|

|

市場調査レポート

商品コード

1378417

ラボ用ガラス器具洗浄機:世界市場の展望・予測 (2023-2028年)Laboratory Glassware Washers Market - Global Outlook & Forecast 2023-2028 |

||||||

|

|||||||

| ラボ用ガラス器具洗浄機:世界市場の展望・予測 (2023-2028年) |

|

出版日: 2023年11月09日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 296 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のラボ用ガラス器具洗浄機の市場規模は、2022年から2028年にかけてCAGR 4.43%で成長すると予測されています。

市場動向と促進要因

自動洗浄ソリューションの採用増加

ラボ器具およびワークフローの領域では清潔さと精度が極めて重要です。ラボ用ガラス器具洗浄機の市場は、自動洗浄ソリューションの採用により大きな進化を遂げています。さまざまな業界のラボでは、ラボ用ガラス器具の洗浄における効率性、正確性、安全性を高めるため、自動化への関心が高まっています。この動向は、ラボ業務に対する技術の変革的な影響を示しています。製薬やヘルスケアなどの業界では、品質と安全基準への厳格な遵守が求められます。自動洗浄ソリューションは、コンプライアンスを満たし、一貫した結果を維持するための信頼できる手段を提供します。多量のサンプルや多数の実験を扱うラボでは、並行した洗浄プロセスが可能になるため、自動化の恩恵を受け、バックログやボトルネックを減らすことができます。多くの自動化システムは、データ記録とモニタリング機能を備えています。これにより、洗浄サイクル、使用パターン、メンテナンスの必要性についての貴重な洞察が得られ、情報に基づいた意思決定が可能になります。

製薬・バイオテクノロジー分野におけるR&D活動の活発化

製薬・バイオテクノロジー分野におけるR&D活動の活発化は、ラボ用ガラス器具洗浄機市場に大きな影響を与えています。研究活動の活発化に伴い、医薬品開発、品質管理、実験に使用されるガラス器具の効率的で信頼性が高く、コンプライアンスに準拠した洗浄・滅菌ソリューションに対する需要が急増しています。この動向は、カスタマイズ、自動化、データ統合機能を提供する技術的に高度なラボ用ガラス器具洗浄機の採用に拍車をかけており、特定ニーズに対応するための市場成長と技術革新も促進しています。

ラボにおける手動から自動へのシフト

ラボにおける手動から自動へのシフトも、ラボ用ガラス器具洗浄機市場に大きな影響を与えています。自動化は洗浄プロセスを合理化し、人為的ミスを減らし、効率を高めるため、ラボ用ガラス器具洗浄機は現代のラボにとって不可欠なツールとなっています。自動化が大きな影響を及ぼしている重要な分野の一つは、ガラス器具のハンドリングとメンテナンスです。また、自動化ラボシステムへのラボ用ガラス器具洗浄機の統合は、効率性と信頼性の追求と完全に一致します。これらの洗浄機は、時間効率、データの完全性、適応性など、自動化へのシフトを補完するさまざまな利点を提供します。

当レポートでは、世界のラボ用ガラス器具洗浄機の市場を調査し、市場の定義と概要、市場機会・市場動向、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 調査目的

