|

|

市場調査レポート

商品コード

1568391

グリーン溶剤:各種技術・新たな機会・市場Green Solvents: Technologies, Emerging Opportunities and Markets |

||||||

|

|||||||

| グリーン溶剤:各種技術・新たな機会・市場 |

|

出版日: 2024年10月08日

発行: BCC Research

ページ情報: 英文 119 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のグリーン溶剤の市場規模は、2023年の45億米ドル、2024年の49億米ドルから、予測期間中は9.3%のCAGRで推移し、2029年には77億米ドルの規模に成長すると予測されています。

北米市場は、2024年の17億米ドルから、8.5%のCAGRで推移し、2029年には25億米ドルに成長すると予測されています。アジア太平洋市場は、2024年の15億米ドルから、10.4%のCAGRで推移し、2029年には24億米ドルに成長すると予測されています。

当レポートでは、世界のグリーン溶剤の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- グリーン溶剤

- 従来の溶剤 vs グリーン溶剤

- グリーン溶剤の用途

- サプライチェーン分析

- ポーターのファイブフォース分析

第3章 市場力学

- 概要

- 市場促進要因

- バイオベースコーティングの需要の増加

- 厳しい環境規制

- エンドユーザーによるグリーン溶剤使用の増加

- 市場機会

- グリーンケミストリー技術の進歩

- エンドユーズ市場の拡大

- 市場課題

- グリーン溶剤の生産コストの高さ

- 従来型溶剤との市場競争

第4章 規制状況

- 規制分析

- 環境規制

- 安全衛生規則

- 業界固有の規制

第5章 新興技術

- 技術の進歩

- バイオベース原料

- 生産技術の革新

- グリーン溶剤の応用

- 技術的課題と将来の展望

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:材料別

- バイオベースのアルコール、グリコール、ジオール

- D-リモネン

- 脂肪酸メチルエステル (FAME)

- 乳酸エステル

- その他

- 市場分析:用途別

- 塗料・コーティング

- 化粧品

- 印刷インク

- クリーニング製品

- 接着剤・シーラント

- 医薬品

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 競合情勢

- 市場の競合情勢

- 企業のポジショニング

- 企業収益

- 地理的プレゼンス

- 企業のポジショニング分析

第8章 グリーン溶剤産業における持続可能性:ESGの観点

- グリーン溶剤業界におけるESGの重要性

- グリーン溶剤業界におけるESGの実践

- 新たな持続可能性の動向

- BCC Researchの見解

第9章 付録

- 調査手法

- 情報源

- 参考文献

- 略語

- 企業プロファイル

- ADM

- ASTROBIO

- BASF SE

- BIO BRANDS LLC.

- BRASKEM

- CARGILL INC.

- CORBION

- DOW

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- SOLVAY

List of Tables

- Summary Table : Global Market for Green Solvents, by Region, Through 2029

- Table 1 : Regulations on Green Solvents Market, 2023

- Table 2 : Global Market Volume for Green Solvents, by Material, Through 2029

- Table 3 : Global Market for Green Solvents, by Material, Through 2029

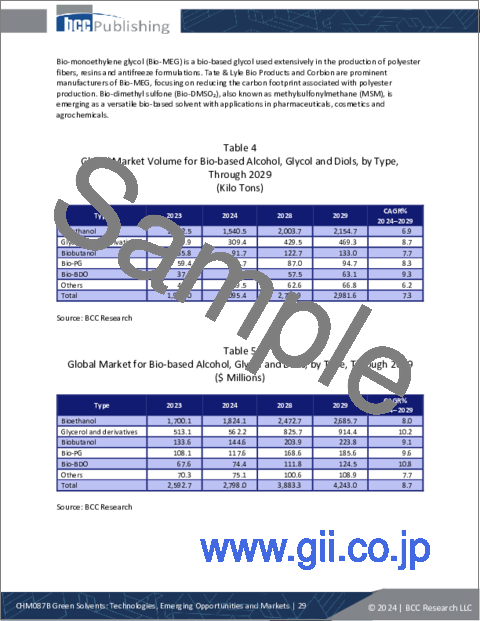

- Table 4 : Global Market Volume for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 5 : Global Market for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 6 : Global Market Volume for Bio-based Alcohol, Glycol and Diols, by Region, Through 2029

