|

|

市場調査レポート

商品コード

1402950

細胞凍結保存市場- 成長、将来展望、競合分析、2024年~2032年Cell Cryopreservation Market - Growth, Future Prospects and Competitive Analysis, 2024 - 2032 |

||||||

|

|||||||

| 細胞凍結保存市場- 成長、将来展望、競合分析、2024年~2032年 |

|

出版日: 2023年12月20日

発行: Acute Market Reports

ページ情報: 英文 116 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

細胞凍結保存市場は、研究、再生医療、生殖補助医療に応用される様々な種類の細胞の保存と保護に重要な役割を果たしています。細胞凍結保存市場は、再生医療、生殖補助医療、バイオバンクにおいて極めて重要な役割を果たしています。細胞凍結保存市場は、2024年から2032年の予測期間中にCAGR 21.5%で成長する見込みです。技術的課題は存在するもの、再生医療、ART、研究活動の拡大により市場は成長を続けています。競合動向は、既存企業が市場の進化する需要に対応できる体制を整えていることを示唆しており、医療や研究における様々な用途での凍結保存細胞の保存と利用をサポートしています。

再生医療の台頭

再生医療や細胞を用いた治療への関心の高まりは、細胞凍結保存市場の主要な促進要因です。凍結保存は、幹細胞や初代細胞を含む貴重な細胞を、潜在的な治療用途のために長期保存することを可能にします。この 促進要因は、個別化細胞療法を中心とした再生医療における臨床試験や研究活動の増加によって支えられています。この原動力の証拠は、再生医療分野における投資や共同研究の急増に見ることができます。

生殖補助医療の拡大

体外受精(IVF)を含む生殖補助医療(ART)の拡大が、卵子、胚細胞、精子の凍結保存の需要を牽引しています。凍結保存は、不妊治療を受ける患者にとって生存可能な生殖細胞の利用可能性を保証します。この原動力は、世界の不妊率の上昇、凍結保存胚の受容、ARTセンターの成長に現れています。この原動力の証拠は、体外受精の処置における凍結保存生殖細胞の利用が増加していることに見ることができます。

バイオバンキングと調査の進歩

バイオバンキングと研究活動は急増しており、細胞を長期保存するための信頼できる方法が必要とされています。凍結保存はバイオバンクや研究機関にとって、細胞株や組織サンプルを維持するための重要なツールとなっています。この原動力は、バイオバンキングネットワークの拡大と医学研究のためのバイオリポジトリの開発によって支えられています。この原動力の証拠は、研究や医薬品開発における凍結保存サンプルの利用が増加していることに見ることができます。

技術的課題

細胞凍結保存市場は、細胞の凍結・融解の技術的側面に関連する課題に直面しています。凍結保存は著しく進歩したが、その過程で細胞が損傷し、解凍時に生存率が低下することがあります。この限界は、再生医療など特定の用途における凍結保存細胞の可能性を妨げています。この制限の証拠は、細胞の解凍後の回復が依然として懸念される例で見ることができます。

製品別(細胞凍結培地、機器、消耗品):細胞凍結保存市場が市場を独占

2024年、細胞凍結保存市場は細胞凍結培地から大きな収益を上げています。しかし、2024年から2032年までの予測期間では、消耗品が最も高い年間平均成長率(CAGR)を示すと予測されています。これは、バイアル、クライオバッグ、その他の必須コンポーネントなど、凍結保存プロセスにおける信頼性の高い消耗品の需要を示しています。

用途別(幹細胞、卵母細胞、胚細胞、精子細胞、肝細胞、その他):幹細胞が市場を独占

2024年には、様々な細胞アプリケーションが市場の収益に貢献しました。注目すべきは、幹細胞が2024年に最も高い収益を上げたことです。2024年から2032年までの期間を展望すると、卵母細胞および胚細胞が最も高いCAGRを示すと予測されます。これは、生殖補助医療技術の継続的な成長と凍結保存された生殖細胞の必要性を反映しています。

