|

市場調査レポート

商品コード

1641753

複合材料試験の世界市場:タイプ別、試験タイプ別、最終用途産業別 - 機会分析と産業予測(2024年~2033年)Composites Testing Market By Type , By Test Type By End-Use Industry : Global Opportunity Analysis and Industry Forecast, 2024-2033 |

||||||

|

|||||||

| 複合材料試験の世界市場:タイプ別、試験タイプ別、最終用途産業別 - 機会分析と産業予測(2024年~2033年) |

|

出版日: 2024年11月01日

発行: Allied Market Research

ページ情報: 英文 340 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

複合材料試験市場

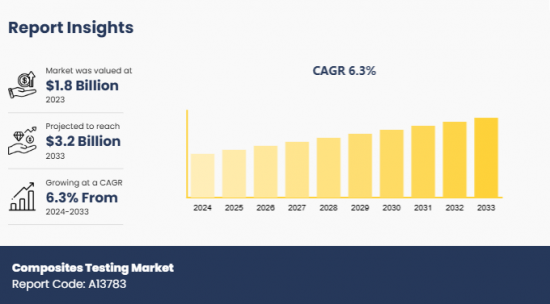

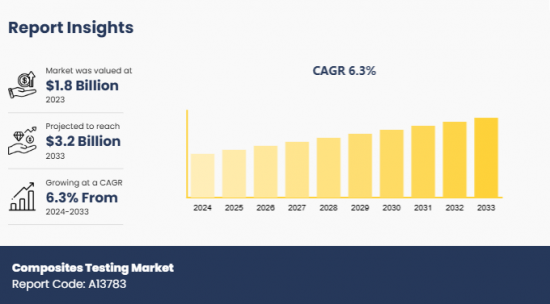

世界の複合材料試験の市場規模は、2023年に18億米ドルと評価され、2024年~2033年にCAGR6.3%で成長し、2033年には32億米ドルに達すると予測されています。

複合材料試験には、複合材料の機械的、熱的、物理的、環境的特性の試験が含まれ、多様な用途で必須性能基準に適合していることを確認します。複合材料は、際立った特性を持つ2つ以上の構成要素の組み合わせによって形成され、その結果、個々の要素に比べて優れた特性を持つ材料になります。複合材料は、その異方性特性や環境条件に対する敏感さにより、金属やポリマーとは異なる挙動を示す傾向があるため、堅牢な試験を実施することが極めて重要です。

軽量であることから、自動車産業や航空宇宙産業からの複合材料に対する需要の増加が、これらの要素の開発と試験を後押しし、市場の成長を促進しています。さらに、複合材料の開発手順における技術革新は、これらのプロセスの信頼性を確保するための試験プロセスを促進し、それによって市場の成長を顕著に増大させています。試験プロセスの精度を高めるために、AI、ML、モノのインターネットなどのインダストリー4.0技術の統合が現在の動向です。これらの技術は、予測モデリングやリアルタイムモニタリングを通じて試験手順の効率を高めます。

しかし、複合材料試験に関連する技術のコストが高いため、予算に敏感なメーカーや研究機関での導入が制限され、市場の成長を妨げています。さらに、試験手順が標準化されていないため、新しい複合材料の認証と受け入れが遅れ、市場開拓を抑制しています。これとは逆に、再生可能な資源からエネルギーを生産するための複合材料の使用量の増加は、複合材料試験市場に新たな道を開くと予測されています。国際エネルギー機関によると、電力、熱、輸送分野における再生可能エネルギーの消費は、2030年までに60%増加すると予測されています。これにより、疲労や天候による劣化に対する複合材料の耐荷重性や有効性を調べるための独創的な試験ソリューションの必要性が高まるものと思われます。

セグメントレビュー

複合材料試験市場は、タイプ、試験タイプ、最終用途産業、地域に区分されます。タイプ別では、市場はセラミック基複合材料、ポリマー基複合材料、金属基複合材料、繊維強化複合材料、その他に分けられます。試験タイプ別では、破壊試験と非破壊試験に二分されます。最終用途産業別では、航空宇宙、自動車、建設、その他に分類されます。地域別では、北米、欧州、アジア太平洋、ラテンアメリカ・中東・アフリカで分析されます。