- Table 7 : Global Market for Bio-based Alcohol, Glycol and Diols, by Region, Through 2029

- Table 8 : Global Market Volume for D-limonene, by Region, Through 2029

- Table 9 : Global Market for D-limonene, by Region, Through 2029

- Table 10 : Global Market Volume for FAME, by Region, Through 2029

- Table 11 : Global Market for FAME, by Region, Through 2029

- Table 12 : Global Market Volume for Lactate Esters, by Region, Through 2029

- Table 13 : Global Market for Lactate Esters, by Region, Through 2029

- Table 14 : Global Market Volume for Other Green Solvents, by Region, Through 2029

- Table 15 : Global Market for Other Green Solvents, by Region, Through 2029

- Table 16 : Global Market Volume for Green Solvents, by Application, Through 2029

- Table 17 : Global Market for Green Solvents, by Application, Through 2029

- Table 18 : Global Market Volume for Green Solvents for Paints and Coatings, by Region, Through 2029

- Table 19 : Global Market for Green Solvents for Paints and Coatings, by Region, Through 2029

- Table 20 : Global Market Volume for Green Solvents for Cosmetics, by Region, Through 2029

- Table 21 : Global Market for Green Solvents for Cosmetics, by Region, Through 2029

- Table 22 : Global Market Volume for Green Solvents for Printing Inks, by Region, Through 2029

- Table 23 : Global Market for Green Solvents for Printing Inks, by Region, Through 2029

- Table 24 : Global Market Volume for Green Solvents for Cleaning Products, by Region, Through 2029

- Table 25 : Global Market for Green Solvents for Cleaning Products, by Region, Through 2029

- Table 26 : Global Market Volume for Green Solvents for Adhesives and Sealants, by Region, Through 2029

- Table 27 : Global Market for Green Solvents for Adhesives and Sealants, by Region, Through 2029

- Table 28 : Global Market Volume for Green Solvents for Pharmaceuticals, by Region, Through 2029

- Table 29 : Global Market for Green Solvents for Pharmaceuticals, by Region, Through 2029

- Table 30 : Global Market Volume for Green Solvents for Other Applications, by Region, Through 2029

- Table 31 : Global Market for Green Solvents for Other Applications, by Region, Through 2029

- Table 32 : Global Market Volume for Green Solvents, by Region, Through 2029

- Table 33 : Global Market for Green Solvents, by Region, Through 2029

- Table 34 : North American Market Volume for Green Solvents, by Country, Through 2029

- Table 35 : North American Market for Green Solvents, by Country, Through 2029

- Table 36 : North American Market Volume for Green Solvents, by Material, Through 2029

- Table 37 : North American Market for Green Solvents, by Material, Through 2029

- Table 38 : North American Market Volume for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 39 : North American Market for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 40 : North American Market Volume for Green Solvents, by Application, Through 2029

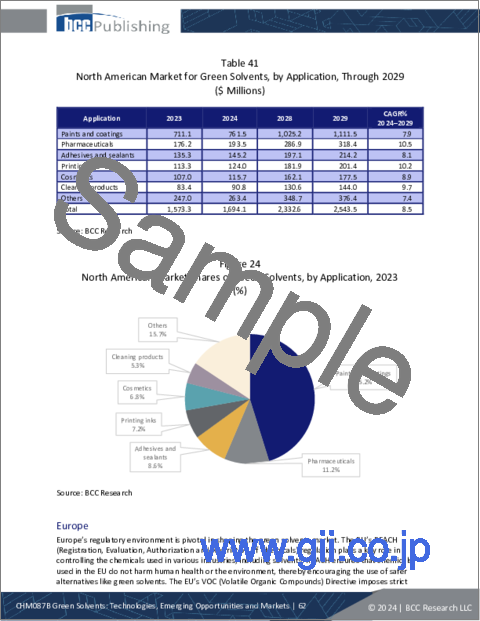

- Table 41 : North American Market for Green Solvents, by Application, Through 2029

- Table 42 : European Market Volume for Green Solvents, by Country, Through 2029

- Table 43 : European Market for Green Solvents, by Country, Through 2029

- Table 44 : European Market Volume for Green Solvents, by Material, Through 2029

