|

|

市場調査レポート

商品コード

1568395

医療用テープの世界市場Global Medical Tapes Market |

||||||

|

|||||||

| 医療用テープの世界市場 |

|

出版日: 2024年10月07日

発行: BCC Research

ページ情報: 英文 113 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療用テープの市場規模は、2024年の56億米ドルから、予測期間中は4.7%のCAGRで推移し、2029年末には70億米ドルの規模に成長すると予測されています。

医療用ファブリックテープの部門は、2024年の17億米ドルから、CAGR 3.6%で推移し、2029年末には21億米ドルに達すると予測されています。医療用紙テープの部門は、2024年の15億米ドルから、CAGR 5.4%で推移し、2029年末には19億米ドルに達すると予測されています。

当レポートでは、世界の医療用テープの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 概要

- 歴史

- 現在の動向と将来の方向性

- PESTEL分析

- ポーターのファイブフォース分析

- サプライチェーン分析

第3章 市場力学

- 市場力学

- 市場促進要因

- 外科手術の急増

- 患者の快適性と利便性に対する意識の高まり

- 医療費の増加

- 慢性疾患の増加と人口の高齢化

- 市場抑制要因

- 規制とコンプライアンスの課題

- 市場機会

- 技術の進歩

- 持続可能性の動向

- 市場の課題

- 競合と市場の飽和

第4章 新興技術と開発

- 新興技術

- 3Dプリント

- ナノテクノロジー

- スマートテープ

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 医療用テープの世界市場

- 市場分析:製品別

- 布テープ

- 紙テープ

- プラスチックテープ

- その他

- 市場分析:用途別

- 創傷ケア

- 手術

- その他

- 市場分析:エンドユーザー別

- 病院・診療所

- 外来手術センター

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 規制状況

- 規制の枠組み

- 米国

- EU

- 日本

第7章 持続可能性:医療用テープ市場におけるESGの観点

- 医療用テープ市場における持続可能性

- ESGデータの理解

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- BCC Researchの見解

第8章 競合情報

- 市場分析

- 業界シナリオ

- 戦略分析

第9章 付録

- 調査手法

- 出典

- 企業プロファイル

- 3M

- ADHESIVE TAPE MANUFACTURER IN INDIA

- B. BRAUN SE

- CARDINAL HEALTH

- DERMARITE INDUSTRIES LLC

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- MOLNLYCKE AB

- MEDIPURPOSE

- SMITH & NEPHEW PLC

List of Tables

- Summary Table A : Global Market for Medical Tapes, by Product, Through 2029

- Summary Table B : Global Market for Medical Tapes, by Region, Through 2029

- Table 1 : Global Health Expenditures, by Select Countries, 2022

- Table 2 : Global Elderly Population, by Country, 2021 and 2022

- Table 3 : Global Market for Medical Tapes, Through 2029

- Table 4 : Global Market for Medical Tapes, by Product, Through 2029

- Table 5 : Global Market for Medical Tapes, by Application, Through 2029

- Table 6 : Global Market for Medical Tapes by End User, Through 2029

- Table 7 : Global Market for Medical Tapes, by Region, Through 2029

- Table 8 : North American Market for Medical Tapes, by Country, Through 2029

- Table 9 : North American Market for Medical Tapes, by Product, Through 2029

- Table 10 : North American Market for Medical Tapes, by Application, Through 2029

