|

|

市場調査レポート

商品コード

1642869

体外診断 (IVD):各種技術と世界市場In Vitro Diagnostics: Technologies and Global Markets |

||||||

|

|||||||

| 体外診断 (IVD):各種技術と世界市場 |

|

出版日: 2025年01月22日

発行: BCC Research

ページ情報: 英文 159 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の体外診断 (IVD) の市場規模は、2024年の947億米ドルから、予測期間中はCAGR 8.4%で推移し、2029年末には1,419億米ドルに達すると予測されています。

免疫化学IVDの市場は、2024年の328億米ドルから、予測期間中はCAGR 5.5%で推移し、2029年末には430億米ドルに達すると予測されています。POC検査IVDの市場は、2024年の232億米ドルから、CAGR 10.6%で推移し、2029年末には384億米ドルに達すると予測されます。

当レポートでは、世界の体外診断 (IVD) の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場と技術の背景

- 体外診断 (IVD) 技術

- 概要

- IVDエレメントの分類

- IVD技術と品質管理の重要性

- IVDと生体診断の違い

- IVD業界の規制

- 各国におけるIVD製品の規制

第3章 市場力学

- 概要

- 市場促進要因

- 高齢者人口の増加:診断処置への依存

- IVDにおけるAIの統合

- 慢性疾患の蔓延

- ポイントオブケア検査 (POCT) の品質向上

- 市場抑制要因

- 技術製品パッケージングに関連する課題

- 配送コストの増加やサービスの問題

- 実験助手の実験器具や消耗品を扱う能力の欠如

- 市場機会

- 在宅ケア検査デバイスの増加

- POCTユニットの需要

- AIとIoTへの需要の高まり

第4章 新興技術と開発

- IVD市場における新興技術

- AI

- 改良された古いIVD技術

- 液体生検

- 自動IVDデバイス

- IVDにおける新たな発展

- FDA承認

- 個別化医療の需要増加

- ラボ自動化とデジタルヘルスプラットフォーム

- IVDデバイスのポータビリティオプション

- がん診断のためのホームケアキット

- FDA承認のIVDデバイス:AI対応

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:技術別

- 免疫化学

- POCテスト

- 血液

- 分子診断

- 組織診断

- 臨床微生物

- 市場分析:用途別

- 糖尿病

- 腎臓

- 血糖値評価とモニタリング (BGEM)

- 腫瘍

- 心臓病

- 感染症

- その他

- 市場分析:エンドユーザー別

- 診断ラボ

- 病院・診療所

- POCセンター

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 競合情報

- 世界の企業ランキングの分析

- 中国の主要なIVD企業の概要

- 協定、協力、パートナーシップ

- IVD企業とスタートアップ

第7章 体外診断 (IVD) 業界における持続可能性:ESGの観点

- IVD製造業界におけるESGの重要性

- IVD業界におけるESGの実践

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- ESG開発における企業の役割

- ESGリスク評価

- BCCによる見解

第8章 付録

- 調査手法

- 参考文献

- 企業プロファイル

- ABBOTT

- BD

- BIOMERIEUX

- BIO-RAD LABORATORIES INC.

- BIO-TECHNE

- BRUKER

- DANAHER CORP.

- EKF DIAGNOSTICS HOLDINGS PLC

- F. HOFFMANN-LA ROCHE LTD.

- HOLOGIC INC.

- JSR CORP.

- QUIDELORTHO CORP.

- SIEMENS HEATHNIEERS AG

- SYSMEX CORP.

- THERMO FISHER SCIENTIFIC INC.

List of Tables

- Summary Table : Global Market for In Vitro Diagnostics, by Technology, Through 2029

- Table 1 : Approved FDA In Vitro Diagnostics Devices, 2021-2024

- Table 2 : Differences Between In Vitro and In Vivo Diagnostics

- Table 3 : FDA Approval of Artificial Intelligence and Machine Learning-Enabled Medical Devices, 2024

- Table 4 : Global Market for In Vitro Diagnostics, by Technology, Through 2029

- Table 5 : Global Market for In Vitro Diagnostics in Immunochemistry, by Region, Through 2029

- Table 6 : Global Market for In Vitro Diagnostics in POC Testing, by Region, Through 2029

- Table 7 : Summary of Electrochemiluminescence POCT Devices with Their Analytic Performance

- Table 8 : Global Market for In Vitro Diagnostics in Hematology, by Region, Through 2029

- Table 9 : Global Market for In Vitro Diagnostics in Molecular Diagnostics, by Region, Through 2029