- Table 45 : European Market for Green Solvents, by Material, Through 2029

- Table 46 : European Market Volume for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 47 : European Market for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 48 : European Market Volume for Green Solvents, by Application, Through 2029

- Table 49 : European Market for Green Solvents, by Application, Through 2029

- Table 50 : Asia-Pacific Market Volume for Green Solvents, by Country, Through 2029

- Table 51 : Asia-Pacific Market for Green Solvents, by Country, Through 2029

- Table 52 : Asia-Pacific Market Volume for Green Solvents, by Material, Through 2029

- Table 53 : Asia-Pacific Market for Green Solvents, by Material, Through 2029

- Table 54 : Asia-Pacific Market Volume for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 55 : Asia-Pacific Market for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 56 : Asia-Pacific Market Volume for Green Solvents, by Application, Through 2029

- Table 57 : Asia-Pacific Market for Green Solvents, by Application, Through 2029

- Table 58 : Rest of the World Market Volume for Green Solvents, by Sub-region, Through 2029

- Table 59 : Rest of the World Market for Green Solvents, by Sub-region, Through 2029

- Table 60 : Rest of the World Market Volume for Green Solvents, by Material, Through 2029

- Table 61 : Rest of the World Market for Green Solvents, by Material, Through 2029

- Table 62 : Rest of the World Market Volume for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 63 : Rest of the World Market for Bio-based Alcohol, Glycol and Diols, by Type, Through 2029

- Table 64 : Rest of the World Market Volume for Green Solvents, by Application, Through 2029

- Table 65 : Rest of the World Market for Green Solvents, by Application, Through 2029

- Table 66 : ESG Carbon Footprint Issue Analysis

- Table 67 : Abbreviations Used in This Report

- Table 68 : ADM: Company Snapshot

- Table 69 : ADM: Financial Performance, FY 2022 and 2023

- Table 70 : ADM: Product Portfolio

- Table 71 : Astrobio: Company Snapshot

- Table 72 : Astrobio: Product Portfolio

- Table 73 : BASF SE: Company Snapshot

- Table 74 : BASF SE: Financial Performance, FY 2022 and 2023

- Table 75 : BASF SE: Product Portfolio

- Table 76 : BASF SE: News/Key Developments, 2023

- Table 77 : Bio Brands LLC.: Company Snapshot

- Table 78 : Bio Brands LLC.: Product Portfolio

- Table 79 : Braskem: Company Snapshot

- Table 80 : Braskem: Financial Performance, FY 2022 and 2023

- Table 81 : Braskem: Product Portfolio

- Table 82 : Cargill Inc.: Company Snapshot

- Table 83 : Cargill Inc.: Product Portfolio

- Table 84 : Corbion: Company Snapshot

- Table 85 : Corbion: Financial Performance, FY 2022 and 2023

- Table 86 : Corbion: Product Portfolio

- Table 87 : Dow: Company Snapshot

- Table 88 : Dow: Financial Performance, FY 2022 and 2023

- Table 89 : Dow: Product Portfolio

- Table 90 : Dow: News/Key Developments, 2024

- Table 91 : LyondellBasell Industries Holdings B.V.: Company Snapshot

- Table 92 : LyondellBasell Industries Holdings B.V.: Financial Performance, FY 2022 and 2023

- Table 93 : LyondellBasell Industries Holdings B.V.: Product Portfolio

- Table 94 : Solvay: Company Snapshot

- Table 95 : Solvay: Financial Performance, FY 2022 and 2023

- Table 96 : Solvay: Product Portfolio

List of Figures

- Summary Figure : Global Market for Green Solvents, by Region, 2023-2029

- Figure 1 : Different Types of Green Solvents

- Figure 2 : Ecosystem of Supply Chain Partners: Green Solvents

- Figure 3 : Porter's Five Forces Analysis: Market for Green Solvents

- Figure 4 : Snapshot of the Market Dynamics for Green Solvents

- Figure 5 : Global Market Shares of Green Solvents, by Material, 2023

- Figure 6 : Global Market Shares of Bio-based Alcohol, Glycol and Diols, by Type, 2023

- Figure 7 : Global Market Shares of Bio-based Alcohol, Glycol and Diols, by Region, 2023