北米が世界のリーダーであり続ける

細胞凍結保存市場は、明確な地理的動向を示しています。2024年には北米が収益面でリードし、市場に大きく貢献します。2024年の売上高比率が最も高かった地域は北米でした。しかし、2024年から2032年までの期間を展望すると、アジア太平洋地域のCAGRが最も高くなると予想されます。これは、アジア太平洋地域における再生医療や生殖補助医療への関心の高まり、研究やバイオバンクへの投資の増加を反映しています。

市場競争は予測期間中に激化へ

細胞凍結保存市場の競合情勢では、Thermo Fisher Scientific社、Merck KGaA社、Stemcell Technologies Inc社、Sartorius AG社、PromoCell GmbH社、Lonza社、HiMedia Laboratories社、Creative Biolabs社、Corning Incorporated社、BioLife Solutions Inc社などの主要企業が一貫してリーダーシップを発揮しています。これらの業界大手は、2024年に多額の収益を報告しており、2024年から2032年までの予測期間における戦略は、製品革新、品質保証、新興市場でのプレゼンス拡大に重点を置くと予想されます。これらの主要プレーヤー間の競合は激化しており、技術革新と凍結保存ソリューションへのアクセスを促進しています。

本レポートでお答えする主な質問

細胞凍結保存市場の成長に影響を与えている主要なミクロおよびマクロ環境要因は何か?

現在および予測期間中の製品セグメントと地域に関する主な投資ポケットは?

2032年までの推定推計・市場予測

予測期間中に最も速いCAGRを占めるセグメントは?

市場シェアの大きいセグメントとその理由は?

中低所得国は細胞凍結保存市場に投資しているか?

細胞凍結保存市場で最大の地域市場はどこか?

アジア太平洋、ラテンアメリカ、中東・アフリカなどの新興市場における市場動向と力学は?

細胞凍結保存市場の成長を促進する主要動向は?

世界の細胞凍結保存市場で存在感を高めるための主要な競合企業とその主要戦略とは?

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

第3章 細胞凍結保存市場:競合分析

- 主要ベンダーの市場での位置付け

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2023 vs 2031年

第4章 細胞凍結保存市場:マクロ分析と市場力学

- イントロダクション

- 世界の細胞凍結保存市場金額 2021-2031年

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- サプライヤーパワー

- バイヤーパワー

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTEL分析

- 政治的情勢

- 経済情勢

- テクノロジーの情勢

- 法的情勢

- 社会的情勢

第5章 細胞凍結保存市場:製品別 2022-2032年

- 市場概要

- 成長・収益分析:2023 vs 2031年

- 市場セグメンテーション

- 細胞凍結培地

- エチレングリコール

- ジメチルスルホキシド

- グリセロール

- その他

- 装置

- 冷凍庫

- 保育器

- 液体窒素供給タンク

- 消耗品

- 極低温バイアル

- 極低温チューブ

- クーラーボックス・コンテナ

- その他

- 細胞凍結培地

第6章 細胞凍結保存市場:用途別 2022-2032年

- 市場概要

- 成長・収益分析:2023 vs 2031年

- 市場セグメンテーション

- 幹細胞

- 卵母細胞と胚細胞

- 精子細胞

- 肝細胞

- その他

第7章 細胞凍結保存市場:最終用途別 2022-2032年

- 市場概要

- 成長・収益分析:2023 vs 2031年

- 市場セグメンテーション

- バイオ医薬品および製薬会社

- 研究機関

- バイオバンク

- 体外受精クリニック

- その他

第8章 北米の細胞凍結保存市場 2022-2032年

- 市場概要

- 細胞凍結保存市場:製品別 2022-2032年

- 細胞凍結保存市場:用途別 2022-2032年

- 細胞凍結保存市場:最終用途別 2022-2032年

- 細胞凍結保存市場:地域別 2022-2032年

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第9章 英国と欧州連合の細胞凍結保存市場 2022-2032年

