|

|

市場調査レポート

商品コード

1322938

プラスチック産業の市場動向:主要プラスチック製造業者の開発分析Market Trends in the Plastics Industry: An Analysis of Developments by Key Plastics Manufacturers |

||||||

| プラスチック産業の市場動向:主要プラスチック製造業者の開発分析 |

|

出版日: 2023年08月03日

発行: BCC Research

ページ情報: 英文 123 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のプラスチック製造の市場規模は、2023年の4億2,870万トンから、予測期間中はCAGR6.2%で推移し、2028年には5億7,920万トンの規模に成長すると予測されています。

地域別で見ると、アジア太平洋地域のプラスチック製造量は、2023年の2億560万トンから、予測期間中は7.3%のCAGRで推移し、2028年には2億9,190万トンに達すると予測されています。また、北米のプラスチック製造量は、2023年の1億40万トンから、4.6%のCAGRで推移し、2028年には1億2,580万トンの規模に成長すると予測されています。

当レポートでは、世界のプラスチック製造の市場を調査し、市場背景、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、ESGの展開、技術・特許の動向、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

- 市場の見通し

第3章 市場概要

- プラスチックの概要

- 世界の製造量

第4章 市場力学

- 市場促進要因

- 市場機会

- 市場抑制要因

- 課題

- 法規制環境

- サプライチェーンと廃棄物管理

- 市場への参入

- イノベーションとR&D

第5章 プラスチック産業:用途別

- 包装

- 建築・建設

- 自動車

- 電子・電気

- 家庭

- スポーツ

- 農業

- その他

第6章 プラスチック産業:地域別

- 世界

- 欧州

- 米国

- アジア太平洋

第7章 プラスチック産業の持続可能性:ESGの観点

- プラスチック産業におけるESGの重要性

- ケーススタディ:ESG導入の成功例

- ESGの未来:新たな動向と機会

- BCCからの総論

第8章 プラスチック産業の新たな動向

- 産業別の動向

- 建築・建設

- プラスチック変換

- 自動車・輸送

- ヘルスケア・福祉

- 包装

- 農業

- 生物由来プラスチック

- スポーツ

- 家電

- 環境

- プラスチックリサイクルの動向

- ケミカルリサイクル

- メカニカルリサイクル

- 溶解リサイクル

- 有機リサイクル

- モノマーリサイクル

- IoTを活用したリサイクル

- その他のプラスチックリサイクルプロジェクト

- 法改正の課題に直面する米国の包装業界

- プラスチックリサイクル技術の加速

第9章 特許分析

第10章 M&A

- M&A分析

- プラスチック産業への資金提供

第11章 競合情報

- 競合分析

- 提携

- Amcor

- BASF SE

- Mondi

- UFlex

- INEOS

- Lanxess

- LG CHEM

- Chevron Philips

- Dow

- SABIC

第12章 企業プロファイル

- AMCOR PLC

- BASF SE

- CELANESE CORP.

- CHEVRON PHILIPS CHEMICAL CO.

- DOW INC.

- ENI S.P.A.

- EXXONMOBIL CORP.

- INEOS

- KRATON CORP.

- LANXESS GMBH

- LG CHEM

- MONDI

- POLIFILM AMERICA INC.

- SABIC

- UFLEX LTD.

第13章 付録:略語

List of Tables

- Summary Table : Global Market Volume for Plastics Production, by Region, Through 2028

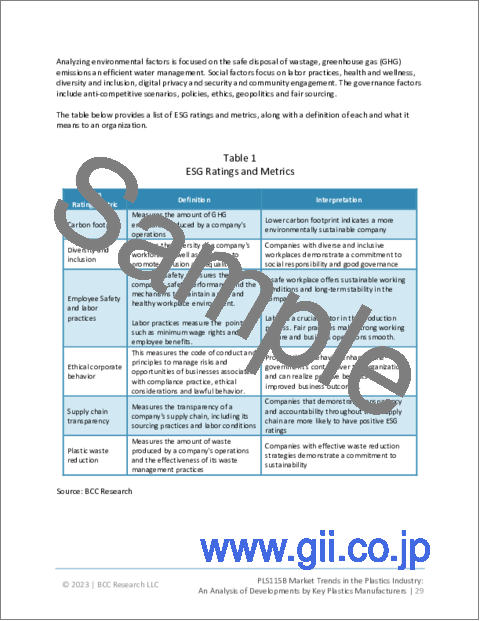

- Table 1 : ESG Ratings and Metrics

- Table 2 : Analysis of Carbon Footprint Issue in the Plastics Industry

- Table 3 : Analysis of Diversity Issues in the Plastics Industry

- Table 4 : Analysis of Employee Safety and Labor Issues in the Plastics Industry

