|

|

市場調査レポート

商品コード

1421537

データセンターの火災検知・鎮火市場 - 世界の展望と予測(2023年~2028年)Data Center Fire Detection and Suppression Market - Global Outlook & Forecast 2023-2028 |

||||||

|

|||||||

| データセンターの火災検知・鎮火市場 - 世界の展望と予測(2023年~2028年) |

|

出版日: 2024年02月06日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 323 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデータセンターの火災検知・鎮火の市場規模は2022年~2028年にCAGR 7.52%で成長する見込みです。

データセンターの火災検知・鎮火市場は、アジア太平洋地域が中心となって大きな成長を示し、北米や欧州などの地域がそれに続きます。プロジェクト数に関してはラテンアメリカ、中東・アフリカなどの新興地域がそれに続いています。

消火分野が市場を独占し、予測期間中、火災安全システム分野の成長率が最も高いと予測されます。消火システムは、データセンターの火災安全において重要な役割を果たしています。これらのシステムは、水ベースの散水、ガスベースのソリューション、不活性剤、化学消火器など、さまざまな技術を採用しています。データセンター運営者は、サーバールームやIT機器の保護に成功していることから、ガスベースの消火システムを好むことが多いです。

当レポートでは、世界のデータセンターの火災検知・鎮火市場について調査し、市場の概要とともに、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査範囲

第2章 市場の概要

第3章 重要考察

第4章 イントロダクション

第5章 市場機会と動向

- 消火システムの革新

- 火災検知と鎮火におけるAI

- ガス消火システムの人気

- エッジデータセンターの需要

第6章 市場成長促進要因

- コロケーション投資により消防安全インフラの調達が促進

- ハイパースケールデータセンターへの投資の増加

- 火災事故の増加

- 高ラック電力密度

第7章 市場抑制要因

- 煙検知システムの問題

- サプライチェーンの課題

第8章 市場情勢

- 市場概要

- 投資:市場規模と予測

第9章 防火システム

- 市場スナップショット

- 主なハイライト

- 消火

- 火災検知

第10章 導入場所

- 市場スナップショット

- 主なハイライト

- 技術空間

- その他

第11章 北米

第12章 ラテンアメリカ

第13章 西欧

第14章 北欧

第15章 中欧および東欧

第16章 中東

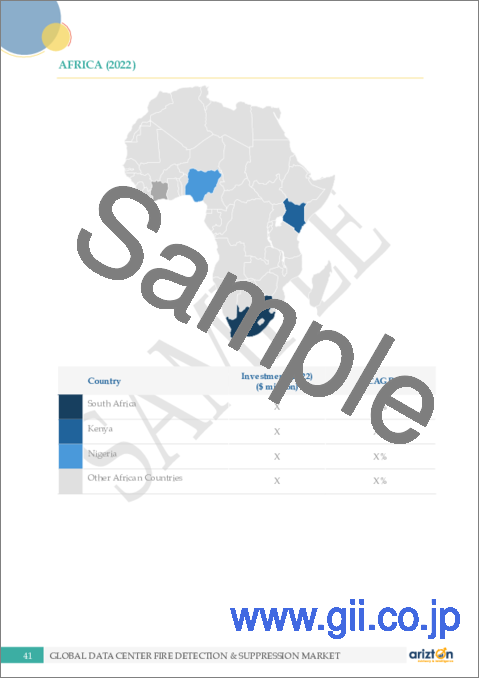

第17章 アフリカ

第18章 アジア太平洋

第19章 東南アジア

第20章 主要なデータセンターサポートインフラプロバイダー

- AUTOMATIC

- AVA PREVENT

- CANNON FIRE PROTECTION

- CARRIER

- DANFOSS FIRE SAFETY

- EATON

- ENCORE FIRE PROTECTION

- FIKE

- FIREBOY-XINTEX

- HALMA

- HOCHIKI EUROPE

- HONEYWELL HBT

- INCONTROL SYSTEMS

- JOHNSON CONTROLS

- MINIMAX (VIKING GROUP)

- PRO DELTA FIRE SAFETY SYSTEMS

- ROBERT BOSCH

- SECURITON

- SEVO SYSTEMS

- SIEMENS

- SMITH & SHARKS

- STANG KOREA

- STERLING SAFETY SYSTEMS(HYFIRE)

- THE CHEMOURS COMPANY

- THE HILLER COMPANIES

- TORVAC SOLUTIONS

- WAGNER GROUP

第21章 定量的な概要

- データセンターの火災検知・鎮火の世界市場

- 火災安全システム

- 導入場所

- 北米

- 米国

- カナダ

- ラテンアメリカ

- ブラジル

- メキシコ

- チリ

- コロンビア

- その他ラテンアメリカ

- 西欧

- 英国

- フランス

- ドイツ

- オランダ

- アイルランド

- スイス

- イタリア

- スペイン

- ベルギー

- その他の西欧諸国

- 北欧

- スウェーデン

- デンマーク

- ノルウェー

- フィンランドとアイスランド

- 中欧および東欧

- ロシア

- ポーランド

- オーストリア

- その他の中欧および東欧諸国

- 中東

- アラブ首長国連邦

- サウジアラビア

- イスラエル

- その他の中東諸国

- アフリカ

- 南アフリカ

- ケニア

- ナイジェリア

- その他のアフリカ諸国

- アジア太平洋

- 中国

- 香港

- オーストラリア

- ニュージーランド

- インド

- 日本

- 韓国

- 台湾

- その他のアジア太平洋諸国

- 東南アジア

- シンガポール

- インドネシア

- マレーシア

- タイ

- フィリピン

- ベトナム

- その他の東南アジア諸国

第22章 付録

List Of Exhibits

LIST OF EXHIBITS

Exhibit 1: Market Derivation

Exhibit 2: Global Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 3: Market Snapshot ($ million)

