|

|

市場調査レポート

商品コード

1341912

糖尿病治療・診断の世界市場Global Markets for Diabetes Therapeutics and Diagnostics |

||||||

|

|||||||

| 糖尿病治療・診断の世界市場 |

|

出版日: 2023年08月31日

発行: BCC Research

ページ情報: 英文 336 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の糖尿病治療・診断の市場規模は、2023年の1,022億米ドルから、予測期間中は5.2%のCAGRで推移し、2028年には1,320億米ドルの規模に成長すると予測されています。

治療薬の部門は2023年の593億米ドルから、4.0%のCAGRで推移し、2028年には722億米ドルの規模に成長すると予測されています。また、糖尿病モニタリング機器および付属品の部門は、2023年の250億米ドルから、6.4%のCAGRで推移し、2028年には341億米ドルの規模に成長すると予測されています。

当レポートでは、世界の糖尿病治療・診断の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術開発の動向、製品パイプライン、市場規模の推移・予測、各種区分・地域別の詳細分析、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 市場概要

- 糖尿病とは

- 糖尿病のタイプ

- 1型糖尿病

- 2型糖尿病

- 妊娠性糖尿病 (GDM) または妊娠中の高血糖

- 耐糖能異常 (IGT) および空腹時血糖異常 (IFG)

- 糖尿病の疫学

- 性別分布

- 地域差

- 成長促進要因・市場の発展

- 市場促進要因

- 市場抑制要因

第4章 世界の糖尿病治療薬市場

- 概要

- 抗糖尿病薬の分類・タイプ

- 糖尿病の注射薬

- 経口抗糖尿病薬 (OAD)

- パテントクリフ

- 糖尿病治療薬の最新の技術の進歩・開発・製品パイプライン

- 現在の製品パイプライン

- 現在研究中の他の潜在治療薬

第5章 世界の糖尿病モニタリング機器および付属品市場

- 概要

- 血糖自己モニタリング (SMBG)

- SMBG市場の構造

- 血糖デバイスにおける最新の技術の進歩と開発

- 持続血糖モニタリング (CGM) システム

- CGMシステムの開発

第6章 世界の糖尿病薬剤送達デバイス市場

- 概要

- インスリン注射器

- インスリン注射器を使用するメリット

- インスリン注射器を使用するデメリット

- インスリン注射器の最新の技術の進歩と開発

- インスリン投与ペン型デバイス

- 使い捨てインスリンペン

- 再利用可能インスリンペン

- インスリン投与ペン型デバイスにおける最新の技術の進歩と開発

- インスリンジェットインジェクター

- インスリンジェットインジェクターを使用するメリット

- インスリンジェット注射器の使用のデメリット

- 外部インスリンポンプ

- インスリンポンプのメリット

- インスリンポンプのデメリット

- インスリンポンプシステムにおける最新の技術の進歩と開発

- 埋め込み型インスリンポンプ

- クローズドループ人工膵臓

- バイオニック膵臓

- 人工膵臓 (生理学的アプローチ)

- インスリン吸入器

- インスリン吸入器のメリット

- インスリン吸入器のデメリット

- インスリン吸入器のタイプ

- インスリンパッチ

- 経口インスリン投与

第7章 世界の糖尿病治療・診断市場:エンドユーザー別

- 概要

- 病院・診療所

- 診断センター

- 在宅ケア組織

第8章 世界の糖尿病治療・診断市場:地域別

- 概要

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋地域

- その他の地域

- 南米

- 中東・アフリカ

第9章 糖尿病治療・診断市場の持続可能性:ESGの観点

- ESGパフォーマンス分析

第10章 新興技術

- 血糖コントロールを超えた患者の転帰

- デジタルヘルスを活用した糖尿病技術

- 経口抗糖尿病薬への傾向が高まる

- 医療のアクセスしやすさと手頃な価格への注目の高まり

- 人工膵臓

第11章 市場におけるM&Aとベンチャー資金調達の見通し

- M&A分析

- Lilly'sによるProtomer Technologiesの買収

第12章 競合情勢

- 主要企業による最近の戦略的取り組み

第13章 企業プロファイル

- 77 ELEKTRONIKA KFT.

- ABBOTT

- ALTUCELL

- ASCENSIA DIABETES CARE HOLDINGS AG.