- Table 5 : Analysis of Ethical Corporate Behaviour Issues in the Plastics Industry

- Table 6 : Analysis of Supply Chain Issues in the Plastics Industry

- Table 7 : Analysis of Plastic Recycling Issues in the Plastics Industry

- Table 8 : ESG Scores of Leading Plastics Companies

- Table 9 : Top Plastics Companies: Heatmap on ESG Basis

- Table 10 : Patents Registered to BASF SE

- Table 11 : Patents Registered to Lanxess

- Table 12 : Patents Registered to Dow

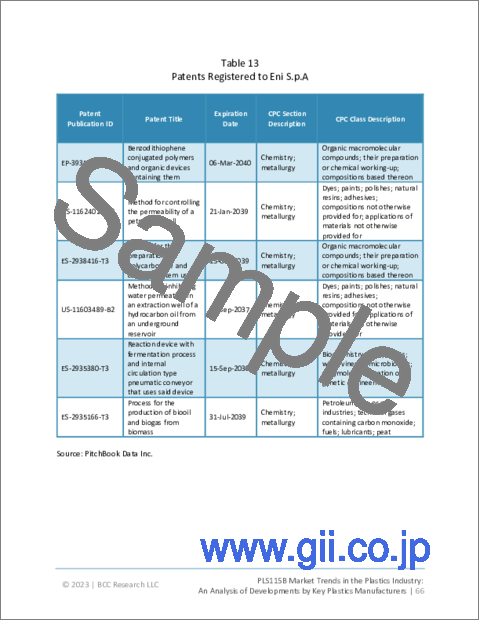

- Table 13 : Patents Registered to Eni S.p.A

- Table 14 : Patents Registered to ExxonMobil Corp.

- Table 15 : Patents Registered to INEOS

- Table 16 : Patents Registered to LG Chem

- Table 17 : Patents Registered to Sabic

- Table 18 : M&A in the Plastics Industry, January 2020-June 2023

- Table 19 : Funding in the Plastics Industry, January 2021-March 2023

- Table 20 : Amcor PLC: Annual Revenue, 2022

- Table 21 : Amcor PLC: Recent Developments, 2023

- Table 22 : BASF SE: Annual Revenue, 2022

- Table 23 : BASF SE: News, 2022

- Table 24 : Celanese Corp.: Annual Revenue, 2022

- Table 25 : Celanese Corp.: News, 2022

- Table 26 : Chevron Phillips Chemical Co.: Annual Revenue, 2022

- Table 27 : Chevron Phillips Chemical Co.: News, 2022

- Table 28 : Dow: Annual Revenue, 2022

- Table 29 : Dow: News, 2023

- Table 30 : Eni S.p.A.: Annual Revenue, 2022

- Table 31 : Eni S.p.A: News, 2022

- Table 32 : ExxonMobil Corp.: Annual Revenue, 2022

- Table 33 : ExxonMobil Corp.: News, 2022

- Table 34 : INEOS: Annual Revenue, 2021

- Table 35 : INEOS: News, 2022

- Table 36 : Kraton Corp.: Annual Revenue, 2021

- Table 37 : Kraton Corp.: News, 2022

- Table 38 : Lanxess : Annual Revenue, 2022

- Table 39 : Lanxess: News, 2022

- Table 40 : LG Chem: Annual Revenue, 2022

- Table 41 : LG Chem: News, 2023

- Table 42 : Mondi: Annual Revenue, 2022

- Table 43 : Mondi: News, 2023

- Table 44 : PoliFilm Group: News, 2023

- Table 45 : Sabic: Annual Revenue, 2022

- Table 46 : Sabic: News, 2023

- Table 47 : UFlex Ltd.: Annual Revenue, 2022

- Table 48 : UFlex Ltd.: News, 2023

- Table 49 : Abbreviations Used in the Plastics Industry

List of Figures

- Summary Figure : Global Market Volume Share of Plastics Production, by Region, 2021

- Figure 1 : Global Market Volume Share of Plastics Production, by Application, 2021

- Figure 2 : Global Market Volume Share of Plastics Production, by Production Type, 2021

- Figure 3 : Global Market Volume Share of Plastics Production, by Region/Country, 2017 and 2021

- Figure 4 : European Market Volume Share of Plastics Production, by Production Type, 2021