Exhibit 4: Cumulative Investment by Fire Safety System (2023-2028)

Exhibit 5: Data Center Fire Detection & Suppression Market by Fire Suppression 2022-2028 ($ million)

Exhibit 6: Data Center Fire Detection & Suppression Market by Fire Detection 2022-2028 ($ million)

Exhibit 7: Market Snapshot ($ million)

Exhibit 8: Cumulative Investment by Deployment Location (2023-2028)

Exhibit 9: Data Center Fire Detection & Suppression Market by Technical Space 2022-2028 ($ million)

Exhibit 10: Data Center Fire Detection & Suppression Market by Other Spaces 2022-2028 ($ million)

Exhibit 11: North America Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 12: North America Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 13: US Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 14: US Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 15: US Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 16: Canada Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 17: Canada Data Center Fire Detection & Suppression Center Market 2022-2028 ($ million)

Exhibit 18: Canada Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 19: Latin America Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 20: Latin America Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 21: Brazil Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 22: Brazil Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 23: Brazil Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 24: Mexico Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 25: Mexico Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 26: Mexico Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 27: Chile Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 28: Chile Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 29: Chile Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 30: Colombia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 31: Colombia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 32: Colombia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 33: Rest of Latin America Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 34: Rest of Latin America Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 35: Rest of Latin America Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 36: Western Europe Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 37: Western Europe Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 38: UK Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 39: UK Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 40: UK Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 41: France Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 42: France Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 43: France Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 44: Germany Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 45: Germany Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 46: Germany Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 47: Netherlands Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 48: Netherlands Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 49: Netherlands Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 50: Ireland Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 51: Ireland Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 52: Ireland Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 53: Switzerland Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 54: Switzerland Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 55: Switzerland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 56: Italy Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 57: Italy Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 58: Italy Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 59: Spain Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 60: Spain Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 61: Spain Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 62: Belgium Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 63: Belgium Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 64: Belgium Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 65: Other Western European Countries Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 66: Other Western European Countries Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 67: Other Western European Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 68: Nordics Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 69: Nordics Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 70: Denmark Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 71: Denmark Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 72: Denmark Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 73: Sweden Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 74: Sweden Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 75: Sweden Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 76: Norway Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 77: Norway Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 78: Norway Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 79: Finland & Iceland Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 80: Finland & Iceland Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 81: Finland & Iceland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 82: Central & Eastern Europe Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 83: Central & Eastern Europe Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 84: Russia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 85: Russia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 86: Russia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 87: Poland Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 88: Poland Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 89: Poland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 90: Austria Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 91: Austria Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 92: Austria Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 93: Other Central & Eastern European Countries Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 94: Other Central & Eastern European Countries Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 95: Other Central & Eastern European Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 96: Middle East Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 97: Middle East Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 98: UAE Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 99: UAE Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 100: UAE Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 101: Saudi Arabia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 102: Saudi Arabia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 103: Saudi Arabia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 104: Israel Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 105: Israel Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 106: Israel Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 107: Other Middle Eastern Countries Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 108: Other Middle Eastern Countries Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 109: Other Western European Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 110: Africa Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 111: Africa Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 112: South Africa Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 113: South Africa Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 114: South Africa Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 115: Kenya Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 116: Kenya Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 117: Kenya Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 118: Nigeria Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 119: Nigeria Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 120: Nigeria Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 121: Other African Countries Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 122: Other African Countries Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 123: Other African Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 124: APAC Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 125: APAC Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 126: China Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 127: China Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 128: China Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 129: Hong Kong Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 130: Hong Kong Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 131: Hong Kong Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 132: Australia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 133: Australia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 134: Australia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 135: New Zealand Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 136: New Zealand Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 137: New Zealand Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 138: India Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 139: India Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 140: India Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 141: Japan Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 142: Japan Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 143: Japan Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 144: South Korea Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 145: South Korea Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 146: South Korea Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 147: Taiwan Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 148: Taiwan Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 149: Taiwan Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 150: Rest of APAC Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 151: Rest of APAC Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 152: Rest of APAC Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 153: Southeast Asia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 154: Southeast Asia Data Center Fire Detection & Suppression Market by Investment 2022-2028 ($ million)

Exhibit 155: Singapore Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 156: Singapore Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 157: Singapore Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 158: Indonesia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 159: Indonesia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 160: Indonesia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 161: Malaysia Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 162: Malaysia Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 163: Malaysia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 164: Thailand Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 165: Thailand Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 166: Thailand Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 167: Philippines Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 168: Philippines Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 169: Philippines Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 170: Vietnam Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 171: Vietnam Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 172: Vietnam Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Exhibit 173: Other Southeast Asian Countries Data Center Fire Detection & Suppression Market Overview ($ million)

