|

|

市場調査レポート

商品コード

1452910

歯列矯正の世界市場Global Orthodontic and Orthopedic Market |

||||||

|

|||||||

| 歯列矯正の世界市場 |

|

出版日: 2024年03月15日

発行: BCC Research

ページ情報: 英文 126 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の歯列矯正デバイスの市場規模は、2023年の189億米ドルから、予測期間中は9.2%のCAGRで推移し、2028年末には293億米ドルの規模に成長すると予測されています。

固定デバイスの市場は2023年の83億米ドルから、同期間中8.4%のCAGRで推移し、2028年末には124億米ドルの規模に成長すると予測されています。また、リムーバブルデバイスの市場は2023年の106億米ドルから、9.7%のCAGRで推移し、2028年末には168億米ドルの規模に成長すると予測されています。

当レポートでは、世界の歯列矯正の市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 市場と技術の背景

- 矯正デバイスの新時代

- 従来の歯列矯正

- 神経筋(GNM)整形/矯正歯科

- 歯科疾患と手術

- 口腔の健康へのアクセスの向上

- 歯科矯正デバイスの市場動向

- カスタマイズされた個別のスマイルデザインシステム

- 銅チタン線およびニッケル線の需要

- 新しいスキャナとミニネジの使用

- 自己結紮性の目に見えないブレースの需要

- ますます迅速化する矯正治療

第3章 市場力学

- 市場促進要因

- 歯科技術の急速な発展と進歩

- 高齢者人口の増加とそれに関連する矯正手術

- 歯科医療の需要の増加

- 消費者プレゼンスの構築

- 市場抑制要因

- ブレースの一般的な副作用

- 送料の値上げまたはサービスの問題

- 市場機会

- 審美歯科の需要の高まり

- 歯科観光で人気を集める

第4章 新たな技術と開発

- AI

- 下顎拡張デバイスまたは器具

- Schwartz アプライアンス

- TORKOアプライアンス

- ベータチタン補助拡張アーチワイヤー(TMA-EA)

- バイヘリックスエキスパンダー

- 3Dプリント設計

- 歯科矯正補助具

- 咬合副木

- 歯科矯正デバイスの新たな動向

- 3Dフェイシャルスキャナー

- クリアアライナー市場が大幅な成長の見通し

- ナビゲート手術

- 再生歯科の台頭

第5章 市場セグメンテーション分析

- セグメント内訳

- 市場内訳:デバイスタイプ別

- 固定デバイス

- 市場規模・予測

- 市場分析

- ブレース

- 固定リテーナ・スペースメンテナー

- その他の固定デバイス

- リムーバブルデバイス

- 市場規模・予測

- 市場分析

- アライナー

- ヘッドギア

- リップ&チークバンパー

- 口蓋拡張器

- リテーナーおよびリムーバブルスペースメンテナー(RSM)

- スプリント

- 市場内訳:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- ラテンアメリカ

- 市場規模・予測

- ブラジル

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- 市場規模・予測

- 南アフリカ

- GCC諸国

- その他の中東およびアフリカ

第6章 競合情報

- 企業シェアの分析

- 主要企業の市場シェアに影響を与える要因

- 補償範囲と償還

- 顧客体験の向上

- 買収とコラボレーション

- M&A

- 協定、コラボレーション、パートナーシップ

第7章 持続可能性

- 矯正歯科製造業におけるESGの重要性

- 矯正歯科デバイス製造業におけるESGの実践

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- ケーススタディ

- BCCによる見解

第8章 付録

- 調査手法

- 頭字語

- 参考文献

- 企業プロファイル

- 3M

- ALIGN TECHNOLOGY INC.