主な調査結果

タイプ別では、繊維強化複合材料セグメントが2023年に最も高い市場シェアを占めました。

試験タイプ別では、非破壊試験セグメントが2023年の市場を独占しました。

最終用途産業別では、航空宇宙セグメントが2023年の市場で注目すべき地位を獲得しました。

地域別では、欧州が2023年に最も高い収益を上げました。

本レポートで可能なレポートカスタマイズ(追加費用とタイムラインに関しましては販売担当へご連絡ください)

- 設備投資の内訳

- 消費者の購買行動分析

- エンドユーザーの嗜好とペインポイント

- 製品ベンチマーク/製品仕様と用途

- 製品ライフサイクル

- サプライチェーン分析とベンダーのマージン

- 地域別の新規参入企業

- 技術動向分析

- ディストリビューターのマージン分析

- 市場参入戦略

- 製品/セグメント別の市場セグメンテーション

- 主な企業の新製品開発/製品マトリックス

- 規制ガイドライン

- 顧客の関心に応じた追加企業プロファイル

- 国別または地域別の追加分析:市場規模と予測

- ブランドシェア分析

- 過去の市場データ

- 輸出入分析/データ

- 主要企業の詳細(所在地、連絡先詳細、サプライヤー/ベンダーネットワークなどを含む、エクセル形式)

- 一人当たり消費動向

- 製品消費分析

- SWOT分析

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場情勢

- 市場の定義と範囲

- 主な調査結果

- 主な投資機会

- 主要成功戦略

- ポーターのファイブフォース分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

第4章 複合材料試験市場:タイプ別

- 市場概要

- セラミック基複合材料

- ポリマー基複合材料

- 金属基複合材料

- 繊維強化複合材料

- その他

第5章 複合材料試験市場:試験タイプ別

- 市場概要

- 破壊試験

- 非破壊試験

第6章 複合材料試験市場:最終用途産業別

- 市場概要

- 航空宇宙

- 自動車

- 建設

- その他

第7章 複合材料試験市場:地域別

- 市場概要

- 北米

- 主な市場動向と機会

- 米国の複合材料試験市場

- カナダの複合材料試験市場

- メキシコの複合材料試験市場

- 欧州

- 主な市場動向と機会

- フランスの複合材料試験市場

- ドイツの複合材料試験市場

- イタリアの複合材料試験市場

- スペインの複合材料試験市場

- 英国の複合材料試験市場

- その他欧州の複合材料試験市場

- アジア太平洋

- 主な市場動向と機会

- 中国の複合材料試験市場

- 日本の複合材料試験市場

- インドの複合材料試験市場

- 韓国の複合材料試験市場

- オーストラリアの複合材料試験市場

- その他アジア太平洋の複合材料試験市場

- ラテンアメリカ・中東・アフリカ

- 主な市場動向と機会

- ブラジルの複合材料試験市場

- 南アフリカの複合材料試験市場

- サウジアラビアの複合材料試験市場

- その他ラテンアメリカ・中東・アフリカの複合材料試験市場

第8章 競合情勢

- イントロダクション

- 主要成功戦略

- 主要10企業の製品マッピング

- 競合ダッシュボード

- 競合ヒートマップ

- 主要企業のポジショニング:2023年

第9章 企業プロファイル

- Intertek Group Plc

- TA Instruments

- Micro Materials

- Element Materials Technology

- Thermtest Inc.

- Kinectrics

- SGS General Surveillance Company SA

- Henkel AG And Co. KGaA

- Instron Corporation

- R-TECH MATERIALS

Composites Testing Market

The composites testing market was valued at $1.8 billion in 2023 and is projected to reach $3.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Composites testing involves the examination of mechanical, thermal, physical, and environmental properties of composite materials to ensure they cater to the essential performance criteria across diverse applications. A composite is formed by the combination of two or more components with distinguished characteristics, resulting in a material with superior properties as compared to the individual elements. Conducting robust testing is crucial as composites tend to behave differently from metals or polymers owing to their anisotropic properties and sensitivity to environmental conditions.