第3章 調査プロセス

第4章 調査対象・調査範囲

第5章 レポートの前提・注記

第6章 重要考察

第7章 市場概要

第8章 イントロダクション

第9章 市場機会と動向

- 自動洗浄ソリューションの採用の増加

- スマートラボ用ガラス洗浄機の登場

- 洗浄技術の進歩

- 製薬およびバイオテクノロジー分野でのR&D発活動の増加

第10章 市場成長の実現要因

- 臨床および診断ラボにおける検査量の増加

- 厳格な検査基準と規制

- ラボにおける手動から自動への移行

第11章 市場抑制要因

- 高額な導入・メンテナンスのコスト

- 使い捨て製品の使用の急増

- カスタマイズの複雑さと認識の限界

第12章 市場情勢

- 市場概要

- 市場規模・予測

- 市場機会

- ファイブフォース分析

第13章 製品タイプ

- 市場のスナップショットと成長エンジン

- 市場概要

- 自立型

- アンダーベンチ/アンダーカウンター/コンパクト型

第14章 容量

- 市場のスナップショットと成長エンジン

- 市場概要

- 大容量

- 小・中容量

第15章 エンドユーザー

- 市場のスナップショットと成長エンジン

- 市場概要

- ヘルスケアおよび臨床ラボ

- 研究機関・学術機関

- 製薬およびバイオテクノロジー会社

- その他

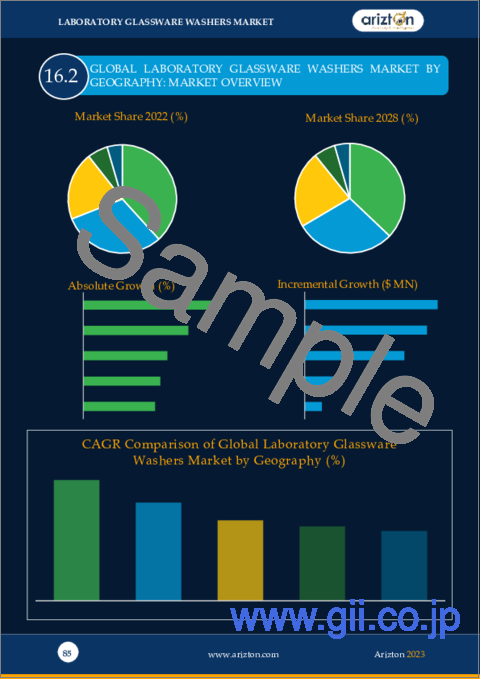

第16章 地域

- 市場のスナップショットと成長エンジン

- 地域概要

第17章 北米

第18章 欧州

第19章 アジア太平洋

第20章 ラテンアメリカ

第21章 中東・アフリカ

第22章 競合情勢

- 競合概要

- 市場シェア分析

- ATS CORPORATION

- BELIMED

- GETINGE

- LABINDIA

- SMEG

- STEELCO

- STERIS

第23章 主要企業プロファイル

- ATS CORPORATION

- BELIMED

- GETINGE

- LABINDIA

- SMEG

- STEELCO

- STERIS

第24章 他の主要ベンダー

- AT-OS S.R.L.

- AVANTOR

- BIOBASE

- BIOEVOPEAK

- BIOMETER

- DE LAMA S.P.A.

- FEDEGARI AUTOCLAVI S.P.A.

- LABCONCO

- LABELIANS

- LABSTAC

- LABTRON EQUIPMENT

- MRC LABORATORY INSTRUMENTS

- NIAGARA SYSTEMS

- PROHS

- RHIMA

- SPIRE INTEGRATED SOLUTIONS

- TUTTNAUER

- YAMATO SCIENTIFIC

第25章 レポート概要

- 重要ポイント

- 戦略的提言

第26章 定量的概要

第27章 付録

The global laboratory glassware washers market is expected to grow at a CAGR of 4.43% from 2022-2028.

MARKET TRENDS AND DRIVERS

Increasing Adoption of Automated Cleaning Solutions

In the domain of laboratory equipment and workflows, cleanliness and precision are vital. The laboratory glassware washers market has witnessed a significant evolution with the adoption of automated cleaning solutions. Laboratories across various industries, from research and healthcare to pharmaceuticals and academics, are increasingly turning to automation to enhance efficiency, accuracy, and safety in cleaning laboratory glassware. This trend emphasizes the transformative impact of technology on laboratory operations. Industries such as pharmaceuticals and healthcare require adherence to rigorous quality and safety standards. Automated cleaning solutions provide a reliable means of achieving compliance and maintaining consistent results. Laboratories dealing with high sample volumes or numerous experiments benefit from automation as it enables parallel cleaning processes, reducing backlogs and bottlenecks. Many automated systems come equipped with data recording and monitoring capabilities. This provides valuable insights into cleaning cycles, usage patterns, and maintenance needs, enabling informed decision-making.