- Table 11 : North American Market for Medical Tapes, by End User, Through 2029

- Table 12 : European Market for Medical Tapes, by Country, Through 2029

- Table 13 : European Market for Medical Tapes, by Product, Through 2029

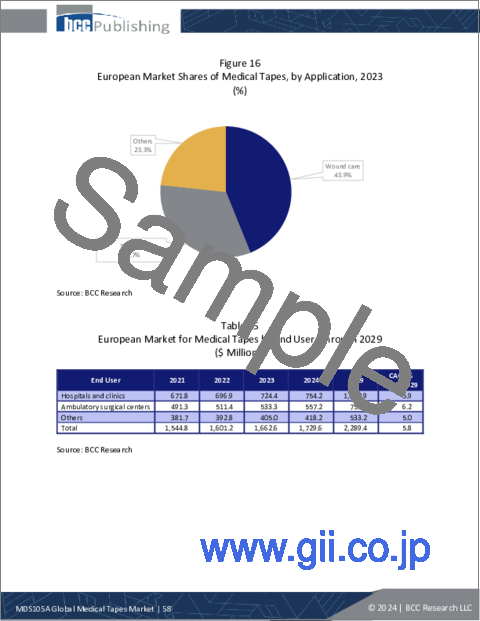

- Table 14 : European Market for Medical Tapes, by Application, Through 2029

- Table 15 : European Market for Medical Tapes by End User, Through 2029

- Table 16 : Asia-Pacific Market for Medical Tapes, by Country, Through 2029

- Table 17 : Asia-Pacific Market for Medical Tapes, by Product, Through 2029

- Table 18 : Asia-Pacific Market for Medical Tapes, by Application, Through 2029

- Table 19 : Asia-Pacific Market for Medical Tapes by End User, Through 2029

- Table 20 : RoW Market for Medical Tapes, by Product, Through 2029

- Table 21 : RoW Market for Medical Tapes, by Application, Through 2029

- Table 22 : RoW Market for Medical Tapes by End User, Through 2029

- Table 23 : ESG Rankings for Major Medical Tapes Companies, 2024*

- Table 24 : Medical Tapes: Market Player Ranking

- Table 25 : Report Sources

- Table 26 : 3M: Company Snapshot

- Table 27 : 3M: Financial Performance, FY 2022 and 2023

- Table 28 : 3M: Product Portfolio

- Table 29 : Adhesive Tape Manufacturer in India: Company Snapshot

- Table 30 : Adhesive Specialties Inc.: Product Portfolio

- Table 31 : B. BRAUN SE: Company Snapshot

- Table 32 : B.Braun SE: Financial Performance, FY 2022 and 2023

- Table 33 : B.Braun SE: Product Portfolio

- Table 34 : B.Braun SE: News/Key Developments, 2024

- Table 35 : Cardinal Health: Company Snapshot

- Table 36 : Cardinal Health: Financial Performance, FY 2022 and 2023

- Table 37 : Cardinal Health: Product Portfolio

- Table 38 : Dermarite Industries LLC: Company Snapshot

- Table 39 : Dermarite Industries LLC: Product Portfolio

- Table 40 : Johnson & Johnson Services Inc.: Company Snapshot

- Table 41 : Johnson & Johnson Services Inc.: Financial Performance, FY 2022 and 2023