- ASTRAZENECA

- B. BRAUN SE

- BIOCON

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- DANAHER

- DEXCOM INC.

- EMBECTA CORP.

- INSULET CORPORATION.

- JOHNSON & JOHNSON SERVICES INC.

- LIFESCAN IP HOLDINGS LLC

- LILLY

- MEDTRONIC

- MENARINI GROUP (A. MENARINI DIAGNOSTICS S.R.L)

- MERCK & CO. INC.

- MERCK KGAA

- NEXTCELL PHARMA AB

- NIPRO

- NOVA BIOMEDICAL

- NOVARTIS AG

- NOVO NORDISK A/S

- ROCHE (F. HOFFMANN-LA ROCHE LTD)

- SANOFI

- TAKEDA PHARMACEUTICAL COMPANY LIMITED.

- TANDEM DIABETES CARE INC.

- TERUMO CORPORATION

- YPSOMED AG

第14章 付録

- 政府規制機関および専門組織

List of Tables

- Summary Table : Global Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 1 : Key Facts and Latest Data for Diabetes Globally, 2021 and 2045

- Table 2 : Global Diabetes Estimates and Projections, 2019-2045

- Table 3 : Global Prevalence of Diabetes, by Type, Through 2040

- Table 4 : Global Diabetes Cases, by Country, 2000-2045

- Table 5 : Age-Adjusted Comparative Prevalence of Diabetes, by Region, 2010-2040

- Table 6 : First-Time Generic Drug Approvals for Type 2 Diabetes, October 2022-2021

- Table 7 : Global Revenues of Leading Antidiabetic Pharmaceutical Companies, 2022

- Table 8 : Comparison of Insulin Action of Leading Insulin Products

- Table 9 : Comparison of GLP-1 Analogs

- Table 10 : U.S. Patent Expiry Dates for the World's Top Selling Diabetes Drugs

- Table 11 : Novo Nordisk's Current R&D Pipeline

- Table 12 : Lilly's Current R&D Pipeline

- Table 13 : AstraZeneca's Current R&D Pipeline

- Table 14 : Terminology Used to Describe Generic Biopharmaceuticals, by Country/Region

- Table 15 : Global Market for Diabetes Therapeutics, by Region, Through 2028

- Table 16 : Global Market for Diabetes Therapeutics, by Type, Through 2028

- Table 17 : Global Market for Injectable Diabetes Therapies, by Region, Through 2028

- Table 18 : Global Market for Oral Antidiabetic Drugs, by Region, Through 2028

- Table 19 : Global Market for Injectable Diabetes Therapies, by Type, Through 2028

- Table 20 : Global Market for Diabetic GLP-1 Therapy, by Region, Through 2028

- Table 21 : Global Market for Insulin Therapy, by Region, Through 2028

- Table 22 : Leading Blood Glucose Manufacturers and Blood Glucose Products

- Table 23 : Leading Lancet and Lancet Device Manufacturers and Products

- Table 24 : Comparison of Abbott Freestyle Blood Glucose Monitoring System Readers

- Table 25 : Global Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 26 : Global Market for Diabetes Monitoring Devices and Accessories, by Region, Through 2028

- Table 27 : Global Market for Blood Glucose Test Strips, by Region, Through 2028

- Table 28 : Globa Market for Blood Glucose Meters, by Region, Through 2028

- Table 29 : Global Market for Lancets and Lancet Devices, by Region, Through 2028

- Table 30 : Global Market for Continuous Glucose Monitoring Systems, by Region, Through 2028

- Table 31 : Leading Insulin Syringes Manufacturers and Insulin Syringe Products

- Table 32 : Commercially Available Insulin Injector Pens

- Table 33 : Leading Insulin Jet Injectors Manufacturers and Products

- Table 34 : Leading External Insulin Pump Manufacturers and Products

- Table 35 : Key Features of Current Leading Insulin Pump Systems

- Table 36 : Global Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 37 : Global Market for Diabetes Delivery Devices, by Region, Through 2028

- Table 38 : Global Market for Insulin Syringes, by Region, Through 2028

- Table 39 : Global Market for Insulin Pens and Needles (Reusable and Disposable), by Region, Through 2028

- Table 40 : Global Market for Insulin Jet Injectors, by Region, Through 2028

- Table 41 : Global Market for External Insulin Pumps, by Region, Through 2028

- Table 42 : Global Market for Implantable Insulin Pumps, by Region, Through 2028

