|

|

市場調査レポート

商品コード

1132101

パルプ・製紙の世界市場 (数量・金額ベース) - 種類別・エンドユーザー別・地域別・国別の分析 (2022年版):市場の考察・予測、新型コロナウイルス感染症 (COVID-19) の影響 (2023年~2028年)Global Pulp and Paper Market (Volume, Value) - Analysis By Type, End User, By Region, By Country (2022 Edition): Market Insights and Forecast with Impact of COVID-19 (2023-2028) |

||||||

| パルプ・製紙の世界市場 (数量・金額ベース) - 種類別・エンドユーザー別・地域別・国別の分析 (2022年版):市場の考察・予測、新型コロナウイルス感染症 (COVID-19) の影響 (2023年~2028年) |

|

出版日: 2022年09月30日

発行: Azoth Analytics

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のパルプ・製紙の市場規模は、2021年に3,743億4,000万米ドルと評価されました。さまざまな地域・国でエコフレンドリーな包装製品に対するエンドユーザーの需要が増加したことや、パルプ業界のリサイクルインフラの進歩により、世界のパルプ市場は拡大すると予測されます。さらに、反プラスチック意識の高まりや使い捨てプラスチック削減のための政府施策により、近い将来にパルプ製包装の需要が増加すると予測され、最終的に世界のパルプ・製紙市場を牽引することになると考えられます。

種類別では、2028年には広葉樹セグメントが最大のシェアを占めると予想されます。針葉樹と比較して広葉樹は密度が高いため、パルプ消化器のチャージを大きく増やすことで工場の生産能力を向上させることができます。

当レポートでは、世界のパルプ・製紙市場について分析し、市場の概略や基本構造、主な市場促進・抑制要因、市場規模の実績値 (2018年~2021年) と予測値 (2022年~2028年)、種類別・用途別・エンドユーザー別の詳細動向、地域別・主要国の市場構造・動向、市場の競合情勢と魅力、主要企業のプロファイル・戦略展開状況などを調査しております。

目次

第1章 分析の範囲・手法

第2章 戦略提言

第3章 パルプ・製紙市場:製品概要

第4章 世界のパルプ・製紙市場:分析

- 世界のパルプ・製紙市場:市場指標

- 市場規模 (金額ベース、2018年~2028年)

- 市場規模 (数量ベース、2018年~2028年)

- 世界のパルプ・製紙市場:新型コロナウイルス感染症 (COVID-19) の影響

第5章 世界のパルプ・製紙市場:セグメント別の分析

- 世界のパルプ・製紙市場:種類別の内訳

- 競合ポジショニング:種類別

- 広葉樹 (単位:10億米ドル、2018年~2028年)

- 針葉樹 (単位:10億米ドル、2018年~2028年)

- 無漂白 (単位:10億米ドル、2018年~2028年)

- 機械 (単位:10億米ドル、2018年~2028年)

- フラッフ (単位:10億米ドル、2018年~2028年)

第6章 世界のパルプ・製紙市場:用途別の詳細分析

- 世界のパルプ・製紙市場:用途別の内訳

- 競合ポジショニング:用途別

- 組織 (単位:10億米ドル、2018年~2028年)

- 製紙 (単位:10億米ドル、2018年~2028年)

- フラッフ (単位:10億米ドル、2018年~2028年)

- 特殊用途 (単位:10億米ドル、2018年~2028年)

- 包装 (単位:10億米ドル、2018年~2028年)

第7章 世界のパルプ・製紙市場:エンドユーザー別の詳細分析

- 世界のパルプ・製紙市場:エンドユーザー別の内訳

- 競合ポジショニング:エンドユーザー別

- パーソナルケア用品・化粧品 (単位:10億米ドル、2018年~2028年)

- 日用品 (単位:10億米ドル、2018年~2028年)

- 医療 (単位:10億米ドル、2018年~2028年)

- 教育・文房具 (単位:10億米ドル、2018年~2028年)

- その他 (単位:10億米ドル、2018年~2028年)