Increase in demand for composites from the automotive and aerospace industries owing to their lightweight property has boosted the development & testing of these elements, which is driving the growth of the market. In addition, innovations in the development procedures of composites have fueled the testing process to ensure the reliability of these processes, thereby augmenting the market growth notably. To enhance precision in the testing process, the integration of Industry 4.0 technologies such as AI, ML, and the Internet of Things is currently trending. These technologies enhance the efficiency of testing procedures through predictive modeling and real-time monitoring.

However, the high cost of technologies associated with composites testing restricts its adoption among budget-sensitive manufacturers and research institutions, which hinders the growth of the market. Furthermore, lack of standardization in testing procedures delays the certification and acceptance of new composites, restraining the market development. On the contrary, rise in the usage of composites to produce energy from renewable sources is projected to open new avenues for the composites testing market. According to the International Energy Agency, the consumption of renewable energy in the power, heat, and transport sectors is projected to increase by 60% by 2030. This is poised to fuel the need for ingenious testing solutions to examine the load-bearing capacity and effectiveness of composites against fatigue & weather-induced degradation.

Segment Review

The composites testing market is segmented into type, test type, end-use industry, and region. On the basis of type, the market is divided into ceramic matrics composites, polymer matrics composites, metal matrics composites, fiber reinforced composites, and others. As per test type, it is bifurcated into destructive test and non-destructive test. Depending on end-use industry, it is categorized into aerospace, automotive, construction, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Findings

On the basis of type, the fiber reinforced composites segment held the highest market share in 2023.

As per test type, the non-destructive test segment dominated the market in 2023.

Depending on end-use industry, the aerospace segment acquired a notable stake in the market in 2023.

Region wise, Europe was the highest revenue generator in 2023.

Competition Analysis

The major players in the global composites testing market include Intertek Group plc, TA Instruments, Micro Materials, Element Materials Technology, Thermtest Inc., Kinectrics, SGS General Surveillance Company SA, Henkel AG & Co. KGaA, Instron Corporation, and R-TECH MATERIALS. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships to strengthen their foothold in the competitive market.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Capital Investment breakdown

- Consumer Buying Behavior Analysis

- End user preferences and pain points

- Product Benchmarking / Product specification and applications

- Product Life Cycles

- Supply Chain Analysis & Vendor Margins

- Upcoming/New Entrant by Regions

- Technology Trend Analysis

- Distributor margin Analysis

- Go To Market Strategy

- Market share analysis of players by products/segments

- New Product Development/ Product Matrix of Key Players

- Regulatory Guidelines

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Brands Share Analysis

- Historic market data

- Import Export Analysis/Data

- Key player details (including location, contact details, supplier/vendor network etc. in excel format)

- Per Capita Consumption Trends

- Product Consumption Analysis

- SWOT Analysis

Key Market Segments

By Type

- Ceramic Matrics Composites

- Polymer Matrics Composites

- Metal Matrics Composites

- Fiber Reinforced Composites

- Others

By Test Type

- Destructive Test

- Non-Destructive Test

By End-Use Industry

- Aerospace

- Automotive

- Construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players:

- Intertek Group plc

- TA Instruments

- Micro Materials

- Element Materials Technology

- Thermtest Inc.

- Kinectrics

- SGS General Surveillance Company SA

- Henkel AG & Co. KGaA

- Instron Corporation

- R-TECH MATERIALS

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report Description

- 1.2. Key Market Segments

- 1.3. Key Benefits

- 1.4. Research Methodology

- 1.4.1. Primary Research

- 1.4.2. Secondary Research

- 1.4.3. Analyst Tools and Models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET LANDSCAPE

