|

|

市場調査レポート

商品コード

1641380

非経口栄養の世界市場:注目の洞察(2024年~2029年)Global Parenteral Nutrition Market - Focused Insights 2024-2029 |

||||||

|

|||||||

| 非経口栄養の世界市場:注目の洞察(2024年~2029年) |

|

出版日: 2025年01月21日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 155 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

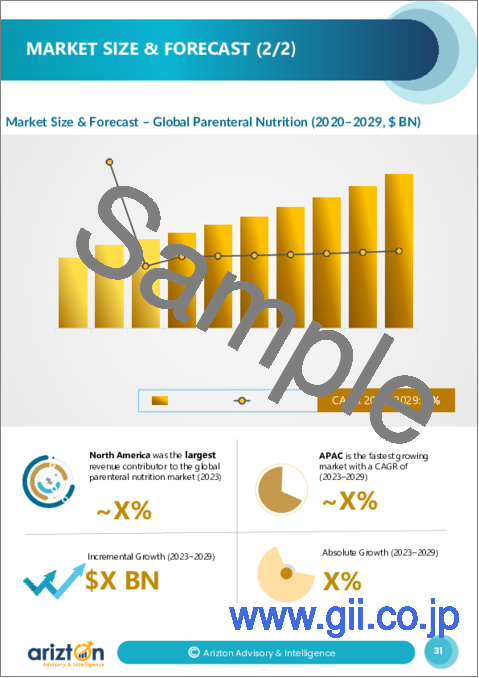

世界の非経口栄養の市場規模は、2023年から2029年にかけて8.24%のCAGRで成長すると予測されています。

2023年、American Regentは、リン酸カリウムと同様の機能を持つリン酸カリウム注射剤USPを導入しました。このFDA承認製品は、食物や栄養チューブから十分なリンを摂取できない子供や大人に、静脈内液でリンを供給します。Otsuka Pharmaceutical Co., Ltd. は、2022年に日本初の末梢静脈栄養液「エネフルイド注」の承認を取得しました。この革新的な製品は、脂肪と水溶性ビタミン、ブドウ糖、電解質、アミノ酸を二重室バッグに配合しています。この承認により、同社の製品ポートフォリオが大幅に強化され、市場の成長に貢献しました。

2022年、Fresenius KabiはIvenix, Inc.の買収を完了し、米国の輸液療法市場における地位を強化しました。この買収により、業界をリードする包括的でプレミアムな輸液療法製品の提供が実現し、患者、顧客、利害関係者に利益をもたらすとともに、フレゼニウスカビの非経口栄養製品のラインアップが拡大しました。

2022年、Fresenius Kabiは、米国の小児患者向けに脂質注射用乳剤(ILE)を発売すると発表しました。対象は満期産児と早産児の両方です。この製品は、あらゆる年齢層の非経口栄養に使用することが承認された、初めてかつ唯一の4オイル脂質乳剤となりました。

ヘルスケア業界が栄養補給の安全性、効率性、費用対効果を重視していることを反映して、プレミックス非経口栄養剤(PN)の使用が増加しています。プレミックスPNソリューションは、すぐに使用できる標準化された栄養剤であり、ヘルスケアの現場での調合や手作業による調製の必要性を減らします。この利便性は、救急科や救命救急科など、迅速な対応が必要な病院や診療所で特に役立ちます。プレミックス製剤は調製プロセスを簡素化し、ヘルスケア提供者の時間を節約し、患者の安全にとって重要な栄養素の手作業による混合に伴う人為的ミスのリスクを減らします。プレミックスPNの採用が増えている主な要因の1つは、プレミックス製剤が提供する無菌性と安定性の向上です。プレミックス製剤は管理された環境で製造されるため、厳格な品質および安全基準を満たし、社内での調合から生じる可能性のある汚染のリスクを最小限に抑えます。この無菌性は、直接血流に投与されるため、わずかな汚染でも深刻な合併症につながる可能性があるPNでは特に重要です。ヘルスケア施設では、プレミックスPNを使用すると、保管、取り扱い、輸送も容易になります。これらの製剤は通常、保存期間が長く、パッケージが標準化されているため、さまざまなケア環境で便利かつ多用途に使用できます。

