|

|

市場調査レポート

商品コード

1344319

細胞凍結保存市場:タイプ別、用途別、エンドユーザー別:世界の機会分析と産業予測、2023-2032年Cell Cryopreservation Market By Type, By Application, By End User : Global Opportunity Analysis and Industry Forecast, 2023-2032 |

||||||

|

|||||||

| 細胞凍結保存市場:タイプ別、用途別、エンドユーザー別:世界の機会分析と産業予測、2023-2032年 |

|

出版日: 2023年06月01日

発行: Allied Market Research

ページ情報: 英文 266 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

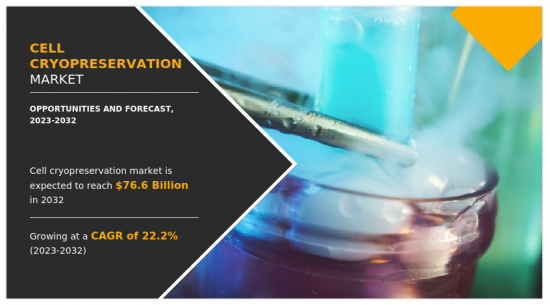

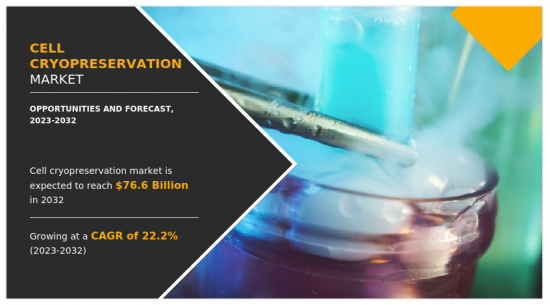

Allied Market Researchが発行した調査レポート「細胞凍結保存市場」によると、細胞凍結保存市場は2022年に103億米ドルと評価され、2023年から2032年にかけてCAGR 22.2%で成長し、2032年には766億米ドルに達すると推定されています。

細胞凍結保存は、細胞を超低温で凍結保存し、その生存能力と機能性を長期間維持するプロセスです。この技術により、細胞を保存し、後に解凍して研究、医療、その他の用途に使用することができます。この研究では、幹細胞、卵母細胞、精子細胞、その他の用途を対象としています。また、製薬会社、バイオテクノロジー会社、研究機関、その他が主なエンドユーザーです。

世界の細胞凍結保存市場の成長は、卵子凍結サイクル数の増加と相まって、女性の不妊症の増加が主な要因となっています。The Society for Assisted Reproductive Technology(生殖補助技術協会)によると、米国では2020年から2021年にかけて卵子凍結サイクルが31%増加したと報告されています。さらに、バイオバンクの存在の増加により、細胞凍結保存市場の成長が促進されると予想されます。バイオバンクは、生物医学研究、創薬、個別化医療を促進する上で極めて重要な役割を担っているため、注目を集めています。バイオバンク・リソース・センターによると、2023年現在、カナダと国際的なバイオバンクを含め340のバイオバンクが登録されています。

さらに、Journal of Biopreservation and Biobankingによると、2022年には、BBMRIのディレクトリに17カ国641のバイオバンクが登録されていると報告されています(2021年2月12日現在)。バイオバンキング技術の進歩や、より大規模で包括的なバイオバンクの設立に伴い、効率的で信頼性の高い細胞凍結保存法の需要は著しく高まっています。さらに、製薬業界やバイオテクノロジー業界における研究開発活動の増加、研究開発活動に対する政府支援の増加、がんやパーキンソン病などの慢性疾患の有病率の増加が市場の成長を後押ししています。

医療資源サービス局によると2023年に、米国のドナー登録は900万人を超える潜在的なドナーが含まれていると報告されました。さらに、国立医学図書館によると、2022年には、網膜疾患、パーキンソン病、ハンチントン病、脊髄損傷、心筋梗塞、1型糖尿病などの幅広い疾患の治療のために、胚性幹細胞でさまざまな前臨床研究活動が行われていると報告されています。さらに、インド政府は、インド医学研究評議会(ICMR)、バイオテクノロジー省(DBT)、科学技術省(DST)などの国家助成機関を通じて、基礎研究だけでなく臨床研究も支援することで、様々な省庁や機関を通じて幹細胞研究を実施しています。

Regulatory Affairs Professionals Societyによると、2021年には約2,754のクリニックが幹細胞治療を提供しています。その結果、幹細胞治療に対する需要の高まりが細胞凍結保存市場の重要な促進要因となっています。また、個別化医療に対する需要の急増は、細胞凍結保存市場の重要な促進要因として作用すると予想されます。免疫細胞ベースの免疫療法や人工細胞療法などの細胞ベースの治療法は、個別化治療のアプローチとして研究されています。凍結保存は、免疫細胞を含む患者特異的な細胞の長期保存を可能にし、個別化治療の開発に利用できます。