Exhibit 174: Other Southeast Asian Countries Data Center Fire Detection & Suppression Market 2022-2028 ($ million)

Exhibit 175: Other Southeast Asian Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

List Of Tables

LIST OF TABLES

Table 1: Data Center Fire Safety According to Design

Table 2: North America Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 3: North America Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 4: Latin America Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 5: Latin America Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 6: Western Europe Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 7: Western Europe Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 8: Nordics Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 9: Nordics Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 10: Center & Eastern Europe Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 11: Central & Eastern Europe Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 12: Middle East Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 13: Middle East Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 14: Africa Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 15: Africa Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 16: APAC Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 17: APAC Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 18: Southeast Asia Data Center Fire Detection & Suppression Market by Country 2022-2028 ($ million)

Table 19: Southeast Asia Data Center Fire Detection & Suppression Market by Infrastructure 2022-2028 ($ million)

Table 20: Global Data Center Fire Detection& Suppression Market 2022-2028

Table 21: Global Data Center Fire Detection& Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 22: Global Data Center Fire Detection& Suppression Market Deployment Location 2022-2028 ($ million)

Table 23: North America Data Center Fire Detection & Suppression Market by Fires Safety System 2022-2028 ($ million)

Table 24: US Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 25: Canada Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 26: Latin America Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 27: Brazil Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 28: Mexico Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 29: Chile Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 30: Colombia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 31: Rest of Latin America Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 32: Western Europe Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 33: UK Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028

Table 34: France Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 35: Germany Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 36: Netherlands Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 37: Ireland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 38: Switzerland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 39: Italy Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 40: Spain Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 41: Belgium Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 42: Other Western European Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 43: Nordics Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 44: Sweden Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 45: Denmark Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 46: Norway Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 47: Finland & Iceland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 48: Central & Eastern Europe Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 49: Russia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 50: Poland Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 51: Austria Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 52: Other Central & Eastern European Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 53: Middle East Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 54: UAE Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 55: Saudi Arabia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 56: Israel Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 57: Other Middle Eastern Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 58: Africa Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 59: South Africa Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 60: Kenya Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 61: Nigeria Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 62: Other African Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 63: APAC Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 64: China Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 65: Hong Kong Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 66: Australia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 67: New Zealand Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028

Table 68: India Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 69: Japan Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 70: South Korea Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 71: Taiwan Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 72: Rest of APAC Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 73: Southeast Asia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 74: Singapore Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 75: Indonesia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 76: Malaysia Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028($ million)

Table 77: Thailand Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

Table 78: Philippines Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028($ million)

Table 79: Vietnam Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028($ million)

Table 80: Other Southeast Asian Countries Data Center Fire Detection & Suppression Market by Fire Safety System 2022-2028 ($ million)

The global data center fire detection and suppression market is expected to grow at a CAGR of 7.52% from 2022-2028.

KEY HIGHLIGHTS

- HYGOOD Acoustic Nozzle, iFLOW Technology, and special fire suppression agents such as clean agent fire extinguishants, inert gas like nitrogen or argon, or high-pressure water mist fire suppression systems such as HI-FOG from Marioff are witnessing a growth in adoption in fire suppression systems for fire hazards in data centers.

- The increasing number of internet users and growth in the use of advanced technologies such as AI, IoT, and digitalization across all industries will increase the demand for data center investments by colocation, hyperscale, enterprises, and telecommunication providers.

- The data center fire detection and suppression market witnessed significant growth with a central dominance from the APAC region, followed by regions such as North America and Europe, followed by emerging areas such as Latin America, the Middle East, and Africa regarding the number of projects.

SEGMENTATION INSIGHTS

- The fire suppression segment dominated the market and is projected to witness the highest fire safety systems segmental growth rate during the forecast period. Fire suppression systems play a critical role in fire safety in data centers. These systems employ various techniques, such as water-based sprinkles, gas-based solutions, inert agents, and chemical extinguishers. The data center operator often prefers a gas-based fire suppression system due to their success in safeguarding server rooms and IT equipment.

- Under the deployment locations segment, the technical space/room level segment held the higher data center fire detection and suppression market share due to its importance in the day-to-day operation and the characteristics of the machines in these rooms. Different fire suppression and detection techniques and products are used in server rooms or data halls. Some common fire suppression and fire detection products are used globally in data centers in technical space (server room/ data hall). For example, inert gas fire suppression suits servers and data rooms. The National Fire Protection Association (NFPA) has set two standards, NFPA 75 and NFPA 76, specifically designed for data center fire safety protection.

Segmentation by Fire Safety Systems

- Fire Suppression

- Fire Detection

Segmentation by Deployment Locations

- Technical Space/Room Level

- Other Space/Building Level

GEOGRAPHICAL ANALYSIS

- The Middle East, Africa, and Latin America are developing data center markets. Many new investments are witnessed in these regions; thus, the growing investments will increase demand for the data center fire detection and suppression market.

- The APAC region dominated the industry regarding several data center investments and thus emerged as the dominant location for emerging demand for fire safety products in 2022.