第8章 世界のパルプ・製紙市場:地域分析

- 世界のパルプ・製紙市場:地域別

- 世界のパルプ・製紙市場の競合ポジショニング:地域別

第9章 南北アメリカのパルプ・製紙市場:分析 (2018年~2028年)

- 南北アメリカのパルプ・製紙市場:市場指標

- 南北アメリカのパルプ・製紙市場 (金額ベース、2018年~2028年)

- 南北アメリカのパルプ・製紙市場 (数量ベース、2018年~2028年)

- 南北アメリカの代表的企業

- 市場区分:種類別 (広葉樹、針葉樹、無漂白、機械、フラッフ)

- 市場区分:用途別 (組織、製紙、フラッフ、特殊用途、包装)

- 市場区分:エンドユーザー別 (パーソナルケア用品・化粧品、日用品、医療、教育・文房具、その他)

- 南北アメリカのパルプ・製紙市場:国別分析

- 市場機会チャート:国別 (金額ベース、2028年)

- 競合ポジショニング:国別

- 米国市場

- カナダ市場

- ブラジル市場

第10章 欧州のパルプ・製紙市場:分析 (2018年~2028年)

- 英国市場

- ドイツ市場

- イタリア市場

第11章 アジア太平洋のパルプ・製紙市場:分析 (2018年~2028年)

- 中国市場

- 日本市場

- インド市場

- 韓国市場

第12章 中東・アフリカのパルプ・製紙市場:分析

第13章 世界のパルプ・製紙の市場力学

- 世界のパルプ・製紙市場の促進要因

- 世界のパルプ・製紙市場の抑制要因

- 世界のパルプ・製紙市場の動向

第14章 市場の魅力と戦略的分析

- 世界のパルプ・製紙市場の魅力 (図説):種類別 (2028年)

- 世界のパルプ・製紙市場の魅力 (図説):用途別 (2028年)

- 世界のパルプ・製紙市場の魅力 (図説):エンドユーザー別 (2028年)

- 世界のパルプ・製紙市場の魅力 (図説):地域別 (2028年)

第13章 競合情勢

- 世界の大手企業の市場シェア

- ポーターファイブフォース分析:世界のパルプ・製紙市場

第16章 企業プロファイル(事業内容、財務分析、事業戦略)

- International paper

- Nine Dragon Paper Holdings Ltd.

- Kimberly Clark Corporation

- Sappi Limited

- WestRock

- Stora Enso Oyj

- The Smurfit Kappa Group

- UPM Kymmene Oyj

- Amcor PLC

- Georgia Pacific Corporation

List of Figures

List of Figures

- Figure 1: Raw Material Consumption of Pulp and Paper, 2020, (% of total)

- Figure 2: Pulp Consumption by Region, 2020

- Figure 3: Utilization of Paper for Recycling by Sector, 2020

- Figure 4: Recovered Paper producing/ collection countries, (million metric ton), 2019

- Figure 5: Top Ten Paper Producing Countries in the World (2018), (in million metric tonnes)

- Figure 6: Global Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 7: Global Pulp and Paper Market Size, By Volume, 2018-2028 (Million Tonnes)

- Figure 8: Global Pulp and Paper Market- By Type Market Share, 2022E & 2028F

- Figure 9: Global Pulp and Paper Market- By Hardwood, By Value (USD Billion), 2018-2028

- Figure 10: Global Pulp and Paper Market- By Softwood, By Value (USD Billion), 2018-2028

- Figure 11: Global Pulp and Paper Market- By Unbleached, By Value (USD Billion), 2018-2028

- Figure 12: Global Pulp and Paper Market- By Mechanical, By Value (USD Billion), 2018-2028

- Figure 13: Global Pulp and Paper Market- By Fluff, By Value (USD Billion), 2018-2028

- Figure 14: Global Pulp and Paper Market- By Application, Market Share, 2022E & 2028F

- Figure 15: Global Pulp and Paper Market- By Tissue, (USD Billion), 2018-2028

- Figure 16: Global Pulp and Paper Market- By Paper, (USD Billion), 2018-2028

- Figure 17: Global Pulp and Paper Market- By Fluff, (USD Billion), 2018-2028

- Figure 18: Global Pulp and Paper Market- By Specialty, (USD Billion), 2018-2028