非経口栄養(PN)市場における主な課題は、一部の新しい技術や製剤の有効性と安全性を裏付ける強力な臨床的証拠が不足していることです。新しい製剤、投与システム、自動調合などの革新的技術など、PNの進歩は可能性を秘めていますが、広範な臨床試験や長期データがないため、広範な導入が制限されています。十分な臨床的証拠がなければ、ヘルスケア提供者は新しい技術を患者ケアに取り入れることをためらい、安全性が実証された確立された方法を好む可能性があります。これにより、患者の転帰を改善し、合併症を減らし、よりパーソナライズされた栄養サポートを提供できる可能性のある革新的技術の導入が遅れる可能性があります。さらに、規制当局はこれらの新しい技術を承認する前にさらに実質的な証拠を要求する可能性があり、市場への導入が遅れることがあります。

当レポートでは、世界の非経口栄養市場について調査し、市場の概要とともに、製品別、栄養別、患者グループ別、適応症別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 非経口栄養市場概要

- エグゼクティブサマリー

- 主な調査結果

第2章 非経口栄養市場

- 世界:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

第3章 非経口栄養市場の見通しと機会

- 非経口栄養市場の機会と動向

- 非経口栄養市場促進要因

- 非経口栄養市場の抑制要因

第4章 非経口栄養市場セグメンテーションデータ

- 世界:製品別の予想収益(2020年~2029年、10億米ドル)

- 世界:栄養別の収益予測(2020年~2029年、10億米ドル)

- 世界:患者グループ別の予想収益(2020年~2029年、10億米ドル)

- 世界:適応症別の収益予測(2020年~2029年、10億米ドル)

- 世界:エンドユーザー別の収益予測(2020年~2029年、10億米ドル)

第5章 主要地域の概要

- 北米:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

- 米国

- カナダ

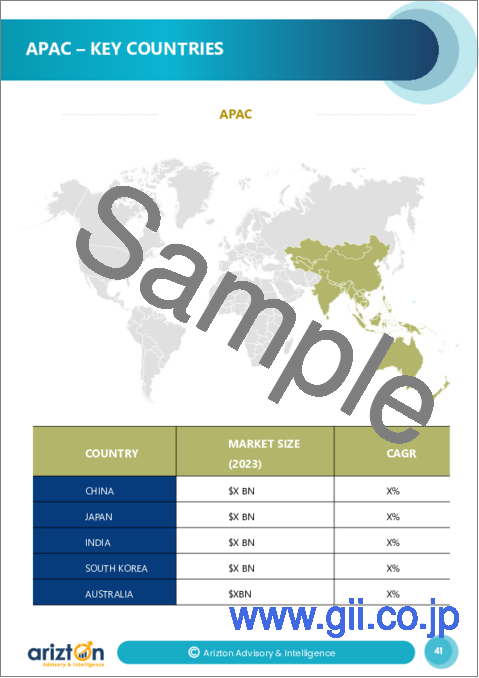

- アジア太平洋:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- 欧州:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ラテンアメリカ:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ:非経口栄養市場の収益予測(2020年~2029年、10億米ドル)

- トルコ

- 南アフリカ

- サウジアラビア

第6章 非経口栄養市場の業界概要

- 非経口栄養市場-競合情勢

- 非経口栄養市場- 主要ベンダーのプロファイル

- 非経口栄養市場- その他の主要ベンダー

- 非経口栄養市場- 主要な戦略的推奨事項

第7章 付録

LIST OF EXHIBITS

- Exhibit 1: Market Size & Forecast - Global Parenteral Nutrition Market (2020-2029, $ BN)

- Exhibit 2: Market Size & Forecast - Macronutrients (2020-2029, $ BN)

- Exhibit 3: Market Size & Forecast - Automated Compounds (2020-2029, $ BN)

- Exhibit 4: Market Size & Forecast - Micronutrients (2020-2029, $ BN)

- Exhibit 5: Market Size & Forecast - RTU/Standard Commercial PN (2020-2029, $ BN)

- Exhibit 6: Market Size & Forecast - Compounded PN (2020-2029, $ BN)

- Exhibit 7: Market Size & Forecast - Pediatric Patient Group (2020-2029, $ BN)

- Exhibit 8: Market Size & Forecast - Adult Patient Group (2020-2029, $ BN)

- Exhibit 9: Market Size & Forecast - Short-term (2020-2029, $ BN)