Segmentation by Geography

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Chile

- Colombia

- Rest of Latin America

- Western Europe

- UK

- France

- Germany

- Netherlands

- Ireland

- Switzerland

- Italy

- Spain

- Belgium

- Other Western European Countries

- Nordics

- Denmark

- Sweden

- Norway

- Finland & Iceland

- Central & Eastern Europe

- Russia

- Poland

- Austria

- Other Central & Eastern European Countries

- Middle East

- UAE

- Saudi Arabia

- Israel

- Other Middle Eastern Countries

- Africa

- South Africa

- Kenya

- Nigeria

- Other African Countries

- APAC

- China

- Hong Kong

- Australia

- New Zealand

- India

- Japan

- South Korea

- Taiwan

- Rest of APAC

- Southeast Asia

- Singapore

- Indonesia

- Malaysia

- Thailand

- Philippines

- Vietnam

- Other Southeast Asian Countries

VENDOR LANDSCAPE

- Many colocation providers' data centers are constructing facilities phased, depending on the market demand. Over the next few years, there is expected to be more demand for advanced fire safety systems in developing regions.

- Vendors such as Honeywell HBT, Johnson Controls, SEVO Systems, Fike, Eaton, and others constantly innovate their fire safety solutions for data centers.

Key Data Center Support Infrastructure Providers

- Automatic

- AVA PREVENT

- Cannon Fire Protection

- Carrier

- Danfoss Fire Safety

- Eaton

- Encore Fire Protection

- Fike

- Fireboy-Xintex (A Darley Company)

- Halma

- Hochiki Europe

- Honeywell HBT

- InControl Systems

- Johnson Controls

- Minimax (Viking Group)

- Pro Delta Fire Safety Systems

- Robert Bosch

- Securiton

- SEVO Systems

- Siemens

- Smith & Sharks (India)

- STANG Korea

- Sterling Safety Systems (Hyfire)

- The Chemours Company

- The Hiller Companies

- Torvac Solutions

- WAGNER Group

KEY QUESTIONS ANSWERED:

1. How big is the global data center fire detection and suppression market?

2. What is the projected growth rate of the global data center fire detection and suppression market?

3. What are the latest trends in the data center fire detection and suppression market?

4. What is the projected growth rate of the global data center fire suppression market?

5. Who are the key players in the data center fire detection and suppression market?

TABLE OF CONTENTS

1. REPORT COVERAGE

- 1.1. WHAT'S INCLUDED

- 1.2. SEGMENTAL COVERAGE

- 1.2.1. Market Segmentation by Deployment Location

- 1.2.2. Market Segmentation by Fire Safety System

2. MARKET AT A GLANCE

- 2.1. SEGMENTAL & GEOGRAPHICAL SNAPSHOT

- 2.2. MaRKET SEGMENTATION

- 2.3. Geographical SNAPSHOT

- 2.4. Key market trends

3. PREMIUM INSIGHTS

- 3.1. KEY HIGHLIGHTS

- 3.2. SEGMENTATION ANALYSIS

- 3.3. GEOGRAPHICAL ANALYSIS

- 3.4. VENDOR ANALYSIS

4. INTRODUCTION

- 4.1. DATA CENTER - FIRE OVERVIEW

- 4.2. REASONS FOR DATA CENTER FIRE

- 4.2.1. Fuel

- 4.2.2. Heat

- 4.2.3. Oxygen & Chemical Chain Reaction

- 4.3. CAUSES OF DATA CENTER FIRE

- 4.3.1. Electrical Failures

- 4.3.2. UPS Batteries

- 4.3.3. Inadequate Maintenance

- 4.3.4. Human Error

- 4.4. INDUSTRY FIRE & SAFETY STANDARDS

- 4.5. FIRE PROTECTION FOR CRITICAL AREAS IN DATA CENTERS

5. MARKET OPPORTUNITIES & TRENDS

- 5.1. INNOVATIONS IN FIRE SUPPRESSION SYSTEMS

- 5.1.1. HYGOOD Acoustic Nozzle

- 5.1.2. iFLOW Technology

- 5.1.3. Water Mist Fire Suppression Systems

- 5.1.4. Inert Gas Fire Suppression Systems

- 5.1.5. Chemical/Synthetic Gas Fire Suppression Systems

- 5.2. AI IN FIRE DETECTION & SUPPRESSION

- 5.2.1. Real-time Monitoring

- 5.2.2. Automated Fire Suppression Systems

- 5.3. POPULARITY OF GASEOUS FIRE SUPPRESSION SYSTEMS

- 5.4. DEMAND FOR EDGE DATA CENTERS

6. MARKET GROWTH ENABLERS

- 6.1. FIRE & SAFETY INFRASTRUCTURE PROCUREMENT BOOSTED BY COLOCATION INVESTMENTS

- 6.1.1. North America

- 6.1.2. Latin America

- 6.1.3. Western Europe

- 6.1.4. Nordics

- 6.1.5. Middle East

- 6.1.6. APAC

- 6.1.7. Southeast Asia

- 6.2. INCREASED HYPERSCALE DATA CENTER INVESTMENTS

- 6.2.1. North America

- 6.2.2. Latin America

- 6.2.3. Europe

- 6.2.4. Middle East

- 6.2.5. Africa

- 6.2.6. APAC

- 6.2.7. Southeast Asia

- 6.3. INCREASE IN FIRE INCIDENTS

- 6.3.1. Electrical Failures

- 6.3.2. Lithium-ion Batteries

- 6.3.3. Inadequate Maintenance

- 6.3.4. Human Error

- 6.3.5. Examples of Major Data Center Fire Incidents

- 6.4. HIGH RACK POWER DENSITY

- 6.4.1. Increase in Energy Density with AI & ML Adoption

- 6.4.2. IT Equipment's Increased Rack Density

7. MARKET RESTRAINTS

- 7.1. SMOKE DETECTION SYSTEM ISSUES

- 7.1.1. False Alarm

- 7.1.2. Structural Barriers

- 7.2. SUPPLY CHAIN CHALLENGES

8. MARKET LANDSCAPE

- 8.1. MARKET OVERVIEW

- 8.2. INVESTMENT: MARKET SIZE & FORECAST

9. FIRE SAFETY SYSTEM

- 9.1. MARKET SNAPSHOT

- 9.2. KEY HIGHLIGHTS

- 9.3. FIRE SUPPRESSION

- 9.3.1. Market Overview

- 9.3.2. Market Size & Forecast

- 9.4. FIRE DETECTION

- 9.4.1. Market Overview

- 9.4.2. Market Size & Forecast

10. DEPLOYMENT LOCATION

- 10.1. MARKET SNAPSHOT

- 10.2. KEY HIGHLIGHTS

- 10.3. TECHNICAL SPACE

- 10.3.1. Market Overview

- 10.3.2. Market Size & Forecast

- 10.4. OTHER SPACES

- 10.4.1. Market Overview

- 10.4.2. Market Size & Forecast

11. NORTH AMERICA

- 11.1. Market Overview

- 11.2. Investment: Market Size & Forecast

- 11.3. US

- 11.3.1. Market Overview

- 11.3.2. Investment: Market Size & Forecast

- 11.3.3. Infrastructure: Market Size & Forecast

- 11.4. CANADA

- 11.4.1. Market Overview

- 11.4.2. Investment: Market Size & Forecast

- 11.4.3. Infrastructure: Market Size & Forecast

12. LATIN AMERICA

- 12.1. Market Overview

- 12.2. Investment: Market Size & Forecast

- 12.3. BRAZIL

- 12.3.1. Market Overview

- 12.3.2. Investment: Market Size & Forecast

- 12.3.3. Infrastructure: Market Size & Forecast

- 12.4. MEXICO

- 12.4.1. Market Overview

- 12.4.2. Investment: Market Size & Forecast

- 12.4.3. Infrastructure: Market Size & Forecast

- 12.5. CHILE

- 12.5.1. Market Overview

- 12.5.2. Investment: Market Size & Forecast

- 12.5.3. Infrastructure: Market Size & Forecast

- 12.6. COLOMBIA

- 12.6.1. Market Overview

- 12.6.2. Investment: Market Size & Forecast

- 12.6.3. Infrastructure: Market Size & Forecast

- 12.7. REST OF LATIN AMERICA

- 12.7.1. Market Overview

