|

|

市場調査レポート

商品コード

1532348

持続可能プラスチック包装:世界市場Sustainable Plastic Packaging: Global Markets |

||||||

|

|||||||

| 持続可能プラスチック包装:世界市場 |

|

出版日: 2024年08月09日

発行: BCC Research

ページ情報: 英文 140 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の持続可能プラスチック包装の市場規模は、2023年の37億米ドル、2024年の866億米ドルから、予測期間中はCAGR 7.2%で推移し、2029年末には1,224億米ドルに達すると予測されています。

欧州地域は、2023年の816億米ドル、2024年の354億米ドルから、CAGR 8.1%で推移し、2029年末には522億米ドルに達すると予測されています。また、アジア太平洋地域は、2024年の247億米ドルから、CAGR 6.9%で推移し、2029年末には346億米ドルに達すると予測されています。

当レポートでは、世界の持続可能プラスチック包装の市場を調査し、市場概要、市場影響因子および市場機会の分析、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- プラスチック廃棄物の発生

- リサイクル包装

- 再利用可能包装

- バイオベースプラスチック包装

- サプライチェーン分析

- ポーターのファイブフォース分析

第3章 市場力学

- 概要

- 市場促進要因

- バイオプラスチックに対する消費者の嗜好の高まり

- 一次包装におけるバイオベースのフレキシブル素材の使用

- 使用済みプラスチックのリサイクル包装の需要が増加

- 効率性と環境目標を達成するための再利用可能包装

- 市場機会

- リサイクル技術の進歩

- 環境意識、規制圧力、循環型経済の取り組み

- 市場の課題

- プラスチックリサイクル率の低さ

- バイオポリマーのコスト上昇

- その他の持続可能包装ソリューション

第4章 規制状況

- 規制分析

第5章 新興技術

- バイオプラスチック包装の進歩

- リサイクル技術の進歩

- 化学リサイクル

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:包装タイプ別

- リサイクル包装

- 再利用可能包装

- バイオプラスチック包装

- 市場分析:エンドユーザー別

- 食品・飲料

- 工業・化学

- ヘルスケア

- パーソナルケア・ホームケア

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第7章 競合情勢

- 市場競争力

- 市場の位置付け

- 戦略分析

第8章 持続可能プラスチック包装産業における持続可能性:ESGの観点

- 持続可能プラスチック包装業界におけるESG

- 持続可能プラスチック包装業界におけるESG実践

- 新たな持続可能性の動向

- BCCからの結論

第9章 付録

- 調査手法

- 情報源

- 参考文献

- 略語

- 企業プロファイル:持続可能プラスチック包装

- AIM REUSABLE PACKAGING LLC.

- AMCOR PLC

- BERRY GLOBAL INC.

- CONSTANTIA FLEXIBLES

- GEORG UTZ HOLDING AG

- MONDI

- NATUREWORKS LLC.

- PLASTIPAK HOLDINGS INC.

- SWAPBOX BV

- TIPA LTD.

- 企業プロファイル:バイオポリマー製造会社

- 3M

- ARKEMA

- BASF SE

- BRASKEM

- TOTALENERGIES CORBION

List of Tables

- Summary Table : Global Market for Sustainable Plastic Packaging, by Region, Through 2029

- Table 1 : Regulations on Recycled Plastic Packaging, 2024

- Table 2 : Regulations on Bio-Based Plastic Packaging, 2024

- Table 3 : Global Market for Sustainable Plastic Packaging, by Packaging Type, Through 2029