- Figure 19: Global Pulp and Paper Market- By Packaging, (USD Billion), 2018-2028

- Figure 20: Global Pulp and Paper Market- By End User, Market Share, 2022E & 2028F

- Figure 21: Global Pulp and Paper Market- By Personal Care & Cosmetics, (USD Billion), 2018-2028

- Figure 22: Global Pulp and Paper Market- By Consumer Goods, (USD Billion), 2018-2028

- Figure 23: Global Pulp and Paper Market- By Healthcare, (USD Billion), 2018-2028

- Figure 24: Global Pulp and Paper Market- By Education & Stationary, (USD Billion), 2018-2028

- Figure 25: Global Pulp and Paper Market- By Others, (USD Billion), 2018-2028

- Figure 26: Global Pulp and Paper Market- By Region Market Share, 2022E & 2028F

- Figure 27: North America pulp and paperboard production, (in million metric tons), 2019

- Figure 28: North America recovered paper collection (in million metric tons), 2019

- Figure 29: North America Urban Population (% of total population), 2018-2020

- Figure 30: Americas Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 31: Americas Pulp and Paper Market Size, By Volume, 2018-2028 (Million Tonnes)

- Figure 32: Americas Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 33: Americas Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 34: Americas Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 35: Market Opportunity Chart of Americas Pulp and Paper Market- By Country, By Value (Year-2027)

- Figure 36: America Pulp and Paper Market- By Country Market Share, 2022E & 2028F

- Figure 37: United States Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 38: United States Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 39: United States Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 40: United States Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 41: Canada Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 42: Canada Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 43: Canada Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 44: Canada Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 45: Brazil Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 46: Brazil Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 47: Brazil Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 48: Brazil Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 49: Europe production of Paper Packaging by Countries (in million metric tons), 2019

- Figure 50: European Union Urban Population (% of total), 2019-2021

- Figure 51: Utilization of Paper for Recycling by Country, 2020

- Figure 52: Europe Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 53: Europe Pulp and Paper Market Size, By Volume, 2018-2028 (Million Tonnes)

- Figure 54: Europe Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 55: Europe Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 56: Europe Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 57: Market Opportunity Chart of Europe Pulp and Paper Market- By Country, By Value (Year-2028)

- Figure 58: Europe Pulp and Paper Market- By Country Market Share, 2022E & 2028F

- Figure 59: United Kingdom Pulp and Paper Market Size, By Value, 2018-2028 (USD Million)

- Figure 60: United Kingdom Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 61: United Kingdom Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 62: United Kingdom Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 63: Germany Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 64: Germany Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 65: Germany Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 66: Germany Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 67: Italy Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 68: Italy Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 69: Italy Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 70: Italy Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 71: Asia Pacific paper packaging production, in million metric tons, 2019

- Figure 72: Urban Population in East Asia & Pacific (in %), 2019-2021

- Figure 73: Asia Pacific production, in million metric tons, 2019

- Figure 74: Asia Pacific Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 75: Asia Pacific Pulp and Paper Market Size, By Volume, 2018-2028 (Million Tonnes)

- Figure 76: Asia Pacific Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 77: Asia Pacific Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 78: Asia Pacific Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 79: Market Opportunity Chart of APAC Pulp and Paper Market- By Country, By Value (Year-2028)

- Figure 80: APAC Pulp and Paper Market- By Country Market Share, 2021 & 2028

- Figure 81: China Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 82: China Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 83: China Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 84: China Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 85: Japan Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 86: Japan Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 87: Japan Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 88: Japan Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 89: India Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 90: India Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 91: India Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 92: India Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 93: South Korea Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 94: South Korea Pulp and Paper Market- By Type, By Value (USD Billion), 2018-2028

- Figure 95: South Korea Pulp and Paper Market- By Application, By Value (USD Billion), 2018-2028

- Figure 96: South Korea Pulp and Paper Market- By End User, By Value (USD Billion), 2018-2028

- Figure 97: MEA Pulp and Paper Market Size, By Value, 2018-2028 (USD Billion)