- 市場概要

- 細胞凍結保存市場:製品別 2022-2032年

- 細胞凍結保存市場:用途別 2022-2032年

- 細胞凍結保存市場:最終用途別 2022-2032年

- 細胞凍結保存市場:地域別 2022-2032年

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第10章 アジア太平洋の細胞凍結保存市場 2022-2032年

- 市場概要

- 細胞凍結保存市場:製品別 2022-2032年

- 細胞凍結保存市場:用途別 2022-2032年

- 細胞凍結保存市場:最終用途別 2022-2032年

- 細胞凍結保存市場:地域別 2022-2032年

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋

第11章 ラテンアメリカの細胞凍結保存市場 2022-2032年

- 市場概要

- 細胞凍結保存市場:製品別 2022-2032年

- 細胞凍結保存市場:用途別 2022-2032年

- 細胞凍結保存市場:最終用途別 2022-2032年

- 細胞凍結保存市場:地域別 2022-2032年

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第12章 中東・アフリカの細胞凍結保存市場 2022-2032年

- 市場概要

- 細胞凍結保存市場:製品別 2022-2032年

- 細胞凍結保存市場:用途別 2022-2032年

- 細胞凍結保存市場:最終用途別 2022-2032年

- 細胞凍結保存市場:地域別 2022-2032年

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第13章 企業プロファイル

- Thermo Fisher Scientific

- Merck KGaA

- Stemcell Technologies Inc

- Sartorius AG

- PromoCell GmbH

- Lonza

- HiMedia Laboratories

- Creative Biolabs

- Corning Incorporated

- BioLife Solutions Inc.

- その他の主要企業

List of Tables

- TABLE 1 Global Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 2 Global Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 3 Global Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 4 Global Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 5 Global Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 6 Global Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 7 North America Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 8 North America Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 9 North America Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 10 North America Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 11 North America Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 12 North America Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 13 U.S. Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 14 U.S. Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 15 U.S. Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 16 U.S. Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 17 U.S. Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 18 U.S. Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 19 Canada Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 20 Canada Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 21 Canada Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 22 Canada Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 23 Canada Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 24 Canada Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 25 Rest of North America Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 26 Rest of North America Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 27 Rest of North America Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 28 Rest of North America Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 29 Rest of North America Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 30 Rest of North America Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 31 UK and European Union Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 32 UK and European Union Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 33 UK and European Union Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 34 UK and European Union Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 35 UK and European Union Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 36 UK and European Union Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 37 UK Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 38 UK Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 39 UK Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 40 UK Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 41 UK Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 42 UK Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 43 Germany Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 44 Germany Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 45 Germany Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 46 Germany Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 47 Germany Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 48 Germany Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 49 Spain Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 50 Spain Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 51 Spain Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 52 Spain Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 53 Spain Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 54 Spain Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 55 Italy Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 56 Italy Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 57 Italy Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 58 Italy Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 59 Italy Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 60 Italy Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 61 France Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 62 France Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 63 France Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 64 France Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 65 France Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 66 France Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 67 Rest of Europe Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 68 Rest of Europe Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 69 Rest of Europe Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 70 Rest of Europe Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 71 Rest of Europe Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 72 Rest of Europe Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 73 Asia Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 74 Asia Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 75 Asia Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 76 Asia Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 77 Asia Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 78 Asia Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 79 China Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 80 China Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 81 China Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 82 China Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 83 China Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 84 China Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 85 Japan Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 86 Japan Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 87 Japan Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 88 Japan Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 89 Japan Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 90 Japan Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 91 India Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 92 India Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 93 India Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 94 India Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 95 India Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 96 India Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 97 Australia Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 98 Australia Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 99 Australia Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 100 Australia Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 101 Australia Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 102 Australia Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 103 South Korea Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 104 South Korea Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 105 South Korea Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 106 South Korea Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 107 South Korea Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 108 South Korea Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 109 Latin America Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 110 Latin America Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 111 Latin America Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 112 Latin America Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 113 Latin America Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 114 Latin America Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 115 Brazil Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 116 Brazil Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 117 Brazil Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 118 Brazil Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 119 Brazil Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 120 Brazil Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 121 Mexico Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 122 Mexico Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 123 Mexico Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 124 Mexico Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 125 Mexico Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 126 Mexico Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 127 Rest of Latin America Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 128 Rest of Latin America Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 129 Rest of Latin America Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 130 Rest of Latin America Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 131 Rest of Latin America Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 132 Rest of Latin America Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 133 Middle East and Africa Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 134 Middle East and Africa Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 135 Middle East and Africa Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 136 Middle East and Africa Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 137 Middle East and Africa Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 138 Middle East and Africa Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 139 GCC Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 140 GCC Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 141 GCC Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 142 GCC Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 143 GCC Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 144 GCC Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 145 Africa Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 146 Africa Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 147 Africa Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 148 Africa Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 149 Africa Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 150 Africa Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

