|

市場調査レポート

商品コード

1735753

無人ヘリコプターの世界市場(2025年~2035年)Global Unmanned Helicopter Market 2025-2035 |

||||||

|

|||||||

| 無人ヘリコプターの世界市場(2025年~2035年) |

|

出版日: 2025年05月29日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

全表示

- 概要

- 図表

- 目次

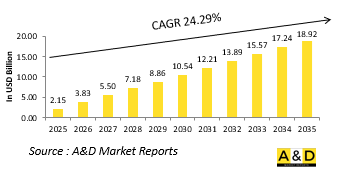

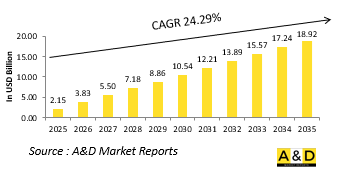

世界の無人ヘリコプターの市場規模は、2025年に21億5,000万米ドルと推定され、2035年までに189億2,000万米ドルに達すると予測され、予測期間の2025年~2035年にCAGRで24.29%の成長が見込まれます。

無人ヘリコプター市場における技術の影響

技術の急速な進化は、防衛向け無人ヘリコプターの能力と作戦プロファイルを大幅に向上させました。自律航法、センサーフュージョン、オンボードコンピューティングの技術革新により、これらのプラットフォームはダイナミックな戦闘環境で効果的に活動できるようになっています。戦場のデータをリアルタイムで処理し、反応することができるため、オペレーターの負担が軽減され、より複雑な作戦が可能になります。高解像度のイメージングシステム、合成開口レーダー、電子戦ペイロードは、状況認識と脅威の検知を強化する標準機能となっています。AIは意思決定能力を一変させ、無人ヘリコプターによる脅威の予測分析や自律的な目標追跡を可能にしています。セキュア通信リンクは、信号干渉の激しい環境下でも、司令部や他の軍事資産との連携を確保します。さらに、エネルギー効率の高い推進システムは、飛行時間の延長と、ステルス作戦に不可欠な静粛性の向上に寄与しています。その他の無人・有人システムとの相互運用性も優先度の高いものとなっており、統合軍の作戦や統合防衛戦略をサポートしています。モジュラーアーキテクチャーは、迅速なペイロードの交換を可能にし、偵察から戦術的補給まで、さまざまな作戦にヘリコプターを合わせることができます。全体として、技術の進歩により、防衛向け無人ヘリコプターは、多様な戦闘条件下で能力を発揮できる適応性の高いプラットフォームへと変化しつつあり、同時に、人的リスクを軽減し、戦略的リーチを拡大しつつあります。

無人ヘリコプター市場の主な促進要因

複数の要因が、防衛部門における無人ヘリコプターの世界的な採用と進歩を後押ししています。中でももっとも重要なのは、リスクの高い作戦から人員を外すことで死傷者を減らす必要性です。無人ヘリコプターは、前方偵察、敵地での捜索救助、戦火下での兵站支援といった作戦に信頼できるソリューションを提供します。複雑化する現代戦では、迅速で柔軟な対応メカニズムが求められますが、こうした航空プラットフォームはその実現に適しています。地政学的緊張と領土紛争は、各国に監視・情報収集能力の強化を促しており、それは有人航空機が制限に直面するような環境下にあることも多いです。予算の制約と運用効率の要求も、軍事計画者をメンテナンスと人員の削減を通じて長期的なコスト優位性を提供するプラットフォームへと向かわせています。さらに、ネットワーク中心の戦争が重視されるようになったことで、無人ヘリコプターのリアルタイムのデータ共有能力は特に貴重なものとなっています。世界中の国防近代化プログラムでは、従来の資産を補完し、戦場での認識を高めるために、無人システムの統合を優先しています。環境適応性、ステルス機能、陸上/海上作戦との互換性が、無人システムの魅力をさらに高めています。こうした促進要因が集約されるにつれて、防衛戦略における無人ヘリコプターの役割は拡大し続け、現代の軍事作戦に不可欠なツールとなっています。

無人ヘリコプター市場の地域動向

防衛向け無人ヘリコプターの開発と展開は、地域ごとに異なるパターンを示しており、それぞれの地域の戦略的優先順位や安全保障情勢によって形成されています。北米、特に米国では、既存の戦力構造とシームレスに統合できるマルチミッション自律型プラットフォームの構築に向け、多額の投資が行われています。相互運用性、耐久性、先進のペイロード能力が重視されています。欧州では、各国が監視、国境警備、即応作戦の強化を目的とした共同開発プログラムに注力しています。こうした取り組みには、コストや専門知識を共有するために、国内企業と国際的な防衛パートナーが協力することも多いです。