- Table 43 : Global Market for Insulin Inhalers, by Region, Through 2028

- Table 44 : Global Market for Insulin Patches, by Region, Through 2028

- Table 45 : Global Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 46 : Global Market for Diabetes Therapeutic and Diagnostics in Hospitals and Clinics, by Region, Through 2028

- Table 47 : Global Market for Diabetes Therapeutic and Diagnostics in Diagnostic Centers, by Region, Through 2028

- Table 48 : Global Market for Diabetes Therapeutics and Diagnostics in Home Care Organizations, by Region, Through 2028

- Table 49 : Global Market for Diabetes Therapeutics and Diagnostics, by Region, Through 2028

- Table 50 : North American Market for Diabetes Therapeutics and Diagnostics, by Country, Through 2028

- Table 51 : North American Market for Diabetes Therapeutics and Diagnostics, by Segment Type, Through 2028

- Table 52 : North American Market for Diabetes Therapeutics, by Type, Through 2028

- Table 53 : North American Market for Injectable Therapies, by Type, Through 2028

- Table 54 : North American Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 55 : North American Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 56 : North American Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 57 : U.S. Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 58 : U.S. Market for Diabetes Therapeutics, by Type, Through 2028

- Table 59 : U.S. Market for Injectable Therapeutics, by Type, Through 2028

- Table 60 : U.S. Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 61 : U.S. Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 62 : U.S. Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 63 : Canadian Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 64 : Canadian Market for Diabetes Therapeutics, by Type, Through 2028

- Table 65 : Canadian Market for Injectable Therapeutics, by Type, Through 2028

- Table 66 : Canadian Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 67 : Canadian Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 68 : Canadian Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 69 : European Market for Diabetes Therapeutics and Diagnostics, by Country, Through 2028

- Table 70 : European Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 71 : European Market for Diabetes Therapeutics, by Type, Through 2028

- Table 72 : European Market for Injectable Therapeutics, by Type, Through 2028

- Table 73 : European Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 74 : European Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 75 : European Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 76 : German Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 77 : German Market for Diabetes Therapeutics, by Type, Through 2028

- Table 78 : German Market for Injectable Therapeutics, by Type, Through 2028

- Table 79 : German Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 80 : German Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 81 : German Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 82 : U.K. Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 83 : U.K. Market for Diabetes Therapeutics, by Type, Through 2028

- Table 84 : U.K. Market for Injectable Therapeutics, by Type, Through 2028

- Table 85 : U.K. Market for Diabetes Monitoring Device and Accessories, by Type, Through 2028

- Table 86 : U.K. Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 87 : UK Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 88 : French Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 89 : French Market for Diabetes Therapeutics, by Type, Through 2028

- Table 90 : French Market for Injectable Therapeutics, by Type, Through 2028

- Table 91 : French Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 92 : French Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 93 : French Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 94 : Spanish Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 95 : Spanish Market for Diabetes Therapeutics, by Type, Through 2028

- Table 96 : Spanish Market for Injectable Therapeutics, by Type, Through 2028

- Table 97 : Spanish Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 98 : Spanish Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 99 : Spanish Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 100 : Italian Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 101 : Italian Market for Diabetes Therapeutics, by Type, Through 2028

- Table 102 : Italian Market for Injectable Therapeutics, by Type, Through 2028

- Table 103 : Italian Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 104 : Italian Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 105 : Italian Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 106 : Rest of European Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 107 : Rest of European Market for Diabetes Therapeutics, by Type, Through 2028

- Table 108 : Rest of European Market for Injectable Therapeutics, by Type, Through 2028

- Table 109 : Rest of European Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 110 : Rest of European Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 111 : Rest of European Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 112 : Asia-Pacific Market for Diabetes Therapeutics and Diagnostics, by Country, Through 2028

- Table 113 : Asia-Pacific Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 114 : Asia-Pacific Market for Diabetes Therapeutics, by Type, Through 2028

- Table 115 : Asia-Pacific Market for Injectable Therapeutics, by Type, Through 2028

- Table 116 : Asia-Pacific Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 117 : Asia-Pacific Market for Diabetes Delivery Devices, by Type, Through 2028