- AMERICAN ORTHODONTICS

- DENTSPLY SIRONA

- ENVISTA

- HENRY SCHEIN ORTHODONTICS

- INSTITUT STRAUMANN AG

List of Tables

- Summary Table : Global Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 1 : Global Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 2 : Global Market for Fixed Orthodontic Devices, by Region, Through 2028

- Table 3 : Number of Orthodontic Departments and Members in Each Country, 2019

- Table 4 : Global Market for Orthodontic Braces, by Region, Through 2028

- Table 5 : Global Market for Fixed Retainers and Space Maintainers, by Region, Through 2028

- Table 6 : Global Market for Other Types of Fixed Orthodontic Devices, by Region, Through 2028

- Table 7 : Global Market for Removable Orthodontic Devices, by Region, Through 2028

- Table 8 : Global Market for Orthodontic Aligners, by Region, Through 2028

- Table 9 : Global Market for Orthodontic Headgear, by Region, Through 2028

- Table 10 : Global Market for Lip and Cheek Bumpers, by Region, Through 2028

- Table 11 : Global Market for Palatal Expanders, by Region, Through 2028

- Table 12 : Global Market for Removable Space Maintainers, by Region, Through 2028

- Table 13 : Global Market for Orthodontic Splints, by Region, Through 2028

- Table 14 : Global Market for Orthodontic Devices, by Region, Through 2028

- Table 15 : North American Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 16 : North American Market Shares of Orthodontic Braces & Removable Devices, by Type, 2022 and 2028

- Table 17 : North American Market for Orthodontic Devices, by Country, Through 2028

- Table 18 : European Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 19 : European Market Shares of Orthodontic Braces, by Type, 2022 and 2028

- Table 20 : European Market for Orthodontic Devices, by Country, Through 2028

- Table 21 : Asia-Pacific Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 22 : Asia-Pacific Market Shares of Orthodontic Devices, by Type, 2022 and 2028

- Table 23 : Asia-Pacific Market for Orthodontic Devices, by Country, Through 2028

- Table 24 : Latin American Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 25 : Latin American Market Shares of Orthodontic Devices, by Type, 2022 and 2028

- Table 26 : Latin American Market for Orthodontic Devices, by Country, Through 2028

- Table 27 : Middle Eastern and African Market for Orthodontic Devices, by Type of Device, Through 2028

- Table 28 : Middle Eastern and African Market Shares of Orthodontic Braces, by Type, 2022 and 2028

- Table 29 : Middle Eastern and African Market for Orthodontic Devices, by Country, Through 2028

