|

市場調査レポート

商品コード

1930542

航空機搭載型ISRの世界市場:2026年~2036年Global Airborne ISR Market 2026-2036 |

||||||

|

|||||||

| 航空機搭載型ISRの世界市場:2026年~2036年 |

|

出版日: 2026年02月04日

発行: Aviation & Defense Market Reports (A&D)

ページ情報: 英文 150+ Pages

納期: 3営業日

|

概要

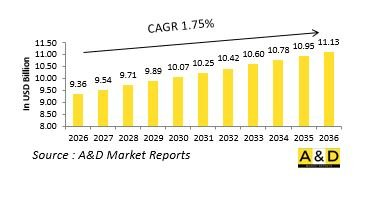

世界の航空機搭載型ISRの市場規模は、2026年に93億6,000万米ドルと推定され、2026年から2036年までの予測期間においてCAGR 1.75%で成長し、2036年までに111億3,000万米ドルに達すると見込まれています。

イントロダクション

航空機搭載型情報収集・監視・偵察(ISR)能力は、広大な作戦空間における持続的な観測と情報優位性を提供することで、現代の状況認識の基盤を形成しています。これらの能力により、軍隊は敵対勢力の活動を監視し、地形を評価し、移動を追跡し、戦術・作戦・戦略レベルでの意思決定を支援することが可能となります。航空機搭載型ISRプラットフォームは、有人航空機やヘリコプターから長距離航続型無人システムまで幅広い範囲で運用され、それぞれがカバー範囲と応答性において独自の利点を提供しています。航空機搭載ISRの価値は、動的な環境下で柔軟性を維持しつつ、タイムリーかつ実用的な情報を提供できる点にあります。紛争が分散化・争奪化された領域で展開する中、航空機搭載ISRは早期警戒、脅威インテリジェンス、作戦計画を支援します。また、国境監視、海上哨戒、災害対応、人道支援活動といった非戦闘作戦においても重要な役割を果たします。リアルタイム情報への依存度が高まる中、航空機搭載型ISRは支援機能から作戦を決定づける重要な要素へと格上げされました。指揮統制システムや攻撃資産との統合は、情報優位性と作戦の一貫性を達成する上での重要性を裏付けています。

航空機搭載ISRにおける技術的影響

技術革新は航空機搭載ISRシステムの適用範囲と有効性を著しく拡大しています。センサー技術の進歩により、高解像度画像取得、多波長分析、悪天候・低視程条件下での探知能力が向上しました。信号処理技術の進展は大量データの迅速な解析を可能にし、収集から情報伝達までの時間を短縮します。人工知能は自動目標認識と異常検知を強化し、意思決定サイクルの高速化を支援します。安全なデータリンクは、司令部や展開部隊への情報伝達を途切れなく行います。プラットフォームの持続性向上により、任務時間とカバー範囲が拡大しています。小型化により、先進的なセンサーをより小型で機動性の高いプラットフォームに搭載することが可能となりました。単一プラットフォームへの複数センサータイプの統合は、包括的な情報収集を支援します。これらの技術的発展により、航空機搭載型ISRは、複雑なマルチドメイン作戦を支援できる、継続的かつ適応性の高い情報資源へと変貌を遂げています。

航空機搭載ISRの主要促進要因

航空機搭載型ISR能力の拡大は、現代の安全保障環境の複雑化によって推進されています。軍事作戦は分散した部隊の管理や急速に変化する脅威への対応において、正確かつタイムリーな情報への依存度を高めています。国境警備や海洋領域認識の要件は、継続的な監視需要を持続させています。非対称的脅威の台頭は、持続的な監視と迅速な情報拡散を必要とします。防衛近代化プログラムは情報優位性とネットワーク化された作戦を優先事項としています。同盟軍間の相互運用性は、標準化と情報共有フレームワークを推進します。無人システムの普及は、ISRの到達範囲と柔軟性をさらに拡大します。訓練と即応態勢の考慮事項も、ISRプラットフォームと分析技術への投資に影響を与えます。これらの促進要因が相まって、中核的な防衛機能としての航空情報能力への持続的な重点が確保されています。