これらの細胞を保存することで、凍結保存は患者特異的治療に必要な時に利用可能であることを保証します。個別化医療への関心が高まるにつれ、細胞凍結保存法や保存施設への需要も同時に高まり、世界市場の成長を後押ししています。さらに、不妊率の上昇も市場の成長に大きく寄与しています。しかし、細胞凍結保存の代替療法が利用可能であることや、保存手順の維持コストが高いことが市場成長の妨げとなっています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 市場概要

- 市場の定義と範囲

- 主な調査結果

- 影響要因

- 主な投資機会

- ポーターのファイブフォース分析

- 市場力学

- 促進要因

- 卵子凍結サイクルの増加

- 幹細胞の研究開発活動の増加

- バイオバンク数の増加と個別化医療需要の急増

- 抑制要因

- 細胞凍結保存の代替療法の利用可能性

- 機会

- 研究開発活動に対する政府支援の増加

- 様々な細胞を保存するための新規製品の開発に注力するメーカーの増加

- 促進要因

- COVID-19による市場への影響分析

- 特許情勢

第4章 細胞凍結保存市場:タイプ別

- 凍結保存媒体

- 細胞凍結保存市場:エージェント別

- 装置

- 細胞凍結保存市場:タイプ別

第5章 細胞凍結保存市場:用途別

- 幹細胞

- 卵母細胞

- 精子細胞

- その他

第6章 細胞凍結保存市場:エンドユーザー別

- 製薬・バイオテクノロジー企業

- 研究機関

- その他

第7章 細胞凍結保存市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- マレーシア

- その他アジア太平洋地域

- ラテンアメリカ・中東・アフリカ

- ブラジル

- 南アフリカ

- サウジアラビア

- その他の地域

第8章 競合情勢

- イントロダクション

- 主要成功戦略

- 主要10社の製品マッピング

- 競合ダッシュボード

- 競合ヒートマップ

- 主要企業のポジショニング、2022年

第9章 企業プロファイル

- Creative Biolabs

- Eppendorf Corporate

- Lonza

- PromoCell GmbH

- Sartorius AG

- BioLife Solutions, Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- HiMedia Laboratories

- Merck Group KGaA

LIST OF TABLES

- TABLE 01. GLOBAL CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 02. CELL CRYOPRESERVATION MARKET FOR CRYOPRESERVATION MEDIA, BY REGION, 2022-2032 ($MILLION)

- TABLE 03. GLOBAL CRYOPRESERVATION MEDIA CELL CRYOPRESERVATION MARKET, BY AGENT, 2022-2032 ($MILLION)

- TABLE 04. CELL CRYOPRESERVATION MARKET FOR EQUIPMENT, BY REGION, 2022-2032 ($MILLION)

- TABLE 05. GLOBAL EQUIPMENT CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 06. GLOBAL CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 07. CELL CRYOPRESERVATION MARKET FOR STEM CELLS, BY REGION, 2022-2032 ($MILLION)

- TABLE 08. CELL CRYOPRESERVATION MARKET FOR OOCYTES CELLS, BY REGION, 2022-2032 ($MILLION)

- TABLE 09. CELL CRYOPRESERVATION MARKET FOR SPERM CELLS, BY REGION, 2022-2032 ($MILLION)

- TABLE 10. CELL CRYOPRESERVATION MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

- TABLE 11. GLOBAL CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 12. CELL CRYOPRESERVATION MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANY, BY REGION, 2022-2032 ($MILLION)

- TABLE 13. CELL CRYOPRESERVATION MARKET FOR RESEARCH INSTITUTE, BY REGION, 2022-2032 ($MILLION)

- TABLE 14. CELL CRYOPRESERVATION MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

- TABLE 15. CELL CRYOPRESERVATION MARKET, BY REGION, 2022-2032 ($MILLION)

- TABLE 16. NORTH AMERICA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 17. NORTH AMERICA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 18. NORTH AMERICA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 19. NORTH AMERICA CELL CRYOPRESERVATION MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 20. U.S. CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 21. U.S. CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 22. U.S. CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 23. CANADA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 24. CANADA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 25. CANADA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 26. MEXICO CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 27. MEXICO CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 28. MEXICO CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 29. EUROPE CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 30. EUROPE CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 31. EUROPE CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 32. EUROPE CELL CRYOPRESERVATION MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 33. GERMANY CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 34. GERMANY CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 35. GERMANY CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 36. FRANCE CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 37. FRANCE CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 38. FRANCE CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 39. UK CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 40. UK CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 41. UK CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 42. ITALY CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 43. ITALY CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 44. ITALY CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 45. SPAIN CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 46. SPAIN CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 47. SPAIN CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 48. REST OF EUROPE CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 49. REST OF EUROPE CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 50. REST OF EUROPE CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 51. ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 52. ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 53. ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 54. ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 55. JAPAN CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 56. JAPAN CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 57. JAPAN CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 58. CHINA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 59. CHINA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 60. CHINA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 61. INDIA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 62. INDIA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 63. INDIA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 64. AUSTRALIA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 65. AUSTRALIA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 66. AUSTRALIA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 67. SOUTH KOREA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 68. SOUTH KOREA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 69. SOUTH KOREA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 70. MALAYSIA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 71. MALAYSIA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 72. MALAYSIA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 73. REST OF ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 74. REST OF ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 75. REST OF ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 76. LAMEA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 77. LAMEA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 78. LAMEA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 79. LAMEA CELL CRYOPRESERVATION MARKET, BY COUNTRY, 2022-2032 ($MILLION)