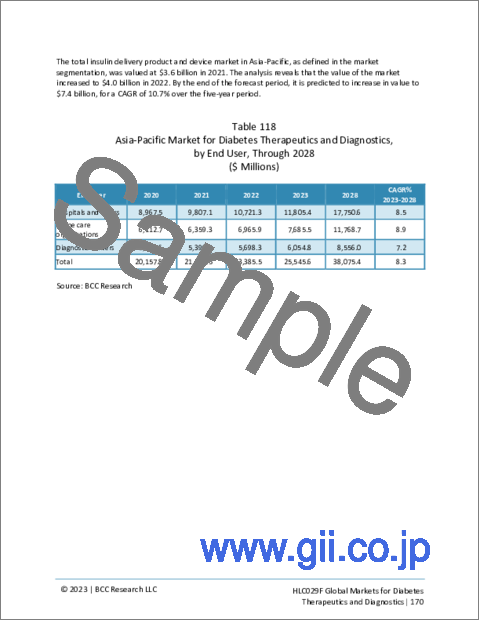

- Table 118 : Asia-Pacific Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 119 : Major Chinese Pharmaceutical Companies Developing Antidiabetic Medicines, by Type

- Table 120 : Chinese Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 121 : Chinese Market for Diabetes Therapeutics, by Type, Through 2028

- Table 122 : Chinese Market for Injectable Therapeutics, by Type, Through 2028

- Table 123 : Chinese Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 124 : Chinese Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 125 : Chinese Market for Diabetes Therapeutics and Diagnostics, by End User,

- Table 126 : Indian Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 127 : Indian Market for Diabetes Therapeutics, by Type, Through 2028

- Table 128 : Indian Market for Injectable Therapeutics, by Type, Through 2028

- Table 129 : Indian Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 130 : Indian Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 131 : Indian Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 132 : Japanese Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 133 : Japanese Market for Diabetes Therapeutics, by Type, Through 2028

- Table 134 : Japanese Market for Injectable Therapeutics, by Type, Through 2028

- Table 135 : Japanese Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 136 : Japanese Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 137 : Japanese Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 138 : Australian Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 139 : Australian Market for Diabetes Therapeutics, by Type, Through 2028

- Table 140 : Australian Market for Injectable Therapeutics, by Type, Through 2028

- Table 141 : Australian Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 142 : Australian Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 143 : Australian Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 144 : Rest of Asia-Pacific Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 145 : Rest of Asia-Pacific Market for Diabetes Therapeutics, by Type, Through 2028

- Table 146 : Rest of Asia-Pacific Market for Injectable Therapeutics, by Type, Through 2028

- Table 147 : Rest of Asia-Pacific Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 148 : Rest of Asia-Pacific Market for Diabetes Delivery Devices, by Region, Through 2028

- Table 149 : Rest of Asia-Pacific Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 150 : Rest of the World Market for Diabetes Therapeutics and Diagnostics, by Segment, Through 2028

- Table 151 : Rest of the World Market for Diabetes Therapeutics, by Type, Through 2028

- Table 152 : Rest of the World Market for Injectable Therapeutics, by Type, Through 2028

- Table 153 : Rest of the World Market for Diabetes Monitoring Devices and Accessories, by Type, Through 2028

- Table 154 : Rest of the World Market for Diabetes Delivery Devices, by Type, Through 2028

- Table 155 : Rest of the World Market for Diabetes Therapeutics and Diagnostics, by End User, Through 2028

- Table 156 : ESG Performance Analysis of the Market for Diabetes Therapeutics and Diagnostics

- Table 157 : Social Performance of the Market for Diabetes Therapeutics and Diagnostics

- Table 158 : Governance Performance of the Market for Diabetes Therapeutics and Diagnostics

- Table 159 : Selected Artificial Pancreas in Clinical Trials, as of 2023

- Table 160 : Mergers and Acquisitions in the Global Market for Diabetes Therapeutics and Diagnostics, January 2018 to June 2023

- Table 161 : Top 10 Deals in the Market for Diabetes Therapeutics and Diagnostics, by Size, January 2018 to June 2023

- Table 162 : Top 10 Deals in the Market for Diabetes Therapeutics and Diagnostics, by Status, January 2018 to June 2023

- Table 163 : Global Market Share Analysis for Diabetes Therapeutics and Diagnostics, 2022

- Table 164 : Global Market Share Analysis for Diabetes Therapeutics, 2022

- Table 165 : Global Market Share Analysis for Diabetes Monitoring Devices and Accessories, 2022