航空ISRの地域的動向

地域ごとの航空ISR導入状況は、多様な作戦上のニーズと地理的課題を反映しています。北米の防衛部隊は、長距離監視と統合軍・同盟ネットワーク間での連携に重点を置いています。欧州諸国は国境を越えた情報共有と、航空・海上アプローチの持続的監視を重視しています。アジア太平洋地域では、広大な海洋空間と複雑な領土環境を管理するため、ISRを優先しています。中東諸国の軍隊は、不安定な安全保障環境下での継続的な状況認識のために、航空機搭載型ISRに依存しています。アフリカの防衛組織は、国境監視や平和維持活動を支援するため、ISRプラットフォームをますます活用しています。地域を問わず、投資はデータ融合の強化、プラットフォームの持続性向上、国内能力開発に向けられています。これらの動向は、航空機搭載型ISR戦略が地域の安全保障上の優先事項や作戦上の現実とどのように整合しているかを示しています。

主要な航空機搭載型ISRプログラム:

Northrop Grummanは2025年初頭、航空機搭載型情報収集・監視・偵察プラットフォームを含む、世界の航空・ミサイル防衛能力の近代化に向け、14億米ドルの契約を獲得しました。同社は引き続き、米国陸軍の固定翼ISR航空機近代化を支援しており、地上指揮官や統合任務部隊を支援する持続的な広域監視任務に向け、センサーのアップグレード、データ融合能力、航続距離延長改修に焦点を当てた、最大7億5,000万米ドル規模のプログラムを実施中です。

目次

航空機搭載型ISR市場- 目次

航空機搭載型ISR市場レポートの定義

航空機搭載型ISR市場セグメンテーション

用途別

地域別

航空機タイプ別

今後10年間の航空機搭載型ISR市場分析

この章では、10年間の航空機搭載型ISR市場分析により、航空機搭載型ISR市場の成長、変化する動向、技術採用の概要、および市場の魅力について詳細な概要が示されます。

航空機搭載型ISR市場の市場技術

このセグメントでは、この市場に影響を与えると予想される上位10の技術と、これらの技術が市場全体に与える可能性のある影響について説明します。

世界の航空機搭載型ISR市場予測

この市場の10年間の航空機搭載型ISR市場予測は、上記のセグメント全体で詳細にカバーされています。

地域別航空機搭載型ISR市場動向と予測

このセグメントでは、地域別の航空機搭載型ISR市場の動向、促進要因、抑制要因、課題、そして政治、経済、社会、技術といった側面を網羅しています。また、地域別の市場予測とシナリオ分析も詳細に取り上げています。地域分析の最後の部分では、主要企業のプロファイリング、サプライヤーの状況、企業ベンチマークなどについて分析しています。現在の市場規模は、通常のシナリオに基づいて推定されています。

北米

促進要因、抑制要因、課題

PEST

市場予測とシナリオ分析

主要企業

サプライヤー階層の状況

企業ベンチマーク

欧州

中東

アジア太平洋

南米

航空機搭載型ISR市場の国別分析

この章では、この市場における主要な防衛プログラムを取り上げ、この市場で申請された最新のニュースや特許についても解説します。また、国レベルの10年間の市場予測とシナリオ分析についても解説します。

米国

最新ニュース

特許

この市場における現在の技術成熟度

市場予測とシナリオ分析

カナダ

イタリア

フランス

ドイツ

オランダ

ベルギー

スペイン

スウェーデン

ギリシャ

オーストラリア

南アフリカ

インド

中国

ロシア

韓国

日本

マレーシア

シンガポール

ブラジル

航空機搭載型ISR市場の機会マトリックス

機会マトリックスは、読者がこの市場における機会の高いセグメントを理解するのに役立ちます。

航空機搭載型ISR市場レポートに関する専門家の意見

この市場の分析の可能性について、当社の専門家の意見をまとめています。