- Table 4 : Global Market for Recycled Packaging, by Plastic, Through 2029

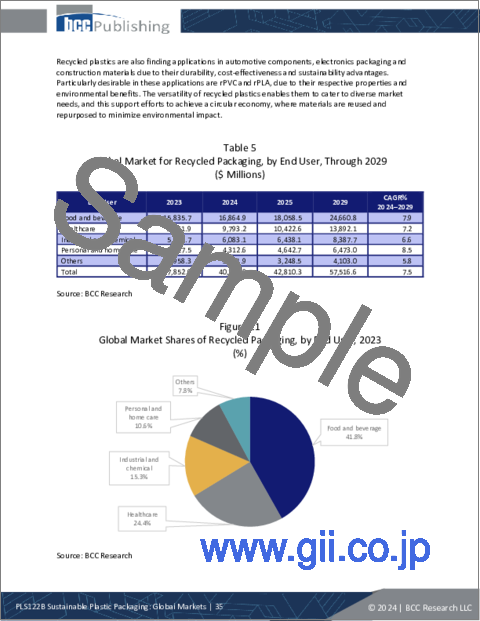

- Table 5 : Global Market for Recycled Packaging, by End User, Through 2029

- Table 6 : Global Market for Recycled Packaging, by Region, Through 2029

- Table 7 : Global Market for Reusable Packaging, by End User, Through 2029

- Table 8 : Global Market for Reusable Packaging, by Region, Through 2029

- Table 9 : Global Market for Bioplastic Packaging, by Type, Through 2029

- Table 10 : Global Market for Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 11 : Global Market for Non-Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 12 : Global Market for Bioplastic Packaging, by End User, Through 2029

- Table 13 : Global Market for Bioplastic Packaging, by Region, Through 2029

- Table 14 : Global Market for Sustainable Plastic Packaging, by End User, Through 2029

- Table 15 : Global Market for Sustainable Plastic Packaging for Food and Beverage End Users, by Region, Through 2029

- Table 16 : Global Market for Sustainable Plastic Packaging for Industrial and Chemical End Users, by Region, Through 2029

- Table 17 : Global Market for Sustainable Plastic Packaging for Healthcare End Users, by Region, Through 2029

- Table 18 : Global Market for Sustainable Plastic Packaging for Personal and Home Care End Users, by Region, Through 2029

- Table 19 : Global Market for Sustainable Plastic Packaging for Other End Users, by Region, Through 2029

- Table 20 : Global Market for Sustainable Plastic Packaging, by Region, Through 2029

- Table 21 : North American Market for Sustainable Plastic Packaging, by Country, Through 2029

- Table 22 : North American Market for Sustainable Plastic Packaging, by Packaging Type, Through 2029

- Table 23 : North American Market for Recycled Packaging, by Plastic, Through 2029

- Table 24 : North American Market for Recycled Packaging, by End User, Through 2029

- Table 25 : North American Market for Reusable Packaging, by End User, Through 2029

- Table 26 : North American Market for Bioplastic Packaging, by Type, Through 2029

- Table 27 : North American Market for Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 28 : North American Market for Non-Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 29 : North American Market for Bioplastic Packaging, by End User, Through 2029

- Table 30 : North American Market for Sustainable Plastic Packaging, by End User, Through 2029

- Table 31 : European Market for Sustainable Plastic Packaging, by Country, Through 2029

- Table 32 : European Market for Sustainable Plastic Packaging, by Packaging Type, Through 2029

- Table 33 : European Market for Recycled Packaging, by Plastic, Through 2029

- Table 34 : European Market for Recycled Packaging, by End User, Through 2029

- Table 35 : European Market for Reusable Packaging, by End User, Through 2029

- Table 36 : European Market for Bioplastic Packaging, by Type, Through 2029

- Table 37 : European Market for Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 38 : European Market for Non-Biodegradable Plastic Packaging, by Polymer, Through 2029

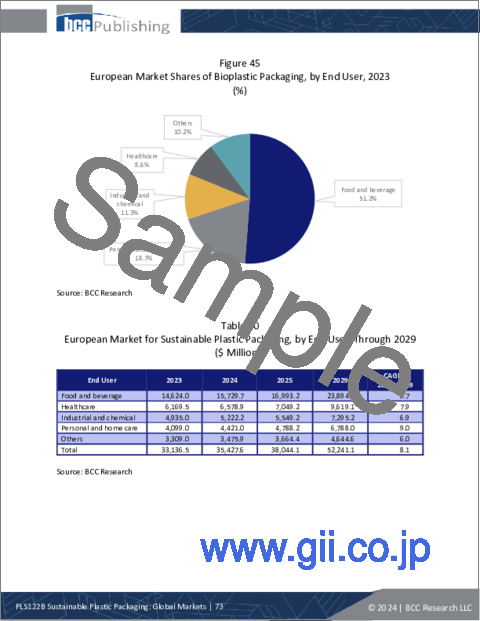

- Table 39 : European Market for Bioplastic Packaging, by End User, Through 2029

- Table 40 : European Market for Sustainable Plastic Packaging, by End User, Through 2029