- Table 166 : Global Market Share Analysis for Diabetes Delivery Devices, 2022

- Table 167 : Global Diabetes Diagnostics and Delivery Devices Market: Key Product Portfolio

- Table 168 : Abbott: Financials, 2016-2022

- Table 169 : Abbott: Product Portfolio, by Business Segment

- Table 170 : Abbott: Recent Developments, 2023

- Table 171 : AstraZeneca: Product Portfolio for Type 2 Diabetes Treatment

- Table 172 : AstraZeneca: Financial Performance, 2018-2022

- Table 173 : AstraZeneca: Selected Key Developments, 2023

- Table 174 : Braun: Products

- Table 175 : Braun: Financials, 2021

- Table 176 : Biocon: Product Portfolio for Type 2 Diabetes Treatment

- Table 177 : Biocon: Selected Key Developments, 2022

- Table 178 : Boehringer Ingelheim: Products Portfolio for Type 2 Diabetes Treatment

- Table 179 : Boehringer Ingelheim: Selected Key Developments, 2023

- Table 180 : Danaher Corp.: Product Portfolio

- Table 181 : Danaher Corp.: Financials, 2021

- Table 182 : Danaher Corp.: Products and Services

- Table 183 : Danaher Corp.: Recent Developments, 2023

- Table 184 : Dexcom: Financials, 2021 and 2022

- Table 185 : Insulet Corp.: Revenue, by Segment, 2020-2022

- Table 186 : Johnson & Johnson: Product Portfolio for Type 2 Diabetes Treatment

- Table 187 : Johnson & Johnson: Financials, 2021

- Table 188 : Johnson & Johnson: Product Portfolio

- Table 189 : Johnson & Johnson: Recent Developments and Strategies, 2017-2022

- Table 190 : Lilly: Product Portfolio for Type 2 Diabetes Treatment

- Table 191 : Lilly: Business Segments

- Table 192 : Lilly: Financial Performance, 2018-2021

- Table 193 : Lilly: Key Developments, 2023

- Table 194 : Medtronic: Financials, 2016-2022

- Table 195 : Medtronic: Product Portfolio

- Table 196 : Medtronic: Patient Monitoring Device Product Portfolio

- Table 197 : Medtronic: Recent Developments, 2015-2022

- Table 198 : Menarini Group: Key Financials, 2021

- Table 199 : Merck & Co. Inc.: Product Portfolio for Type 2 Diabetes Treatment

- Table 200 : Merck & Co. Inc.: Financial Performance, 2018-2022

- Table 201 : Merck KGaA: Key Financials, 2021

- Table 202 : Nipro Group: Financials, 2021

- Table 203 : Nipro Group: Product Portfolio, by Business Segment

- Table 204 : Nipro: Recent Developments, 2020

- Table 205 : Novartis: Product Portfolio for Type 2 Diabetes Treatment

- Table 206 : Novartis: Key Financials, 2021

- Table 207 : Novartis Key Developments, 2022

- Table 208 : Novo Nordisk: Product Portfolio for Type 2 Diabetes Treatment

- Table 209 : Novo Nordisk: Key Financials, 2021

- Table 210 : Novo Nordisk: Selected Key Developments, 2023

- Table 211 : Roche: Financials, 2021

- Table 212 : Roche: Revenue, by Business Segment, 2016-2021

- Table 213 : Roche: Revenue, by Diagnostic Segment, 2016-2021

- Table 214 : Roche: Product Portfolio

- Table 215 : Roche: Diagnostics Patient Monitoring Product Portfolio

- Table 216 : Roche: Recent Developments, 2023

- Table 217 : Sanofi: Product Portfolio for Type 2 Diabetes Treatment

- Table 218 : Sanofi: Business Segment

- Table 219 : Sanofi: Financial Performance, 2021 and 2022

- Table 220 : Sanofi: Key Developments, 2023

- Table 221 : Takeda: Key Financials, 2021

- Table 222 : Terumo Corp.: Financials, 2021

- Table 223 : Terumo Corp.: Recent Developments, 2020

- Table 224 : Government Regulatory Agencies and Professional Organizations

List of Figures

- Summary Figure : Global Market for Diabetes Therapeutics and Diagnostics, by Segment, 2020-2028

- Figure 1 : Global Diabetes Incidence

- Figure 2 : Classification of Injectable Therapies for Diabetes

- Figure 3 : Classification of Oral Antidiabetic Drugs (OADs)

- Figure 4 : Global Initiatives Pertaining to Type 2 Diabetes

- Figure 5 : Type 2 Diabetes Agents in Clinical Development

- Figure 6 : Clinical Development Pipeline for Hanmi Pharma Co. Ltd.