Rising R&D Activities in Pharmaceutical & Biotechnology Sectors

The increasing R&D activities in the pharmaceutical and biotechnology sectors have significantly impacted the laboratory glassware washers market. As research efforts intensify, the demand for efficient, reliable, and compliant cleaning and sterilization solutions for glassware used in drug development, quality control, and experimentation has surged. This trend has spurred the adoption of technologically advanced laboratory glassware washers that offer customization, automation, and data integration features, thus driving market growth and innovation to cater to the specific needs of these critical sectors. Further, the rising R&D activities in the pharmaceutical and biotechnology sectors serve as a market catalyst. As these sectors push the boundaries of scientific knowledge and innovation, the demand for precise and efficient glassware cleaning solutions becomes paramount.

A Shift from Manual to Automation in Laboratories

The manual to laboratory automation shift has significantly impacted the laboratory glassware washers market. Automation streamlines cleaning processes, reduces human error, and enhances efficiency, making laboratory glassware washers essential tools in modern labs. One of the key areas where automation is making a profound impact is glassware handling and maintenance. Laboratory glassware, ranging from delicate test tubes to intricate reaction vessels, requires meticulous cleaning and decontamination to ensure reliable experimental outcomes. The importance of clean and sterile glassware cannot be overstated in an automated laboratory setting, where instruments and systems are interconnected to execute tasks seamlessly. Furthermore, integrating laboratory glassware washers with automated laboratory systems aligns perfectly with the pursuit of efficiency and reliability. These washers offer a range of benefits that complement the growing shift toward automation, like time efficiency, data integrity, adaptability, and more.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT TYPE

The global laboratory glassware washers market by product type is segmented into freestanding and underbench/undercounter/compact. The freestanding segment dominated the segmental share in 2022. Freestanding washers are standalone units that can be placed independently in laboratories. They offer flexibility in placement and can accommodate larger quantities of glassware. These washers often come with advanced features such as automation, connectivity, and customizable cycles, catering to the needs of diverse industries. Also, the freestanding segment is expected to grow at the highest CAGR during the forecast period. Further, underbench/undercounter/compact are ideal for laboratories with limited space and offer efficient cleaning and decontamination for various glassware types. Undercounter washers are known for their convenience, user-friendly interfaces, and customizable cleaning cycles.

Segmentation by Product Type

- Freestanding

- Underbench/Undercunter/Compact

INSIGHTS BY CAPACITY

The global laboratory glassware washers market by capacity is segmented into high and medium capacity. In 2022, the high-capacity segment accounted for a significant market share. High-capacity washers cater to laboratories with high-volume glassware cleaning needs. These units are commonly found in pharmaceutical & biotechnology companies, research facilities, and industrial labs. They offer advanced automation, multiple washing cycles, and features for compliance with stringent regulations. High-capacity washers streamline operations by handling a substantial workload, ensuring efficient cleaning and sterilization processes for a wide range of glassware.

Segmentation by Capacity

- High Capacity

- Small & Medium Capacity

INSIGHTS BY END-USER

Healthcare & clinical laboratories end-user segment accounted for the largest share of the global laboratory glassware washers market in 2022. Hospitals, clinics, and clinical laboratories utilize laboratory glassware washers to uphold cleanliness standards for glassware used in patient diagnostics and healthcare procedures. Ensuring sterility and accurate results are crucial in healthcare settings, making these washers integral to patient care. Moreover, the healthcare & clinical laboratories segment is expected to grow at the highest CAGR during the forecast period. Also, healthcare laboratories process many patient samples, including blood, urine, and tissues. Glassware washers ensure that sample collection containers, such as test tubes and pipettes, are thoroughly cleaned and decontaminated between uses, preventing any residual material from affecting subsequent analyses.

Segmentation by End-user

- Healthcare & Clinical Laboratories

- Research Facilities & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Others

GEOGRAPHICAL ANALYSIS

North America held the most prominent global laboratory glassware washers market share in 2022 and exhibited robust growth due to well-funded research institutions, universities, and pharmaceutical companies. The U.S. and Canada lead the region in adopting cutting-edge technologies, including automation and advanced cleaning systems. Stringent regulatory standards and the emphasis on data integrity further drive the demand for laboratory glassware washers. Furthermore, automation, connectivity, and smart features have become essential components of modern laboratory glassware washers. Manufacturers in North America are embracing these advancements to meet the demand for precision, efficiency, and data integration.