- TABLE 151 Rest of Middle East and Africa Cell Cryopreservation Market By Product, 2022-2032, USD (Million)

- TABLE 152 Rest of Middle East and Africa Cell Cryopreservation Market By Cell Freezing Media, 2022-2032, USD (Million)

TABLE 153 Rest of Middle East and Africa Cell Cryopreservation Market By Equipment, 2022-2032, USD (Million)

TABLE 154 Rest of Middle East and Africa Cell Cryopreservation Market By Consumables, 2022-2032, USD (Million)

TABLE 155 Rest of Middle East and Africa Cell Cryopreservation Market By Application, 2022-2032, USD (Million)

- TABLE 156 Rest of Middle East and Africa Cell Cryopreservation Market By End-Use, 2022-2032, USD (Million)

List of Figures

- FIG. 1 Global Cell Cryopreservation Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Cell Cryopreservation Market: Quality Assurance

- FIG. 5 Global Cell Cryopreservation Market, By Product, 2023

- FIG. 6 Global Cell Cryopreservation Market, By Application, 2023

- FIG. 7 Global Cell Cryopreservation Market, By End-Use, 2023

- FIG. 8 Global Cell Cryopreservation Market, By Geography, 2023

- FIG. 9 Market Geographical Opportunity Matrix - Global Cell Cryopreservation Market, 2023

FIG. 10Market Positioning of Key Cell Cryopreservation Market Players, 2023

FIG. 11Global Cell Cryopreservation Market - Tier Analysis - Percentage of Revenues by Tier Level, 2023 Versus 2031

- FIG. 12 Global Cell Cryopreservation Market, By Product, 2023 Vs 2032, %

- FIG. 13 Global Cell Cryopreservation Market, By Application, 2023 Vs 2032, %

- FIG. 14 Global Cell Cryopreservation Market, By End-Use, 2023 Vs 2032, %

- FIG. 15 U.S. Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 16 Canada Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 17 Rest of North America Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 18 UK Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 19 Germany Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 20 Spain Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 21 Italy Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 22 France Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 23 Rest of Europe Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 24 China Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 25 Japan Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 26 India Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 27 Australia Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 28 South Korea Cell Cryopreservation Market (US$ Million), 2022 - 2032

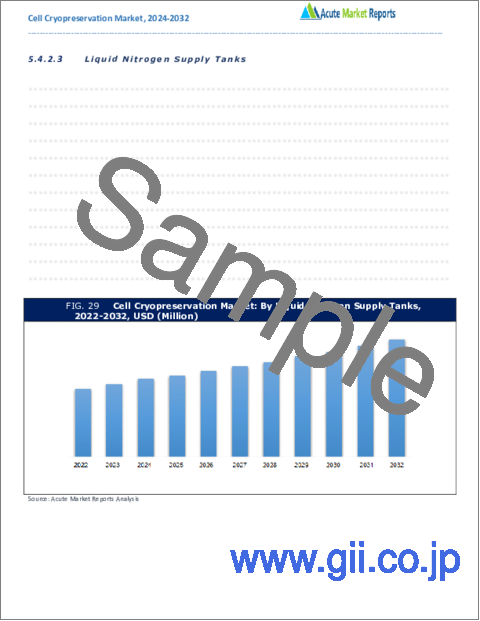

- FIG. 29 Rest of Asia Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 30 Brazil Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 31 Mexico Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 32 Rest of Latin America Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 33 GCC Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 34 Africa Cell Cryopreservation Market (US$ Million), 2022 - 2032