- TABLE 80. BRAZIL CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 81. BRAZIL CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 82. BRAZIL CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 83. SOUTH AFRICA, CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 84. SOUTH AFRICA, CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 85. SOUTH AFRICA, CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 86. SAUDI ARABIA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 87. SAUDI ARABIA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 88. SAUDI ARABIA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 89. REST OF LAMEA CELL CRYOPRESERVATION MARKET, BY TYPE, 2022-2032 ($MILLION)

- TABLE 90. REST OF LAMEA CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022-2032 ($MILLION)

- TABLE 91. REST OF LAMEA CELL CRYOPRESERVATION MARKET, BY END USER, 2022-2032 ($MILLION)

- TABLE 92. CREATIVE BIOLABS: KEY EXECUTIVES

- TABLE 93. CREATIVE BIOLABS: COMPANY SNAPSHOT

- TABLE 94. CREATIVE BIOLABS: PRODUCT SEGMENTS

- TABLE 95. CREATIVE BIOLABS: SERVICE SEGMENTS

- TABLE 96. CREATIVE BIOLABS: PRODUCT PORTFOLIO

- TABLE 97. EPPENDORF CORPORATE: KEY EXECUTIVES

- TABLE 98. EPPENDORF CORPORATE: COMPANY SNAPSHOT

- TABLE 99. EPPENDORF CORPORATE: PRODUCT SEGMENTS

- TABLE 100. EPPENDORF CORPORATE: PRODUCT PORTFOLIO

- TABLE 101. EPPENDORF CORPORATE: KEY STRATERGIES

- TABLE 102. LONZA: KEY EXECUTIVES

- TABLE 103. LONZA: COMPANY SNAPSHOT

- TABLE 104. LONZA: PRODUCT SEGMENTS

- TABLE 105. LONZA: SERVICE SEGMENTS

- TABLE 106. LONZA: PRODUCT PORTFOLIO

- TABLE 107. PROMOCELL GMBH: KEY EXECUTIVES

- TABLE 108. PROMOCELL GMBH: COMPANY SNAPSHOT

- TABLE 109. PROMOCELL GMBH: PRODUCT SEGMENTS

- TABLE 110. PROMOCELL GMBH: PRODUCT PORTFOLIO

- TABLE 111. SARTORIUS AG: KEY EXECUTIVES

- TABLE 112. SARTORIUS AG: COMPANY SNAPSHOT

- TABLE 113. SARTORIUS AG: PRODUCT SEGMENTS

- TABLE 114. SARTORIUS AG: PRODUCT PORTFOLIO

- TABLE 115. BIOLIFE SOLUTIONS, INC.: KEY EXECUTIVES

- TABLE 116. BIOLIFE SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 117. BIOLIFE SOLUTIONS, INC.: PRODUCT SEGMENTS

