|

市場調査レポート

商品コード

1719521

アビオニクステストシステムの世界市場(2025年~2035年)Global Avionics Test Systems Market 2025-2035 |

||||||

|

|||||||

| アビオニクステストシステムの世界市場(2025年~2035年) |

|

出版日: 2025年05月07日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

全表示

- 概要

- 図表

- 目次

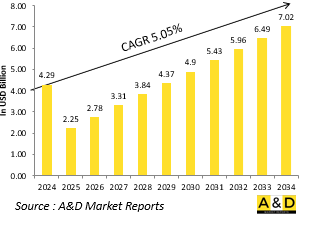

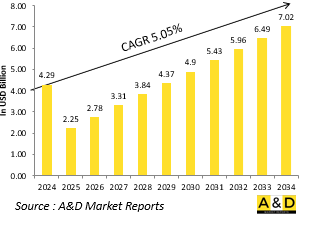

世界のアビオニクステストシステムの市場規模は、2025年に推定42億9,000万米ドルであり、2035年までに70億2,000万米ドルに達すると予測され、予測期間の2025年~2035年にCAGRで5.05%の成長が見込まれます。

アビオニクステストシステム市場のイントロダクション

防衛向けアビオニクステストシステムは、現代の軍用機の運用の完全性と作戦の即応性の維持に不可欠です。これらのシステムは、飛行制御、脅威検出、通信、武器運搬、有人・無人プラットフォームのナビゲーションを司る複雑な電子サブシステムをテストし、検証するための基礎を提供します。防衛アビオニクスは商業アビオニクスとは異なり、過酷な条件下で動作し、敵対的な環境に耐え、より広い戦闘システムにシームレスに統合する必要があります。そのため、そのテスト要件は大いに厳しく、戦場でのストレス要因や作戦特有のシナリオを再現できる特殊な装置や処理が必要となります。テストシステムは、開発、試作から展開、維持に至るまで、航空機のライフサイクルのあらゆる段階をサポートし、故障が運用の有効性や人員の安全を損なうことのないよう支援します。急速に進化する電子戦の要件をサポートし、旧式の機体に最先端のアビオニクスを統合するため、防衛組織は世界的に先進のテストプラットフォームに依存しています。これらのシステムは、技術者の訓練、システムの異常診断、作戦のアップグレードの検証にも不可欠です。軍隊がより高いアジリティとシステムの相互運用性を追求し続ける中、アビオニクステストシステムは、航空機システムがもっとも困難な状況でも完璧に機能することを保証する、セキュアな制御されたコスト効率の高い手段を提供します。防衛航空におけるアビオニクステストシステムの戦略的役割は、急速に変化する世界の安全保障環境におけるアビオニクステストシステムの価値を強く示しています。

アビオニクステストシステム市場における技術の影響

技術革新により、防衛向けアビオニクステストシステムは、高度化する軍用機に対応する強力で適応力のあるツールへと変わりつつあります。これらのシステムは、柔軟性のないプラットフォーム固有のツールから、さまざまな航空機の幅広いサブシステムをテストできるモジュラーソリューションへと進化しています。組み込みソフトウェア診断を取り入れることで、技術者は複雑な戦況をシミュレートし、システムの挙動をほぼリアルタイムで評価することができます。AIと機械学習は、ミッションクリティカルになる前に問題を特定する、予知保全と故障解析の役割を果たし始めています。テストシステムは現在、標準化されたインターフェースを通じてデジタルアビオニクススイートと統合され、より迅速なシステム更新とスムーズなテストプロセスを可能にしています。仮想化環境とハードウェアインザループシミュレーションにより、アビオニクスのソフトウェアとハードウェアの包括的な検証が可能になり、遠隔/分散テストアーキテクチャをサポートします。先進のデータ可視化ツールは、技術者やエンジニアにシステム性能に関する直感的な知見を提供し、学習曲線を短縮してダウンタイムを最小化します。これらの技術革新はサイバーハードニングの取り組みも支援し、防衛組織が潜在的な侵入や電子戦の戦術に対するシステムのレジリエンスをテストできるようにします。アビオニクスシステムがより相互接続されデータドリブン化していることから、テストプラットフォームを支える技術は、セキュアでレジリエンスのある、作戦に対応できる防衛航空システムを確保するための中心的存在であり続けます。

アビオニクステストシステム市場の主な促進要因

電子戦能力の拡大、航空機隊の近代化、迅速な展開の必要性は、世界の防衛向けアビオニクステストシステムへの投資を促進している主な要因の1つです。軍事作戦のデジタルアビオニクスとマルチドメイン統合への依存が増大していることから、高い性能と作戦継続性を維持する圧力はかつてないほど高まっています。