- Table 42 : Johnson & Johnson Services Inc.: Product Portfolio

- Table 43 : Medtronic.: Company Snapshot

- Table 44 : Medtronic: Financial Performance, FY 2023

- Table 45 : Medtronic: Product Portfolio

- Table 46 : Molnlycke AB: Company Snapshot

- Table 47 : Molnlycke AB: Financial Performance, 2023

- Table 48 : Molnlycke AB: Product Portfolio

- Table 49 : MediPurpose: Company Snapshot

- Table 50 : MediPurpose: Product Portfolio

- Table 51 : Smith & Nephew plc: Company Snapshot

- Table 52 : Smith & Nephew plc: Financial Performance, FY 2022 and 2023

- Table 53 : Smith & Nephew plc: Product Portfolio

List of Figures

- Summary Figure A : Global Market Shares of Medical Tapes by Product 2023

- Summary Figure B : Global Market Shares of Medical Tapes, by Region, 2023

- Figure 1 : Supply Chain Analysis of Medical Tapes

- Figure 2 : Market Dynamics of Medical Tapes

- Figure 3 : Emerging Trends and Technologies in the Medical Tapes Market

- Figure 4 : Global Market Shares of Medical Tapes, by Product, 2023

- Figure 5 : Global Market Shares of Medical Tapes, by Application, 2023

- Figure 6 : Global Market Shares of Medical Tapes, by End User, 2023

- Figure 7 : Global Market Shares of Medical Tapes, by Region, 2023

- Figure 8 : North American Shares of Medical Tapes, by Country, 2023

- Figure 9 : North American Market for Medical Tapes, 2021-2029

- Figure 10 : North American Market Shares of Medical Tapes, by Product, 2023

- Figure 11 : North American Market Shares of Medical Tapes, by Application, 2023

- Figure 12 : North American Market Shares of Medical Tapes, by End User, 2023

- Figure 13 : European Market Shares of Medical Tapes, by Country, 2023

- Figure 14 : European Market for Medical Tapes, 2021-2029

- Figure 15 : European Market Shares of Medical Tapes, by Product, 2023

- Figure 16 : European Market Shares of Medical Tapes, by Application, 2023

- Figure 17 : European Market Shares of Medical Tapes, by End User, 2023

- Figure 18 : Asia-Pacific Market Shares of Medical Tapes, by Country, 2023

- Figure 19 : Asia-Pacific Market for Medical Tapes, 2021-2029

- Figure 20 : Asia-Pacific Market Shares of Medical Tapes, by Product, 2023

- Figure 21 : Asia-Pacific Market Shares of Medical Tapes, by Application, 2023

- Figure 22 : Asia-Pacific Market Shares of Medical Tapes, by End User, 2023

- Figure 23 : Rest of the World Market for Medical Tapes, 2021-2029

- Figure 24 : RoW Market Shares of Medical Tapes, by Product, 2023

- Figure 25 : RoW Market Shares of Medical Tapes, by Application, 2023

- Figure 26 : RoW Market Shares of Medical Tapes, by End User, 2023

- Figure 27 : Key ESG Metrics of Medical Tape Companies

- Figure 28 : Methodology Used in the Medical Tapes Market

- Figure 29 : 3M: Revenue Shares, by Business Unit, FY 2023

- Figure 30 : 3M: Revenue Shares, by Country/Region, FY 2023

- Figure 31 : B.Braun SE: Revenue Shares, by Business Unit, FY 2023

- Figure 32 : B.Braun SE: Revenue Shares, by Country/Region, FY 2023

- Figure 33 : Cardinal Health: Revenue Shares, by Business Unit, FY 2023

- Figure 34 : Cardinal Health: Revenue Shares, by Country/Region, 2023

- Figure 35 : Johnson & Johnson Services Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 36 : Johnson & Johnson Services Inc: Revenue Shares, by Country/Region, 2023

- Figure 37 : Medtronic: Revenue Shares, by Business Unit, FY 2023

- Figure 38 : Medtronic: Revenue Shares, by Country/Region, FY 2023

- Figure 39 : Molnlycke AB: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : Molnlycke AB: Revenue Shares, by Country/Region, FY 2023

- Figure 41 : Smith & Nephew plc: Revenue Shares, by Business Unit, FY 2023

- Figure 42 : Smith & Nephew plc: Revenue Shares, by Country/Region, FY 2023

The global market for medical tapes is expected to grow from $5.6 billion in 2024 and is projected to reach $7.0 billion by the end of 2029, at a compound annual growth rate (CAGR) of 4.7% during the forecast period of 2024 to 2029.

The global market for medical fabric tapes is expected to grow from $1.7 billion in 2024 and is projected to reach $2.1 billion by the end of 2029, at a CAGR of 3.6% during the forecast period of 2024 to 2029.

The global market for medical paper tapes is expected to grow from $1.5 billion in 2024 and is projected to reach $1.9 billion by the end of 2029, at a CAGR of 5.4% during the forecast period of 2024 to 2029.

