|

|

市場調査レポート

商品コード

1563137

医薬品賦形剤:世界市場 (~2029年)Excipients in Pharmaceuticals: Global Markets to 2029 |

||||||

|

|||||||

| 医薬品賦形剤:世界市場 (~2029年) |

|

出版日: 2024年09月27日

発行: BCC Research

ページ情報: 英文 105 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医薬品賦形剤の市場規模は、2023年の92億米ドル、2024年の97億米ドルから、予測期間中はCAGR 5.1%で推移し、2029年末には124億米ドルの規模に達すると予測されています。

有機賦形剤の部門は、2024年の87億米ドルから、5.2%のCAGRで推移し、2029年末には112億米ドルに成長すると予測されています。無機医薬品賦形剤の部門は、2024年の7億1,630万米ドルから、3.8%のCAGRで推移し、2029年末には8億6,170万米ドルに成長すると予測されています。

当レポートでは、世界の医薬品賦形剤の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 医薬品における添加剤の役割

- 賦形剤の機能

第3章 市場力学

- 市場力学スナップショット

- 市場促進要因

- 医薬品およびバイオ医薬品の消費量の増加

- 機能性添加剤の需要増加

- 新規添加剤の需要増加

- 賦形剤の即時調達

- 市場抑制要因

- 高い開発コスト

- 新規添加剤に関する独立した規制機関の欠如

- 厳格な医薬品規制

- 市場機会

- バイオ医薬品、バイオシミラー、特殊医薬品の需要増加

- 市場の課題

- サプライチェーンの混乱

第4章 新興技術と開発

- 概要

- 医薬品製剤における3Dプリント

- 添加剤選択におけるAI

- 新しい賦形剤

- 臨床試験

- 主な臨床試験

第5章 世界の医薬品添加剤市場

- セグメンテーションの内訳

- 市場内訳:材料タイプ別

- 有機添加剤:タイプ別

- 無機添加剤:タイプ別

- USPウォーター:タイプ別

- 市場内訳:剤形別

- 市場内訳:投与経路別

- 市場内訳:エンドユーザー別

- 地理的内訳

- 市場内訳:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

- 市場内訳:製品別

- 有機添加剤:地域・国別市場

- 無機添加剤:地域・国別市場

第6章 競合情報

- 業界シナリオ

- 企業シェア

- 競合情勢

第7章 医薬品添加剤市場における持続可能性:ESGの観点

- ESG:イントロダクション

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- BCCによる総論

第8章 付録

- 調査手法

- 略語

- 参考文献

- 企業プロファイル

- ADM

- ASAHI KASEI CORP.

- ASHLAND

- BASF SE

- CRODA INTERNATIONAL PLC

- EVONIK INDUSTRIES AG

- INGREDION

- KERRY GROUP PLC

- ROQUETTE FRERES

List of Tables

- Summary Table : Global Market for Pharmaceutical Excipients, by Material Type, Through 2029

- Table 1 : Cases of Diabetes, by Country, 2021

- Table 2 : People Living with HIV Globally, by Region, 2022

- Table 3 : Global Incidence of All Cancers, by Region, 2022-2045

- Table 4 : Clinical Trials of Pharmaceutical Excipients

- Table 5 : Global Market for Pharmaceutical Excipients, by Material Type, Through 2029

- Table 6 : Global Market for Organic Excipients, by Product Type, Through 2029

- Table 7 : Global Market for Carbohydrate Pharmaceutical Excipients, by Type, Through 2029

- Table 8 : Global Market for Sugar Pharmaceutical Excipients, by Type, Through 2029

- Table 9 : Global Market for Cellulose Pharmaceutical Excipients, by Type, Through 2029

- Table 10 : Global Market for Starch Pharmaceutical Excipients, Through 2029

- Table 11 : Global Market for Petrochemical-based Pharmaceutical Excipients, by Type, Through 2029

- Table 12 : Global Market for Mineral Hydrocarbon-based Pharmaceutical Excipients, by Type, Through 2029

- Table 13 : Global Market for Oleochemical-based Pharmaceutical Excipients, by Type, Through 2029