- Figure 5 : European Market Volume Share of Plastics Production, by Application, 2021

- Figure 6 : Environmental Score of Major Companies

- Figure 7 : Social Score of Major Companies

- Figure 8 : Governance Score of Major Companies

- Figure 9 : Total Score of Major Companies

- Figure 10 : Distribution Share of M&A in Plastics Industry, by Region, 2020-2022

- Figure 11 : Funding in the Plastics Industry, by Type and Year, 2021-2023

- Figure 12 : Distribution Share of Funding Amount, by Round, 2022-2023

- Figure 13 : Shares of Leading Companies in the Plastics Market

- Figure 14 : Amcor PLC: Annual Revenue, 2021 and 2022

- Figure 15 : Amcor PLC: Revenue Shares, by Business Unit, 2022

- Figure 16 : Amcor PLC: Revenue Shares, by Region, 2022

- Figure 17 : BASF SE: Annual Revenue, 2021 and 2022

- Figure 18 : BASF SE: Revenue Shares, by Business Unit, 2022

- Figure 19 : BASF SE: Revenue Shares, by Region, 2022

- Figure 20 : Celanese Corp.: Annual Revenue, 2021 and 2022

- Figure 21 : Celanese Corp.: Revenue Shares, by Business Unit, 2022

- Figure 22 : Celanese Corp.: Revenue Shares, by Region, 2022

- Figure 23 : Chevron Phillips Chemical Co.: Annual Revenue, 2021 and 2022

- Figure 24 : Chevron Philips Corp.: Revenue Shares, by Business Unit, 2022

- Figure 25 : Chevron Philips Corp.: Revenue Shares, by Region, 2022

- Figure 26 : Dow: Annual Revenue, 2021 and 2022

- Figure 27 : Dow: Revenue Shares, by Business Unit, 2021

- Figure 28 : Dow: Revenue Shares, by Region, 2021

- Figure 29 : Eni S.p.A: Annual Revenue, 2021 and 2022

- Figure 30 : Eni S.p.A: Revenue Shares, by Business Unit, 2022

- Figure 31 : Eni S.p.A: Revenue Shares, by Region, 2022

- Figure 32 : ExxonMobil Corp.: Annual Revenue, 2021 and 2022

- Figure 33 : ExxonMobil Corp.: Revenue Shares, by Business Unit, 2022

- Figure 34 : ExxonMobil Corp.: Revenue Shares, by Region, 2022

- Figure 35 : INEOS: Annual Revenue, 2020 and 2021

- Figure 36 : INEOS: Revenue Shares, by Business Unit, 2021

- Figure 37 : INEOS: Revenue Shares, by Region, 2021

- Figure 38 : Kraton Corp.: Annual Revenue, 2020 and 2021

- Figure 39 : Kraton Corp.: Revenue Shares, by Business Unit, 2021

- Figure 40 : Kraton Corp.: Revenue Shares, by Region, 2021

- Figure 41 : Lanxess: Annual Revenue, 2021 and 2022

- Figure 42 : Lanxess: Revenue Shares, by Business Unit, 2021

- Figure 43 : Lanxess: Revenue Shares, by Region, 2021

- Figure 44 : LG Chem: Annual Revenue, 2021 and 2022

- Figure 45 : LG Chem: Revenue Shares, by Business Unit, 2021

- Figure 46 : LG Chem: Revenue Shares, by Region, 2021

- Figure 47 : Mondi: Annual Revenue, 2021 and 2022

- Figure 48 : Mondi: Revenue Shares, by Business Unit, 2022

- Figure 49 : Mondi: Revenue Shares, by Region, 2022

- Figure 50 : Sabic: Annual Revenue, 2021 and 2022

- Figure 51 : Sabic: Revenue Shares, by Business Unit, 2022

- Figure 52 : Sabic: Revenue Shares, by Region, 2022

- Figure 53 : UFlex Ltd.: Annual Revenue, 2021 and 2022

- Figure 54 : UFlex Ltd.: Revenue Shares, by Business Unit, 2022

Highlights:

The global market volume for plastics production is estimated to increase from 428.7 million metric tons in 2023 to reach 579.2 million metric tons by 2028, at a compound annual growth rate (CAGR) of 6.2% from 2023 through 2028.

Asia-Pacific market volume for plastics production is estimated to increase from 205.6 million metric tons in 2023 to reach 291.9 million metric tons by 2028, at a CAGR of 7.3% from 2023 through 2028.