- FIG. 35 Rest of Middle East and Africa Cell Cryopreservation Market (US$ Million), 2022 - 2032

The cell cryopreservation market plays a vital role in preserving and safeguarding various cell types for applications in research, regenerative medicine, and assisted reproductive technology. The cell cryopreservation market plays a pivotal role in regenerative medicine, assisted reproductive technology, and biobanking. The cell cryopreservation market is expected to grow at a CAGR of 21.5% during the forecast period of 2024 to 2032. While technological challenges exist, the market continues to grow due to the expansion of regenerative medicine, ART, and research activities. Competitive trends suggest that established players are well-positioned to meet the evolving demands of the market, supporting the storage and utilization of cryopreserved cells for various applications in healthcare and research.

Rise in Regenerative Medicine

The growing interest in regenerative medicine and cell-based therapies is a major driver of the cell cryopreservation market. Cryopreservation enables the long-term storage of valuable cells, including stem cells and primary cells, for potential therapeutic use. This driver is supported by the increasing number of clinical trials and research activities in regenerative medicine, with a focus on personalized cell therapies. Evidence for this driver can be observed in the surging investments and collaborations in the regenerative medicine sector.

Expansion of Assisted Reproductive Technology

The expansion of assisted reproductive technology (ART), including in vitro fertilization (IVF), has driven the demand for cryopreservation of oocytes, embryonic cells, and sperm. Cryopreservation ensures the availability of viable reproductive cells for patients undergoing fertility treatments. This driver is evident in the rising global infertility rates, the acceptance of cryopreserved embryos, and the growth of ART centers. Evidence for this driver can be seen in the increasing utilization of cryopreserved reproductive cells in IVF procedures.

Biobanking and Research Advancements

Biobanking and research activities have surged, requiring reliable methods for long-term cell storage. Cryopreservation serves as a crucial tool for biobanks and research institutions to maintain cell lines and tissue samples. This driver is supported by the expansion of biobanking networks and the development of biorepositories for medical research. Evidence for this driver can be observed in the increasing utilization of cryopreserved samples in research and drug development.

Technological Challenges

The cell cryopreservation market faces challenges related to the technological aspects of freezing and thawing cells. While cryopreservation has advanced significantly, the process can still result in cell damage and reduced viability upon thawing. This limitation hinders the potential of cryopreserved cells for certain applications, such as regenerative medicine. Evidence for this restraint can be seen in instances where the post-thaw recovery of cells remains a concern.

By Product (Cell Freezing Media, Equipment, Consumables): The cell Cryopreservation Market Dominates the Market

In 2024, the cell cryopreservation market witnessed substantial revenue from Cell Freezing Media. However, during the forecast period from 2024 to 2032, Consumables are expected to exhibit the highest Compound Annual Growth Rate (CAGR). This indicates the demand for reliable consumables in cryopreservation processes, including vials, cryobags, and other essential components.

By Application (Stem Cells, Oocytes, Embryotic cells, Sperm Cells, Hepatocytes, Others): Stem Cells Dominate the Market

In 2024, various cell applications contributed to the market's revenue. Notably, Stem Cells generated the highest revenue in 2024. Looking ahead to the period from 2024 to 2032, Oocytes and Embryotic cells are projected to have the highest CAGR. This reflects the continued growth of assisted reproductive technology and the need for cryopreserved reproductive cells.

