

- Table 133 : Global Adhesive-Applying Equipment Market for Dispensing Equipment, by Region, Through 2029

- Table 134 : Global Adhesive-Applying Equipment Market for Dispensing Equipment, by Type, Through 2029

- Table 135 : Global Adhesive-Applying Equipment Market for Hot-Melt Tanks, by Region, Through 2029

- Table 136 : Global Adhesive-Applying Equipment Market for Mixer and Meter, by Region, Through 2029

- Table 137 : Global Adhesive-Applying Equipment Market for Other Types, by Region, Through 2029

- Table 138 : Global Adhesive-Applying Equipment Market for Unloading Equipment, by Region, Through 2029

- Table 139 : Global Adhesive-Applying Equipment Market for Unloading Equipment, by Type, Through 2029

- Table 140 : Global Adhesive-Applying Equipment Market for Tubes and Cartridges, by Region, Through 2029

- Table 141 : Global Adhesive-Applying Equipment Market for Drums, Pails and Totes, by Region, Through 2029

- Table 142 : Global Adhesive-Applying Equipment Market for Pallets, Slats and Bricks, by Region, Through 2029

- Table 143 : Global Adhesive-Applying Equipment Market, by Region, Through 2029

- Table 144 : North American Adhesive-Applying Equipment Market, by Country, Through 2029

- Table 145 : North American Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 146 : North American Auxiliary Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 147 : North American Application Process Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 148 : North American Dispensing Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 149 : North American Unloading Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 150 : North American Adhesive-Applying Equipment Market, by End Use, Through 2029

- Table 151 : European Adhesive-Applying Equipment Market, by Country, Through 2029

- Table 152 : European Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 153 : European Auxiliary Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 154 : European Application Process Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 155 : European Dispensing Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 156 : European Unloading Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 157 : European Adhesive-Applying Equipment Market, by End Use, Through 2029

- Table 158 : Asia-Pacific Adhesive-Applying Equipment Market, by Country, Through 2029

- Table 159 : Asia-Pacific Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 160 : Asia-Pacific Auxiliary Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 161 : Asia-Pacific Application Process Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 162 : Asia-Pacific Dispensing Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 163 : Asia-Pacific Unloading Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 164 : Asia-Pacific Adhesive-Applying Equipment Market, by End Use, Through 2029

- Table 165 : Rest of the World Adhesive-Applying Equipment Market, by Country, Through 2029

- Table 166 : Rest of the World Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 167 : Rest of the World Auxiliary Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 168 : Rest of the World Application Process Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 169 : Rest of the World Dispensing Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 170 : Rest of the World Unloading Equipment in Adhesive-Applying Equipment Market, by Type, Through 2029

- Table 171 : Rest of the World Adhesive-Applying Equipment Market, by End Use, Through 2029

- Table 172 : Environmental Performance

- Table 173 : Social Performance

- Table 174 : Governance Performance

- Table 175 : ESG Score Analysis of Adhesives and Adhesive-Applying Equipment Market

List of Figures

- Figure 1 : Global Market for Paints and Coatings, by Region, 2023-2029

- Figure 2 : Paints and Coatings Raw Materials

- Figure 3 : Ecosystem of Supply Chain Partners: Paints and Coatings

- Figure 4 : Porter's Five Forces Analysis: Market for Paints and Coatings

- Figure 5 : Motor Vehicle Production, 2019-2023

- Figure 6 : Global Market Shares of Paints and Coatings, by Technology, 2023

- Figure 7 : Global Market Shares of Water-borne Coatings, by Application, 2023

- Figure 8 : Global Market Shares of Water-borne Coatings, by Region, 2023

- Figure 9 : Global Market Shares of Solvent-borne Coatings, by Application, 2023

- Figure 10 : Global Market Shares of Solvent-borne Coatings, by Region, 2023

- Figure 11 : Global Market Shares of Powder Coatings, by Application, 2023

- Figure 12 : Global Market Shares of Powder Coatings, by Region, 2023

- Figure 13 : Global Market Shares of UV Cure Coatings, by Application, 2023

- Figure 14 : Global Market Shares of UV Cure Coatings, by Region, 2023

- Figure 15 : Global Market Shares of Emerging Coatings Technology, by Type, 2023