- 12.7.2. Investment: Market Size & Forecast

- 12.7.3. Infrastructure: Market Size & Forecast

13. WESTERN EUROPE

- 13.1. Market Overview

- 13.2. Investment: Market Size & Forecast

- 13.3. UK

- 13.3.1. Market Overview

- 13.3.2. Investment: Market Size & Forecast

- 13.3.3. Infrastructure: Market Size & Forecast

- 13.4. FRANCE

- 13.4.1. Market Overview

- 13.4.2. Investment: Market Size & Forecast

- 13.4.3. Infrastructure: Market Size & Forecast

- 13.5. GERMANY

- 13.5.1. Market Overview

- 13.5.2. Investment: Market Size & Forecast

- 13.5.3. Infrastructure: Market Size & Forecast

- 13.6. NETHERLANDS

- 13.6.1. Market Overview

- 13.6.2. Investment: Market Size & Forecast

- 13.6.3. Infrastructure: Market Size & Forecast

- 13.7. IRELAND

- 13.7.1. Market Overview

- 13.7.2. Investment: Market Size & Forecast

- 13.7.3. Infrastructure: Market Size & Forecast

- 13.8. SWITZERLAND

- 13.8.1. Market Overview

- 13.8.2. Investment: Market Size & Forecast

- 13.8.3. Infrastructure: Market Size & Forecast

- 13.9. ITALY

- 13.9.1. Market Overview

- 13.9.2. Investment: Market Size & Forecast

- 13.9.3. Infrastructure: Market Size & Forecast

- 13.10. SPAIN

- 13.10.1. Market Overview

- 13.10.2. Investment: Market Size & Forecast

- 13.10.3. Infrastructure: Market Size & Forecast

- 13.11. BELGIUM

- 13.11.1. Market Overview

- 13.11.2. Investment: Market Size & Forecast

- 13.11.3. Infrastructure: Market Size & Forecast

- 13.12. OTHER WESTERN EUROPEAN COUNTRIES

- 13.12.1. Market Overview

- 13.12.2. Investment: Market Size & Forecast

- 13.12.3. Infrastructure: Market Size & Forecast

14. NORDICS

- 14.1. Market Overview

- 14.2. Investment: Market Size & Forecast

- 14.3. DENMARK

- 14.3.1. Market Overview

- 14.3.2. Investment: Market Size & Forecast

- 14.3.3. Infrastructure: Market Size & Forecast

- 14.4. SWEDEN

- 14.4.1. Market Overview

- 14.4.2. Investment: Market Size & Forecast

- 14.4.3. Infrastructure: Market Size & Forecast

- 14.5. NORWAY

- 14.5.1. Market Overview

- 14.5.2. Investment: Market Size & Forecast

- 14.5.3. Infrastructure: Market Size & Forecast

- 14.6. FINLAND & ICELAND

- 14.6.1. Market Overview

- 14.6.2. Investment: Market Size & Forecast

- 14.6.3. Infrastructure: Market Size & Forecast

15. CENTRAL & EASTERN EUROPE

- 15.1. Market Overview

- 15.2. Investment: Market Size & Forecast

- 15.3. RUSSIA

- 15.3.1. Market Overview

- 15.3.2. Investment: Market Size & Forecast

- 15.3.3. Infrastructure: Market Size & Forecast

- 15.4. POLAND

- 15.4.1. Market Overview

- 15.4.2. Investment: Market Size & Forecast

- 15.4.3. Infrastructure: Market Size & Forecast

- 15.5. AUSTRIA

- 15.5.1. Market Overview

- 15.5.2. Investment: Market Size & Forecast

- 15.5.3. Infrastructure: Market Size & Forecast

- 15.6. OTHER CENTRAL & EASTERN EUROPEAN COUNTRIES

- 15.6.1. Market Overview

- 15.6.2. Investment: Market Size & Forecast

- 15.6.3. Infrastructure: Market Size & Forecast

16. MIDDLE EAST

- 16.1. Market Overview

- 16.2. Investment: Market Size & Forecast

- 16.3. UAE

- 16.3.1. Market Overview

- 16.3.2. Investment: Market Size & Forecast

- 16.3.3. Infrastructure: Market Size & Forecast

- 16.4. SAUDI ARABIA

- 16.4.1. Market Overview

- 16.4.2. Investment: Market Size & Forecast

- 16.4.3. Infrastructure: Market Size & Forecast

- 16.5. ISRAEL

- 16.5.1. Market Overview

- 16.5.2. Investment: Market Size & Forecast

- 16.5.3. Infrastructure: Market Size & Forecast

- 16.6. OTHER MIDDLE EASTERN COUNTRIES

- 16.6.1. Market Overview

- 16.6.2. Investment: Market Size & Forecast

- 16.6.3. Infrastructure: Market Size & Forecast

17. AFRICA

- 17.1. Market Overview

- 17.2. Investment: Market Size & Forecast

- 17.3. SOUTH AFRICA

- 17.3.1. Market Overview

- 17.3.2. Investment: Market Size & Forecast

- 17.3.3. Infrastructure: Market Size & Forecast

- 17.4. KENYA

- 17.4.1. Market Overview

- 17.4.2. Investment: Market Size & Forecast

- 17.4.3. Infrastructure: Market Size & Forecast

- 17.5. NIGERIA

- 17.5.1. Market Overview

- 17.5.2. Investment: Market Size & Forecast

- 17.5.3. Infrastructure: Market Size & Forecast

- 17.6. OTHER AFRICAN COUNTRIES

- 17.6.1. Market Overview

- 17.6.2. Investment: Market Size & Forecast

- 17.6.3. Infrastructure: Market Size & Forecast

18. APAC

- 18.1. Market Overview

- 18.2. Investment: Market Size & Forecast

- 18.3. CHINA