- TABLE 118. BIOLIFE SOLUTIONS, INC.: SERVICE SEGMENTS

- TABLE 119. BIOLIFE SOLUTIONS, INC.: PRODUCT PORTFOLIO

- TABLE 120. BIOLIFE SOLUTIONS, INC.: KEY STRATERGIES

- TABLE 121. DANAHER CORPORATION: KEY EXECUTIVES

- TABLE 122. DANAHER CORPORATION: COMPANY SNAPSHOT

- TABLE 123. DANAHER CORPORATION: PRODUCT SEGMENTS

- TABLE 124. DANAHER CORPORATION: PRODUCT PORTFOLIO

- TABLE 125. DANAHER CORPORATION: KEY STRATERGIES

- TABLE 126. THERMO FISHER SCIENTIFIC INC. : KEY EXECUTIVES

- TABLE 127. THERMO FISHER SCIENTIFIC INC. : COMPANY SNAPSHOT

- TABLE 128. THERMO FISHER SCIENTIFIC INC. : PRODUCT SEGMENTS

- TABLE 129. THERMO FISHER SCIENTIFIC INC. : SERVICE SEGMENTS

- TABLE 130. THERMO FISHER SCIENTIFIC INC. : PRODUCT PORTFOLIO

- TABLE 131. THERMO FISHER SCIENTIFIC INC. : KEY STRATERGIES

- TABLE 132. HIMEDIA LABORATORIES: KEY EXECUTIVES

- TABLE 133. HIMEDIA LABORATORIES: COMPANY SNAPSHOT

- TABLE 134. HIMEDIA LABORATORIES: PRODUCT SEGMENTS

- TABLE 135. HIMEDIA LABORATORIES: PRODUCT PORTFOLIO

- TABLE 136. MERCK GROUP KGAA: KEY EXECUTIVES

- TABLE 137. MERCK GROUP KGAA: COMPANY SNAPSHOT

- TABLE 138. MERCK GROUP KGAA: PRODUCT SEGMENTS

- TABLE 139. MERCK GROUP KGAA: PRODUCT PORTFOLIO

LIST OF FIGURES

- FIGURE 01. CELL CRYOPRESERVATION MARKET, 2022-2032

- FIGURE 02. SEGMENTATION OF CELL CRYOPRESERVATION MARKET, 2022-2032

- FIGURE 03. TOP INVESTMENT POCKETS IN CELL CRYOPRESERVATION MARKET (2023-2032)

- FIGURE 04. LOW BARGAINING POWER OF SUPPLIERS

- FIGURE 05. LOW THREAT OF NEW ENTRANTS

- FIGURE 06. LOW THREAT OF SUBSTITUTES

- FIGURE 07. LOW INTENSITY OF RIVALRY

- FIGURE 08. LOW BARGAINING POWER OF BUYERS

- FIGURE 09. DRIVERS, RESTRAINTS AND OPPORTUNITIES: GLOBALCELL CRYOPRESERVATION MARKET

- FIGURE 10. PATENT ANALYSIS BY COMPANY

- FIGURE 11. PATENT ANALYSIS BY COUNTRY

- FIGURE 11. CELL CRYOPRESERVATION MARKET, BY TYPE, 2022(%)

- FIGURE 12. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR CRYOPRESERVATION MEDIA, BY COUNTRY 2022 AND 2032(%)

- FIGURE 13. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR EQUIPMENT, BY COUNTRY 2022 AND 2032(%)

- FIGURE 14. CELL CRYOPRESERVATION MARKET, BY APPLICATION, 2022(%)

- FIGURE 15. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR STEM CELLS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 16. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR OOCYTES CELLS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 17. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR SPERM CELLS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 18. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 19. CELL CRYOPRESERVATION MARKET, BY END USER, 2022(%)

- FIGURE 20. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANY, BY COUNTRY 2022 AND 2032(%)

- FIGURE 21. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR RESEARCH INSTITUTE, BY COUNTRY 2022 AND 2032(%)

- FIGURE 22. COMPARATIVE SHARE ANALYSIS OF CELL CRYOPRESERVATION MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

- FIGURE 23. CELL CRYOPRESERVATION MARKET BY REGION, 2022

- FIGURE 24. U.S. CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 25. CANADA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 26. MEXICO CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 27. GERMANY CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 28. FRANCE CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 29. UK CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 30. ITALY CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 31. SPAIN CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 32. REST OF EUROPE CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 33. JAPAN CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 34. CHINA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 35. INDIA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 36. AUSTRALIA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 37. SOUTH KOREA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 38. MALAYSIA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 39. REST OF ASIA-PACIFIC CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 40. BRAZIL CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 41. SOUTH AFRICA, CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 42. SAUDI ARABIA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 43. REST OF LAMEA CELL CRYOPRESERVATION MARKET, 2022-2032 ($MILLION)

- FIGURE 44. TOP WINNING STRATEGIES, BY YEAR

- FIGURE 45. TOP WINNING STRATEGIES, BY DEVELOPMENT

- FIGURE 46. TOP WINNING STRATEGIES, BY COMPANY

- FIGURE 47. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 48. COMPETITIVE DASHBOARD

- FIGURE 49. COMPETITIVE HEATMAP: CELL CRYOPRESERVATION MARKET

- FIGURE 50. TOP PLAYER POSITIONING, 2022

- FIGURE 51. EPPENDORF CORPORATE: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 52. EPPENDORF CORPORATE: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 53. EPPENDORF CORPORATE: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 54. LONZA: NET SALES, 2020-2022 ($MILLION)

- FIGURE 55. LONZA: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 56. LONZA: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 57. SARTORIUS AG: NET SALES, 2020-2022 ($MILLION)

- FIGURE 58. SARTORIUS AG: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 59. SARTORIUS AG: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 60. BIOLIFE SOLUTIONS, INC.: NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 61. BIOLIFE SOLUTIONS, INC.: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 62. DANAHER CORPORATION: NET SALES, 2020-2022 ($MILLION)