当レポートでは、世界の無人ヘリコプター市場について調査分析し、成長促進要因、今後10年間の見通し、各地域の動向などの情報を提供しています。

目次

無人ヘリコプター市場レポートの定義

無人ヘリコプター市場のセグメンテーション

エンドユーザー別

地域別

ペイロード別

今後10年間の無人ヘリコプター市場の分析

無人ヘリコプター市場の技術

世界の無人ヘリコプター市場の予測

地域の無人ヘリコプター市場の動向と予測

北米

促進要因、抑制要因、課題

PEST

市場予測とシナリオ分析

主要企業

サプライヤーのTierの情勢

企業ベンチマーク

欧州

中東

アジア太平洋

南米

無人ヘリコプター市場の分析:国別

米国

防衛プログラム

最新ニュース

特許

この市場における現在の技術成熟度

市場予測とシナリオ分析

カナダ

イタリア

フランス

ドイツ

オランダ

ベルギー

スペイン

スウェーデン

ギリシャ

オーストラリア

南アフリカ

インド

中国

ロシア

韓国

日本

マレーシア

シンガポール

ブラジル

無人ヘリコプター市場の機会マトリクス

無人ヘリコプター市場レポートに関する専門家の意見

結論

Aviation and Defense Market Reportsについて

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Payload, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Payload, 2025-2035

List of Figures

- Figure 1: Global Unmanned Helicopter Market Forecast, 2025-2035

- Figure 2: Global Unmanned Helicopter Market Forecast, By Region, 2025-2035

- Figure 3: Global Unmanned Helicopter Market Forecast, By End User, 2025-2035

- Figure 4: Global Unmanned Helicopter Market Forecast, By Payload, 2025-2035

- Figure 5: North America, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 6: Europe, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 8: APAC, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 9: South America, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 10: United States, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 11: United States, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 12: Canada, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 14: Italy, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 16: France, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 17: France, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 18: Germany, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 24: Spain, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 30: Australia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 32: India, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 33: India, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 34: China, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 35: China, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 40: Japan, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Unmanned Helicopter Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Unmanned Helicopter Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Unmanned Helicopter Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Unmanned Helicopter Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Unmanned Helicopter Market, By End User (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Unmanned Helicopter Market, By End User (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Unmanned Helicopter Market, By Payload (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Unmanned Helicopter Market, By Payload (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Unmanned Helicopter Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Unmanned Helicopter Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Unmanned Helicopter Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Unmanned Helicopter Market, By Region, 2025-2035

- Figure 58: Scenario 1, Unmanned Helicopter Market, By End User, 2025-2035

- Figure 59: Scenario 1, Unmanned Helicopter Market, By Payload, 2025-2035

- Figure 60: Scenario 2, Unmanned Helicopter Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Unmanned Helicopter Market, By Region, 2025-2035

- Figure 62: Scenario 2, Unmanned Helicopter Market, By End User, 2025-2035

- Figure 63: Scenario 2, Unmanned Helicopter Market, By Payload, 2025-2035

- Figure 64: Company Benchmark, Unmanned Helicopter Market, 2025-2035

The global Unmanned Helicopter market is estimated at USD 2.15 billion in 2025, projected to grow to USD 18.92 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 24.29% over the forecast period 2025-2035.

Introduction to Global Unmanned Helicopter market:

Defense unmanned helicopters are emerging as critical assets in modern military operations due to their ability to conduct missions without risking human life. These systems combine the agility of rotary-wing aircraft with the benefits of autonomy or remote operation, making them well-suited for reconnaissance, target acquisition, logistics, and electronic warfare. Their ability to hover and operate in confined or hostile environments gives military planners greater flexibility compared to traditional aerial platforms. As the nature of warfare evolves, defense forces around the world are increasingly prioritizing systems that can provide persistent surveillance, quick response, and low observable profiles. Unmanned helicopters are particularly valuable in missions that require quiet operation, rapid deployment, and access to complex terrains. Militaries globally are investing in both the development of indigenous platforms and the acquisition of advanced models from established defense contractors. These systems are being integrated into broader defense networks, working in tandem with ground forces, satellites, and other aerial vehicles. Their modular design allows customization based on mission requirements, which enhances their versatility. In an era of asymmetric threats and contested airspaces, the global interest in defense unmanned helicopters continues to grow, reflecting their strategic importance in achieving operational superiority without direct human involvement.