- 18.3.1. Market Overview

- 18.3.2. Investment: Market Size & Forecast

- 18.3.3. Infrastructure: Market Size & Forecast

- 18.4. HONG KONG

- 18.4.1. Market Overview

- 18.4.2. Investment: Market Size & Forecast

- 18.4.3. Infrastructure: Market Size & Forecast

- 18.5. AUSTRALIA

- 18.5.1. Market Overview

- 18.5.2. Investment: Market Size & Forecast

- 18.5.3. Infrastructure: Market Size & Forecast

- 18.6. NEW ZEALAND

- 18.6.1. Market Overview

- 18.6.2. Investment: Market Size & Forecast

- 18.6.3. Infrastructure: Market Size & Forecast

- 18.7. INDIA

- 18.7.1. Market Overview

- 18.7.2. Investment: Market Size & Forecast

- 18.7.3. Infrastructure: Market Size & Forecast

- 18.8. JAPAN

- 18.8.1. Market Overview

- 18.8.2. Investment: Market Size & Forecast

- 18.8.3. Infrastructure: Market Size & Forecast

- 18.9. SOUTH KOREA

- 18.9.1. Market Overview

- 18.9.2. Investment: Market Size & Forecast

- 18.9.3. Infrastructure: Market Size & Forecast

- 18.10. TAIWAN

- 18.10.1. Market Overview

- 18.10.2. Investment: Market Size & Forecast

- 18.10.3. Infrastructure: Market Size & Forecast

- 18.11. REST OF APAC

- 18.11.1. Market Overview

- 18.11.2. Investment: Market Size & Forecast

- 18.11.3. Infrastructure: Market Size & Forecast

19. SOUTHEAST ASIA

- 19.1. Market Overview

- 19.2. Investment: Market Size & Forecast

- 19.3. SINGAPORE

- 19.3.1. Market Overview

- 19.3.2. Investment: Market Size & Forecast

- 19.3.3. Infrastructure: Market Size & Forecast

- 19.4. INDONESIA

- 19.4.1. Market Overview

- 19.4.2. Investment: Market Size & Forecast

- 19.4.3. Infrastructure: Market Size & Forecast

- 19.5. MALAYSIA

- 19.5.1. Market Overview

- 19.5.2. Investment: Market Size & Forecast

- 19.5.3. Infrastructure: Market Size & Forecast

- 19.6. THAILAND

- 19.6.1. Market Overview

- 19.6.2. Investment: Market Size & Forecast

- 19.6.3. Infrastructure: Market Size & Forecast

- 19.7. PHILIPPINES

- 19.7.1. Market Overview

- 19.7.2. Investment: Market Size & Forecast

- 19.7.3. Infrastructure: Market Size & Forecast

- 19.8. VIETNAM

- 19.8.1. Market Overview

- 19.8.2. Investment: Market Size & Forecast

- 19.8.3. Infrastructure: Market Size & Forecast

- 19.9. OTHER SOUTHEAST ASIAN COUNTRIES

- 19.9.1. Market Overview

- 19.9.2. Investment: Market Size & Forecast

- 19.9.3. Infrastructure: Market Size & Forecast

- 19.10. COMPETITIVE LANDSCAPE

- 19.10.1. Competition Overview

20. KEY DATA CENTER SUPPORT INFRASTRUCTURE PROVIDERS

- 20.1. AUTOMATIC

- 20.1.1. Business Overview

- 20.1.2. Products Offerings

- 20.2. AVA PREVENT

- 20.2.1. Business Overview

- 20.2.2. Products Offerings

- 20.3. CANNON FIRE PROTECTION

- 20.3.1. Business Overview

- 20.3.2. Products Offerings

- 20.4. CARRIER

- 20.4.1. Business Overview

- 20.4.2. Products Offerings

- 20.5. DANFOSS FIRE SAFETY

- 20.5.1. Business Overview

- 20.5.2. Product Offerings

- 20.6. EATON

- 20.6.1. Business Overview

- 20.6.2. Product Offerings

- 20.7. ENCORE FIRE PROTECTION

- 20.7.1. Business Overview

- 20.7.2. Products Offerings

- 20.8. FIKE

- 20.8.1. Business Overview

- 20.8.2. Products Offerings

- 20.9. FIREBOY-XINTEX (A DARLEY COMPANY)

- 20.9.1. Business Overview

- 20.9.2. Product Offerings

- 20.10. HALMA

- 20.10.1. Business Overview

- 20.10.2. Product Offerings

- 20.11. HOCHIKI EUROPE

- 20.11.1. Business Overview

- 20.11.2. Product Offerings

- 20.12. HONEYWELL HBT

- 20.12.1. Business Overview

- 20.12.2. Product Offerings

- 20.13. INCONTROL SYSTEMS

- 20.13.1. Business Overview

- 20.13.2. Product Offerings

- 20.14. JOHNSON CONTROLS

- 20.14.1. Business Overview

- 20.14.2. Product Offerings

- 20.15. MINIMAX (VIKING GROUP)

- 20.15.1. Business Overview

- 20.15.2. Product Offerings

- 20.16. PRO DELTA FIRE SAFETY SYSTEMS

- 20.16.1. Business Overview

- 20.16.2. Product Offerings

- 20.17. ROBERT BOSCH

- 20.17.1. Business Overview

- 20.17.2. Product Offerings

- 20.18. SECURITON

- 20.18.1. Business Overview

- 20.18.2. Product Offerings

- 20.19. SEVO SYSTEMS

- 20.19.1. Business Overview

- 20.19.2. Product Offerings

- 20.20. SIEMENS

- 20.20.1. Business Overview

- 20.20.2. Product Offerings

- 20.21. SMITH & SHARKS (INDIA)

- 20.21.1. Business Overview

- 20.21.2. Product Offerings

- 20.22. STANG KOREA

- 20.22.1. Business Overview

- 20.22.2. Product Offerings

- 20.23. STERLING SAFETY SYSTEMS (HYFIRE)

