|

市場調査レポート

商品コード

1838162

地雷探知機の世界市場:2025年~2035年Global Mine Detection Market 2025-2035 |

||||||

|

|||||||

| 地雷探知機の世界市場:2025年~2035年 |

|

出版日: 2025年10月13日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

概要

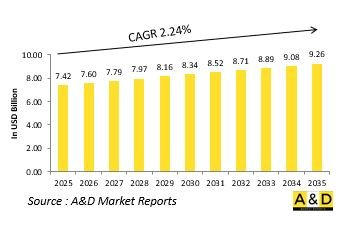

世界の地雷探知機の市場規模は、2025年に74億2,000万米ドルと推定され、2035年までに92億6,000万米ドルに成長すると予測されており、予測期間の2025年~2035年の年間平均成長率(CAGR)は2.24%と見込まれています。

地雷探知機市場のイントロダクション

防衛用地雷探知機市場は、陸上および海上環境における隠れた爆発性脅威の特定と無力化に重点を置く、近代的な軍事作戦の重要な構成要素です。これらのシステムは、戦闘任務と平和維持任務の両方において、人員、車両、インフラの安全を確保するために不可欠です。地雷探知機技術は、地雷、即席爆発装置、海底地雷がもたらすリスクを軽減するために、戦場整理、国境警備、紛争後の復興において幅広く使用されています。この市場には、多様な地形で地雷の位置を特定するために設計されたハンドヘルド探知機、地上貫通レーダー、無人車両、空中センサーなど、幅広い機器が含まれます。軍事作戦が非対称戦争やハイブリッド戦争へとますますシフトする中、地雷探知機能力の重要性は高まり続けています。軍隊は、機動性を維持し、作戦中の死傷者を防ぐために、迅速かつ正確な探知ツールに依存しています。最新の地雷探知機システムは、高度なセンシング、イメージング、データ処理技術を組み合わせて、リアルタイムで正確な結果を提供します。市場の拡大は、長引く紛争の影響を受けた地域の地雷除去を目的とした人道的イニシアチブによっても推進されています。安全性と効率性が最優先事項である防衛地雷探知機市場は、紛争後や紛争環境において作戦の有効性を確保し、安定性を回復するために不可欠な存在であり続けています。

地雷探知機市場における技術の影響:

技術革新は、精度、スピード、オペレーターの安全性を高めることで、防衛地雷探知機市場を再形成しています。従来の手作業による探知方法は、高度なセンサー、人工知能、自動化を統合した洗練されたシステムに取って代わられたり、補完されたりしています。地中レーダー、電磁誘導、化学センサーは、複雑な環境に隠された金属製と非金属製の爆発物を検出するために改良されています。これらの技術は、埋設された地雷の種類、深さ、形状をより高い信頼性で特定することを可能にする高解像度画像を提供します。自律型地上・空中プラットフォームは、人間が直接関与することなく危険地帯の偵察やマッピングを行うことで、探知活動に革命をもたらしています。機械学習アルゴリズムの統合により、時間の経過とともに改善される適応型探知が可能になり、誤報を最小限に抑え、任務効率を最適化します。データ・フュージョン技術は、複数のセンサーからの入力を組み合わせ、脅威の状況を包括的に把握します。さらに、軽量で頑丈な素材により、現場での運用における可搬性と耐久性が向上しています。デジタル通信ネットワークとリアルタイムのデータ伝送の融合は、より迅速な意思決定と部隊間の連携強化を保証します。国防軍がより高い精度と安全性を追求する中、こうした技術の進歩により、地雷探知機は労働集約的な作業から、高度に自動化されたインテリジェンス主導の能力へと変貌を遂げ、近代的な軍事ミッションに不可欠なものとなっています。

地雷探知機市場の主な促進要因:

防衛用地雷探知機市場は、軍の機動性と人道活動を危険にさらす爆発性危険物の持続的な脅威によって牽引されています。紛争地帯での地雷や即席爆発装置の使用増加により、兵士と民間人を同様に保護する高度な検出機能の必要性が強調されています。政府や防衛機関は、より高い精度、より速い応答時間、多様な環境条件下で機能する能力を提供する最新の検知システムへの投資を優先しています。現在進行中の軍の近代化と対反乱活動により、最先端の検知技術の採用がさらに加速しています。隠された爆発物がロジスティクスを混乱させ、移動を制限するために使用されるハイブリッド戦の普及が進んでいるため、携帯型、自律型、無人検出プラットフォームへの需要が高まっています。国際的な協力関係によって支えられている人道的な地雷除去イニシアチブも、各国が戦災地域への安全なアクセスの回復に向けて取り組んでいることから、市場の成長に大きく寄与しています。もう一つの重要な推進力は、脅威の自動識別とマッピングを可能にする人工インテリジェンスとセンサー・フュージョンの地雷探知機作業への統合です。このような進歩は、作戦の安全性を高め、危険にさらされる機会を減らし、戦術的優位性を維持するという、より広範な軍事的目的に合致しています。これらの要因を総合すると、防衛地雷探知機市場における持続的な需要と革新が確実なものとなります。