- Table 14 : Global Market for Protein-based Pharmaceutical Excipients, by Type, Through 2029

- Table 15 : Global Market for Other Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 16 : Global Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 17 : Global Market for USP Water, Through 2029

- Table 18 : Global Market for Pharmaceutical Excipients, by Dosage Form, Through 2029

- Table 19 : Global Market for Pharmaceutical Excipients, by Route of Administration, Through 2029

- Table 20 : Global Market for Pharmaceutical Excipients, by End User, Through 2029

- Table 21 : Global Market for Pharmaceutical Excipients, by Region, Through 2029

- Table 22 : North American Market for Pharmaceutical Excipients, by Country, Through 2029

- Table 23 : European Market for Pharmaceutical Excipients, by Country, Through 2029

- Table 24 : Asia-Pacific Market for Pharmaceutical Excipients, by Country, Through 2029

- Table 25 : Latin American Market for Pharmaceutical Excipients, by Country, Through 2029

- Table 26 : RoW Market for Pharmaceutical Excipients, Through 2029

- Table 27 : North American Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 28 : U.S. Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 29 : Canadian Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 30 : Mexican Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 31 : European Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 32 : German Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 33 : French Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 34 : U.K. Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 35 : Italian Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 36 : Spanish Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 37 : Rest of European Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 38 : Asia-Pacific Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 39 : Chinese Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 40 : Japanese Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 41 : Indian Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 42 : Rest of Asia-Pacific Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 43 : Latin American Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 44 : Brazilian Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 45 : Argentinian Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 46 : Chilean Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 47 : RoW Market for Organic Pharmaceutical Excipients, by Type, Through 2029

- Table 48 : North American Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 49 : U.S. Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 50 : Canadian Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 51 : Mexican Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 52 : European Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 53 : German Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 54 : French Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 55 : U.K. Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 56 : Italian Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 57 : Spanish Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 58 : Rest of European Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 59 : Asia-Pacific Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 60 : Chinese Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 61 : Japanese Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 62 : Indian Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 63 : Rest of Asia-Pacific Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

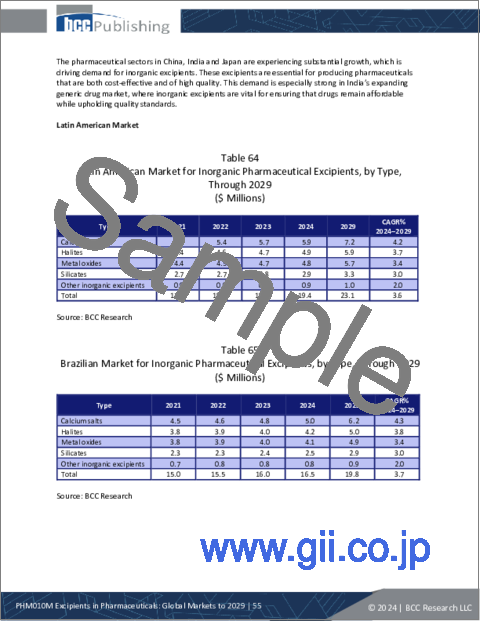

- Table 64 : Latin American Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 65 : Brazilian Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 66 : Argentinian Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 67 : Chilean Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 68 : RoW Market for Inorganic Pharmaceutical Excipients, by Type, Through 2029