- Figure 98: MEA Pulp and Paper Market Size, By Volume, 2018-2028 (Million Tonnes)

- Figure 99: Market Attractiveness Chart of Global Pulp and Paper Market- By Type (Year-2028)

- Figure 100: Market Attractiveness Chart of Global Pulp and Paper Market- By Application (Year-2028)

- Figure 101: Market Attractiveness Chart of Global Pulp and Paper Market- By End User (Year-2028)

- Figure 102: Market Attractiveness Chart of Global Pulp and Paper- By Region (Year-2028)

- Figure 103: Global Pulp and Paper Market Share (%), 2021

- Figure 104: International Paper, Net Sales, 2019-2021 (USD Million)

- Figure 105: International Paper, Net Earning, 2019-2021 (USD Million)

- Figure 106: International Paper, Revenues, By Geographical Segment (%), FY2021

- Figure 107: International Paper, Revenues, By Business Segment (%), FY2021

- Figure 108: Nine Dragons Holdings Ltd., Net Sales, 2019-2021 (USD Million)

- Figure 109: Nine Dragons Holdings Ltd., Net Earning, 2019-2021 (USD Million)

- Figure 100: Nine Dragons Holdings Ltd., Revenues, By Business Segment (%), FY2021

- Figure 111: Nine Dragons Holdings Ltd., Revenues, By Business Segment (%), FY2021

- Figure 112: Kimberly Clark Corporation, Net Sales, 2019-2021 (USD Million)

- Figure 113: Kimberly Clark Corporation, Net Earning, 2019-2021 (USD Million)

- Figure 114: Kimberly Clark Corporation, Revenues, By Geographical Segment (%), FY2021

- Figure 115: Kimberly Clark Corporation, Revenues, By Business Segment (%), FY2021

- Figure 116: Sappi Limited, Net Sales, 2019-2021 (USD Million)

- Figure 117: Sappi Limited, Net Earning, 2019-2021 (USD Million)

- Figure 118: Sappi Limited, Revenues, By Geographical Segment (%), FY2021

- Figure 119: Sappi Limited, Revenues, By Business Segment (%), FY2021

- Figure 120: WestRock, Net Sales, 2019-2021 (USD Million)

- Figure 121: WestRock, Net Earning, 2019-2021 (USD Million)

- Figure 122: WestRock, Revenues, By Geographical Segment (%), FY2021

- Figure 123: WestRock, Revenues, By Business Segment (%), FY2021

- Figure 124: Stora Enso Oyj., Net Sales, 2019-2021 (USD Million)

- Figure 125: Stora Enso Oyj., Net Earning, 2019-2021 (USD Million)

- Figure 126: Stora Enso Oyj., Revenues, By Geographical Segment (%), FY2021

- Figure 127: Stora Enso Oyj., Revenues, By Business Segment (%), FY2021

- Figure 128: Smurfit Kappa Group, Net Sales, 2019-2021 (USD Million)

- Figure 129: Smurfit Kappa Group, Net Earning, 2019-2021 (USD Million)

- Figure 130: Smurfit Kappa Group, Revenues, By Geographical Segment (%), FY2021

- Figure 131: Smurfit Kappa Group, Revenues, By Geographical Segment (%), FY2020

- Figure 132: UPM Kymmene Oyj., Net Sales, 2019-2021 (USD Million)

- Figure 133: UPM Kymmene Oyj., Net Earning, 2019-2021 (USD Million)

- Figure 134: UPM Kymmene Oyj., Revenues, By Business Segment (%), FY2021

- Figure 135: UPM Kymmene Oyj., Revenues, By Business Segment (%), FY2020

- Figure 136: Amcor PLC, Net Sales, 2019-2021 (USD Million)

- Figure 137: Amcor PLC, Net Earning, 2019-2021 (USD Million)