Segmentation by Geography

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Turkey

- South Africa

- Saudi Arabia

COMPETITIVE LANDSCAPE

The global laboratory glassware washers market is an evolving market landscape that caters to the diverse needs of scientific research, experimentation, and industrial processes. As laboratories and industries seek to enhance efficiency, accuracy, and data integrity, the demand for advanced cleaning and sterilization solutions has driven the growth of this market. However, this growth has also fueled competition among manufacturers vying to offer innovative products, exceptional quality, and unparalleled customer support.

Key Company Profiles

- ATS Corporation

- Belimed

- Getinge

- LABINDIA

- Smeg

- Steelco

- STERIS

Other Prominent Vendors

- AT-OS S.r.l.

- Avantor

- Biobase

- Bioevopeak

- Biometer

- DE LAMA S.P.A.

- Fedegari Autoclavi S.p.A.

- Labconco

- LABELIANS

- Labstac

- Labtron Equipment

- MRC Laboratory Instruments

- Niagara Systems

- PROHS

- Rhima

- Spire Integrated Solutions

- Tuttnauer

- Yamato Scientific

KEY QUESTIONS ANSWERED:

1. How big is the global laboratory glassware washers market?

2. What is the projected growth rate of the global laboratory glassware washers market?

3. What are the rising trends in the laboratory glassware washers market?

4. Which region holds the most significant global laboratory glassware washers market share?

5. Who are the key players in the global laboratory glassware washers market?

TABLE OF CONTENTS

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

- 4.1 MARKET DEFINITION

- 4.1.1 INCLUSIONS

- 4.1.2 EXCLUSIONS

- 4.1.3 MARKET ESTIMATION CAVEATS

- 4.2 BASE YEAR

- 4.3 SCOPE OF THE STUDY

- 4.3.1 MARKET SEGMENTATION BY PRODUCT TYPE

- 4.3.2 MARKET SEGMENTATION BY CAPACITY

- 4.3.3 MARKET SEGMENTATION BY END-USER

- 4.3.4 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

- 5.1 KEY CAVEATS

- 5.2 CURRENCY CONVERSION

- 5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

- 6.1 OVERVIEW

- 6.1.1 GEOGRAPHY INSIGHTS

- 6.1.2 PRODUCT TYPE INSIGHTS

- 6.1.3 CAPACITY INSIGHTS

- 6.1.4 END-USER INSIGHTS