- Table 30 : ESG Practices: Environmental Performance

- Table 31 : ESG Practices: Social Performance

- Table 32 : ESG Practices: Governance Performance

- Table 33 : Acronyms Used in This Report

- Table 34 : 3M: Company Snapshot

- Table 35 : 3M: Financial Performance, FY 2022 and 2023

- Table 36 : 3M: Product Portfolio

- Table 37 : 3M: News/Key Developments, 2024

- Table 38 : Align Technology Inc.: Company Snapshot

- Table 39 : Align Technology Inc.: Financial Performance, FY 2022 and 2023

- Table 40 : Align Technology Inc.: Product Portfolio

- Table 41 : Align Technology Inc.: News/Key Developments, 2022-2023

- Table 42 : American Orthodontics: Company Snapshot

- Table 43 : American Orthodontics: Product Portfolio

- Table 44 : American Orthodontics: News/Key Developments,2023

- Table 45 : Dentsply Sirona: Company Snapshot

- Table 46 : Dentsply Sirona: Financial Performance, FY 2022 and 2023

- Table 47 : Dentsply Sirona: Product Portfolio

- Table 48 : Dentsply Sirona: News/Key Developments, 2021-2022

- Table 49 : Envista: Company Snapshot

- Table 50 : Envista: Financial Performance, FY 2022 and 2023

- Table 51 : Envista: Product Portfolio

- Table 52 : Envista: News/Key Developments, 2022

- Table 53 : Henry Schein Inc.: Company Snapshot

- Table 54 : Henry Schein Inc.: Financial Performance, FY 2022 and 2023

- Table 55 : Henry Schein Inc.: Product Portfolio

- Table 56 : Henry Schein Inc.: News/Key Developments, 2023

- Table 57 : Institut Straumann AG: Company Snapshot

- Table 58 : Institut Straumann AG: Financial Performance, FY 2022 and 2023

- Table 59 : Institut Straumann AG: Product Portfolio

- Table 60 : Institut Straumann AG: News/Key Developments, 2022

List of Figures

- Summary Figure : Global Market Shares of Orthodontic Devices, by Type, 2022

- Figure 1 : Number of People Affected by Common Dental Diseases Globally, 2022

- Figure 2 : Patient Access to Quality Dental Treatment in Emerging Countries

- Figure 3 : Global Market for Orthodontic Devices: Market Dynamics

- Figure 4 : Global Projected Shares of Elderly Population (Aged 65 and Above), by Region, 2050

- Figure 5 : Type of Patients Treated with Clear Aligners, 2019

- Figure 6 : U.S. National Dental Expenditures, 2020 and 2021

- Figure 7 : Adults Over 18 Years Old Who Visited a Dentist in the Past 12 Months, by Survey Year and Sex, 2019 and 2020

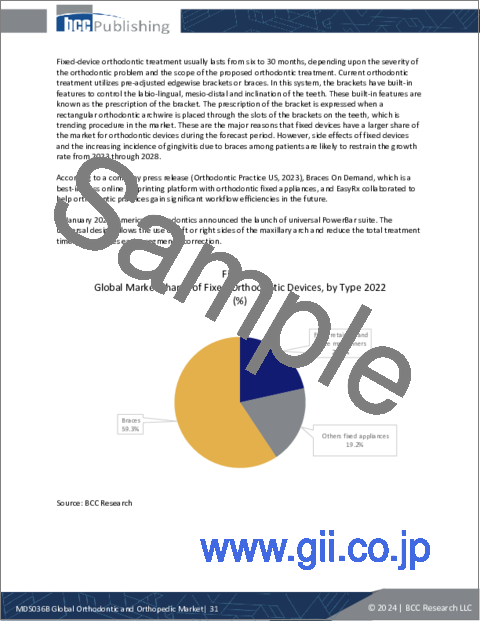

- Figure 8 : Global Market Shares of Fixed Orthodontic Devices, by Type 2022

- Figure 9 : Global Market Shares of Orthodontic Braces, by Type, 2022

- Figure 10 : Global Market Shares of Removable Orthodontic Devices, by Type, 2022

- Figure 11 : Global Market Shares of Orthodontic Devices, by Region, 2022

- Figure 12 : North American Market Shares of Orthodontic Devices, by Type, 2022

- Figure 13 : North American Market Shares of Fixed Orthodontic Devices, by Type, 2022

- Figure 14 : North American Market Shares of Orthodontic Devices, by Country, 2022

- Figure 15 : U.S. Dental Expenditures as a Share of Total Health Expenditures, 1990-2022

- Figure 16 : European Market Shares of Orthodontic Devices, by Type, 2022

- Figure 17 : European Market Shares of Fixed Orthodontic Devices, by Type, 2022

- Figure 18 : European Market Shares of Orthodontic Devices, by Country, 2022

- Figure 19 : Asia-Pacific Market Shares of Orthodontic Devices, by Type, 2022

- Figure 20 : Asia-Pacific Market Shares of Fixed Orthodontic Devices, by Type, 2022

- Figure 21 : Asia-Pacific Market Shares of Orthodontic Devices, by Country, 2022

- Figure 22 : Latin American Market Shares of Orthodontic Devices, by Type, 2022

- Figure 23 : Latin American Market Shares of Fixed Orthodontic Devices, by Type, 2022

- Figure 24 : Latin American Market Shares of Orthodontic Devices, by Country, 2022