- Figure 138: Amcor PLC, Revenues, By Business Segment (%), FY2021

- Figure 139: Amcor PLC, Revenues, By Geographical Segment (%), FY2020

Executive Summary

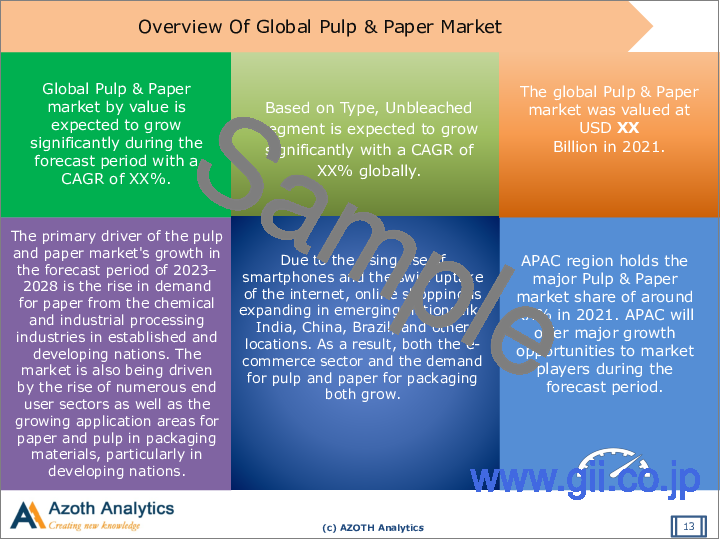

The Global Pulp and Paper Market was valued at USD 374.34 Billion in the year 2021. Across different regions and countries, due to increasing end-user demand for eco-friendly packaging products and advancements in the pulp industry's recycling infrastructure, the global pulp market is anticipated to expand. Additionally, the demand for packaging made of pulp is projected to increase in the near future due to rising anti-plastic attitudes and government measures to reduce single-use plastics, which will ultimately drive the global pulp and paper market.

The primary driver of the pulp and paper market's growth in the forecast period of 2023-2028 is the rise in demand for paper from the chemical and industrial processing industries in established and developing nations. The market is also being driven by the rise of numerous end-user sectors as well as the growing application areas for paper and pulp in packaging materials, particularly in developing nations.

With raw materials typically accounting for 55-65% of a paper company's costs, strategic sourcing is crucial to reducing cost and achieving performance excellence. Many paper companies are falling behind on sourcing best practices, routinely making mistakes in costs in procurement. The use of demand prediction models can help paper companies better anticipate periods of high demand and plan procurement more accurately, reducing their inventory costs. At the same time, price prediction modelling for key input materials helps organisations time their purchases to take advantage of favourable price fluctuations.

Based on the Type segment, the Hardwood segment is expected to hold the largest share in Pulp and Paper market in the year 2028. The hardwood pulp is competitive among all kinds of paper pulp. Compared to softwood, hardwood is dense, so the large increase in the charge of the pulp digester improves the production capacity of paper and pulp mill.

Scope of the Report

- The report presents the analysis of the Pulp and Paper market for the historical period of 2018-2021 and the forecast period of 2023-2028.

- The report analyses the Pulp and Paper Market by Value (USD Billion).

- The report analyses the Pulp and Paper Market by Volume (Million Tonnes).

- The report analyses the Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff).

- The report analyses the Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging).

- The report analyses the Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others).

- The Global Pulp and Paper Market has been analysed by countries (United States, Canada, Brazil, United Kingdom, Germany, Italy, China, Japan, India, South Korea).

- The key insights of the report have been presented through the frameworks of SWOT and Porter's Five Forces Analysis. Also, the attractiveness of the market has been presented by region, Location and by Product.

- Also, the major opportunities, trends, drivers and challenges of the industry have been analysed in the report.

- The report tracks competitive developments, strategies, mergers and acquisitions and new product development. The companies analysed in the report include International paper, Nine Dragon Paper Holdings Ltd., Kimberly Clark Corporation, Sappi Limited, WestRock, Stora Enso Oyj., The Smurfit Kappa Group, UPM Kymmene Oyj, Amcor PLC, Georgia Pacific Corporation.