- Figure 7 : Administration Route for Insulin Delivery

- Figure 8 : Schematic of a Closed-Loop Artificial Pancreas System

- Figure 9 : Schematic of the Edmonton Protocol

- Figure 10 : Product Pipeline Portfolio of Diabetology Ltd.

- Figure 11 : Global Market for Diabetes Therapeutics and Diagnostics, by Region

- Figure 12 : Global Market Shares of Diabetes Therapeutic and Diagnostics, by Region, 2022

- Figure 13 : Key Components of the German Statutory Health Insurance System, 2019

- Figure 14 : Risk of Developing Diabetes-Related Comorbidities

- Figure 15 : Global Market for Diabetes Therapeutics and Diagnostics Deal Activity, by Type, January 2018 to June 2023

- Figure 16 : Global Market for Diabetes Therapeutics and Diagnostics Deal Activity, by Top 10 Industries, January 2018 to June 2023

- Figure 17 : Global Market Share Analysis for Diabetes Therapeutics and Diagnostics, 2022

- Figure 18 : Global Market Share Analysis for Diabetes Therapeutics, 2022

- Figure 19 : Global Market Share Analysis for Diabetes Monitoring Devices and Accessories, 2022

- Figure 20 : Global Market Share Analysis for Diabetes Delivery Devices, 2022

- Figure 21 : Abbott: Revenue Share, by Country/Region, 2021 and 2022

- Figure 22 : Abbott: Revenue Share, by Business Segment, 2021 and 2022

- Figure 23 : Abbott: R&D Expenditures, 2015-2022

- Figure 24 : AstraZeneca: Sales Share, by Segment, 2022

- Figure 25 : AstraZeneca: Revenue Share, by Region, 2022

- Figure 26 : Braun: Revenue, 2015-2021

- Figure 27 : Braun: Revenue Share, by Country/Region, 2021

- Figure 28 : Braun: Revenue Share, by Segment, 2021

- Figure 29 : Boehringer Ingelheim: Annual Revenue, 2021 and 2022

- Figure 30 : Boehringer Ingelheim: Revenue Share, by Business Segment, 2021 and 2022