7 MARKET AT A GLANCE

8 INTRODUCTION

- 8.1 OVERVIEW

9 MARKET OPPORTUNITIES & TRENDS

- 9.1 INCREASE IN ADOPTION OF AUTOMATED CLEANING SOLUTIONS

- 9.2 EMERGENCE OF SMART LABORATORY GLASSWARE WASHERS

- 9.3 ADVANCES IN CLEANING TECHNOLOGY

- 9.4 RISE IN R&D ACTIVITIES IN PHARMACEUTICAL & BIOTECHNOLOGY SECTORS

10 MARKET GROWTH ENABLERS

- 10.1 INCREASE IN VOLUME OF TESTS IN CLINICAL & DIAGNOSTIC LABORATORIES

- 10.2 STRINGENT LABORATORY STANDARDS & REGULATIONS

- 10.3 SHIFT FROM MANUAL TO AUTOMATION IN LABORATORIES

11 MARKET RESTRAINTS

- 11.1 HIGH COST OF DEPLOYMENT & MAINTENANCE

- 11.2 SURGE IN USE OF DISPOSABLE/SINGLE-USE PRODUCTS

- 11.3 CUSTOMIZATION COMPLEXITY & LIMITED AWARENESS

12 MARKET LANDSCAPE

- 12.1 MARKET OVERVIEW

- 12.2 MARKET SIZE & FORECAST

- 12.3 MARKET OPPORTUNITY

- 12.3.1 MARKET BY GEOGRAPHY

- 12.3.2 MARKET BY PRODUCT TYPE

- 12.3.3 MARKET BY CAPACITY

- 12.3.4 MARKET BY END-USER

- 12.4 FIVE FORCES ANALYSIS

- 12.4.1 THREAT OF NEW ENTRANTS

- 12.4.2 BARGAINING POWER OF SUPPLIERS

- 12.4.3 BARGAINING POWER OF BUYERS

- 12.4.4 THREAT OF SUBSTITUTES

- 12.4.5 COMPETITIVE RIVALRY

13 PRODUCT TYPE

- 13.1 MARKET SNAPSHOT & GROWTH ENGINE

- 13.2 MARKET OVERVIEW

- 13.3 FREESTANDING

- 13.3.1 MARKET OVERVIEW

- 13.3.2 MARKET SIZE & FORECAST

- 13.3.3 MARKET BY GEOGRAPHY

- 13.4 UNDERBENCH/UNDERCOUNTER/COMPACT

- 13.4.1 MARKET OVERVIEW

- 13.4.2 MARKET SIZE & FORECAST

- 13.4.3 MARKET BY GEOGRAPHY

14 CAPACITY

- 14.1 MARKET SNAPSHOT & GROWTH ENGINE

- 14.2 MARKET OVERVIEW

- 14.3 HIGH CAPACITY

- 14.3.1 MARKET OVERVIEW

- 14.3.2 MARKET SIZE & FORECAST

- 14.3.3 MARKET BY GEOGRAPHY

- 14.4 SMALL & MEDIUM CAPACITY

- 14.4.1 MARKET OVERVIEW

- 14.4.2 MARKET SIZE & FORECAST

- 14.4.3 MARKET BY GEOGRAPHY

15 END-USER

- 15.1 MARKET SNAPSHOT & GROWTH ENGINE

- 15.2 MARKET OVERVIEW

- 15.3 HEALTHCARE & CLINICAL LABORATORIES

- 15.3.1 MARKET OVERVIEW

- 15.3.2 MARKET SIZE & FORECAST

- 15.3.3 MARKET BY GEOGRAPHY

- 15.4 RESEARCH FACILITIES & ACADEMIC INSTITUTES

- 15.4.1 MARKET OVERVIEW

- 15.4.2 MARKET SIZE & FORECAST

- 15.4.3 MARKET BY GEOGRAPHY

- 15.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 15.5.1 MARKET OVERVIEW