- Figure 8 : Global Market Shares of D-limonene, by Region, 2023

- Figure 9 : Global Market Shares of FAME, by Region, 2023

- Figure 10 : Global Market Shares of Lactate Esters, by Region, 2023

- Figure 11 : Global Market Shares of Other Green Solvents, by Region, 2023

- Figure 12 : Global Market Shares of Green Solvents, by Application, 2023

- Figure 13 : Global Market Shares of Green Solvents for Paints and Coatings, by Region, 2023

- Figure 14 : Global Market Shares of Green Solvents for Cosmetics, by Region, 2023

- Figure 15 : Global Market Shares of Green Solvents for Printing Inks, by Region, 2023

- Figure 16 : Global Market Shares of Green Solvents for Cleaning Products, by Region, 2023

- Figure 17 : Global Market Shares of Green Solvents for Adhesives and Sealants, by Region, 2023

- Figure 18 : Global Market Shares of Green Solvents for Pharmaceuticals, by Region, 2023

- Figure 19 : Global Market Shares of Green Solvents for Other Applications, by Region, 2023

- Figure 20 : Global Market Shares of Green Solvents, by Region, 2023

- Figure 21 : North American Market Shares of Green Solvents, by Country, 2023

- Figure 22 : North American Market Shares of Green Solvents, by Material, 2023

- Figure 23 : North American Market Shares of Bio-based Alcohol, Glycol and Diols, by Type, 2023

- Figure 24 : North American Market Shares of Green Solvents, by Application, 2023

- Figure 25 : European Market Shares of Green Solvents, by Country, 2023

- Figure 26 : European Market Shares of Green Solvents, by Material, 2023

- Figure 27 : European Market Shares of Bio-based Alcohol, Glycol and Diols, by Type, 2023

- Figure 28 : European Market Shares of Green Solvents, by Application, 2023

- Figure 29 : Asia-Pacific Market Shares of Green Solvents, by Country, 2023

- Figure 30 : Asia-Pacific Market Shares of Green Solvents, by Material, 2023

- Figure 31 : Asia-Pacific Market Shares of Bio-based Alcohol, Glycol and Diols, by Type, 2023

- Figure 32 : Asia-Pacific Market Shares of Green Solvents, by Application, 2023

- Figure 33 : Rest of the World Market Shares of Green Solvents, by Sub-region, 2023

- Figure 34 : Rest of the World Market Shares of Green Solvents, by Material, 2023

- Figure 35 : Rest of the World Market Shares of Bio-based Alcohol, Glycol and Diols, by Type, 2023

- Figure 36 : Rest of the World Market Shares of Green Solvents, by Application, 2023

- Figure 37 : Market Entry Strategies: Suggestions for Small- and Medium-Sized Players

- Figure 38 : Market Player Positioning Analysis, 2023

- Figure 39 : ESG Factors in the Market for Sustainable Packaging

- Figure 40 : ADM: Revenue Share, by Business Unit, FY 2023

- Figure 41 : ADM: Revenue Share, by Country/Region, FY 2023

- Figure 42 : BASF SE: Revenue Share, by Business Unit, FY 2023

- Figure 43 : BASF SE: Revenue Share, by Country/Region, FY 2023

- Figure 44 : Braskem: Revenue Share, by Region/Country, FY 2023

- Figure 45 : Corbion: Revenue Share, by Business Unit, FY 2022

- Figure 46 : Corbion: Revenue Share, by Region, FY 2022

- Figure 47 : Dow: Revenue Share, by Business Unit, FY 2023

- Figure 48 : Dow: Revenue Share, by Country/Region, FY 2023

- Figure 49 : LyondellBasell Industries Holdings B.V.: Revenue Share, by Business Unit, FY 2023

- Figure 50 : LyondellBasell Industries Holdings B.V.: Revenue Share, by Country/Region, FY 2023

- Figure 51 : Solvay: Revenue Share, by Business Unit, FY 2023

- Figure 52 : Solvay: Revenue Share, by Country/Region, FY 2023

The global market for green solvents reached $4.5 billion in 2023. The market is expected to grow from $4.9 billion in 2024 and forecast to reach $7.7 billion by 2029, at a compound annual growth rate (CAGR) of 9.3% from 2024 through 2029.

The North American market for green solvents is expected to grow from $1.7 billion in 2024 to $2.5 billion by 2029, at a CAGR of 8.5% from 2024 through 2029.