当レポートでは、世界のアビオニクステストシステム市場について調査分析し、成長促進要因、今後10年間の見通し、各地域の動向などの情報を提供しています。

目次

世界の防衛向けアビオニクステストシステム - 目次

世界の防衛向けアビオニクステストシステムレポートの定義

世界の防衛向けアビオニクステストシステム

地域別

プラットフォーム別

製品タイプ別

用途別

今後10年間の世界の防衛向けアビオニクステストシステムの分析

世界の防衛向けアビオニクステストシステムの市場の技術

世界の防衛向けアビオニクステストシステム予測

地域の世界の防衛向けアビオニクステストシステムの動向と予測

北米

促進要因、抑制要因、課題

PEST

市場予測とシナリオ分析

主要企業

サプライヤーのTierの情勢

企業ベンチマーク

欧州

中東

アジア太平洋

南米

世界の防衛向けアビオニクステストシステム国の分析

米国

防衛プログラム

最新ニュース

特許

市場予測とシナリオ分析

カナダ

イタリア

フランス

ドイツ

オランダ

ベルギー

スペイン

スウェーデン

ギリシャ

オーストラリア

南アフリカ

インド

中国

ロシア

韓国

日本

マレーシア

シンガポール

ブラジル

世界の防衛向けアビオニクステストシステムの機会マトリクス

世界の防衛向けアビオニクステストシステムに関する専門家の意見

結論

Aviation and Defense Market Reportsについて

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Product Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Product Type, 2025-2035

List of Figures

- Figure 1: Global Avionics Test Systems Market Forecast, 2025-2035

- Figure 2: Global Avionics Test Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Avionics Test Systems Market Forecast, By Platform, 2025-2035

- Figure 4: Global Avionics Test Systems Market Forecast, By Application, 2025-2035

- Figure 5: Global Avionics Test Systems Market Forecast, By Product Type, 2025-2035

- Figure 6: North America, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 7: Europe, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 9: APAC, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 10: South America, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 11: United States, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 12: United States, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 13: Canada, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 15: Italy, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 17: France, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 18: France, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 19: Germany, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 25: Spain, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 31: Australia, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 33: India, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 34: India, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 35: China, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 36: China, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 41: Japan, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Avionics Test Systems Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Avionics Test Systems Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Avionics Test Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Avionics Test Systems Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Avionics Test Systems Market, By Platform (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Avionics Test Systems Market, By Platform (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Avionics Test Systems Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Avionics Test Systems Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Avionics Test Systems Market, By Product Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Avionics Test Systems Market, By Product Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Avionics Test Systems Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Avionics Test Systems Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Avionics Test Systems Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Avionics Test Systems Market, By Region, 2025-2035

- Figure 61: Scenario 1, Avionics Test Systems Market, By Platform, 2025-2035

- Figure 62: Scenario 1, Avionics Test Systems Market, By Application, 2025-2035

- Figure 63: Scenario 1, Avionics Test Systems Market, By Product Type, 2025-2035

- Figure 64: Scenario 2, Avionics Test Systems Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Avionics Test Systems Market, By Region, 2025-2035

- Figure 66: Scenario 2, Avionics Test Systems Market, By Platform, 2025-2035

- Figure 67: Scenario 2, Avionics Test Systems Market, By Application, 2025-2035

- Figure 68: Scenario 2, Avionics Test Systems Market, By Product Type, 2025-2035

- Figure 69: Company Benchmark, Avionics Test Systems Market, 2025-2035

The Global Avionics Test Systems market is estimated at USD 4.29 billion in 2025, projected to grow to USD 7.02 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.05% over the forecast period 2025-2035.

Introduction to Avionics Test Systems Market:

Defense avionics test systems are essential for maintaining the operational integrity and mission readiness of modern military aircraft. These systems provide the foundation for testing and validating the complex electronic subsystems that govern flight control, threat detection, communication, weapons delivery, and navigation in both manned and unmanned platforms. Unlike their commercial counterparts, defense avionics must perform under extreme conditions, withstand hostile environments, and integrate seamlessly into broader combat systems. As such, their testing requirements are significantly more rigorous, necessitating specialized equipment and procedures capable of replicating battlefield stressors and mission-specific scenarios. Test systems support every phase of an aircraft's lifecycle, from development and prototyping to deployment and sustainment, helping ensure that no failure compromises operational effectiveness or personnel safety. Globally, defense organizations rely on advanced testing platforms to support rapidly evolving electronic warfare requirements and to integrate cutting-edge avionics into legacy airframes. These systems are also critical for training technical personnel, diagnosing system anomalies, and validating mission upgrades. As military forces continue to pursue greater agility and system interoperability, avionics test systems offer a secure, controlled, and cost-effective means of ensuring aircraft systems perform flawlessly when stakes are highest. Their strategic role in defense aviation underscores their value in a fast-changing global security environment.