- Table 69 : ESG: Environmental Performance

- Table 70 : ESG: Social Performance

- Table 71 : ESG: Governance Performance

- Table 72 : Abbreviations Used in This Report

- Table 73 : ADM: Company Snapshot

- Table 74 : ADM: Financial Performance, 2022 and 2023

- Table 75 : ADM: Product Portfolio

- Table 76 : Asahi Kasei Corp.: Company Snapshot

- Table 77 : Asahi Kasei Corp.: Financial Performance, 2022 and 2023

- Table 78 : Asahi Kasei Corp.: Product Portfolio

- Table 79 : Ashland: Company Snapshot

- Table 80 : Ashland: Financial Performance, 2022 and 2023

- Table 81 : Ashland: Product Portfolio

- Table 82 : Ashland.: News/Key Developments, 2022

- Table 83 : BASF SE: Company Snapshot

- Table 84 : BASF SE: Financial Performance, 2022 and 2023

- Table 85 : BASF SE: Product Portfolio

- Table 86 : BASF SE: News/Key Developments, 2023

- Table 87 : Croda International Plc: Company Snapshot

- Table 88 : Croda International Plc: Financial Performance, 2022 and 2023

- Table 89 : Croda International Plc: Product Portfolio

- Table 90 : Croda International Plc: News/Key Developments, 2023

- Table 91 : Evonik Industries AG: Company Snapshot

- Table 92 : Evonik Industries AG: Financial Performance, 2022 and 2023

- Table 93 : Evonik Industries AG: Product Portfolio

- Table 94 : Evonik.: News/Key Developments, 2023

- Table 95 : Ingredion: Company Snapshot

- Table 96 : Ingredion: Financial Performance, FY 2022 and 2023

- Table 97 : Ingredion: Product Portfolio

- Table 98 : Ingredion: News/Key Developments, 2023

- Table 99 : Kerry Group Plc: Company Snapshot

- Table 100 : Kerry Group Plc: Financial Performance, 2022 and 2023

- Table 101 : Kerry Group Plc: Product Portfolio

- Table 102 : Kerry Group Plc: News/Key Developments, 2023

- Table 103 : Roquette Freres: Company Snapshot

- Table 104 : Roquette Freres: Product Portfolio

- Table 105 : Roquette Freres: News/Key Developments, 2023 and 2024

List of Figures

- Summary Figure A : Global Market for Pharmaceutical Excipients, by Material Type, 2021-2029

- Summary Figure B : Global Market Shares of Pharmaceutical Excipients, by Material Type, 2023

- Figure 1 : Pharmaceutical Excipients: Market Dynamics

- Figure 2 : Emerging Trends and Technologies in Pharmaceutical Excipients

- Figure 3 : Global Market Shares of Pharmaceutical Excipients, by Company, 2023

- Figure 4 : ESG Pillars

- Figure 5 : Advantages of ESG for Pharmaceutical Excipient Companies

- Figure 6 : ADM: Revenue Share, by Business Unit, 2023

- Figure 7 : Asahi Kasei Corp.: Revenue Share, by Business Unit, 2023

- Figure 8 : Asahi Kasei Corp.: Revenue Share, by Country/Region, 2023

- Figure 9 : Ashland: Revenue Share, by Business Unit, 2023

- Figure 10 : Ashland: Revenue Share, by Region, 2023

- Figure 11 : BASF SE: Revenue Share, by Business Unit, 2023

- Figure 12 : BASF SE: Revenue Share, by Region, 2023

- Figure 13 : Croda International Plc: Revenue Share, by Business Unit, 2023

- Figure 14 : Croda International Plc: Revenue Share, by Region, 2023

- Figure 15 : Evonik Industries AG: Revenue Share, by Business Unit, 2023

- Figure 16 : Evonik Industries AG: Revenue Share, by Region, 2023

- Figure 17 : Ingredion: Revenue Shares, by Business Unit, 2023

- Figure 18 : Ingredion: Revenue Share, by Region, 2023

- Figure 19 : Kerry Group Plc: Revenue Share, by Business Unit, 2023

- Figure 20 : Kerry Group Plc: Revenue Share, by Region, 2023

The global market for pharmaceutical excipients was valued at $9.2 billion in 2023. It is expected to grow from $9.7 billion in 2024 to $12.4 billion by the end of 2029, at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2029.

The global market for organic excipients is expected to grow from $8.7 billion in 2024 to $11.2 billion by the end of 2029, at a CAGR of 5.2% from 2024 to 2029.

The global market for inorganic pharmaceutical excipients is expected to grow from $716.3 million in 2024 to $861.7 million by the end of 2029, at a CAGR of 3.8% from 2024 to 2029.