- Exhibit 10: Market Size & Forecast - Long-term (2020-2029, $ BN)

- Exhibit 11: Market Size & Forecast - Hospitals (2020-2029, $ BN)

- Exhibit 12: Market Size & Forecast - Home Care & Long-term Care Settings (2020-2029, $ BN)

- Exhibit 13: Market Size & Forecast - Ambulatory Care Settings (2020-2029, $ BN)

- Exhibit 14: Market Size & Forecast - Parenteral Nutrition Market in North America (2020-2029, $ BN)

- Exhibit 15: Market Size & Forecast - Parenteral Nutrition Market in the US (2020-2029, $ BN)

- Exhibit 16: Market Size & Forecast - Parenteral Nutrition Market in Canada (2020-2029, $ BN)

- Exhibit 17: Market Size & Forecast - Parenteral Nutrition Market in APAC (2020-2029, $ BN)

- Exhibit 18: Market Size & Forecast - Parenteral Nutrition Market in China (2020-2029, $ BN)

- Exhibit 19: Market Size & Forecast - Parenteral Nutrition Market in Japan (2020-2029, $ BN)

- Exhibit 20: Market Size & Forecast - Parenteral Nutrition Market in India (2020-2029, $ BN)

- Exhibit 21: Market Size & Forecast - Parenteral Nutrition Market in South Korea (2020-2029, $ BN)

- Exhibit 22: Market Size & Forecast - Parenteral Nutrition Market in Australia (2020-2029, $ BN)

- Exhibit 23: Market Size & Forecast - Parenteral Nutrition Market in Europe (2020-2029, $ BN)

- Exhibit 24: Market Size & Forecast - Parenteral Nutrition Market in Germany (2020-2029, $ BN)

- Exhibit 25: Market Size & Forecast - Parenteral Nutrition Market in France (2020-2029, $ BN)

- Exhibit 26: Market Size & Forecast - Parenteral Nutrition Market in the UK (2020-2029, $ BN)

- Exhibit 27: Market Size & Forecast - Parenteral Nutrition Market in Italy (2020-2029, $ BN)

- Exhibit 28: Market Size & Forecast - Parenteral Nutrition Market in Spain (2020-2029, $ BN)

- Exhibit 29: Market Size & Forecast - Parenteral Nutrition Market in Latin America (2020-2029, $ BN)

- Exhibit 30: Market Size & Forecast - Parenteral Nutrition in Mexico (2020-2029, $ BN)

- Exhibit 31: Market Size & Forecast - Parenteral Nutrition in Brazil (2020-2029, $ BN)

- Exhibit 32: Market Size & Forecast - Parenteral Nutrition in Argentina (2020-2029, $ BN)

- Exhibit 33: Market Size & Forecast - Parenteral Nutrition in the MEA (2020-2029, $ BN)

- Exhibit 34: Market Size & Forecast - Parenteral Nutrition in Turkey (2020-2029, $ BN)

- Exhibit 35: Market Size & Forecast - Parenteral Nutrition in South Africa (2020-2029, $ BN)

- Exhibit 36: Market Size & Forecast - Parenteral Nutrition in Saudi Arabia (2020-2029, $ BN)

LIST OF TABLES

- Table 1: Global Parenteral Nutrition Market (2020-2029, $ BN)

- Table 2: Global Parenteral Nutrition Market by Product (2020-2029, %)

- Table 3: Global Parenteral Nutrition Market by Product (2020-2029, $ BN)

- Table 4: Global Parenteral Nutrition Market by Nutrition (2020-2029, %)

- Table 5: Global Parenteral Nutrition Market by Nutrition (2020-2029, $ BN)

- Table 6: Global Parenteral Nutrition Market by Patient Group (2020-2029, %)

- Table 7: Global Parenteral Nutrition Market by Patient Group (2020-2029, $ BN)

- Table 8: Global Parenteral Nutrition Market by Indication (2020-2029, %)

- Table 9: Global Parenteral Nutrition Market by Indication (2020-2029, $ BN)

- Table 10: Global Parenteral Nutrition Market by End-user (2020-2029, %)

- Table 11: Global Parenteral Nutrition Market by End-user (2020-2029, $ BN)

- Table 12: Global Parenteral Nutrition Market by Geography (2020-2029, %)

- Table 13: Global Parenteral Nutrition Market by Geography (2020-2029, $ BN)

The global parenteral nutrition market is expected to grow at a CAGR of 8.24% from 2023 to 2029.