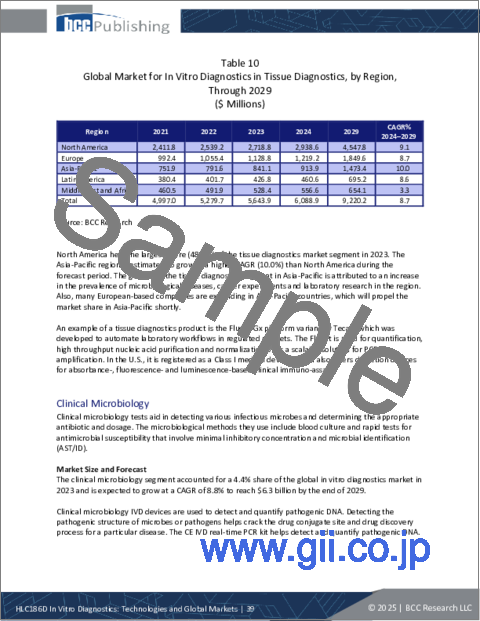

- Table 10 : Global Market for In Vitro Diagnostics in Tissue Diagnostics, by Region, Through 2029

- Table 11 : Global Market for In Vitro Diagnostics in Clinical Microbiology, by Region, Through 2029

- Table 12 : Global Market for In Vitro Diagnostics, by Application, Through 2029

- Table 13 : Global Market for Diabetes in In Vitro Diagnostics, by Region, Through 2029

- Table 14 : Global Market for Nephrology in In Vitro Diagnostics, by Region, Through 2029

- Table 15 : Global Market for BGEM in In Vitro Diagnostics, by Region, Through 2029

- Table 16 : Global Market for Oncology in In Vitro Diagnostics, by Region, Through 2029

- Table 17 : Global Market for Cardiology in In Vitro Diagnostics, by Region, Through 2029

- Table 18 : Global Market for Infectious Diseases in In Vitro Diagnostics, by Region, Through 2029

- Table 19 : Global Market for Other Applications in In Vitro Diagnostics, by Region, Through 2029

- Table 20 : Global Market for In Vitro Diagnostics, by End User, Through 2029

- Table 21 : Global Market for In Vitro Diagnostics for Diagnostic Laboratory, by Region, Through 2029

- Table 22 : Global Market for In Vitro Diagnostics for Hospitals and Clinics, by Region, Through 2029

- Table 23 : Global Market for In Vitro Diagnostics for Point-of-Care Centers, by Region, Through 2029

- Table 24 : Global Market for In Vitro Diagnostics for Other End Users, by Region, Through 2029

- Table 25 : Global Market for In Vitro Diagnostics, by Region, Through 2029

- Table 26 : North American Market for In Vitro Diagnostics, by Country, Through 2029

- Table 27 : European Market for In Vitro Diagnostics, by Country, Through 2029

- Table 28 : Asia-Pacific Market for In Vitro Diagnostics, by Country, Through 2029

- Table 29 : Latin American Market for In Vitro Diagnostics, by Sub-Region, Through 2029

- Table 30 : Total Imports of Medical Equipment into Brazil, 2021 and 2022

- Table 31 : Middle Eastern and African Market for In Vitro Diagnostics Technology, by Sub-Region, Through 2029

- Table 32 : bioMerieux Agreements

- Table 33 : ESG Practices: Environmental Performance

- Table 34 : ESG Practices: Social Performance

- Table 35 : ESG Practices: Governance Performance

- Table 36 : Creating an Attractive Workplace: Social Performance

- Table 37 : ESG Rankings for Leading In Vitro Diagnostics Companies, 2023 and 2024*