Key Target Audience

- Pulp and Paper Industry Vendors

- Consulting and Advisory Firms

- Government and Policy Makers

- Regulatory Authorities

Table of Contents

1. Report Scope and Methodology

- 1.1 Scope of the Report

- 1.2 Research Methodology

- 1.3 Executive Summary

2. Strategic Recommendations

3. Global Pulp and Paper Market: Product Overview

4. Global Pulp and Paper Market: An Analysis

- 4.1 Global Pulp and Paper Market, Market Indicators

- 4.2 Market Size, By Value, 2018-2028

- 4.3 Market Size, By Volume, 2018-2028

- 4.4 Impact of COVID-19 on Global Pulp and Paper Market

5. Global Pulp and Paper Market: Segmental Analysis

- 5.1 Global Pulp and Paper Market by Type

- 5.2 Competitive Positioning of Global Pulp and Paper Market- By Type

- 5.3 By Hardwood, By Value (USD Billion), 2018-2028

- 5.4 By Softwood, By Value (USD Billion), 2018-2028

- 5.5 By Unbleached, By Value (USD Billion), 2018-2028

- 5.6 By Mechanical, By Value (USD Billion), 2018-2028

- 5.7 By Fluff, By Value (USD Billion), 2018-2028

6. Global Pulp and Paper Market By Application

- 6.1 Global Pulp and Paper Market by Application

- 6.2 Competitive Positioning of Global Pulp and Paper Market- By Application

- 6.3 By Tissue, By Value (USD Billion), 2018-2028

- 6.4 By Paper, By Value (USD Billion), 2018-2028

- 6.5 By Fluff, By Value (USD Billion), 2018-2028

- 6.6 By Specialty, By Value (USD Billion), 2018-2028

- 6.7 By Packaging, By Value (USD Billion), 2018-2028

7. Global Pulp and Paper Market By End User

- 7.1 Global Pulp and Paper Market by End User

- 7.2 Competitive Positioning of Global Pulp and Paper Market- By End User

- 7.3 By Personal Care & Cosmetics, By Value (USD Billion), 2018-2028

- 7.4 By Consumer Goods, By Value (USD Billion), 2018-2028

- 7.5 By Healthcare, By Value (USD Billion), 2018-2028

- 7.6 By Education & Stationery, By Value (USD Billion), 2018-2028

- 7.7 By Others, By Value (USD Billion), 2018-2028

8. Global Pulp and Paper Market By Region

- 8.1 Global Pulp and Paper Market by Region

- 8.2 Competitive Positioning of Global Pulp and Paper Market- By Region

9. Americas Pulp and Paper Market: An Analysis (2018-2028)

- 9.1 Americas Pulp and Paper Market: Market Indicators

- 9.2 Americas Pulp and Paper Market by value: Size and Forecast (2018-2028)

- 9.3 Americas Pulp and Paper Market by volume: Size and Forecast (2018-2028)

- 9.4 Americas Prominent Companies

- 9.5 Market Segmentation By Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 9.6 Market Segmentation By Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 9.7 Market Segmentation By End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 9.8 Americas Pulp and Paper Market: Country Analysis

- 9.9 Market Opportunity Chart of Americas Pulp and Paper Market - By Country, By Value (Year-2028)

- 9.10 Competitive Positioning of Americas Pulp and Paper Market- By Country

- 9.11 United States Pulp and Paper Market: Size and Forecast (2018-2028)

- 9.12 United States Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 9.13 United States Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 9.14 United States Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 9.15 Canada Pulp and Paper Market: Size and Forecast (2018-2028)

- 9.16 Canada Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 9.17 Canada Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 9.18 Canada Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 9.19 Brazil Pulp and Paper Market: Size and Forecast (2018-2028)

- 9.20 Brazil Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 9.21 Brazil Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 9.22 Brazil Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

10. Europe Pulp and Paper Market: An Analysis (2018-2028)

- 10.1 Europe Pulp and Paper Market: Market Indicators

- 10.2 Europe Pulp and Paper Market by value: Size and Forecast (2018-2028)

- 10.3 Europe Pulp and Paper Market by volume: Size and Forecast (2018-2028)

- 10.4 Europe Prominent Companies

- 10.5 Market Segmentation By Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 10.6 Market Segmentation By Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 10.7 Market Segmentation By End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 10.8 Europe Pulp and Paper Market: Country Analysis