- FIGURE 63. DANAHER CORPORATION: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 64. DANAHER CORPORATION: REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 65. THERMO FISHER SCIENTIFIC INC. : NET REVENUE, 2020-2022 ($MILLION)

- FIGURE 66. THERMO FISHER SCIENTIFIC INC. : REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 67. THERMO FISHER SCIENTIFIC INC. : REVENUE SHARE BY REGION, 2022 (%)

- FIGURE 68. MERCK GROUP KGAA: NET SALES, 2020-2022 ($MILLION)

- FIGURE 69. MERCK GROUP KGAA: REVENUE SHARE BY SEGMENT, 2022 (%)

- FIGURE 70. MERCK GROUP KGAA: REVENUE SHARE BY REGION, 2022 (%)

According to a new report published by Allied Market Research, titled, "Cell Cryopreservation Market," The cell cryopreservation market was valued at $10.3 billion in 2022, and is estimated to reach $76.6 billion by 2032, growing at a CAGR of 22.2% from 2023 to 2032. Cell cryopreservation is the process of freezing and storing cells at ultra-low temperatures to preserve their viability and functionality for extended periods. This technique allows cells to be stored and later thawed for use in research, medical treatments, or other applications. The applications covered in t study include stem cells, oocytes cells, sperm cells, and others. In addition, pharmaceutical & biotechnology company, research institute, and others are the major end users detailed in the report.

The growth of the global cell cryopreservation market is majorly driven by increase in infertility among women coupled with rise in number of egg freezing cycles. According to The Society for Assisted Reproductive Technology, it was reported that the egg freezing cycle increased by 31% from 2020 to 2021 in the U.S. In addition, rise in presence of biobanks is anticipated to drive the growth of the cell cryopreservation market. Biobanking has gained prominence due to its crucial role in facilitating biomedical research, drug discovery, and personalized medicine. According to the Biobank Resource Center, as of 2023, there are 340 registered biobanks, including both Canadian and international biobanks.

Moreover, according to the Journal of Biopreservation and Biobanking, in 2022, it was reported that the BBMRI directory listed 641 biobanks from 17 countries (as of February 12, 2021). With the advancement of biobanking technologies and the establishment of larger and more comprehensive biobanks, the demand for efficient and reliable cell cryopreservation methods has grown significantly. Furthermore, increase in R&D activities in pharmaceutical and biotechnology industries, rise in government support for R&D activities, and increase in prevalence of chronic diseases such as cancer and Parkinson's propel the growth of the market.

According to Health Resource and Service Administration, in 2023, it was reported that the donor registry contains more than 9 million potential donors in the U.S. Furthermore, as per the National Library of Medicine, in 2022, it was reported that various preclinical research activities are conducted in embryonic stem cells for the treatment of wide range of disease such as retinal diseases, Parkinson's disease, Huntington's disease, spinal cord injury, myocardial infarction, and type 1 diabetes. In addition, the Government of India conducted stem cell research through various departments and institutions by supporting basic as well as clinical research through national funding agencies such as the Indian Council of Medical Research (ICMR), Department of Biotechnology (DBT), and Department of Science and Technology (DST).

Furthermore, according to Regulatory Affairs Professionals Society, in 2021, there were around 2,754 clinics engaged in providing stem cell therapies. Consequently, the growing demand for stem cell therapies acts as a significant driver of the cell cryopreservation market. In addition, surge in demand for personalized medicines is expected to act as a significant driver of the cell cryopreservation market. Cell-based therapies, such as immune cell-based immunotherapies and engineered cell therapies, are being explored as personalized treatment approaches. Cryopreservation enables long-term storage of patient-specific cells, including immune cells, which can be used in the development of personalized therapies.

By preserving these cells, cryopreservation ensures their availability when needed for patient-specific treatments. As the interest in personalized medicine continues to grow, the demand for cell cryopreservation methods and storage facilities increases simultaneously, thereby augmenting the growth of the global market. Furthermore, rise in infertility rates notably contributes toward the growth of the market. However, availability of alternative therapies for cell cryopreservation and high maintenance cost in storage procedure hinder the growth of the market.

- The global cell cryopreservation market is segmented into type, application, end user, and region. On the basis of type, the market is bifurcated into cryopreservation media and equipment. The cryopreservation media segment is further sub segmented into ethylene glycol, dimethyl sulfoxide, glycerol, and others.. The equipment segment is subsegmented into freezers, liquid nitrogen supply tanks, and others.