- 3.1. Market Definition and Scope

- 3.2. Key Findings

- 3.2.1. Top Investment Pockets

- 3.2.2. Top Winning Strategies

- 3.3. Porter's Five Forces Analysis

- 3.3.1. Bargaining Power of Suppliers

- 3.3.2. Threat of New Entrants

- 3.3.3. Threat of Substitutes

- 3.3.4. Competitive Rivalry

- 3.3.5. Bargaining Power among Buyers

- 3.4. Market Dynamics

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.3. Opportunities

CHAPTER 4: COMPOSITES TESTING MARKET, BY TYPE

- 4.1. Market Overview

- 4.1.1 Market Size and Forecast, By Type

- 4.2. Ceramic Matrics Composites

- 4.2.1. Key Market Trends, Growth Factors and Opportunities

- 4.2.2. Market Size and Forecast, By Region

- 4.2.3. Market Share Analysis, By Country

- 4.3. Polymer Matrics Composites

- 4.3.1. Key Market Trends, Growth Factors and Opportunities

- 4.3.2. Market Size and Forecast, By Region

- 4.3.3. Market Share Analysis, By Country

- 4.4. Metal Matrics Composites

- 4.4.1. Key Market Trends, Growth Factors and Opportunities

- 4.4.2. Market Size and Forecast, By Region

- 4.4.3. Market Share Analysis, By Country

- 4.5. Fiber Reinforced Composites

- 4.5.1. Key Market Trends, Growth Factors and Opportunities

- 4.5.2. Market Size and Forecast, By Region

- 4.5.3. Market Share Analysis, By Country

- 4.6. Others

- 4.6.1. Key Market Trends, Growth Factors and Opportunities

- 4.6.2. Market Size and Forecast, By Region

- 4.6.3. Market Share Analysis, By Country

CHAPTER 5: COMPOSITES TESTING MARKET, BY TEST TYPE

- 5.1. Market Overview

- 5.1.1 Market Size and Forecast, By Test Type

- 5.2. Destructive Test

- 5.2.1. Key Market Trends, Growth Factors and Opportunities

- 5.2.2. Market Size and Forecast, By Region

- 5.2.3. Market Share Analysis, By Country

- 5.3. Non-Destructive Test

- 5.3.1. Key Market Trends, Growth Factors and Opportunities

- 5.3.2. Market Size and Forecast, By Region

- 5.3.3. Market Share Analysis, By Country

CHAPTER 6: COMPOSITES TESTING MARKET, BY END-USE INDUSTRY

- 6.1. Market Overview

- 6.1.1 Market Size and Forecast, By End-use Industry

- 6.2. Aerospace

- 6.2.1. Key Market Trends, Growth Factors and Opportunities

- 6.2.2. Market Size and Forecast, By Region

- 6.2.3. Market Share Analysis, By Country

- 6.3. Automotive

- 6.3.1. Key Market Trends, Growth Factors and Opportunities

- 6.3.2. Market Size and Forecast, By Region

- 6.3.3. Market Share Analysis, By Country

- 6.4. Construction

- 6.4.1. Key Market Trends, Growth Factors and Opportunities

- 6.4.2. Market Size and Forecast, By Region

- 6.4.3. Market Share Analysis, By Country

- 6.5. Others

- 6.5.1. Key Market Trends, Growth Factors and Opportunities

- 6.5.2. Market Size and Forecast, By Region

- 6.5.3. Market Share Analysis, By Country

CHAPTER 7: COMPOSITES TESTING MARKET, BY REGION

- 7.1. Market Overview

- 7.1.1 Market Size and Forecast, By Region

- 7.2. North America

- 7.2.1. Key Market Trends and Opportunities

- 7.2.2. Market Size and Forecast, By Type

- 7.2.3. Market Size and Forecast, By Test Type

- 7.2.4. Market Size and Forecast, By End-use Industry

- 7.2.5. Market Size and Forecast, By Country

- 7.2.6. U.S. Composites Testing Market

- 7.2.6.1. Market Size and Forecast, By Type

- 7.2.6.2. Market Size and Forecast, By Test Type

- 7.2.6.3. Market Size and Forecast, By End-use Industry

- 7.2.7. Canada Composites Testing Market

- 7.2.7.1. Market Size and Forecast, By Type

- 7.2.7.2. Market Size and Forecast, By Test Type