RECENT VENDORS ACTIVITIES

- In 2023, American Regent introduced Potassium Phosphates Injection USP, which functions similarly to Potassium Phosphates. This FDA-approved product provides phosphorus in intravenous fluids for children and adults who are unable to obtain sufficient phosphorus from food or feeding tubes.

- In 2022, Otsuka Pharmaceutical Co., Ltd. received approval for ENEFLUID Injection, Japan's first peripheral parenteral nutrition solution. This innovative product combines fat and water-soluble vitamins, along with glucose, electrolytes, and amino acids, in a dual-chamber bag. The approval significantly enhanced the company's product portfolio and contributed to its market growth.

- In 2022, Fresenius Kabi completed the acquisition of Ivenix, Inc., strengthening its position in the U.S. infusion therapy market. This acquisition created a comprehensive, industry-leading offering of premium infusion therapy products, benefiting patients, customers, and stakeholders, while expanding Fresenius Kabi's range of parenteral nutrition products.

- In 2022, Fresenius Kabi announced that its Lipid Injectable Emulsion (ILE) would be available for pediatric patients in the U.S., including both full-term and preterm newborns. This product became the first and only four-oil lipid emulsion approved for use in parenteral nutrition across all age groups.

KEY TAKEAWAYS

- By Product: The macronutrient segment holds the largest market share of 66%. The segmental growth is due to advancements in clinical understanding and patient-specific requirements.

- By Nutrition: The compounded PN segment shows the highest growth of 10.33%, as they play a critical role in providing tailored nutritional solutions for patients with specific medical needs.

- By Patient Group: The adult segment holds the largest market share due to malnutrition being a significant concern in adult populations.

- By Indication: The short-term segment accounts for the largest market share, as short-term parenteral nutrition (PN) continues to be a critical tool in supporting patients when enteral nutrition (EN) is insufficient or contraindicated.

- By End-User: The home care & long-term care settings segment shows the highest growth, as more patients with chronic conditions seek nutritional support at home to enhance quality of life and avoid hospital-acquired infections.

- By Geography: North America accounted for the largest share of the global parenteral nutrition market, primarily driven by the increasing prevalence of malnutrition, particularly among hospitalized patients in the U.S.

- Growth Factor: The global parenteral nutrition market is set to grow due to increased utilization of premixed PN formulations and growing preference for home parenteral nutrition.

MARKET TRENDS & DRIVERS

Increased Utilization of Premixed PN Formulations

The utilization of premixed parenteral nutrition (PN) formulations is on the rise, reflecting the healthcare industry's focus on safety, efficiency, and cost-effectiveness in delivering nutritional support. Premixed PN solutions are standardized nutrient formulas that come ready for use, reducing the need for compounding or manual preparation in healthcare settings. This convenience is especially valuable in hospitals and clinics where rapid response is necessary, such as emergency or critical care departments. Premixed formulations simplify the preparation process, saving time for healthcare providers and reducing the risk of human error associated with the manual mixing of nutrients, which is critical for patient safety. One of the major drivers behind the increased adoption of premixed PN is the enhanced sterility and stability it offers. Since premixed formulations are manufactured in controlled environments, they meet rigorous quality and safety standards, minimizing the risk of contamination that can arise from in-house compounding. This sterility is particularly crucial in PN, where even slight contamination can lead to severe complications due to direct bloodstream delivery. For healthcare facilities, using premixed PN also allows for easier storage, handling, and transportation, as these formulations typically have longer shelf lives and standardized packaging, making them convenient and versatile in various care settings.

Growing Preference for Home Parenteral Nutrition (HPN)

The growing preference for Home Parenteral Nutrition (HPN) reflects a shift toward patient-centered, at-home care, offering essential nutritional support for patients with long-term needs, such as gastrointestinal disorders and malabsorption syndromes. HPN enhances comfort, flexibility, and quality of life by allowing patients to receive treatment at home, reducing hospital visits, and freeing up healthcare resources for acute care. Technological advancements, such as portable infusion pumps and remote monitoring tools, have made HPN safer and more manageable for patients and caregivers, enabling healthcare providers to oversee progress remotely. This trend is further driven by healthcare policies promoting cost-effective, patient-focused care. HPN reduces hospitalization expenses and provides a viable alternative for long-term nutritional support. Improved insurance coverage in many regions has increased its accessibility, making HPN an increasingly preferred option for both patients and healthcare systems.