North America Remains the Global Leader

The cell cryopreservation market exhibits distinct geographic trends. In 2024, North America led in terms of revenue, contributing significantly to the market. The region with the highest revenue percentage in 2024 was North America. However, looking ahead to the period from 2024 to 2032, the Asia-Pacific region is expected to have the highest CAGR. This reflects the growing interest in regenerative medicine and assisted reproductive technology in the Asia-Pacific region, along with increasing investments in research and biobanking.

Market Competition to Intensify during the Forecast Period

In the competitive landscape of the cell cryopreservation market, top players such as Thermo Fisher Scientific, Merck KGaA, Stemcell Technologies Inc, Sartorius AG, PromoCell GmbH, Lonza, HiMedia Laboratories, Creative Biolabs, Corning Incorporated and BioLife Solutions Inc. have consistently demonstrated their leadership. These industry leaders reported substantial revenues in 2024, and their strategies for the forecast period from 2024 to 2032 are expected to focus on product innovation, quality assurance, and expanding their presence in emerging markets. Competition among these key players intensifies, driving innovation and access to cryopreservation solutions.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation ofCell Cryopreservation market are as follows:

Research and development budgets of manufacturers and government spending

Revenues of key companies in the market segment

Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report:

Micro and macro environment factors that are currently influencing the Cell Cryopreservation market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

Market Segmentation

Product

- Cell Freezing Media

- Ethylene Glycol

- Dimethyl Sulfoxide

- Glycerol

- Others

- Equipment

- Freezers

- Incubators

- Liquid Nitrogen Supply Tanks

- Consumables

- Cryogenic Vials

- Cryogenic Tubes

- Cooler Boxes/Containers

- Others

Application

- Stem Cells

- Oocytes and Embryotic cells

- Sperm Cells

- Hepatocytes

- Others

End-Use

- Biopharmaceutical & Pharmaceutical Companies

- Research Institutes

- Biobanks

- IVF Clinics

- Others

Region Segment (2022-2032; US$ Million)

North America

U.S.

Canada

Rest of North America

UK and European Union

UK

Germany

Spain

Italy

France

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East and Africa

GCC

Africa

Rest of Middle East and Africa

Key questions answered in this report

What are the key micro and macro environmental factors that are impacting the growth of Cell Cryopreservation market?

What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

Estimated forecast and market projections up to 2032.

Which segment accounts for the fastest CAGR during the forecast period?

Which market segment holds a larger market share and why?

Are low and middle-income economies investing in the Cell Cryopreservation market?

Which is the largest regional market for Cell Cryopreservation market?

What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

Which are the key trends driving Cell Cryopreservation market growth?

Who are the key competitors and what are their key strategies to enhance their market presence in the Cell Cryopreservation market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Cell Cryopreservation Market

- 2.2. Global Cell Cryopreservation Market, By Product, 2023 (US$ Million)

- 2.3. Global Cell Cryopreservation Market, By Application, 2023 (US$ Million)

- 2.4. Global Cell Cryopreservation Market, By End-Use, 2023 (US$ Million)

- 2.5. Global Cell Cryopreservation Market, By Geography, 2023 (US$ Million)

- 2.6. Attractive Investment Proposition by Geography, 2023

3. Cell Cryopreservation Market: Competitive Analysis

- 3.1. Market Positioning of Key Cell Cryopreservation Market Vendors

- 3.2. Strategies Adopted by Cell Cryopreservation Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2023 Versus 2031

4. Cell Cryopreservation Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Cell Cryopreservation Market Value, 2021 - 2031, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