- 15.5.2 MARKET SIZE & FORECAST

- 15.5.3 MARKET BY GEOGRAPHY

- 15.6 OTHERS

- 15.6.1 MARKET OVERVIEW

- 15.6.2 MARKET SIZE & FORECAST

- 15.6.3 MARKET BY GEOGRAPHY

16 GEOGRAPHY

- 16.1 MARKET SNAPSHOT & GROWTH ENGINE

- 16.2 GEOGRAPHIC OVERVIEW

17 NORTH AMERICA

- 17.1 MARKET OVERVIEW

- 17.2 MARKET SIZE & FORECAST

- 17.2.1 MARKET BY PRODUCT TYPE

- 17.2.2 MARKET BY CAPACITY

- 17.2.3 MARKET BY END-USER

- 17.3 KEY COUNTRIES

- 17.3.1 US: MARKET SIZE & FORECAST

- 17.3.2 CANADA: MARKET SIZE & FORECAST

18 EUROPE

- 18.1 MARKET OVERVIEW

- 18.2 MARKET SIZE & FORECAST

- 18.2.1 MARKET BY PRODUCT TYPE

- 18.2.2 MARKET BY CAPACITY

- 18.2.3 MARKET BY END-USER

- 18.3 KEY COUNTRIES

- 18.3.1 GERMANY: MARKET SIZE & FORECAST

- 18.3.2 FRANCE: MARKET SIZE & FORECAST

- 18.3.3 UK: MARKET SIZE & FORECAST

- 18.3.4 ITALY: MARKET SIZE & FORECAST

- 18.3.5 SPAIN: MARKET SIZE & FORECAST

19 APAC

- 19.1 MARKET OVERVIEW

- 19.2 MARKET SIZE & FORECAST

- 19.2.1 MARKET BY PRODUCT TYPE

- 19.2.2 MARKET BY CAPACITY

- 19.2.3 MARKET BY END-USER

- 19.3 KEY COUNTRIES

- 19.3.1 CHINA: MARKET SIZE & FORECAST

- 19.3.2 JAPAN: MARKET SIZE & FORECAST

- 19.3.3 INDIA: MARKET SIZE & FORECAST

- 19.3.4 SOUTH KOREA: MARKET SIZE & FORECAST

- 19.3.5 AUSTRALIA: MARKET SIZE & FORECAST

20 LATIN AMERICA

- 20.1 MARKET OVERVIEW

- 20.2 MARKET SIZE & FORECAST

- 20.2.1 MARKET BY PRODUCT TYPE

- 20.2.2 MARKET BY CAPACITY

- 20.2.3 MARKET BY END-USER

- 20.3 KEY COUNTRIES

- 20.3.1 BRAZIL: MARKET SIZE & FORECAST

- 20.3.2 MEXICO: MARKET SIZE & FORECAST

- 20.3.3 ARGENTINA: MARKET SIZE & FORECAST

21 MIDDLE EAST & AFRICA

- 21.1 MARKET OVERVIEW

- 21.2 MARKET SIZE & FORECAST

- 21.2.1 MARKET BY PRODUCT TYPE

- 21.2.2 MARKET BY CAPACITY

- 21.2.3 MARKET BY END-USER

- 21.3 KEY COUNTRIES

- 21.3.1 TURKEY: MARKET SIZE & FORECAST

- 21.3.2 SOUTH AFRICA: MARKET SIZE & FORECAST

- 21.3.3 SAUDI ARABIA: MARKET SIZE & FORECAST

22 COMPETITIVE LANDSCAPE

- 22.1 COMPETITION OVERVIEW

- 22.2 MARKET SHARE ANALYSIS

- 22.2.1 ATS CORPORATION

- 22.2.2 BELIMED

- 22.2.3 GETINGE

- 22.2.4 LABINDIA

- 22.2.5 SMEG

- 22.2.6 STEELCO

- 22.2.7 STERIS

23 KEY COMPANY PROFILES

- 23.1 ATS CORPORATION

- 23.1.1 BUSINESS OVERVIEW

- 23.1.2 PRODUCT OFFERINGS

- 23.1.3 KEY STRATEGIES

- 23.1.4 KEY STRENGTHS

- 23.1.5 KEY OPPORTUNITIES

- 23.2 BELIMED

- 23.2.1 BUSINESS OVERVIEW

- 23.2.2 PRODUCT OFFERINGS

- 23.2.3 KEY STRATEGIES

- 23.2.4 KEY STRENGTHS

- 23.2.5 KEY OPPORTUNITIES

- 23.3 GETINGE

- 23.3.1 BUSINESS OVERVIEW

- 23.3.2 PRODUCT OFFERINGS

- 23.3.3 KEY STRATEGIES

- 23.3.4 KEY STRENGTHS

- 23.3.5 KEY OPPORTUNITIES

- 23.4 LABINDIA

- 23.4.1 BUSINESS OVERVIEW

- 23.4.2 PRODUCT OFFERINGS

- 23.4.3 KEY STRATEGIES

- 23.4.4 KEY STRENGTHS

- 23.4.5 KEY OPPORTUNITIES

- 23.5 SMEG

- 23.5.1 BUSINESS OVERVIEW

- 23.5.2 PRODUCT OFFERINGS

- 23.5.3 KEY STRATEGIES

- 23.5.4 KEY STRENGTHS

- 23.5.5 KEY OPPORTUNITIES

- 23.6 STEELCO

- 23.6.1 BUSINESS OVERVIEW

- 23.6.2 PRODUCT OFFERINGS

- 23.6.3 KEY STRATEGIES

- 23.6.4 KEY STRENGTHS

- 23.6.5 KEY OPPORTUNITIES

- 23.7 STERIS

- 23.7.1 BUSINESS OVERVIEW

- 23.7.2 PRODUCT OFFERINGS

- 23.7.3 KEY STRATEGIES

- 23.7.4 KEY STRENGTHS

- 23.7.5 KEY OPPORTUNITIES

24 OTHER PROMINENT VENDORS

- 24.1 AT-OS S.R.L.