North American market volume for plastics production is estimated to increase from 100.4 million metric tons in 2023 to reach 125.8 million metric tons by 2028, at a CAGR of 4.6% from 2023 through 2028.

Report Scope:

Over the next five years, significant changes are forecast to take place in the plastics industry and related end-user industries across the globe, in areas such as packaging and construction. This study covers market segments such as plastics packaging, plastics resins and plastics recycling. The report's final chapter includes profiles of 15 of the leading plastics manufacturers, with global as well as smaller companies covered.

Report Includes:

- 50 tables

- An up-to-date overview and analysis of the global plastics industry and related end-user industries

- Analyses of the global market trends for plastics production, with historic market revenue (sales figures) for 2021 and 2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Estimation of the actual market size and revenue forecast of the global market for plastics in volumetric terms, and corresponding market share analysis based on application, and region

- In-depth information (facts and figures) concerning the major factors influencing the progress of this market (benefits, and industry-specific challenges) with respect to specific growth trends, upcoming technologies, prospects, and contributions to the overall market

- Review and identification of the major manufacturers of plastics and plastics products, and analysis of the company competitive landscape based on their recent developments, financial performance, segmental revenues, and operational integration

- Information about ESG-related developments in global plastics industry, emerging trends, ESG practices by companies, and analyses of factors affecting ESG implementation in the plastics sector

- Analysis of patents granted in areas related to plastics manufacturing and applications to the companies involved in global plastic market business

- Updated information on recent industry acquisitions, partnerships, agreements, collaborations, and other strategic alliances in the global plastics market

- Company profiles of the leading global players, including Amcor, BASF SE, Mondi, UFlex, INEOS, and SABIC

Table of Contents

Chapter 1 Introduction

- Study Goals and Objectives

- What's New in This Update

- Scope of Report

- Information Sources

- Methodology

- Market Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

Chapter 3 Market Overview

- Introduction

- Plastics at a Glance

- Global Production

Chapter 4 Market Dynamics

- Introduction

- Market Drivers

- Lightweight

- Growth of Packaging Sector

- Cost-effectiveness

- Industrialization

- Market Opportunities

- Collaborations and Partnerships

- Sustainable and Bio-based Plastics

- Advanced Manufacturing Technologies

- Market Restraints

- Issues Related to Recycled Plastic

- Challenges

- Plastic Waste and Pollution

- Regulatory Landscape

- Supply Chain and Waste Management

- Market Penetration

- Innovation and R&D

Chapter 5 Plastics Industry by Application

- Introduction

- Packaging

- Building and Construction

- Automotive

- Electronic and Electrical

- Household

- Sports

- Agricultural

- Other Applications

Chapter 6 Plastics Industry by Region

- Global Production

- Europe

- United States

- Asia-Pacific

Chapter 7 Sustainability in the Plastics Industry - An ESG Perspective

- Importance of ESG in the Plastics Industry

- Case Study: Example of Successful ESG Implementation

- Future of ESG: Emerging Trends and Opportunities

- Concluding Remarks from BCC Research

Chapter 8 Emerging Trends in the Plastics Industry

- Introduction

- Trends by Industry

- Building and Construction

- Plastic Conversion

- Automotive and Transportation

- Healthcare and Wellbeing

- Packaging

- Agriculture

- Bio-sourced Plastics

- Sports

- Home Appliances

- The Environment

- Trends in Plastics Recycling

- Chemical Recycling

- Mechanical Recycling

- Dissolution Recycling

- Organic Recycling

- Monomer Recycling

- IoT-Enabled Recycling

- Other Plastics Recycling Projects

- U.S. Packaging Industry Facing Legislative Changes

- Plastics Recycling Technologies Heat Up

Chapter 9 Patent Analysis

Chapter 10 Mergers & Acquisitions

- M&A Analysis

- Funding in the Plastics Industry

Chapter 11 Competitive Intelligence

- Competitive Analysis

- Partnerships

- Amcor

- BASF SE

- Mondi

- UFlex

- INEOS

- Lanxess

- LG CHEM

- Chevron Philips

- Dow

- SABIC

Chapter 12 Company Profiles

- AMCOR PLC

- BASF SE

- CELANESE CORP.

- CHEVRON PHILIPS CHEMICAL CO.

- DOW INC.

- ENI S.P.A.

- EXXONMOBIL CORP.

- INEOS

- KRATON CORP.

- LANXESS GMBH

- LG CHEM

- MONDI

- POLIFILM AMERICA INC.

- SABIC

- UFLEX LTD.