- 4.6. Porter's Five Force Model

- 4.6.1. Supplier Power

- 4.6.2. Buyer Power

- 4.6.3. Threat Of Substitutes

- 4.6.4. Threat Of New Entrants

- 4.6.5. Competitive Rivalry

- 4.7. PESTEL Analysis

- 4.7.1. Political Landscape

- 4.7.2. Economic Landscape

- 4.7.3. Technology Landscape

- 4.7.4. Legal Landscape

- 4.7.5. Social Landscape

5. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2023 Versus 2031

- 5.3. Market Segmentation

- 5.3.1. Cell Freezing Media

- 5.3.1.1. Ethylene Glycol

- 5.3.1.2. Dimethyl Sulfoxide

- 5.3.1.3. Glycerol

- 5.3.1.4. Others

- 5.3.2. Equipment

- 5.3.2.1. Freezers

- 5.3.2.2. Incubators

- 5.3.2.3. Liquid Nitrogen Supply Tanks

- 5.3.3. Consumables

- 5.3.3.1. Cryogenic Vials

- 5.3.3.2. Cryogenic Tubes

- 5.3.3.3. Cooler Boxes/Containers

- 5.3.3.4. Others

- 5.3.1. Cell Freezing Media

6. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2023 Versus 2031

- 6.3. Market Segmentation

- 6.3.1. Stem Cells

- 6.3.2. Oocytes and Embryotic cells

- 6.3.3. Sperm Cells

- 6.3.4. Hepatocytes

- 6.3.5. Others

7. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2023 Versus 2031

- 7.3. Market Segmentation

- 7.3.1. Biopharmaceutical & Pharmaceutical Companies

- 7.3.2. Research Institutes

- 7.3.3. Biobanks

- 7.3.4. IVF Clinics

- 7.3.5. Others

8. North America Cell Cryopreservation Market, 2022-2032, USD (Million)

- 8.1. Market Overview

- 8.2. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 8.3. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 8.4. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 8.5.Cell Cryopreservation Market: By Region, 2022-2032, USD (Million)

- 8.5.1.North America

- 8.5.1.1. U.S.

- 8.5.1.1.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 8.5.1.1.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 8.5.1.1.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 8.5.1.2. Canada

- 8.5.1.2.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 8.5.1.2.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 8.5.1.2.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 8.5.1.3. Rest of North America

- 8.5.1.3.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 8.5.1.3.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 8.5.1.3.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 8.5.1.1. U.S.

- 8.5.1.North America

9. UK and European Union Cell Cryopreservation Market, 2022-2032, USD (Million)

- 9.1. Market Overview

- 9.2. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.3. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.4. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.Cell Cryopreservation Market: By Region, 2022-2032, USD (Million)

- 9.5.1.UK and European Union

- 9.5.1.1. UK

- 9.5.1.1.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.1.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.1.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.2. Germany

- 9.5.1.2.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.2.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.2.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.3. Spain

- 9.5.1.3.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.3.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.3.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.4. Italy

- 9.5.1.4.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.4.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.4.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.5. France

- 9.5.1.5.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.5.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.5.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.6. Rest of Europe

- 9.5.1.6.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 9.5.1.6.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 9.5.1.6.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 9.5.1.1. UK

- 9.5.1.UK and European Union

10. Asia Pacific Cell Cryopreservation Market, 2022-2032, USD (Million)

- 10.1. Market Overview

- 10.2. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.3. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.4. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.Cell Cryopreservation Market: By Region, 2022-2032, USD (Million)

- 10.5.1.Asia Pacific

- 10.5.1.1. China

- 10.5.1.1.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.1.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.1.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.2. Japan

- 10.5.1.2.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.2.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.2.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.3. India

- 10.5.1.3.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.3.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.3.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.4. Australia

- 10.5.1.4.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.4.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.4.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.5. South Korea

- 10.5.1.5.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.5.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.5.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.6. Rest of Asia Pacific

- 10.5.1.6.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 10.5.1.6.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 10.5.1.6.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 10.5.1.1. China