- Table 38 : Abbott: Company Snapshot

- Table 39 : Abbott: Financial Performance, FY 2022 and 2023

- Table 40 : Abbott: Product Portfolio

- Table 41 : Abbott: News/Key Developments, 2022-2024

- Table 42 : BD: Company Snapshot

- Table 43 : BD: Financial Performance, FY 2022 and 2023

- Table 44 : BD: Product Portfolio

- Table 45 : BD: News/Key Developments, 2022-2024

- Table 46 : BIOMERIEUX: Company Snapshot

- Table 47 : BIOMERIEUX: Financial Performance, FY 2022 and 2023

- Table 48 : BIOMERIEUX: Product Portfolio

- Table 49 : BIOMERIEUX: News/Key Developments, 2023 and 2024

- Table 50 : Bio-Rad Laboratories Inc.: Company Snapshot

- Table 51 : Bio-Rad Laboratories Inc.: Financial Performance, FY 2022 and 2023

- Table 52 : Bio-Rad Laboratories Inc.: Product Portfolio

- Table 53 : Bio-Rad Laboratories Inc.: News/Key Developments, 2021-2024

- Table 54 : Bio-Techne: Company Snapshot

- Table 55 : Bio-Techne: Financial Performance, FY 2022 and 2023

- Table 56 : Bio-Techne: Product Portfolio

- Table 57 : Bio-Techne: News/Key Developments, 2022 and 2023

- Table 58 : Bruker: Company Snapshot

- Table 59 : Bruker: Financial Performance, FY 2022 and 2023

- Table 60 : Bruker: Product Portfolio

- Table 61 : Bruker: News/Key Developments, 2021-2024

- Table 62 : Danaher Corp.: Company Snapshot

- Table 63 : Danaher Corp.: Financial Performance, FY 2022 and 2023

- Table 64 : Danaher Corp.: Product Portfolio

- Table 65 : Danaher Corp.: News/Key Developments, 2021-2023

- Table 66 : EKF Diagnostics Holdings plc.: Company Snapshot

- Table 67 : EKF Diagnostics Holdings plc.: Financial Performance, FY 2022 and 2023

- Table 68 : EKF Diagnostics Holdings plc.: Product Portfolio

- Table 69 : EKF Diagnostics Holdings plc.: News/Key Developments, 2022-2024

- Table 70 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 71 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 72 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 73 : F. Hoffmann-La Roche Ltd.: News/Key Developments, 2022-2024

- Table 74 : Hologic Inc.: Company Snapshot

- Table 75 : Hologic Inc.: Financial Performance, FY 2022 and 2023

- Table 76 : Hologic Inc.: Product Portfolio

- Table 77 : Hologic Inc.: News/Key Developments, 2022-2024

- Table 78 : JSR Corp.: Company Snapshot

- Table 79 : JSR Corp.: Financial Performance, FY 2022 and 2023

- Table 80 : JSR Corp.: Product Portfolio

- Table 81 : JSR Corp.: News/Key Developments, 2024

- Table 82 : QuidelOrtho Corp.: Company Snapshot

- Table 83 : QuidelOrtho Corp.: Financial Performance, FY 2022 and 2023

- Table 84 : QuidelOrtho Corp.: Product Portfolio

- Table 85 : QuidelOrtho Corp.: News/Key Developments, 2021-2024

- Table 86 : Siemens Healthineers AG: Company Snapshot

- Table 87 : Siemens Healthineers AG: Financial Performance, FY 2022 and 2023

- Table 88 : Siemens Healthineers AG: Product Portfolio

- Table 89 : Siemens Healthineers AG: News/Key Developments, 2021-2024

- Table 90 : Sysmex Corp.: Company Snapshot

- Table 91 : Sysmex Corp.: Financial Performance, FY 2022 and 2023

- Table 92 : Sysmex Corp.: Product Portfolio

- Table 93 : Sysmex Corp.: News/Key Developments, 2022 and 2023

- Table 94 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 95 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2022 and 2023

- Table 96 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 97 : Thermo Fisher Scientific Inc.: News/Key Developments, 2022 and 2023

List of Figures

- Summary Figure : Global Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 1 : Snapshot of Market Dynamics

- Figure 2 : Older Adults Using Technology to Manage Chronic Health Issues in the U.S., by Age Group, 2024

- Figure 3 : Percentage of People Aged 50+ Using Digital Services in the U.S., 2024

- Figure 4 : Breakdown of Global Elderly Population (Aged 65+ Years), by Select Countries, 2022

- Figure 5 : Emerging AI Applications in In Vitro Diagnostics

- Figure 6 : Global Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 7 : Global Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 8 : Snapshot of IVD Tests in Oncology

- Figure 9 : Global Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 10 : Global Market Shares of In Vitro Diagnostics, by Region, 2023

- Figure 11 : North American Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 12 : North American Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 13 : North American Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 14 : North American Market Shares of In Vitro Diagnostics, by Country, 2023

- Figure 15 : European Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 16 : European Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 17 : European Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 18 : European Market Shares of In Vitro Diagnostics, by Sub-Region , 2023

- Figure 19 : Asia-Pacific Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 20 : Asia-Pacific Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 21 : Asia-Pacific Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 22 : Asia-Pacific Market Shares of In Vitro Diagnostics, by Country, 2023

- Figure 23 : Latin American Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 24 : Latin American Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 25 : Latin American Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 26 : Latin American Market Shares of In Vitro Diagnostics, by Sub-Region, 2023

- Figure 27 : Middle Eastern and African Market Shares of In Vitro Diagnostics, by Technology, 2023

- Figure 28 : Middle Eastern and African Market Shares of In Vitro Diagnostics, by Application, 2023

