|

|

市場調査レポート

商品コード

1308029

水素エンジンの世界市場Hydrogen Engine: Global Markets |

||||||

|

|||||||

| 水素エンジンの世界市場 |

|

出版日: 2023年07月12日

発行: BCC Research

ページ情報: 英文 201 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の水素エンジンの市場規模は、2022年の26億米ドル、2023年の32億米ドルから、予測期間中は26.8%のCAGRで推移し、2028年には105億米ドルの規模に成長すると予測されています。

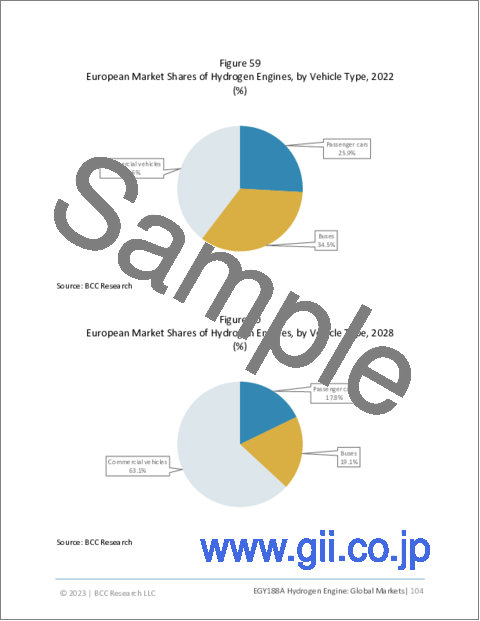

アジア太平洋地域は、2022年の15億米ドル、2023年の20億米ドルから、31.4%のCAGRで推移し、2028年には77億米ドルの規模に成長すると予測されています。また、欧州地域は、2022年の2億4,950万米ドル、2023年の2億9,910万米ドルから、23.1%のCAGRで推移し、2028年には8億4,660万米ドルの規模に成長すると予測されています。

当レポートでは、世界の水素エンジンの市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、新興技術と開発の動向、競合情勢、主要企業のプロファイルなどをまとめています。

レポートに含まれる内容:

- 世界の水素燃焼エンジン技術市場の概要

- 市場収益データの推計・予測・CAGR・市場動向

- 水素燃焼エンジン技術市場に直接影響を与える規制環境、人口統計、その他の要因の評価

- 現在の市場規模・市場成長と水素燃焼エンジン技術の影響

- 業界の主要な買収と戦略的提携の評価、主要サプライヤーの市場シェア分析

- 主要企業プロファイル:Cummins Inc., Honda Motor Co. Ltd., Hyundai Motor Co., Tata Motors Ltd., Hyzon Motors, and Nikola Corp.