- Depending on application, the market is classified into stem cells, oocytes cells, sperm cells, and others. By end user, it is segregated into pharmaceutical & biotechnology company, research institute, and others. Region wise, it is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA). The major companies profiled in the report include: Merck Group KGaA, HiMedia Laboratories, Thermo Fisher Scientific Inc. , Eppendorf Corporate, BioLife Solutions, Inc., Lonza, Sartorius AG, Creative Biolabs, Sartorius AG, and PromoCell GmbH.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell cryopreservation market analysis from 2021 to 2031 to identify the prevailing cell cryopreservation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell cryopreservation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cell cryopreservation market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

By Type

- Cryopreservation media

- Agent

- Ethylene glycol

- Dimethyl sulfoxide

- Glycerol

- Others

- Equipment

- Type

- Freezers

- Liquid nitrogen supply tanks

- Others

By Application

- Stem cells

- Oocytes cells

- Sperm cells

- Others

By End User

- Pharmaceutical and biotechnology company

- Research institute

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa,

- Saudi Arabia

- Rest of LAMEA

Key Market Players:

- BioLife Solutions, Inc.

- Creative Biolabs

- Danaher Corporation

- Eppendorf Corporate

- HiMedia Laboratories

- Lonza

- Merck Group KGaA

- PromoCell GmbH

- Sartorius AG

- Thermo Fisher Scientific Inc.

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report description

- 1.2. Key market segments

- 1.3. Key benefits to the stakeholders

- 1.4. Research Methodology

- 1.4.1. Primary research

- 1.4.2. Secondary research

- 1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

- 3.1. Market definition and scope

- 3.2. Key findings

- 3.2.1. Top impacting factors

- 3.2.2. Top investment pockets

- 3.3. Porter's five forces analysis

- 3.3.1. Low bargaining power of suppliers

- 3.3.2. Low threat of new entrants

- 3.3.3. Low threat of substitutes

- 3.3.4. Low intensity of rivalry

- 3.3.5. Low bargaining power of buyers

- 3.4. Market dynamics

- 3.4.1. Drivers

- 3.4.1.1. Increase in number of egg freezing cycles

- 3.4.1.2. Increase in research and development activities for stem cells

- 3.4.1.3. Rise in number of biobanks and surge in demand for personalized medicines

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.2.1. Availability of alternative therapies for cell cryopreservation

- 3.4.3. Opportunities

- 3.4.3.1. Increase in government support for research and development activities

- 3.4.3.2. Rise in focus of manufacturers on developing novel products for preserving various cells

- 3.5. COVID-19 Impact Analysis on the market

- 3.6. Patent Landscape

CHAPTER 4: CELL CRYOPRESERVATION MARKET, BY TYPE

- 4.1. Overview

- 4.1.1. Market size and forecast

- 4.2. Cryopreservation media

- 4.2.1. Key market trends, growth factors and opportunities

- 4.2.2. Market size and forecast, by region

- 4.2.3. Market share analysis by country

- 4.2.4. Cryopreservation media Cell Cryopreservation Market by Agent

- 4.3. Equipment

- 4.3.1. Key market trends, growth factors and opportunities

- 4.3.2. Market size and forecast, by region

- 4.3.3. Market share analysis by country

- 4.3.4. Equipment Cell Cryopreservation Market by Type

CHAPTER 5: CELL CRYOPRESERVATION MARKET, BY APPLICATION

- 5.1. Overview

- 5.1.1. Market size and forecast

- 5.2. Stem cells

- 5.2.1. Key market trends, growth factors and opportunities

- 5.2.2. Market size and forecast, by region

- 5.2.3. Market share analysis by country

- 5.3. Oocytes cells

- 5.3.1. Key market trends, growth factors and opportunities

- 5.3.2. Market size and forecast, by region

- 5.3.3. Market share analysis by country

- 5.4. Sperm cells

- 5.4.1. Key market trends, growth factors and opportunities

- 5.4.2. Market size and forecast, by region

- 5.4.3. Market share analysis by country

- 5.5. Others

- 5.5.1. Key market trends, growth factors and opportunities

- 5.5.2. Market size and forecast, by region

- 5.5.3. Market share analysis by country

CHAPTER 6: CELL CRYOPRESERVATION MARKET, BY END USER

- 6.1. Overview

- 6.1.1. Market size and forecast

- 6.2. Pharmaceutical and biotechnology company

- 6.2.1. Key market trends, growth factors and opportunities

- 6.2.2. Market size and forecast, by region

- 6.2.3. Market share analysis by country

- 6.3. Research institute

- 6.3.1. Key market trends, growth factors and opportunities

- 6.3.2. Market size and forecast, by region

- 6.3.3. Market share analysis by country

- 6.4. Others

- 6.4.1. Key market trends, growth factors and opportunities

- 6.4.2. Market size and forecast, by region

- 6.4.3. Market share analysis by country

CHAPTER 7: CELL CRYOPRESERVATION MARKET, BY REGION

- 7.1. Overview

- 7.1.1. Market size and forecast By Region

- 7.2. North America

- 7.2.1. Key trends and opportunities

- 7.2.2. Market size and forecast, by Type

- 7.2.3. Market size and forecast, by Application

- 7.2.4. Market size and forecast, by End User

- 7.2.5. Market size and forecast, by country

- 7.2.5.1. U.S.