- Figure 16 : Global Market Shares of Emerging Coatings Technology, by Application, 2023

- Figure 17 : Global Market Shares of Emerging Coatings Technology, by Region, 2023

- Figure 18 : Global Market Shares of Paints and Coatings, by Region, 2023

- Figure 19 : North American Market Shares of Paints and Coatings, by Country, 2023

- Figure 20 : North American Market Shares of Paints and Coatings, by Chemistry, 2023

- Figure 21 : North American Market Shares of Paints and Coatings, by End Use, 2023

- Figure 22 : European Market Shares of Paints and Coatings, by Country, 2023

- Figure 23 : European Market Shares of Paints and Coatings, by Technology, 2023

- Figure 24 : European Market Shares of Paints and Coatings, by Chemistry, 2023

- Figure 25 : European Market Shares of Paints and Coatings, by End Use, 2023

- Figure 26 : Asia-Pacific Market Shares of Paints and Coatings, by Country, 2023

- Figure 27 : Asia-Pacific Market Shares of Paints and Coatings, by Technology, 2023

- Figure 28 : Asia-Pacific Market Shares of Paints and Coatings, by Chemistry, 2023

- Figure 29 : Asia-Pacific Market Shares of Paints and Coatings, by End Use, 2023

- Figure 30 : Rest of World Market Shares of Paints and Coatings, by Sub-Region, 2023

- Figure 31 : Rest of World Market Shares of Paints and Coatings, by Technology, 2023

- Figure 32 : Rest of World Market Shares of Paints and Coatings, by Chemistry, 2023

- Figure 33 : Rest of World Market Shares of Paints and Coatings, by End Use, 2023

- Figure 34 : ESG Factors in Market for Paints and Coatings

- Figure 35 : Global Adhesives & Sealants or Joining and Fastening Market, by Region, 2023-2029

- Figure 36 : World Motor Vehicle Production, by Year, 2021-2023

- Figure 37 : Global Adhesives & Sealants or Joining and Fastening Market Shares, by Type, 2023

- Figure 38 : Global Adhesives Market Shares, by Technology, 2023

- Figure 39 : Global Adhesives Market Shares for Other Adhesives, by Region, 2023

- Figure 40 : Global Sealants Market Shares, by Chemicals, 2023

- Figure 41 : Global Adhesives & Sealants or Joining and Fastening Market Shares, by Region, 2023

- Figure 42 : North American Adhesives & Sealants or Joining and Fastening Market Shares, by Country, 2023

- Figure 43 : European Adhesives & Sealants or Joining and Fastening Market Shares, by Country, 2023

- Figure 44 : Asia-Pacific Adhesives & Sealants or Joining and Fastening Market Shares, by Country, 2023

- Figure 45 : Rest of the World Adhesives & Sealants or Joining and Fastening Market Shares, by Sub-Region, 2023

- Figure 46 : ESG Perspective

- Figure 47 : Global Adhesives and Adhesive-Applying Equipment Market, by Segment, 2023-2029

- Figure 48 : Porter's Five Forces Analysis for Adhesives and Adhesive-Applying Equipment Market

- Figure 49 : Adhesive and Adhesive-Applying Equipment Market: Supply Chain Analysis

- Figure 50 : Global Adhesives Market Shares, by Chemicals, 2023

- Figure 51 : Global Adhesives Market Shares, by Region, 2023

- Figure 52 : North American Adhesives Market Shares, by Country, 2023

- Figure 53 : European Adhesives Market Shares, by Country, 2023

- Figure 54 : Asia-Pacific Adhesives Market Shares, by Country, 2023

- Figure 55 : Rest of the World Adhesives Market Shares, by Sub-Region, 2023

- Figure 56 : Global Adhesive-Applying Equipment Market Shares, by Type, 2023

- Figure 57 : Global Adhesive-Applying Equipment Market Shares for Auxiliary Equipment, by Region, 2023

- Figure 58 : Global Adhesive-Applying Equipment Market Shares for Application Process Equipment, by Type, 2023

- Figure 59 : Global Adhesive-Applying Equipment Market Shares for Dispensing Equipment, by Type, 2023