- Table 41 : Asia-Pacific Market for Sustainable Plastic Packaging, by Country, Through 2029

- Table 42 : Asia-Pacific Market for Sustainable Plastic Packaging, by Packaging Type, Through 2029

- Table 43 : Asia-Pacific Market for Recycled Packaging, by Plastic, Through 2029

- Table 44 : Asia-Pacific Market for Recycled Packaging, by End User, Through 2029

- Table 45 : Asia-Pacific Market for Reusable Packaging, by End User, Through 2029

- Table 46 : Asia-Pacific Market for Bioplastic Packaging, by Type, Through 2029

- Table 47 : Asia-Pacific Market for Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 48 : Asia-Pacific Market for Non-Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 49 : Asia-Pacific Market for Bioplastic Packaging, by End User, Through 2029

- Table 50 : Asia-Pacific Market for Sustainable Plastic Packaging, by End User, Through 2029

- Table 51 : RoW Market for Sustainable Plastic Packaging, by Sub-region, Through 2029

- Table 52 : RoW Market for Sustainable Plastic Packaging, by Packaging Type, Through 2029

- Table 53 : RoW Market for Recycled Packaging, by Plastic, Through 2029

- Table 54 : RoW Market for Recycled Packaging, by End User, Through 2029

- Table 55 : RoW Market for Reusable Packaging, by End User, Through 2029

- Table 56 : RoW Market for Bioplastic Packaging, by Type, Through 2029

- Table 57 : RoW Market for Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 58 : RoW Market for Non-Biodegradable Plastic Packaging, by Polymer, Through 2029

- Table 59 : RoW Market for Bioplastic Packaging, by End User, Through 2029

- Table 60 : RoW Market for Sustainable Plastic Packaging, by End User, Through 2029

- Table 61 : Partnerships Formed in the Sustainable Plastic Packaging Industry, 2022-2024

- Table 62 : ESG Carbon Footprint Issue Analysis

- Table 63 : Abbreviations Used in This Report

- Table 64 : AIM Reusable Packaging LLC.: Company Snapshot

- Table 65 : AIM Reusable Packaging LLC.: Product Portfolio

- Table 66 : Amcor plc: Company Snapshot

- Table 67 : Amcor plc: Financial Performance, FY 2022 and 2023

- Table 68 : Amcor plc: Product Portfolio

- Table 69 : Amcor plc: News/Key Developments, 2023 and 2024

- Table 70 : Berry Global Inc.: Company Snapshot

- Table 71 : Berry Global Inc.: Financial Performance, FY 2022 and 2023

- Table 72 : Berry Global Inc.: Product Portfolio

- Table 73 : Berry Global Inc.: News/Key Developments, 2024

- Table 74 : Constantia Flexibles: Company Snapshot

- Table 75 : Constantia Flexibles: Product Portfolio

- Table 76 : Georg Utz Holding AG: Company Snapshot

- Table 77 : Georg Utz Holding AG: Product Portfolio

- Table 78 : Mondi: Company Snapshot

- Table 79 : Mondi: Financial Performance, FY 2022 and 2023

- Table 80 : Mondi: Product Portfolio

- Table 81 : Mondi: News/Key Developments, 2024

- Table 82 : NatureWorks LLC.: Company Snapshot

- Table 83 : NatureWorks LLC.: Product Portfolio

- Table 84 : NatureWorks LLC.: News/Key Developments, 2023

- Table 85 : Plastipak Holdings Inc.: Company Snapshot

- Table 86 : Plastipak Holdings Inc.: Product Portfolio

- Table 87 : Plastipak Holdings Inc.: News/Key Developments, 2024

- Table 88 : SwapBox BV: Company Snapshot

- Table 89 : SwapBox BV: Product Portfolio

- Table 90 : Tipa Ltd.: Company Snapshot

- Table 91 : Tipa Ltd.: Product Portfolio

- Table 92 : 3M: Company Snapshot

- Table 93 : 3M: Financial Performance, FY 2022 and 2023

- Table 94 : 3M: Product Portfolio

- Table 95 : Arkema: Company Snapshot

- Table 96 : Arkema: Financial Performance, FY 2022 and 2023

- Table 97 : Arkema: Product Portfolio

- Table 98 : BASF SE: Company Snapshot

- Table 99 : BASF SE: Financial Performance, FY 2022 and 2023

- Table 100 : BASF SE: Product Portfolio

- Table 101 : BASF SE: News/Key Developments, 2022

- Table 102 : Braskem: Company Snapshot

- Table 103 : Braskem: Financial Performance, FY 2022 and 2023

- Table 104 : Braskem: Product Portfolio

- Table 105 : Braskem: News/Key Developments, 2023

- Table 106 : TotalEnergies Corbion: Company Snapshot

- Table 107 : TotalEnergies Corbion: Product Portfolio

List of Figures

- Summary Figure : Global Market for Sustainable Plastic Packaging, by Region, 2023-2029