- 7.2.5.1.1. Key market trends, growth factors and opportunities

- 7.2.5.1.2. Market size and forecast, by Type

- 7.2.5.1.3. Market size and forecast, by Application

- 7.2.5.1.4. Market size and forecast, by End User

- 7.2.5.2. Canada

- 7.2.5.2.1. Key market trends, growth factors and opportunities

- 7.2.5.2.2. Market size and forecast, by Type

- 7.2.5.2.3. Market size and forecast, by Application

- 7.2.5.2.4. Market size and forecast, by End User

- 7.2.5.3. Mexico

- 7.2.5.3.1. Key market trends, growth factors and opportunities

- 7.2.5.3.2. Market size and forecast, by Type

- 7.2.5.3.3. Market size and forecast, by Application

- 7.2.5.3.4. Market size and forecast, by End User

- 7.3. Europe

- 7.3.1. Key trends and opportunities

- 7.3.2. Market size and forecast, by Type

- 7.3.3. Market size and forecast, by Application

- 7.3.4. Market size and forecast, by End User

- 7.3.5. Market size and forecast, by country

- 7.3.5.1. Germany

- 7.3.5.1.1. Key market trends, growth factors and opportunities

- 7.3.5.1.2. Market size and forecast, by Type

- 7.3.5.1.3. Market size and forecast, by Application

- 7.3.5.1.4. Market size and forecast, by End User

- 7.3.5.2. France

- 7.3.5.2.1. Key market trends, growth factors and opportunities

- 7.3.5.2.2. Market size and forecast, by Type

- 7.3.5.2.3. Market size and forecast, by Application

- 7.3.5.2.4. Market size and forecast, by End User

- 7.3.5.3. UK

- 7.3.5.3.1. Key market trends, growth factors and opportunities

- 7.3.5.3.2. Market size and forecast, by Type

- 7.3.5.3.3. Market size and forecast, by Application

- 7.3.5.3.4. Market size and forecast, by End User

- 7.3.5.4. Italy

- 7.3.5.4.1. Key market trends, growth factors and opportunities

- 7.3.5.4.2. Market size and forecast, by Type

- 7.3.5.4.3. Market size and forecast, by Application

- 7.3.5.4.4. Market size and forecast, by End User

- 7.3.5.5. Spain

- 7.3.5.5.1. Key market trends, growth factors and opportunities

- 7.3.5.5.2. Market size and forecast, by Type

- 7.3.5.5.3. Market size and forecast, by Application

- 7.3.5.5.4. Market size and forecast, by End User

- 7.3.5.6. Rest of Europe

- 7.3.5.6.1. Key market trends, growth factors and opportunities

- 7.3.5.6.2. Market size and forecast, by Type

- 7.3.5.6.3. Market size and forecast, by Application

- 7.3.5.6.4. Market size and forecast, by End User

- 7.4. Asia-Pacific

- 7.4.1. Key trends and opportunities

- 7.4.2. Market size and forecast, by Type

- 7.4.3. Market size and forecast, by Application

- 7.4.4. Market size and forecast, by End User

- 7.4.5. Market size and forecast, by country

- 7.4.5.1. Japan

- 7.4.5.1.1. Key market trends, growth factors and opportunities

- 7.4.5.1.2. Market size and forecast, by Type

- 7.4.5.1.3. Market size and forecast, by Application

- 7.4.5.1.4. Market size and forecast, by End User

- 7.4.5.2. China

- 7.4.5.2.1. Key market trends, growth factors and opportunities

- 7.4.5.2.2. Market size and forecast, by Type

- 7.4.5.2.3. Market size and forecast, by Application

- 7.4.5.2.4. Market size and forecast, by End User

- 7.4.5.3. India

- 7.4.5.3.1. Key market trends, growth factors and opportunities

- 7.4.5.3.2. Market size and forecast, by Type

- 7.4.5.3.3. Market size and forecast, by Application

- 7.4.5.3.4. Market size and forecast, by End User

- 7.4.5.4. Australia

- 7.4.5.4.1. Key market trends, growth factors and opportunities

- 7.4.5.4.2. Market size and forecast, by Type

- 7.4.5.4.3. Market size and forecast, by Application

- 7.4.5.4.4. Market size and forecast, by End User

- 7.4.5.5. South Korea

- 7.4.5.5.1. Key market trends, growth factors and opportunities

- 7.4.5.5.2. Market size and forecast, by Type

- 7.4.5.5.3. Market size and forecast, by Application

- 7.4.5.5.4. Market size and forecast, by End User

- 7.4.5.6. Malaysia

- 7.4.5.6.1. Key market trends, growth factors and opportunities

- 7.4.5.6.2. Market size and forecast, by Type