- 7.2.7.3. Market Size and Forecast, By End-use Industry

- 7.2.8. Mexico Composites Testing Market

- 7.2.8.1. Market Size and Forecast, By Type

- 7.2.8.2. Market Size and Forecast, By Test Type

- 7.2.8.3. Market Size and Forecast, By End-use Industry

- 7.3. Europe

- 7.3.1. Key Market Trends and Opportunities

- 7.3.2. Market Size and Forecast, By Type

- 7.3.3. Market Size and Forecast, By Test Type

- 7.3.4. Market Size and Forecast, By End-use Industry

- 7.3.5. Market Size and Forecast, By Country

- 7.3.6. France Composites Testing Market

- 7.3.6.1. Market Size and Forecast, By Type

- 7.3.6.2. Market Size and Forecast, By Test Type

- 7.3.6.3. Market Size and Forecast, By End-use Industry

- 7.3.7. Germany Composites Testing Market

- 7.3.7.1. Market Size and Forecast, By Type

- 7.3.7.2. Market Size and Forecast, By Test Type

- 7.3.7.3. Market Size and Forecast, By End-use Industry

- 7.3.8. Italy Composites Testing Market

- 7.3.8.1. Market Size and Forecast, By Type

- 7.3.8.2. Market Size and Forecast, By Test Type

- 7.3.8.3. Market Size and Forecast, By End-use Industry

- 7.3.9. Spain Composites Testing Market

- 7.3.9.1. Market Size and Forecast, By Type

- 7.3.9.2. Market Size and Forecast, By Test Type

- 7.3.9.3. Market Size and Forecast, By End-use Industry

- 7.3.10. UK Composites Testing Market

- 7.3.10.1. Market Size and Forecast, By Type

- 7.3.10.2. Market Size and Forecast, By Test Type

- 7.3.10.3. Market Size and Forecast, By End-use Industry

- 7.3.11. Rest Of Europe Composites Testing Market

- 7.3.11.1. Market Size and Forecast, By Type

- 7.3.11.2. Market Size and Forecast, By Test Type

- 7.3.11.3. Market Size and Forecast, By End-use Industry

- 7.4. Asia-Pacific

- 7.4.1. Key Market Trends and Opportunities

- 7.4.2. Market Size and Forecast, By Type

- 7.4.3. Market Size and Forecast, By Test Type

- 7.4.4. Market Size and Forecast, By End-use Industry

- 7.4.5. Market Size and Forecast, By Country

- 7.4.6. China Composites Testing Market

- 7.4.6.1. Market Size and Forecast, By Type

- 7.4.6.2. Market Size and Forecast, By Test Type

- 7.4.6.3. Market Size and Forecast, By End-use Industry

- 7.4.7. Japan Composites Testing Market

- 7.4.7.1. Market Size and Forecast, By Type

- 7.4.7.2. Market Size and Forecast, By Test Type

- 7.4.7.3. Market Size and Forecast, By End-use Industry

- 7.4.8. India Composites Testing Market

- 7.4.8.1. Market Size and Forecast, By Type

- 7.4.8.2. Market Size and Forecast, By Test Type

- 7.4.8.3. Market Size and Forecast, By End-use Industry

- 7.4.9. South Korea Composites Testing Market

- 7.4.9.1. Market Size and Forecast, By Type

- 7.4.9.2. Market Size and Forecast, By Test Type

- 7.4.9.3. Market Size and Forecast, By End-use Industry

- 7.4.10. Australia Composites Testing Market

- 7.4.10.1. Market Size and Forecast, By Type

- 7.4.10.2. Market Size and Forecast, By Test Type

- 7.4.10.3. Market Size and Forecast, By End-use Industry

- 7.4.11. Rest of Asia-Pacific Composites Testing Market

- 7.4.11.1. Market Size and Forecast, By Type

- 7.4.11.2. Market Size and Forecast, By Test Type

- 7.4.11.3. Market Size and Forecast, By End-use Industry

- 7.5. LAMEA

- 7.5.1. Key Market Trends and Opportunities

- 7.5.2. Market Size and Forecast, By Type

- 7.5.3. Market Size and Forecast, By Test Type

- 7.5.4. Market Size and Forecast, By End-use Industry

- 7.5.5. Market Size and Forecast, By Country

- 7.5.6. Brazil Composites Testing Market