Growing Prevalence of Premature Births

The increasing prevalence of premature births globally is driving the demand for specialized neonatal care, including parenteral nutrition (PN). Premature infants, born before 37 weeks of gestation, cannot often consume or absorb adequate nutrition orally or enterally due to underdeveloped gastrointestinal systems, making PN critical for their growth and development. Rising premature birth rates, particularly in regions like Sub-Saharan Africa and parts of the U.S., have highlighted the need for nutrient-rich PN solutions that support growth, brain development, and immune function during critical early life stages. To address these needs, advancements in PN formulations enriched with essential nutrients such as trace elements, fatty acids, and micronutrients have improved neonatal care quality. These innovations reduce complications like nutrient imbalances and liver disease, improving survival rates and long-term outcomes for preterm infants in neonatal intensive care units (NICUs). As premature birth rates continue to rise, the emphasis on improving PN quality and safety grows, ensuring better support for vulnerable infants.

INDUSTRY RESTRAINTS

Lack of Clinical Evidence to Support Novel Technology

A key challenge in the parenteral nutrition (PN) market is the lack of robust clinical evidence to support the efficacy and safety of some novel technologies and formulations. While advances in PN, such as new formulations, delivery systems, and innovations like automated compounding, hold potential, the absence of extensive clinical trials and long-term data limits their widespread adoption. Without sufficient clinical evidence, healthcare providers may hesitate to incorporate new technologies into patient care, preferring established methods with proven safety profiles. This can slow down the adoption of innovations that could potentially improve patient outcomes, reduce complications, or offer more personalized nutritional support. Furthermore, regulatory agencies may require more substantial evidence before approving these new technologies, delaying their availability to the market.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The global parenteral nutrition market by product is segmented into macronutrients, automated compounds, and micronutrients. The macronutrients segment accounted for the largest market share of 66% in 2023. In the parenteral nutrition (PN) market, macronutrients such as carbohydrates, lipids, and amino acids form the core of nutritional formulas aimed at patients with compromised digestive functions or specific nutrient needs. The demand for PN with balanced macronutrient compositions has grown with advancements in clinical understanding and patient-specific requirements. Multichamber bags (MCBs) are increasingly popular, as they contain glucose, amino acids, and lipids in pre-compounded formats, streamlining the preparation and reducing error risks in both inpatient and outpatient settings. These bags are available in dual- and tri-chamber forms, with the latter containing all three primary macronutrients, which reduces manipulation and supports safer administration. The focus on macronutrient optimization aligns with the broader trends in the PN market, which is projected to grow as clinicians and manufacturers work together to improve product safety, standardization, and personalized care options.

By Product

- Macronutrients

- Automated Compounds

- Micronutrients

INSIGHTS BY NUTRITION

The global parenteral nutrition market by nutrition is categorized into RTU/standard commercial PN and compounded PN. The compounded PN segment shows prominent growth, with the fastest-growing CAGR of 10.33% during the forecast period. Compounded parenteral nutrition (PN) plays a critical role in the global parenteral nutrition market, providing tailored nutritional solutions for patients with specific medical needs. Unlike standardized PN formulas, compounded PN is custom-made, allowing healthcare providers to adjust macronutrients, micronutrients, and fluid volumes to meet individual patient requirements. This approach is especially valuable for patients with unique metabolic demands or complex health conditions, such as critically ill patients or those with organ dysfunction, who require precise nutrient management. The ability to personalize nutritional content enhances treatment efficacy, reduces the risk of nutrient imbalances, and improves overall patient outcomes, making compounded PN a growing segment within the broader PN market.