- 7.4.5.6.3. Market size and forecast, by Application

- 7.4.5.6.4. Market size and forecast, by End User

- 7.4.5.7. Rest of Asia-Pacific

- 7.4.5.7.1. Key market trends, growth factors and opportunities

- 7.4.5.7.2. Market size and forecast, by Type

- 7.4.5.7.3. Market size and forecast, by Application

- 7.4.5.7.4. Market size and forecast, by End User

- 7.5. LAMEA

- 7.5.1. Key trends and opportunities

- 7.5.2. Market size and forecast, by Type

- 7.5.3. Market size and forecast, by Application

- 7.5.4. Market size and forecast, by End User

- 7.5.5. Market size and forecast, by country

- 7.5.5.1. Brazil

- 7.5.5.1.1. Key market trends, growth factors and opportunities

- 7.5.5.1.2. Market size and forecast, by Type

- 7.5.5.1.3. Market size and forecast, by Application

- 7.5.5.1.4. Market size and forecast, by End User

- 7.5.5.2. South Africa,

- 7.5.5.2.1. Key market trends, growth factors and opportunities

- 7.5.5.2.2. Market size and forecast, by Type

- 7.5.5.2.3. Market size and forecast, by Application

- 7.5.5.2.4. Market size and forecast, by End User

- 7.5.5.3. Saudi Arabia

- 7.5.5.3.1. Key market trends, growth factors and opportunities

- 7.5.5.3.2. Market size and forecast, by Type

- 7.5.5.3.3. Market size and forecast, by Application

- 7.5.5.3.4. Market size and forecast, by End User

- 7.5.5.4. Rest of LAMEA

- 7.5.5.4.1. Key market trends, growth factors and opportunities

- 7.5.5.4.2. Market size and forecast, by Type

- 7.5.5.4.3. Market size and forecast, by Application

- 7.5.5.4.4. Market size and forecast, by End User

CHAPTER 8: COMPETITIVE LANDSCAPE

- 8.1. Introduction

- 8.2. Top winning strategies

- 8.3. Product Mapping of Top 10 Player

- 8.4. Competitive Dashboard

- 8.5. Competitive Heatmap

- 8.6. Top player positioning, 2022

CHAPTER 9: COMPANY PROFILES

- 9.1. Creative Biolabs

- 9.1.1. Company overview

- 9.1.2. Key Executives

- 9.1.3. Company snapshot

- 9.1.4. Operating business segments

- 9.1.5. Product portfolio

- 9.2. Eppendorf Corporate

- 9.2.1. Company overview

- 9.2.2. Key Executives

- 9.2.3. Company snapshot

- 9.2.4. Operating business segments

- 9.2.5. Product portfolio

- 9.2.6. Business performance

- 9.2.7. Key strategic moves and developments

- 9.3. Lonza

- 9.3.1. Company overview

- 9.3.2. Key Executives

- 9.3.3. Company snapshot

- 9.3.4. Operating business segments

- 9.3.5. Product portfolio

- 9.3.6. Business performance

- 9.4. PromoCell GmbH

- 9.4.1. Company overview

- 9.4.2. Key Executives

- 9.4.3. Company snapshot

- 9.4.4. Operating business segments

- 9.4.5. Product portfolio

- 9.5. Sartorius AG

- 9.5.1. Company overview

- 9.5.2. Key Executives

- 9.5.3. Company snapshot

- 9.5.4. Operating business segments

- 9.5.5. Product portfolio

- 9.5.6. Business performance

- 9.6. BioLife Solutions, Inc.

- 9.6.1. Company overview

- 9.6.2. Key Executives

- 9.6.3. Company snapshot

- 9.6.4. Operating business segments

- 9.6.5. Product portfolio

- 9.6.6. Business performance

- 9.6.7. Key strategic moves and developments

- 9.7. Danaher Corporation

- 9.7.1. Company overview

- 9.7.2. Key Executives

- 9.7.3. Company snapshot

- 9.7.4. Operating business segments

- 9.7.5. Product portfolio

- 9.7.6. Business performance

- 9.7.7. Key strategic moves and developments

- 9.8. Thermo Fisher Scientific Inc.

- 9.8.1. Company overview

- 9.8.2. Key Executives

- 9.8.3. Company snapshot

- 9.8.4. Operating business segments

- 9.8.5. Product portfolio

- 9.8.6. Business performance

- 9.8.7. Key strategic moves and developments

- 9.9. HiMedia Laboratories

- 9.9.1. Company overview

- 9.9.2. Key Executives

- 9.9.3. Company snapshot

- 9.9.4. Operating business segments

- 9.9.5. Product portfolio

- 9.10. Merck Group KGaA

- 9.10.1. Company overview

- 9.10.2. Key Executives

- 9.10.3. Company snapshot

- 9.10.4. Operating business segments

- 9.10.5. Product portfolio

- 9.10.6. Business performance