- Figure 25 : Middle Eastern and African Market Shares of Orthodontic Devices, by Type, 2022

- Figure 26 : Middle Eastern and African Market Shares of Fixed Orthodontic Devices, by Type, 2022

- Figure 27 : Middle Eastern and African Market Shares of Orthodontic Devices, by Country, 2022

- Figure 28 : Global Market Shares of Orthodontic Devices, by Company, 2022

- Figure 29 : Snapshot: Key ESG Trends in the Dental Industry

- Figure 30 : 3M: Revenue Share, by Country/Region, FY 2023

- Figure 31 : 3M: Revenue Share, by Business Unit, FY 2023

- Figure 32 : Align Technology Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 33 : Align Technology Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 34 : Dentsply Sirona: Revenue Share, by Country/Region, FY 2023

- Figure 35 : Dentsply Sirona: Revenue Share, by Business Unit, FY 2023

- Figure 36 : Envista: Revenue Share, by Business Unit, FY 2023

- Figure 37 : Envista: Revenue Share, by Country/Region, FY 2023

- Figure 38 : Henry Schein Orthodontics: Revenue Share, by Business Unit, FY 2023

- Figure 39 : Henry Schein Orthodontics: Revenue Share, by Country/Region, FY 2023

- Figure 40 : Institut Straumann AG: Revenue Share, by Business Unit, FY 2023

- Figure 41 : Institut Straumann AG: Revenue Share, by Country/Region, FY 2023

The global market for orthodontic devices is expected to grow from $18.9 billion in 2023 and projected to reach $29.3 billion by the end of 2028, at a compound annual growth rate (CAGR) of 9.2% during the forecast period of 2023 to 2028.

The fixed devices segment for orthodontic devices market is expected to grow from $8.3 billion in 2023 and projected to reach $12.4 billion by the end of 2028, at a CAGR of 8.4% during the forecast period of 2023 to 2028.

The removable devices segment for orthodontic devices market is expected to grow from $10.6 billion in 2023 and projected to reach $16.8 billion by the end of 2028, at a CAGR of 9.7% during the forecast period of 2023 to 2028.

Report Scope:

The report will provide details about the orthodontic devices used in the treatment of dental disease and facial dental surgery. This includes devices used for aligning teeth, due to damage caused by trauma or genetic disorder, or any aesthetic purpose. This report will also highlight the current and future market potentiality of orthodontic devices with a detailed analysis of the competitive environment between companies and dental surgery-related issues. Drivers, restraints, opportunities, pricing analyses, prevalence or incidence of dental diseases, and a regulatory scenario assessment will be covered in the current report. The report includes market projections for 2028 and market shares for key players.

The report segments the market for orthodontic devices based on device type and geography.

Based on device type, the market is segmented into fixed and removable devices. Fixed devices are further segmented into braces (metal wired braces, ceramic wired braces, lingual braces), other metal braces, maintainers and others fixed appliances (for tongue thrusting or thumb sucking). The market size includes devices and major brands on sale and is serviceable in the market. Based on removable devices, the market is segmented into aligners, headgear, lip and cheek bumpers, palatal expander, retainers, and splints.

By geography, the market has been segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Detailed analyses of major countries such as the U.S., Germany, the U.K., Italy, France, Spain, Japan, China, India, Brazil, Mexico, GCC countries and South Africa will be covered in the regional segment. For market estimates, data will be provided for 2022 as the base year, with estimates for 2023 and forecast value for 2028.