Table of Contents

Chapter 1 Introduction

- Introduction

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- Information Sources

- Research Methodology

- Geographic Breakdown

- Analyst's Credentials

- BCC Custom Research

- Related BCC Research Reports

Chapter 2 Summary and Highlights

- Market Summary

Chapter 3 Market Overview

- Current Market Overview

- Brief History of Fuel Cell Vehicles

- Technology Roadmap for Hydrogen Fuel Cell Vehicles

- CO2 Emission in the Transportation Industry

- Advantages and Disadvantages of Hydrogen-powered Vehicles

- Cost Analysis of Fuel Cells for the Transportation Industry

- Incentives to Purchase Fuel Cell Electric Vehicles

- Value Chain Analysis

- Porter's Five Force Model

- Supplier Power

- Buyer Power

- Threat of New Entrants

- Threat of Substitute

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factors

- Sociocultural Factors

- Technological Factors

- Environmental Factors

- Legal Factors

- Impact of COVID-19 on the Market for Hydrogen Engines

- Impact of Russia-Ukraine War on the Global Hydrogen Engine Industry

- Industry Expert Insights

Chapter 4 Market Dynamics

- Introduction

- Market Dynamics

- Market Restraints

- Challenges

- Market Opportunities

- Market Dynamics Impact Analysis

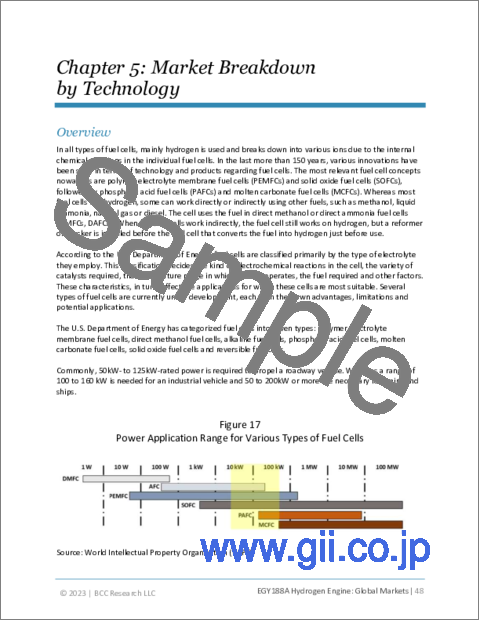

Chapter 5 Market Breakdown by Technology

- Overview

- Proton Membrane Exchange

- Components of a Fuel Cell

- Fuel Cell Stack

- Fuel Processor

- Power Conditioners

- Air Compressors

- Humidifiers

- Components of PEM Fuel Cell

- Membrane Electrode Assembly

- Hardware

- Hydrogen Production Methods

- Types of Fuel Cells

- Phosphoric Acid Fuel Cell and Others

- Direct Methanol Fuel Cells (DMFC)

- Alkaline Fuel Cells (AFC)

- Molten Carbonate Fuel Cells (MCFC)

- Solid Oxide Fuel Cells (SOFC)

- Reversible Fuel Cells

Chapter 6 Market Breakdown by Sales Channel

- Overview

- OEMs

- Retrofitting/Conversion

Chapter 7 Market Breakdown by Vehicle Type

- Overview

- Global Market based on Vehicle Type

- Passenger Cars

- Buses

- Commercial Vehicles

- Additional Applications of Hydrogen Fuel Cells in the Transportation Industry

Chapter 8 Market Breakdown by Region

- Overview

- North America

- Europe

- Asia-Pacific

- Rest of World

Chapter 9 Emerging Technologies and Developments

- Overview

- Hydrogen-powered Technology Assessment

- Trends

Chapter 10 Patent Analysis

- Overview

- Recent Key Granted Patents

Chapter 11 M&A and Funding Outlook

- M&A Analysis

- Startups Funding in Hydrogen Engine

Chapter 12 Competitive Landscape

- Overview

- Market Share Analysis

- Strategy Analysis

- SWOT Analysis in Brief for the Global Market

- Key Developments

Chapter 13 Company Profiles

- Introduction

- CUMMINS INC.

- DAIMLER TRUCK AG

- GENERAL MOTORS

- HONDA MOTOR CO. LTD.

- HYUNDAI MOTOR CO.

- HYZON MOTORS

- MAN ENERGY SOLUTIONS SE

- NIKOLA CORP.

- TATA MOTORS LTD.

- TOYOTA MOTOR CORPORATION

- Other Players (Hydrogen-based Engines/Products Providers)

- Fuel Cell Electric Vehicle (FCEV) Models

Chapter 14 Appendix: Acronyms

List of Tables

- Summary Table : Global Market for Hydrogen Engines, by Region, Through 2028

- Table 1 : Incentives to Purchase Fuel Cell Electric Vehicles, by Country

- Table 2 : Top Platinum Production Countries, by Platinum Volume, 2022

- Table 3 : Phasing Out Plans for ICE (Internal Combustion Engine) Vehicles, by Country

- Table 4 : Market Dynamics: Impact Analysis

- Table 5 : Global Market for Hydrogen Engines, by Technology, Through 2028

- Table 6 : Global Market for Proton Membrane Exchange Fuel Cells, by Region, Through 2028

- Table 7 : Types of Fuel Cells and Their Properties

- Table 8 : Types of Fuel Cells and Their Applications, Advantages and Challenges

- Table 9 : Global Market for Phosphoric Acid Fuel Cells and Others, by Region, Through 2028

- Table 10 : Global Market for Hydrogen Engines, by Sales Channel, Through 2028

- Table 11 : Global Market for OEM Hydrogen Engines, by Region, Through 2028

- Table 12 : Global Market for Retrofitting/Conversion of Hydrogen Engines, by Region, Through 2028

- Table 13 : Fuel Cell Roadway Vehicle Type, by Weight

- Table 14 : Global Market for Hydrogen Engines, by Vehicle Type, Through 2028

- Table 15 : Global Market for Hydrogen Engine in Passenger Cars, by Region, Through 2028