- Figure 31 : Boehringer Ingelheim: Revenue Share, by Region, 2021 and 2022

- Figure 32 : Danaher Corp.: Revenue Share, by Segment, 2021

- Figure 33 : Danaher Corp.: Revenue Share, by Country/Region, 2021

- Figure 34 : Dexcom Inc.: Annual Revenue, 2019-2021

- Figure 35 : Dexcom: Revenue Share, by Region, 2022

- Figure 36 : Dexcom: Revenue Share, by Sales Channel, 2022

- Figure 37 : Johnson & Johnson: Financials, 2017-2021

- Figure 38 : Johnson & Johnson: Revenue Share, by Country/Region, 2021

- Figure 39 : Johnson & Johnson: Revenue Share, by Segment, 2021

- Figure 40 : Lilly: Total Sales Share, by Product Segment, 2020

- Figure 41 : Lilly: Revenue Share, by Product, 2020

- Figure 42 : Medtronic: Financials, 2015-2022

- Figure 43 : Medtronic: Revenue Share, by Country/Region, 2022

- Figure 44 : Medtronic: Revenue Share, by Key Disease Segment, 2022

- Figure 45 : Menarini Group: Revenue Share, by Business Segment, 2021

- Figure 46 : Menarini Group: Total Revenue Share, by Region, 2021

- Figure 47 : Merck & Co. Inc.: Revenue Share, by Business Segment, 2022

- Figure 48 : Merck & Co. Inc.: Revenue Share, by Region, 2022

- Figure 49 : Merck KGaA: Revenue Share, by Business Segment, 2021

- Figure 50 : Merck KGaA: Total Revenue Share, by Region, 2021

- Figure 51 : Nipro Group: Revenue Share, by Country/Region, 2021

- Figure 52 : Nipro Group: Revenue Share, by Business Segment, 2021

- Figure 53 : Novartis: Revenue Share, by Business Segment, 2021

- Figure 54 : Novartis: Total Revenue Share, by Region, 2021

- Figure 55 : Novo Nordisk: Revenue Share, by Region, 2021

- Figure 56 : Novo Nordisk: Revenue Share, by Business Segment, 2021

- Figure 57 : Roche: Revenue Share, by Business Segment, 2021

- Figure 58 : Roche: Revenue Share, by Country/Region, 2021

- Figure 59 : Sanofi: Net Sales Share, by Business Segment, 2022

- Figure 60 : Sanofi: Net Sales Share, by Region, 2022

- Figure 61 : Takeda: Revenue Share, by Business Segment, 2021

- Figure 62 : Takeda Pharmaceutical: Total Revenue Share, by Region, 2021

- Figure 63 : Terumo Corp.: Revenue Share, by Segment, 2021

- Figure 64 : Terumo Corp.: Revenue Share, by Country/Region, 2021

Highlights:

The global market for diabetes therapeutics and diagnostics is estimated to increase from $102.2 billion in 2023 to reach $132.0 billion by 2028, at a compound annual growth rate (CAGR) of 5.2% from 2023 through 2028.

The global market for diabetes therapeutics is estimated to increase from $59.3 billion in 2023 to reach $72.2 billion by 2028, at a compound annual growth rate (CAGR) of 4.0% from 2023 through 2028.

The global market for diabetes monitoring devices and accessories is estimated to increase from $25.0 billion in 2023 to reach $34.1 billion by 2028, at a compound annual growth rate (CAGR) of 6.4% from 2023 through 2028.

Report Scope:

This report discusses the implications of the trends mentioned above in the context of the current size and growth of the diabetes market, in global terms and by the most important national markets. Companies in the relevant pharmaceutical and medical industries are discussed, with profiles of the leaders and an update on M&A activity. Five-year global sales forecasts are provided for the leading drug and device categories, and there are country-level breakdowns of the diabetes market.

Major players, competitive intelligence, innovative technologies, market dynamics and regional opportunities are discussed in detail. The report examines recent developments and product portfolios of major players. The patent analysis focuses on technological trends in recent years in regions such as the U.S., Europe, and Japan. The report presents a market analysis and estimates the compound annual growth rate (CAGR) for the diabetes therapeutics and diagnostics market.

This report segments the global market by these geographic regions: North America, Europe, Asia-Pacific and the Rest of the World. For market estimates, data is provided for 2022 as the base year, 2023 and forecast through year-end 2028.

Report Includes:

- 162 data tables and 63 additional tables

- An up-to-date overview and analysis of the global markets for diabetes therapeutics and diagnostics

- Analyses of the global market trends, with market revenue (sales figures) for 2020-2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Understanding of the upcoming market potential for AI in diabetic mellitus management with an emphasis on new products and solutions/platform technologies, and areas of focus to forecast this market into various segments and sub-segments

- Estimation of the actual market size and revenue forecast for the global diabetes therapeutics and diagnostics market, and corresponding market share analysis based on product type, end user, and geographical region

- In-depth information (facts and figures) on major market dynamics, opportunities and gaps estimating the demand, technology adaptations in diabetes care, industry developments, regulatory dynamics, and the COVID-19 impact on the progress of this market

- Identification of the companies best positioned to meet this demand owing to or in conjunction with their proprietary technologies, product launches, and other strategic advantages

- Review of key patent grants and patent applications on diabetes therapeutics and diagnostics, and emerging technologies and new developments in this market

- Analysis of the company competitive landscape based on their recent developments, financial performance, segmental revenues, and operational integration

- Company profiles of the leading global players, including Novo Nordisk, Sanofi S.A., Lilly, Takeda, Danaher Corp., and AstraZeneca

Table of Contents

Chapter 1 Introduction

- Diabetes

- Type 1 Diabetes

- Type 2 Diabetes

- Study Goals and Objectives

- Reasons for Doing This Study

- What's New in This Report

- Scope of Report

- Information Sources

- Methodology

- Secondary Research

- Primary Interviews

- Geographic Breakdown

Chapter 2 Summary and Highlights

- Market Overview

- Significant Developments and Trends

Chapter 3 Market Overview

- What is Diabetes?