Technology Impact in Unmanned Helicopter Market:

The rapid evolution of technology has significantly enhanced the capabilities and mission profiles of defense unmanned helicopters. Innovations in autonomous navigation, sensor fusion, and onboard computing allow these platforms to operate effectively in dynamic combat environments. They can process and react to battlefield data in real time, reducing the burden on operators and enabling more complex missions. High-resolution imaging systems, synthetic aperture radars, and electronic warfare payloads are now standard features, enhancing situational awareness and threat detection. Artificial intelligence is transforming decision-making capabilities, enabling unmanned helicopters to conduct predictive threat analysis and autonomous target tracking. Secure communication links ensure coordination with command centers and other military assets, even in environments with heavy signal interference. Furthermore, energy-efficient propulsion systems contribute to extended flight durations and quieter operation, which is crucial for stealth missions. Interoperability with other unmanned and manned systems has also become a priority, supporting joint-force operations and integrated defense strategies. Modular architectures allow rapid payload swapping, tailoring the helicopter for missions ranging from surveillance to tactical resupply. Overall, technological advancements are turning defense unmanned helicopters into highly adaptive platforms that can perform under diverse combat conditions while reducing risk to human personnel and increasing strategic reach.

Key Drivers in Unmanned Helicopter Market:

Several key factors are fueling the global adoption and advancement of unmanned helicopters within defense sectors. Foremost among these is the need to reduce casualties by removing personnel from high-risk missions. Unmanned helicopters provide a reliable solution for tasks such as forward reconnaissance, search and rescue in hostile zones, and logistics support under fire. The increasing complexity of modern warfare demands rapid and flexible response mechanisms, which these aerial platforms are well-suited to deliver. Geopolitical tensions and territorial disputes are prompting nations to strengthen surveillance and intelligence-gathering capabilities, often in environments where manned aircraft face limitations. Budget constraints and the demand for operational efficiency are also pushing military planners toward platforms that offer long-term cost advantages through reduced maintenance and personnel requirements. Additionally, the growing emphasis on network-centric warfare makes the real-time data-sharing capabilities of unmanned helicopters particularly valuable. Defense modernization programs worldwide are prioritizing the integration of unmanned systems to complement traditional assets and enhance battlefield awareness. Environmental adaptability, stealth features, and compatibility with land and naval operations further amplify their appeal. As these drivers converge, the role of unmanned helicopters in defense strategy continues to expand, making them essential tools for modern military operations.

Regional Trends in Unmanned Helicopter Market:

Different regions are exhibiting distinct patterns in the development and deployment of defense unmanned helicopters, shaped by their strategic priorities and security landscapes. In North America, particularly within the United States, significant investment is directed toward creating multi-mission autonomous platforms that can seamlessly integrate with existing force structures. Emphasis is placed on interoperability, endurance, and advanced payload capabilities. In Europe, nations are focusing on joint development programs aimed at enhancing surveillance, border security, and rapid-response operations. These efforts often involve collaborations between domestic firms and international defense partners to share costs and expertise. Asia-Pacific countries are rapidly expanding their defense capabilities, with unmanned helicopters seen as a critical component for maritime security, territorial monitoring, and asymmetric threat deterrence. Nations with large coastlines or contested borders are especially focused on systems that provide persistent aerial presence. In the Middle East, concerns about insurgency and border infiltration are driving demand for unmanned platforms that can conduct surveillance and precision targeting in harsh environments. Meanwhile, Latin America and Africa are gradually exploring these technologies, often through partnerships or procurement from established producers. Across all regions, the underlying trend is a growing recognition of the value unmanned helicopters bring to modern, tech-enabled defense strategies.

Key Unmanned Helicopter Program:

Dutch unmanned helicopter systems specialist High Eye announced it had secured a contract from the Netherlands Ministry of Defence (MoD) to supply its Airboxer vertical take-off and landing unmanned aerial vehicle (VTOL UAV). The contract was awarded through an open international tender, according to High Eye. While the company did not disclose the number of UAVs ordered or the contract's value, it confirmed that the first unit will be delivered within the year. The Airboxer VTOL UAV features a traditional helicopter configuration with a main and tail rotor and is powered by an air-cooled boxer engine with fuel injection. It can carry a variety of payloads, sensors, and other equipment weighing up to 7 kg. At sea level, the UAV can carry a 7 kg payload for several hours. With a 2 kg payload, it can sustain flight for more than three hours at a cruising speed of 30 knots (55.6 km/h) and reach speeds of up to 70 knots. The aircraft's maximum take-off weight at sea level is 32 kg, which gradually decreases with altitude up to its service ceiling of 10,000 ft (approximately 3,048 meters).

Table of Contents

Unmanned Helicopter Market Report Definition

Unmanned Helicopter Market Segmentation

By End User

By Region

By Payload

Unmanned Helicopter Market Analysis for next 10 Years

The 10-year unmanned helicopter market analysis would give a detailed overview of unmanned helicopter market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Helicopter Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Helicopter Market Forecast

The 10-year unmanned helicopter market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Helicopter Market Trends & Forecast

The regional unmanned helicopter market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Unmanned Helicopter Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Helicopter Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Helicopter Market Report

Hear from our experts their opinion of the possible analysis for this market.