- Table 16 : Global Market for Hydrogen Engines in Buses, by Region, Through 2028

- Table 17 : Global Market for Hydrogen Engines in Commercial Vehicles, by Region, Through 2028

- Table 18 : Global Market for Hydrogen Engines, by Region, Through 2028

- Table 19 : North American Market for Hydrogen Engines, by Country, Through 2028

- Table 20 : North American Market for Hydrogen Engines, by Technology, Through 2028

- Table 21 : North American Market for Hydrogen Engines, by Sales Channel, Through 2028

- Table 22 : North American Market for Hydrogen Engines, by Vehicle Type, Through 2028

- Table 23 : Fuel Cell Vehicle Deployment Targets in the U.S.

- Table 24 : European Market for Hydrogen Engines, by Country, Through 2028

- Table 25 : European Market for Hydrogen Engines, by Technology, Through 2028

- Table 26 : European Market for Hydrogen Engines, by Sales Channel, Through 2028

- Table 27 : European Market for Hydrogen Engines, by Vehicle Type, Through 2028

- Table 28 : Fuel Cell Vehicle Deployment Targets in the Netherlands

- Table 29 : Fuel Cell Vehicle Deployment Targets in France

- Table 30 : Fuel Cell Vehicle Deployment Targets in Switzerland

- Table 31 : Fuel Cell Vehicle Deployment Targets in Norway

- Table 32 : Fuel Cell Vehicle Deployment Targets in Italy

- Table 33 : Fuel Cell Vehicle Deployment Targets in Spain

- Table 34 : Asia-Pacific Market for Hydrogen Engines, by Country, Through 2028

- Table 35 : Asia-Pacific Market for Hydrogen Engines, by Technology, Through 2028

- Table 36 : Asia-Pacific Market for Hydrogen Engines, by Sales Channel, Through 2028

- Table 37 : Asia-Pacific Market for Hydrogen Engines, by Vehicle Type, Through 2028

- Table 38 : Fuel Cell Vehicle Deployment Scenario in Japan, by Vehicle Type

- Table 39 : Fuel Cell Vehicle Deployment Targets in South Korea

- Table 40 : Rest of World Market for Hydrogen Engines, by Region, Through 2028

- Table 41 : Rest of World Market for Hydrogen Engines, by Technology, Through 2028

- Table 42 : Rest of World Market for Hydrogen Engines, by Sales Channel, Through 2028

- Table 43 : Rest of World Market for Hydrogen Engines, by Vehicle Type, Through 2028

- Table 44 : Comparison among Conventional Vehicles, Electric Vehicles and Fuel Cell Vehicles

- Table 45 : Key Patents Published on Hydrogen Engines, by Applicant Company, 2022 to till May 2023

- Table 46 : Active Patents in the Transportation, by Top 20 Fuel Cell Companies, 2000-2021

- Table 47 : Startup Funding in Hydrogen Engines, January 2022-March 2023

- Table 48 : Product Launches, by Key Players, May 2021 to November 2022

- Table 49 : Acquisitions, by Key Players, June 2022 to December 2022

- Table 50 : Collaboration, by Key Players, June 2021 to March 2023

- Table 51 : Expansion, by Key Players, January 2021 to April 2023

- Table 52 : Partnerships/Agreements, by Key Players, April 2021 to May 2023

- Table 53 : Honda Motor Co. Ltd..: Product Offering

- Table 54 : Honda Motor Co. Ltd.: Revenue and YOY, 2020-2022

- Table 55 : Hyundai Motor Co.: Product Offering

- Table 56 : Hyzon Motors: Product Offering

- Table 57 : Nikola Corp.: Product Offering

- Table 58 : Tata Motors Ltd.: Product Offering

- Table 59 : Toyota Motor Corp.: Product Offering

- Table 60 : List of Hydrogen-based Technology/Products Providers

- Table 61 : Common Fuel Cell Electric Vehicle Models, by Manufacturing Company

- Table 62 : Top Association/Organization/Regulatory Body/Research Institutes Serving the Fuel Cell Field

- Table 63 : Acronyms Used in This Report

Highlights:

The global hydrogen engines market reached $2.6 billion in 2022, should reach $3.2 billion by 2023 and $10.5 billion by 2028 with a compound annual growth rate (CAGR) of 26.8% during the forecast period of 2023-2028.