- Figure 1 : Plastic Recycling Rates in Six Countries, 2024

- Figure 2 : Global Recycled Polymer Capacity, by Type, 2021

- Figure 3 : Plastic Packaging Waste Generated and Recycled in the EU, 2015-2023

- Figure 4 : Ecosystem of Supply Chain Partners: Sustainable Plastic Packaging

- Figure 5 : Porter's Five Forces Analysis: Market for Sustainable Plastic Packaging

- Figure 6 : Market Dynamics: Drivers and Challenges

- Figure 7 : Consumption of Biodegradable and Non-Biodegradable Bioplastic in the Packaging Industry, 2022-2027

- Figure 8 : Potential Market for Chemical Recycling, 2022

- Figure 9 : Global Market Shares of Sustainable Plastic Packaging, by Packaging Type, 2023

- Figure 10 : Global Market Shares of Recycled Packaging, by Plastic, 2023

- Figure 11 : Global Market Shares of Recycled Packaging, by End User, 2023

- Figure 12 : Global Market Shares of Recycled Packaging, by Region, 2023

- Figure 13 : Global Market Shares of Reusable Packaging, by End User, 2023

- Figure 14 : Global Market Shares of Reusable Packaging, by Region, 2023

- Figure 15 : Global Market Shares of Bioplastic Packaging, by Type, 2023

- Figure 16 : Global Market Shares of Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 17 : Global Market Shares of Non-Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 18 : Global Market Shares of Bioplastic Packaging, by End User, 2023

- Figure 19 : Global Market Shares of Bioplastic Packaging, by Region, 2023

- Figure 20 : Global Market Shares of Sustainable Plastic Packaging, by End User, 2023

- Figure 21 : Global Market Shares of Sustainable Plastic Packaging for Food and Beverage End Users, by Region, 2023

- Figure 22 : Global Market Shares of Sustainable Plastic Packaging for Industrial and Chemical End Users, by Region, 2023

- Figure 23 : Global Market Shares of Sustainable Plastic Packaging for Healthcare End Users, by Region, 2023

- Figure 24 : Global Market Shares of Sustainable Plastic Packaging for Personal and Home Care End Users, by Region, 2023

- Figure 25 : Global Market Shares of Sustainable Plastic Packaging for Other End Users, by Region, 2023

- Figure 26 : Global Market Shares of Sustainable Plastic Packaging, by Region, 2023

- Figure 27 : North American Market Shares of Sustainable Plastic Packaging, by Country, 2023

- Figure 28 : North American Market Shares of Sustainable Plastic Packaging, by Packaging Type, 2023

- Figure 29 : North American Market Shares of Recycled Packaging, by Plastic, 2023

- Figure 30 : North American Market Shares of Recycled Packaging, by End User, 2023

- Figure 31 : North American Market Shares of Reusable Packaging, by End User, 2023

- Figure 32 : North American Market Shares of Bioplastic Packaging, by Type, 2023

- Figure 33 : North American Market Shares of Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 34 : North American Market Shares of Non-Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 35 : North American Market Shares of Bioplastic Packaging, by End User, 2023

- Figure 36 : North American Market Shares of Sustainable Plastic Packaging, by End User, 2023

- Figure 37 : European Market Shares of Sustainable Plastic Packaging, by Country, 2023

- Figure 38 : European Market Shares of Sustainable Plastic Packaging, by Packaging Type, 2023

- Figure 39 : European Market Shares of Recycled Packaging, by Plastic, 2023

- Figure 40 : European Market Shares of Recycled Packaging, by End User, 2023

- Figure 41 : European Market Shares of Reusable Packaging, by End User, 2023

- Figure 42 : European Market Shares of Bioplastic Packaging, by Type, 2023

- Figure 43 : European Market Shares of Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 44 : European Market Shares of Non-Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 45 : European Market Shares of Bioplastic Packaging, by End User, 2023