Report Includes:

- 35 data tables and 25 additional tables

- A discussion of the global market for orthodontic and orthopedic devices

- Analysis of global market trends, featuring historical revenue data for 2020-2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Evaluation of the current market size and revenue growth prospects for orthodontic and orthopedic devices, along with a market share analysis by device type and region

- A discussion of the advantages of orthodontic treatment appliances such as fixed and removable appliances

- Description of gneuromuscular (GNM) orthopedic/orthodontics and a comparison of the advantages and disadvantages of dental surgery

- Insights into the incidence and epidemiology of dental diseases, currently marketed branded drugs, along with a regulatory and pricing analysis of orthodontic and orthopedic devices

- Review of ESG trends and emerging technologies

- Market share analysis of the key companies in the industry and coverage of their M&A activity, joint ventures, collaborations and partnerships, and other corporate market strategies

- Profiles of leading market participants, including Henry Schein Inc., Align Technology, Institut Straumann A, American Orthodontics, and Envista

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market and Technology Background

- New Era of Orthodontic Devices

- Conventional Orthodontics

- Gneuromuscular (GNM) Orthopedics/Orthodontics

- Dental Diseases and Surgery

- Increased Access to Oral Health

- Market Trends for Orthodontic Devices

- Customized and Individualized Smile Design System

- Demand for Copper-Titanium and Nickel Wires

- Usage of New Scanners and Miniscrews

- Demand for Self-Ligating and Invisible Braces

- Increasingly Fast Orthodontic Treatment

Chapter 3 Market Dynamics

- Market Drivers

- Rapid Development and Advancement of Dental Technology

- Rise in Geriatric Population and Related Orthodontic Surgery

- Rise in Demand of Dental Care

- Building Consumer Presence

- Market Restraints

- Common Side Effects of Braces

- Increases in Shipping Costs or Service Issues

- Market Opportunities

- Rise in Demand for Cosmetic Dentistry

- Gaining Popularity for Dental Tourism

Chapter 4 Emerging Technologies and Developments

- Artificial Intelligence

- Mandibular Expansion Devices or Appliances

- Schwartz Appliance

- TORKO Appliance

- Beta-Titanium Auxiliary Expansion Archwire (TMA-EA)

- Bi-Helix Expander

- 3D Printing Designs

- Orthodontic Auxiliaries

- Occlusal Splints

- Emerging Trends in Orthodontic Devices

- 3D Facial Scanners

- Clear Aligner Market Set for Significant Growth

- Navigated Surgery

- Rise in Regenerative Dentistry

Chapter 5 Market Segmentation Analysis

- Segmental Breakdown

- Market Breakdown by Type of Device

- Fixed Devices

- Market Size and Forecast

- Market Analysis

- Braces

- Fixed Retainers and Space Maintainers

- Other Fixed Appliances

- Removable Devices

- Market Size and Forecast

- Market Analysis

- Aligners

- Headgear

- Lip and Cheek Bumpers

- Palatal Expander

- Retainers and Removable Space Maintainers (RSM)

- Splints

- Market Analysis by Region

- Geographic Breakdown

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia and New Zealand

- Rest of Asia-Pacific

- Latin America

- Market Size and Forecast

- Brazil

- Argentina

- Rest of Latin America

- Middle East and Africa

- Market Size and Forecast

- South Africa

- GCC Countries

- Rest of Middle East and Africa

Chapter 6 Competitive Intelligence

- Introduction

- Global Analysis of Company Market Shares

- Factors Affecting Key Players' Market Shares

- Coverage and Reimbursement

- Increasing Customer Experience

- Acquisitions and Collaboration

- Mergers and Acquisitions

- Agreements, Collaborations and Partnerships

Chapter 7 Sustainability

- Importance of ESG in the Orthodontic Manufacturing Industry

- ESG Practices in the Orthodontic Device Manufacturing Industry

- Environmental Performance

- Social Performance

- Governance Performance

- Case Studies

- BCC Research Viewpoint

Chapter 8 Appendix

- Research Methodology

- Acronyms

- References

- Company Profiles

- 3M

- ALIGN TECHNOLOGY INC.

- AMERICAN ORTHODONTICS

- DENTSPLY SIRONA

- ENVISTA

- HENRY SCHEIN ORTHODONTICS

- INSTITUT STRAUMANN AG