- 10.5.1.Asia Pacific

11. Latin America Cell Cryopreservation Market, 2022-2032, USD (Million)

- 11.1. Market Overview

- 11.2. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 11.3. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 11.4. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 11.5.Cell Cryopreservation Market: By Region, 2022-2032, USD (Million)

- 11.5.1.Latin America

- 11.5.1.1. Brazil

- 11.5.1.1.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 11.5.1.1.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 11.5.1.1.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 11.5.1.2. Mexico

- 11.5.1.2.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 11.5.1.2.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 11.5.1.2.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 11.5.1.3. Rest of Latin America

- 11.5.1.3.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 11.5.1.3.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 11.5.1.3.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 11.5.1.1. Brazil

- 11.5.1.Latin America

12. Middle East and Africa Cell Cryopreservation Market, 2022-2032, USD (Million)

- 12.1. Market Overview

- 12.2. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 12.3. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 12.4. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 12.5.Cell Cryopreservation Market: By Region, 2022-2032, USD (Million)

- 12.5.1.Middle East and Africa

- 12.5.1.1. GCC

- 12.5.1.1.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 12.5.1.1.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 12.5.1.1.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 12.5.1.2. Africa

- 12.5.1.2.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 12.5.1.2.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 12.5.1.2.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 12.5.1.3. Rest of Middle East and Africa

- 12.5.1.3.1. Cell Cryopreservation Market: By Product, 2022-2032, USD (Million)

- 12.5.1.3.2. Cell Cryopreservation Market: By Application, 2022-2032, USD (Million)

- 12.5.1.3.3. Cell Cryopreservation Market: By End-Use, 2022-2032, USD (Million)

- 12.5.1.1. GCC

- 12.5.1.Middle East and Africa

13. Company Profile

- 13.1. Thermo Fisher Scientific

- 13.1.1. Company Overview

- 13.1.2. Financial Performance

- 13.1.3. Product Portfolio

- 13.1.4. Strategic Initiatives

- 13.2. Merck KGaA

- 13.2.1. Company Overview

- 13.2.2. Financial Performance

- 13.2.3. Product Portfolio

- 13.2.4. Strategic Initiatives

- 13.3. Stemcell Technologies Inc

- 13.3.1. Company Overview

- 13.3.2. Financial Performance

- 13.3.3. Product Portfolio

- 13.3.4. Strategic Initiatives

- 13.4. Sartorius AG

- 13.4.1. Company Overview

- 13.4.2. Financial Performance

- 13.4.3. Product Portfolio

- 13.4.4. Strategic Initiatives

- 13.5. PromoCell GmbH

- 13.5.1. Company Overview

- 13.5.2. Financial Performance

- 13.5.3. Product Portfolio

- 13.5.4. Strategic Initiatives

- 13.6. Lonza

- 13.6.1. Company Overview

- 13.6.2. Financial Performance

- 13.6.3. Product Portfolio

- 13.6.4. Strategic Initiatives

- 13.7. HiMedia Laboratories

- 13.7.1. Company Overview

- 13.7.2. Financial Performance

- 13.7.3. Product Portfolio

- 13.7.4. Strategic Initiatives

- 13.8. Creative Biolabs

- 13.8.1. Company Overview

- 13.8.2. Financial Performance

- 13.8.3. Product Portfolio

- 13.8.4. Strategic Initiatives

- 13.9. Corning Incorporated

- 13.9.1. Company Overview

- 13.9.2. Financial Performance

- 13.9.3. Product Portfolio

- 13.9.4. Strategic Initiatives

- 13.10. BioLife Solutions Inc.

- 13.10.1. Company Overview

- 13.10.2. Financial Performance

- 13.10.3. Product Portfolio

- 13.10.4. Strategic Initiatives

- 13.11. Other Notable Players

- 13.11.1. Company Overview

- 13.11.2. Financial Performance

- 13.11.3. Product Portfolio

- 13.11.4. Strategic Initiatives