Technology Impact in Avionics Test Systems Market:

Technological innovation is transforming defense avionics test systems into powerful, adaptive tools that keep pace with increasingly sophisticated military aircraft. These systems have evolved from rigid, platform-specific tools into modular solutions capable of testing a wide array of subsystems across various aircraft. The inclusion of embedded software diagnostics allows technicians to simulate complex combat scenarios and evaluate system behavior in near real-time, all within a controlled environment. Artificial intelligence and machine learning are beginning to play a role in predictive maintenance and fault analysis, identifying issues before they become mission-critical. Test systems are now being integrated with digital avionics suites through standardized interfaces, enabling quicker system updates and smoother testing processes. Virtualized environments and hardware-in-the-loop simulations allow for comprehensive validation of avionics software and hardware, supporting remote and distributed testing architectures. Advanced data visualization tools provide technicians and engineers with intuitive insights into system performance, reducing the learning curve and minimizing downtime. These innovations also support cyber-hardening efforts, enabling defense organizations to test system resilience against potential intrusions and electronic warfare tactics. As avionics systems grow more interconnected and data-driven, the technologies underpinning test platforms will remain central to ensuring secure, resilient, and mission-ready defense aviation systems.

Key Drivers in Avionics Test Systems Market:

The expansion of electronic warfare capabilities, modernization of air fleets, and need for rapid deployment are among the primary forces driving global investment in defense avionics test systems. As military operations grow more reliant on digital avionics and multi-domain integration, the pressure to maintain high performance and operational continuity has never been greater. Defense planners are emphasizing the importance of diagnostics and validation tools that can identify faults quickly, support continuous system updates, and reduce the risk of mission failure. Integration of advanced sensors, adaptive flight controls, and mission-critical communications has made testing more complex, requiring platforms that can manage multiple protocols and system interfaces simultaneously. The need for long-term sustainment of both legacy and next-generation aircraft is also fueling demand for flexible, upgradable test solutions that extend platform life while accommodating future technologies. In addition, geopolitical tensions and accelerated readiness cycles are compelling military forces to streamline testing to reduce aircraft downtime and support real-time decision-making. Regulatory compliance, cybersecurity mandates, and the growth of autonomous aerial systems are adding further layers of complexity that only robust, scalable testing environments can manage effectively. These drivers underscore the growing reliance on avionics test systems as a core pillar of strategic defense operations worldwide.

Regional Trends in Avionics Test Systems Market:

Regional dynamics are shaping the development and adoption of defense avionics test systems in diverse ways. In North America, the focus is on supporting large-scale modernization programs that require test systems to accommodate both cutting-edge technology and extensive legacy fleets. Emphasis is placed on open architecture and interoperability to streamline maintenance and enhance force integration. European defense programs prioritize multinational collaboration, and simulation-rich testing platforms are used to standardize protocols across allied forces and joint aircraft initiatives. The Asia-Pacific region, with its expanding defense budgets and growing investment in indigenous air power, is increasingly adopting versatile, scalable testing solutions that support locally developed avionics and hybrid fleet configurations. These systems are often tailored to meet regional terrain challenges, maritime surveillance roles, and forward-deployed readiness. In the Middle East, the focus is on integrating advanced avionics into multi-role platforms, and test systems are being deployed to maintain performance under extreme environmental conditions. Latin America and Africa are gradually enhancing their testing capabilities through international cooperation and technology transfer, enabling broader access to state-of-the-art avionics maintenance and training infrastructure. Across regions, the common thread is a recognition of the strategic value of avionics test systems in safeguarding mission effectiveness and technological sovereignty.

Key Avionics Test Systems Program:

In a bid to preserve U.S. leadership in assault-utility rotorcraft, the Army is prioritizing the launch of the Future Long-Range Assault Aircraft (FLRAA) as a key element of its Future Vertical Lift (FVL) program. This initiative aims to develop a highly advanced fleet of aircraft capable of providing the essential capabilities needed by military services to deter threats, engage in combat, and achieve victory in the future. The FLRAA will replace the iconic UH-60 Black Hawk, which has long been the backbone of the tactical-utility helicopter fleet for the U.S. Army, Air Force, Navy, Coast Guard, and several allied nations. First introduced in 1979, the Black Hawk has played a vital role in conflicts in Afghanistan, Iraq, and beyond. Over the past four decades, the aircraft has undergone numerous upgrades, driven by Sikorsky and key suppliers like Honeywell, ensuring that this Cold War-era platform remains effective and relevant for modern-day military operations.

Table of Contents

Global Avionics Test Systems in defense- Table of Contents

Global Avionics Test Systems in defense Report Definition

Global Avionics Test Systems in defense Segmentation

By Region

By Platform

By Product Type

By Application

Global Avionics Test Systems in defense Analysis for next 10 Years

The 10-year Global Avionics Test Systems in defense analysis would give a detailed overview of Global Avionics Test Systems in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Avionics Test Systems in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Avionics Test Systems in defense Forecast

The 10-year Global Avionics Test Systems in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Avionics Test Systems in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Avionics Test Systems in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Avionics Test Systems in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Avionics Test Systems in defense

Hear from our experts their opinion of the possible analysis for this market.