- 20.23.1. Product Offerings

- 20.24. THE CHEMOURS COMPANY

- 20.24.1. Business Overview

- 20.24.2. Product offerings

- 20.25. THE HILLER COMPANIES

- 20.25.1. Business Overview

- 20.25.2. Products Offerings

- 20.26. TORVAC SOLUTIONS

- 20.26.1. Business Overview

- 20.26.2. Product Offerings

- 20.27. WAGNER GROUP

- 20.27.1. Business Overview

- 20.27.2. Product Offerings

21. QUANTITATIVE SUMMARY

- 21.1. GLOBAL DATA CENTER FIRE DETECTION & SUPPRESSION MARKET

- 21.1.1. Market Size & Forecast

- 21.2. FIRE SAFETY SYSTEM

- 21.2.1. Market Size & Forecast

- 21.3. DEPLOYMENT LOCATION

- 21.3.1. Market Size & Forecast

- 21.4. NORTH AMERICA

- 21.4.1. Market Size & Forecast

- 21.5. US

- 21.5.1. Market Size & Forecast

- 21.6. CANADA

- 21.6.1. Market Size & Forecast

- 21.7. LATIN AMERICA

- 21.7.1. Market Size & Forecast

- 21.8. BRAZIL

- 21.8.1. Market Size & Forecast

- 21.9. MEXICO

- 21.9.1. Market Size & Forecast

- 21.10. CHILE

- 21.10.1. Market Size & Forecast

- 21.11. COLOMBIA

- 21.11.1. Market Size & Forecast

- 21.12. REST OF LATIN AMERICA

- 21.12.1. Market Size & Forecast

- 21.13. WESTERN EUROPE

- 21.13.1. Market Size & Forecast

- 21.14. UK

- 21.14.1. Market Size & Forecast

- 21.15. FRANCE

- 21.15.1. Market Size & Forecast

- 21.16. GERMANY

- 21.16.1. Market Size & Forecast

- 21.17. NETHERLANDS

- 21.17.1. Market Size & Forecast

- 21.18. IRELAND

- 21.18.1. Market Size & Forecast

- 21.19. SWITZERLAND

- 21.19.1. Market Size & Forecast

- 21.20. ITALY

- 21.20.1. Market Size & Forecast

- 21.21. SPAIN

- 21.21.1. Market Size & Forecast

- 21.22. BELGIUM

- 21.22.1. Market Size & Forecast

- 21.23. OTHER WESTERN EUROPEAN COUNTRIES

- 21.23.1. Market Size & Forecast

- 21.24. NORDICS

- 21.24.1. Market Size & Forecast

- 21.25. SWEDEN

- 21.25.1. Market Size & Forecast

- 21.26. DENMARK

- 21.26.1. Market Size & Forecast

- 21.27. NORWAY

- 21.27.1. Market Size & Forecast

- 21.28. FINLAND & ICELAND

- 21.28.1. Market Size & Forecast

- 21.29. CENTRAL & EASTERN EUROPE

- 21.29.1. Market Size & Forecast

- 21.30. RUSSIA

- 21.30.1. Market Size & Forecast

- 21.31. POLAND

- 21.31.1. Market Size & Forecast

- 21.32. AUSTRIA

- 21.32.1. Market Size & Forecast

- 21.33. OTHER CENTRAL & EASTERN EUROPEAN COUNTRIES

- 21.33.1. Market Size & Forecast

- 21.34. MIDDLE EAST

- 21.34.1. Market Size & Forecast

- 21.35. UAE

- 21.35.1. Market Size & Forecast

- 21.36. SAUDI ARABIA

- 21.36.1. Market Size & Forecast

- 21.37. ISRAEL

- 21.37.1. Market Size & Forecast

- 21.38. OTHER MIDDLE EASTERN COUNTRIES

- 21.38.1. Market Size & Forecast

- 21.39. AFRICA

- 21.39.1. Market Size & Forecast

- 21.40. SOUTH AFRICA

- 21.40.1. Market Size & Forecast

- 21.41. KENYA

- 21.41.1. Market Size & Forecast

- 21.42. NIGERIA

- 21.42.1. Market Size & Forecast

- 21.43. OTHER AFRICAN COUNTRIES

- 21.43.1. Market Size & Forecast

- 21.44. APAC

- 21.44.1. Market Size & Forecast

- 21.45. CHINA

- 21.45.1. Market Size & Forecast

- 21.46. HONG KONG

- 21.46.1. Market Size & Forecast

- 21.47. AUSTRALIA

- 21.47.1. Market Size & Forecast

- 21.48. NEW ZEALAND

- 21.48.1. Market Size & Forecast

- 21.49. INDIA

- 21.49.1. Market Size & Forecast

- 21.50. JAPAN

- 21.50.1. Market Size & Forecast

- 21.51. SOUTH KOREA

- 21.51.1. Market Size & Forecast

- 21.52. TAIWAN

- 21.52.1. Market Size & Forecast

- 21.53. REST OF APAC

- 21.53.1. Market Size & Forecast

- 21.54. SOUTHEAST ASIA

- 21.54.1. Market Size & Forecast

- 21.55. SINGAPORE

- 21.55.1. Market Size & Forecast

- 21.56. INDONESIA

- 21.56.1. Market Size & Forecast

- 21.57. MALAYSIA

- 21.57.1. Market Size & Forecast

- 21.58. THAILAND

- 21.58.1. Market Size & Forecast

- 21.59. PHILIPPINES

- 21.59.1. Market Size & Forecast

- 21.60. VIETNAM

- 21.60.1. Market Size & Forecast

- 21.61. OTHER SOUTHEAST ASIAN COUNTRIES

- 21.61.1. Market Size & Forecast

22. APPENDIX

- 22.1. LIST OF ABBREVIATIONS

- 22.2. CURRENCY CONVERSION