Report Scope

This report provides a comprehensive summary of pharmaceutical excipients, along with a discussion of the competitive landscape and profiles of key market players that highlight revenues, product portfolios, and recent activities. The report analyzes trends and dynamics, including drivers, limitations, challenges and opportunities. This research study discusses historical, current and potential market size. The report will enable market players and new entrants to make informed decisions about the production and licensing of goods and services. Organizations, distributors and exporters will find useful information about market developments and trends. The report segments the market by three product types: organic, inorganic or water that meets the standards of the U.S. Pharmacopeia (USP). Regional and country-level market analysis is provided for all the major segments. The market excludes the excipients used in the cosmetics, food and beverage, and chemical industries.

The market is divided into segments as follows:

By excipient material type:

- Organic.

- Inorganic.

- USP water.

By organic type:

- Carbohydrates.

- Petrochemicals.

- Oleochemicals.

- Proteins.

- Other organic excipients.

By inorganic type:

- Calcium salts.

- Halites.

- Metal oxides.

- Silicates.

- Other inorganic excipients.

By dosage form:

- Solid dosage form.

- Liquid dosage form.

- Semisolid dosage form.

- Other dosage forms.

By administration route:

Oral.

- Injectable.

- Topical.

- Advanced drug delivery.

By end user:

- Pharmaceutical companies.

- Contract formulators.

- Research institutes.

- Other end users.

For each area, for the base year of 2023, BCC Research identified the current products in the market as well as market drivers; measured the current market size; quantified current company market shares; and made forecasts for 2029.

Report Includes

- 73 data tables and 33 additional tables

- An overview of the global market for excipients in pharmaceuticals industry

- Analysis of global market trends, featuring historical revenue data from 2021 to 2023, estimated figures for 2024, and projected CAGRs through 2029

- Evaluation of the current market's size and revenue growth prospects, along with a market share analysis by material, product type, dosage form, route of administration, end user and region

- A look at the innovations, technological advances, clinical trials, and recent product launches

- Analysis of the industry's regulatory framework and policies

- A discussion of ESG challenges and ESG practices in the industry

- An analysis of the key companies' market shares, proprietary technologies, strategic alliances and patents

- Profiles of the leading players, including ADM, BASF SE, Roquette Freres, Ashland Global, and Croda International Plc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Role of Excipients in Pharmaceuticals

- Functions of Excipients

Chapter 3 Market Dynamics

- Market Dynamics Snapshot

- Market Drivers

- Increasing Pharmaceutical and Biopharmaceutical Consumption

- Increasing Demand for Functional Excipients

- Increasing Demand for Novel Excipients

- Instant Sourcing of Excipients

- Market Restraints

- High Development Costs

- Lack of Independent Regulatory Body for Novel Excipients

- Stringent Pharmaceutical Regulations

- Market Opportunities

- Growing Demand for Biologics, Biosimilars and Specialty Drugs

- Market Challenges

- Supply Chain Disruptions

Chapter 4 Emerging Technologies and Developments

- Overview

- 3D Printing in Drug Formulations

- AI in Excipient Selection

- Novel Excipients

- Clinical Trials

- Selected Trials

Chapter 5 Global Market for Pharmaceutical Excipients

- Segmentation Breakdown

- Market Breakdown by Material Type

- Organic Excipients Market, by Type

- Market for Inorganic Excipients, by Type

- Market for USP Water, by Type

- Market Breakdown by Dosage Form

- Market Breakdown by Route of Administration

- Market Breakdown by End User

- Geographic Breakdown

- Market Breakdown by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest of the World

- Market Breakdown by Product

- Regional and Country-level Markets for Organic Excipients

- Regional and Country-level Markets for Inorganic Excipients

Chapter 6 Competitive Intelligence

- Industry Scenario

- Company Shares

- Competitive Landscape

Chapter 7 Sustainability in the Market for Pharmaceutical Excipients: An ESG Perspective

- Introduction to ESG

- Environmental Performance

- Social Performance

- Governance Performance

- Concluding Remarks from BCC

Chapter 8 Appendix

- Research Methodology

- Abbreviations

- References

- Company Profiles

- ADM

- ASAHI KASEI CORP.

- ASHLAND

- BASF SE

- CRODA INTERNATIONAL PLC

- EVONIK INDUSTRIES AG

- INGREDION

- KERRY GROUP PLC

- ROQUETTE FRERES