- Figure 46 : European Market Shares of Sustainable Plastic Packaging, by End User, 2023

- Figure 47 : Asia-Pacific Market Shares of Sustainable Plastic Packaging, by Country, 2023

- Figure 48 : Asia-Pacific Market Shares of Sustainable Plastic Packaging, by Packaging Type, 2023

- Figure 49 : Asia-Pacific Market Shares of Recycled Packaging, by Plastic, 2023

- Figure 50 : Asia-Pacific Market Shares of Recycled Packaging, by End User, 2023

- Figure 51 : Asia-Pacific Market Shares of Reusable Packaging, by End User, 2023

- Figure 52 : Asia-Pacific Market Shares of Bioplastic Packaging, by Type, 2023

- Figure 53 : Asia-Pacific Market Shares of Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 54 : Asia-Pacific Market Shares of Non-Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 55 : Asia-Pacific Market Shares of Bioplastic Packaging, by End User, 2023

- Figure 56 : Asia-Pacific Market Shares of Sustainable Plastic Packaging, by End User, 2023

- Figure 57 : RoW Market Shares of Sustainable Plastic Packaging, by Sub-region, 2023

- Figure 58 : RoW Market Shares of Sustainable Plastic Packaging, by Packaging Type, 2023

- Figure 59 : RoW Market Shares of Recycled Packaging, by Plastic, 2023

- Figure 60 : RoW Market Shares of Recycled Packaging, by End User, 2023

- Figure 61 : RoW Market Shares of Reusable Packaging, by End User, 2023

- Figure 62 : RoW Market Shares of Bioplastic Packaging, by Type, 2023

- Figure 63 : RoW Market Shares of Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 64 : RoW Market Shares of Non-Biodegradable Plastic Packaging, by Polymer, 2023

- Figure 65 : RoW Market Shares of Bioplastic Packaging, by End User, 2023

- Figure 66 : RoW Market Shares of Sustainable Plastic Packaging, by End User, 2023

- Figure 67 : Market Entry Strategies: Suggestions for Small and Medium-Sized Players

- Figure 68 : Market Positioning of Five Key Companies in Sustainable Plastic Packaging

- Figure 69 : ESG Factors in Market for Sustainable Plastic Packaging

- Figure 70 : Amcor plc: Revenue Share, by Business Unit, FY 2023

- Figure 71 : Amcor plc: Revenue Share, by Country/Region, FY 2023

- Figure 72 : Berry Global Inc.: Revenue Share, by Business Unit, FY 2022

- Figure 73 : Berry Global Inc.: Revenue Share, by Country/Region, FY 2022

- Figure 74 : Constantia Flexibles: Revenue Share, by Business Unit, FY 2022

- Figure 75 : Constantia Flexibles: Revenue Share, by Country/Region, FY 2022

- Figure 76 : Mondi: Revenue Share, by Business Unit, FY 2022

- Figure 77 : Mondi: Revenue Share, by Customer Country/Region, FY 2022

- Figure 78 : 3M: Revenue Share, by Business Unit, FY 2023

- Figure 79 : 3M: Revenue Share, by Region, FY 2023

- Figure 80 : Arkema: Revenue Share, by Business Unit, FY 2023

- Figure 81 : Arkema: Revenue Share, by Country/Region, FY 2023

- Figure 82 : BASF SE: Revenue Share, by Business Unit, FY 2023

- Figure 83 : BASF SE: Revenue Share, by Region, FY 2023

- Figure 84 : Braskem: Revenue Share, by Country/Region, FY 2023

The global market for sustainable plastic packaging was valued at $81.6 billion in 2023. The market is expected to grow from $86.6 billion in 2024 to $122.4 billion by the end of 2029, at a compound annual growth rate, or CAGR, of 7.2% from 2024 to 2029.

The European market for sustainable plastic packaging is expected to grow from $35.4 billion in 2024 to $52.2 billion by the end of 2029, at a CAGR of 8.1% from 2024 to 2029.

The Asia-Pacific market for sustainable plastic packaging is expected to grow from $24.7 billion in 2024 to $34.6 billion by the end of 2029, at a CAGR of 6.9% from 2024 to 2029.