Asia-Pacific hydrogen engines market reached $1.5 billion in 2022, should reach $2.0 billion by 2023 and $7.7 billion by 2028 with a CAGR of 31.4% during the forecast period of 2023-2028.

European hydrogen engines market reached $249.5 million in 2022, should reach $299.1 million by 2023 and $846.6 million by 2028 with a CAGR of 23.1% during the forecast period of 2023-2028.

Report Scope:

This report analyzes the type of vehicle, technology type, sales channels, regional market and others for the hydrogen engine market. Hydrogen engines are commonly marketed as fuel cell vehicles, hydrogen-powered vehicles or fuel cell electric vehicles (FCEV) in many countries. Therefore, the study examines the scenario for fuel-cell electric vehicles and provides the market potential for such vehicles in the coming five years. The study also provides market dynamics such as drivers, restraints, trends and opportunities in the global market. Furthermore, the report includes a chapter deliberately for fundings and M&A related information.

The report is prepared in a simple, easy-to-understand format; tables and figures are included to illustrate historical, current and future market scenarios. The report also covers leading companies with information on product types, business footprints, revenues and employee strength, among other categories. We will also list emerging players in the global and regional markets, along with their product-related information. The study also includes the patent analysis for the hydrogen combustion engine technology market, representing a significant investment area for investors.

The study includes the impact of COVID-19 and the Russia-Ukraine war on the global and regional markets.

2022 is considered as the historic/base year for this report, with 2023 as an estimated year; and the market values are forecasted for five years until 2028. All market values are in U.S. dollars ($).

Report Includes:

- 29 data tables and 35 additional tables

- An overview of the global markets for hydrogen combustion engine technology

- Estimation of market size and analyses of global market trends, with data from 2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Assessment of the regulatory environment, demographics, and other factors that directly affect the hydrogen combustion engine technology market

- Discussion on the implications of hydrogen combustion engine technology in the context of the current size and growth of the market

- Evaluation of key industry acquisitions and strategic alliances and market share analysis of the leading suppliers of the industry

- Company profiles of major players within the industry, including Cummins Inc., Honda Motor Co. Ltd., Hyundai Motor Co., Tata Motors Ltd., Hyzon Motors, and Nikola Corp.

Summary:

The hydrogen engine market was valued at $REDACTED billion in 2022 and is projected to reach $REDACTED billion by 2028. This market is expected to grow at a CAGR of REDACTED% between 2023 and 2028.

Nowadays, most countries worldwide are looking for alternative solutions to decarbonization. Hydrogen as a fuel is one of the best alternative solutions for carbon emissions-related issues. In the automotive industry, heady duty trucks are the major CO2 gas emitter in the environment. Therefore, automakers are working significantly on hydrogen-powered trucks.

Currently, fuel-cell electric vehicles are available in most developed countries, such as the U.S., Germany, Japan and others. Since these vehicles are very costly compared to conventional vehicles, the governments of individual countries are providing incentives to vehicle purchasers and OEM companies to decrease the overall cost of vehicles.

Currently, proton membrane exchange technology is the main technology used for fuel cells because it can produce electricity frequently, which helps propel vehicles continuously. However, fuel cell companies and automotive companies are working together to develop different types of fuel cells for vehicles, such as phosphoric acid fuel cells and others. Still, this option could increase the overall price of vehicles.

Most OEM (Original Equipment Manufacturer) companies, such as Hyundai, Toyota, Volvo & Daimler, and others, are engaged in producing fuel cell vehicles. However, many OEM companies are working with fuel cell manufacturing companies to design and produce a complete vehicle. Conversely, a few OEM and aftermarket companies can convert vehicles from gasoline/diesel-powered to hydrogenpowered vehicles. Once the hydrogen infrastructure is ready, fleet operators of trucks, taxis, rented vehicles and the like could choose the conversion option.

Currently, fuel cells are integrated with passenger cars, buses and commercial vehicles. Due to the high cost of fuel cell trucks, the commercial vehicle segment dominates the global market. For passenger cars, only two companies, Hyundai and Toyota, offer commercial fuel cell cars across the globe. In comparison, most of the companies are working on heavy-duty trucks.