By Nutrition

- RTU/Standard Commercial PN

- Compounded PN

INSIGHTS BY PATIENT GROUP

The global parenteral nutrition market by patient group is segmented into adults and pediatric. The adult segment dominates and holds the largest market share in 2023. The adult population relying on parenteral nutrition (PN) is growing due to conditions requiring intravenous nutritional support, such as short bowel syndrome, pancreatitis, Crohn's disease, and enterocutaneous fistulas. Total Parenteral Nutrition (TPN) is crucial for adults unable to absorb nutrients through the gastrointestinal tract. As malnutrition linked to various health issues rises, comprehensive nutritional assessments and TPN interventions are vital for improving patient outcomes. Standardized diagnostic frameworks will further enhance the management of adult malnutrition in healthcare systems.

By Patient Group

- Adults

- Pediatric

INSIGHTS BY INDICATION

Based on the indication, the short-term segment holds the largest share of the global parenteral nutrition market. The short-term parenteral nutrition (PN) market has evolved to address the metabolic needs of critically ill patients more effectively. Fat-based solutions, compared to glucose-heavy ones, reduce inflammation and stabilize blood sugar, suggesting they can mitigate risks like hyperglycemia. This advancement highlights the importance of tailoring PN to individual needs. Short-term PN serves as a bridge for patients requiring immediate stabilization, such as during preoperative bowel rest. However, PN's complexity demands strict oversight to prevent complications like infections and electrolyte imbalances. In lower-volume facilities, particularly U.S. hospitals, ensuring safety underscores the need for rigorous training and proper handling of formulations.

By Indication

- Short-term

- Long-term

INSIGHTS BY END-USER

Based on the end-user, the home care & long-term care settings segment shows significant growth with the fastest-growing CAGR of the global parenteral nutrition market during the forecast period. This growth is driven by the rising number of patients with chronic conditions who require long-term nutritional support but prefer to avoid hospital stays to improve their quality of life and reduce infection risks. Parenteral nutrition in-home care provides a cost-effective solution, allowing patients to manage their conditions comfortably while minimizing healthcare costs. Similarly, long-term care facilities, such as nursing homes, are increasingly adopting parenteral nutrition to support an aging population with complex health needs. Elderly patients with illnesses or age-related conditions that impair nutrient absorption rely on parenteral nutrition to maintain their health.

By End-Users

- Hospitals

- Home Care & Long-term Care Settings

- Ambulatory Care Settings

GEOGRAPHICAL ANALYSIS

North America dominates and holds the largest market share in the global parenteral nutrition market in 2023. This growth is driven by an increasing prevalence of gastrointestinal diseases such as Crohn's disease, ulcerative colitis, and short bowel syndrome, which necessitate nutritional support through parenteral methods when patients cannot ingest food orally. The market's growth is further supported by the rising rates of chronic diseases. Approximately 60% of adults in the U.S. live with at least one chronic condition, and this figure is projected to increase significantly, leading to greater reliance on parenteral nutrition to meet dietary needs during treatment. Overall, as healthcare systems adapt to these rising demands, the parenteral nutrition market in North America is poised for significant expansion in the coming years.

APAC accounted for the second-largest share of the global parenteral nutrition market and shows the highest growth during the forecast period. The parenteral nutrition (PN) market in the Asia-Pacific (APAC) region is experiencing rapid growth, fueled by increasing chronic disease prevalence, a rising aging population, and growing awareness about malnutrition's impact on health. Several APAC countries, including China, India, and Japan, are seeing significant investments in healthcare infrastructure, which, combined with government efforts to improve nutritional health, is accelerating the adoption of clinical nutrition solutions, particularly parenteral nutrition. Chronic diseases, such as cancer, diabetes, and gastrointestinal disorders, are prevalent across APAC.

By Geography

- North America

- US

- Canada

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Latin America

- Brazil

- Argentina

- Mexico

- Middle East & Africa

- Turkey

- South Africa

- Saudi Arabia

COMPETITIVE LANDSCAPE

The global parenteral nutrition market report contains exclusive data on 26 vendors. The market is marked by intense competition, driven by the presence of several key players, including Baxter, B. Braun, Fresenius Kabi, JW Pharmaceutical, Sichuan Kelun Pharmaceutical, and Grifols. These companies hold a significant share of the market and are known for their comprehensive parenteral nutrition portfolios. They focus on innovations to improve nutrient delivery systems, increase efficiency, and enhance patient outcomes. Local and regional players are also emerging, especially in developing markets, where the need for effective nutrition management solutions is increasing. In regions such as Asia-Pacific and Latin America, these players often offer cost-effective solutions that address local needs. Moreover, emerging companies are increasingly focusing on personalized nutrition solutions, which are designed to meet the specific metabolic needs of individual patients.