Report Scope:

This report analyzes the global sustainable plastic packaging market by segmenting it based on packaging type and end user. On the basis of packaging type, the market is further segmented into recycled packaging, reusable packaging and bioplastic packaging. Recycled packaging is additionally segmented into R-PET, R-PE, R-PP, R-PS and others (such as R-PVC, R-PLA, etc.). Bioplastic packaging is additionally segmented into biodegradable and non-biodegradable bioplastic. The sustainable plastic packaging market is segmented based on end user into the following segments: food and beverage, industrial and chemical, healthcare, personal and home care, and others.

These market segments are analyzed at the global and regional levels. The base year for this analysis is 2023, and market estimates and forecasts are given from 2024 through 2029. The market estimates are provided in terms of revenue (in millions of U.S. dollars).

Report Includes:

- 66 data tables and 42 additional tables

- An analysis of the current and future global markets for sustainable plastic packaging

- Analyses of global market trends, with market revenue data (sales figures) for 2023, estimates for 2024, forecast for 2025, and projected CAGRs through 2029

- Estimates of the market size and revenue forecasts for the sustainable plastic packaging market, with market share analysis by packaging type, end use application, and region

- Discussions of the market dynamics, opportunities and challenges, as well as emerging technologies

- Overview of the sustainability trends and ESG developments in the industry, with emphasis on the ESG practices of leading companies, their ESG scores, and consumer attitudes

- Competitive intelligence, including companies' market shares, recent M&A activity and venture funding

- Profiles of the leading companies, including Amcor plc, Berry Global Group Inc., Constantia Flexibles, NatureWorks LLC., and Plastipak Holdings Inc.

Table of Contennts

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Generation of Plastic Waste

- Recycled Packaging

- Reusable Packaging

- Bio-based Plastic Packaging

- Supply Chain Analysis

- Feedstock

- Sustainable Plastic Packaging

- Distribution and Logistics

- Consumers

- Porter's Five Forces Analysis

- Bargaining Power of Suppliers: Moderate

- Competition in the Industry: High

- Threat of Substitutes: High

- Threat of Market Entry: Moderate

- Bargaining Power of Buyers: Low

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Increasing Consumer Preference for Bioplastic

- Use of Bio-Based Flexible Materials for Primary Packaging

- Post-Consumer Recycled Plastic Packaging Demand Increases

- Reusable Packaging to Achieve Efficiency and Environmental Goals

- Market Opportunities

- Advances in Recycling Technology

- Environmental Awareness, Regulatory Pressures and Circular Economy Initiatives

- Market Challenges

- Low Plastic Recycling Rate

- Higher Cost of Biopolymers

- Other Sustainable Packaging Solutions

Chapter 4 Regulatory Landscape

- Regulatory Analysis

Chapter 5 Emerging Technologies

- Advances in Bioplastic Packaging

- Advances in Recycling Technology

- Chemical Recycling

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis, by Packaging Type

- Recycled Packaging

- Reusable Packaging

- Bioplastic Packaging

- Market Analysis, by End User

- Food and Beverage

- Industrial and Chemical

- Healthcare

- Personal and Home Care

- Other End Users

- Geographic Breakdown

- Market Analysis, by Region

- North America

- Europe

- Asia-Pacific

- Rest of World

Chapter 7 Competitive Landscape

- Market Competitiveness

- Market Positioning

- Strategic Analysis

Chapter 8 Sustainability in Sustainable Plastic Packaging Industry: An ESG Perspective

- ESG in the Sustainable Plastic Packaging Industry

- ESG Practices in the Sustainable Plastic Packaging Industry

- Emerging Sustainability Trends

- Concluding Remarks from BCC Research

Chapter 9 Appendix

- Methodology

- Information Sources

- References

- Abbreviations

- Company Profiles: Sustainable Plastic Packaging

- AIM REUSABLE PACKAGING LLC.

- AMCOR PLC

- BERRY GLOBAL INC.

- CONSTANTIA FLEXIBLES

- GEORG UTZ HOLDING AG

- MONDI

- NATUREWORKS LLC.

- PLASTIPAK HOLDINGS INC.

- SWAPBOX BV

- TIPA LTD.

- Company Profiles: Biopolymer Producers

- 3M

- ARKEMA

- BASF SE

- BRASKEM

- TOTALENERGIES CORBION