The Asia-Pacific market for green solvents is expected to grow from $1.5 billion in 2024 to $2.4 billion by 2029, at a CAGR of 10.4% from 2024 through 2029.

Report Scope

This report analyzes the global market for green solvents by segmenting it based on material, application and region. These market segments are analyzed at the global and regional levels. The base year for this analysis is 2023 and market estimates and forecasts are given from 2024 through 2029. The market estimates are provided in terms of volume (kilo tons) and revenue ($ millions).

Based on material, the market is segmented into:

- Bio-based alcohol, glycol, diols.

- D-limonene.

- Fatty acid methyl esters (FAME).

- Lactate esters.

- Others.

Bio-based alcohol, glycol and diols are further bifurcated into:

- Bioethanol.

- Biobutanol.

- Bio-PG.

- Bio-BDO.

- Glycerol and derivatives.

- Others.

Based on application, the market is segmented into:

- Paints and coatings.

- Cosmetics.

- Printing inks.

- Cleaning products.

- Adhesives and sealants.

- Pharmaceuticals.

- Others.

Based on region, the market is segmented into:

- North America.

- Europe.

- Asia-Pacific.

- Rest of the World (RoW).

Report Includes

- 72 data tables and 25 additional tables

- An analysis of trends, technologies and opportunities in the global market for green solvents

- Analyses of the industry structure, with market revenue data from 2023, estimates for 2024, forecasts for 2028, and projected CAGRs through 2029

- Estimates of the market size and growth forecasts both in value and volumetric terms, and a corresponding market share analysis by material type, application, and region

- Facts and figures pertaining to the market dynamics, technology advances, regulatory landscape, and the impact of macroeconomic variables

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, ESG score analysis, and the ESG practices of leading companies

- Analysis of the competitive intelligence, including company shares, strategic alliances, M&A activity and venture fundings outlook

- Company profiles of market leaders, including ADM, Braskem, Cargill Inc., Corbion, and BASF SE

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Green Solvents

- Traditional Solvents Vs. Green Solvents

- Applications of Green Solvents

- Supply Chain Analysis

- Feedstock

- Green Solvents

- Distribution and Logistics

- Consumers

- Porter's Five Forces Analysis

- Bargaining Power of Suppliers: Moderate

- Competition in the Industry: High

- Threat of Substitutes: Moderate

- Threat of Market Entry: Moderate

- Bargaining Power of Buyers: Moderate

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Increasing Demand for Bio-based Coatings

- Stringent Environmental Regulations

- Increasing Use of Green Solvents by End Users

- Market Opportunities

- Technological Advances in Green Chemistry

- Expansion in End-use Markets

- Market Challenges

- The High Production Cost of Green Solvents

- Market Competition from Traditional Solvents

Chapter 4 Regulatory Landscape

- Regulatory Analysis

- Environmental Regulations

- Safety and Health Regulations

- Industry-specific Regulations

Chapter 5 Emerging Technologies

- Technological Advances

- Bio-based Feedstocks

- Innovation in Production Technologies

- Green Solvents Application

- Technological Challenges and Future Scope

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis by Material

- Bio-based Alcohol, Glycol, Diols

- D-limonene

- Fatty Acid Methyl Esters (FAME)

- Lactate Esters

- Other Green Solvents

- Market Analysis by Application

- Paints and Coatings

- Cosmetics

- Printing inks

- Cleaning Products

- Adhesives and Sealants

- Pharmaceuticals

- Other Applications

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 7 Competitive Landscape

- Market Competitiveness

- Market Player Positioning

- Company Revenue

- Product Portfolio

- Geographic Presence

- Market Player Positioning Analysis

Chapter 8 Sustainability in Green Solvents Industry: An ESG Perspective

- Importance of ESG in the Green Solvents Industry

- ESG Practices in the Green Solvents Industry

- Emerging Sustainability Trends

- Concluding Remarks from BCC Research

Chapter 9 Appendix

- Methodology

- Information Sources

- References

- Abbreviations

- Company Profiles

- ADM

- ASTROBIO

- BASF SE

- BIO BRANDS LLC.

- BRASKEM

- CARGILL INC.

- CORBION

- DOW

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- SOLVAY