- Figure 60 : Global Adhesive-Applying Equipment Market Shares for Unloading Equipment, by Region, 2023

- Figure 61 : Global Adhesive-Applying Equipment Market Shares, by Region, 2023

- Figure 62 : North American Adhesive-Applying Equipment Market Shares, by Country, 2023

- Figure 63 : European Adhesive-Applying Equipment Market Shares, by Country, 2023

- Figure 64 : Asia-Pacific Adhesive-Applying Equipment Market Shares, by Country, 2023

- Figure 65 : Rest of the World Adhesive-Applying Equipment Market Shares, by Sub-Region, 2023

- Figure 66 : ESG Perspective

The global market for paints and coatings is estimated to increase from $203.8 billion in 2024 to reach $263.2 billion by 2029, at a compound annual growth rate (CAGR) of 5.2% from 2024 through 2029.

The global market for adhesives & sealants is estimated to increase from $66.1 billion in 2024 to reach $81.6 billion by 2029, at a CAGR of 4.3% from 2024 through 2029.

The global market for adhesives and adhesive-applying equipment is estimated to increase from $72.1 billion in 2024 to reach $89.9 billion by 2029, at a CAGR of 4.5% from 2024 through 2029.

Research Review Scope

The global chemicals industry plays a significant role in modern manufacturing, supplying essential materials for a wide range of applications, from construction and automotive to aerospace, healthcare, and consumer goods. With ongoing advancements in technology, regulatory shifts, and a growing emphasis on sustainability, the industry is undergoing a significant transformation. The demand for advanced chemicals, low-emission coatings, and circular economy initiatives is reshaping market dynamics. Additionally, automation and digitalization are streamlining production processes, improving efficiency, and reducing waste.

Among the many industries within the chemicals sector, three key areas, paints and coatings, adhesives and sealants, and adhesive-applying equipment are witnessing rapid growth. The paints and coatings market is experiencing strong growth, fueled by rising demand for construction, automotive, marine, and industrial applications. These materials serve both decorative and protective functions, safeguarding surfaces from corrosion, wear, and environmental damage. With urbanization and infrastructure development on the rise, the demand for high-performance coating continues to increase.

A major shift in the industry is the push toward sustainable formulations that reduce environmental impact. Waterborne coatings, powder coatings, and bio-based resins are becoming more prevalent as increased regulations around volatile organic compounds (VOCs) and hazardous chemicals. Companies such as PPG Industries, AkzoNobel, Sherwin-Williams, and BASF are at the forefront of developing advanced coatings that offer durability, efficiency, and eco-friendly properties. These innovations are particularly important in sectors like automotive and aerospace, where lightweight, high-strength coatings can enhance fuel efficiency and longevity.

Adhesives and sealants are increasingly replacing traditional mechanical fasteners, on account of their ability to provide lightweight, high-strength bonding solutions across industries such as automotive, aerospace, construction, electronics, and packaging. With industries focusing on reducing weight, improving durability, and enhancing energy efficiency, adhesives have become indispensable in modern manufacturing. A key trend in this market is the growing use of adhesives in electric vehicles (EVs) and lightweight composites. As automakers strive to improve vehicle efficiency, adhesives are being used to replace welding and mechanical fasteners, reducing weight without compromising safety.

As manufacturing becomes more automated and precise, the demand for advanced adhesive-applying equipment is rising. These systems are essential in automotive, packaging, electronics, and construction, where accuracy and efficiency in bonding processes are critical. With increasing production speeds and the need for consistent application, businesses are turning to robotic dispensing systems, AI-driven process controls, and smart sensors to enhance adhesive application.

Research Reviews from BCC Research provide market professionals with concise market coverage within a specific research category. This 2024 Research Review of Chemical provides a sampling of the type of quantitative market information, analysis, and guidance that BCC Research has been developing since its inception in 1971 to help its customers make informed business decisions. This Research Review includes highlights and excerpts from the following reports published by BCC Research in 2024:

- CHM049H Global Markets and Advanced Technologies for Paints and Coatings

- CHM048E Global Markets for Adhesives & Sealants or Joining and Fastening

- CHM073E Adhesives and Adhesive-Applying Equipment: Technologies and Global Markets

After you survey the excerpts in this Research Review, we encourage you to follow up on these topics by checking out the full market research reports associated with each topic. BCC Research looks forward to serving your market intelligence needs in the future.