Key Vendors

- Baxter

- B.Braun

- Fresenius Kabi

- JW Pharmaceutical

- Sichuan Kelun Pharmaceutical

- Grifols

Other Prominent Vendors

- Aculife Healthcare

- Albert David

- Amanta Healthcare

- American Regent

- Axa Parenterals Ltd

- BML Parenteral Drugs

- Caritas Healthcare Pvt. Ltd

- Eurofarma

- Eurolife Healthcare Pvt. Ltd

- ICU Medical

- Otsuka

- Pfizer

- Enzymes Pharmaceuticals

- Anhui Medipharma

- Lxir Medilabs Pvt. Ltd

- Nymak Pharma Ltd

- Salius Pharma

- Schwitz Biotech

- Soxa formulations

- Reviv

KEY QUESTIONS ANSWERED:

1. How large is the global parenteral nutrition market?

2. What are the latest trends in the global parenteral nutrition market?

3. Which product has the largest share of the global parenteral nutrition market?

4. Which region has the largest market share of the global parenteral nutrition market?

5. Who are the key players in the global parenteral nutrition market?

TABLE OF CONTENTS

CHAPTER - 1: Parenteral Nutrition Market Overview

- Executive Summary

- Key Findings

CHAPTER - 2: Parenteral Nutrition Market

- GLOBAL: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

CHAPTER - 3: Parenteral Nutrition Market Prospects & Opportunities

- Parenteral Nutrition Market Opportunities & Trends

- Parenteral Nutrition Market Drivers

- Parenteral Nutrition Market Constraints

CHAPTER - 4: Parenteral Nutrition Market Segmentation Data

- GLOBAL: Projected Revenue by Product (2020-2029; $ Billions)

- Macronutrients

- Automated Compounds

- Micronutrients

- GLOBAL: Projected Revenue by Nutrition (2020-2029; $ Billions)

- RTU/Standard Commercial PN

- Compounded PN

- GLOBAL: Projected Revenue by Patient group (2020-2029; $ Billions)

- Adults

- Pediatric

- GLOBAL: Projected Revenue by Indication (2020-2029; $ Billions)

- Short-term

- Long-term

- GLOBAL: Projected Revenue by End-user (2020-2029; $ Billions)

- Hospitals

- Home Care & Long-term Care Settings

- Ambulatory Care Settings

CHAPTER - 5: Key Regions Overview

- North America: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

- Projected Revenue of Parenteral Nutrition Market in the US

- Projected Revenue of Parenteral Nutrition Market in Canada

- APAC: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

- Projected Revenue of Parenteral Nutrition Market in China

- Projected Revenue of Parenteral Nutrition Market in Japan

- Projected Revenue of Parenteral Nutrition Market in India

- Projected Revenue of Parenteral Nutrition Market in South Korea

- Projected Revenue of Parenteral Nutrition Market in Australia

- Europe: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

- Projected Revenue of the Parenteral Nutrition Market in Germany

- Projected Revenue of Parenteral Nutrition Market in France

- Projected Revenue of Parenteral Nutrition Market in the UK

- Projected Revenue of Parenteral Nutrition Market in Italy

- Projected Revenue of Parenteral Nutrition Market in Spain

- Latin America: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

- Projected Revenue of Parenteral Nutrition Market in Brazil

- Projected Revenue of Parenteral Nutrition Market in Mexico

- Projected Revenue of the Parenteral Nutrition Market in Argentina

- Middle East & Africa: Projected Revenue of Parenteral Nutrition Market (2020-2029; $ Billions)

- Projected Revenue of the Parenteral Nutrition Market in Turkey

- Projected Revenue of Parenteral Nutrition Market in South Africa

- Projected Revenue of Parenteral Nutrition Market in Saudi Arabia

CHAPTER - 6: Parenteral Nutrition Market Industry Overview

- Parenteral Nutrition Market - Competitive Landscape

- Parenteral Nutrition Market- Key Vendor Profiles

- Parenteral Nutrition Market- Other Prominent Vendors

- Parenteral Nutrition Market - Key Strategic Recommendations

CHAPTER - 7: Appendix

- Research Methodology

- Abbreviations

- About Arizton