- Figure 29 : Middle Eastern and African Market Shares of In Vitro Diagnostics, by End User, 2023

- Figure 30 : Middle Eastern and African Market Shares of In Vitro Diagnostics, by Sub-Region, 2023

- Figure 31 : Rankings of Leading Companies in Global In Vitro Diagnostics Market, 2023

- Figure 32 : Snapshot: Key ESG Trends in the In Vitro Diagnostics Industry

- Figure 33 : Abbott: Revenue Shares, by Business Unit, FY 2023

- Figure 34 : Abbott: Revenue Shares, by Country/Region, FY 2023

- Figure 35 : BD: Revenue Shares, by Business Unit, FY 2023

- Figure 36 : BD: Revenue Shares, by Country/Region, FY 2023

- Figure 37 : BIOMERIEUX: Revenue Shares, by Business Unit, FY 2023

- Figure 38 : BIOMERIEUX: Revenue Shares, by Country/Region, FY 2023

- Figure 39 : Bio-Rad Laboratories Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : Bio-Rad Laboratories Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 41 : Bio-Techne: Revenue Shares, by Business Unit, FY 2023

- Figure 42 : Bio-Techne: Revenue Shares, by Country/Region, FY 2023

- Figure 43 : Bruker: Revenue Shares, by Business Unit, FY 2023

- Figure 44 : Bruker: Revenue Shares, by Country/Region, FY 2023

- Figure 45 : Danaher Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 46 : Danaher Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 47 : EKF Diagnostics Holdings plc.: Revenue Shares, by Business Unit, FY 2023

- Figure 48 : EKF Diagnostics Holdings plc.: Revenue Shares, by Country/Region, FY 2023

- Figure 49 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Business Unit, FY 2023

- Figure 50 : F. Hoffmann-La Roche Ltd.: Revenue Shares, by Country/Region, FY 2023

- Figure 51 : Hologic Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 52 : Hologic Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 53 : JSR Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 54 : JSR Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 55 : QuidelOrtho Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 56 : QuidelOrtho Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 57 : Siemens Healthineers AG: Revenue Shares, by Business Unit, FY 2023

- Figure 58 : Siemens Healthineers AG: Revenue Shares, by Country/Region, FY 2023

- Figure 59 : Sysmex Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 60 : Sysmex Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 61 : Thermo Fisher Scientific Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 62 : Thermo Fisher Scientific Inc.: Revenue Shares, by Country/Region, FY 2023

The global market for In Vitro Diagnostics (IVD) is expected to grow from $94.7 billion in 2024 and is projected to reach $141.9 billion by the end of 2029, at a compound annual growth rate (CAGR) of 8.4% during the forecast period of 2024 to 2029.

The immunochemistry IVD market is expected to grow from $32.8 billion in 2024 and is projected to reach $43.0 billion by the end of 2029, at a CAGR of 5.5% during the forecast period of 2024 to 2029.

The POC testing IVD market is expected to grow from $23.2 billion in 2024 and is projected to reach $38.4 billion by the end of 2029, at a CAGR of 10.6% during the forecast period of 2024 to 2029.

Report Scope

This report covers the in vitro diagnostic (IVD) technologies as well as in vitro diagnostic devices used in hospitals and point-of-care (POC) facilities to diagnose diseases. It also details the current and future market potential of in vitro diagnostic technology and includes an analysis of this market's competitive environment. The report covers market drivers, restraints, opportunities, product approvals, regulatory scenario assessments and emerging technologies. It features market projections and estimates of the market shares of key players through 2029.

In this analysis, the in vitro diagnostics market is segmented based on technologies, applications, end users and region. Based on technologies, the market is segmented into the following categories: hematology, immunochemistry, molecular diagnostics, POC testing, clinical microbiology and tissue diagnostics. Based on applications, the in vitro diagnostics market is segmented into these categories: diabetes, nephrology, blood glucose evaluation and monitoring (BGEM), oncology, cardiology, infectious diseases and other applications. The market is segmented based on end users into diagnostic laboratories, hospitals and clinics, point-of-care centers, and other end users.

The global in vitro diagnostics market has been segmented by the following geographical regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. The report features detailed analyses of major countries such as the U.S., Germany, the U.K., Italy, France, Spain, Japan, China, India, Australia and New Zealand (ANZ), Argentina, Brazil, South Africa, Mexico and the GCC countries. Market analysis data is provided for 2023, which serves as the base year, and estimates are given for 2024 and forecast values through 2029.