Table of Contents

Chapter 1 Foreword

- Research Review Scope

Chapter 2 Global Markets and Advanced Technologies for Paints and Coatings (CHM049H)

- Global Markets and Advanced Technologies for Paints and Coatings

- Market Outlook

- Scope of Report

- Market Summary

- Market Overview of Paints and Coatings

- Market Definition

- Composition of Paints and Coatings

- Value Chain Analysis

- Porter's Five Forces Analysis of Paints and Coatings

- Market Dynamics of Paints and Coatings

- Market Driver

- Market Opportunity

- Market Challenge

- Regulatory Landscape of Paints and Coatings

- Regulatory Analysis

- Emerging Technologies of Paints and Coatings

- Advances in Paints and Coatings

- Quotes from Industry Experts on Technologies and Innovations

- Market Segmentation Analysis of Paints and Coatings

- Market Analysis by Technology

- Geographic Breakdown

- Market Analysis by Region

- Sustainability in Paints and Coatings Industry: An ESG Perspective

- Importance of ESG in the Paints and Coatings Industry

- ESG Practices in the Paints and Coatings Industry

- Current ESG Status in the Market for Paints and Coatings

- Emerging Sustainability Trends

- Concluding Remarks from BCC Research

Chapter 3 Global Markets for Adhesives & Sealants or Joining and Fastening (CHM048E)

- Global Markets for Adhesives & Sealants or Joining and Fastening

- Market Outlook

- Scope of Report

- Market Summary

- Market Overview of Adhesives & Sealants or Joining and Fastening

- Market Definition

- Characteristics of adhesive and sealant

- Market Dynamics of Adhesives & Sealants or Joining and Fastening

- Market Driver

- Market Restraint

- Market Opportunity

- Emerging Technologies and Developments of Adhesives & Sealants or Joining and Fastening

- New Technologies

- Market Segmentation Analysis of Adhesives & Sealants or Joining and Fastening

- Market Analysis by Type

- Geographic Breakdown

- Market Analysis, by Region

- Sustainability in Adhesive & Sealant or Joining and Fastening Industry: An ESG Perspective

- Key ESG Issues in the Adhesive & Sealant or Joining and Fastening Sector

- Adhesive & Sealant or Joining and Fastening Industry ESG Performance Analysis

- Consumer Attitudes Towards ESG in the Adhesive and Sealant or Joining and Fastening Market

- Concluding Remarks from BCC

Chapter 4 Adhesives and Adhesive-Applying Equipment: Technologies and Global Markets (CHM073E)

- Adhesives and Adhesive-Applying Equipment

- Market Outlook

- Scope of Report

- Market Summary

- Market Overview of Adhesives and Adhesive-Applying Equipment

- Market Definition

- Porter's Five Forces Analysis

- Supply Chain Analysis

- Market Dynamics of Adhesives and Adhesive-Applying Equipment

- Market Driver

- Market Restraint

- Market Opportunity

- Emerging Technologies and Developments of Adhesives and Adhesive-Applying Equipment

- New Technologies

- Market Segmentation Analysis of Adhesives and Adhesive-Applying Equipment

- Adhesives

- Geographic Breakdown of Adhesives

- Market Analysis of Adhesives by Region

- Adhesives-Applying Equipment

- Geographic Breakdown of Adhesive-Applying Equipment

- Market Analysis of Adhesive-Applying Equipment by Region

- Sustainability in Adhesives and Adhesive-Applying Equipment Industry: An ESG Perspective

- Key ESG Issues in the Adhesives and Adhesive-Applying Equipment Sector

- Adhesives and Adhesive-Applying Equipment Industry ESG Performance Analysis

- Current Status of ESG in the Adhesives and Adhesive-Applying Equipment Market

- Concluding Remarks from BCC Research

Chapter 5 Appendix

- Methodology

- Analyst's Credentials