- 10.9 Market Opportunity Chart of Europe Pulp and Paper Market - By Country, By Value (Year-2028)

- 10.10 Competitive Positioning of Europe Pulp and Paper Market- By Country

- 10.11 United Kingdom Pulp and Paper Market: Country Analysis

- 10.12 United Kingdom Pulp and Paper Market: Size and Forecast (2018-2028)

- 10.13 United Kingdom Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 10.14 United Kingdom Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 10.15 United Kingdom Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 10.16 Germany Pulp and Paper Market: Size and Forecast (2018-2028)

- 10.17 Germany Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 10.18 Germany Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 10.19 Germany Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 10.20 Italy Pulp and Paper Market: Size and Forecast (2018-2028)

- 10.21 Italy Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 10.22 Italy Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 10.23 Italy Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

11. APAC Pulp and Paper Market: An Analysis (2018-2028)

- 11.1 APAC Pulp and Paper Market: Market Indicators

- 11.2 APAC Pulp and Paper Market by value: Size and Forecast (2018-2028)

- 11.3 APAC Pulp and Paper Market by volume: Size and Forecast (2018-2028)

- 11.4 APAC Prominent Companies

- 11.5 Market Segmentation By Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 11.6 Market Segmentation By Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 11.7 Market Segmentation By End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 11.8 APAC Pulp and Paper Market: Country Analysis

- 11.9 Market Opportunity Chart of APAC Pulp and Paper Market - By Country, By Value (Year-2028)

- 11.10 Competitive Positioning of Europe Pulp and Paper Market- By Country

- 11.11 China Pulp and Paper Market: Country Analysis

- 11.12 China Pulp and Paper Market: Size and Forecast (2018-2028)

- 11.13 China Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 11.14 China Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 11.15 China Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 11.16 Japan Pulp and Paper Market: Size and Forecast (2018-2028)

- 11.17 Japan Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 11.18 Japan Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 11.19 Japan Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 11.20 India Pulp and Paper Market: Size and Forecast (2018-2028)

- 11.21 India Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 11.22 India Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 11.23 India Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

- 11.24 South Korea Pulp and Paper Market: Size and Forecast (2018-2028)

- 11.25 South Korea Pulp and Paper Market by Type (Hardwood, Softwood, Unbleached, Mechanical, Fluff)

- 11.26 South Korea Pulp and Paper Market by Application (Tissue, Paper, Fluff, Specialty, Packaging)

- 11.27 South Korea Pulp and Paper Market by End User (Personal Care & Cosmetics, Consumer Goods, Healthcare, Education & Stationery, Others)

12. MEA Pulp and Paper Market: An Analysis

- 12.1 MEA Pulp and Paper Market by value: Size and Forecast (2018-2028)

- 12.2 MEA Pulp and Paper Market by volume: Size and Forecast (2018-2028)

13. Global Pulp and Paper Market Dynamics

- 13.1 Global Pulp and Paper Market Drivers

- 13.2 Global Pulp and Paper Market Restraints

- 13.3 Global Pulp and Paper Market Trends

14. Market Attractiveness and Strategic Analysis

- 14.1 Market Attractiveness Chart of Global Pulp and Paper - By Type (2028)

- 14.2 Market Attractiveness Chart of Global Pulp and Paper - By Application (2028)

- 14.3 Market Attractiveness Chart of Global Pulp and Paper - By End User (2028)

- 14.4 Market Attractiveness Chart of Global Pulp and Paper - By Region (2028)

15. Competitive Landscape

- 15.1 Market Share of global leading companies

- 15.2 Porter Five Forces Analysis-Global Pulp and Paper Market

16. Company Profiles (Business Description, Financial Analysis, Business Strategy)

- 16.1 International paper

- 16.2 Nine Dragon Paper Holdings Ltd.

- 16.3 Kimberly Clark Corporation

- 16.4 Sappi Limited

- 16.5 WestRock

- 16.6 Stora Enso Oyj

- 16.7 The Smurfit Kappa Group

- 16.8 UPM Kymmene Oyj

- 16.9 Amcor PLC

- 16.10 Georgia Pacific Corporation