- 24.1.1 BUSINESS OVERVIEW

- 24.1.2 PRODUCT OFFERINGS

- 24.2 AVANTOR

- 24.2.1 BUSINESS OVERVIEW

- 24.2.2 PRODUCT OFFERINGS

- 24.3 BIOBASE

- 24.3.1 BUSINESS OVERVIEW

- 24.3.2 PRODUCT OFFERINGS

- 24.4 BIOEVOPEAK

- 24.4.1 BUSINESS OVERVIEW

- 24.4.2 PRODUCT OFFERINGS

- 24.5 BIOMETER

- 24.5.1 BUSINESS OVERVIEW

- 24.5.2 PRODUCT OFFERINGS

- 24.6 DE LAMA S.P.A.

- 24.6.1 BUSINESS OVERVIEW

- 24.6.2 PRODUCT OFFERINGS

- 24.7 FEDEGARI AUTOCLAVI S.P.A.

- 24.7.1 BUSINESS OVERVIEW

- 24.7.2 PRODUCT OFFERINGS

- 24.8 LABCONCO

- 24.8.1 BUSINESS OVERVIEW

- 24.8.2 PRODUCT OFFERINGS

- 24.9 LABELIANS

- 24.9.1 BUSINESS OVERVIEW

- 24.9.2 PRODUCT OFFERINGS

- 24.10 LABSTAC

- 24.10.1 BUSINESS OVERVIEW

- 24.10.2 PRODUCT OFFERINGS

- 24.11 LABTRON EQUIPMENT

- 24.11.1 BUSINESS OVERVIEW

- 24.11.2 PRODUCT OFFERINGS

- 24.12 MRC LABORATORY INSTRUMENTS

- 24.12.1 BUSINESS OVERVIEW

- 24.12.2 PRODUCT OFFERINGS

- 24.13 NIAGARA SYSTEMS

- 24.13.1 BUSINESS OVERVIEW

- 24.13.2 PRODUCT OFFERINGS

- 24.14 PROHS

- 24.14.1 BUSINESS OVERVIEW

- 24.14.2 PRODUCT OFFERINGS

- 24.15 RHIMA

- 24.15.1 BUSINESS OVERVIEW

- 24.15.2 PRODUCT OFFERINGS

- 24.16 SPIRE INTEGRATED SOLUTIONS

- 24.16.1 BUSINESS OVERVIEW

- 24.16.2 PRODUCT OFFERINGS

- 24.17 TUTTNAUER

- 24.17.1 BUSINESS OVERVIEW

- 24.17.2 PRODUCT OFFERINGS

- 24.18 YAMATO SCIENTIFIC

- 24.18.1 BUSINESS OVERVIEW

- 24.18.2 PRODUCT OFFERINGS

25 REPORT SUMMARY

- 25.1 KEY TAKEAWAYS

- 25.2 STRATEGIC RECOMMENDATIONS

26 QUANTITATIVE SUMMARY

- 26.1 MARKET BY PRODUCT TYPE

- 26.1.1 NORTH AMERICA

- 26.1.2 EUROPE

- 26.1.3 APAC

- 26.1.4 LATIN AMERICA

- 26.1.5 MIDDLE EAST & AFRICA

- 26.2 MARKET BY CAPACITY

- 26.2.1 NORTH AMERICA

- 26.2.2 EUROPE

- 26.2.3 APAC

- 26.2.4 LATIN AMERICA

- 26.2.5 MIDDLE EAST & AFRICA

- 26.3 MARKET BY END-USER

- 26.3.1 NORTH AMERICA

- 26.3.2 EUROPE

- 26.3.4 APAC

- 26.3.6 LATIN AMERICA

- 26.3.8 MIDDLE EAST & AFRICA

- 26.4 MARKET BY GEOGRAPHY

- 26.4.1 FREESTANDING

- 26.4.2 UNDERBENCH/UNDERCOUNTER/COMPACT

- 26.4.3 HIGH CAPACITY

- 26.4.4 SMALL & MEDIUM CAPACITY

- 26.4.5 HEALTHCARE & CLINICAL LABORATORIES

- 26.4.6 RESEARCH FACILITIES & ACADEMIC INSTITUTES

- 26.4.7 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 26.4.8 OTHERS

27 APPENDIX

- 27.1 ABBREVIATIONS