Report Scope

The current report provides detailed information about the medical tapes market. The report provides market projections for 2029 and market rank for key market players. The report details the market share of medical tapes based on product, applications, and end users. The medical tapes market is segmented into fabric, paper, plastic, and others based on the product. Based on the application, the report is segmented into wound care, surgery, and others. The market is categorized into hospitals and clinics, ambulatory surgical centers, and others based on end users. It covers market growth dynamics, including increased healthcare expenditure, technological advances, and the rising prevalence of chronic diseases. The report also highlights challenges such as high costs and regulatory complexities while identifying opportunities like innovations in tape materials and expanding markets in developing regions. A detailed competitive landscape includes major players, market share, and recent strategic developments.

The report offers a regional analysis, breaking down market trends and growth prospects across different geographical areas. It includes market forecasts, consumer insights, and a thorough supply chain analysis, addressing distribution channels and key suppliers. By examining these elements, the report aims to provide a comprehensive view of the market's current state and future potential, assisting stakeholders in making well-informed decisions and identifying strategic opportunities within the medical tape industry.

Report Includes

- 30 data tables and 25 additional tables

- An analysis of the current and future global markets for medical tapes

- Analyses of global market trends, with market revenue data (sales figures) for 2021-2023, estimates for 2024, and projected CAGRs through 2029

- Estimates of the market size and revenue forecasts, with market share analysis by product, application, end user, and region

- Discussions of the market dynamics, opportunities and challenges, as well as emerging technologies

- Overview of the sustainability trends and ESG developments in the industry, with emphasis on the ESG practices of leading companies, their ESG score, and consumer attitudes

- Competitive intelligence, including companies' market shares, recent M&A activity and venture funding

- Profiles of the leading companies, including 3M, Johnson & Johnson, Smith & Nephew, B. Braun Melsungen AG, and Molnlycke Health Care

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- History

- Current Trends and Future Directions

- PESTEL Analysis

- Political

- Economic

- Social

- Technological

- Environmental

- Legal

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential of New Entrants

- Threat of Substitutes

- Competition in the Industry

- Supply Chain Analysis

- Raw Materials Procurement

- Manufacturing

- Packaging and Distribution

- Wholesalers and Distributors

- Retailers and End Users

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Surge in Surgical Procedures

- Growing Awareness of Patient Comfort and Convenience

- Increasing Healthcare Expenditure

- Increasing Prevalence of Chronic Diseases and an Aging Population

- Market Restraints

- Regulatory and Compliance Challenges

- Market Opportunities

- Technological Advances

- Sustainability Trends

- Market Challenges

- Competition and Market Saturation

Chapter 4 Emerging Technologies and Developments

- Emerging Technologies

- 3D Printing

- Nanotechnology

- Smart Tapes

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Medical Tapes: Global Markets

- Market Analysis by Product

- Fabric Tapes

- Paper Tapes

- Plastic Tapes

- Others

- Market Breakdown by Application

- Wound Care

- Surgery

- Others

- Market Breakdown by End User

- Hospital and Clinics

- Ambulatory Surgical Centers

- Others

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Regulatory Landscape

- Regulatory Framework

- United States

- European Union (EU)

- Japan

Chapter 7 Sustainability: An ESG Perspective in the Medical Tapes Market

- Sustainability in the Medical Tapes Market

- Understanding the ESG Data

- Environmental Performance

- Social Performance

- Governance Performance

- Concluding Remarks on ESG from BCC

Chapter 8 Competitive Intelligence

- Market Analysis

- Industry Scenario

- Strategic Analysis

Chapter 9 Appendix

- Methodology

- Sources

- Company Profiles

- 3M

- ADHESIVE TAPE MANUFACTURER IN INDIA

- B. BRAUN SE

- CARDINAL HEALTH

- DERMARITE INDUSTRIES LLC

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- MOLNLYCKE AB

- MEDIPURPOSE

- SMITH & NEPHEW PLC