- 7.5.6.1. Market Size and Forecast, By Type

- 7.5.6.2. Market Size and Forecast, By Test Type

- 7.5.6.3. Market Size and Forecast, By End-use Industry

- 7.5.7. South Africa Composites Testing Market

- 7.5.7.1. Market Size and Forecast, By Type

- 7.5.7.2. Market Size and Forecast, By Test Type

- 7.5.7.3. Market Size and Forecast, By End-use Industry

- 7.5.8. Saudi Arabia Composites Testing Market

- 7.5.8.1. Market Size and Forecast, By Type

- 7.5.8.2. Market Size and Forecast, By Test Type

- 7.5.8.3. Market Size and Forecast, By End-use Industry

- 7.5.9. Rest of LAMEA Composites Testing Market

- 7.5.9.1. Market Size and Forecast, By Type

- 7.5.9.2. Market Size and Forecast, By Test Type

- 7.5.9.3. Market Size and Forecast, By End-use Industry

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top Winning Strategies

- 8.3. Product Mapping Of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top Player Positioning, 2023

CHAPTER 9: COMPANY PROFILES

- 9.1. Intertek Group Plc

- 9.1.1. Company Overview

- 9.1.2. Key Executives

- 9.1.3. Company Snapshot

- 9.1.4. Operating Business Segments

- 9.1.5. Product Portfolio

- 9.1.6. Business Performance

- 9.1.7. Key Strategic Moves and Developments

- 9.2. TA Instruments

- 9.2.1. Company Overview

- 9.2.2. Key Executives

- 9.2.3. Company Snapshot

- 9.2.4. Operating Business Segments

- 9.2.5. Product Portfolio

- 9.2.6. Business Performance

- 9.2.7. Key Strategic Moves and Developments

- 9.3. Micro Materials

- 9.3.1. Company Overview

- 9.3.2. Key Executives

- 9.3.3. Company Snapshot

- 9.3.4. Operating Business Segments

- 9.3.5. Product Portfolio

- 9.3.6. Business Performance

- 9.3.7. Key Strategic Moves and Developments

- 9.4. Element Materials Technology

- 9.4.1. Company Overview

- 9.4.2. Key Executives

- 9.4.3. Company Snapshot

- 9.4.4. Operating Business Segments

- 9.4.5. Product Portfolio

- 9.4.6. Business Performance

- 9.4.7. Key Strategic Moves and Developments

- 9.5. Thermtest Inc.

- 9.5.1. Company Overview

- 9.5.2. Key Executives

- 9.5.3. Company Snapshot

- 9.5.4. Operating Business Segments

- 9.5.5. Product Portfolio

- 9.5.6. Business Performance

- 9.5.7. Key Strategic Moves and Developments

- 9.6. Kinectrics

- 9.6.1. Company Overview

- 9.6.2. Key Executives

- 9.6.3. Company Snapshot

- 9.6.4. Operating Business Segments

- 9.6.5. Product Portfolio

- 9.6.6. Business Performance

- 9.6.7. Key Strategic Moves and Developments

- 9.7. SGS General Surveillance Company SA

- 9.7.1. Company Overview

- 9.7.2. Key Executives

- 9.7.3. Company Snapshot

- 9.7.4. Operating Business Segments

- 9.7.5. Product Portfolio

- 9.7.6. Business Performance

- 9.7.7. Key Strategic Moves and Developments

- 9.8. Henkel AG And Co. KGaA

- 9.8.1. Company Overview

- 9.8.2. Key Executives

- 9.8.3. Company Snapshot

- 9.8.4. Operating Business Segments

- 9.8.5. Product Portfolio

- 9.8.6. Business Performance

- 9.8.7. Key Strategic Moves and Developments

- 9.9. Instron Corporation

- 9.9.1. Company Overview

- 9.9.2. Key Executives

- 9.9.3. Company Snapshot

- 9.9.4. Operating Business Segments

- 9.9.5. Product Portfolio

- 9.9.6. Business Performance

- 9.9.7. Key Strategic Moves and Developments

- 9.10. R-TECH MATERIALS

- 9.10.1. Company Overview

- 9.10.2. Key Executives

- 9.10.3. Company Snapshot

- 9.10.4. Operating Business Segments

- 9.10.5. Product Portfolio

- 9.10.6. Business Performance

- 9.10.7. Key Strategic Moves and Developments