- Types of Diabetes

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes Mellitus (GDM) or Hyperglycemia in Pregnancy

- Impaired Glucose Tolerance (IGT) and Impaired Fasting Glucose (IFG)

- Epidemiology of Diabetes

- Gender Distribution

- Regional Disparities

- Market Factors Driving the Growth and Development of the Market

- Market Drivers

- Market Restraints

Chapter 4 Global Market for Diabetes Therapeutics

- Overview

- Classification and Types of Antidiabetic Medications

- Injectable Therapies for Diabetes

- Oral Antidiabetic Drugs (OADs)

- Facing the Patent Cliff

- Latest Technological Advances, Developments and Product Pipelines for Diabetic Medications

- Current Product Pipeline

- Other Potential Therapies Currently Under Investigation

Chapter 5 Global Market for Diabetes Monitoring Devices and Accessories

- Overview

- Self-Monitoring of Blood Glucose (SMBG)

- SMBG Market Structure

- Latest Technological Advances and Developments in Blood Glucose Devices

- Continuous Glucose Monitoring (CGM) Systems

- Development of CGM Systems

Chapter 6 Global Market for Diabetes Delivery Devices by Type

- Overview

- Insulin Syringes

- Advantages of Using Insulin Syringes

- Disadvantages of Using Insulin Syringes

- Latest Technological Advances and Developments in Insulin Syringes

- Insulin Delivery Pen Devices

- Disposable Insulin Pens

- Reusable Insulin Pens

- Latest Technological Advances and Developments in Insulin Delivery Pen Devices

- Insulin Jet Injectors

- Advantages of Using Insulin Jet Injectors

- Disadvantages of Using Insulin Jet Injectors

- External Insulin Pumps

- Advantages of Insulin Pumps

- Disadvantages of Insulin Pumps

- Latest Technological Advances and Developments in Insulin Pump Systems

- Implantable Insulin Pumps

- Closed-Loop Artificial Pancreas

- Bionic Pancreas

- Artificial Pancreas (the Physiological Approach)

- Insulin Inhalers

- Advantages of Insulin Inhalers

- Disadvantages of Insulin Inhalers

- Types of Insulin Inhalers

- Insulin Patches

- Oral Insulin Delivery

Chapter 7 Global Market for Diabetes Therapeutics and Diagnostics by End User

- Overview

- Hospitals and Clinics

- Diagnostic Centers

- Home Care Organizations

Chapter 8 Global Market for Diabetes Therapeutics and Diagnostics by Region

- Overview

- North America

- United States

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Rest of the World

- South America

- Middle East and Africa

Chapter 9 Sustainability in the Market for Diabetes Therapeutics and Diagnostics: An ESG Perspective

- Introduction

- Market for Diabetes Therapeutics and Diagnostics: ESG Performance Analysis

Chapter 10 Emerging Technologies

- Patient Outcomes Beyond Glucose Control

- Diabetes Technology with Digital Health

- Growing Trend Toward Oral Antidiabetics

- Growing Focus on Accessibility and Affordability of Medicine

- Artificial Pancreas

Chapter 11 M&As and Venture Funding Outlook in the Market

- M&A Analysis

- Lilly's Acquisition of Protomer Technologies

Chapter 12 Competitive Landscape

- Recent Strategic Initiatives, By Major Players in The Market

Chapter 13 Company Profiles

- 77 ELEKTRONIKA KFT.

- ABBOTT

- ALTUCELL

- ASCENSIA DIABETES CARE HOLDINGS AG.

- ASTRAZENECA

- B. BRAUN SE

- BIOCON

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- DANAHER

- DEXCOM INC.

- EMBECTA CORP.

- INSULET CORPORATION.

- JOHNSON & JOHNSON SERVICES INC.

- LIFESCAN IP HOLDINGS LLC

- LILLY

- MEDTRONIC

- MENARINI GROUP (A. MENARINI DIAGNOSTICS S.R.L)

- MERCK & CO. INC.

- MERCK KGAA

- NEXTCELL PHARMA AB

- NIPRO

- NOVA BIOMEDICAL

- NOVARTIS AG

- NOVO NORDISK A/S

- ROCHE (F. HOFFMANN-LA ROCHE LTD)

- SANOFI

- TAKEDA PHARMACEUTICAL COMPANY LIMITED.

- TANDEM DIABETES CARE INC.

- TERUMO CORPORATION

- YPSOMED AG

Chapter 14 Appendix

- Government Regulatory Agencies and Professional Organizations