Report Includes

- 41 data tables and 54 additional tables

- Analysis of global market trends, with data from 2021-2023, estimates for 2024, and projections of compound annual growth rates (CAGRs) through 2029

- Estimates of the size of the market for in vitro diagnostics (IVD) technologies, revenues, and market shares by technology, product, application, end user and region

- Assessment of market dynamics such as drivers, restraints and opportunities

- Discussion of how the rise in the number of respiratory infections, hospital acquired infections (HAIs), and sexually transmitted diseases are creating a constant need for IVD testing in hospitals and laboratories

- Discussion of IVD for neglected infectious diseases, chemistry-based portable analysis and microfluidic platform-based POC tests

- A discussion on ESG challenges and practices in the industry

- Assessment of the competitive landscape, including the market shares of key companies, their product portfolios and financial overviews

- Information on recent mergers, acquisitions, expansions, collaborations, investments, divestments and product launches

- Profiles of the leading companies, including F. Hoffmann-La Roche Ltd., Abbott, Sysmex Corp., Danaher, BD, and Siemens Healthineers AG

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market and Technology Background

- Introduction

- In vitro Diagnostics Technology

- Overview

- Classification of In Vitro Diagnostic Elements

- Importance of In Vitro Diagnostics Technologies and Quality Control

- Difference Between In Vitro and In Vivo Diagnostics

- Regulations in the IVD Industry

- Regulation of IVD Products in Different Countries

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Rise in Population of Older Adults: Dependence on Diagnosis Procedures

- Integration of Artificial Intelligence in Vitro Diagnostics

- Rising Prevalence of Chronic Diseases

- Improving the Quality of Point-of-Care Testing (POCT)

- Market Restraints

- Challenges Associated with Technologies Product Packaging

- Increases in Shipping Costs or Service Issues

- Laboratory Assistant's Inability to Handle Laboratory Equipment and Consumables

- Market Opportunities

- Rise in Home Care Testing Devices

- Demand for Point-of-Care (POC) Testing Units

- Growing Demand for AI and the Internet of Things

Chapter 4 Emerging Technologies and Developments

- Emerging Technologies in the IVD Market

- Artificial Intelligence

- Modified Old IVD Techniques

- Liquid Biopsy

- Automated In Vitro Diagnostic Devices

- Emerging Developments in In Vitro Diagnostics

- FDA Approval

- Rise in Demand for Personalized Medicine

- Lab Automation and Digital Health Platform

- Portability Option in IVD Devices

- Home Care Kits for Cancer Diagnosis

- FDA Approved In Vitro Diagnostic Devices: AI Enabled

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis by Technology

- Immunochemistry

- POC Testing

- Hematology

- Molecular Diagnostics

- Tissue Diagnostics

- Clinical Microbiology

- Market Analysis by Application

- Diabetes

- Nephrology

- Blood Glucose Evaluation and Monitoring (BGEM)

- Oncology

- Cardiology

- Infectious Diseases

- Other Applications

- Market Analysis by End User

- Diagnostic Laboratory

- Hospitals and Clinics

- Point-of-Care (POC) Centers

- Other End Users

- Geographical Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Chapter 6 Competitive Intelligence

- Introduction

- Global Analysis of Company Market Ranking

- Glimpse of Leading In Vitro Diagnostics (IVD) Companies in China

- Agreements, Collaborations and Partnerships

- bioMerieux Agreements

- Siemens Healthineers and Sysmex Enter into a Global Agreement

- Roche Enters into Agreement with Path AI

- Quidel Corp. Signs Agreement to Acquire Ortho Clinical Diagnostics

- In Vitro Diagnostics Companies and Start-Ups in 2021-2023

- Diagopreutic Private Limited

- Diatherax

- IPLEXMED

- Magnify Bioscience Inc.

Chapter 7 Sustainability in the In Vitro Diagnostics Industry: An ESG Perspective

- Importance of ESG in In Vitro Diagnostics Manufacturing Industry

- ESG Practices in the In Vitro Diagnostics Industry

- Environmental Performance

- Social Performance

- Governance Performance

- Company Role in ESG Development

- ESG Risk Ratings

- BCC Research Viewpoint

Chapter 8 Appendix

- Research Methodology

- References

- Company Profiles

- ABBOTT

- BD

- BIOMERIEUX

- BIO-RAD LABORATORIES INC.

- BIO-TECHNE

- BRUKER

- DANAHER CORP.

- EKF DIAGNOSTICS HOLDINGS PLC

- F. HOFFMANN-LA ROCHE LTD.

- HOLOGIC INC.

- JSR CORP.

- QUIDELORTHO CORP.

- SIEMENS HEATHNIEERS AG

- SYSMEX CORP.

- THERMO FISHER SCIENTIFIC INC.