地雷探知機市場の地域動向:

防衛用地雷探知機市場の地域動向は、さまざまなレベルの紛争、地形課題、近代化の優先順位によって形成されます。過去または現在進行中の紛争の影響を受けた地域は、安全を回復し復興を可能にするために地雷除去作業に多額の投資を続けています。多様な地域にわたる軍事近代化プログラムが、従来の爆発物と即席爆発物の両方の脅威に対処できる統合型地雷探知機システムの需要を促進しています。技術先進地域では、防衛機関が、より迅速かつ正確な結果を得るために、自動化、ロボット工学、AIを活用したデータ分析を組み合わせた次世代検知プラットフォームの開発と配備に注力しています。一方、新興防衛市場では、国境警備や対反乱戦の要件に対応するため、費用対効果が高く、しかも信頼性の高いシステムの導入が進んでいます。協力的な防衛プログラムや国際的なパートナーシップは、地域の能力を高めるための技術移転や共有訓練を促進しています。海洋地域では、航路や沿岸インフラを保護するために水中機雷探知に重点を置き、深海監視のためにソナーや無人水中ビークルを統合する動きが広がっています。一方、内陸諸国は、戦術的な現場活動のために、地上ベースおよび車両搭載型システムを重視しています。全体として、複雑な安全保障環境において安全性、機動性、任務の継続性を確保する、高度で適応性があり、相互運用可能な地雷探知機技術を採用しようとする世界的な動きが、地域的な力学によって浮き彫りにされています。

主要な地雷探知機プログラム

Northrop Grumman Corporation (NOC) は、韓国航空宇宙産業(KAI)から航空機搭載型地雷探知機の供給契約を受注しました。(KAI)より、韓国地雷対策ヘリコプター(KMCH)プログラムのエンジニアリング、製造、設計(EMD)段階において、空中レーザー地雷探知機システム(ALMDS)ソリューションを供給し、技術サポートを提供する契約を獲得しました。EMDフェーズは2027年に完了する予定です。ALMDSは昼夜を問わず無拘束での運用を可能にし、効率的な地雷検知のための高エリア探索率を達成します。さらに、地雷対策活動の全体的な有効性を高めるため、特定された地雷のその後の無効化を促進する正確なターゲット地理位置データを提供します。

目次

地雷探知機市場レポート- 目次

地雷探知機市場レポートの定義

地雷探知機市場セグメンテーション

地域別

プラットフォーム別

タイプ別

今後10年間の地雷探知機市場分析

この章では、10年間の地雷検出市場分析により、地雷検出市場の成長、変化する動向、技術採用の概要、および市場の魅力について詳細な概要が示されます。

地雷探知機市場の市場技術

このセグメントでは、この市場に影響を与えると予想される上位10の技術と、これらの技術が市場全体に与える可能性のある影響について説明します。

世界の地雷探知機市場予測

この市場の10年間の地雷探知機市場予測は、上記のセグメント全体で詳細に説明されています。

地域別地雷探知機市場動向と予測

このセグメントでは、地域別の地雷探知機市場動向、促進要因、抑制要因、課題、そして政治、経済、社会、技術といった側面を網羅しています。また、地域別の市場予測とシナリオ分析も詳細に取り上げています。地域分析の最終段階では、主要企業のプロファイリング、サプライヤーの情勢、企業ベンチマークなどについて分析しています。現在の市場規模は、通常のシナリオに基づいて推定されています。

北米

促進要因、抑制要因、課題

PEST

市場予測とシナリオ分析

主要企業

サプライヤー階層の情勢

企業ベンチマーク

欧州

中東

アジア太平洋

南米

地雷探知機市場の国別分析

この章では、この市場における主要な防衛プログラムを取り上げ、この市場で申請された最新のニュースや特許についても解説します。また、国レベルの10年間の市場予測とシナリオ分析についても解説します。

米国

防衛プログラム

最新ニュース

特許

この市場における現在の技術成熟度

市場予測とシナリオ分析

カナダ

イタリア

フランス

ドイツ

オランダ

ベルギー

スペイン

スウェーデン

ギリシャ

オーストラリア

南アフリカ

インド

中国

ロシア

韓国

日本

マレーシア

シンガポール

ブラジル

地雷探知機市場の機会マトリックス

機会マトリックスは、読者がこの市場における機会の高いセグメントを理解するのに役立ちます。

地雷探知機市場レポートに関する専門家の意見

この市場の分析の可能性について、当社の専門家の意見をお届けします。